Laboratory Proficiency Testing Market by Industry (Clinical Diagnostics, Microbiology, Pharmaceutical, Food & Animal Feed, Water, Opioid), Technology (PCR, Cell Culture), and Region; Unmet Needs, Stakeholder & Buying Criteria - Global Forecast to 2028

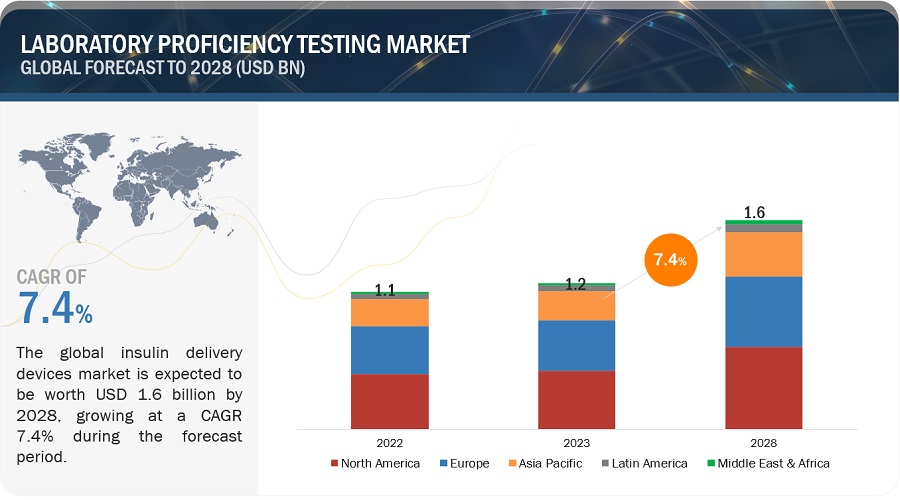

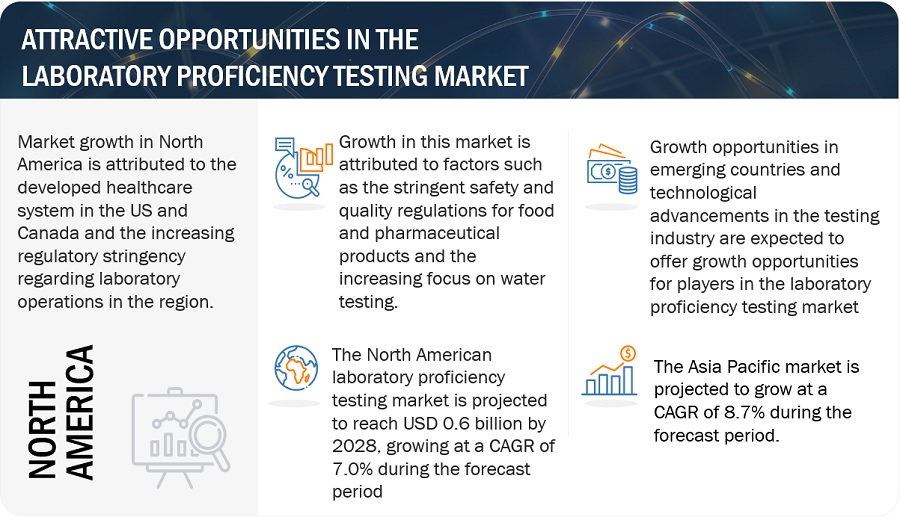

The global laboratory proficiency testing market, valued at US$1.1 billion in 2022, stood at US$1.2 billion in 2023 and is projected to advance at a resilient CAGR of 7.4% from 2023 to 2028, culminating in a forecasted valuation of US$1.6 billion by the end of the period. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The proficiency testing market is projected to experience substantial expansion in the forecasted period due to its mandatory requirement for laboratories operating in various regulated industries like APIAC, CLIA, and CLSI. The market's growth is further bolstered by stringent safety and quality regulations governing food and pharmaceutical products, alongside a growing emphasis on water testing. However, the requirement of high capital investments for accurate and sensitive testing is expected to restrain the growth of this market during the forecast period.

In this report, the laboratory proficiency testing market is segmented based on industry, technology, and region.

Global Laboratory Proficiency Testing Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Laboratory Proficiency Testing Market Dynamics

Driver: Stringent safety and quality regulations for food and pharmaceutical products

Growing complexities in the supply chain of food and pharmaceutical products, rising use of economic lack of adoption of proper hygiene, growing instances of adulteration, and sanitation practices during production, transportation, and storage, lack of awareness about allergens, growing instances of cross-contamination, and non-compliance with labeling laws have increased the incidence of contamination of final products, which in turn are responsible for large-scale outbreaks of foodborne illnesses in consumers. This has raised severe concerns among producers, regulatory authorities, end consumers, and other industry stakeholders.

To curb such violations, regulatory authorities across countries are focusing on framing and implementing strict safety and quality regulations. This has fueled the growth of the inspection, testing, and certification markets, with regulatory bodies such as the United States Department of Agriculture (USDA) and EFSA introducing guidelines for testing, inspection, and sampling services for the food industry to ensure the safety and quality of products. Thus, the increasing focus of regulatory organizations on product safety is driving the growth of the laboratory proficiency market.

Restraint: Requirement of high-capital investments for accurate and sensitive testing

The growing utilization of proficiency testing as a means for accreditation bodies to verify the credibility of laboratories engaged in accreditation initiatives is placing increased financial strain on the laboratories involved. The expenses tied to proficiency testing typically encompass the operational overhead costs of running a laboratory. These investments are necessary at different stages of proficiency testing programs, including program preparation, sample processing, sample handling, and shipment, as well as the interpretation and reporting phases. The need for thorough sample preparation necessitates laboratory analysts to employ sophisticated testing methodologies and advanced technologies. Advanced technologies, such as liquid chromatography (LC), high-performance liquid chromatography (HPLC), and spectrometry, are accurate, sensitive, and efficient. However, these technologies come with drawbacks, including prolonged sample preparation times and calibration challenges, contributing to the substantial investments needed for proficiency testing. Furthermore, many analytical methods are tailored to specific sample types, necessitating the adoption of more advanced techniques for substances like pharmaceuticals and opioids. This incorporation of advanced methods, however, escalates the overall testing expenses, thereby leading to increased capital outlays for laboratories.

