Heavy Metal Testing Market Type (Arsenic, Cadmium, Lead, Mercury), Technology (ICP-MS/OES, AAS), Sample (Food, Water, Blood), Food Tested (Meat, Poultry, Seafood, Processed, Dairy, Cereals & Grains), and Region - Global Forecast to 2022

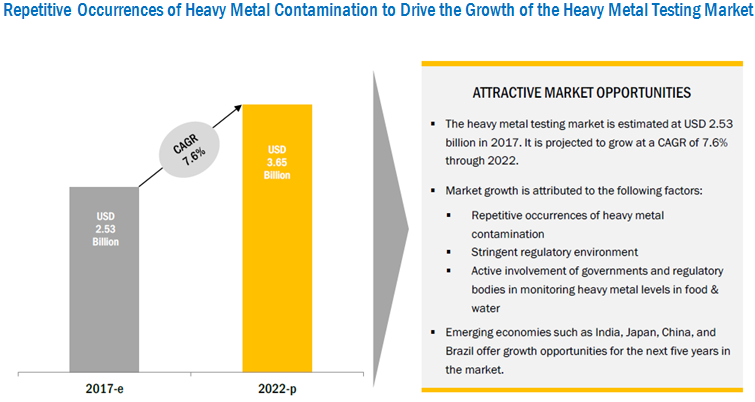

[230 Pages Report] The heavy metal testing market was valued at USD 2.37 Billion in 2016. It is projected to reach USD 3.65 Billion by 2022, at a CAGR of 7.6% from 2017. Heavy metal testing includes the testing of food, water, and blood & other samples for various heavy metals such as arsenic, cadmium, lead, mercury, and others. Active involvement of government and regulatory bodies to monitor heavy metal levels in food & environment is driving the market for heavy metal testing. Market players are responding to new opportunities by expanding their global presence and service offerings.

For More details on this research, Request Free Sample Report

The objectives of the study are:

- To define, segment, and forecast the size of the heavy metal testing market with respect to heavy metal type, technology, sample, and region

- To analyze the market structure by identifying various subsegments of the heavy metal testing market

- To forecast the size of the heavy metal testing market and its various submarkets with respect to four main regions, namely, North America, Asia Pacific, Europe, and the Rest of the World (RoW)

- To provide detailed information about crucial factors that are influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments such as expansions & investments, new product, service, & technology launches, acquisitions, agreements, collaborations, joint ventures, and partnerships in the heavy metal testing market

The years considered for the study are as follows:

- Base Year: 2016

- Estimated Year: 2017

- Projected Year: 2022

- Forecast Period: 2017 to 2022

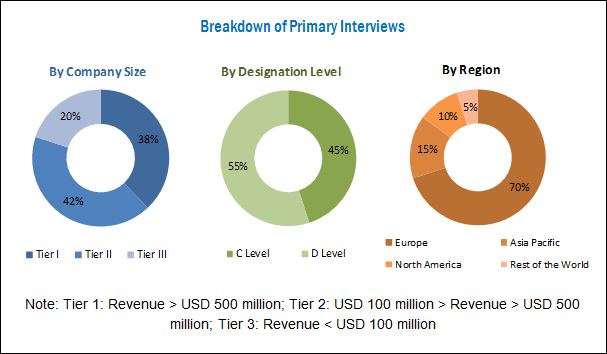

This report includes estimations of the market size in terms of value (USD million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the heavy metal testing market and to estimate the size of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research through various sources such as the Centers for Disease Control and Prevention (CDC), The European Federation of National Associations of Measurement, Testing and Analytical Laboratories (EUROLAB), The World Health Organization (WHO), I.E. Canada (Canadian Association of Importers and Exporters), Environmental Protection Agency (EPA), Food and Agricultural Organization (FAO), Food Safety Council (FSC), and Statistics Canada, and their market ranking in the respective regions have been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

The heavy metal testing ecosystem comprises heavy metal testing service providers such as SGS (Switzerland), Eurofins (Luxembourg), Intertek (UK), TάV SάD (Germany), ALS Limited (Australia), and Merieux NutriSciences (US) as the major players. Other players such as LGC Group (UK), AsureQuality (New Zealand), Microbac Laboratories (US), EMSL Analytical (US), IFP Institut Fόr Produktqualitδt (Germany), and OMIC USA (US) also have a significant presence in this market.

