Life Science Instrumentation Market Size, Growth, Share & Trends Analysis

Life Science Instrumentation Market by Technology (Spectroscopy, Chromatography, Immunoassay, NGS, PCR, Microscopy), Application (Diagnostic, Clinical), End User (Pharma, Agriculture & Food Industry, Hospital, Diagnostic Lab) - Global Forecasts to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

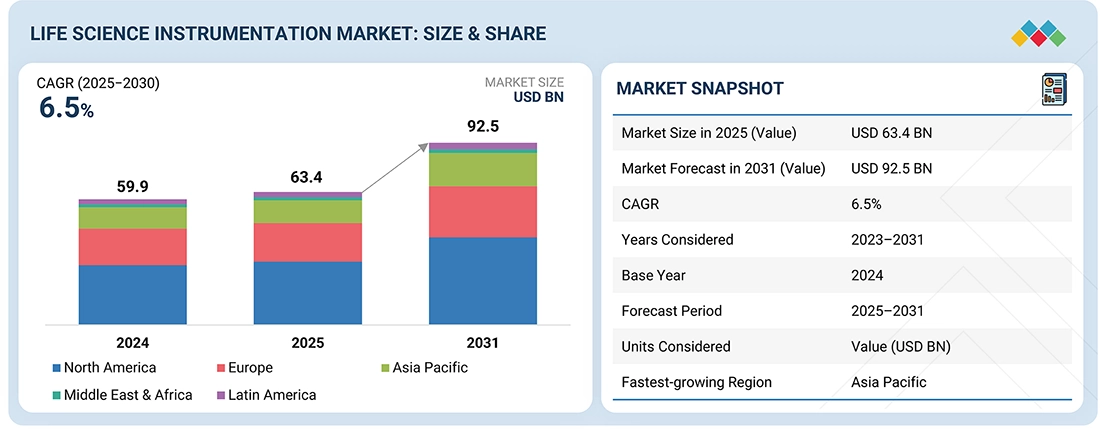

The global life science instrumentation market is expected to experience significant growth, with projections indicating it will reach USD 92.5 billion by 2031, up from USD 63.4 billion in 2025, representing a CAGR of 6.5%. The main drivers of the life science instrumentation market include increasing demand for advanced analytical technologies in drug discovery, genomics, and proteomics research, along with rising investments in pharmaceutical and biotechnology R&D.

KEY TAKEAWAYS

-

BY TECHNOLOGYIn the technology sector, spectroscopy instruments dominate the market share, driven by the rising adoption of portable, hybrid, and multi-modal spectroscopic systems for quick molecular analysis. The incorporation of AI and machine learning further improves automated data interpretation and analytical precision, supporting their widespread use.

-

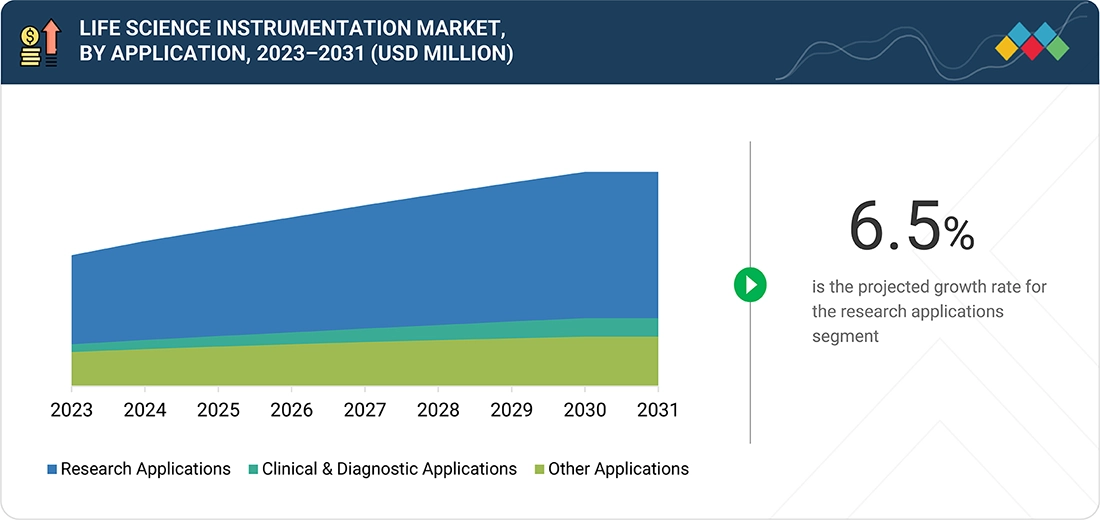

BY APPLICATIONIn the application segment, the research application segment holds the largest market share, driven by the growing focus on genomics, proteomics, and metabolomics studies, which increases the demand for advanced analytical tools. Additionally, rising investments from academic institutions, government bodies, and private research organizations are improving laboratory infrastructure and research capabilities.

-

BY END-USERSIn the end user segment, pharmaceutical and biotechnology companies represent a large portion, driven by the growing use of advanced analytical instruments such as mass spectrometry, spectroscopy, and molecular diagnostic systems for early disease detection and precise diagnostics. The rising focus on personalized medicine and biomarker-based testing is also increasing the demand for high-sensitivity instruments.

-

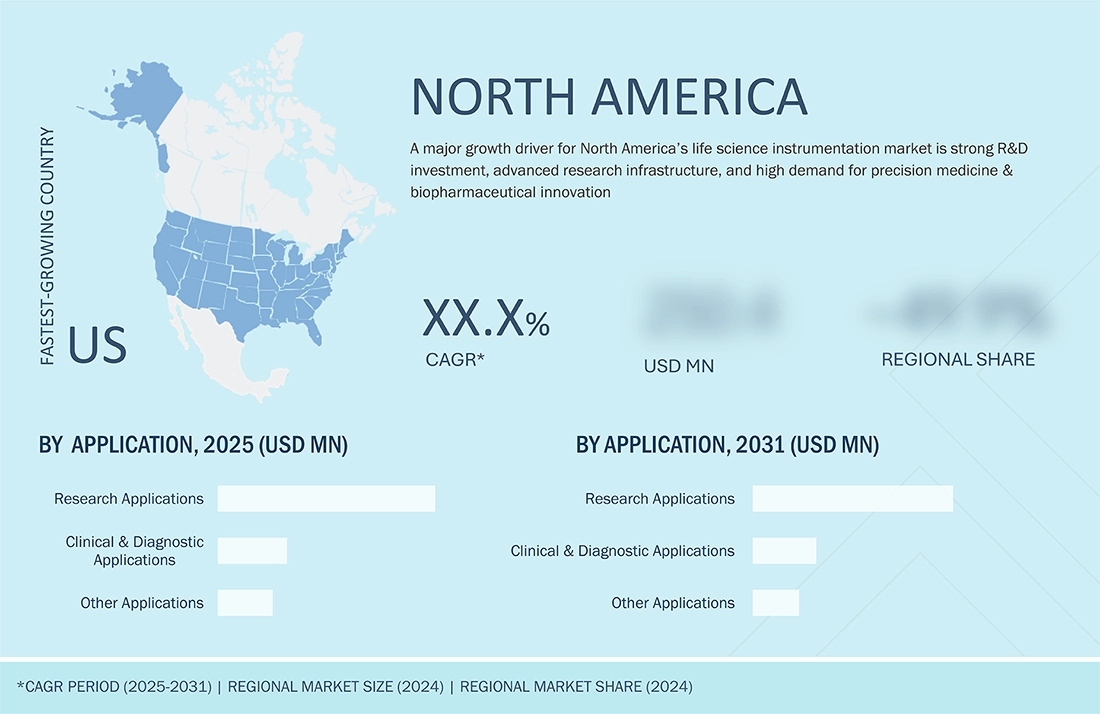

BY REGIONNorth America has the largest market share, driven by its robust R&D infrastructure, widespread use of advanced analytical technologies, and significant funding from both government and private sectors.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including product launches. For example, Waters Corporation launched the Xevo Charge Detection Mass Spectrometer (CDMS), providing unprecedented measurement and characterization capabilities for large biomolecules essential to next-generation therapeutics and structural biology.

Growing emphasis on precision medicine, automation, and high-throughput analysis has further boosted instrument adoption across clinical, academic, and industrial laboratories. Additionally, advances in spectroscopy, chromatography, and molecular analysis, along with expanding applications in healthcare, food safety, and environmental testing, are driving market growth. Supportive government funding, regulatory compliance requirements, and the integration of AI and digital tools into laboratory workflows continue to propel the global life science instrumentation market.