Opportunity: Growth opportunities in emerging countries

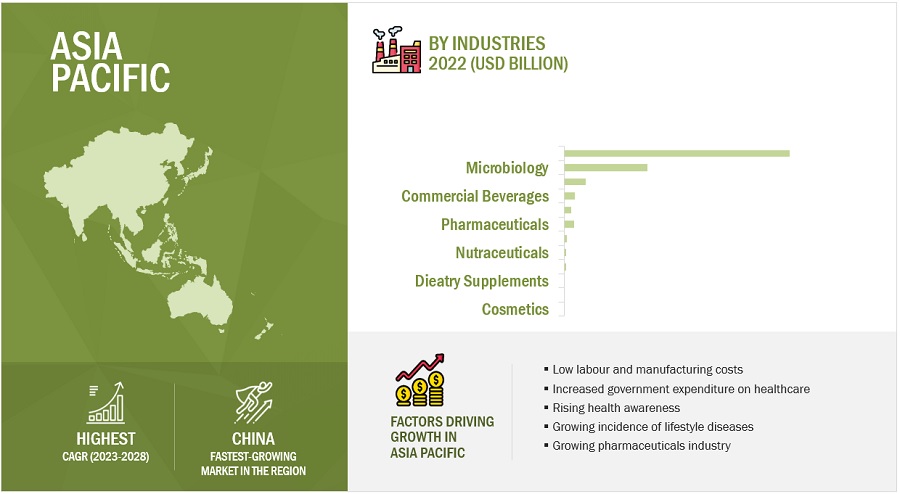

Emerging economies such as China, India, and South Korea are expected to offer significant growth opportunities for players operating in the laboratory proficiency testing market. This can primarily be attributed to the presence of less stringent regulatory policies, low labor costs, and high growth in their respective pharmaceutical and food sectors.

These countries are attracting pharmaceutical companies not only because of the low-cost manufacturing advantage but also due to the high and growing incidence of chronic and infectious diseases, rising disposable income levels, improving access to healthcare services, and implementation of favorable government policies. The growing presence of global as well as local pharmaceutical and biopharmaceutical companies in these countries is, in turn, driving the demand for proficiency testing services.

Challenge: Logistical and data interpretation challenges

Participation in external PT programs, internal PT programs, and benchmarking or comparison studies (between laboratories using proficiency testing or reference materials) is needed for the validation and evaluation of test methods. However, certain logistical activities, such as shipping and handling of samples (availability of carriers or spills in traffic), need careful planning as they may potentially influence the end results. Also, the number of laboratories necessary to conduct a valid inter-laboratory comparison and the availability of a commercial PT program for a specific analyte of interest may also influence the overall results. These are some of the major challenges faced by laboratories while assessing their standards and gaining accreditation.

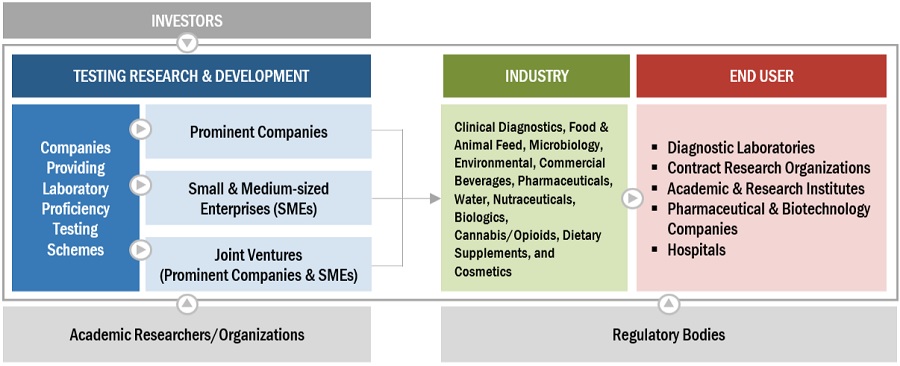

Laboratory Proficiency Testing Market Ecosystem Map

Based on industry, Clinical Diagnostics to account for the largest share of the laboratory proficiency testing industry during the forecast period.

Based on industry, the laboratory proficiency testing market is categorized into various segments, including clinical diagnostics, pharmaceuticals, microbiology, water analysis, environmental testing, food & animal feed, biologics, commercial beverages, cannabis/opioids, cosmetics, dietary supplements, and nutraceuticals. In the year 2022, the clinical diagnostics segment held the largest share of the market. This can be attributed to advancements in clinical diagnostic techniques, a rising demand for early and precise disease detection, increased government initiatives aimed at enhancing the quality and affordability of clinical diagnostic tests, and growing investments from both public and private sectors, including research funding and grants, aimed at developing innovative laboratory testing procedures.

Based on technology, the global laboratory proficiency testing market has been segmented into PCR, immunoassays, cell culture, spectrophotometry, chromatography , and other technologies. In 2022, the cell culture segment accounted for the largest share of the market. Growing awareness about the application of cell cultures in the production and testing of microbiology samples, biopharmaceuticals, and clinical diagnostic samples is supporting the growth of this market.

The APAC laboratory proficiency testing industry is projected to grow at the highest rate during the forecast period.

The laboratory proficiency testing market is anticipated to witness its highest growth rate in the Asia-Pacific (APAC) region during the forecast period. This can be attributed to the presence of emerging economies like China and India and the substantial expansion in outsourcing services in recent years. Additionally, Singapore is emerging as another promising market within the APAC region. Other than these APAC countries, Latin American countries also exhibit significant growth potential in the market. Most of this growth is driven by the significant growth in the healthcare industry. Technological advancements in clinical diagnostics, low-cost manufacturing advantage, microbiology, and pharmaceutical industries are contributing to the growth opportunities of the laboratory proficiency market in these regions.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in this market are LGC Limited (UK), American Proficiency Institute (US), College of American Pathologists (US), Bio-Rad Laboratories (US), Randox Laboratories (UK), Merck (Germany), Fapas (UK), Waters Corporation (US), Weqas (UK), AOAC INTERNATIONAL (US).

