Aerospace Adhesives & Sealants Market by Resin Type (Epoxy, Silicone, PU), Technology (Solvent-based, Water-based), End-use Industry (Commercial, Military, General Aviation), User Type (OEM, MRO), Aircraft Type, and Region - Global Forecast to 2023

Updated on : March 10, 2023

Aerospace Adhesives and Sealants Market

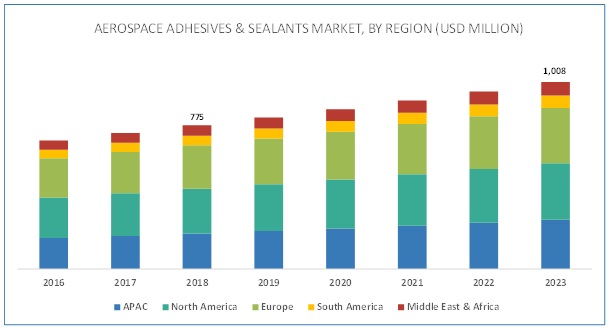

The global aerospace adhesives and sealants market was valued at USD 775 million in 2018 and is projected to reach USD 1,008 million by 2023, growing at a cagr 5.4% from 2018 to 2023. The increasing penetration of composites in aircraft and rising aircraft deliveries are increasing the demand for aerospace adhesives and sealants. The emerging middle-class population in developing countries, such as China, India, and Brazil, has also triggered the growth of the market.

The commercial segment is estimated to account for the largest market share during the forecast period.

In 2017, the commercial aircraft segment accounted for the largest market share, in terms of value, followed by the military and general aviation segments. In APAC, the aerospace adhesives and sealants market is driven by the growing demand for air travel in countries such as China and India. This growth in demand for air travel can be attributed to the increasing disposable income of the middle-class population in these countries.

Epoxy is estimated to be the fastest-growing resin type segment of the aerospace adhesives and sealants during the forecast period.

By resin type, the epoxy segment dominates the aerospace adhesives and sealants market and is also projected to witness the highest CAGR between 2018 and 2023. Epoxy has a unique combination of adhesion, chemical resistance, and physical properties. It has liquid reactive polymers and provides outstanding protection against severe corrosive environments. These properties are attributed to its high demand in end-use industries such as commercial, military, and general aviation.

The APAC aerospace adhesives and sealants market is projected to register the highest CAGR during the forecast period.

The APAC aerospace adhesives and sealants market is segmented into China, Japan, India, South Korea, Thailand, Indonesia, and Rest of APAC. Over the past years, there has been an enormous increase in air traffic in APAC due to affordable fares offered by low-cost airlines. This increase in air traffic leads to a rise in demand for newer aircraft and associated services, which, in turn, drive the aerospace adhesives and sealants market in this region.

Key Market Players

Major players operating in the aerospace adhesives and sealants market include 3M (US), Henkel AG & Co. KGaA (Germany), Huntsman International LLC. (US), PPG Industries Inc. (US), and Cytec Solvay Group (Belgium).

3M occupies the top position for its global distribution capabilities and strong financial background to strengthen its product portfolio and market position. The company strategically focuses on organic growth to drive efficiencies of its adhesive business. In May 2017, the company invested USD 40 million in the expansion of its operations in Missouri, US. Through this expansion, the company produces industrial adhesives and tapes for the aerospace industry and other heavy industrial customers, globally. It also focuses on technological advancement to provide custom solutions and develop new products

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year |

2017 |

|

Forecast period |

2018–2023 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

Type, Resin Type, Technology, User Type, End-use Industry, and Region |

|

Regions |

North America, Europe, APAC, South America, Middle East & Africa |

|

Companies |

3M (US), Henkel AG & Co. KGaA (Germany), Huntsman Corporation (US), PPG Industries Inc. (US), and Cytec Solvay Group (Belgium) are the major players of the aerospace adhesives & sealants market. |

On the basis of type, the aerospace adhesives & sealants market has been segmented as:

- Adhesives

- Sealants

On the basis of resin type, the aerospace adhesives & sealants market has been segmented as:

- Epoxy

- Silicone

- Polyurethane

- Others (Hot-melt Adhesives and Pressure-sensitive Adhesives)

On the basis of technology, the aerospace adhesives & sealants market has been segmented as:

- Solvent-based

- Water-based

- Others (Polysulfide, Cyanoacrylate, Structural Acrylics, Methyl Methacrylate, and Polyester)

On the basis of user type, the aerospace adhesives & sealants market has been segmented as:

- OEM

- MRO

On the basis of end-use industry, the aerospace adhesives & sealants market has been segmented as:

- Commercial

- Military

- General Aviation

On the basis of region, the aerospace adhesives & sealants market has been segmented as:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In September 2018, Cytec-Solvay inaugurated its state-of-the-art manufacturing center for aerospace structural adhesives and surfacing films in Wrexham, UK. This investment broadens the footprint and strengthens its leadership in the growing global aviation industry.