Target Audience:

- R&D institutes

- Technology providers

- Heavy metal testing service providers

- Intermediary suppliers

- Wholesalers

- Dealers

- Consumers

- End users

- Retailers

The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.

Scope of the report

This research report categorizes the heavy metal testing market based on heavy metal type, technology, sample, and region.

Based on heavy metal Type, the market has been segmented as follows:

- Arsenic

- Cadmium

- Lead

- Mercury

- Others

Based on Technology, the market has been segmented as follows:

- ICP-MS & -OES

- Atomic absorption spectroscopy (AAS)

- Others

Based on Sample, the market has been segmented as follows:

- Food

- Meat, poultry, and seafood

- Dairy products

- Processed food

- Fruits & vegetables

- Cereals & grains

- Nuts, seeds, and spices

- Others

- Water

- Drinking water

- Waste water

- Industrial water

- Blood & other samples

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (South America and the Middle East & Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Segmental Analysis

- Segmental analysis, which provides further breakdown of the in the arsenic, cadmium, lead, mercury, and heavy metals type segment.

- Further breakdown of heavy metal testing in food samples such as meat & meat products; dairy products; packaged food; fruits & vegetables; cereals, grains, & pulses; nuts, seeds, & spices; and other food products.

- Further breakdown of heavy metal testing in blood & other samples.

- Market size for heavy metal testing in air & soil.

Geographic Analysis

- Further breakdown of the Rest of Asia-Pacific heavy metal testing market, by country

- Further breakdown of other countries in the Rest of the World heavy metal testing market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

The global market for heavy metal testing has grown exponentially in the last few years. The market is estimated to be valued at USD 2.53 Billion in 2017 and is projected to reach USD 3.65 Billion by 2022, at a CAGR of around 7.6% from 2017. Emerging economies such as India, China, Japan, South Africa, and Brazil are the potential primary markets of the industry. Factors such as increasing heavy metal pollution in water due to industrial discharge, implementation of stringent regulations, and growth in the packaged food industry leading to increase in packaging induced heavy metals are the major driving factors for this market. Increasing international trade activities helps to drive the growth of the heavy metal testing industry.

The heavy metal testing market for food, based on heavy metal type, is segmented into arsenic, cadmium, lead, mercury, and others which include aluminum, thallium, tin, antimony, barium, copper, chromium, iron, nickel, selenium, and zinc. The arsenic segment dominated the market with the largest share in 2016 since arsenic is frequently used in various food additives. This is followed by cadmium testing in food which is conducted because cadmium is another major heavy metal present in most cereals, fruits, vegetables, meat, and fish. This metal contaminant is found at the highest levels in the offal of mammals & mussels, oysters, and scallops. Inhalation of cadmium through food material is lower (5%) compared to inhalation through fumes, dust, and cigarettes (90%).

The heavy metal testing market for food, based on technology, is segmented into ICP-MS & OES, Atomic absorption spectroscopy (AAS), and others which include volumetric, HPLC with ICP, and other spectroscopy techniques. The ICP-MS & OES segment dominated the market in 2016 and is projected to grow at the highest CAGR from 2017 to 2022. ICP-MS & OES technologies have various advantages over AAS such as lower detection limits and faster test results by automation.

The heavy metal testing market, based on sample, is segmented into food, water, and blood & other samples. The food segment includes meat, poultry, and seafood; dairy products; processed food; fruits & vegetables; cereals & grains; nuts, seeds, and spices; and others comprising dietary supplements, food additives, and food ingredients. The water segment includes drinking water, waste water, and industrial water. Blood & other samples segment comprise cellular samples such as blood, urine, serum, and saliva samples. The water sample segment dominated the market in 2016 whereas, the blood & other samples segment is projected to grow at the highest CAGR due to growing heavy metal levels in food & water.