Scope of the Laboratory Proficiency Testing Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$1.2 billion |

|

Estimated Value by 2028 |

$1.6 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 7.4% |

|

Market Driver |

Stringent safety and quality regulations for food and pharmaceutical products |

|

Market Opportunity |

Growth opportunities in emerging countries |

This report categorizes the global laboratory proficiency testing market to forecast revenue and analyze trends in each of the following submarkets:

By Industry

-

Clinical Diagnostics

- Clinical Chemistry

- Immunoassay/immunochemistry

- Hematology

- Molecular diagnostic

- Cytology

- Other Clinical Diagnostics

-

Microbiology

- Pathogen Testing

- Sterility Testing

- Endotoxin & Pyrogen Testing

- Growth Promotion Testing

- Other Microbial Testing

-

Food & Animal Feed

- Meat & Meat Products

- Vegetables & Fruits

- Dairy Products

- Fish

- Egss

- Fat/oil

- Other Food & Animal Feed

-

Commercial Beverages

- Non-Alcoholic Beverages

- Alcoholic Beverages

- Environmental

-

Pharmaceuticals

- Branded/Innovator Drugs

- Generic Drugs

- Over-THE -Counter Drugs

- Biosimilars

- Water

- Nutraceuticals

-

Biologics

- Monoclonal Antibodies

- Vaccines

- Blood

- Tissue

-

Cannabis/Opioids

- Potency Testing

- Terpene Profiling

- Residual Solvents

- Pesticide Screening

- Heavy Metal Testing

- Other Cannabis/Opioids Testing

- Dietary Supplements

-

Cosmetics

- Trace Elements

- Other Cosmetic Testing

By Technology

- Cell Culture

- PCR

- Immunoassays

- Chromatography

- Spectrophotometry

- Others

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- ROE

-

Asia Pacific

- China

- Japan

- India

- South Korea

- RoPAC

- Latin America

- Middle East & Africa

Recent Developments of Laboratory Proficiency Testing Industry

- In July 2023, LGC Limited (US) acquired Kavo International (US) to strengthen its portfolio of quality measurement tools.

- In March 2023, the College of American Pathologists (US)launched a new proficiency testing program focused on the monkeypox (mpox) virus. By introducing the new mpox PT program, laboratories can enhance the quality assurance of their molecular testing process and contribute to the assurance of precise and dependent test outcomes, aiding in the detection of the mpox virus.

- In April 2022, Spex CertiPrep (US) acquired NSI Lab Solutions (US) to strengthen its product portfolio in the proficiency testing segment.

- In January 2022, Fera Science Ltd. - FAPAS (UK) formed a partnership with BioFront Technologies, which will act as the agent representing FAPAS proficiency testing services in the United States.

- In October 2021, Waters Corporation (US) entered into a partnership with Sartorius AG (Germany). The objective of this collaboration was to offer bioprocess experts direct access to top-notch mass spectrometry (MS) data, thereby enhancing the efficiency and precision of biopharmaceutical process development.

- Also in October 2021, Waters Corporation (US) partnered with the University of Delaware (US) to develop new analytical solutions for bioprocessing and biomanufacturing.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global laboratory proficiency testing market?

The global laboratory proficiency testing market boasts a total revenue value of $1.6 billion by 2028.

What is the estimated growth rate (CAGR) of the global laboratory proficiency testing market?

The global laboratory proficiency testing market has an estimated compound annual growth rate (CAGR) of 7.4% and a revenue size in the region of $1.2 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSMARKET DRIVERS- Growing need for proficiency testing for operational excellence- Stringent safety and quality regulations for food and pharmaceutical products- Increasing focus on water testingMARKET RESTRAINTS- Requirement of high-capital investments for accurate and sensitive testing- Complexity in testing techniquesMARKET OPPORTUNITIES- Technological advancements in testing industry- Growth opportunities in emerging countries- Increasing adoption of proficiency tests to prevent food adulterationMARKET CHALLENGES- Need for proficiency testing scheme harmonization- Logistical and data interpretation challenges- Dearth of skilled professionals

-

5.3 INDUSTRY TRENDSGROWING FOCUS ON ORGANIC GROWTH STRATEGIES

- 5.4 TECHNOLOGY ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.8 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR LABORATORY PROFICIENCY TESTINGINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

-

5.9 TARIFF & REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- India- Japan- China

-

5.10 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY LABORATORY PROFICIENCY TESTING PROGRAMINDICATIVE PRICING ANALYSIS, BY TECHNOLOGYINDICATIVE PRICING ANALYSIS, BY INDUSTRY

-

5.11 TRENDS & DISRUPTIONS AFFECTING CUSTOMERS’ BUSINESSESREVENUE SHIFT & NEW REVENUE POCKETS FOR LABORATORY PROFICIENCY TESTING MARKET

- 5.12 KEY CONFERENCES & EVENTS IN 2023–2024

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA FOR LABORATORY PROFICIENCY TESTING SERVICES

-

5.14 UNMET NEEDSEND-USER EXPECTATIONS

- 6.1 INTRODUCTION

-

6.2 CLINICAL DIAGNOSTICSDRIVERS- Increasing adoption of fully automated instruments and automation in laboratories- Growth opportunities in developing economiesRESTRAINTS- Procedural shift from lab-based to home-based/point-of-care testing proceduresLABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE- Clinical chemistry- Immunology/immunochemistry- Hematology- Molecular diagnostics- Cytology- Other clinical diagnostic tests