- In February 2018, Henkel adhesive technologies business unit started the construction of a new production facility for the aerospace application at the Henkel site in Montornès del Vallès (Montornès), Spain. The new line will serve the growing demand for high-impact solutions supporting key trends in the global aerospace industry such as weight reduction and automation.

- In May 2017, 3M Company invested USD 40 million in the expansion of its operations in Missouri, US. Through this expansion, the company produces industrial adhesives and tapes for the aerospace industry and other heavy industrial customers, globally.

- In October 2017, PPG Industries launched a webstore for customers in the US to purchase products that are used for aerospace sealants and adhesive applications. These products can be ordered online and delivered within two business days through its support center.

Critical questions the report answers:

- What are the mid- to long-term impact of these developments on the industry?

- What are the upcoming advancements in the aerospace adhesives and sealants formulations?

- What are the upcoming applications of aerospace adhesives and sealants?

- What are the key trends in various applications of aerospace adhesives and sealants?

- Who are the major players in the aerospace adhesives and sealants market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regions Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Aerospace Adhesives & Sealants Market

4.2 Aerospace Adhesives & Sealants Market, By Resin Type

4.3 Aerospace Adhesives & Sealants Market, By Resin Type and End-Use Industry

4.4 Aerospace Adhesives & Sealants Market Attractiveness

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Lightweight and Fuel-Efficient Aircraft

5.2.1.2 Increasing Air Travel Due to Affordable Carriers in the Emerging Regions

5.2.2 Restraints

5.2.2.1 Reduced Defense Spending in Developed Economies

5.2.3 Opportunities

5.2.3.1 Growing Demand for Commercial Aircraft

5.2.4 Challenges

5.2.4.1 Increasing Need for High-Quality Adhesives and Sealants to Bond Lightweight Materials

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Bargaining Power of Suppliers

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Adjacent Markets

5.4.1 Aerostructures Market By Component

5.4.4.1 Fuselage

5.4.4.2 Empennage

5.4.4.3 Flight Control Surfaces

5.4.4.4 Wings

5.4.4.5 Nose

5.4.4.6 Nacelle and Pylon

5.4.2 Aircraft Cabin Interiors Market, By Type

5.4.4.1 Aircraft Seating

5.4.4.2 In-Flight Entertainment & Connectivity

5.4.4.3 Aircraft Cabin Lighting

5.4.4.4 Aircraft Galley

5.4.4.5 Aircraft Lavatory

5.4.4.6 Aircraft Windows & Windshields

5.4.4.7 Aircraft Stowage Bins

5.4.4.8 Aircraft Interior Panels

6 Aerospace Adhesives & Sealants Market, By Type (Page No. - 42)

6.1 Introduction

6.2 Adhesives

6.2.1 Use of Adhesives Results in Weight Reduction and Increased Efficiency of an Aircraft

6.2.2 Wings & Door Mouldings

6.2.3 Interior Trims

6.2.4 Seats

6.2.5 Others

6.3 Sealants

6.3.1 Excellent Physical Properties and Adhesion to Substrates Make Sealants Suitable for Use in the Aviation Industry

6.3.2 Windshield

6.3.3 Fuel Tanks

6.3.4 Fuselage

6.3.5 Others

7 Aerospace Adhesives & Sealants Market, By Resin Type (Page No. - 46)

7.1 Introduction

7.2 Adhesive

7.2.1 Epoxy

7.2.2 Polyurethane

7.2.3 Others

7.4 Sealants

7.4.1 Polysulfide

7.4.2 Silicone

7.4.3 Others

8 Aerospace Adhesives & Sealants Market, By Technology (Page No. - 54)

8.1 Introduction

8.2 Solvent-Based

8.2.1 Solvent-Based Technology is Preferred in the Aviation Industry Due to Its High Initial Strength, Excellent Adhesion to Various Substrates, and Less Curing Time

8.3 Water-Based

8.3.1 Water-Based Technology is Slowing Marking Its Footprint With the Increasing Environmental Regulations and Increasing Usability

