This study involved four major activities in estimating the current size of the drug screening market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the drug screening market. The researchers used secondary sources, which means they looked at existing information instead of collecting new data themselves. These secondary sources included reports and publications from organizations like the World Health Organization (WHO) and the National Institute on Drug Abuse (NIDA), National Institute on Alcohol Abuse and Alcoholism (NIAAA), Substance Abuse and Mental Health Services Administration (SAMHSA), European Monitoring Centre for Drugs and Drug Addiction (EMCDDA), Asia-Pacific Society for Alcohol and Addiction Research (APSAAR), National Institute on Drug Abuse (NIDA), Federation of Indian NGOs for Drugs and AIDS Prevention (FINGODAP), International Journal of Drug Policy, American Journal of Drug and Alcohol Abuse, Annual Reports, SEC Filings, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis. This method allowed the researchers to gather information on the market size, segmentation (by product type, customer, etc.), regional analysis, future trends, and technological advancements in the drug screening market.

Primary Research

In-depth interviews were conducted with various primary respondents, researchers conducted in-depth interviews with a variety of people. They talked to important people in the industry, like CEOs of major companies that make drug screening products or provide drug screening services. They also spoke with specialists who know a lot about this market, and consultants who advise businesses on how to make money in this field.

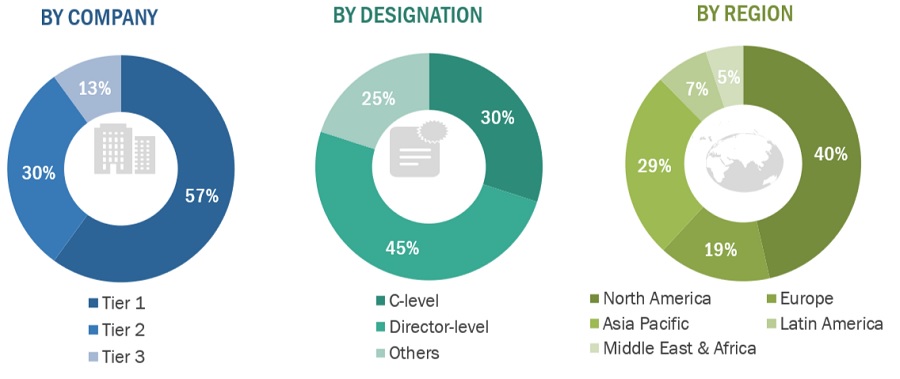

Breakdown of the primary respondents:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product and service managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2023: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the drug screening market as well as to estimate the market size of various other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and market have been identified through extensive secondary research.

-

The revenues generated from the drug screening business of leading players have been determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Bottom-Up Approach: No of Testing Volume Based Estimation:

To know about the assumptions considered for the study, Request for Free Sample Report

Drug Screening Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Drug & alcohol testing or drug screening refers to testing individuals for illegal abuse of drugs (including legal drugs such as prescription drugs) through the use of biological samples, such as urine, oral fluids/saliva, hair, blood, and sweat.

Key stakeholders:

-

Drug and alcohol testing laboratories

-

Drug and alcohol testing product manufacturers

-

Rapid drug screening device manufacturers

-

Law enforcement agencies

-

Healthcare providers

-

Government agencies

-

Research and consulting firms

-

Venture capitalists

Report Objectives

-

To define, describe, and forecast the global drug screening market based on the product and service, sample type, drug type, end user and region.

-

To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, and opportunities)

-

To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall drug screening market.

-

To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

-

To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

-

To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies.

-

To track and analyze competitive developments such as acquisitions, product and services launches, approvals, expansions, agreements, partnerships, and R&D activities in the drug screening market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

-

An additional five company profiles

Growth opportunities and latent adjacency in Drug Screening Market