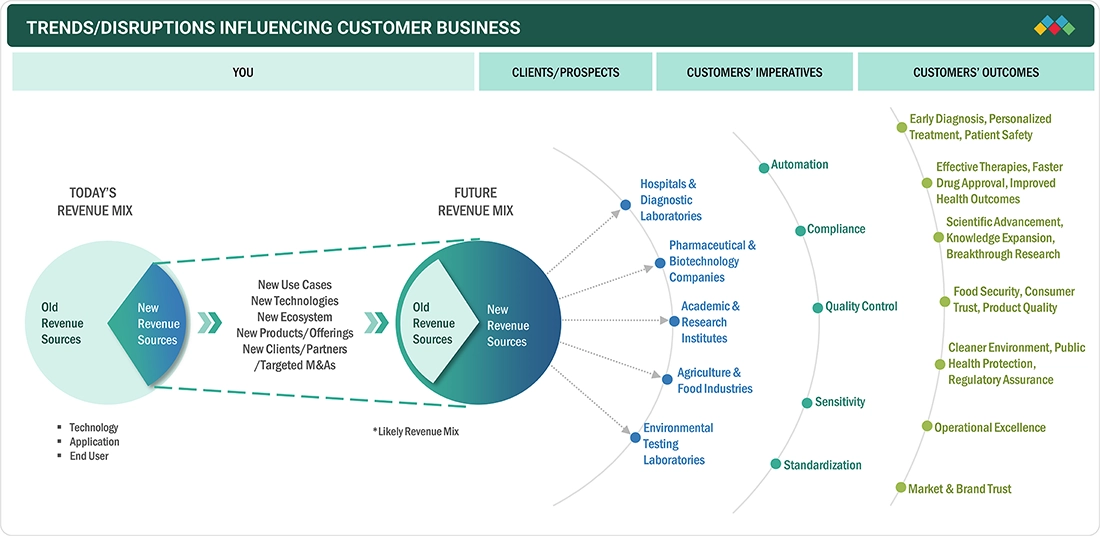

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The life science instrumentation market is experiencing several trends and disruptions that are significantly impacting customers’ customers, especially in healthcare, pharmaceuticals, agriculture, and environmental sectors. The growing trend toward personalized medicine and precision diagnostics is prompting hospitals and clinicians to seek faster, more accurate analytical results, encouraging instrument users to adopt advanced, automated, and AI-enabled systems. In the pharmaceutical and biotechnology industries, patients and healthcare providers are gaining from faster drug discovery, improved therapeutic effectiveness, and shorter time-to-market due to innovations in chromatography, spectroscopy, and liquid handling technologies. In the food and agriculture sectors, increasing consumer expectations for safety, traceability, and quality are driving the adoption of more rigorous analytical testing protocols. Similarly, rising public and regulatory awareness of environmental sustainability is motivating testing laboratories to use high-sensitivity instruments for pollution and contamination monitoring. Overall, the integration of digitalization, data sharing, and sustainability goals is transforming downstream customer demands, leading end-users of life science instrumentation to focus on greater accuracy, transparency, and efficiency to provide measurable value across the scientific and industrial ecosystems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing investment in pharmaceutical R&D

-

Growing concerns regarding food contamination

Level

-

Premium product pricing for instruments

-

Shortage of skilled professionals

Level

-

Growing opportunities from CRO, CDMO, and CTL expansion

-

Broad applications of analytical instruments across industries

Level

-

Inadequate healthcare infrastructure in emerging economics

-

Data privacy concerns associated with NGS software

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing investment in pharmaceutical R&D

Rising investment in pharmaceutical R&D continues to drive the growth of the life science instrumentation market. Global pharmaceutical and biotech companies, supported by government funding and private capital, are significantly expanding their research pipelines and manufacturing infrastructure. This expansion increases demand for high-performance analytical, separation, imaging, and automation instruments crucial for genomics, proteomics, cell therapy, bioprocessing, and formulation workflows. The surge in R&D activities leads to greater needs for high-throughput screening, advanced molecular characterization, and data-driven process optimization. For example, • In October 2025, Merck broke ground on a USD 3 billion Center of Excellence for pharmaceutical manufacturing in Elkton, Virginia, to accelerate drug development and scale-up operations • In August 2025, Johnson & Johnson (J&J) announced an expansion into North Carolina with a 160,000+ sq. ft. biopharmaceutical manufacturing facility at Fujifilm Biotechnologies’ new site in Holly Springs, boosting biologics production capacity. • In September 2025, GSK revealed a $30 billion investment over the next five years to strengthen its R&D and supply chain infrastructure in the US. The UK-based firm stated this includes a $1.2 billion allocation for advanced manufacturing facilities and AI integration to develop next-generation biopharma factories and labs. • In July 2025, AstraZeneca announced a USD 50 billion investment plan in the U.S. through 2030, focused on establishing a new multi-billion-dollar manufacturing facility to produce drug substances for its weight-management and metabolic portfolio, including an oral GLP-1, baxdrostat, an oral PCSK9 inhibitor, and combination small-molecule products. This facility will focus on small molecules, peptides, and oligonucleotides, building on the company’s earlier USD 3.5 billion investment announced in November 2024. • In April 2025, Roche stated plans to invest USD 50 billion in pharmaceuticals and diagnostics in the U.S. over the next five years, aiming to strengthen its innovation and manufacturing capabilities. Such large-scale investments reflect a strong push toward advanced biologics and next-generation therapeutics, directly influencing demand for precision analytical instruments, chromatography systems, mass spectrometers, sequencing platforms, and lab automation solutions. Instrument manufacturers benefit from this momentum as pharmaceutical companies increasingly adopt integrated and digital research environments to improve efficiency, ensure regulatory compliance, and cut time-to-market. Additionally, the ongoing global focus on biologics, vaccines, and personalized medicine reinforces the long-term growth prospects for life science instrumentation, as these tools remain essential for discovery, validation, and production workflows throughout the drug development process. chain

Restraint: Shortage of skilled professionals

The life science instrumentation market is facing a significant shortage of skilled professionals capable of efficiently operating, maintaining, and interpreting data from advanced analytical, imaging, and automation systems. Rapid advances in genomics, proteomics, and cell-based research have outpaced the number of trained experts, creating a growing gap between the complexity of modern instruments and user proficiency. This issue is especially severe in emerging regions, where limited access to specialized training, high technical requirements, and evolving digital workflows hinder adoption. As a result, research productivity and instrument utilization often suffer, prompting manufacturers and academic institutions to focus on workforce development, technical training programs, and user-friendly system designs to close the skills gap. For example, the Pistoia Alliance—a global non-profit promoting collaboration in life sciences R&D—released its 2025 Lab of the Future survey in partnership with Open Pharma Research, gathering insights from over 200 professionals across pharma, biotech, software, academia, and non-profits in Europe, the Americas, and APAC. The results show that more than 75% of life science laboratories plan to implement artificial intelligence (AI) within the next two years, with AI remaining the top investment priority for 63% of respondents for the third consecutive year. However, the survey also highlights a growing talent shortage, as 34% of participants cited the lack of qualified personnel as a major obstacle—up from 23% in 2024.

Opportunity: Growing opportunities from CRO, CDMO, and CTL expansion

The growing expansion of CROs, CDMOs, and CTLs opens significant opportunities for the life science instrumentation market. As biopharmaceutical and biotechnology companies increasingly outsource research, production, and quality assurance to improve efficiency and reduce costs, the demand for advanced analytical, imaging, separation, and automation tools is rapidly increasing. CROs and CDMOs depend on high-precision, high-throughput technologies to support drug discovery, formulation, and process optimization, while CTLs require robust systems to ensure product quality and regulatory compliance. This trend toward outsourcing continues to drive investment in next-generation instrumentation solutions that enhance accuracy, accelerate development timelines, and boost overall laboratory productivity. For instance, in October 2024, Samsung Biologics, a leading global CDMO, announced its largest-ever manufacturing contract with a major pharmaceutical company based in Asia, with production taking place at its state-of-the-art biomanufacturing facility in Songdo, South Korea. Earlier, in September 2024, Samsung Biologics launched two innovative biological development platforms, S-AfuCHO and S-OptiCharge. S-AfuCHO allows for the production of fucosylated antibodies with improved antibody-dependent cellular cytotoxicity (ADCC) for better therapeutic results, while S-OptiCharge serves as an upstream platform to optimize a molecule’s charge variant distribution. These developments underscore how CDMOs are fueling demand for advanced life science instrumentation to support innovative biology and manufacturing.

Challenge: Inadequate healthcare infrastructure in emerging economics

Inadequate healthcare infrastructure in emerging economies presents a significant challenge to the growth of the life science instrumentation market. Many developing countries face limitations in laboratory capacity, diagnostic facilities, and research infrastructure, which restrict the adoption of advanced analytical, imaging, and automation tools. Factors such as insufficient funding for healthcare and R&D, a shortage of skilled professionals, poor maintenance capabilities, and uneven distribution of healthcare resources between urban and rural areas further hinder market growth. Additionally, outdated laboratory setups and limited access to modern technologies slow down activities like clinical research, disease diagnosis, and drug development. Although government initiatives and public-private partnerships are being introduced to strengthen healthcare systems and research capabilities, the pace of infrastructure modernization remains slow compared to the rapid progress in science and technology. As a result, instrument manufacturers face barriers to market expansion, service delivery, and user training in these regions, emphasizing the need for sustained investment in healthcare infrastructure to enable the effective use of life science instrumentation. These emerging economies are experiencing continuous growth, which creates an ongoing need for advancements in their healthcare systems. The rapidly growing population in these areas increases pressure on medical services. While higher healthcare spending and funding initiatives support infrastructure development to some degree, challenges persist. These include an increasing number of patients with chronic diseases and high treatment costs that are often limited by reimbursement options.