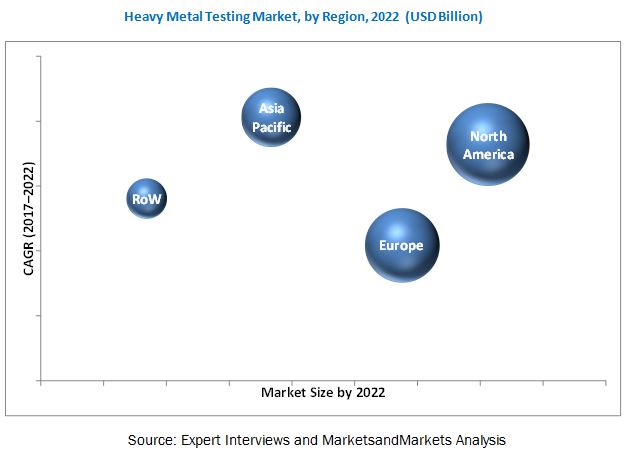

The North American region is projected to dominate the heavy metal testing market by 2022. The Asia Pacific region is projected to be the fastest-growing market during the forecast period since the demand in countries such as Japan and China is increasing due to growing international trade from these countries and the high concentration of heavy metals in agricultural soil here. Other factors responsible for the growth of the Asia Pacific market are the emerging economies and growing R&D activities for launching new technologies.

Heavy metal testing by advanced technologies involves high costs of energy & power, which increases the capital investment. The equipment cost and the cost of high-end technologies are high. Increased focus on R&D activities, coupled with the minimum requirements for accuracy and reliability of readings, is increasing the price of instruments.

Expansions & investments, new product, service, & technology launches, acquisitions, agreements, collaborations, joint ventures, and partnerships are the key strategies adopted by market players to ensure their growth in the market. The market is dominated by players such as SGS (Switzerland), Eurofins (Luxembourg), Intertek (UK), TάV SάD (Germany), ALS Limited (Australia), and Merieux NutriSciences (US). Other major players in the market include LGC Group (UK), AsureQuality (New Zealand), Microbac Laboratories (US), EMSL Analytical (US), IFP Institut Fόr Produktqualitδt (Germany), and OMIC USA (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Research Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in the Heavy Metal Testing Market

4.2 Heavy Metal Testing Market in Food, By Heavy Metal Type & Region

4.3 Heavy Metal Testing Market, By Sample

4.4 Heavy Metal Testing Market for Food, By Technology & Region

4.5 Heavy Metal Testing Market, By Key Country

4.6 Developed vs Developing Markets for Heavy Metal Testing in Food

4.7 North America: Heavy Metal Testing Market for Food, By Food Tested & Country, 2016

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Repetitive Occurrences of Heavy Metal Contamination