-

6.3 MICROBIOLOGYDRIVERS- Stringent safety regulationsLABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE- Pathogen testing- Sterility testing- Endotoxin & pyrogen testing- Growth promotion testing- Other microbiology tests

-

6.4 FOOD & ANIMAL FEEDDRIVERS- Stringent food safety regulations- Increasing outbreaks of foodborne illnesses- Increasing demand for packaged food products- Increasing cases of chemical contamination in food processing and manufacturingRESTRAINTS- Lack of harmonization of food safety regulations- Lack of food control infrastructure in developing countriesLABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE- Meat & meat product testing- Fruit & vegetable testing- Dairy product testing- Fish testing- Egg testing- Fat/oil testing- Other food & animal feed tests

-

6.5 COMMERCIAL BEVERAGESDRIVERS- Rising consumption of commercial beveragesRESTRAINTS- High capital investmentsLABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE- Non-alcoholic beverages- Alcoholic beverages

-

6.6 ENVIRONMENTALNEED TO REDUCE EMISSIONS AND PREVENT EXPOSURE TO TOXIC CHEMICALS TO BOOST MARKETDRIVERS- Privatization of environmental testing services- Environment protection regulations- Availability of cost- and time-efficient customized testing servicesRESTRAINTS- Lack of basic supporting infrastructure

-

6.7 PHARMACEUTICALDRIVERS- Stringent quality control in production of pharmaceutical products- Growth in pharmaceutical industry- Surge in generics market- Emerging biosimilars marketRESTRAINTS- Cost- and time-intensive drug manufacturing processLABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE- Branded/innovator drug testing- Generic drug testing- Over-the-counter drug testing- Biosimilar testing

-

6.8 WATERDRIVERS- Growing industrial applications- Increasing need for microbial water quality analysisRESTRAINTS- Limited market penetration in non-industrial applications

-

6.9 NUTRACEUTICALGROWING NUTRACEUTICAL MARKET TO INCREASE NEED FOR PROFICIENCY TESTING

-

6.10 BIOLOGICSDRIVERS- Growing R&D investments in life science industry- High incidence and large economic burden of chronic diseasesRESTRAINTS- Dearth of skilled professionalsLABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE- Monoclonal antibody testing- Vaccine testing- Blood testing- Tissue testing

-

6.11 CANNABIS/OPIOIDSDRIVERS- Legalization of medical cannabis and growing number of cannabis testing laboratories- Emerging markets- Growing adoption of LIMS in cannabis testing laboratories- Increasing awarenessRESTRAINTS- Dearth of trained laboratory professionals- Lack of industry standards for cannabis testing- High start-up costs for cannabis testing laboratoriesLABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE- Potency testing- Terpene profiling- Residual solvent testing- Pesticide screening- Heavy metal testing- Other cannabis/opioids tests

-

6.12 DIETARY SUPPLEMENTSNEED TO ENSURE SAFETY AND QUALITY OF DIETARY SUPPLEMENTS TO DRIVE MARKET

-

6.13 COSMETICDRIVERS- Opposition to animal testing- Customer interest in environmentally friendly and sustainable product ingredients in cosmetics and personal care productsLABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE- Trace elements testing- Other cosmetic tests

- 7.1 INTRODUCTION

-

7.2 CELL CULTUREGROWING USE OF CELL CULTURES IN PRODUCTION AND TESTING OF VARIOUS BIOPHARMACEUTICALS TO SUPPORT MARKET GROWTH

-

7.3 POLYMERASE CHAIN REACTION (PCR)HIGH SPECIFICITY AND ACCURACY OF PCR TO BOOST DEMAND

-

7.4 IMMUNOASSAYSEMERGENCE OF COST-EFFECTIVE TECHNOLOGIES AND LABORATORY AUTOMATION FOR IMMUNOASSAYS TO DRIVE MARKET

-

7.5 CHROMATOGRAPHYHIGH ADOPTION OF CHROMATOGRAPHY IN BIOLOGICS AND PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

-

7.6 SPECTROPHOTOMETRYTECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET GROWTH

- 7.7 OTHER TECHNOLOGIES

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- US to dominate North American laboratory proficiency testing market during forecast periodCANADA- Growing demand for analytical testing services to support growth

-

8.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Germany to dominate laboratory proficiency testing market in Europe during forecast periodFRANCE- France to become most attractive destination for FDI projects in EuropeUK- Increased government funding for biopharmaceutical research to support growthITALY- Increasing number of clinical trials to drive market growthSPAIN- Growth in biologics industry and rising consumption of biosimilars to boost marketRUSSIA- Growth in pharmaceutical and water testing industries to favor market growthREST OF EUROPE

-

8.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTJAPAN- Japan to dominate APAC laboratory proficiency testing market during forecast periodCHINA- Growth of pharmaceutical and biologics testing to drive marketINDIA- Increasing government support for biotechnology R&D to support market growthSOUTH KOREA- Investments in biopharmaceutical research to propel marketREST OF ASIA PACIFIC

-

8.5 LATIN AMERICAFINANCIAL AND ECONOMIC LIMITATIONS IN LATIN AMERICAN COUNTRIES TO LIMIT MARKET GROWTHLATIN AMERICA: RECESSION IMPACT

-

8.6 MIDDLE EAST & AFRICAGROWING AWARENESS OF HEALTHCARE AND ANALYTICAL TESTING TO SUPPORT MARKET GROWTHMIDDLE EAST & AFRICA: RECESSION IMPACT

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 9.3 RIGHT TO WIN

- 9.4 REVENUE SHARE ANALYSIS

- 9.5 MARKET RANKING ANALYSIS

-

9.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT- Company industry footprint- Company regional footprint

-

9.7 START-UPS/SMES EVALUATION MATRIXPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING- Company industry footprint- Company regional footprint

-

9.8 COMPETITIVE SITUATION AND TRENDSLABORATORY PROFICIENCY TESTING MARKET: PRODUCT LAUNCHESLABORATORY PROFICIENCY TESTING MARKET: DEALSLABORATORY PROFICIENCY TESTING MARKET: OTHER DEVELOPMENTS

