TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

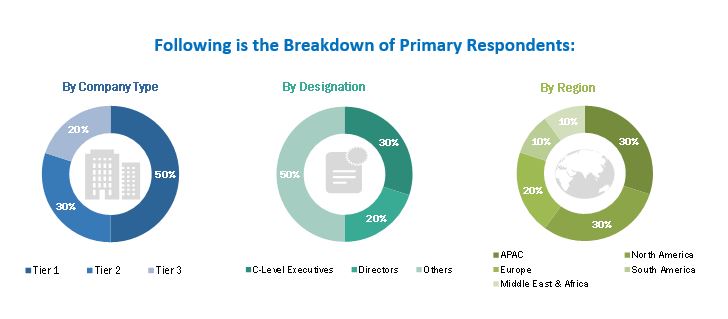

2 RESEARCH METHODOLOGY (Page No. - 29)

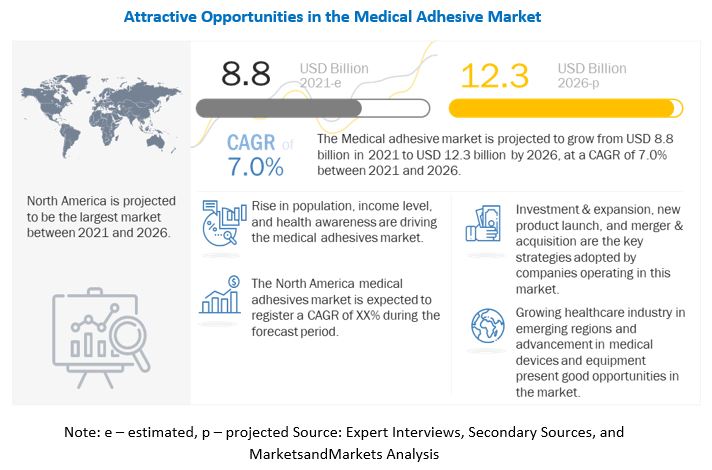

3 EXECUTIVE SUMMARY (Page No. - 40)

4 PREMIUM INSIGHTS (Page No. - 43)

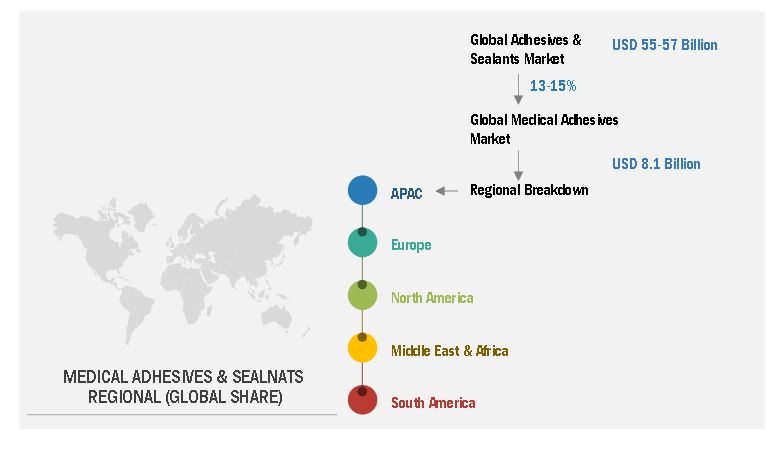

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rise in population, income level, and health awareness in developing countries

5.2.1.2 High growth of the medical implants market

5.2.1.3 Increase in demand for single-use disposable medical products

5.2.1.4 Increasing use of cyanoacrylate-based tissue adhesives

5.2.2 RESTRAINTS

5.2.2.1 Rising cost of healthcare facilities

5.2.2.2 Low shelf-life of adhesives

5.2.3 OPPORTUNITIES

5.2.3.1 Growing healthcare industry in developing regions

5.2.3.2 Advancement of medical device & equipment

5.2.4 CHALLENGES

5.2.4.1 Stringent regulations and lengthy approval process

5.2.4.2 Variation in regulations across countries

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECASTS OF GDP

5.4.3 TRENDS AND FORECASTS OF HEALTHCARE INDUSTRY

5.5 COVID-19 IMPACT

5.6 COVID-19 ECONOMIC ASSESSMENT

5.6.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

5.7 IMPACT OF COVID-19 ON END-USE INDUSTRIES

5.7.1 IMPACT ON HEALTHCARE INDUSTRY

5.8 IMPACT OF COVID-19 ON REGIONS

5.8.1 IMPACT OF COVID-19 ON APAC

5.8.2 IMPACT OF COVID-19 ON NORTH AMERICA

5.8.3 IMPACT OF COVID-19 ON EUROPE

5.8.4 IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA

5.8.5 IMPACT OF COVID-19 ON SOUTH AMERICA

5.9 VALUE CHAIN ANALYSIS

5.10 AVERAGE SELLING PRICE ANALYSIS

5.11 ECOSYSTEM/MARKET MAP

5.12 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MEDICAL ADHESIVES MANUFACTURERS

