Surgical Sealants and Adhesives Market Size by Product (Natural (Fibrin, Collagen, Gelatin), Synthetic (Hydrogel)), Indication (Tissue Sealing, Tissue Engineering), Application (CNS, Cardiovascular, Cosmetic Surgery), End User & Region - Global Forecasts to 2025

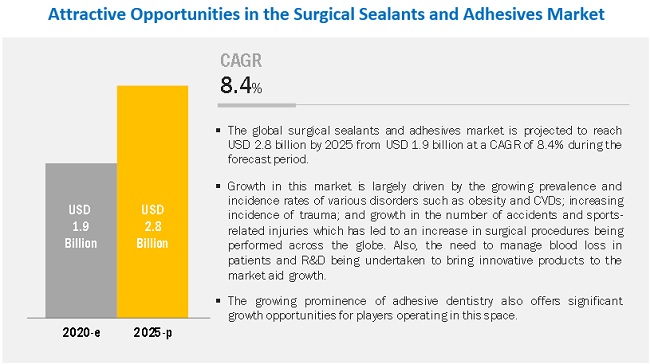

The size of global surgical sealants market in terms of revenue was estimated to be worth $1.9 billion in 2020 and is poised to reach $2.8 billion by 2025, growing at a CAGR of 8.4% from 2020 to 2025. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Growth in this market is driven by the growing prevalence and incidence rates of various disorders such as obesity and CVDs; increasing incidence of trauma; growth in the number of accidents and sports-related injuries, which has led to an increase in surgical procedures being performed across the globe. Also, the need to manage blood loss in patients and R&D being undertaken to bring innovative products to the market is aiding the market growth. Better cosmetic outcomes are also increasing the adoption of surgical sealants and adhesives in cosmetic procedures across the globe.

The natural/biological sealants and adhesives segment is expected to account for the largest share of the surgical sealants industry, by product.

By product, the surgical sealants market is segmented into natural/biological sealants and adhesives and synthetic & semisynthetic sealants and adhesives. The natural/biological sealants and adhesives segment accounted for the largest share of the market in 2019. This segment is further segmented into polypeptide/protein-based sealants and adhesives and polysaccharide-based sealants and adhesives. The large share of natural/biological sealants and adhesives segment can be attributed to the fact that sealants derived from natural polymers provide superior biocompatibility, reduced immune response, and in vivo degradability as compared to synthetic sealants; and are used to repair injured tissues and reinforce surgical wounds, thus having replaced common suturing techniques.

The tissue engineering segment of the surgical sealants industry is expected to grow at the highest CAGR during the forecast period.

Based on indication, the surgical sealants market is segmented into tissue sealing, surgical hemostasis, and tissue engineering. The tissue engineering segment is projected to witness the highest growth in the market during the forecast period. This is due to the growing need for tissue regeneration in cases of skin injuries or burn injuries, along with the increasing number of cosmetic surgeries taking place across the globe.

The cosmetic surgery segment of the surgical sealants industry is expected to grow at the highest CAGR during the forecast period.

Based on application, the surgical sealants market is segmented into cardiovascular surgery, general surgery, CNS surgery, pulmonary surgery, ophthalmic surgery, orthopedic surgery, cosmetic surgery, urological surgery, and other applications. The cosmetic surgery segment is projected to witness the highest growth in the market during the forecast period. This is due to the increasing adoption of tissue sealants and adhesives for cosmetic procedures and burn treatment surgeries. It is further set to increase with the increasing number of facial cosmetic surgeries, increasing cases of skin injuries, growing incidence of burn injuries, and an increasing number of breast cancer patients undergoing mastectomy and breast reconstruction procedures across the globe.

Hospitals to account for the largest share of the surgical sealants industry, by end user.

On the basis of end users, the surgical sealants market is segmented into hospitals, clinics, and other end users (ambulatory surgery centers, burn care centers, and research institutes). The hospital segment accounted for the largest share of the market in 2019. This is primarily attributed to the increasing number of surgeries taking place across the globe due to the rising geriatric population and the incidence of various diseases. Moreover, the increasing need to control blood loss and achieve efficient hemostasis and wound closure in trauma cases, injuries, or surgical procedures is leading to their rising adoption by surgeons. The low cost of these products along with their ease of use and lower risk of complications, offer significant advantages, further supporting market growth.