-

10.1 KEY PLAYERSLGC LIMITED- Business overview- Services offered- Recent developments- MnM viewCOLLEGE OF AMERICAN PATHOLOGISTS- Business overview- Services offered- Recent developments- MnM viewBIO-RAD LABORATORIES, INC.- Business overview- Services offered- MnM viewMERCK KGAA- Business overview- Services offered- Recent developments- MnM ViewAMERICAN PROFICIENCY INSTITUTE- Business overview- Services offered- Recent developments- MnM viewRANDOX LABORATORIES LTD.- Business overview- Services offered- Recent developmentsFAPAS (A DIVISION OF FERA SCIENCE LTD.)- Business overview- Services offered- Recent developmentsWATERS CORPORATION- Business overview- Services offered- Recent developmentsQACS- Business overview- Services offeredWEQAS- Business overview- Services offeredAOAC INTERNATIONAL- Business overview- Services offered- Recent developmentsBIPEA- Business overview- Services offered- Recent developmentsSPEX CERTIPREP- Business overview- Services offered- Recent developmentsABSOLUTE STANDARDS INC.- Business overview- Services offeredTRILOGY ANALYTICAL LABORATORY- Business overview- Services offered- Recent developmentsADVANCED ANALYTICAL SOLUTIONS- Business overview- Services offeredAMERICAN INDUSTRIAL HYGIENE ASSOCIATION- Business overview- Services offeredMATRIX SCIENCES- Business overview- Services offeredAASHVI PROFICIENCY TESTING & ANALYTICAL SERVICES- Business overview- Services offeredGLOBAL PROFICIENCY LTD.- Business overview- Services offeredTHE EMERALD TEST- Business overview- Services offered

-

10.2 OTHER PLAYERSFLUXANA GMBH & CO. KGPHENOVA INC.FARE LABSGO PLUS SERVICES SDN BHD.MUVA KEMPTEN GMBH

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORT

- 11.5 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT: LABORATORY PROFICIENCY TESTING MARKET

- TABLE 2 FOOD SAFETY LEGISLATION IN DEVELOPING COUNTRIES

- TABLE 3 REGULATORY AGENCIES FOR PHARMACEUTICAL INDUSTRY

- TABLE 4 COST OF ADVANCED TECHNOLOGIES USED FOR PROFICIENCY TESTING

- TABLE 5 NUMBER OF PRODUCT LAUNCHES, BY KEY PLAYER (JANUARY 2020 TO JULY 2023)

- TABLE 6 LABORATORY PROFICIENCY TESTING MARKET: ECOSYSTEM

- TABLE 7 LABORATORY PROFICIENCY TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 ICH QUALITY GUIDELINES FOR PHARMACEUTICAL GMP

- TABLE 9 EUROPE: ACCREDITATION BODIES FOR MEDICAL LABORATORIES

- TABLE 10 OVERVIEW OF GUIDELINES OF LABORATORY SERVICES

- TABLE 11 RULES FOR PROFICIENCY TESTING LAID DOWN BY CNAS: REQUIREMENTS FOR SELECTION OF PROFICIENCY TESTING ACTIVITIES

- TABLE 12 DEVELOPMENT OF GLP ACROSS COUNTRIES

- TABLE 13 REGULATORY AUTHORITIES AND LAUNCH OF GLP MONITORING PROGRAMS IN EUROPEAN COUNTRIES

- TABLE 14 AVERAGE SELLING PRICE FOR LABORATORY PROFICIENCY TESTING PROGRAMS, BY KEY PLAYER (2022)

- TABLE 15 AVERAGE PRICING ANALYSIS OF LABORATORY PROFICIENCY TESTING PROGRAMS (2022)

- TABLE 16 LABORATORY PROFICIENCY TESTING MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF LABORATORY PROFICIENCY TESTING SERVICES (%)

- TABLE 18 KEY BUYING CRITERIA FOR INDUSTRIES

- TABLE 19 UNMET NEEDS IN LABORATORY PROFICIENCY TESTING MARKET

- TABLE 20 END-USER EXPECTATIONS IN LABORATORY PROFICIENCY TESTING MARKET

- TABLE 21 LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 22 LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 23 LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL CHEMISTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 LABORATORY PROFICIENCY TESTING MARKET FOR IMMUNOLOGY/IMMUNOCHEMISTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 LABORATORY PROFICIENCY TESTING MARKET FOR HEMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 LABORATORY PROFICIENCY TESTING MARKET FOR MOLECULAR DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 LABORATORY PROFICIENCY TESTING MARKET FOR CYTOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 LABORATORY PROFICIENCY TESTING MARKET FOR OTHER CLINICAL DIAGNOSTIC TESTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 31 LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 LABORATORY PROFICIENCY TESTING MARKET FOR PATHOGEN TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 LABORATORY PROFICIENCY TESTING MARKET FOR STERILITY TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 LABORATORY PROFICIENCY TESTING MARKET FOR ENDOTOXIN & PYROGEN TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 LABORATORY PROFICIENCY TESTING MARKET FOR GROWTH PROMOTION TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 LABORATORY PROFICIENCY TESTING MARKET FOR OTHER MICROBIOLOGY TESTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 38 LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 LABORATORY PROFICIENCY TESTING MARKET FOR MEAT & MEAT PRODUCT TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 LABORATORY PROFICIENCY TESTING MARKET FOR FRUIT & VEGETABLE TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 LABORATORY PROFICIENCY TESTING MARKET FOR DAIRY PRODUCT TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 LABORATORY PROFICIENCY TESTING MARKET FOR FISH TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 LABORATORY PROFICIENCY TESTING MARKET FOR EGG TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 LABORATORY PROFICIENCY TESTING MARKET FOR FAT/OIL TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 LABORATORY PROFICIENCY TESTING MARKET FOR OTHER FOOD & ANIMAL FEED TESTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 47 LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 LABORATORY PROFICIENCY TESTING MARKET FOR NON-ALCOHOLIC BEVERAGES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 LABORATORY PROFICIENCY TESTING MARKET FOR ALCOHOLIC BEVERAGES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 LABORATORY PROFICIENCY TESTING MARKET FOR ENVIRONMENTAL INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 PROMINENT ENVIRONMENT PROTECTION REGULATIONS, BY COUNTRY