5.12.1 HEALTHCARE

5.12.1.1 Wearable medical devices

5.12.1.2 Microfluidics-based POC and LOC diagnostic devices for laboratory testing

5.13 EXPORT–IMPORT TRADE STATISTICS

5.14 PATENTS ANALYSIS

5.14.1 METHODOLOGY

5.14.2 PUBLICATION TRENDS

5.14.3 PATENTS ANALYSIS, BY JURISDICTION

5.14.4 TOP APPLICANTS

5.15 REGULATIONS

5.16 CASE STUDY ANALYSIS

5.16.1 CASE STUDY 1: BIOCOMPATIBLE EPOXIES FOR MEDICAL DEVICE MANUFACTURING

5.16.2 CASE STUDY 2: UV ADHESIVE CURES TIME PROBLEM FOR BRANDON MEDICAL

5.16.3 CASE STUDY 3: BONDING SOLUTIONS FOR NEEDLE ASSEMBLIES

6 MEDICAL ADHESIVES MARKET, BY TECHNOLOGY (Page No. - 76)

6.1 INTRODUCTION

6.2 WATER-BASED MEDICAL ADHESIVES

6.2.1 BROADLY USED TECHNOLOGY FOR MEDICAL ADHESIVES

6.3 SOLVENT-BASED MEDICAL ADHESIVES

6.3.1 DECLINING DEMAND DUE TO VOC EMISSIONS

6.4 SOLIDS & HOT MELT-BASED

6.4.1 EXTREMELY FAST RATE OF BOND FORMATION

7 MEDICAL ADHESIVES MARKET, BY NATURAL RESIN TYPE (Page No. - 84)

7.1 INTRODUCTION

7.2 FIBRIN

7.2.1 FLEXIBILITY LEADS TO INCREASED USE OF THE SEALANT

7.2.2 MEDICAL APPLICATIONS OF FIBRIN-BASED ADHESIVES

7.2.2.1 Dental extraction and oral surgery

7.2.2.2 Orthopedic operations

7.2.2.3 Circumcision

7.2.2.4 Traumatology

7.2.2.5 Cardiac surgery

7.2.2.6 Thoracic surgery

7.2.2.7 Vascular surgery

7.2.2.8 Oncologic surgery

7.2.2.9 Plastic surgery

7.2.2.10 Neurosurgery

7.2.2.11 Ophthalmologic surgery

7.2.3 COMPETITION

7.3 COLLAGEN

7.3.1 COMPATIBILITY WITH THE ENVIRONMENT AND AVAILABILITY IN ABUNDANCE DRIVE THE MARKET

7.3.2 SOURCES OF MEDICAL-GRADE COLLAGEN

7.3.2.1 Animal-derived collagen

7.3.2.2 Human-derived collagen

7.3.2.3 Transgenically-derived collagen

7.3.2.4 Medical applications of collagen-based adhesives

7.3.2.5 Competition

7.4 OTHERS

8 MEDICAL ADHESIVES MARKET, BY SYNTHETIC & SEMI- SYNTHETIC RESIN TYPE (Page No. - 99)

8.1 INTRODUCTION

8.2 ACRYLIC RESIN

8.2.1 EASY TO USE AND SUBSTRATE VERSATILITY INCREASE THE MARKET SHARE

8.2.2 MEDICAL APPLICATIONS OF ACRYLIC-BASED ADHESIVES

8.2.2.1 Medical device assembly

8.2.2.2 Medical adhesive tapes

8.2.2.3 Orthopedic surgery

8.2.2.4 Dental

8.2.2.5 Pressure-sensitive adhesives

8.2.2.6 Other applications

8.3 SILICONE RESIN

8.3.1 LOW PEEL ADHESION PROPERTY MAKES IT IDEAL FOR MEDICAL APPLICATION

8.3.2 MEDICAL APPLICATIONS OF SILICONE-BASED ADHESIVES

8.3.2.1 Pressure-sensitive adhesives

8.3.2.2 Soft skin adhesives

8.4 CYANOACRYLATE RESIN

8.4.1 FAST POLYMERIZATION PROPERTY AND HIGH TENSILE STRENGTH TO INCREASE THE DEMAND

8.4.2 MEDICAL APPLICATIONS OF CYANOACRYLATE-BASED ADHESIVES

8.4.2.1 Topical wound closure

8.4.2.2 Other applications

8.5 EPOXY RESIN

8.5.1 WIDE SUBSTRATE APPLICABILITY MAKES IT IDEAL FOR DIFFERENT PURPOSES