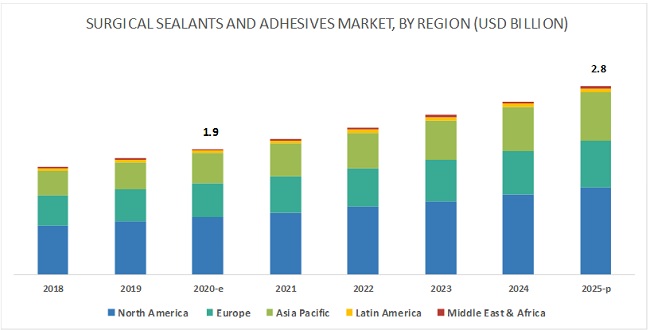

The APAC market of the surgical sealants industry is expected to grow at the highest CAGR during the forecast period

The surgical sealants market in the Asia Pacific is expected to witness the highest CAGR during the forecast period. Factors such as the increasing investments by major players in these regions, rising health awareness, growing per capita income, increasing medical tourism, presence of less stringent regulations, and the growing demand for quality healthcare are expected to drive the growth of this market during the forecast period.

The prominent players in the surgical sealants market are Johnson & Johnson (Ethicon, Inc.) (US), Baxter International, Inc. (US), Becton, Dickinson and Company (US), CryoLife, Inc. (US), Cardinal Health, Inc. (US), B. Braun Melsungen AG (Germany), Integra Lifesciences Holdings Corporation (US), Medline Industries, Inc. (US), Adhezion Biomedical, LLC (US), Tricol Biomedical, Inc. (US), Vivostat A/S (Denmark), Advanced Medical Solutions Group plc (UK), Stryker Corporation (US), CSL Limited (Australia), Ocular Therapeutix, Inc. (US), MicroVal (France), GEM Srl (Italy), Hemostasis, LLC (US), Péters Surgical (France), and Tissuemed Ltd (UK).

Johnson & Johnson (Ethicon, Inc.) (US) is the leading player in the global surgical sealants and adhesives market. The company has a strong brand value as well as an established geographic presence. It offers a strong and broad product portfolio for surgical sealants and adhesives, whsome of the leading brands in the global biosurgery market. The company has reported revenue growth of ~ 5-8% in its biosurgical products segment between 2018 and 2019. The growth of this segment is mainly dich serves as an important factor for its large market share. Its flagship sealants and hemostatic products such as EVICEL, SURGICEL series, EVARREST, SURGIFLOW, and SURGIFOAM series are riven by the company’s wide presence in the APAC market and continuous growth in the US market. It further focuses on increasing its presence in this market through continuous R&D activities to provide technologically advanced solutions to customers.

Scope of the Surgical Sealants Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

USD 1.9 billion |

|

Projected Revenue Size by 2025 |

USD 2.8 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 8.4% |

|

Market Driver |

Rising need for effective blood loss management in patients |

|

Market Opportunity |

Improving healthcare systems in emerging markets |

The research report categorizes the surgical sealants market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Natural/Biological Sealants and Adhesives

-

Natural/Biological Sealants and Adhesives, By Type

- Polypeptide/protein-based sealants and adhesives

-

Polysaccharide-based sealants and adhesives

- Chitosan-based sealants and adhesives

- Other Polysaccharide-based sealants and adhesives

-

Natural/Biological Sealants and Adhesives, By Origin

- Human-blood based sealants and adhesives

- Animal-based sealants and adhesives

-

Natural/Biological Sealants and Adhesives, By Type

-

Synthetic & Semi-synthetic Sealants and Adhesives

- PEG Hydrogels

- Cyanoacrylates

- Urethane-based sealants and adhesives

- Other Synthetic & semi-synthetic sealants and adhesives

By Indication

- Tissue Sealing

- Surgical Hemostasis

- Tissue Engineering

By Application

- Cardiovascular Surgery

- General Surgery

- CNS Surgery

- Orthopedic Surgery

- Cosmetic Surgery

- Urological Surgery

- Pulmonary Surgery

- Ophthalmic Surgery

- Other Applications

By End User

- Hospitals

- Clinics

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Switzerland

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Surgical Sealants Industry:

- In 2019, Johnson & Johnson (Ethicon, Inc.) launched VISTASEAL Fibrin Sealant (Human) to manage bleeding during surgery.

- In 2019, CSL opened its new global headquarters in Melbourne, Australia, for the fostering and supporting of collaborations between academic biomedical research and industry, creating important linkages in the translation for new medicines for unmet medical needs.

- In 2019, AMS acquired Sealantis, an Israeli-based medical device company with a patent-protected alga-mimetic sealant technology platform that has a wide range of potential surgical indications under development. This helped AMS strengthen its presence with a technology platform and delivery systems that have significant potential across a range of applications in the high-margin internal surgery market.

- In 2018, Baxter acquired two hemostat and sealant products from Mallinckrodt. RECOTHROM Thrombin topical hemostat is the first and only stand-alone recombinant thrombin, and PREVELEAK surgical sealant is used in vascular reconstruction. This acquisition helped Baxter expand its product offerings and garner a larger share of the global surgical sealants and adhesives market.

- In 2018, Baxter launched the disposable curved applicator, which enhances the delivery experience of the FLOSEAL Hemostatic Matrix product line for procedures in the otolaryngology and head & neck surgical specialty.