Life Science Instrumentation Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilizes advanced mass spectrometry and sequencing instruments for early disease detection and personalized treatment. | Enhanced diagnostic accuracy, faster turnaround time, and improved patient outcomes through precision-based, data-driven clinical decision-making |

|

Advanced life science instrumentation such as chromatography, mass spectrometry, and cell analysis systems for drug discovery, biologics development, and quality control of vaccines and therapeutics | Accelerated R&D timelines, enhanced data accuracy, and improved efficiency in developing safe and effective medicines |

|

Advanced life science instrumentation such as spectroscopy, chromatography, and mass spectrometry to analyze food composition, detect contaminants, and ensure product safety and nutritional quality across its global supply chain. | Improved food safety, consistent product quality, regulatory compliance, and enhanced consumer trust. |

|

Advanced life science instrumentation such as mass spectrometry, gas chromatography, and molecular spectroscopy to detect pollutants, microplastics, and chemical residues in air, water, and soil samples | Higher analytical precision, faster contamination detection, regulatory compliance, and improved environmental and public health protection. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market ecosystem for the life science instrumentation industry is highly interconnected, including manufacturers, raw material suppliers, regulatory authorities, and end-users who collectively drive innovation, compliance, and adoption. Manufacturers are at the core of this ecosystem, developing advanced analytical, molecular, and imaging instruments used in life sciences, such as spectroscopy, chromatography, sequencing, and liquid handling systems. These companies focus on integrating automation, AI, and digital technologies to improve precision, throughput, and reproducibility. Raw material suppliers provide vital components like optical elements, precision electronics, reagents, columns, and high-grade metals, ensuring consistent quality and performance of instrumentation. Regulatory authorities, including the US FDA, EMA (Europe), PMDA (Japan), and CDSCO (India), play a key role in maintaining product safety, performance standards, and compliance through strict approval and quality frameworks. End-users such as hospitals and diagnostic laboratories, pharmaceutical and biotechnology companies, academic and research institutes, food and agriculture industries, and environmental testing labs use these instruments for applications ranging from disease diagnosis and drug discovery to quality control and sustainability monitoring. Together, these interconnected stakeholders create a dynamic ecosystem that promotes technological advancement, ensures regulatory compliance, and drives the global growth of the life science instrumentation market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Life Science Instrumentation Market, By Technology

The life science instrumentation market is segmented into spectroscopy, chromatography, polymerase chain reaction (quantitative PCR, digital PCR), immunoassays, lyophilization, liquid handling systems, clinical chemistry analyzers, microscopy, flow cytometry, Next-Generation Sequencing, centrifuges, electrophoresis, cell counting, and other technologies. The growth of spectroscopy technology in life science instrumentation is fueled by the increasing demand for precise molecular characterization and biomolecular analysis in research and diagnostic fields. Rapid technological advancements, including high-resolution detectors, advanced laser sources, and automation, have significantly enhanced the sensitivity, speed, and efficiency of spectroscopic instruments. The growing fields of proteomics, metabolomics, and structural biology further drive the adoption of spectroscopic techniques such as mass spectrometry, Raman, and infrared spectroscopy for detailed chemical and biological profiling. Additionally, the rising emphasis on personalized medicine, strict quality control in biopharmaceutical manufacturing, and adherence to regulatory standards in clinical testing are boosting the global integration of spectroscopy technologies across laboratories, research centers, and industries.

Life Science Instrumentation Market, Application

The life science instrumentation market is categorized into research applications, clinical & diagnostic applications, and other uses. The primary drivers for research applications in this market include the growing focus on understanding complex biological systems through genomics, proteomics, and metabolomics studies, which rely heavily on advanced analytical and imaging technologies. Increased investments from academic institutions, government agencies, and public-private research partnerships are also contributing to higher demand for high-performance instruments. Moreover, ongoing technological progress—such as automation, miniaturization, AI-driven data processing, and integrated laboratory systems—are improving research accuracy, speed, and reproducibility. These innovations make life science instruments crucial for advancing scientific discovery, innovation, and translational research across multiple fields.

REGION

North America to be fastest-growing region in global life science instrumentation market during forecast period

The life science instrumentation market is divided into five major regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America led the global market, with Europe and Asia-Pacific following. Growth in North America is mainly driven by significant government and private investments in biomedical and genomic research, supported by a strong network of academic and research institutions and the presence of top pharmaceutical and biotech companies. The region’s advanced healthcare infrastructure, quick adoption of cutting-edge analytical technologies, and clear regulatory framework also help maintain its market leadership. Additionally, increasing focus on precision medicine, expanding biopharmaceutical manufacturing, and rising automation in laboratories are driving ongoing investment in high-performance life science instruments across the US and Canada.

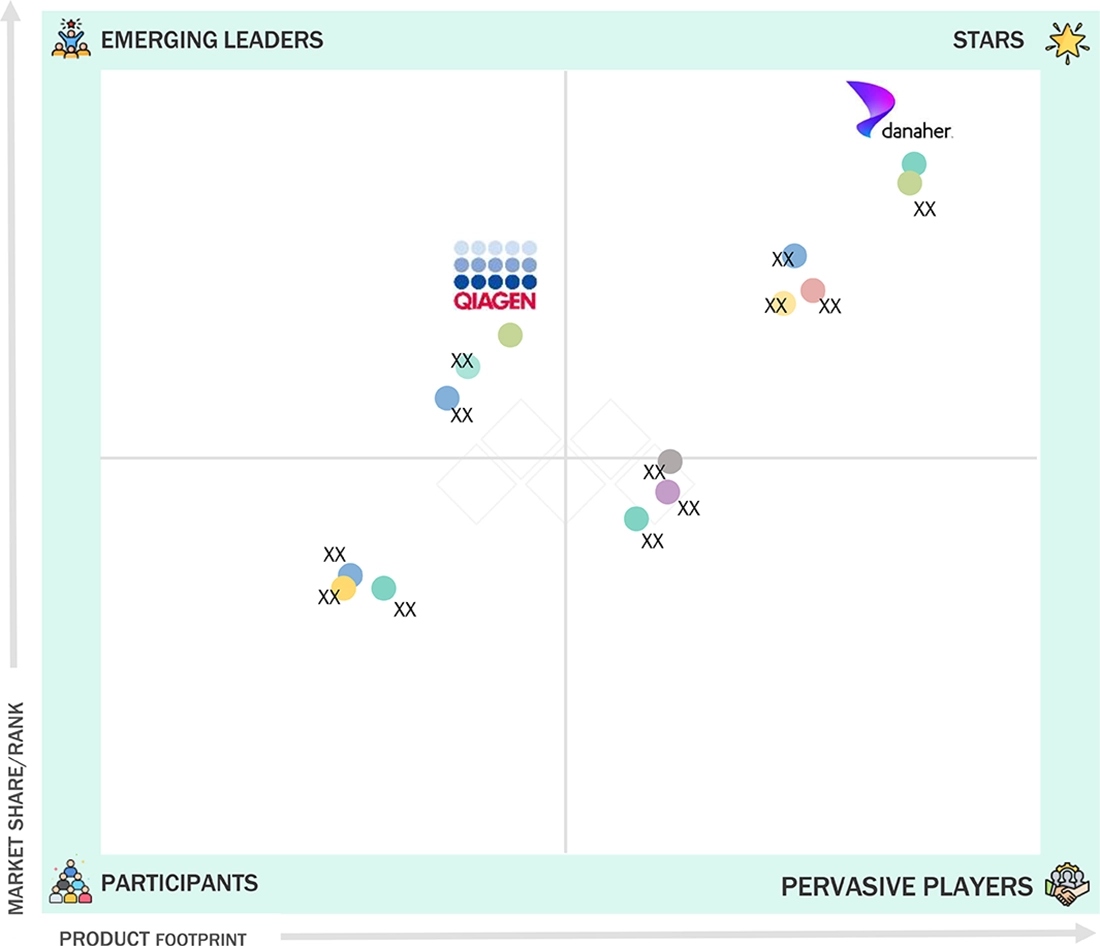

Life Science Instrumentation Market: COMPANY EVALUATION MATRIX

In the company evaluation matrix for the life science instrumentation market, Danaher Corporation is classified as a Star Player, reflecting its strong market presence, extensive product portfolio, and ongoing innovation across analytical, molecular, and laboratory automation technologies. Danaher’s strategic acquisitions, robust R&D capabilities, and global reach help it sustain leadership and promote growth in various life science segments. Meanwhile, QIAGEN is categorized as an Emerging Leader, gradually expanding its presence through advancements in molecular diagnostics, sample preparation, and nucleic acid analysis. The company’s focus on affordable, user-friendly technologies and its growing footprint in emerging markets position it for faster growth and increased competitiveness in the years ahead.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 63.4 Billion |