8.5.2 MEDICAL APPLICATIONS OF EPOXY-BASED ADHESIVES

8.5.2.1 Medical devices

8.6 POLYURETHANE

8.6.1 DIFFERENT BONDING PROPERTIES TO ACHIEVE DESIRED APPLICATION

8.6.2 MEDICAL APPLICATIONS OF POLYURETHANE-BASED ADHESIVES

8.7 OTHERS

9 MEDICAL ADHESIVES MARKET, BY APPLICATION (Page No. - 117)

9.1 INTRODUCTION

9.2 DENTAL

9.2.1 DIFFERENT FORMULATIONS AND COMPOSITIONS AVAILABLE FOR VARIED PURPOSES

9.2.2 DENTURE ADHESIVES

9.2.3 PIT & FISSURE SEALANTS

9.2.4 DENTAL RESTORATIVE ADHESIVES

9.2.5 OTHER DENTAL APPLICATIONS

9.3 SURGERY

9.3.1 CARDIOVASCULAR

9.3.1.1 Fibrin and synthetic sealants and adhesives are used in cardiac surgical procedures

9.3.2 GENERAL

9.3.2.1 Quicker healing time, less trauma, and reduced inflammation are the benefits of medical adhesives in general surgery

9.3.3 CENTRAL NERVOUS SYSTEM (CNS)

9.3.3.1 Fibrin sealants are useful in neurosurgical procedures

9.3.4 ORTHOPEDIC

9.3.4.1 The use of medical adhesives in orthopedic surgeries helps in hemostasis and promotes tissue fixation

9.3.5 UROLOGICAL

9.3.5.1 Hemostasis, tissue adhesion, and urinary tract sealing are among the key applications of medical adhesives in this segment

9.3.6 COSMETIC

9.3.6.1 Decreased blood loss and improved graft survival are the advantages of using medical adhesives during cosmetic procedures

9.3.7 PULMONARY

9.3.7.1 Cyanoacrylate- and gelatin-based adhesives are used in pulmonary surgeries as they offer extensive tissue adherence

9.3.8 OPHTHALMIC

9.3.8.1 Medical adhesives are used in ophthalmic surgeries to prevent postoperative wound infection and corneal graft rejection

9.3.9 OTHER APPLICATIONS

9.4 MEDICAL DEVICE & EQUIPMENT

9.4.1 NEEDLES & SYRINGES

9.4.1.1 Acrylic-based adhesives are used for the assembly of lancets, syringes, injectors, hypodermics, and blood collection sets

9.4.2 CATHETERS

9.4.2.1 The use of adhesives with less curing properties for bonding catheters leads to reduced processing costs

9.4.3 TUBE SETS

9.4.3.1 UV and visible light-curable adhesives are mainly used for bonding tube sets

9.4.4 MASKS

9.4.4.1 Increasing pollution levels are among the major factors driving the production of face masks

9.4.5 OTHERS

9.5 OTHERS

10 MEDICAL ADHESIVES MARKET, BY REGION (Page No. - 136)

10.1 INTRODUCTION

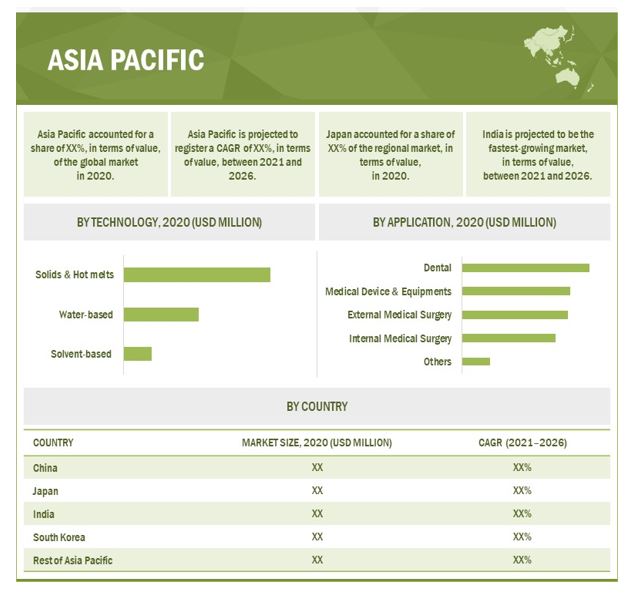

10.2 ASIA PACIFIC

10.2.1 CHINA

10.2.1.1 Reorganization of the healthcare industry will be helpful for the market in the next five years

10.2.2 INDIA

10.2.2.1 Increasing instances of cardiovascular diseases and dental tourism are driving the market

10.2.3 JAPAN

10.2.3.1 More accessible healthcare services and government efforts for faster approval process for medical devices are the market drivers