8.4 Others

9 Aerospace Adhesives & Sealants Market, By User Type (Page No. - 60)

9.1 Introduction

9.2 Maintenance, Repair & Overhaul

9.2.1 APAC Experiences High Growth Opportunities Due to Demand for Maintenance Services in the Commercial Aerospace MRO Industry

9.3 Original Equipment Manufacturer

9.3.1 Advanced Manufacturing Technologies and Implementation of New Electrical Systems in Aircraft are Driving the Demand From OEMs

10 Aerospace Adhesives & Sealants Market, By End-Use Industry (Page No. - 64)

10.1 Introduction

10.2 Commercial

10.2.1 Global Economic Recovery and Increase in Passenger Air Travel are Augmenting the Growth of the Commercial Aircraft Segment

10.3 Military

10.3.1 Increased Spending in the Defense Sector of the Us to Fuel Growth of the Market in the Military End-Use Industry

10.4 General Aviation

10.4.1 Increase in Production of Business Jets in Emerging Economies Such as China, India, and South Korea to Boost the General Aviation End-Use Industry

11 Aerospace Adhesives & Sealants Market, By Aircraft Type (Page No. - 71)

11.1 Introduction

11.2 Single-Aisle

11.3 Regional Jets

11.4 Small Wide-Body

11.5 Medium Wide-Body

11.6 Large Wide-Body

12 Aerospace Adhesives & Sealants Market, By Region (Page No. - 73)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.1.1 The Country has the Largest Aerospace Manufacturing Base, Mainly Relying on International Market to Increase Sales

12.2.2 Canada

12.2.2.1 Commercial End-Use Industry Creates High Growth Opportunities for Aerospace Adhesives & Sealants Manufacturers

12.2.3 Mexico

12.2.3.1 Low Cost Manufacturing and Strategic Location are Expected to Increase the Export of Aerospace Adhesives & Sealants to Neighboring Countries

12.3 Europe

12.3.1 Russia

12.3.1.1 Strategic Development in the Aviation Industry Makes the Country the Largest Aerospace Adhesives & Sealants Market

12.3.2 Germany

12.3.2.1 The Country is A Major Aerospace Hub for Several Countries in Europe

12.3.3 France

12.3.3.1 Focus on R&D Helps the Country to Remain at the Forefront of the Development of Sustainable Aircraft and Aviation Technologies

12.3.4 UK

12.3.4.1 Emphasis on Maximization of Aerospace Projects By Implementing Partnership With Aerospace OEMs

12.3.5 Italy

12.3.5.1 Moderate Growth is Expected in the Market Due to High Public Debt and Economic Challenges

12.3.6 Turkey

12.3.6.1 High Targets to Develop the Defense & Aerospace Industry and Focus on Innovation to Manufacture Sustainable Aircraft are Fueling Market Growth

12.3.7 Rest of Europe

12.4 APAC

12.4.1 China

12.4.1.1 Y-O-Y Growth of Air Travel By Passengers in China is Expected to Drive the Aerospace Adhesives & Sealants Market

12.4.2 Japan

12.4.2.1 The Country Experiences A Decline in Growth Due to the Maturity of the Adhesives & Sealants Market

12.4.3 India

12.4.3.1 Demand for New Aircraft, Dominated By Business Jets, Drives the Aerospace Industry

12.4.4 South Korea

12.4.4.1 Increasing Spending in the Aerospace Military & Defense Sector to Drive the Aerospace Adhesives & Sealants Market

12.4.5 Singapore

12.4.5.1 Singapore Experiences Steady Growth Due to Various Investments in the Aerospace Industry

12.4.6 Thailand

12.4.6.1 High Air Traffic Due to Rise in Tourism Activities to Boost the Aviation Industry

12.4.7 Australia & New Zealand

12.4.7.1 Increase in Domestic Air Travel has Created Demand for New Aircraft, thereby Augment Market Growth

12.4.8 Rest of APAC

12.5 South America

12.5.1 Brazil

12.5.1.1 Focus to Acquire General Aviation Capabilities Through Fdi for the MRO Industry to Drive the Market

12.5.2 Argentina

12.5.2.1 The Market is Expected to Register Moderate Growth Due to Less Investor-Friendly Regulator

12.5.3 Chile

12.5.3.1 Collaboration With Neighboring Countries to Enhance the Manufacturing Facilities for the Aerospace Industry

12.5.4 Rest of South America

12.6 Middle East & Africa

12.6.1 Iran

12.6.1.1 Increase in Aircraft Production and Sanctions of International Funds has Increased the Demand for Aerospace Adhesives & Sealants