- TABLE 52 LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 53 LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 LABORATORY PROFICIENCY TESTING MARKET FOR BRANDED/INNOVATOR DRUG TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 LABORATORY PROFICIENCY TESTING MARKET FOR GENERIC DRUG TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 LABORATORY PROFICIENCY TESTING MARKET FOR OVER-THE-COUNTER DRUG TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 57 LABORATORY PROFICIENCY TESTING MARKET FOR BIOSIMILAR TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 LABORATORY PROFICIENCY TESTING MARKET FOR WATER INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 LABORATORY PROFICIENCY TESTING MARKET FOR NUTRACEUTICAL INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 LABORATORY PROFICIENCY TESTING MARKET FOR MONOCLONAL ANTIBODY TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 LABORATORY PROFICIENCY TESTING MARKET FOR VACCINE TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 LABORATORY PROFICIENCY TESTING MARKET FOR BLOOD TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 LABORATORY PROFICIENCY TESTING MARKET FOR TISSUE TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 LABORATORY PROFICIENCY TESTING MARKET FOR POTENCY TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 LABORATORY PROFICIENCY TESTING MARKET FOR TERPENE PROFILING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 LABORATORY PROFICIENCY TESTING MARKET FOR RESIDUAL SOLVENT TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 LABORATORY PROFICIENCY TESTING MARKET FOR PESTICIDE SCREENING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 LABORATORY PROFICIENCY TESTING MARKET FOR HEAVY METAL TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 LABORATORY PROFICIENCY TESTING MARKET FOR OTHER CANNABIS/OPIOIDS TESTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 LABORATORY PROFICIENCY TESTING MARKET FOR DIETARY SUPPLEMENTS INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 LABORATORY PROFICIENCY TESTING MARKET FOR TRACE ELEMENTS TESTING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 LABORATORY PROFICIENCY TESTING MARKET FOR OTHER COSMETIC TESTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 80 LABORATORY PROFICIENCY TESTING MARKET FOR CELL CULTURE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 LABORATORY PROFICIENCY TESTING MARKET FOR PCR, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 82 LABORATORY PROFICIENCY TESTING MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 83 LABORATORY PROFICIENCY TESTING MARKET FOR CHROMATOGRAPHY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 LABORATORY PROFICIENCY TESTING MARKET FOR SPECTROPHOTOMETRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 LABORATORY PROFICIENCY TESTING MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 86 LABORATORY PROFICIENCY TESTING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 98 US: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 99 US: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 US: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 US: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 102 US: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 US: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 US: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 105 US: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 US: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 US: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 108 CANADA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 109 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 111 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 112 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 116 CANADA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 117 CANADA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 118 EUROPE: LABORATORY PROFICIENCY TESTING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 119 EUROPE: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 120 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 121 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 122 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 123 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 126 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 127 EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 128 EUROPE: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 129 GERMANY: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 130 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 135 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 136 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 GERMANY: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 GERMANY: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 139 FRANCE: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 140 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 141 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 142 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 143 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 144 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 147 FRANCE: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 148 FRANCE: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 149 UK: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 150 UK: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 151 UK: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 152 UK: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 153 UK: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 154 UK: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 UK: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 UK: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 157 UK: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 158 UK: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 159 ITALY: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 160 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 162 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 163 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 164 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 165 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 167 ITALY: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 168 ITALY: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 169 SPAIN: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 170 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 171 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 172 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 173 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 174 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 175 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 176 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 177 SPAIN: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 178 SPAIN: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 179 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 180 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 181 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 182 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 183 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 184 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 185 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 186 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 187 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 188 RUSSIA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 189 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 190 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 191 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 192 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 193 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 194 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 195 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 196 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 197 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 198 REST OF EUROPE: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 199 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 200 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 201 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 202 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 203 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 204 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 205 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 206 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 207 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 208 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 209 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 210 JAPAN: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 211 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 212 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 213 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 214 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 215 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 216 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 217 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 218 JAPAN: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 219 JAPAN: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 220 CHINA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 221 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 222 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 223 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 224 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 225 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 226 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 227 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 228 CHINA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 229 CHINA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 230 INDIA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 231 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 232 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 233 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 234 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 235 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 236 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 237 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 238 INDIA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 239 INDIA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 240 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 241 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 242 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 243 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 244 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 245 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 246 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 247 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 248 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 249 SOUTH KOREA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 250 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 251 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 252 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 253 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 254 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 255 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 256 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 257 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 258 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 259 REST OF ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 260 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 261 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 262 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 263 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 264 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 265 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 266 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 267 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 268 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 269 LATIN AMERICA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 270 FOOD SAFETY LEGISLATION IN AFRICAN COUNTRIES

- TABLE 271 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 272 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR COMMERCIAL BEVERAGES INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 276 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR BIOLOGICS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR COSMETIC INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 279 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET FOR CANNABIS/OPIOIDS INDUSTRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 281 COMPANY FOOTPRINT: LABORATORY PROFICIENCY TESTING MARKET (2022)

- TABLE 282 INDUSTRY FOOTPRINT: LABORATORY PROFICIENCY TESTING MARKET (2022)

- TABLE 283 REGIONAL FOOTPRINT: LABORATORY PROFICIENCY TESTING MARKET (2022)

- TABLE 284 START-UP/SME FOOTPRINT: LABORATORY PROFICIENCY TESTING MARKET (2022)

- TABLE 285 START-UP/SME INDUSTRY FOOTPRINT: LABORATORY PROFICIENCY TESTING MARKET (2022)