Critical questions answered in the report:

- How will the current trends affect the surgical sealants and adhesives market in the long term?

- How is the synthetic & semisynthetic sealants and adhesives market faring?

- What are the application areas of the surgical sealants and adhesives market?

- Which regions are likely to grow at the highest CAGR?

- What are the growth strategies being implemented by major market players?

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global surgical sealants market?

The global surgical sealants market boasts a total revenue value of USD 2.8 billion by 2025.

What is the estimated growth rate (CAGR) of the global surgical sealants market?

The global surgical sealants market has an estimated compound annual growth rate (CAGR) of 8.4% and a revenue size in the region of USD 1.9 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION & SCOPE

1.2.1 MARKETS COVERED

1.2.2 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 STAKEHOLDERS

1.5 LIMITATIONS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH APPROACH

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION APPROACH

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 40)

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 SURGICAL SEALANTS MARKET OVERVIEW

4.2 LATIN AMERICA: MARKET, BY INDICATION

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

4.4 GLOBAL MARKET, BY REGION (2018–2025)

4.5 GLOBAL SURGICAL SEALANTS INDUSTRY: DEVELOPED VS. DEVELOPING MARKETS

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 MARKET DRIVERS

5.2.1.1 Rising need for effective blood loss management in patients

5.2.1.2 Increasing number of surgical procedures across the globe

5.2.1.3 Growing use of technologically advanced products

5.2.2 MARKET RESTRAINTS

5.2.2.1 Rising healthcare costs and lack of reimbursements

5.2.2.2 Cost-intensive requirement of clinical data for new product launches

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Improving healthcare systems in emerging markets