5.2.1.1.1 Increase in Heavy Metal Contaminated Meat & Meat Products Due to Contaminated Animal Feed

5.2.1.1.2 Increase in Heavy Metal Pollution in Water Due to Industrial Discharge

5.2.1.2 Implementation of Stringent Regulations

5.2.1.3 Globalization of Food Trade

5.2.1.4 Active Involvement of Government and Regulatory Bodies to Monitor Heavy Metal Levels in Food & Water

5.2.1.5 Growth in Packaged Food Industry Leading to Increase in Packaging-Induced Heavy Metal Contamination

5.2.1.6 Rising Geriatric Population and Resultant Growth in the Need for Cellular Health Screening

5.2.2 Restraints

5.2.2.1 Lack of Harmonization in Regulations & Stakeholders

5.2.3 Opportunities

5.2.3.1 Need for Heavy Metal Testing in Animal Feed

5.2.3.2 Expansion in Emerging Markets

5.2.3.2.1 Growth in the Food Industry

5.2.3.2.2 Growth in Awareness About Environmental Safety

5.2.3.3 Launch of Cost-Effective Rapid Technologies for Faster and Reliable Test Results

5.2.4 Challenges

5.2.4.1 Fraudulent Practices By the Local Players

5.2.4.2 Improper Sample Size & Collection

5.2.4.3 Lack of Affordability Due to High Costs of Testing Methods

5.2.4.3.1 High Capital Investment

6 Regulations for the Heavy Metal Testing Market (Page No. - 61)

6.1 Introduction

6.2 International Body for Food Safety Standards and Regulations

6.2.1 Codex Alimentarius Commission (CAC)

6.3 Global Food Safety Initiative (GFSI)

6.4 North America

6.4.1 Us

6.4.1.1 US Environmental Protection Agency

6.4.1.1.1 EPA Regulations on Drinking Water

6.4.1.2 Federal Legislation

6.4.1.2.1 Food Safety in Retail Food

6.4.1.2.2 Food Safety in Trade

6.4.1.2.3 Haccp Regulation in the Us

6.4.1.2.4 Food Safety Regulations for Fruit & Vegetable Growers

6.4.1.3 FDA Food Safety Modernization Act (FSMA)

6.4.1.4 US FDA CFR - Code of Federal Regulations Title 21

6.4.1.5 The Toxic Substances Control Act of 1976

6.4.1.6 US Food and Drug Administration (FDA)

6.4.2 Canada

6.4.3 Mexico

6.4.3.1 Mexican Official Norms (NOMS)

6.5 Europe

6.5.1 European Commission

6.5.2 European Union Regulations

6.5.2.1 General Food Law for Food Safety

6.5.3 Germany

6.5.3.1 Regulations for Food

6.5.3.2 Federal Water Act

6.5.3.3 Waste Water Charges Act

6.5.4 UK

6.5.4.1 Environment Protection Act, 1990

6.5.4.1.1 Part I

6.5.4.1.2 Part Ii

6.5.4.1.3 Part Iii

6.5.4.2 The Environment Agency

6.5.5 France

6.5.5.1 Food Safety

6.5.5.2 Regulations on Water

6.5.6 Italy

6.5.7 Poland

6.6 Asia Pacific

6.6.1 China

6.6.2 India

6.6.2.1 Food Safety Standards Amendment Regulations, 2012

6.6.2.2 Food Safety Standards Amendment Regulations, 2011

6.6.2.3 Food Safety and Standards Act, 2006

6.6.2.4 Regulations on Water Protection

6.6.3 Japan

6.6.3.1 Food & Feed

6.6.3.2 Water Pollution Control Law

6.6.4 Australia

6.6.4.1 Food Standards Australia and New Zealand

6.6.5 New Zealand

6.6.6 Indonesia

6.6.6.1 General Law for Food Safety

6.6.6.2 Water Pollution Control Policy

6.7 South Africa

6.7.1 Private Standards in South Africa & the Requirements for Product Testing

7 Heavy Metal Testing Market in Food, By Heavy Metal Type (Page No. - 82)

7.1 Introduction

7.2 Arsenic

7.3 Cadmium

7.4 Lead

7.5 Mercury

7.6 Others

8 Heavy Metal Testing Market in Food, By Technology (Page No. - 102)

8.1 Introduction

8.2 ICP-MS & OES

8.3 Atomic Absorption Spectroscopy (AAS)

8.4 Others

9 Heavy Metal Testing Market, By Sample (Page No. - 108)

9.1 Introduction

9.1.1 Heavy Metal Exposure Due to Mining Activities & Construction Projects

9.1.2 Toxic Effect of Heavy Metals on Agricultural Practices

9.2 Food

9.2.1 Meat, Poultry, and Seafood

9.2.2 Dairy Products

9.2.3 Processed Food

9.2.3.1 Baby Food

9.2.4 Fruits & Vegetables

9.2.5 Cereals & Grains

9.2.6 Nuts, Seeds, and Spices

9.2.7 Others

9.3 Water

9.3.1 Drinking Water

9.3.2 Wastewater

9.3.3 Industrial Water

9.4 Blood & Other Samples

10 Heavy Metal Testing Market, By Region (Page No. - 122)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.2.1 20112013: Mercury in Selected Foods

10.2.2.2 20132015: Aluminum in Baking Powders, Baking Mixes, Baked Goods, and Breads

10.2.2.3 20112013: Arsenic Speciation in Selected Foods

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Poland

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia & New Zealand

10.4.5 Rest of Asia Pacific

10.5 Rest of the World (RoW)

10.5.1 Brazil

10.5.2 South Africa

10.5.3 Argentina

10.5.4 Others in RoW

11 Competitive Landscape (Page No. - 169)

11.1 Overview

11.2 Market Ranking

11.3 Competitive Scenario

11.3.1 New Product, Service & Technology Launches

11.3.2 Expansions & Investments

11.3.3 Acquisitions

11.3.4 Agreements, Collaborations, Joint Ventures & Partnerships

12 Company Profiles (Page No. - 176)

(Business Overview, Services Offered, Recent Developments, SWOT Analysis & MnM View)*

12.1 SGS

12.2 Intertek

12.3 Eurofins

12.4 TUV SUD

12.5 ALS Limited

12.6 Mιrieux Nutrisciences

12.7 LGC Group

12.8 Asurequality

12.9 Microbac Laboratories

12.10 EMSL Analytical

12.11 IFP Institut Fόr Produktqualitδt

12.12 Omic USA

*Details on Business Overview, Services Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 209)

