The study involved four major activities in order to estimate the current size of the bioadhesives market. Exhaustive secondary research was conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the supply chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource; and publications and databases from associations, Association of European Adhesives and Sealants (FEICA), British Adhesives and Sealants Association (BASA), Adhesives and Sealants Manufacturers Association of Canada, Japan Adhesive Industry Association (JAIA), The Adhesive And Sealant Council (ASC), and China Adhesives and Tape Industry Association (CATIA).

Primary Research

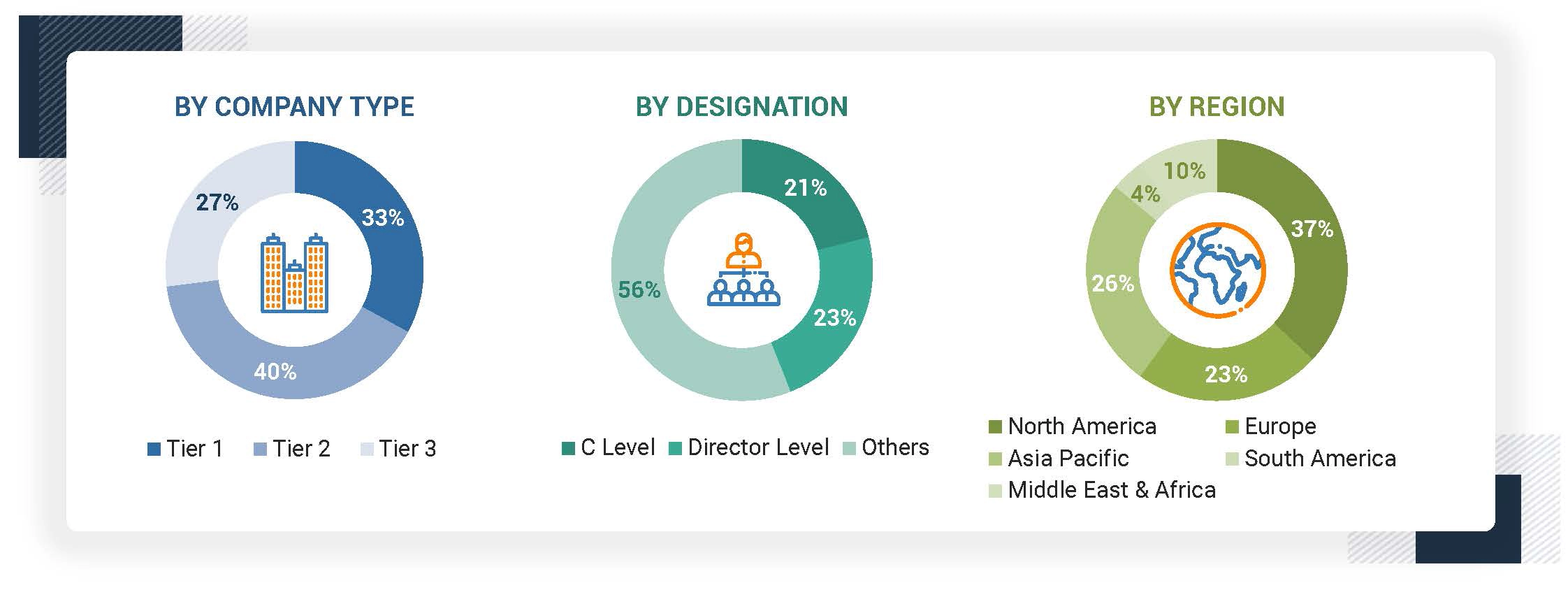

Extensive primary research was carried out after gathering information bioadhesives market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the bioadhesives market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to type, application, and region.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

BIOADHESIVES MANUFACTURERS |

|

Henkel AG & Co. KGaA |

Jowat SE |

|

DuPont de Nemours, Inc. |

Paramelt RMC B.V. |

|

Arkema |

EcoSynthetix Inc. |

|

H.B. Fuller Company |

Danimer Scientific |

|

Ingredion Incorporated |

The Compound Company |

Market Size Estimation

The following information is part of the research methodology used to estimate the size of the bioadhesives market. The market sizing of the bioadhesives market was undertaken from the demand side. The market size was estimated based on market size for bioadhesives in various technology.

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Bioadhesives are natural polymeric materials with a high molecular weight, biocompatibility, and biodegradability. These adhesives derive from both plant and animal sources; they include plant-based adhesives like soy protein and starch and animal-based adhesives like casein, collagen, and hide glues.

These adhesives' strong bonding and environmentally benign qualities make them excellent in a variety of applications, including as the construction, medical, and paper & packaging. Demands for sustainability are rising, and regulations are putting pressure on businesses and industries to find greener solutions for commercial and industrial applications.

Stakeholders

-

Bioadhesives Manufacturers

-

Raw material suppliers

-

Formulators and applicators

-

Industry associations

-

Manufacturers in various applications, such as paper & packaging, construction, woodworking, personal care, and medical

-

Investment banks, venture capitalists, and private equity firms

-

Regional manufacturers’ associations and general bioadhesives associations

-

Government and regional agencies and research organizations

Report Objectives

-

To define, describe, and forecast the size of the bioadhesives market in terms of value and volume.

-

To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the market.

-

To forecast the market size by type, and application.

-

To forecast the market size with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

-

To analyze the opportunities in the market for stakeholders by identifying high growth segments and provide a competitive landscape for the market leaders.

-

To analyze competitive developments in the market, such as product launches, acquisitions, investments, expansions, and joint ventures.

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies2.

Growth opportunities and latent adjacency in Bioadhesives Market