10.2.4 SOUTH KOREA

10.2.4.1 The country is emerging as an important medical device market

10.2.5 REST OF ASIA PACIFIC

10.3 NORTH AMERICA

10.3.1 US

10.3.1.1 The country’s medical device industry is witnessing constant innovations

10.3.2 CANADA

10.3.2.1 The growth of the dental implants market is positive for the demand of medical adhesives in the country

10.3.3 MEXICO

10.3.3.1 Mexico is a major exporter of medical devices worldwide

10.4 EUROPE

10.4.1 GERMANY

10.4.1.1 The country’s medical device market ranks third in the world

10.4.2 FRANCE

10.4.2.1 The country has a strong medical device manufacturing industry

10.4.3 UK

10.4.3.1 Government support in the field of wound care is helping in the market growth

10.4.4 ITALY

10.4.4.1 The medical device market is reliant on imported products

10.4.5 REST OF EUROPE

10.5 MIDDLE EAST & AFRICA

10.5.1 SAUDI ARABIA

10.5.1.1 Saudi Arabia is the most promising market for medical adhesives in the Middle East

10.5.2 REST OF MIDDLE EAST & AFRICA

10.6 SOUTH AMERICA

10.6.1 BRAZIL

10.6.1.1 Brazil is the largest medical adhesives market in South America

10.6.2 REST OF SOUTH AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 179)

11.1 OVERVIEW

11.2 COMPANY EVALUATION MATRIX: DEFINITIONS AND METHODOLOGY, 2020

11.2.1 STARS

11.2.2 EMERGING LEADERS

11.2.3 PERVASIVE PLAYERS

11.2.4 PARTICIPANTS

11.3 STRENGTH OF PRODUCT PORTFOLIO

11.4 BUSINESS STRATEGY EXCELLENCE

11.5 COMPETITIVE SCENARIO

11.5.1 MARKET EVALUATION MATRIX

11.6 SMALL AND MEDIUM ENTERPRISE MATRIX, 2020

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

11.7 MEDICAL ADHESIVES MARKET SHARE ANALYSIS

11.8 REVENUE ANALYSIS

11.9 MARKET RANKING ANALYSIS

11.9.1 COMPETITIVE SCENARIO AND TRENDS

12 COMPANY PROFILES (Page No. - 196)

12.1 MAJOR PLAYERS

12.1.1 ETHICON, INC. (JOHNSON & JOHNSON SERVICES)

12.1.1.1 Business overview

12.1.1.2 Products offered

12.1.1.3 Recent developments

12.1.1.4 MnM view

12.1.1.4.1 Right to win

12.1.1.4.2 Strategic choices made

12.1.1.4.3 Weaknesses and competitive threats

12.1.2 HENKEL AG & CO. KGAA

12.1.2.1 Business overview

12.1.2.2 Products offered

12.1.2.3 Recent developments

12.1.2.4 MnM view

12.1.2.4.1 Right to win

12.1.2.4.2 Strategic choices made

12.1.2.4.3 Weaknesses and competitive threats

12.1.3 3M COMPANY

12.1.3.1 Business overview

12.1.3.2 Products offered

12.1.3.3 Recent developments

12.1.3.4 MnM view

12.1.3.4.1 Right to win

12.1.3.4.2 Strategic choices made

12.1.3.4.3 Weaknesses and competitive threats

12.1.4 BAXTER INTERNATIONAL

12.1.4.1 Business overview

12.1.4.2 Products offered

12.1.4.3 Recent developments

12.1.4.4 MnM view

12.1.4.4.1 Right to win

12.1.4.4.2 Strategic Choices made

12.1.4.4.3 Weaknesses and competitive threats

12.1.5 NITTO DENKO CORPORATION

12.1.5.1 Business overview

12.1.5.2 Products offered

12.1.5.3 MnM view

12.1.5.3.1 Right to win

12.1.5.3.2 Strategic choices made

12.1.5.3.3 Weakness and competitive threats

12.1.6 B. BRAUN MELSUNGEN AG

12.1.6.1 Business overview

12.1.6.2 Products offered

12.1.6.3 Recent developments

12.1.7 SCAPA GROUP PLC (SWM INTERNATIONAL)

12.1.7.1 Business overview

12.1.7.2 Products offered

12.1.7.3 Recent developments

12.1.8 ADHEZION BIOMEDICAL, LLC

12.1.8.1 Business overview

12.1.8.2 Products offered

12.1.8.3 Recent developments

12.1.9 CHEMENCE

12.1.9.1 Business overview

12.1.9.2 Products offered

12.1.10 CRYOLIFE INC.

12.1.10.1 Business overview

12.1.10.2 Products offered

12.2 OTHER COMPANIES

12.2.1 COVIDIEN (MEDTRONIC)

12.2.1.1 Products offered

12.2.2 DENTSPLY SIRONA

12.2.2.1 Products offered

12.2.3 H.B. FULLER

12.2.3.1 Products offered

12.2.3.2 Recent developments

12.2.4 PERMABOND LLC

12.2.4.1 Products offered

12.2.5 MASTERBOND INC.

12.2.5.1 Products offered

12.2.6 OCULAR THERAPUTIX, INC.

12.2.6.1 Products offered

12.2.7 DYMAX CORPORATION

12.2.7.1 Products offered

12.2.7.2 Recent developments

12.2.8 ASHLAND INC.

12.2.8.1 Products offered

12.2.9 AVERY DENNISON CORPORATION

12.2.9.1 Products offered

12.2.10 DUPONT

12.2.10.1 Products offered

12.2.11 ADVANCED MEDICAL SOLUTIONS GROUP PLC

12.2.11.1 Products offered

12.2.11.2 Recent developments

12.2.12 PANACOL-ELOSOL GMBH

12.2.12.1 Products offered

12.2.13 BACTON DICKISON (BD)

12.2.13.1 Products offered

12.2.14 GEM SRL

12.2.14.1 Products offered

12.2.15 VIVOSTAT A/S

12.2.15.1 Products offered

12.2.16 PROCTER & GAMBLE CO. (P&G)

12.2.16.1 Products offered

12.2.17 GLAXOSMITHKLINE PLC (GSK)

12.2.17.1 Products offered

13 APPENDIX (Page No. - 266)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHORS DETAILS

LIST OF TABLES (250 TABLES)

TABLE 1 MEDICAL ADHESIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 2 GDP GROWTH TRENDS AND FORECASTS, PERCENTAGE CHANGE, 2019–2026

TABLE 3 MEDICAL ADHESIVES MARKET: SUPPLY CHAIN ECOSYSTEM

TABLE 4 EXPORTS DATA FOR MEDICAL ADHESIVES, 2020

TABLE 5 IMPORTS DATA FOR MEDICAL ADHESIVES, 2020