| Market Forecast in 2031 (Value) | USD 92.5 Billion |

| Growth Rate | CAGR of 6.5% from 2025-2031 |

| Years Considered | 2023-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

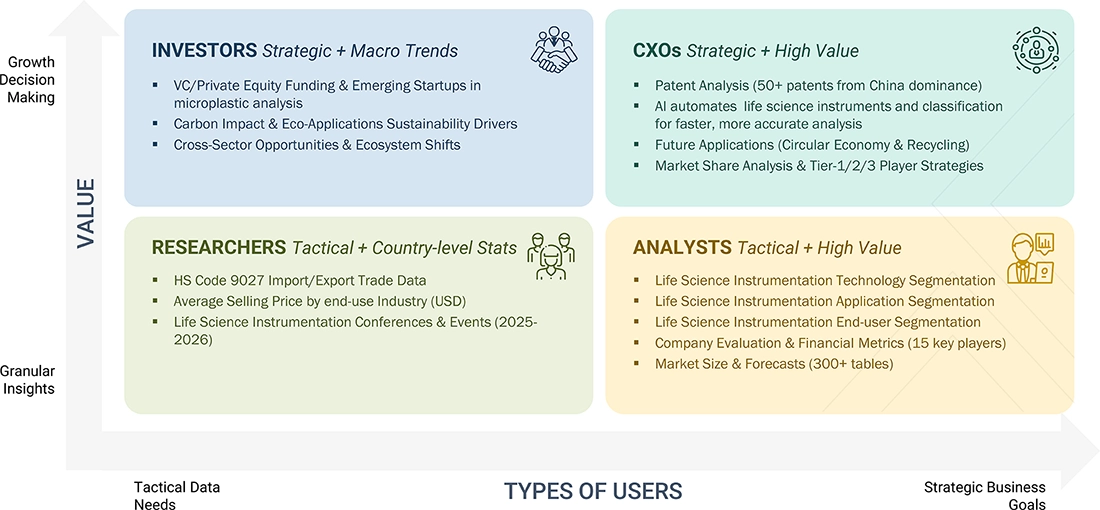

WHAT IS IN IT FOR YOU: Life Science Instrumentation Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Flexibility in instrument configuration to match diverse research or diagnostic needs | Modular and configurable instrument designs | Tailored performance for specific applications |

| Seamless integration with existing laboratory information systems (LIMS/ELN) | Software interfaces optimized for interoperability | Unified data management and streamlined workflows |

RECENT DEVELOPMENTS

- October 2025 : Waters Corporation launched the Xevo Charge Detection Mass Spectrometer (CDMS), offering unprecedented measurement and characterization capabilities for large biomolecules essential to next-generation therapeutics and structural biology.

- June, 2025 : Agilent Technologies introduced the InfinityLab Pro iQ Series at ASMS 2025, marking the next generation of LC-mass detection systems. The series offers enhanced sensitivity and performance for analyzing oligonucleotides, peptides, and proteins, along with intelligent features for real-time monitoring, simplified maintenance, and reduced downtime.

- June, 2025 : Thermo Fisher Scientific unveiled next-generation instruments and software solutions for omics, biopharma, and environmental workflows, marking a major leap in analytical performance aimed at uncovering complex biological processes and advancing disease, environmental, and food safety research.

Table of Contents

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising investments in pharmaceutical R&D- Growing concerns regarding food contamination- Increasing public-private investments in life science research- Rising incidence of infectious diseases and genetic disorders- Technological advancements in NGS platforms- Growing significance of biomolecular analysis- Growing use of capillary electrophoresis with mass spectroscopy- Increasing adoption of flow cytometry techniques in research laboratories- Rising incidence of hospital-acquired infectionsRESTRAINTS- Premium product pricing for instruments- Shortage of skilled professionals- Technical limitations associated with qPCR and dPCR techniques- High cost of advanced microscopesOPPORTUNITIES- Growth opportunities in emerging economies- Broad applications of analytical instruments across industries- Application of NGS in precision medicine and molecular diagnostics- Growing preference for personalized medicineCHALLENGES- Inadequate healthcare infrastructure in emerging economies- Data privacy concerns associated with NGS software

-

5.3 INDUSTRY TRENDSRISING FOCUS ON DEVELOPMENT OF MINIATURE INSTRUMENTSINCREASING ADOPTION OF HYPHENATED TECHNOLOGIESCOLLABORATIONS BETWEEN ANALYTICAL INSTRUMENT MANUFACTURERS AND RESEARCH-ACADEMIA

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.5 TRADE ANALYSIS

-

5.6 PATENT ANALYSIS

-

5.7 ECOSYSTEM ANALYSIS

- 5.8 VALUE CHAIN ANALYSIS

-

5.9 SUPPLY CHAIN ANALYSISPROMINENT COMPANIESSMALL & MEDIUM-SIZED ENTERPRISESEND USERS

- 5.10 PRICING TREND ANALYSIS

-

5.11 TECHNOLOGY ANALYSISHPLC TECHNOLOGYSPECTROSCOPYMICROSCOPYPCR TECHNOLOGY

-

5.12 CASE STUDY ANALYSISTECHNOLOGICAL CHALLENGES IN CASE 1TECHNOLOGICAL CHALLENGES IN CASE 2INCREASING SALES MODEL IN CASE 3

-

5.13 REGULATORY ANALYSISUSEUROPEASIA PACIFICREST OF THE WORLD

- 5.14 KEY CONFERENCES AND EVENTS (2023–2024)

- 6.1 INTRODUCTION

-

6.2 SPECTROSCOPYMASS SPECTROMETERS- Rising analytical applications in laboratories to drive segmentMOLECULAR SPECTROMETERS- Applications in pathology detection and protein quantification to propel segmentATOMIC SPECTROMETERS- Utilization in environmental testing and industrial chemistry to support segment

-

6.3 CHROMATOGRAPHYLIQUID CHROMATOGRAPHY SYSTEMS- Rising use of LC systems in pharmaceutical processes to drive marketGAS CHROMATOGRAPHY SYSTEMS- Separation of volatile organic compounds in pharmaceutical and food & beverage industries to boost marketSUPERCRITICAL FLUID CHROMATOGRAPHY SYSTEMS- Advantages of low viscosity and high diffusivity to support marketTHIN-LAYER CHROMATOGRAPHY SYSTEMS- Rising use of TLC to separate several samples concurrently to aid market

-

6.4 POLYMERASE CHAIN REACTION (PCR)QUANTITATIVE PCR (QPCR)- Increasing adoption of qPCR among researchers and healthcare professionals to drive segmentDIGITAL PCR (DPCR)- Ongoing technological developments to drive segment

-

6.5 IMMUNOASSAYSHIGH SENSITIVITY AND ACCURACY OF IMMUNOASSAY TESTS TO AID MARKET

-

6.6 LYOPHILIZATIONTRAY-STYLE FREEZE DRYERS- Rising demand for freeze-dried in pharmaceutical industry to propel segmentMANIFOLD FREEZE DRYERS- Rising use in laboratories for storage of bottles and vials to drive segmentSHELL (ROTARY) FREEZE DRYERS- Rising research for development of food ingredients and biologic molecules to drive segment

-

6.7 LIQUID HANDLING SYSTEMSELECTRONIC LIQUID HANDLING SYSTEMS- High accuracy and reproducibility benefits in pharmaceutical industry to augment segmentAUTOMATED LIQUID HANDLING SYSTEMS- Elimination of cross-contamination and clogging to drive segmentMANUAL LIQUID HANDLING SYSTEMS MARKET- Rising use of manual systems by small-scale industries to drive segment

-

6.8 CLINICAL CHEMISTRY ANALYZERSRISING VOLUME OF CLINICAL TESTING PROCEDURES TO DRIVE MARKET

-

6.9 MICROSCOPYOPTICAL MICROSCOPES- Low maintenance costs and ease of use to drive segmentELECTRON MICROSCOPES- Increasing R&D and availability of funds to support segmentSCANNING PROBE MICROSCOPES- Rising applications in nanotechnology research to fuel segmentOTHER MICROSCOPES

-

6.10 FLOW CYTOMETRYCELL ANALYZERS- Ongoing technological advancements resulting in innovative product launches to fuel marketCELL SORTERS- Utilization of cost-efficient cell sorters in core laboratory functions to drive market

-

6.11 NEXT-GENERATION SEQUENCING (NGS)WIDE APPLICATION IN PERSONALIZED MEDICINE FOR CANCER AND GENETIC DISORDERS TO DRIVE MARKET

-

6.12 CENTRIFUGESMICROCENTRIFUGES- Growing use in blood transfusion and biomedical analysis to support segmentMULTIPURPOSE CENTRIFUGES- Applications in cell culture and microbiology to propel segmentMINICENTRIFUGES- Compact-sized and smooth functioning in clinical & diagnostic applications to support segmentULTRACENTRIFUGES- Routine density and size-gradient separations to support adoption of ultracentrifuges

-

6.13 ELECTROPHORESISGEL ELECTROPHORESIS SYSTEMS- Rising demand in proteomics research and personalized medicine to support marketCAPILLARY ELECTROPHORESIS SYSTEMS- Numerous analytical benefits offered by CE systems to support segment