12.6.2 Israel

12.6.2.1 Implementation of Several Programs to Upgrade and Modernize Military Aircraft and Helicopters Have Increased the Demand for Aerospace Adhesives & Sealants

12.6.3 South Africa

12.6.3.1 Rising Need to Replace Aging Fleet has Resulted in High Demand for New Aircraft

12.6.4 Rest of Middle East & Africa

13 Competitive Landscape (Page No. - 103)

13.1 Introduction

13.2 Competitive Leadership Mapping

13.2.1 Visionary Leaders

13.2.2 Innovators

13.2.3 Dynamic Differentiators

13.2.4 Emerging Companies

13.3 Market Ranking

13.4 Competitive Scenario

13.4.1 Investment & Expansion

13.4.2 New Product Launch

13.4.3 Merger & Acquisition

14 Company Profiles (Page No. - 108)

14.1 3M

14.1.1 Business Overview

14.1.2 Products Offered

14.1.3 Recent Developments

14.1.4 SWOT Analysis

14.1.5 MnM View

14.2 Huntsman Corporation

14.2.1 Business Overview

14.2.2 Products Offered

14.2.3 Recent Developments

14.2.4 SWOT Analysis

14.2.5 MnM View

14.3 H.B. Fuller

14.3.1 Business Overview

14.3.2 Products Offered

14.3.3 Recent Developments

14.3.4 H.B. Fuller: SWOT Analysis

14.3.5 MnM View

14.4 Henkel

14.4.1 Business Overview

14.4.2 Products Offered

14.4.3 Recent Developments

14.4.4 SWOT Analysis

14.4.5 MnM View

14.5 Illinois Tool Works Inc.

14.5.1 Business Overview

14.5.2 Products Offered

14.5.3 SWOT Analysis

14.5.4 MnM View

14.6 PPG

14.6.1 Business Overview

14.6.2 Products Offered

14.6.3 Recent Developments

14.7 Cytec Solvay Group

14.7.1 Business Overview

14.7.2 Products Offered

14.7.3 Recent Developments

14.8 Hexcel Corporation

14.8.1 Business Overview

14.8.2 Products Offered

14.8.3 Recent Developments

14.9 Bostik (Arkema)

14.9.1 Business Overview

14.9.2 Products Offered

14.9.3 Recent Developments

14.10 Dowdupont

14.10.1 Business Overview

14.10.2 Products Offered

14.10.3 Recent Developments

14.11 Other Key Companies

14.11.1 Permabond

14.11.2 Lord Corporation

14.11.3 Master Bond

14.11.4 Scigrip Adhesives

14.11.5 General Sealants

14.11.6 Beacon Adhesives

14.11.7 Sika

14.11.8 Parson Adhesives

14.11.9 Delo Industrial Adhesives

14.11.10 Hernon Manufacturing

14.11.11 Dymax Corporation

14.11.12 The Reynolds Company

14.11.13 Hylomar Limited

14.11.14 L&L Products

14.11.15 Uniseal

15 Appendix (Page No. - 136)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (212 Tables)

Table 1 Aerospace Adhesives & Sealants Market Snapshot, 2018 vs. 2023

Table 2 Aerospace Adhesives & Sealants Market Size, By Type, 2016–2023 (USD Million)

Table 3 Market Size, By Type, 2016–2023 (Kiloton)

Table 4 Aerospace Adhesives Market Size, By Region, 2016–2023 (USD Million)

Table 5 Size, By Region, 2016–2023 (Kiloton)

Table 6 Aerospace Sealants Market Size, By Region, 2016–2023 (USD Million)

Table 7 Size, By Region, 2016–2023 (Kiloton)

Table 8 Aerospace Adhesives & Sealants Market Size, By Resin Type, 2016–2023 (USD Million)

Table 9 Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 10 Epoxy: Aerospace Adhesives & Sealants Market Size, By Region, 2016–2023 (USD Million)

Table 11 Epoxy: Market Size, By Region, 2016–2023 (Kiloton)

Table 12 Silicone: Aerospace Adhesives & Sealants Market Size, By Region, 2016–2023 (USD Million)

Table 13 Silicone: Market Size, By Region, 2016–2023 (Kiloton)

Table 14 Polyurethane: Aerospace Adhesives & Sealants Market Size, By Region, 2016–2023 (USD Million)

Table 15 Polyurethane: Market Size, By Region, 2016–2023 (Kiloton)

Table 16 Others: Aerospace Adhesives & Sealants Market Size, By Region, 2016–2023 (USD Million)

Table 17 Others: Market Size, By Region, 2016–2023 (Kiloton)