13.1 Discussion Guide

13.2 More Company Developments

13.2.1 New Product, Service, and Technology Launches

13.2.2 Expansions & Investments

13.2.3 Acquisitions

13.2.4 Agreements, Collaborations, Joint Ventures, and Partnerships

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (136 Tables)

Table 1 US Dollar Exchange Rates Considered for Study, 20142016

Table 2 Types of Heavy Metals, Their Permissible Limits, and Their Effect on Human Health

Table 3 Some Heavy Metals Recalls

Table 4 Mean Content of Cadmium, Lead, and Arsenic in Various Foods

Table 5 Water Regulations, By Country

Table 6 Regulatory Bodies That Actively Participate in Water Protection and Monitoring

Table 7 Regulatory Bodies That Actively Participate in Food Protection and Monitoring

Table 8 US Heavy Metals Test Results: Popular Breakfast Cereals, 2014

Table 9 Heavy Metal Limits and Amount in Some Common Food

Table 10 EPA Regulatory Limits for Toxic Elements in Potable Water

Table 11 Recommended Levels of Heavy Metal Contamination By National Secondary Drinking Water Regulations

Table 12 EPA Regulations on Drinking Water

Table 13 Action Levels for Mercury in Food By FDA

Table 14 UK: Non-Exclusive List of Food Commodities and Heavy Metals Controlled By the Food Contaminants Regulations, 2006

Table 15 Specified Limits for Metal Types in Food By Fssai

Table 16 Environmental Quality Standards for Soil Pollution

Table 17 Average Amount of Heavy Metals Found in Some Common Foods (In 100gm Servings)

Table 18 Specific Release Limits (SRL) for Heavy Metals & Alloy Components

Table 19 Specific Release Limits (SRL) for Heavy Metals as Contaminants & Impurities

Table 20 Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 21 Arsenic Content in Commonly Consumed Foods

Table 22 Arsenic: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 23 North America: Arsenic Testing Market in Food, By Country, 20152022 (USD Million)

Table 24 Europe: Arsenic Testing Market in Food, By Country, 20152022 (USD Million)

Table 25 Asia Pacific: Arsenic Testing Market in Food, By Country, 20152022 (USD Million)

Table 26 RoW: Arsenic Testing Market in Food, By Country, 20152022 (USD Million)

Table 27 Cadmium Content in Commonly Consumed Foods

Table 28 Maximum Levels of Cadmium in Food as Per Commission Regulations No. 1881/2006 and No. 629/2008

Table 29 Cadmium: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 30 North America: Cadmium Testing Market in Food, By Country, 20152022 (USD Million)

Table 31 Europe: Cadmium Testing Market in Food, By Country, 20152022 (USD Million)

Table 32 Asia Pacific: Cadmium Testing Market in Food, By Country, 20152022 (USD Million)

Table 33 RoW: Cadmium Testing Market in Food, By Country, 20152022 (USD Million)

Table 34 Lead Content in Commonly Consumed Foods

Table 35 Maximum Levels of Lead in Food as Per Commission Regulations No. 1881/2006 and No. 629/2008

Table 36 Lead: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 37 North America: Lead Testing Market in Food, By Country, 20152022 (USD Million)

Table 38 Europe: Lead Testing Market in Food, By Country, 20152022 (USD Million)

Table 39 Asia Pacific: Lead Testing Market in Food, By Country, 20152022 (USD Million)

Table 40 RoW: Lead Testing Market in Food, By Country, 20152022 (USD Million)

Table 41 Maximum Levels of Mercury in Food as Per Commission Regulations No. 1881/2006 and No. 629/2008

Table 42 Mercury: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 43 North America: Mercury Testing Market in Food, By Country, 20152022 (USD Million)

Table 44 Europe: Mercury Testing Market in Food, By Country, 20152022 (USD Million)

Table 45 Asia Pacific: Mercury Testing Market in Food, By Country, 20152022 (USD Million)

Table 46 RoW: Mercury Testing Market in Food, By Country, 20152022 (USD Million)

Table 47 Maximum Levels of Tin in Food as Per Commission Regulations No. 1881/2006 and No. 629/2008

Table 48 Others: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 49 North America: Other Heavy Metal Testing Market in Food, By Country, 20152022 (USD Million)

Table 50 Europe: Other Heavy Metal Testing Market in Food, By Country, 20152022 (USD Million)