-

6.14 CELL COUNTINGAUTOMATED CELL COUNTERS- Growing focus on research for life-threatening diseases to drive marketHEMOCYTOMETERS AND MANUAL CELL COUNTERS- Rising use of manual cell counters over automated cell counters to support market

-

6.15 OTHER TECHNOLOGIESLABORATORY FREEZERS- Rising demand for blood and blood components to drive market- Freezers- RefrigeratorsHEAT STERILIZATION- Rising incidence of hospital-acquired infections to drive market- Moist heat/Steam sterilization instruments- Dry heat sterilization instrumentationMICROPLATE SYSTEMS- Wide applications in several industries to support market growth- Microplate readers- Microplate dispensers- Microplate washersLABORATORY BALANCES- Increasing adoption of laboratory balances due to technical benefits to support market growthCOLORIMETERS- Low price and ease of operation to support marketINCUBATORS- Rising demand for microbiological applications to drive marketFUME HOODS- Improvements in device structure to fuel marketROBOTIC SYSTEMS- Technological advancements to support market- Robotic arms- Track robot systemsPH METERS- Applications in pharmaceutical and food & beverage industries to drive marketCONDUCTIVITY AND RESISTIVITY METERS- Efficient operation and low cost benefits to support marketDISSOLVED CO2 AND O2 METERS- Rising utilization in water testing to fuel marketTITRATORS- Quality control testing for industrial chemical applications to support market growthGAS ANALYZERS- Utilization in iron and steel industries to support market growthTOC ANALYZERS- Critical parameter for water testing & purification to drive marketTHERMAL ANALYZERS- Applications in polymer & metal industries to fuel segmentSHAKERS/ROTATORS AND STIRRERS- Increasing research in pharmaceutical & biotechnology research to drive market

- 7.1 INTRODUCTION

-

7.2 RESEARCH APPLICATIONSRISING RESEARCH ACTIVITIES IN DRUG DISCOVERY & BIOMARKER DEVELOPMENT TO FUEL MARKET

-

7.3 CLINICAL & DIAGNOSTIC APPLICATIONSRISING PREVALENCE OF INFECTIOUS & TARGET DISEASES TO DRIVE MARKET

- 7.4 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 HOSPITALS AND DIAGNOSTIC LABORATORIESGROWING ADOPTION OF MOLECULAR DIAGNOSTICS TO DRIVE MARKET

-

8.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESGROWING FOCUS ON EXPANDING R&D FOR THERAPEUTIC DRUG PIPELINES TO DRIVE MARKET

-

8.4 ACADEMIC & RESEARCH INSTITUTESINCREASING NUMBER OF CLINICAL TRIALS AND RESEARCH ACTIVITIES TO BOLSTER DEMAND FOR LIFE SCIENCE INSTRUMENTS

-

8.5 AGRICULTURE & FOOD INDUSTRIESGROWING FOCUS ON FOOD SAFETY AND QUALITY CONTROL TO DRIVE MARKET

-

8.6 ENVIRONMENTAL TESTING LABORATORIESINCREASING ADOPTION OF CHROMATOGRAPHY INSTRUMENTS FOR AIR QUALITY TESTING TO DRIVE MARKET

-

8.7 CLINICAL RESEARCH ORGANIZATIONSOUTSOURCING OF R&D ACTIVITIES BY PHARMA & BIOTECH COMPANIES TO SUPPORT MARKET GROWTH

- 8.8 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Increased presence of major pharmaceutical and biotechnology companies to drive marketCANADA- Increasing funding for genomic and clinical research to increase adoption of life science instrumentation technologies

-

9.3 EUROPEGERMANY- Favorable reimbursement and insurance scenarios for various diagnostic tests to support marketUK- Rising number of research activities and academia-industry partnerships to propel marketFRANCE- Increasing investments in infrastructure development for life science R&D to fuel marketSPAIN- Growing focus on cancer research and advanced R&D structure to support marketITALY- Growing advancements in biotechnology and increasing R&D investments by pharmaceutical companies to boost marketREST OF EUROPE

-

9.4 ASIA PACIFICJAPAN- Growing adoption of technologically advanced products to increase adoption of life science instrumentsCHINA- Increasing production and export of pharmaceuticals to favor market growthINDIA- Increasing healthcare expenditure and growing availability of advanced molecular diagnosis technology to drive marketAUSTRALIA- Rising healthcare spending, increasing cancer diagnostics, and growing agricultural research to augment marketSOUTH KOREA- High spending on research activities and developments in pharmaceutical drug discovery to positively influence marketREST OF ASIA PACIFIC

-

9.5 LATIN AMERICABRAZIL- Rising R&D activities and increasing growth in biologics sector to propel marketMEXICO- Presence of favorable business environment for market players to attract investment and drive marketREST OF LATIN AMERICA

-

9.6 MIDDLE EAST & AFRICAINCREASING GOVERNMENT EXPENDITURE AND DEVELOPING HEALTHCARE INFRASTRUCTURE TO FUEL MARKET

- 10.1 OVERVIEW

- 10.2 RIGHT-TO-WIN STRATEGIES ADOPTED BY PLAYERS

- 10.3 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS IN LIFE SCIENCE INSTRUMENTATION MARKET

- 10.4 REVENUE SHARE ANALYSIS

-

10.5 MARKET SHARE ANALYSISMARKET SHARE ANALYSIS FOR SPECTROSCOPYMARKET SHARE ANALYSIS FOR CHROMATOGRAPHYMARKET SHARE ANALYSIS FOR PCRMARKET SHARE ANALYSIS FOR NGS

-

10.6 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS (2022)

-

10.7 VENDOR INCLUSION CRITERIASTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

10.8 COMPANY EVALUATION QUADRANT FOR SMES/START-UPS (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 10.9 COMPETITIVE BENCHMARKING

-

10.10 COMPETITIVE SCENARIO AND TRENDSKEY PRODUCT LAUNCHESKEY DEALSOTHER KEY DEVELOPMENTS

-

11.1 KEY PLAYERSTHERMO FISHER SCIENTIFIC INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDANAHER CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAGILENT TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewWATERS CORPORATION- Business overview- products/Services/Solutions offered- Recent developmentsSHIMADZU CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsBECTON, DICKINSON AND COMPANY- Business overview- Products/Services/Solutions offered- Recent developmentsPERKINELMER INC.- Business overview- Products/Services/Solutions offered- Recent developmentsBIO-RAD LABORATORIES, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsBRUKER- Business overview- Products/Services/Solutions offered- Recent developmentsQIAGEN N.V.- Business overview- Products/Services/Solutions offered- Recent developmentsEPPENDORF SE- Business overview- Products/Services/Solutions offered- Recent developmentsHITACHI HIGH-TECHNOLOGIES CORPORATION- Business overview- Products/Services/solutions offered- Recent developmentsHORIBA, LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsMERCK KGAA- Business overview- Products/Services/Solutions offered- Recent developmentsJEOL LTD.- Business overview- Products/Services/Solutions offered- Recent developments

-

11.2 OTHER COMPANIESBIOMERIEUX S.A.CARL ZEISS AGTECAN TRADING AGSIGMA LABORZENTRIFUGEN GMBHILLUMINA, INC.AVANTOR, INC.OLYMPUS CORPORATIONOXFORD INSTRUMENTSGILSON INCORPORATEDGL SCIENCES INC.ACCU-SCOPEPANOMEX INC.CLEAVER SCIENTIFICMOTIC GROUPHYRIS LTD.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 IMPACT OF RESEARCH ASSUMPTIONS

- TABLE 2 LIFE SCIENCE INSTRUMENTATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 IMPORT DATA FOR INSTRUMENTS AND APPARATUS FOR PHYSICAL & CHEMICAL ANALYSIS, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 4 EXPORT DATA FOR INSTRUMENTS AND APPARATUS FOR PHYSICAL & CHEMICAL ANALYSIS, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 5 IMPORT DATA FOR ELECTRON MICROSCOPES, PROTON MICROSCOPES, AND DIFFRACTION APPARATUS, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 6 EXPORT DATA FOR ELECTRON MICROSCOPES, PROTON MICROSCOPES, AND DIFFRACTION APPARATUS, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 7 IMPORT DATA FOR CENTRIFUGES, BY COUNTRY, 2018–2022 (USD THOUSANDS)

- TABLE 8 EXPORT DATA FOR CENTRIFUGES, BY COUNTRY, 2018–2022 (USD THOUSANDS)

- TABLE 9 IMPORT DATA FOR LYOPHILIZATION, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR LYOPHILIZATION, BY COUNTRY, 2018–2022 (USD THOUSANDS)

- TABLE 11 IMPORT DATA FOR LIQUID HANDLING, BY COUNTRY, 2018–2022 (USD THOUSANDS)

- TABLE 12 EXPORT DATA FOR LIQUID HANDLING, BY COUNTRY, 2018–2022 (USD THOUSANDS)

- TABLE 13 IMPORT DATA FOR CELL SORTING, BY COUNTRY, 2018–2022 (USD THOUSANDS)