Table 18 Aerospace Adhesives & Sealants Market Size, By Technology, 2016–2023 (USD Million)

Table 19 Market Size, By Technology, 2016–2023 (Kiloton)

Table 20 Solvent-Based: Aerospace Adhesives & Sealants Market Size, By Region, 2016–2023 (USD Million)

Table 21 Solvent-Based: Market Size, By Region, 2016–2023 (Kiloton)

Table 22 Water-Based: Aerospace Adhesives & Sealants Market Size, By Region, 2016–2023 (USD Million)

Table 23 Water-Based: Market Size, By Region, 2016–2023 (Kiloton)

Table 24 Others: Aerospace Adhesives & Sealants Market Size, By Region, 2016–2023 (USD Million)

Table 25 Others: Market Size, By Region, 2016–2023 (Kiloton)

Table 26 Aerospace Adhesives & Sealants Market Size, By User Type, 2016–2023 (USD Million)

Table 27 Market Size, By User Type, 2016–2023 (Kiloton)

Table 28 MRO: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 29 MRO: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 30 OEM: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 31 OEM: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 32 Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 33 Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 34 Commercial: Aerospace Adhesives & Sealants Market Size, By Region, 2016–2023 (USD Million)

Table 35 Commercial: Market Size, By Region, 2016–2023 (Kiloton)

Table 36 Commercial: Market Size, By User Type, 2016–2023 (USD Million)

Table 37 Commercial: Market Size, By User Type, 2016–2023 (Kiloton)

Table 38 Military: Aerospace Adhesives & Sealants Market Size, By Region, 2016–2023 (USD Million)

Table 39 Military: Market Size, By Region, 2016–2023 (Kiloton)

Table 40 Military: Market Size, By User Type, 2016–2023 (USD Million)

Table 41 Military: Market Size, By User Type, 2016–2023 (Kiloton)

Table 42 General Aviation: Aerospace Adhesives & Sealants Market Size, By Region, 2016–2023 (USD Million)

Table 43 General Aviation: Market Size, By Region, 2016–2023 (Kiloton)

Table 44 General Aviation: Market Size, By User Type, 2016–2023 (USD Million)

Table 45 General Aviation: Market Size, By User Type, 2016–2023 (Kiloton)

Table 46 Aerospace Adhesives & Sealants Market Size, By Region, 2016–2023 (USD Million)

Table 47 Market Size, By Region, 2016–2023 (Kiloton)

Table 48 North America: Aerospace Adhesives & Sealants Market Size, By Country, 2016–2023 (USD Million)

Table 49 North America: Market Size, By Country, 2016–2023 (Kiloton)

Table 50 North America: Market Size, By Type, 2016–2023 (USD Million)

Table 51 North America: Market Size, By Type, 2016–2023 (Kiloton)

Table 52 North America: Market Size, By Resin Type, 2016–2023 (USD Million)

Table 53 North America: Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 54 North America: Market Size, By Technology, 2016–2023 (USD Million)

Table 55 North America: Market Size, By Technology, 2016–2023 (Kiloton)

Table 56 US: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 57 US: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 58 Canada: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 59 Canada: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 60 Mexico: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 61 Mexico: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 62 Europe: Aerospace Adhesives & Sealants Market Size, By Country, 2016–2023 (USD Million)

Table 63 Europe: Market Size, By Country, 2016–2023 (Kiloton)

Table 64 Europe: Market Size, By Type, 2016–2023 (USD Million)

Table 65 Europe: Market Size, By Type, 2016–2023 (Kiloton)

Table 66 Europe: Market Size, By Resin Type, 2016–2023 (USD Million)

Table 67 Europe: Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 68 Europe: Market Size, By Technology, 2016–2023 (USD Million)

Table 69 Europe: Market Size, By Technology, 2016–2023 (Kiloton)

Table 70 Russia: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 71 Russia: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 72 Germany: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 73 Germany: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 74 France: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 75 France: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 76 UK: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 77 UK: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 78 Italy: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 79 Italy: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 80 Turkey: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 81 Turkey: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 82 Rest of Europe: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 83 Rest of Europe: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 84 APAC: Aerospace Adhesives & Sealants Market Size, By Country, 2016–2023 (USD Million)

Table 85 APAC: Market Size, By Country, 2016–2023 (Kiloton)

Table 86 APAC: Market Size, By Type, 2016–2023 (USD Million)

Table 87 APAC: Market Size, By Type, 2016–2023 (Kiloton)

Table 88 APAC: Market Size, By Resin Type, 2016–2023 (USD Million)