TABLE 6 RECENT PATENTS BY COMPANIES

TABLE 7 MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 8 MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 9 MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (TON)

TABLE 10 MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (TON)

TABLE 11 WATER-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 12 WATER-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 13 WATER-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 14 WATER-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 15 SOLVENT-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 SOLVENT-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 17 SOLVENT-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 18 SOLVENT-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 19 SOLIDS & HOT MELT-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 SOLIDS & HOT MELT-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 21 SOLIDS & HOT MELT-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 22 SOLIDS & HOT MELT-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 23 MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 24 MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 25 MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2017–2020 (TON)

TABLE 26 MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2021–2026 (TON)

TABLE 27 FIBRIN-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 FIBRIN-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 29 FIBRIN-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 30 FIBRIN-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 31 COLLAGEN-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 COLLAGEN-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 33 COLLAGEN-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 34 COLLAGEN-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 35 COMPETITIVE LANDSCAPE OF COLLAGEN-BASED MEDICAL ADHESIVE SUPPLIERS

TABLE 36 OTHER NATURAL RESIN BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 OTHER NATURAL RESIN BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 38 OTHER NATURAL RESIN BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 39 OTHER NATURAL RESIN BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 40 MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC AND SEMI-SYNTHETIC RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 41 MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC AND SEMI-SYNTHETIC RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 42 MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC AND SEMI-SYNTHETIC RESIN TYPE, 2017–2020 (TON)

TABLE 43 MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC AND SEMI-SYNTHETIC RESIN TYPE, 2021–2026 (TON)

TABLE 44 ACRYLIC-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 ACRYLIC-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 46 ACRYLIC-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 47 ACRYLIC-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 48 SILICONE-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 SILICONE-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 50 SILICONE-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 51 SILICONE-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 52 CYANOACRYLATE-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 CYANOACRYLATE-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 54 CYANOACRYLATE-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 55 CYANOACRYLATE-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 56 EPOXY-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 EPOXY-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 58 EPOXY-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 59 EPOXY-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 60 POLYURETHANE-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 POLYURETHANE-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 62 POLYURETHANE-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 63 POLYURETHANE-BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 64 OTHER SYNTHETIC & SEMI-SYNTHETIC RESIN BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 OTHER SYNTHETIC & SEMI-SYNTHETIC RESIN BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 66 OTHER SYNTHETIC & SEMI-SYNTHETIC RESIN BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 67 OTHER SYNTHETIC & SEMI-SYNTHETIC RESIN BASED MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 68 MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 69 MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 70 MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 71 MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 72 MEDICAL ADHESIVES MARKET SIZE IN DENTAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 MEDICAL ADHESIVES MARKET SIZE IN DENTAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 74 MEDICAL ADHESIVES MARKET SIZE IN DENTAL APPLICATION, BY REGION, 2017–2020 (TON)