5.2.3.2 Rising prominence of adhesive dentistry

5.2.4 MARKET CHALLENGES

5.2.4.1 Development of novel biomaterials

5.2.4.2 Requirement of skilled personnel for optimal utilization of products

6 INDUSTRY INSIGHTS (Page No. - 57)

6.1 INTRODUCTION

6.2 INDUSTRY TRENDS

6.2.1 GROWING PREFERENCE FOR GELATIN-BASED ADHESIVES AND HYDROGELS IN SURGICAL PROCEDURES

6.2.2 BIOMIMETIC ADHESIVES

6.2.3 NANO-ENABLED MATERIALS FOR NEXT-GENERATION ADHESIVES

6.3 STRATEGIC BENCHMARKING

6.4 REGULATORY ANALYSIS

6.4.1 NORTH AMERICA

6.4.1.1 US

6.4.1.2 Canada

6.4.2 EUROPE

6.4.3 ASIA PACIFIC

6.4.3.1 Japan

6.4.3.2 China

6.4.3.3 India

6.5 CLINICAL TRIAL ASSESSMENT

6.6 PARENT MARKET ANALYSIS

6.7 COVID-19 IMPACT ON THE GLOBAL MARKET

7 SURGICAL SEALANTS MARKET, BY PRODUCT (Page No. - 70)

7.1 INTRODUCTION

7.2 NATURAL/BIOLOGICAL SEALANTS AND ADHESIVES

7.2.1 NATURAL/BIOLOGICAL SEALANTS AND ADHESIVES, BY TYPE

7.2.1.1 Polypeptide/protein-based sealants and adhesives

7.2.1.1.1 Fibrin-based sealants and adhesives

7.2.1.1.2 Gelatin-based sealants and adhesives

7.2.1.1.3 Collagen-based sealants and adhesives

7.2.1.1.4 Albumin-based sealants and adhesives

7.2.1.2 Polysaccharide-based sealants and adhesives

7.2.1.2.1 Chitosan-based sealants and adhesives

7.2.1.2.2 Other polysaccharide-based sealants and adhesives

7.2.2 NATURAL/BIOLOGICAL SEALANTS AND ADHESIVES, BY ORIGIN

7.2.2.1 Animal-based sealants and adhesives

7.2.2.2 Human blood-based sealants and adhesives

7.3 SYNTHETIC & SEMISYNTHETIC SEALANTS AND ADHESIVES

7.3.1 PEG HYDROGELS

7.3.2 CYANOACRYLATES

7.3.3 URETHANE-BASED SEALANTS AND ADHESIVES

7.3.4 OTHER SYNTHETIC & SEMISYNTHETIC SEALANTS AND ADHESIVES

8 SURGICAL SEALANTS MARKET, BY INDICATION (Page No. - 98)

8.1 INTRODUCTION

8.2 TISSUE SEALING

8.2.1 FIBRIN-BASED SEALANTS ARE MOST WIDELY USED FOR TISSUE SEALING ACROSS A RANGE OF SURGICAL PROCEDURES

8.3 SURGICAL HEMOSTASIS

8.3.1 RISING INCIDENCE OF CARDIOVASCULAR, ORTHOPEDIC, AND SPINAL CONDITIONS TO DRIVE GROWTH FOR SURGICAL HEMOSTASIS

8.4 TISSUE ENGINEERING

8.4.1 INCREASING R&D ON BIOMATERIALS DERIVED FROM HUMAN BLOOD TO ENHANCE THE GROWTH OF THIS SEGMENT

9 SURGICAL SEALANTS MARKET, BY APPLICATION (Page No. - 105)

9.1 INTRODUCTION

9.2 CARDIOVASCULAR SURGERY

9.2.1 FIBRIN SEALANTS ARE WITNESSING INCREASING ADOPTION IN OPCAB AND MIDCAB PROCEDURES

9.3 GENERAL SURGERY

9.3.1 NEED TO PREVENT BLOOD LOSS IN GASTROINTESTINAL SURGERIES IS DRIVING MARKET GROWTH

9.4 CENTRAL NERVOUS SYSTEM SURGERY

9.4.1 SEALANTS WITH ANTIMICROBIAL AND ANALGESIC PROPERTIES ARE UNDERGOING RESEARCH FOR CNS SURGERIES

9.5 ORTHOPEDIC SURGERY

9.5.1 INCREASE IN SPORTS-RELATED INJURY TREATMENTS IS AIDING GROWTH OF SEALANTS AND ADHESIVES IN THIS SEGMENT

9.6 COSMETIC SURGERY

9.6.1 INCREASING NUMBER OF COSMETIC AND SKIN SURGERIES ARE DRIVING MARKET GROWTH

9.7 UROLOGICAL SURGERY

9.7.1 COMPLEX RECONSTRUCTIVE GENITOURINARY PROCEDURES DRIVE THE GROWTH OF THIS SEGMENT

9.8 PULMONARY SURGERY

9.8.1 INCREASE IN LUNG CANCER-RELATED SURGERIES IS EXPECTED TO AID MARKET GROWTH

9.9 OPHTHALMIC SURGERY

9.9.1 REQUIREMENT FOR BETTER BIOCOMPATIBLE SEALANTS IS PROPELLING R&D AND DRIVING MARKET GROWTH

9.10 OTHER APPLICATIONS

10 SURGICAL SEALANTS MARKET, BY END USER (Page No. - 122)

10.1 INTRODUCTION

10.2 HOSPITALS

10.2.1 INCREASING NUMBER OF SURGERIES AND TRAUMA CASES ARE SET TO INCREASE THE ADOPTION OF SEALANTS AND ADHESIVES

10.3 CLINICS

10.3.1 INCREASING NUMBER OF COSMETIC SURGERIES PERFORMED IN CLINICS IS EXPECTED TO DRIVE MARKET GROWTH

10.4 OTHER END USERS

11 SURGICAL SEALANTS MARKET, BY REGION (Page No. - 129)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 US

11.2.1.1 The US dominates the North American market

11.2.2 CANADA

11.2.2.1 Improving healthcare quality and focus on patient safety will aid market growth

11.3 EUROPE

11.3.1 GERMANY

11.3.1.1 Germany holds the largest share in the European market

11.3.2 FRANCE

11.3.2.1 High healthcare spending supported by the government will drive the adoption of surgical products

11.3.3 UK

11.3.3.1 Rising incidence and prevalence of CVDs to drive market growth

11.3.4 ITALY

11.3.4.1 Growth in this market is driven by the improving quality and accessibility to medical care and technologies

11.3.5 SWITZERLAND

11.3.5.1 Increasing demand for healthcare services and growing healthcare awareness drive market growth

11.3.6 SPAIN

11.3.6.1 Increasing demand for bariatric surgeries in the country will drive the adoption of tissue sealing products

11.3.7 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 JAPAN

11.4.1.1 Early adoption of technologically advanced products attracts market players and drives growth

11.4.2 CHINA

11.4.2.1 China is one of the fastest-growing markets offering significant growth opportunities

11.4.3 INDIA

11.4.3.1 Increasing number of surgical procedures being conducted for a large patient population will drive market growth

11.4.4 SOUTH KOREA

11.4.4.1 Highly attractive medical tourism industry in South Korea drives market growth

11.4.5 REST OF ASIA PACIFIC

11.5 LATIN AMERICA

11.5.1 BRAZIL

11.5.1.1 Increasing number of cosmetic surgeries performed in the country is a major factor for market growth

11.5.2 MEXICO

11.5.2.1 Increasing incidence of lifestyle-related disorders is expected to increase surgical interventions thereby driving market growth

11.5.3 REST OF LATIN AMERICA

11.6 MIDDLE EAST & AFRICA

11.6.1 IMPROVING HEALTHCARE INFRASTRUCTURE WILL LEAD TO THE ADOPTION OF TECHNOLOGICALLY ADVANCED PRODUCTS

12 COMPETITIVE LANDSCAPE (Page No. - 219)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS

12.3 COMPETITIVE LEADERSHIP MAPPING

12.3.1 STARS

12.3.2 EMERGING LEADERS

12.3.3 PERVASIVE PLAYERS

12.3.4 EMERGING COMPANIES

12.4 COMPETITIVE SITUATION AND TRENDS

12.4.1 PRODUCT LAUNCHES

12.4.2 EXPANSIONS

12.4.3 ACQUISITIONS

12.4.4 OTHER STRATEGIES

13 COMPANY PROFILES (Page No. - 228)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 JOHNSON & JOHNSON (ETHICON, INC.)