Table 89 APAC: Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 90 APAC: Market Size, By Technology, 2016–2023 (USD Million)

Table 91 APAC: Market Size, By Technology, 2016–2023 (Kiloton)

Table 92 China: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 93 China: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 94 Japan: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 95 Japan: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 96 India: Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 97 India: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 98 South Korea: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 99 South Korea: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 100 Australia: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 101 Australia: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 102 Rest of APAC: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 103 Rest of APAC: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 104 South America: Aerospace Adhesives & Sealants Market Size, By Country, 2016–2023 (USD Million)

Table 105 South America: Market Size, By Country, 2016–2023 (Kiloton)

Table 106 South America: Market Size, By Type, 2016–2023 (USD Million)

Table 107 South America: Market Size, By Type, 2016–2023 (Kiloton)

Table 108 South America: Market Size, By Resin Type, 2016–2023 (USD Million)

Table 109 South America: Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 110 South America: Market Size, By Technology, 2016–2023 (USD Million)

Table 111 South America: Market Size, By Technology, 2016–2023 (Kiloton)

Table 112 Brazil: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 113 Brazil: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 114 Argentina: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 115 Argentina: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 116 Rest of South America: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 117 Rest of South America: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 118 Middle East & Africa: Market Size, By Country, 2016–2023 (USD Million)

Table 119 Middle East & Africa: Market Size, By Country, 2016–2023 (Kiloton)

Table 120 Middle East & Africa: Market Size, By Type, 2016–2023 (USD Million)

Table 121 Middle East & Africa: Market Size, By Type, 2016–2023 (Kiloton)

Table 122 Middle East & Africa: Market Size, By Resin Type, 2016–2023 (USD Million)

Table 123 Middle East & Africa: Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 124 Middle East & Africa: Market Size, By Technology, 2016–2023 (USD Million)

Table 125 Middle East & Africa: Market Size, By Technology, 2016–2023 (Kiloton)

Table 126 Iran: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 127 Iran: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 128 Israel: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 129 Israel: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 130 Rest of Mea: Aerospace Adhesives & Sealants Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 131 Rest of Mea: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 132 Aerostructures Market Size, By Component, 2014-2022 (USD Billion)

Table 133 Fuselage Segment, By Region, 2014-2022 (USD Billion)

Table 134 Empennage Segment, By Region, 2014-2022 (USD Billion)

Table 135 Flight Control Surfaces Segment, By Region, 2014-2022 (USD Billion)

Table 136 Wings Segment, By Region, 2014-2022 (USD Billion)

Table 137 Nose Segment, By Region, 2014-2022 (USD Billion)

Table 138 Nacelle and Pylon Segment, By Region, 2014-2022 (USD Billion)

Table 139 North America Market Size, By Component, 2014–2022 (USD Billion)

Table 140 Us Market Size, By Component, 2014–2022 (USD Billion)

Table 141 Canada Market Size, By Component, 2014–2022 (USD Billion)

Table 142 Europe Market Size, By Component, 2014–2022 (USD Billion)

Table 143 Russia Market Size, By Component, 2014–2022 (USD Billion)

Table 144 Germany Market Size, By Component, 2014–2022 (USD Billion)

Table 145 UK Market Size, By Component, 2014–2022 (USD Billion)

Table 146 Italy Market Size, By Component, 2014–2022 (USD Billion)

Table 147 France Market Size, By Component, 2014–2022 (USD Billion)

Table 148 APAC Market Size, By Component, 2014–2022 (USD Billion)

Table 149 China Market Size, By Component, 2014–2022 (USD Billion)

Table 150 Japan Market Size, By Component, 2014–2022 (USD Billion)

Table 151 India Market Size, By Component, 2014–2022 (USD Billion)

Table 152 Australia Market Size, By Component, 2014–2022 (USD Billion)

Table 153 Brazil Market Size, By Component, 2014–2022 (USD Billion

Table 154 Aircraft Cabin Interiors Market Size, By Type, 2016–2025 (USD Million)

Table 155 Aircraft Seating Market Size, By Class, 2016–2025 (USD Million)

Table 156 Aircraft Seating Business Class Market Size, By End User, 2016–2025 (USD Million)

Table 157 Aircraft Seating Economy Class Market Size, By End User, 2016–2025 (USD Million)

Table 158 Aircraft Seating Premium Economy Class Market Size, By End User, 2016–2025 (USD Million)

Table 159 Aircraft Seating First Class Market Size, By End User, 2016–2025 (USD Million)

Table 160 In-Flight Entertainment & Connectivity Market Size, By Type, 2016–2025 (USD Million)