TABLE 75 MEDICAL ADHESIVES MARKET SIZE IN DENTAL APPLICATION, BY REGION, 2021–2026 (TON)

TABLE 76 MEDICAL ADHESIVES MARKET SIZE IN SURGERY APPLICATION, BY SUB-SEGMENT, 2017–2020 (USD MILLION)

TABLE 77 MEDICAL ADHESIVES MARKET SIZE IN SURGERY APPLICATION, BY SUB-SEGMENT, 2021–2026 (USD MILLION)

TABLE 78 MEDICAL ADHESIVES MARKET SIZE IN SURGERY APPLICATION, BY SUB-SEGMENT, 2017–2020 (TON)

TABLE 79 MEDICAL ADHESIVES MARKET SIZE IN SURGERY APPLICATION, BY SUB-SEGMENT, 2021–2026 (TON)

TABLE 80 MEDICAL ADHESIVES MARKET SIZE IN INTERNAL SURGERY, BY REGION, 2017–2020 (USD MILLION)

TABLE 81 MEDICAL ADHESIVES MARKET SIZE IN INTERNAL SURGERY, BY REGION, 2021–2026 (USD MILLION)

TABLE 82 MEDICAL ADHESIVES MARKET SIZE IN INTERNAL SURGERY, BY REGION, 2017–2020 (TON)

TABLE 83 MEDICAL ADHESIVES MARKET SIZE IN INTERNAL SURGERY, BY REGION, 2021–2026 (TON)

TABLE 84 MEDICAL ADHESIVES MARKET SIZE IN EXTERNAL SURGERY, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 MEDICAL ADHESIVES MARKET SIZE IN EXTERNAL SURGERY, BY REGION, 2021–2026 (USD MILLION)

TABLE 86 MEDICAL ADHESIVES MARKET SIZE IN EXTERNAL SURGERY, BY REGION, 2017–2020 (TON)

TABLE 87 MEDICAL ADHESIVES MARKET SIZE IN EXTERNAL SURGERY, BY REGION, 2021–2026 (TON)

TABLE 88 MEDICAL ADHESIVES MARKET SIZE IN MEDICAL DEVICE & EQUIPMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 89 MEDICAL ADHESIVES MARKET SIZE IN MEDICAL DEVICE & EQUIPMENT, BY REGION, 2021–2026 (USD MILLION)

TABLE 90 MEDICAL ADHESIVES MARKET SIZE IN MEDICAL DEVICE & EQUIPMENT, BY REGION, 2017–2020 (TON)

TABLE 91 MEDICAL ADHESIVES MARKET SIZE IN MEDICAL DEVICE & EQUIPMENT, BY REGION, 2021–2026 (TON)

TABLE 92 MEDICAL ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 93 MEDICAL ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

TABLE 94 MEDICAL ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (TON)

TABLE 95 MEDICAL ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (TON)

TABLE 96 MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 97 MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 98 MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 99 MEDICAL ADHESIVES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 100 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 101 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 102 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 103 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2021–2026 (TON)

TABLE 104 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 105 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 106 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2017–2020 (TON)

TABLE 107 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2021–2026 (TON)

TABLE 108 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 109 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 110 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2017–2020 (TON)

TABLE 111 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2021–2026 (TON)

TABLE 112 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 113 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 114 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (TON)

TABLE 115 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (TON)

TABLE 116 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 117 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 118 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 119 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 120 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 121 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 122 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 123 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2021–2026 (TON)

TABLE 124 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 125 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 126 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2017–2020 (TON)

TABLE 127 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2021–2026 (TON)

TABLE 128 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 129 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 130 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2017–2020 (TON)

TABLE 131 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2021–2026 (TON)

TABLE 132 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 133 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 134 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (TON)

TABLE 135 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (TON)

TABLE 136 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 137 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 138 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 139 NORTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 140 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 141 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 142 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 143 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2021–2026 (TON)

TABLE 144 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 145 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 146 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2017–2020 (TON)

TABLE 147 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2021–2026 (TON)

TABLE 148 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 149 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 150 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2017–2020 (TON)

TABLE 151 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2021–2026 (TON)

TABLE 152 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 153 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 154 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (TON)

TABLE 155 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (TON)

TABLE 156 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 157 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 158 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 159 EUROPE: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 160 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 161 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 162 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 163 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2021–2026 (TON)

TABLE 164 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2017–2020 (TON)

TABLE 167 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2021–2026 (TON)