13.2 BAXTER INTERNATIONAL, INC.

13.3 BECTON, DICKINSON AND COMPANY

13.4 CARDINAL HEALTH, INC.

13.5 CRYOLIFE, INC.

13.6 B. BRAUN MELSUNGEN AG

13.7 INTEGRA LIFESCIENCES HOLDINGS CORPORATION

13.8 ADVANCED MEDICAL SOLUTIONS GROUP PLC (AMS GROUP)

13.9 STRYKER CORPORATION

13.10 CSL LIMITED

13.11 MEDLINE INDUSTRIES, INC.

13.12 ADHEZION BIOMEDICAL, LLC

13.13 TRICOL BIOMEDICAL, INC.

13.14 VIVOSTAT A/S

13.15 OCULAR THERAPEUTIX, INC.

13.16 OTHER COMPANIES

13.16.1 MICROVAL

13.16.2 GEM SRL

13.16.3 HEMOSTASIS, LLC

13.16.4 PÉTERS SURGICAL

13.16.5 TISSUEMED LTD

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 263)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

LIST OF TABLES (264 TABLES)

TABLE 1 SURGICAL SEALANTS MARKET: IMPACT ANALYSIS

TABLE 2 PERCENTAGE INCREASE IN THE NUMBER OF SURGERIES PERFORMED IN THE US

TABLE 3 PRODUCT PORTFOLIO ANALYSIS: NATURAL/BIOLOGICAL MARKET

TABLE 4 PRODUCT PORTFOLIO ANALYSIS: SYNTHETIC & SEMISYNTHETIC MARKET

TABLE 5 US FDA: MEDICAL DEVICE CLASSIFICATION

TABLE 6 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

TABLE 7 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

TABLE 8 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

TABLE 9 CHINA: REGULATORY BODIES APPOINTED FOR MEDICAL DEVICE APPROVAL

TABLE 10 CHINA: CLASSIFICATION OF MEDICAL DEVICES

TABLE 11 GLOBAL MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 12 COMMERCIALLY AVAILABLE NATURAL/BIOLOGICAL SEALANTS AND ADHESIVES

TABLE 13 NATURAL/BIOLOGICAL SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 NATURAL/BIOLOGICAL SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 15 POLYPEPTIDE/PROTEIN-BASED SEALANTS AND ADHESIVES

TABLE 16 POLYPEPTIDE/PROTEIN-BASED SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 17 POLYPEPTIDE/PROTEIN-BASED SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 18 FIBRIN-BASED SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 19 GELATIN-BASED SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 20 COLLAGEN-BASED SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 21 ALBUMIN-BASED SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 22 POLYSACCHARIDE-BASED SEALANTS AND ADHESIVES

TABLE 23 POLYSACCHARIDE-BASED SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 24 POLYSACCHARIDE-BASED SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 25 CHITOSAN-BASED SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 26 OTHER POLYSACCHARIDE-BASED SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 27 NATURAL/BIOLOGICAL SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 28 ANIMAL-BASED SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 29 HUMAN BLOOD-BASED SEALANTS

TABLE 30 HUMAN BLOOD-BASED SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 31 TYPES AND APPLICATIONS OF SYNTHETIC & SEMISYNTHETIC SEALANTS AND ADHESIVES

TABLE 32 COMMERCIALLY AVAILABLE SYNTHETIC & SEMISYNTHETIC SEALANTS AND ADHESIVES

TABLE 33 SYNTHETIC & SEMISYNTHETIC SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 34 SYNTHETIC & SEMISYNTHETIC SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 35 PEG HYDROGELS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 36 CYANOACRYLATES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 37 URETHANE-BASED SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 38 OTHER SYNTHETIC & SEMISYNTHETIC SEALANTS AND ADHESIVES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 39 SURGICAL SEALANTS MARKET, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 40 GLOBAL MARKET FOR TISSUE SEALING, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 41 GLOBAL MARKET FOR SURGICAL HEMOSTASIS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 42 GLOBAL MARKET FOR TISSUE ENGINEERING, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 GLOBAL SURGICAL SEALANTS INDUSTRY, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 44 GLOBAL MARKET FOR CARDIOVASCULAR SURGERY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 45 BARIATRIC SURGERIES IN THE US (2011-2018)

