Injector Nozzle Market by Vehicle Type (Passenger Cars, LCVS, HCVS), Technology (Gasoline Port Fuel Injection, Diesel Direct Injection, Gasoline Direct Injection), by Fuel Type (Diesel, Gasoline), and Geography - Global Forecast to 2020

[67 Pages Report] The overall injector nozzle market is expected to grow from USD 3.95 billion in 2015 to USD 5.33 billion by 2020, at a CAGR of 6.2% from 2015 to 2020. Technologies such as port fuel injection system and direct injection system have helped the automobile industry deal with varied key issues related to maintaining balance between fuel economy, power, and exhaust emission. A fuel injection system offers faster throttle response, better fuel flow, precise control of the air-fuel mixture, and equal distribution of fuel. These parameters help vehicles attain a higher fuel economy at an optimum power, lower exhaust emissions, smoother acceleration, and increased operational reliability. Hence, Injector nozzle pumps the right proportion of fuel and air that is necessary for the engine to continue running at maximum efficiency. Also, government authorities as well as private organizations have started demanding products that are fuel-efficient, reliable, eco-friendly, possess low maintenance costs, and also have the ability to accommodate alternative fuels. The base year considered for the study is 2014, and the forecast has been provided for the period between 2015 and 2020.

Market Dynamics

Drivers

- Necessity for Fuel-Efficient Vehicles

- Stringent Emission Regulations

- Growth in Passenger Vehicle Market

Restraints

- Increasing Popularity of Electric Vehicles

Opportunities

- Growing automobile production in developing economies

Challenges

- Fluctuating fuel prices and trade wars are the challenges for the market

Necessity for fuel efficient vehicles in automotive industry drives the global injector nozzle market

Over the past few years, the awareness for conservation of conventional fuels is increasing in urban societies. In recent years, many automobile companies are primarily focused on manufacturing advanced fuel injection systems that would help consumers save money on fuel usage. The main emphasis is to design highly fuel-efficient automobile engines that stabilize emission. Injector nozzles help automobile engines maintain the right proportion of fuel and air, being injected into the combustor, thereby preventing overheating of the engine. In India, from April 2017, cars and utility vehicles are expected to deliver 18.2 km/liter, which is a 15% increase over the existing average mileage. To fulfil this requirement, automobile manufacturers are ensuring the average fuel efficiency of all models manufactured to be at least 18.2 km/liter. Moreover, the new regulations imposed by the Organization of the Petroleum Exporting Countries (OPEC) have restricted the extraction and export of crude oil, in turn, creating a demand for fuel-efficient vehicles. Therefore, the necessity for fuel-efficient vehicles has further propelled the growth of the injector nozzle market.

The following are the major objectives of the study.

- To define, describe, and forecast the injector nozzle market on the basis of vehicle type, technology, fuel type, and geography

- To provide detailed information of major factors influencing the growth of this market

- To analyze each submarket with respect to individual growth trends

- To analyze various opportunities in the global injector nozzle market for stakeholders

- To forecast the market size of the global injector nozzle market with respect to varied regions, namely, North America, Europe, Asia-Pacific, and rest of the world

- To profile key players and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as partnerships & collaborations, mergers & acquisitions, and contracts in the global injector nozzle market

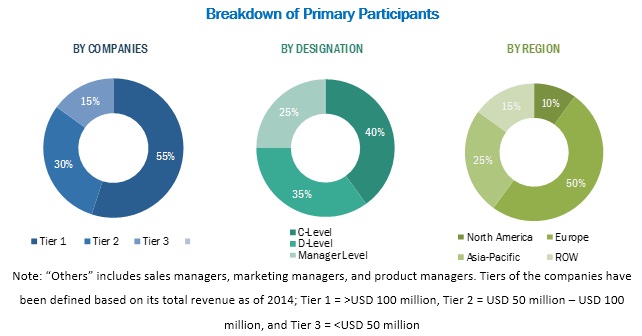

During this research study, major players operating in the injector nozzle market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study

To know about the assumptions considered for the study, download the pdf brochure

The injector nozzle market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the injector nozzle market are Continental AG (Germany), Denso Corporation (Japan), Robert Bosch GmbH (Germany), Infineon Technologies AG (Germany), Keihin Corporation (Japan), and Magneti Marelli S.p.A. (Italy).