Table 161 In-Flight Entertainment & Connectivity Hardware Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 162 In-Flight Entertainment & Connectivity Hardware Market Size, By End User, 2016–2025 (USD Million)

Table 163 In-Flight Entertainment & Connectivity Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 164 In-Flight Entertainment & Connectivity Market Size, By End User, 2016–2025 (USD Million)

Table 165 In-Flight Entertainment & Connectivity Content Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 166 In-Flight Entertainment & Connectivity Content Market Size, By End User, 2016–2025 (USD Million)

Table 167 Aircraft Cabin Lighting Market Size, By Type, 2016–2025 (USD Million)

Table 168 Cabin Signage Lights Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 169 Cabin Signage Lights Market Size, By End User, 2016–2025 (USD Million)

Table 170 Cabin Ceiling & Wall Lights Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 171 Cabin Ceiling & Wall Lights Market Size, By End User, 2016–2025 (USD Million)

Table 172 Cabin Floor Path Lighting Strips Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 173 Cabin Floor Path Lighting Strips Market Size, By End User, 2016–2025 (USD Million)

Table 174 Cabin Reading Lights Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 175 Cabin Reading Lights Market Size, By End User, 2016–2025 (USD Million)

Table 176 Lavatory Lights Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 177 Lavatory Lights Market Size, By End User, 2016–2025 (USD Million)

Table 178 Aircraft Galley Market Size, By Type, 2016–2025 (USD Million)

Table 179 Electric Galley Equipment Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 180 Electric Galley Equipment Market Size, By End User, 2016–2025 (USD Million)

Table 181 Non-Electric Galley Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 182 Non-Electric Galley Market Size, By End User, 2016–2025 (USD Million)

Table 183 Aircraft Lavatory Market Size, By Type, 2016–2025 (USD Million)

Table 184 Reusable Liquid Flush Aircraft Lavatory Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 185 Reusable Liquid Flush Aircraft Lavatory Market Size, By End User, 2016–2025 (USD Million)

Table 186 Vacuum Flush Aircraft Lavatory Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 187 Vacuum Flush Aircraft Lavatory Market Size, By End User, 2016–2025 (USD Million)

Table 188 Aircraft Windows & Windshields Market Size, By Type, 2016–2025 (USD Million)

Table 189 Aircraft Cabin Windows Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 190 Aircraft Cabin Windows Market Size, By End User, 2016–2025 (USD Million)

Table 191 Aircraft Windshields Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 192 Aircraft Windshields Market Size, By End User, 2016–2025 (USD Million)

Table 193 Aircraft Stowage Bins Market Size, By Type, 2016–2025 (USD Million)

Table 194 Shelf Bins Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 195 Shelf Bins Market Size, By End User, 2016–2025 (USD Million)

Table 196 Pivot Bins Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 197 Pivot Bins Market Size, By End User, 2016–2025 (USD Million)

Table 198 Translating Bins Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 199 Translating Bins Market Size, By End User, 2016–2025 (USD Million)

Table 200 Aircraft Interior Panels Market Size, By Type, 2016–2025 (USD Million)

Table 201 Aircraft Floor Panels Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 202 Aircraft Floor Panels Market Size, By End User, 2016–2025 (USD Million)

Table 203 Aircraft Ceiling Panels Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 204 Aircraft Ceiling Panels Market Size, By End User, 2016–2025 (USD Million)

Table 205 Aircraft Side Panels Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 206 Aircraft Side Panels Market Size, By End User, 2016–2025 (USD Million)

Table 207 Aircraft Cabin Dividers Market Size, By Aircraft Type, 2016–2025 (USD Million)

Table 208 Aircraft Cabin Dividers Market Size, By End User, 2016–2025 (USD Million)

Table 209 Ranking of Key Players, 2017

Table 210 Investment & Expansion, 2015–2018

Table 211 New Product Launch, 2015–2018

Table 212 Merger & Acquisition, 2015–2018

List of Figures (40 Figures)

Figure 1 Aerospace Adhesives & Sealants Market Segmentation

Figure 2 Aerospace Adhesives & Sealants Market: Research Design

Figure 3 Aerospace Adhesives & Sealants Market: Data Triangulation

Figure 4 Epoxy Resin Type Dominated the Aerospace Adhesives & Sealants Market in 2017

Figure 5 Solvent-Based Technology to Dominate the Aerospace Adhesives & Sealants Market

Figure 6 MRO User Type Segment to Witness High Growth in the Aerospace Adhesives & Sealants Market

Figure 7 Commercial to Be the Fastest-Growing End-Use Industry of Aerospace Adhesives & Sealants