TABLE 46 GLOBAL MARKET FOR GENERAL SURGERY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 GLOBAL MARKET FOR CNS SURGERY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 48 GLOBAL MARKET FOR ORTHOPEDIC SURGERY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 49 GLOBAL MARKET FOR COSMETIC SURGERY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 50 SURGICAL SEALANTS MARKET FOR UROLOGICAL SURGERY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 51 GLOBAL MARKET FOR PULMONARY SURGERY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 52 MARKET FOR OPHTHALMIC SURGERY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 54 SURGICAL SEALANTS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 55 MARKET FOR HOSPITALS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 56 MARKET FOR CLINICS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 57 MARKET FOR OTHER END USERS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 58 MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 59 NORTH AMERICA: SURGICAL SEALANTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: POLYSACCHARIDE-BASED SURGICAL-SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 65 NORTH AMERICA: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 NORTH AMERICA: SURGICAL SEALANTS INDUSTRY, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 69 US: SURGICAL SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 70 US: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 US: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 72 US: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 73 US: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 74 US: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 US: GLOBAL SURGICAL SEALANTS INDUSTRY, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 76 US: GLOBAL MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 77 US: GLOBAL MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 78 CANADA: SURGICAL SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 79 CANADA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 CANADA: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 81 CANADA: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 82 CANADA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 83 CANADA: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 84 CANADA: SURGICAL SEALANTS MARKET, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 85 CANADA: GLOBAL MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 86 CANADA: GLOBAL SURGICAL SEALANTS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 87 EUROPE: GLOBAL MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 88 EUROPE: GLOBAL MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 89 EUROPE: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 90 EUROPE: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 91 EUROPE: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 92 EUROPE: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 93 EUROPE: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 94 EUROPE: SURGICAL SEALANTS MARKET, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 95 EUROPE: SURGICAL SEALANTS INDUSTRY, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 97 GERMANY: SURGICAL SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 98 GERMANY: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 99 GERMANY: POLYPEPTIDE/PROTEIN-BASED SURGICAL-EALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 100 GERMANY: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 101 GERMANY: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 102 GERMANY: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 GERMANY: SURGICAL SEALANTS MARKET, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 104 GERMANY: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 105 GERMANY: SURGICAL SEALANTS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 106 FRANCE: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 107 FRANCE: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 108 FRANCE: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 109 FRANCE: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 110 FRANCE: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 111 FRANCE: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 112 FRANCE: SURGICAL SEALANTS MARKET, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 113 FRANCE: SURGICAL SEALANTS INDUSTRY, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 114 FRANCE: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 115 UK: SURGICAL SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 116 UK: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 117 UK: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 118 UK: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 119 UK: NATURAL/BIOLOGICAL SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 120 UK: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 121 UK: SURGICAL SEALANTS MARKET, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 122 UK: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 123 UK: SURGICAL SEALANTS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 124 ITALY: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 125 ITALY: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 126 ITALY: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 127 ITALY: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 128 ITALY: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 129 ITALY: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 130 ITALY: SURGICAL SEALANTS INDUSTRY, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 131 ITALY: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 132 ITALY: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 133 SWITZERLAND: SURGICAL SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 134 SWITZERLAND: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 135 SWITZERLAND: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 136 SWITZERLAND: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 137 SWITZERLAND: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 138 SWITZERLAND: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 139 SWITZERLAND: SURGICAL SEALANTS MARKET, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 140 SWITZERLAND: SURGICAL SEALANTS INDUSTRY, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 141 SWITZERLAND: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 142 SPAIN: SURGICAL SEALANTS INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