Table 51 Asia Pacific: Other Heavy Metal Testing Market in Food, By Country, 20152022 (USD Million)

Table 52 RoW: Other Heavy Metal Testing Market in Food, By Country, 20152022 (USD Million)

Table 53 Detection Limits of Different Spectroscopy Technologies for Heavy Metals

Table 54 Heavy Metal Testing Market Size in Food, By Technology, 20152022 (USD Million)

Table 55 ICP-MS & OES: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 56 Atomic Absorption Spectroscopy (AAS): Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 57 Others: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 58 Heavy Metal Testing Market Size, By Sample, 20152022 (USD Million)

Table 59 Heavy Metal Testing Market Size, By Food Tested, 20152022 (USD Million)

Table 60 Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 61 Estimated Daily Intake (Edi) of Heavy Metals for the Population of Kampala City Through the Consumption of Street Roasted and Vended Meats (Μgkg-1day-1)

Table 62 Meat, Poultry, and Seafood: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 63 Dairy Products: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 64 Processed Food: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 65 Fruits & Vegetables: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 66 Cereals & Grains: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 67 Nuts, Seeds, and Spices: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 68 Others: Heavy Metal Testing Market Size in Food, By Region, 20152022 (USD Million)

Table 69 Heavy Metal Testing Market Size in Water, By Region, 20152022 (USD Million)

Table 70 Heavy Metal Testing Market Size in Blood & Other Samples, By Region, 20152022 (USD Million)

Table 71 Regulatory Standards of Heavy Metals in Agricultural Soil (Mg/Kg)

Table 72 Heavy Metal Testing Market Size, By Region, 20152022 (USD Million)

Table 73 North America: Heavy Metal Testing Market Size in Food, By Country, 20152022 (USD Million)

Table 74 North America: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 75 North America: Heavy Metal Testing Market Size in Food, By Technology, 20152022 (USD Million)

Table 76 North America: Heavy Metal Testing Market Size, By Food Tested, 20152022 (USD Million)

Table 77 US: ICP-MS Analysis of Heavy Metals in Municipal Water Samples, 2016 (Ppb)

Table 78 US: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 79 US: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 80 List of Heavy Metal Contaminants and Maximum Levels in Foods

Table 81 Canada: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 82 Canada: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 83 Mexico: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 84 Mexico: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 85 Europe: Heavy Metal Testing Market Size in Food, By Country, 20152022 (USD Million)

Table 86 Europe: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 87 Europe: Heavy Metal Testing Market Size in Food, By Technology, 20152022 (USD Million)

Table 88 Europe: Heavy Metal Testing Market Size, By Food Tested, 20152022 (USD Million)

Table 89 UK: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 90 UK: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 91 Germany: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 92 Germany: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 93 France: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 94 France: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 95 Italy: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 96 Italy: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 97 Poland: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 98 Poland: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 99 Rest of Europe: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 100 Rest of Europe: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 101 Heavy Metal Limits in Food & Ingredients Across Asian Markets, Ppm

Table 102 Asia Pacific: Heavy Metal Testing Market Size in Food, By Country, 20152022 (USD Million)

Table 103 Asia Pacific: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 104 Asia Pacific: Heavy Metal Testing Market Size in Food, By Technology, 20152022 (USD Million)

Table 105 Asia Pacific: Heavy Metal Testing Market Size, By Food Tested, 20152022 (USD Million)

Table 106 China: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 107 China: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 108 Japan: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 109 Japan: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 110 India: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 111 India: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 112 Australia & New Zealand: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 113 Australia & New Zealand: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 114 Rest of Asia Pacific: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 115 Rest of Asia Pacific: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 116 RoW: Heavy Metal Testing Market Size in Food, By Country, 20152022 (USD Million)

Table 117 RoW: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 118 RoW: Heavy Metal Testing Market Size in Food, By Technology, 20152022 (USD Million)

Table 119 RoW: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 120 Brazil: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 121 Brazil: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 122 South Africa: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 123 South Africa: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 124 Argentina: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 125 Argentina: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 126 Others in RoW: Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 20152022 (USD Million)

Table 127 Others in RoW: Heavy Metal Testing Market Size in Food, By Food Tested, 20152022 (USD Million)