- TABLE 14 EXPORT DATA FOR CELL SORTING, BY COUNTRY, 2018–2022 (USD THOUSANDS)

- TABLE 15 IMPORT DATA FOR CELL COUNTING, BY COUNTRY, 2018–2022 (USD THOUSANDS)

- TABLE 16 EXPORT DATA FOR CELL COUNTING, BY COUNTRY, 2018–2022 (USD THOUSANDS)

- TABLE 17 IMPORT DATA FOR FLOW CYTOMETRY, BY COUNTRY, 2018–2022 (USD THOUSANDS)

- TABLE 18 EXPORT DATA FOR FLOW CYTOMETRY, BY COUNTRY, 2018–2022 (USD THOUSANDS)

- TABLE 19 AVERAGE SELLING PRICE OF LIFE SCIENCE INSTRUMENTS

- TABLE 20 CASE 1: GETTING ACQUAINTED WITH INNOVATIVE TECHNOLOGIES

- TABLE 21 CASE–2: BUILDING A NEW AND AUTOMATED DIAGNOSTIC TESTING LABORATORY

- TABLE 22 CASE 3: DEPENDENCE ON CONTRACT MANUFACTURING AND OUTSOURCING OF ACTIVITIES

- TABLE 23 LIFE SCIENCE INSTRUMENTATION MARKET: MAJOR CONFERENCES AND EVENTS (2023-2024)

- TABLE 24 LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 25 LIFE SCIENCE INSTRUMENTATION MARKET FOR SPECTROSCOPY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 26 LIFE SCIENCE INSTRUMENTATION MARKET FOR SPECTROSCOPY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 LIFE SCIENCE INSTRUMENTATION MARKET FOR SPECTROSCOPY, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 28 LIFE SCIENCE INSTRUMENTATION MARKET FOR SPECTROSCOPY, BY END USER, 2021–2028 (USD MILLION)

- TABLE 29 LIFE SCIENCE INSTRUMENTATION MARKET FOR MASS SPECTROMETERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 LIFE SCIENCE INSTRUMENTATION MARKET FOR MOLECULAR SPECTROMETERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 LIFE SCIENCE INSTRUMENTATION MARKET FOR ATOMIC SPECTROMETERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 LIFE SCIENCE INSTRUMENTATION MARKET FOR CHROMATOGRAPHY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 33 LIFE SCIENCE INSTRUMENTATION MARKET FOR CHROMATOGRAPHY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 LIFE SCIENCE INSTRUMENTATION MARKET FOR CHROMATOGRAPHY, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 35 LIFE SCIENCE INSTRUMENTATION MARKET FOR CHROMATOGRAPHY, BY END USER, 2021–2028 (USD MILLION)

- TABLE 36 DIFFERENTIATION OF LIQUID CHROMATOGRAPHY SYSTEMS

- TABLE 37 LIFE SCIENCE INSTRUMENTATION MARKET FOR LIQUID CHROMATOGRAPHY SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 LIFE SCIENCE INSTRUMENTATION MARKET FOR GAS CHROMATOGRAPHY SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 LIFE SCIENCE INSTRUMENTATION MARKET FOR SUPERCRITICAL FLUID CHROMATOGRAPHY SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 LIFE SCIENCE INSTRUMENTATION MARKET FOR THIN-LAYER CHROMATOGRAPHY SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 LIFE SCIENCE INSTRUMENTATION MARKET FOR POLYMERASE CHAIN REACTION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 42 LIFE SCIENCE INSTRUMENTATION MARKET FOR POLYMERASE CHAIN REACTION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 LIFE SCIENCE INSTRUMENTATION MARKET FOR POLYMERASE CHAIN REACTION, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 44 LIFE SCIENCE INSTRUMENTATION MARKET FOR POLYMERASE CHAIN REACTION, BY END USER, 2021–2028 (USD MILLION)

- TABLE 45 LIFE SCIENCE INSTRUMENTATION MARKET FOR QPCR, BY REGION, 2021–2028 (USD MILLION)

- TABLE 46 LIFE SCIENCE INSTRUMENTATION MARKET FOR DPCR, BY REGION, 2021–2028 (USD MILLION)

- TABLE 47 LIFE SCIENCE INSTRUMENTATION MARKET FOR IMMUNOASSAYS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 48 LIFE SCIENCE INSTRUMENTATION MARKET FOR IMMUNOASSAYS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 49 LIFE SCIENCE INSTRUMENTATION MARKET FOR IMMUNOASSAYS, BY END USER, 2021–2028 (USD MILLION)

- TABLE 50 LIFE SCIENCE INSTRUMENTATION MARKET FOR LYOPHILIZATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 51 LIFE SCIENCE INSTRUMENTATION MARKET FOR LYOPHILIZATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 52 LIFE SCIENCE INSTRUMENTATION MARKET FOR LYOPHILIZATION, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 53 LIFE SCIENCE INSTRUMENTATION MARKET FOR LYOPHILIZATION, BY END USER, 2021–2028 (USD MILLION)

- TABLE 54 LIFE SCIENCE INSTRUMENTATION MARKET FOR TRAY-STYLE FREEZE DRYERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 55 LIFE SCIENCE INSTRUMENTATION MARKET FOR MANIFOLD FREEZE DRYERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 56 LIFE SCIENCE INSTRUMENTATION MARKET FOR SHELL (ROTARY) FREEZE DRYERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 57 LIFE SCIENCE INSTRUMENTATION MARKET FOR LIQUID HANDLING SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 58 LIFE SCIENCE INSTRUMENTATION MARKET FOR LIQUID HANDLING SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 59 LIFE SCIENCE INSTRUMENTATION MARKET FOR LIQUID HANDLING SYSTEMS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 60 LIFE SCIENCE INSTRUMENTATION MARKET FOR LIQUID HANDLING SYSTEMS, BY END USER, 2021–2028 (USD MILLION)

- TABLE 61 LIFE SCIENCE INSTRUMENTATION MARKET FOR ELECTRONIC LIQUID HANDLING SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 62 LIFE SCIENCE INSTRUMENTATION MARKET FOR AUTOMATED LIQUID HANDLING SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 63 LIFE SCIENCE INSTRUMENTATION MARKET FOR MANUAL LIQUID HANDLING SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 64 LIFE SCIENCE INSTRUMENTATION MARKET FOR CLINICAL CHEMISTRY ANALYZERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 65 LIFE SCIENCE INSTRUMENTATION MARKET FOR CLINICAL CHEMISTRY ANALYZERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 66 LIFE SCIENCE INSTRUMENTATION MARKET FOR CLINICAL CHEMISTRY ANALYZERS, BY END USER, 2021–2028 (USD MILLION)

- TABLE 67 LIFE SCIENCE INSTRUMENTATION MARKET FOR MICROSCOPY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 68 LIFE SCIENCE INSTRUMENTATION MARKET FOR MICROSCOPY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 69 LIFE SCIENCE INSTRUMENTATION MARKET FOR MICROSCOPY, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 LIFE SCIENCE INSTRUMENTATION MARKET FOR MICROSCOPY, BY END USER, 2021–2028 (USD MILLION)

- TABLE 71 LIFE SCIENCE INSTRUMENTATION MARKET FOR OPTICAL MICROSCOPES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 72 LIFE SCIENCE INSTRUMENTATION MARKET FOR ELECTRON MICROSCOPES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 73 LIFE SCIENCE INSTRUMENTATION MARKET FOR SCANNING PROBE MICROSCOPES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 74 LIFE SCIENCE INSTRUMENTATION MARKET FOR OTHER MICROSCOPES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 75 LIFE SCIENCE INSTRUMENTATION MARKET FOR FLOW CYTOMETRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 LIFE SCIENCE INSTRUMENTATION MARKET FOR FLOW CYTOMETRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 77 LIFE SCIENCE INSTRUMENTATION MARKET FOR FLOW CYTOMETRY, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 78 LIFE SCIENCE INSTRUMENTATION MARKET FOR FLOW CYTOMETRY, BY END USER, 2021–2028 (USD MILLION)

- TABLE 79 LIFE SCIENCE INSTRUMENTATION MARKET FOR CELL ANALYZERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 80 LIFE SCIENCE INSTRUMENTATION MARKET FOR CELL SORTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 81 LIFE SCIENCE INSTRUMENTATION MARKET FOR NEXT-GENERATION SEQUENCING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 82 LIFE SCIENCE INSTRUMENTATION MARKET FOR NEXT-GENERATION SEQUENCING, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 83 LIFE SCIENCE INSTRUMENTATION MARKET FOR NEXT-GENERATION SEQUENCING, BY END USER, 2021–2028 (USD MILLION)

- TABLE 84 LIFE SCIENCE INSTRUMENTATION MARKET FOR CENTRIFUGES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 85 LIFE SCIENCE INSTRUMENTATION MARKET FOR CENTRIFUGES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 86 LIFE SCIENCE INSTRUMENTATION MARKET FOR CENTRIFUGES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 87 LIFE SCIENCE INSTRUMENTATION MARKET FOR CENTRIFUGES, BY END USER, 2021–2028 (USD MILLION)