TABLE 143 SPAIN: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 144 SPAIN: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 145 SPAIN: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 146 SPAIN: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 147 SPAIN: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 148 SPAIN: SURGICAL SEALANTS INDUSTRY, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 149 SPAIN: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 150 SPAIN: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 151 ROE: SURGICAL SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 152 ROE: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 153 ROE: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 154 ROE: POLYSACCHARIDE-BASED SURGICAL SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 155 ROE: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 156 ROE: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 157 ROE: SURGICAL SEALANTS INDUSTRY, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 158 ROE: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 159 ROE: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 160 ASIA PACIFIC: SURGICAL SEALANTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 162 ASIA PACIFIC: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 163 ASIA PACIFIC: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 164 ASIA PACIFIC: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 165 ASIA PACIFIC: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 166 ASIA PACIFIC: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 167 ASIA PACIFIC: SURGICAL SEALANTS INDUSTRY, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 170 JAPAN: SURGICAL SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 171 JAPAN: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 172 JAPAN: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 173 JAPAN US: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 174 JAPAN: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 175 JAPAN: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 176 JAPAN: MARKET, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 177 JAPAN: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 178 JAPAN: SURGICAL SEALANTS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 179 CHINA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 180 CHINA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 181 CHINA: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 182 CHINA: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 183 CHINA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 184 CHINA: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 185 CHINA: MARKET, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 186 CHINA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 187 CHINA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 188 INDIA: SURGICAL SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 189 INDIA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 190 INDIA: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 191 INDIA: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 192 INDIA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 193 INDIA: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 194 INDIA: SURGICAL SEALANTS INDUSTRY, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 195 INDIA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 196 INDIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 197 SOUTH KOREA: SURGICAL SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 198 SOUTH KOREA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 199 SOUTH KOREA: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 200 SOUTH KOREA: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 201 SOUTH KOREA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 202 SOUTH KOREA: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 203 SOUTH KOREA: SURGICAL SEALANTS INDUSTRY, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 204 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 205 SOUTH KOREA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 206 ROAPAC: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 207 ROAPAC: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 208 ROAPAC: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 209 ROAPAC: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 210 ROAPAC: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 211 ROAPAC: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 212 ROAPAC: MARKET, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 213 ROAPAC: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 214 ROAPAC: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 215 LATIN AMERICA: SURGICAL SEALANTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 217 LATIN AMERICA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 218 LATIN AMERICA: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 219 LATIN AMERICA: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 220 LATIN AMERICA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 221 LATIN AMERICA: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 222 LATIN AMERICA: SURGICAL SEALANTS INDUSTRY, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 223 LATIN AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 224 LATIN AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 225 BRAZIL: SURGICAL SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 226 BRAZIL: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 227 BRAZIL: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 228 BRAZIL: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 229 BRAZIL: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 230 BRAZIL: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 231 BRAZIL: MARKET, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 232 BRAZIL: SURGICAL SEALANTS INDUSTRY, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 233 BRAZIL: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 234 MEXICO: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 235 MEXICO: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 236 MEXICO: POLYPEPTIDE/PROTEIN-BASED-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 237 MEXICO: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 238 MEXICO: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 239 MEXICO: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 240 MEXICO: ADHESIVES MARKET, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 241 MEXICO: ADHESIVES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 242 MEXICO: ADHESIVES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 243 ROLA: SURGICAL SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 244 ROLA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 245 ROLA: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 246 ROLA: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 247 ROLA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 248 ROLA: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 249 ROLA: SURGICAL SEALANTS INDUSTRY, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 250 ROLA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 251 ROLA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 252 MIDDLE EAST & AFRICA: SURGICAL SEALANTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 253 MIDDLE EAST & AFRICA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 254 MIDDLE EAST & AFRICA: POLYPEPTIDE/PROTEIN-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 255 MIDDLE EAST & AFRICA: POLYSACCHARIDE-BASED SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 256 MIDDLE EAST & AFRICA: NATURAL/BIOLOGICAL SURGICAL-SEALANTS AND ADHESIVES MARKET, BY ORIGIN, 2018–2025 (USD MILLION)

TABLE 257 MIDDLE EAST & AFRICA: SYNTHETIC & SEMISYNTHETIC SURGICAL-SEALANTS AND ADHESIVES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 258 MIDDLE EAST & AFRICA: SURGICAL-SEALANTS AND ADHESIVES MARKET, BY INDICATION, 2018–2025 (USD MILLION)

TABLE 259 MIDDLE EAST & AFRICA: SURGICAL-SEALANTS AND ADHESIVES MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 260 MIDDLE EAST & AFRICA: SURGICAL-SEALANTS AND ADHESIVES MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 261 PRODUCT LAUNCHES, 2017–2019

TABLE 262 EXPANSIONS, 2017–2019

TABLE 263 ACQUISITIONS, 2017–2019

TABLE 264 OTHER STRATEGIES, 2017–2019

LIST OF FIGURES (49 FIGURES)

FIGURE 1 SURGICAL SEALANTS MARKET

FIGURE 2 RESEARCH DESIGN

FIGURE 3 PRIMARY SOURCES

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 7 MARKET SIZING FROM COMPANY REVENUES

FIGURE 8 MARKET ANALYSIS APPROACH

FIGURE 9 TOP-DOWN APPROACH

FIGURE 10 DATA TRIANGULATION METHODOLOGY

FIGURE 11 SURGICAL SEALANTS MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 12 SURGICAL SEALANTS MARKET, BY INDICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 13 SURGICAL SEALANTS MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 14 SURGICAL SEALANTS MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 15 GEOGRAPHIC ANALYSIS: SURGICAL SEALANTS MARKET

FIGURE 16 INCREASING NEED TO MANAGE BLOOD LOSS IN PATIENTS TO DRIVE MARKET GROWTH

FIGURE 17 TISSUE SEALING SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE LATIN AMERICAN SURGICAL SEALANTS MARKET IN 2019

