The study involved four major activities in estimating the current size of the automotive pump market. Exhaustive secondary research was done to collect information on the market, peer, and child markets. The next step was to validate these findings and assumptions and size them with industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, International Organization of Motor Vehicle Manufacturers (OICA), National Highway Traffic Safety Administration (NHTSA), International Energy Association (IEA)], articles, directories, technical handbooks, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global automotive pump market.

Primary Research

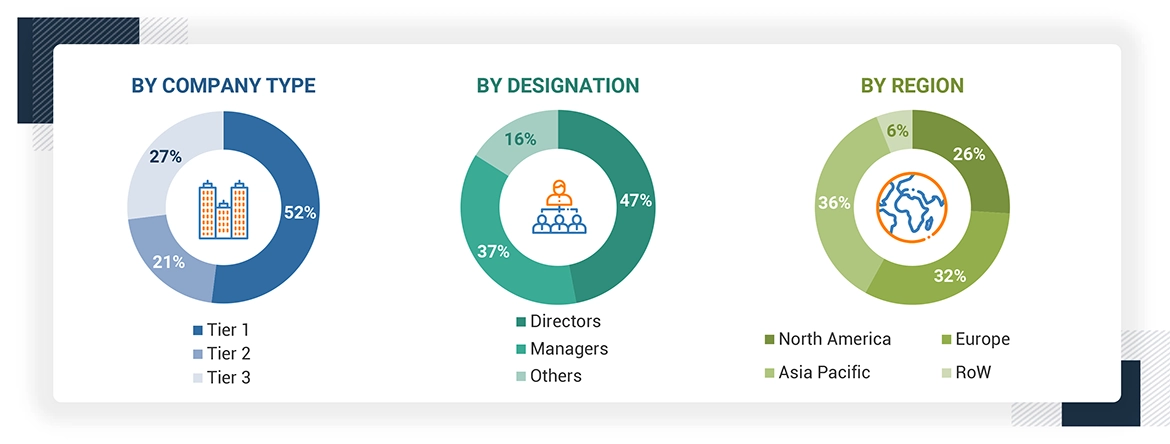

Extensive primary research was conducted after understanding the scenario of the automotive pump market through secondary research. Several primary interviews were conducted with market experts from demand (OEMs) and supply (component manufacturers) across North America, Europe, Asia Pacific, and the Rest of the World. Approximately 52% and 48% of primary interviews were conducted on demand and supply sides. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in this report. After interacting with industry experts, brief sessions with highly experienced independent consultants were also conducted to reinforce the findings from primaries. This and the in-house subject-matter experts’ opinions led to the findings described in the remainder of this report.

Note: Others include sales, managers, and product managers.

Company tiers are based on the value chain; revenue of the company is not considered.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the automotive pump market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Automotive Pump Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

An automotive pump is a mechanical or electrical device used to perform different functions, including raising, compressing, or transferring fluids by mechanical or electric action, and facilitate the circulation of fluids around a system for a vehicle’s operational performance. They are mainly used in Steering, Engine, Transmission, Cooling and Lubrication systems of a vehicle.

Stakeholders

-

Automotive component manufacturers

-

Associations, forums, and alliances related to automobiles

-

Automobile organizations/associations

-

Automotive original equipment manufacturers

-

Automotive investors

-

Automotive pump component suppliers

-

Automotive pump manufacturers

-

Automotive sensor manufacturers

-

EV battery manufacturers

-

EV charging equipment manufacturers

-

EV component manufacturers

-

EV manufacturers

-

Government agencies and policymakers

-

Raw material suppliers for automotive pumps

-

Traders and distributors of automotive pumps

Report Objectives

-

To analyze and forecast the automotive pump market in terms of value (USD million) from 2024 to 2035

-

To segment the market by type, technology, application, displacement, vehicle type, EV type, off-highway vehicle type, sales channel, and region

-

To segment and forecast the market, by value, based on type (fuel pumps, fuel injection pumps, water pumps, headlight washer pumps, vacuum pumps, steering pumps, windshield washer pumps, and oil transmission pumps)

-

To segment and forecast the market, by value, based on technology (electric pumps and mechanical pumps)

-

To segment and forecast the market, by value, based on application (body & interior, engine & HVAC, and powertrain)

-

To segment and forecast the market, by value, based on displacement (variable displacement pumps and fixed displacement pumps)

-

To segment and forecast the market, by value, based on vehicle type (passenger cars, light commercial vehicles, buses, and trucks)

-

To segment and forecast the market, by value, based on EV type (battery electric vehicles, hybrid electric vehicles, plug-in hybrid electric vehicles, and fuel cell electric vehicles)

-

To segment and forecast the market, by value, based on off-highway vehicle type (construction equipment and mining equipment)

-

To segment and forecast the market, by value, based on sales channel (OEM and aftermarket)

-

To segment and forecast the market, by value, based on region (Asia Pacific, Europe, North America, and Rest of the World)

-

To identify and analyze key drivers, challenges, restraints, and opportunities influencing the market growth

-

To strategically analyze the market for individual growth trends, prospects, and contributions to the total marke

-

To study the following with respect to the market

-

Value Chain Analysis

-

Ecosystem Analysis

-

Impact of AI/Gen AI

-

Technology Analysis

-

Trade Analysis

-

Investment and Funding Scenario

-

Pricing Analysis

-

Case Study Analysis

-

Patent Analysis

-

Regulatory Landscape

-

Key Stakeholders and Buying Criteria

-

To strategically profile the key players and comprehensively analyze their market share and core competencies

-

To analyze the opportunities for stakeholders and the competitive landscape for market leaders

-

To track and analyze competitive developments such as deals, product launches/developments, expansions, and other activities undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Additional Company Profiles

-

Detailed Analysis of Automotive Pumps Market, By Electric Commercial Vehicle Type

-

Detailed Analysis of Automotive Pumps Market, By Displacement, By Pump Type

Growth opportunities and latent adjacency in Automotive Pump Market