- TABLE 88 LIFE SCIENCE INSTRUMENTATION MARKET FOR MICROCENTRIFUGES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 89 LIFE SCIENCE INSTRUMENTATION MARKET FOR MULTIPURPOSE CENTRIFUGES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 90 LIFE SCIENCE INSTRUMENTATION MARKET FOR MINICENTRIFUGES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 91 LIFE SCIENCE INSTRUMENTATION MARKET FOR ULTRACENTRIFUGES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 92 LIFE SCIENCE INSTRUMENTATION MARKET FOR ELECTROPHORESIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 LIFE SCIENCE INSTRUMENTATION MARKET FOR ELECTROPHORESIS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 94 LIFE SCIENCE INSTRUMENTATION MARKET FOR ELECTROPHORESIS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 95 LIFE SCIENCE INSTRUMENTATION MARKET FOR ELECTROPHORESIS, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 LIFE SCIENCE INSTRUMENTATION MARKET FOR GEL ELECTROPHORESIS SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 97 LIFE SCIENCE INSTRUMENTATION MARKET FOR CAPILLARY ELECTROPHORESIS SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 98 LIFE SCIENCE INSTRUMENTATION MARKET FOR CELL COUNTING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 LIFE SCIENCE INSTRUMENTATION MARKET FOR CELL COUNTING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 100 LIFE SCIENCE INSTRUMENTATION MARKET FOR CELL COUNTING, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 101 LIFE SCIENCE INSTRUMENTATION MARKET FOR CELL COUNTING, BY END USER, 2021–2028 (USD MILLION)

- TABLE 102 LIFE SCIENCE INSTRUMENTATION MARKET FOR AUTOMATED CELL COUNTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 103 LIFE SCIENCE INSTRUMENTATION MARKET FOR HEMOCYTOMETERS AND MANUAL CELL COUNTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 104 LIFE SCIENCE INSTRUMENTATION MARKET FOR OTHER TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 105 LIFE SCIENCE INSTRUMENTATION MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 106 LIFE SCIENCE INSTRUMENTATION MARKET FOR LABORATORY FREEZERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 LIFE SCIENCE INSTRUMENTATION MARKET FOR LABORATORY FREEZERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 108 LIFE SCIENCE INSTRUMENTATION MARKET FOR HEAT STERILIZATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 LIFE SCIENCE INSTRUMENTATION MARKET FOR HEAT STERILIZATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 110 DRYING CYCLES RECOMMENDED AS PER BP (BRITISH PHARMACOPEIA), 1988

- TABLE 111 LIFE SCIENCE INSTRUMENTATION MARKET FOR MICROPLATE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 112 LIFE SCIENCE INSTRUMENTATION MARKET FOR MICROPLATE SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 113 LIFE SCIENCE INSTRUMENTATION MARKET FOR LABORATORY BALANCES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 114 LIFE SCIENCE INSTRUMENTATION MARKET FOR COLORIMETERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 115 LIFE SCIENCE INSTRUMENTATION MARKET FOR INCUBATORS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 116 LIFE SCIENCE INSTRUMENTATION MARKET FOR FUME HOODS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 117 LIFE SCIENCE INSTRUMENTATION MARKET FOR ROBOTIC SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 118 LIFE SCIENCE INSTRUMENTATION MARKET FOR ROBOTIC SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 119 LIFE SCIENCE INSTRUMENTATION MARKET FOR PH METERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 120 LIFE SCIENCE INSTRUMENTATION MARKET FOR CONDUCTIVITY AND RESISTIVITY METERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 121 LIFE SCIENCE INSTRUMENTATION MARKET FOR DISSOLVED CO2 AND O2 METERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 122 LIFE SCIENCE INSTRUMENTATION MARKET FOR TITRATORS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 123 LIFE SCIENCE INSTRUMENTATION MARKET FOR GAS ANALYZERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 124 LIFE SCIENCE INSTRUMENTATION MARKET FOR TOC ANALYZERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 125 LIFE SCIENCE INSTRUMENTATION MARKET FOR THERMAL ANALYZERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 126 LIFE SCIENCE INSTRUMENTATION MARKET FOR SHAKERS/ROTATORS AND STIRRERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 127 LIFE SCIENCE INSTRUMENTATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 128 LIFE SCIENCE INSTRUMENTATION MARKET FOR RESEARCH APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 129 LIFE SCIENCE INSTRUMENTATION MARKET FOR CLINICAL & DIAGNOSTIC APPLICATIONS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 130 LIFE SCIENCE INSTRUMENTATION MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 131 LIFE SCIENCE INSTRUMENTATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 132 LIFE SCIENCE INSTRUMENTATION MARKET FOR HOSPITALS AND DIAGNOSTIC LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 133 LIFE SCIENCE INSTRUMENTATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 134 LIFE SCIENCE INSTRUMENTATION MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 135 LIFE SCIENCE INSTRUMENTATION MARKET FOR AGRICULTURE & FOOD INDUSTRIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 136 LIFE SCIENCE INSTRUMENTATION MARKET FOR ENVIRONMENTAL TESTING LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 137 LIFE SCIENCE INSTRUMENTATION MARKET FOR CLINICAL RESEARCH ORGANIZATIONS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 138 LIFE SCIENCE INSTRUMENTATION MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 139 LIFE SCIENCE INSTRUMENTATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 141 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR SPECTROSCOPY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 143 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR CHROMATOGRAPHY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR PCR, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR LYOPHILIZATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR LIQUID HANDLING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 147 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR MICROSCOPY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR FLOW CYTOMETRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR CENTRIFUGES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 150 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR ELECTROPHORESIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 151 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR CELL COUNTING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 152 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR OTHER TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 153 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 155 US: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 156 CANADA: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 157 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 158 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 159 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET FOR SPECTROSCOPY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 160 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET FOR CHROMATOGRAPHY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET FOR PCR, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 162 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET FOR LYOPHILIZATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 163 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET FOR LIQUID HANDLING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 164 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET FOR MICROSCOPY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 165 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET FOR FLOW CYTOMETRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET FOR CENTRIFUGES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 167 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET FOR ELECTROPHORESIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 168 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET FOR CELL COUNTING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 169 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET FOR OTHER TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 170 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 171 EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 172 GERMANY: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 173 UK: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 174 FRANCE: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 175 SPAIN: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 176 ITALY: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 177 REST OF EUROPE: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET FOR SPECTROSCOPY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET FOR CHROMATOGRAPHY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET FOR PCR, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 183 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET FOR LYOPHILIZATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 184 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET FOR LIQUID HANDLING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 185 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET FOR MICROSCOPY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 186 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET FOR FLOW CYTOMETRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 187 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET FOR CENTRIFUGES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 188 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET FOR ELECTROPHORESIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 189 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET FOR CELL COUNTING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET FOR OTHER TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 191 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 192 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 193 JAPAN: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 194 CHINA: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 195 INDIA: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 196 AUSTRALIA: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 197 SOUTH KOREA: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 199 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 200 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 201 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR SPECTROSCOPY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 202 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR CHROMATOGRAPHY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 203 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR PCR, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 204 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR LYOPHILIZATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 205 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR LIQUID HANDLING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 206 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR MICROSCOPY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 207 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR FLOW CYTOMETRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 208 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR CENTRIFUGES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 209 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR ELECTROPHORESIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 210 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR CELL COUNTING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 211 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR OTHER TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 212 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 213 LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 214 BRAZIL: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 215 MEXICO: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 216 REST OF LATIN AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR SPECTROSCOPY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR CHROMATOGRAPHY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR PCR, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR LYOPHILIZATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR LIQUID HANDLING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR MICROSCOPY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR FLOW CYTOMETRY, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR CENTRIFUGES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR ELECTROPHORESIS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR CELL COUNTING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET FOR OTHER TECHNOLOGIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: LIFE SCIENCE INSTRUMENTATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 231 LIFE SCIENCE INSTRUMENTATION MARKET: KEY PRODUCT LAUNCHES, JANUARY 2020–FEBRUARY 2023

- TABLE 232 LIFE SCIENCE INSTRUMENTATION MARKET: KEY DEALS, JANUARY 2020–FEBRUARY 2023

- TABLE 233 LIFE SCIENCE INSTRUMENTATION MARKET: OTHER KEY DEVELOPMENTS, JANUARY 2020–FEBRUARY 2023

- TABLE 234 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 235 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 236 AGILENT TECHNOLOGIES, INC: COMPANY OVERVIEW

- TABLE 237 WATERS CORPORATION: COMPANY OVERVIEW

- TABLE 238 SHIMADZU CORPORATION: COMPANY OVERVIEW

- TABLE 239 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 240 PERKINELMER INC.: COMPANY OVERVIEW

- TABLE 241 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 242 BRUKER.: COMPANY OVERVIEW