TABLE 168 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2017–2020 (TON)

TABLE 171 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2021–2026 (TON)

TABLE 172 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (TON)

TABLE 175 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (TON)

TABLE 176 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 179 MIDDLE EAST & AFRICA: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 180 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 181 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 182 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 183 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY COUNTRY, 2021–2026 (TON)

TABLE 184 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 185 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 186 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2017–2020 (TON)

TABLE 187 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY NATURAL RESIN TYPE, 2021–2026 (TON)

TABLE 188 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 189 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 190 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2017–2020 (TON)

TABLE 191 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY SYNTHETIC & SEMI-SYNTHETIC RESIN TYPE, 2021–2026 (TON)

TABLE 192 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 193 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 194 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2017–2020 (TON)

TABLE 195 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY TECHNOLOGY, 2021–2026 (TON)

TABLE 196 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 197 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 198 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 199 SOUTH AMERICA: MEDICAL ADHESIVES MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 200 OVERVIEW OF STRATEGIES ADOPTED BY KEY MEDICAL ADHESIVE PLAYERS

TABLE 201 PRODUCT FOOTPRINT OF COMPANIES

TABLE 202 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 203 REGION FOOTPRINT OF COMPANIES

TABLE 204 STRATEGIC DEVELOPMENTS, BY COMPANY

TABLE 205 MOST FOLLOWED STRATEGIES

TABLE 206 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

TABLE 207 MARKET RANKING OF TOP 5 PLAYERS

TABLE 208 MEDICAL ADHESIVES MARKET: PRODUCT LAUNCHES

TABLE 209 MEDICAL ADHESIVES MARKET: DEALS

TABLE 210 ETHICON, INC.: COMPANY OVERVIEW

TABLE 211 ETHICON, INC.: PRODUCT LAUNCHES

TABLE 212 ETHICON, INC.: DEALS

TABLE 213 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

TABLE 214 HENKEL AG & CO. KGAA: PRODUCT LAUNCHES

TABLE 215 3M COMPANY: COMPANY OVERVIEW

TABLE 216 3M COMPANY: PRODUCT LAUNCHES

TABLE 217 BAXTER INTERNATIONAL: COMPANY OVERVIEW

TABLE 218 BAXTER INTERNATIONAL: PRODUCT LAUNCHES

TABLE 219 BAXTER INTERNATIONAL: DEALS

TABLE 220 NITTO DENKO CORPORATION: COMPANY OVERVIEW

TABLE 221 B. BRAUN MELSUNGEN AG: COMPANY OVERVIEW

TABLE 222 B. BRAUN MELSUNGEN AG: DEALS

TABLE 223 SCAPA GROUP PLC: COMPANY OVERVIEW

TABLE 224 SCAPA GROUP PLC: PRODUCT LAUNCHES

TABLE 225 SCAPA GROUP PLC: DEALS

TABLE 226 ADHEZION BIOMEDICAL, LLC: COMPANY OVERVIEW

TABLE 227 ADHEZION BIOMEDICAL LLC: DEALS

TABLE 228 CHEMENCE: COMPANY OVERVIEW

TABLE 229 CRYOLIFE INC.: COMPANY OVERVIEW

TABLE 230 COVIDIEN (MEDTRONIC): COMPANY OVERVIEW

TABLE 231 DENTSPLY SIRONA: COMPANY OVERVIEW

TABLE 232 H. B. FULLER: COMPANY OVERVIEW

TABLE 233 H.B. FULLER: DEALS

TABLE 234 H.B. FULLER: OTHERS

TABLE 235 PERMABOND LLC: COMPANY OVERVIEW

TABLE 236 MASTERBOND INC.: COMPANY OVERVIEW

TABLE 237 OCULAR THERAPUTIX, INC.: COMPANY OVERVIEW

TABLE 238 DYMAX CORPORATION: COMPANY OVERVIEW

TABLE 239 DYMAX CORPORATION: NEW PRODUCT LAUNCHES

TABLE 240 ASHLAND INC.: COMPANY OVERVIEW

TABLE 241 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

TABLE 242 DUPONT: COMPANY OVERVIEW

TABLE 243 ADVANCED MEDICAL SOLUTIONS GROUP PLC.: COMPANY OVERVIEW

TABLE 244 ADVANCED MEDICAL SOLUTIONS GROUP INC.: DEALS

TABLE 245 PANACOL-ELOSOL GMBH: COMPANY OVERVIEW

TABLE 246 BACTON DICKISON (BD): COMPANY OVERVIEW

TABLE 247 GEM SRL: COMPANY OVERVIEW

TABLE 248 VIVOSTAT A/S: COMPANY OVERVIEW

TABLE 249 PROCTER & GAMBLE CO. (P&G): COMPANY OVERVIEW

TABLE 250 GLAXOSMITHKLINE PLC (GSK): COMPANY OVERVIEW

LIST OF FIGURES (46 FIGURES)