Table 128 Top Five Companies in the Heavy Metal Testing Market, 2016

Table 129 New Product, Service & Technology Launches, 20122015

Table 130 Expansions & Investments, 20162017

Table 131 Acquisitions, 20162017

Table 132 Agreements, Collaborations, Joint Ventures & Partnerships, 2016

Table 133 New Product, Service, and Technology Launches, 20122016

Table 134 Expansions & Investments, 20122017

Table 135 Acquisitions, 20122017

Table 136 Agreements, Collaborations, Joint Ventures, and Partnerships, 20122016

List of Figures (53 Figures)

Figure 1 Heavy Metal Testing Market: Market Segmentation

Figure 2 Heavy Metal Testing Market: Geographic Segmentation

Figure 3 Research Design: Heavy Metal Testing

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Heavy Metal Testing Market in Food, By Heavy Metal Type, 2017 vs 2022

Figure 8 Heavy Metal Testing Market Size for Food, By Technology, 20172022

Figure 9 Heavy Metal Testing Market Size, By Sample, 20172022

Figure 10 Heavy Metal Testing Market, By Region

Figure 11 Repetitive Occurrences of Heavy Metal Contamination to Drive the Growth of the Heavy Metal Testing Market

Figure 12 Europe Dominated the Heavy Metal Testing Market for Food Across All Heavy Metal Types in 2016

Figure 13 Water Segment Projected to Be the Largest By 2022

Figure 14 ICP-MS & OES Segment Dominated the Market in 2016

Figure 15 China to Be the Fastest-Growing Country Market for Heavy Metal Testing By 2022

Figure 16 Developing Countries to Emerge at the Highest Growth Rates During the Forecast Period

Figure 17 US Accounted for the Largest Share in 2016

Figure 18 Market Dynamics: Heavy Metal Testing Market

Figure 19 Australia: Types of Chemical and Other Contaminant Recalls Between 20072016

Figure 20 US Agricultural Imports, 2010-2015

Figure 21 Some Sources of Heavy Metal Contamination in Feed

Figure 22 The Major Food Contamination Hazards & Causes for Food Losses, Europe, 20122016

Figure 23 Legislation Process in the European Union

Figure 24 FSA Response in Relation to Other Government Departments

Figure 25 Heavy Metal Testing Market Size in Food, By Heavy Metal Type, 2017 vs 2022 (USD Million)

Figure 26 Arsenic: Heavy Metal Testing Market Size in Food, By Region, 2017 vs 2022

Figure 27 Heavy Metal Testing Market Size in Food, By Technology, 2017 vs 2022 (USD Million)

Figure 28 ICP-MS & OES: Heavy Metal Testing Market Size in Food, By Region, 2017 vs 2022 (USD Million)

Figure 29 Heavy Metal Testing Market Size, By Sample, 2017 vs 2022 (USD Million)

Figure 30 Heavy Metal Testing Market Size, By Food Tested, 2017 vs 2022 (USD Million)

Figure 31 Decoupling of Heavy Metal Emission in Water From Gross Value Added in the Metal Industry in Europe Between 2004 and 2012

Figure 32 Heavy Metal Testing Market Share in Water, By Water Type, 2016

Figure 33 Overview of Contaminants Affecting Soil and Groundwater in Europe

Figure 34 US Held the Largest Share in the Market for Testing for Heavy Metals in Food, 2016

Figure 35 North America: Heavy Metal Testing Market in Food Snapshot

Figure 36 Export Destination of US Mined Lead Ore, 2014

Figure 37 Europe: Heavy Metal Testing Market in Food Snapshot

Figure 38 Asia Pacific: Heavy Metal Testing Market in Food Snapshot

Figure 39 US Lead Ore Exports to China, 20072014, Million Kg

Figure 40 Key Developments of the Leading Players in the Heavy Metal Testing Market for 2012-2017

Figure 41 Market Evaluation Framework

Figure 42 SGS: Company Snapshot

Figure 43 SGS: SWOT Analysis

Figure 44 Intertek: Company Snapshot

Figure 45 Intertek: SWOT Analysis

Figure 46 Eurofins: Company Snapshot

Figure 47 Eurofins: SWOT Analysis

Figure 48 TUV SUD: Company Snapshot

Figure 49 TUV SUD: SWOT Analysis

Figure 50 ALS Limited: Company Snapshot

Figure 51 ALS Limited: SWOT Analysis

Figure 52 LGC Group: Company Snapshot

Figure 53 Asurequality: Company Snapshot

Growth opportunities and latent adjacency in Heavy Metal Testing Market