This study involved four major activities in estimating the current size of the cannabis testing market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. These findings, assumptions, and sizing were then validated with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive technical, market-oriented, and commercial study of the cannabis testing market. The secondary sources used for this study include the International Cannabis and Cannabinoids Institute (ICCI), Association of Commercial Cannabis Laboratories (ACCL), American Medical Marijuana Association (AMMA), California Cannabis Industry Association (CCIA), Oregon Cannabis Association (OCA), Canadian National Medical Marijuana Association (CNMMA), World Health Organization (WHO), National Institutes of Health (NIH), National Center for Complementary and Integrative Health (NCCIH), American Oil Chemists’ Society (AOCS), Association of Public Health Laboratories (APHL), American Association for Clinical Chemistry (AACC), National Center for Biotechnology Information (NCBI), BioPharm International, EvaluatePharma, ScienceDirect, News Articles, Journals, Press Releases, Paid Databases, Expert Interviews, and MarketsandMarkets Analysis, among others. These sources were also used to obtain key information about major players, global product revenues, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives. Secondary data was collected and analyzed to arrive at the overall size of the global cannabis testing market, which was validated through primary research.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

Note: Tiers are defined based on a company’s total revenue. As of 2023, Tier 1 = >USD 1 Bn, Tier 2 = USD 500 Mn to USD 1 Bn, and Tier 3 <USD 500 Mn.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

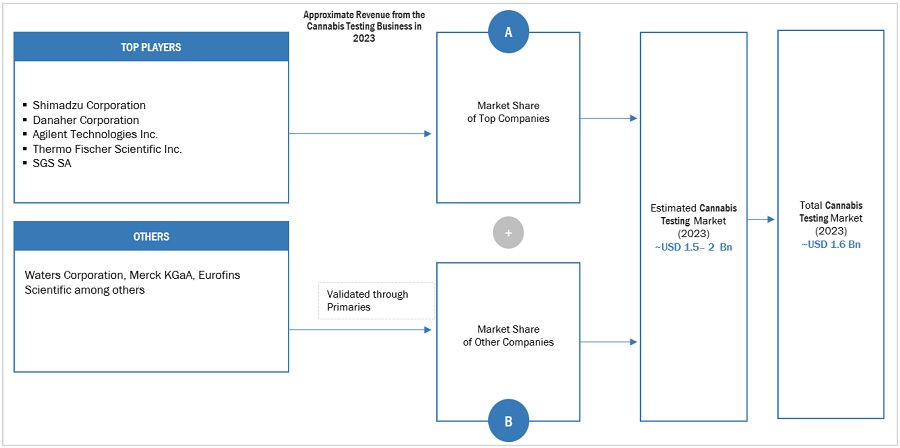

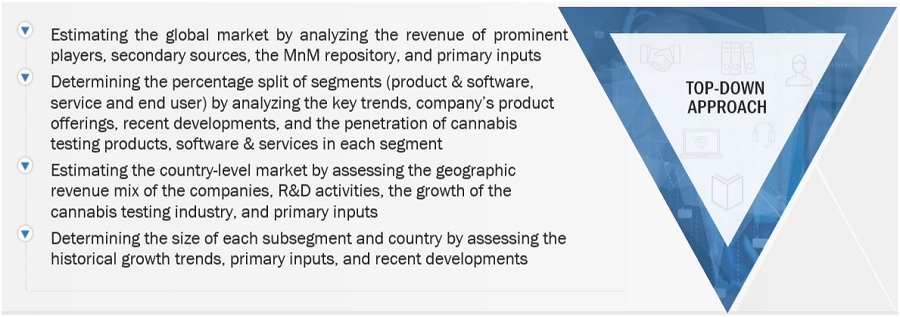

The global size of the cannabis testing market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the market and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The major players in the industry and market have been identified through extensive primary and secondary research.

-

The cannabis testing-related business shares of leading players have been determined through secondary research and primary analysis.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down Approach-

Data Triangulation

After estimating the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Cannabis raw material testing is crucial to quality assurance and regulatory compliance within the cannabis industry. It involves a comprehensive suite of analytical tests, products, and software to assess the safety, potency, and purity of cannabis plants or plant-derived materials before they are utilized in production processes. The key tests involved in cannabis testing include potency analysis, microbial screening, residual solvent testing, heavy metal analysis, pesticide residue testing, moisture content determination, terpene profiling, and foreign material inspection. The key products involved in cannabis testing include analytical and spectroscopy instruments, consumables, and software.

Key Stakeholders

-

Cannabis Testing Product Manufacturing Companies

-

Regulatory Authorities

-

Cannabis Producers/Cultivators

-

Research & Development Companies

-

Biotechnology Companies

-

Research Laboratories & Academic Institutes.

-

Market Research & Consulting Firms

-

Testing Laboratories

The main objectives of this study are as follows:

-

To define, describe, and forecast the cannabis testing market by product & software, service, end user, and region

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall cannabis testing market

-

To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the size of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

-

To profile the key players and analyze their market shares and core competencies2

-

To track and analyze competitive developments, such as product launches, partnerships, agreements, collaborations, and expansions.

-

To benchmark players within the market using the proprietary “Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of business and product excellence strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report with additional efforts:

-

Product, Software & Service-Level Information

-

Country-wise Information: Analysis for additional countries (up to five)

-

Company Information: Detailed analysis and profiling of additional key market players across the globe

Growth opportunities and latent adjacency in Cannabis Testing Market