- TABLE 286 START-UP/SME REGIONAL FOOTPRINT: LABORATORY PROFICIENCY TESTING MARKET (2022)

- TABLE 287 KEY PRODUCT LAUNCHES, JANUARY 2020–AUGUST 2023

- TABLE 288 KEY DEALS, JANUARY 2020–AUGUST 2023

- TABLE 289 OTHER KEY DEVELOPMENTS, JANUARY 2020–AUGUST 2023

- TABLE 290 LGC LIMITED: BUSINESS OVERVIEW

- TABLE 291 COLLEGE OF AMERICAN PATHOLOGISTS: BUSINESS OVERVIEW

- TABLE 292 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- TABLE 293 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 294 AMERICAN PROFICIENCY INSTITUTE: BUSINESS OVERVIEW

- TABLE 295 RANDOX LABORATORIES LTD.: BUSINESS OVERVIEW

- TABLE 296 FAPAS: BUSINESS OVERVIEW

- TABLE 297 WATERS CORPORATION: BUSINESS OVERVIEW

- TABLE 298 QACS: BUSINESS OVERVIEW

- TABLE 299 WEQAS: BUSINESS OVERVIEW

- TABLE 300 AOAC INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 301 BIPEA: BUSINESS OVERVIEW

- TABLE 302 SPEX CERTIPREP: BUSINESS OVERVIEW

- TABLE 303 ABSOLUTE STANDARDS INC.: BUSINESS OVERVIEW

- TABLE 304 TRILOGY ANALYTICAL LABORATORY: BUSINESS OVERVIEW

- TABLE 305 ADVANCED ANALYTICAL SOLUTIONS: BUSINESS OVERVIEW

- TABLE 306 AMERICAN INDUSTRIAL HYGIENE ASSOCIATION: BUSINESS OVERVIEW

- TABLE 307 MATRIX SCIENCES: BUSINESS OVERVIEW

- TABLE 308 AASHVI PROFICIENCY TESTING & ANALYTICAL SERVICES: BUSINESS OVERVIEW

- TABLE 309 GLOBAL PROFICIENCY LTD.: BUSINESS OVERVIEW

- TABLE 310 THE EMERALD TEST: BUSINESS OVERVIEW

- FIGURE 1 LABORATORY PROFICIENCY TESTING MARKET

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEW (SUPPLY SIDE): BY COMPANY TYPE, DESIGNAITON AND REGION

- FIGURE 7 LABORATORY PROFICIENCY TESTING MARKET: BOTTOM-UP APPROACH

- FIGURE 8 LABORATORY PROFICIENCY TESTING MARKET: TOP-DOWN APPROACH

- FIGURE 9 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 10 SUPPLY-SIDE MARKET SIZE ESTIMATION: LABORATORY PROFICIENCY TESTING MARKET (2022)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF LABORATORY PROFICIENCY TESTING MARKET (2023–2028)

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- FIGURE 14 LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 LABORATORY PROFICIENCY TESTING MARKET FOR CLINICAL DIAGNOSTICS INDUSTRY, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 LABORATORY PROFICIENCY TESTING MARKET FOR FOOD & ANIMAL FEED INDUSTRY, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 LABORATORY PROFICIENCY TESTING MARKET FOR MICROBIOLOGY INDUSTRY, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 LABORATORY PROFICIENCY TESTING MARKET FOR PHARMACEUTICAL INDUSTRY, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 19 LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 20 GEOGRAPHICAL SNAPSHOT OF LABORATORY PROFICIENCY TESTING MARKET

- FIGURE 21 STRINGENT SAFETY AND QUALITY REGULATIONS FOR FOOD AND PHARMACEUTICAL PRODUCTS TO DRIVE MARKET GROWTH

- FIGURE 22 CLINICAL CHEMISTRY SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 23 CELL CULTURE ACCOUNTED FOR LARGEST SHARE OF APAC LABORATORY PROFICIENCY TESTING MARKET IN 2022

- FIGURE 24 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 26 LABORATORY PROFICIENCY TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 CLIA-REGISTERED LABORATORIES GLOBALLY (2011–2022)

- FIGURE 28 PROJECTED PHARMACEUTICAL SALES IN ASIAN COUNTRIES (2022)

- FIGURE 29 LABORATORY PROFICIENCY TESTING MARKET: ECOSYSTEM MAP

- FIGURE 30 LABORATORY PROFICIENCY TESTING MARKET: INDUSTRY AND TECHNOLOGY MAPPING

- FIGURE 31 VALUE CHAIN ANALYSIS

- FIGURE 32 PATENT PUBLICATION TRENDS (2011–2023)

- FIGURE 33 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR PROFICIENCY TESTING PATENTS (JANUARY 2011–JULY 2023)

- FIGURE 34 TOP APPLICANT COUNTRIES/REGIONS FOR PROFICIENCY TESTING PATENTS (JANUARY 2011–JULY 2023)

- FIGURE 35 LABORATORY PROFICIENCY TESTING MARKET: TRENDS & DISRUPTIONS AFFECTING CUSTOMERS’ BUSINESSES

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF LABORATORY PROFICIENCY TESTING SERVICES

- FIGURE 37 KEY BUYING CRITERIA FOR INDUSTRIES

- FIGURE 38 GLOBAL PHARMACEUTICAL DRUG SALES, 2012–2022 (USD BILLION)

- FIGURE 39 NORTH AMERICA: LABORATORY PROFICIENCY TESTING MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: LABORATORY PROFICIENCY TESTING MARKET SNAPSHOT

- FIGURE 41 KEY DEVELOPMENTS BY LEADING PLAYERS IN LABORATORY PROFICIENCY TESTING MARKET, 2020–2023

- FIGURE 43 RANK OF COMPANIES IN GLOBAL LABORATORY PROFICIENCY TESTING MARKET (2022)

- FIGURE 44 LABORATORY PROFICIENCY TESTING MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS (2022)

- FIGURE 45 LABORATORY PROFICIENCY TESTING MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2022)

- FIGURE 46 LGC LIMITED: COMPANY SNAPSHOT (2022)

- FIGURE 47 COLLEGE OF AMERICAN PATHOLOGISTS: COMPANY SNAPSHOT (2022)

- FIGURE 48 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 49 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 50 WATERS CORPORATION: COMPANY SNAPSHOT (2022)

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful to the study on the laboratory proficiency testing market. Primary sources were largely several industry experts from core and related industries and preferred suppliers, laboratory proficiency testing service providers, hospitals and clinical diagnostic laboratories, specialty laboratories, distributors, contract research organizations, academic & research institutes, and technology developers. Primary sources also included standard and certification organizations from companies and organizations related to all segments of this industry’s value chain.