FIGURE 1 MEDICAL ADHESIVES MARKET: RESEARCH DESIGN

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF MAJOR PLAYERS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL APPLICATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – BOTTOM UP (DEMAND SIDE)

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 6 MEDICAL ADHESIVES MARKET: DATA TRIANGULATION

FIGURE 7 FIBRIN TO BE THE LEADING NATURAL RESIN SEGMENT DURING THE FORECAST PERIOD

FIGURE 8 ACRYLIC TO BE THE LEADING SYNTHETIC RESIN SEGMENT DURING THE FORECAST PERIOD

FIGURE 9 DENTAL SEGMENT TO BE THE LARGEST APPLICATION DURING THE FORECAST PERIOD

FIGURE 10 NORTH AMERICA WAS THE LARGEST MEDICAL ADHESIVES MARKET IN 2020

FIGURE 11 MEDICAL ADHESIVES MARKET TO WITNESS HIGH GROWTH BETWEEN 2021 AND 2026

FIGURE 12 ASIA PACIFIC TO BE THE FASTEST-GROWING REGION DURING THE FORECAST PERIOD

FIGURE 13 MEDICAL DEVICE & EQUIPMENT SEGMENT AND JAPAN ACCOUNTED FOR THE LARGEST SHARE

FIGURE 14 WATER-BASED TECHNOLOGY DOMINATED MEDICAL ADHESIVES MARKET ACROSS THE REGIONS IN 2020

FIGURE 15 INDIA TO REGISTER HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MEDICAL ADHESIVES MARKET

FIGURE 17 MEDICAL ADHESIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 ECONOMIC OUTLOOK FOR MAJOR COUNTRIES

FIGURE 19 FACTORS THAT IMPACTED ECONOMY OF SELECT G20 COUNTRIES IN 2020

FIGURE 20 MEDICAL ADHESIVES: VALUE CHAIN ANALYSIS

FIGURE 21 AVERAGE SELLING PRICE OF MEDICAL ADHESIVES, BY REGION

FIGURE 22 ADHESIVES & SEALANTS MARKET: ECOSYSTEM

FIGURE 23 REVENUE SHIFT IN MEDICAL ADHESIVES MARKET

FIGURE 24 NUMBER OF PATENTS PUBLISHED, 2015–2021

FIGURE 25 PATENTS PUBLISHED BY EACH JURISDICTION, 2015–2021

FIGURE 26 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2015–2021

FIGURE 27 WATER-BASED TO BE THE LARGEST TECHNOLOGY SEGMENT OF THE MEDICAL ADHESIVES MARKET DURING THE FORECAST PERIOD

FIGURE 28 FIBRIN RESIN TO LEAD THE NATURAL RESIN SEGMENT IN THE MEDICAL ADHESIVES MARKET DURING THE FORECAST PERIOD

FIGURE 29 ACRYLIC RESIN TO LEAD THE SYNTHETIC AND SEMI SYNTHETIC RESIN TYPE SEGMENT DURING THE FORECAST PERIOD

FIGURE 30 MEDICAL DEVICE & EQUIPMENT IS THE MAJOR APPLICATION OF THE MEDICAL ADHESIVES MARKET DURING THE FORECAST PERIOD

FIGURE 31 ASIA PACIFIC TO BE THE FASTEST-GROWING MARKET DURING THE FORECAST PERIOD

FIGURE 32 ASIA PACIFIC: MEDICAL ADHESIVES MARKET SNAPSHOT

FIGURE 33 NORTH AMERICA: MEDICAL ADHESIVES MARKET SNAPSHOT

FIGURE 34 EUROPE: MEDICAL ADHESIVES MARKET SNAPSHOT

FIGURE 35 MEDICAL ADHESIVES MARKET: COMPANY EVALUATION MATRIX, 2020

FIGURE 36 MEDICAL ADHESIVES MARKET: EMERGING COMPANIES EVALUATION MATRIX, 2020

FIGURE 37 MEDICAL ADHESIVES MARKET SHARE ANALYSIS, 2020

FIGURE 38 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2016–2020

FIGURE 39 ETHICON, INC.: COMPANY SNAPSHOT

FIGURE 40 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

FIGURE 41 3M COMPANY: COMPANY SNAPSHOT

FIGURE 42 BAXTER INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 43 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

FIGURE 44 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT

FIGURE 45 SCAPA GROUP PLC: COMPANY SNAPSHOT

FIGURE 46 CRYOLIFE INC.: COMPANY SNAPSHOT

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Adhesives Market