Major Market Developments

- Magneti Marelli formed a joint venture with Hero MotoCorp Ltd. (India) to establish a new manufacturing unit in Manesar, India. This plant is responsible for the manufacture and development of technologies for powertrain and fuel injection systems for the two-wheeler market.

- In January 2015, Denso Corporation is undergoing expansion of its facility in Athens, Tennessee, the US, to manufacture gasoline direct injection products. The production is anticipated to start in the first quarter of 2016. This expansion strategy is expected to support the growing demand of gasoline direct injection technology in the US

Target Audience

- Original equipment manufacturers (OEMs)

- Injector Nozzle manufacturers

- Research organizations and consulting companies

- Subcomponent manufacturers

- Technology providers

- Research institutes and organizations

Report Scope

By Fuel Type

- Gasoline

- Diesel

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By Technology:

- Gasoline Port Fuel Injection

- Gasoline Direct Injection

- Diesel Direct Injection

By Geography

- Europe

- North America

- Asia-Oceania

- RoW

Critical questions which the report answers

- What are new technology areas for injector nozzle market for more efficiency of vehicle?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America Market

- Further breakdown of the Europe Market

- Further breakdown of the Asia-Oceania Market

- Further breakdown of the Middle East & Africa Market

- Further breakdown of the RoW Market

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

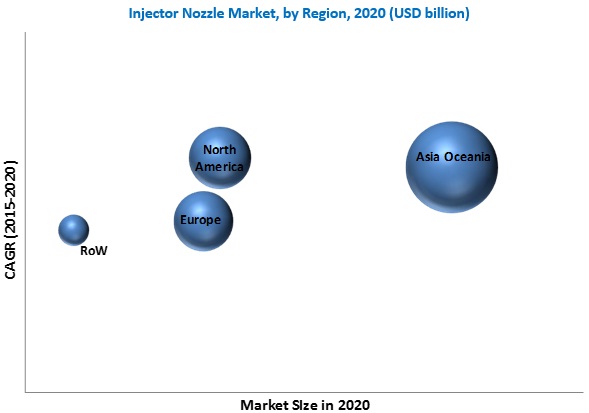

The overall injector nozzle is expected to grow from USD 3.95 billion in 2015 to USD 5.33 billion by 2020 at a CAGR of 6.2%. Increasing need to conserve conventional fuel, rising demand of fuel-efficient vehicles, and significant growth in the passenger cars segment are factors driving the growth of the market. In the emerging economies, gasoline prices are higher than diesel, owing to which the demand for diesel engines is projected to increase in the future. However, advancements in gasoline engine (gasoline direct injection) have increased its fuel-efficiency, thereby making them compatible with diesel engines.

Future emission legislations will require substantial reduction of smoke emissions from engines, such as carbon monoxide (CO), sulfur dioxide (SO2), and mono-nitrogen oxides (mainly NO and NO2 ), among others. Therefore, government authorities as well as private organizations have started demanding products that are fuel-efficient, reliable, eco-friendly, possess low maintenance costs, and also have the ability to accommodate alternative fuels. Several emerging economies are focused on implementing stringent emission norms to reduce air pollution. For instance, the European Union has implemented Euro 6 for gasoline passenger cars, and this is further expected to become a mandate for all regions worldwide.

The injector nozzle market has been segmented, on the basis of fuel type, into gasoline, and diesel. The market for diesel is expected to grow at the highest CAGR between 2015 and 2020. As diesel engines have high thermal energy, they offer better fuel efficiency in comparison to gasoline. Diesel contains about 15% more energy (approximately 36.9 MJ/liter as compared to 33.7 MJ/liter in gasoline) than gasoline. Even though diesel engines are heavier, the overall efficiency of a diesel engine is roughly 20% greater than that of a petrol engine owing to the aforementioned reasons. Improvements in the diesel engine technology have managed to decrease engine noise, as well as exhaust emissions with improved fuel efficiency. This has led to consumers preferring vehicles with diesel engines and manufacturers focusing on the production of diesel engines.

The injector nozzle in North America is expected to grow at the highest CAGR during the forecast period. The automotive industry in the North American region is anticipated to grow in the next five years, which is expected to further fuel the growth of the injector nozzle market. Increase in the global demand for automobiles in the next five years is estimated to drive the automotive industry, which, in turn, has propelled the overall growth of injector nozzle market in this country.