Secondary Research

In the secondary research process, various sources such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and companies’ house documents were referred to, to identify and collect information useful for a technical, market-oriented, and commercial study of the laboratory proficiency testing market. These secondary sources include Clinical and Laboratory Standards Institute (CLSI), Clinical Laboratory Improvement Amendments (CLIA), National Accreditation Board for Testing and Calibration Laboratories (NABL), National Association for Proficiency Testing (NAPT), International Organization for Standardization (ISO), World Health Organization (WHO), Quality Council of India (QCI), and College of American Pathologists (CAP). Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

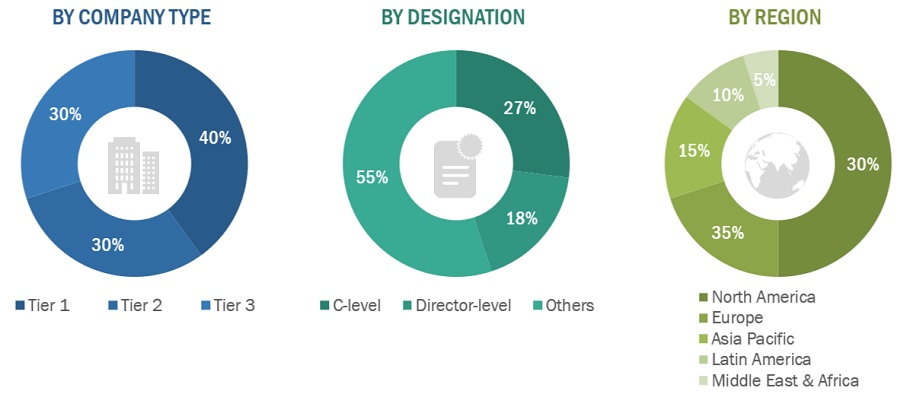

The laboratory proficiency testing market comprises several stakeholders such as laboratory proficiency testing service providers, end-users such as hospitals and clinical diagnostic laboratories and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in the hospitals and clinical laboratories, food testing laboratories, analytical laboratories, water, environmental testing laboratories, and cannabis testing laboratories, among others. The primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies operating in the laboratory proficiency testing market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of primary respondents:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Merck |

Head of Field Sales Advanced Analytical |

|

Cardinal Foods, LLC |

QA Manager |

|

Global Proficiency Testing Ltd. |

Project Manager |

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the laboratory proficiency testing market and to estimate the size of various other dependent submarkets in the overall laboratory proficiency testing market.

The research methodology used to estimate the market size includes the following details:

- The market value of laboratory proficiency testing for clinical diagnostics, food and animal feed, microbiology, environmental, commercial beverages, pharmaceuticals, water, nutraceuticals, biologics, cannabis, dietary supplements, and cosmetics have been extracted from the repository and validated through secondary and primary research.

- The market shares of the polymerase chain reaction (PCR), cell culture, immunoassay, chromatography, spectroscopy, and other technologies have been extracted from the repository and validated through secondary and primary research.

- This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives.

- The bottom-up approach has been applied to different regions and other segments of the laboratory proficiency testing market. All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Approach to calculating the revenue of different players in the Laboratory Proficiency Testing market.

In this report, the global laboratory proficiency testing market size was arrived at by using the revenue share analysis of leading players. For this purpose, major players in the market were identified, and their revenues from the laboratory proficiency testing business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key market players’ marketing executives.

Approach to derive the market size and estimate market growth.

The total size of the laboratory proficiency testing market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Proficiency testing (PT) is the testing of unknown samples sent to a laboratory from an approved provider to evaluate the ability of the laboratory to produce an analytical test along with the verification of the accuracy and reliability of its testing; PT can also be used to validate the entire testing process, including competency of the testing personnel. Proficiency testing comprises an inter-laboratory system for the regular testing of the accuracy that the participant laboratories can achieve. In its usual form, the organizers of the scheme distribute portions of a homogeneous material to each of the participants who analyze the material under typical conditions and report the result to the organizers. The organizers compile the results and inform the participants of the outcome, usually in the form of a score relating to the accuracy of the result.

Key Stakeholders

- Healthcare analytical testing service providers

- Laboratory proficiency testing service providers

- Hospitals and clinical diagnostic laboratories

- Pharmaceutical & biotechnology companies

- Contract research organizations (CROs)

- Food & animal feed testing service providers

- Water and environmental testing companies

- Cannabis/opioid testing service providers

- Commercial beverages and cosmetics testing companies

- Venture capitalists and investors

- Group purchasing organizations (GPOs)

- Research institutes and government organizations

- Market research and consulting firms

- Contract manufacturing organizations (CMOs)

Report Objectives

- To define, describe, and forecast the global laboratory proficiency testing market on the basis of industry, technology, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall laboratory proficiency testing market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for key market players

- To forecast the size of the laboratory proficiency testing market with respect to five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To profile the key players in the global laboratory proficiency testing market and comprehensively analyze their core competencies2 and market shares in terms of key market developments, product portfolios, and financials

- To track and analyze competitive developments such as mergers and acquisitions, expansions, partnerships, product launches, collaborations, and agreements of leading players in the global laboratory proficiency testing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix: Detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the Latin American laboratory proficiency testing market into Brazil, Mexico, and others.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laboratory Proficiency Testing Market