- TABLE 243 QIAGEN N.V.: COMPANY OVERVIEW

- TABLE 244 EPPENDORF SE: COMPANY OVERVIEW

- TABLE 245 HITACHI HIGH-TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 246 HORIBA, LTD.: COMPANY OVERVIEW

- TABLE 247 MERCK KGAA: COMPANY OVERVIEW

- TABLE 248 JEOL LTD.: COMPANY OVERVIEW

- FIGURE 1 LIFE SCIENCE INSTRUMENTATION MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH FOR MARKET SIZE ESTIMATION: LIFE SCIENCE INSTRUMENTATION MARKET

- FIGURE 6 CAGR PROJECTION: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 LIFE SCIENCE INSTRUMENTATION MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 LIFE SCIENCE INSTRUMENTATION MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 LIFE SCIENCE INSTRUMENTATION MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 RISING INVESTMENTS IN PHARMACEUTICAL R&D AND INCREASING TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

- FIGURE 13 SPECTROSCOPY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 RESEARCH APPLICATIONS SEGMENT TO DOMINATE MARKET DURING STUDY PERIOD

- FIGURE 15 CHINA TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 LIFE SCIENCE INSTRUMENTATION MARKET: KEY DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 TOP 10 PATENT APPLICANTS FOR CHROMATOGRAPHY (JANUARY 2012–DECEMBER 2022)

- FIGURE 18 TOP 10 PATENT APPLICANTS FOR SPECTROSCOPY (JANUARY 2012–DECEMBER 2022)

- FIGURE 19 TOP 10 PATENT APPLICANTS FOR MICROSCOPY (JANUARY 2012–DECEMBER 2022)

- FIGURE 20 TOP 10 PATENT APPLICANTS FOR PCR (JANUARY 2012–DECEMBER 2022)

- FIGURE 21 TOP 10 PATENT APPLICANTS FOR LIQUID HANDLING (JANUARY 2012–DECEMBER 2022)

- FIGURE 22 TOP 10 PATENT APPLICANTS FOR NEXT-GENERATION SEQUENCING (JANUARY 2012–DECEMBER 2022)

- FIGURE 23 TOP 10 PATENT APPLICANTS FOR ELECTROPHORESIS (JANUARY 2012–DECEMBER 2022)

- FIGURE 24 VALUE CHAIN ANALYSIS

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- FIGURE 26 NORTH AMERICA: LIFE SCIENCE INSTRUMENTATION MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: LIFE SCIENCE INSTRUMENTATION MARKET SNAPSHOT

- FIGURE 28 REVENUE SHARE ANALYSIS OF TOP FIVE MARKET PLAYERS (2020–2022)

- FIGURE 29 THERMO FISHER SCIENTIFIC HELD LEADING POSITION IN LIFE SCIENCE INSTRUMENTATION MARKET IN 2022

- FIGURE 30 LIFE SCIENCE INSTRUMENTATION MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 31 LIFE SCIENCE INSTRUMENTATION MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2022)

- FIGURE 32 PRODUCT ANALYSIS OF TOP PLAYERS IN LIFE SCIENCE INSTRUMENTATION MARKET

- FIGURE 33 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2021)

- FIGURE 34 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 35 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 36 WATERS CORPORATION: COMPANY SNAPSHOT

- FIGURE 37 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 38 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- FIGURE 39 PERKINELMER INC.: COMPANY SNAPSHOT (2022)

- FIGURE 40 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 41 BRUKER: COMPANY SNAPSHOT (2021)

- FIGURE 42 QIAGEN N.V.: COMPANY SNAPSHOT (2021)

- FIGURE 43 EPPENDORF SE: COMPANY SNAPSHOT (2021)

- FIGURE 44 HITACHI HIGH-TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 45 HORIBA, LTD.: COMPANY SNAPSHOT (2021)

- FIGURE 46 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 47 JEOL LTD.: COMPANY SNAPSHOT (2021)

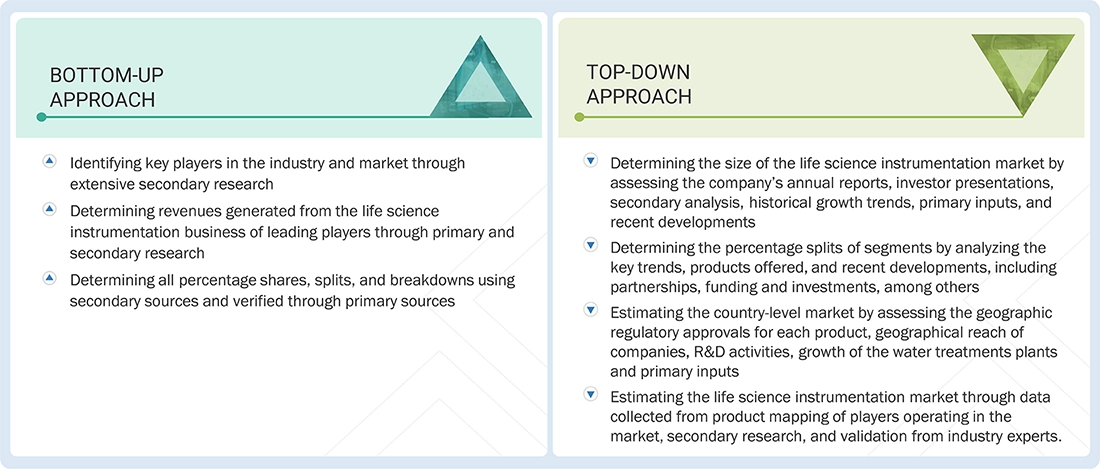

Methodology

The study involved four main activities to estimate the current size of the life science instrumentation market. Comprehensive secondary research was conducted to gather information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and size estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to determine the total market size. Then, market segmentation and data triangulation were applied to estimate the size of segments and subsegments.

Secondary Research

The secondary research process involves extensively using secondary sources, including directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was employed to gather information relevant to the detailed, technical, market-oriented, and commercial life science instrumentation market study. It also helped obtain important data about key players, market classification, and segmentation based on industry trends down to the most detailed levels, as well as significant developments from market and technology perspectives. Additionally, a database of key industry leaders was created using secondary sources research.

Primary Research

During the primary research process, various supply and demand sources were interviewed to gather both qualitative and quantitative data for this report. On the supply side, primary sources include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from various companies and organizations in the life science instrumentation market. On the demand side, the primary sources consist of pharma-biopharma companies, CDMOs, research labs, F&B companies, and service providers. This primary research aimed to validate market segmentation, identify key players, and collect insights on important industry trends and market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2021, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, the size of the life science instrumentation market was determined through revenue share analysis of leading players. To do this, key market players were identified, and their revenues from the market were estimated based on insights gathered during primary and secondary research phases. Secondary research involved studying the annual and financial reports of the top market players. In contrast, primary research included conducting extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing professionals.

Segmental revenues were calculated based on the revenue mapping of major solution/service providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players operating in the life science instrumentation market.

- Mapping annual revenues generated by major global players from the technology segment (or nearest reported business unit/product category)

- Revenue mapping of major players to cover a major share of the global market, as of 2022

- Extrapolating the global value of the life science instrumentation market industry

Data Triangulation

After determining the overall market size through the estimation process described earlier, the global life science instrumentation market was divided into segments and subsegments. Data triangulation and market breakdown methods were used to complete the overall market engineering process and obtain precise statistics for all segments and subsegments. The data was triangulated by examining various factors and trends from both demand and supply sides. Additionally, the life science instrumentation market was validated using both top-down and bottom-up approaches.

Market Definition

Life science techniques encompass various analytical and experimental methods, such as chromatography, spectroscopy, electrophoresis, PCR, and flow cytometry, used to study different living organisms. They have a wide range of applications across multiple industries, including pharma and biotech, clinical diagnostics, food and beverage testing, environmental testing, and industrial chemistry. Additionally, academic and research institutions, along with forensic science laboratories, are major end users of these analytical technologies. These tools enable scientists to observe cellular processes and systems. Collectively, these analytical technologies are known as life science instrumentation technologies in this field report.

Stakeholders

- Product Manufacturers, Distributors, and Suppliers

- Biotechnology and Pharmaceutical Companies and Cros

- Laboratory Technicians and Workers

- Life Science Instruments Manufacturers, Vendors, and Distributors

- Venture Capitalists and Other Government Funding Organizations

- Research and Consulting Firms

- Healthcare Equipment or Product Suppliers and Distributors

- Group Purchasing Organizations (GPOs)

- Academic Universities and Medical Research Centers

- Environmental Testing Laboratories

- Food and Beverage Testing Centers

- Hospitals and Diagnostic Centers

- Clinical Research Organizations

- R&D Centers

- Business Research and Consulting Firms

- Medical Research Laboratories End Users

- R&D Department

- Finance/Procurement Department

Report Objectives

- To define, describe, and forecast the size of the life science instrumentation market based on technology, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global life science instrumentation market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the global life science instrumentation market.

- To analyze key growth opportunities in the global life science instrumentation market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa

- To profile the key players in the life science instrumentation market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global life science instrumentation market, such as product launches, agreements, expansions, and mergers & acquisitions

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Life Science Instrumentation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Life Science Instrumentation Market