FIGURE 18 CHINA SHOWS THE HIGHEST REVENUE GROWTH DURING THE FORECAST PERIOD

FIGURE 19 NORTH AMERICA WILL CONTINUE TO DOMINATE THE SURGICAL SEALANTS MARKET UNTIL 2025

FIGURE 20 DEVELOPING MARKETS TO REGISTER A HIGHER GROWTH RATE IN THE FORECAST PERIOD

FIGURE 21 CANADA: CLASS III MEDICAL DEVICES APPROVAL PROCESS

FIGURE 22 EUROPE: CE APPROVAL PROCESS FOR CLASS III MEDICAL DEVICES

FIGURE 23 CLINICAL TRIAL ASSESSMENT FOR SURGICAL SEALANTS AND ADHESIVES (2016–2019)

FIGURE 24 BIOSURGERY MARKET SNAPSHOT

FIGURE 25 POLYPEPTIDE/PROTEIN BASED SEALANTS AND ADHESIVES DOMINATED THE SURGICAL SEALANTS MARKET IN 2019

FIGURE 26 GELATIN-BASED SEALANTS AND ADHESIVES TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 27 ANIMAL-BASED SEALANTS AND ADHESIVES DOMINATED THE MARKET IN 2019

FIGURE 28 PEG HYDROGELS DOMINATED THE SYNTHETIC & SEMISYNTHETIC SEALANTS AND ADHESIVES MARKET IN 2019

FIGURE 29 TISSUE ENGINEERING SEGMENT TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 30 COSMETIC SURGERY SEGMENT TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 31 HOSPITALS SEGMENT TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 32 SURGICAL SEALANTS MARKET (GLOBAL) GEOGRAPHIC SNAPSHOT, 2019

FIGURE 33 NORTH AMERICA: SURGICAL SEALANTS MARKET SNAPSHOT

FIGURE 34 EUROPE: SURGICAL SEALANTS MARKET SNAPSHOT

FIGURE 35 ASIA PACIFIC: SURGICAL SEALANTS MARKET SNAPSHOT

FIGURE 36 LATIN AMERICA: SURGICAL SEALANTS MARKET SNAPSHOT

FIGURE 37 KEY GROWTH STRATEGIES ADOPTED BY MARKET PLAYERS FROM JANUARY 2017 TO APRIL 2020

FIGURE 38 SURGICAL SEALANTS MARKET SHARE, BY KEY PLAYERS, 2019

FIGURE 39 SURGICAL SEALANTS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 40 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2019)

FIGURE 41 BAXTER INTERNATIONAL: COMPANY SNAPSHOT (2019)

FIGURE 42 BECTON, DICKINSON & COMPANY: COMPANY SNAPSHOT (2019)

FIGURE 43 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT (2019)

FIGURE 44 CRYOLIFE, INC.: COMPANY SNAPSHOT (2019)

FIGURE 45 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2019)

FIGURE 46 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY SNAPSHOT (2019)

FIGURE 47 ADVANCED MEDICAL SOLUTIONS GROUP PLC: COMPANY SNAPSHOT (2018)

FIGURE 48 STRYKER CORPORATION: COMPANY SNAPSHOT (2019)

FIGURE 49 CSL LIMITED: COMPANY SNAPSHOT (2019)

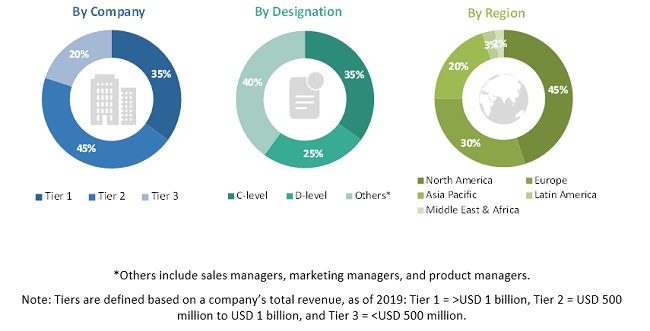

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research study involved the use of widespread secondary sources; directories; databases such as Dun & Bradstreet, Bloomberg BusinessWeek, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global surgical sealants and adhesives market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, key developments related to market, and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the surgical sealants and adhesives market. The primary sources from the demand side include industry experts such as surgeons, physicians and doctors, and life science researchers.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product, indication, application, end user, and region).

Data Triangulation

After arriving at the market size, the surgical sealants and adhesives market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the surgical sealants and adhesives market by product, indication, application, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall surgical sealants and adhesives market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the surgical sealants and adhesives market in five main regions along with their respective key countries, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players in the surgical sealants and adhesives market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions; new product launches; expansions; collaborations, agreements, and partnerships; and R&D activities of the leading players in the surgical sealants and adhesives market

- To benchmark players within the surgical sealants and adhesives market using the "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- A further breakdown of the Rest of Asia Pacific surgical sealants and adhesives market into Australia, New Zealand, and others

- Further breakdown of the Rest of Europe surgical sealants and adhesives market into the Netherlands, Denmark, and Rest of Europe

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Surgical Sealants and Adhesives Market