Figure 8 North America Accounted for the Largest Market Share in 2017

Figure 9 Emerging Economies to Offer Lucrative Growth Opportunities for Aerospace Adhesives & Sealants Manufacturers

Figure 10 Epoxy Segment to Witness the Highest Growth in the Aerospace Adhesives & Sealants Market

Figure 11 Epoxy and Commercial Segments Accounted for the Largest Market Share in 2017

Figure 12 Emerging Countries to Witness High Growth in the Aerospace Adhesives & Sealants Market

Figure 13 Factors Governing the Growth of the Aerospace Adhesives & Sealants Market

Figure 14 Porter’s Five Forces Analysis for the Aerospace Adhesives & Sealants Market

Figure 15 Adhesives Segment to Account for the Larger Share of the Market

Figure 16 Epoxy Resin Type to Dominate the Aerospace Adhesives & Sealants Market

Figure 17 Solvent-Based Technology to Dominate the Aerospace Adhesives & Sealants Market

Figure 18 MRO Segment to Dominate the Aerospace Adhesives & Sealants Market

Figure 19 Commercial End-Use Industry to Witness High Demand for Aerospace Adhesives & Sealants

Figure 20 Large and Medium Wide-Body Aircraft are Preferred Due to Large Interior Cabin Space for Passengers

Figure 21 China and India are Emerging as New Hotspots for the Aerospace Adhesives & Sealants Market

Figure 22 North America: Aerospace Adhesives & Sealants Market Snapshot

Figure 23 Europe: Aerospace Adhesives & Sealants Market Snapshot

Figure 24 APAC: Aerospace Adhesives & Sealants Market Snapshot

Figure 25 Competitive Leadership Mapping, 2017

Figure 26 3M: Company Snapshot

Figure 27 3M: SWOT Analysis

Figure 28 Huntsman Corporation: Company Snapshot

Figure 29 Huntsman Corporation: SWOT Analysis

Figure 30 H.B. Fuller: Company Snapshot

Figure 31 H.B.Fuller: SWOT Analysis

Figure 32 Henkel: Company Snapshot

Figure 33 Henkel: SWOT Analysis

Figure 34 Illinois Tool Works Inc.: Company Snapshot

Figure 35 Illinois Tool Works Inc.: SWOT Analysis

Figure 36 PPG: Company Snapshot

Figure 37 Cytec Solvay Group: Company Snapshot

Figure 38 Hexcel Corporation: Company Snapshot

Figure 39 Bostik (Arkema): Company Snapshot

Figure 40 Dowdupont: Company Snapshot

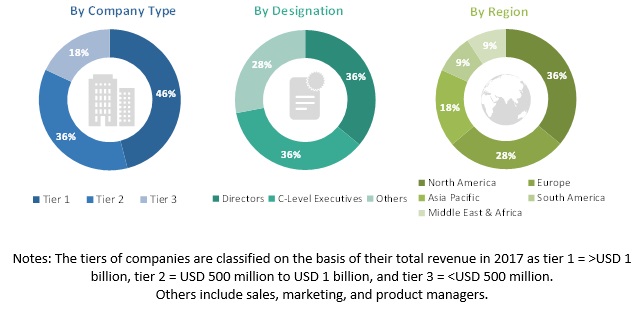

The study involves four major activities to estimate the current market size for aerospace adhesives & sealants. The exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred, to identify and collect information for this study. Secondary sources also include annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; food safety organizations; regulatory bodies; trade directories; and databases.

Primary Research

The aerospace adhesives & sealants market comprises several stakeholders such as raw material suppliers, processors, end users, and regulatory organizations. The demand side of this market is characterized by the usage patterns of OEM and MRO across the commercial, military, and general aviation end-use industries. The supply side is characterized by advancements in technology and diverse applications. Various primary sources from both supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aerospace adhesives & sealants market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation process explained above the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides.

Report Objectives

- To define, segment, and forecast the aerospace adhesives & sealants market, in terms of both value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the market size based on type, resin type, technology, user type, end-use industry, and region

- To define, describe, and forecast the market size with respect to the five major regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa along with their key countries

- To analyze the micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for the market leaders

- To track and analyze the competitive developments, such as merger & acquisition, investment & expansion, and new product launch, in the aerospace adhesives & sealants market

- To provide strategic profiles of the key players in the market and comprehensively analyze their core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the aerospace adhesives & sealants market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Aerospace Adhesives & Sealants Market

General inquiry on price of the report

Aerospace adhesive & sealants market