Injector nozzle technology in gasoline direct injection drive the growth of the market

Gasoline Port Fuel Injection

In a single point (or throttle body) injection system, one out of two injectors thrusts fuel into the intake manifold. However, in a gasoline port (multi-point) fuel injection system, each cylinder is provided with a separate fuel injector, which sprays fuel into the intake port. Single point fuel injection system is low-cost, and acts as a connecting channel between carburetors and port fuel injection systems. However, owing to the varied advantages of gasoline port fuel injection systems, it is widely preferred in comparison to the single point fuel injection systems.

Gasoline Direct Injection

Gasoline direct injection (GDI) is an advanced version of port fuel injection system. The point at which fuel is added to the intake port has further moved closer to the combustion chamber. In this injection system, fuel is injected directly into the combustion chamber for each cylinder instead of the intake port. Better dispersion and homogeneity of fuel improve the compression ratios of engine resulting in enhanced power output with increased fuel efficiency. Precise management of gasoline allows complete combustion of the fuel, leading to improved emission control.

Diesel Direct Injection

Diesel engine is a compression ignition (CI) engine that uses heat (generated from compression) to burn the fuel injected into the combustion chamber. Owing to the high compression ratio of the diesel engine, it possesses the highest thermal efficiency. All the aforesaid reasons have further contributed to increasing the fuel efficiency of diesel engine in comparison to gasoline engine. There are various types of injection systems used in the diesel engine, such as indirect injection, unit direction injection, and direct diesel injection. In indirect injection system, the diesel engine sprays the diesel into the ante-chamber to start the combustion, and later sprays it into the main combustion chamber. This kind of injection system is still observed in some all-terrain vehicles (ATVs). However, the most popular injection system in the diesel engine is the direct injection system.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry technologies for injector nozzles?

The increasing popularity of electric vehicles is a major factor restraining the growth of the market. The concept of electric vehicles is gaining momentum, and becomes the best alternative for conventional fuel vehicles, especially in cities. Electric vehicles do not emit harmful gases and the cost of maintenance of these vehicles is comparatively lesser than conventional automobiles. In terms of volume, the electric vehicles segment account for a share of 0.4% of the global passenger car market, and this number is projected to reach 2% by 2020. The demand for electric vehicles is increasing mainly in the European passenger car market, followed by North America. Hence, increase in demand for electric vehicles can serve to be a major restraint for the injector nozzle market, as these nozzles are basically used only in conventional fuel engines.

Key players in the market include Continental AG (Germany), Denso Corporation (Japan), Robert Bosch GmbH (Germany), Infineon Technologies AG (Germany), Keihin Corporation (Japan), and Magneti Marelli S.p.A. (Italy). These players are increasingly undertaking mergers and acquisitions, and product launches to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 9)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.2.1 Years Considered in the Report

1.3 Stakeholders

2 Research Methodology (Page No. - 11)

2.1 Integrated Ecosystem of Injector Nozzle Market

2.2 Arriving at the Market Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Analysis

2.2.3.1 Vehicle Production Increasing in Emerging Economies

2.2.3.2 Urbanization vs Passenger Cars Per 1,000 Individuals

2.3 Assumptions

3 Executive Summary (Page No. - 16)

4 Market Overview (Page No. - 18)

4.1 Introduction

4.2 Market

4.3 Market Drivers and Restraints

5 Injector Nozzle Market, By Fuel Type (Page No. - 21)

5.1 Introduction

5.2 Gasoline

5.3 Diesel

6 Injector Nozzle Market, By Vehicle Type (Page No. - 26)

6.1 Introduction

6.2 Passenger Cars

6.3 Light Commercial Vehicles (LCVS)

6.4 Heavy Commercial Vehicles (HCVS)

7 Injector Nozzle Market, By Technology (Page No. - 32)

7.1 Introduction

7.2 Gasoline Port Fuel Injection

7.3 Gasoline Direct Injection

7.4 Diesel Direct Injection

8 Injector Nozzle Market, By Geography (Page No. - 37)

8.1 Introduction

8.2 Asia-Oceania

8.3 Europe

8.4 North America

8.5 Rest of the World

9 Competitive Landscape (Page No. - 45)

9.1 Company Presence in the Injector Nozzle Market, By Component

9.2 Mergers & Acquisitions

9.3 Agreements & Expansions

9.4 New Product Launches

9.5 Agreements, Partnerships, and Collaborations

10 Company Profiles (Page No. - 49)

(Overview, Financials, Products & Services, Strategy, and Developments)*

10.1 Continental AG

10.2 Delphi Automotive PLC

10.3 Denso Corporation

10.4 Robert Bosch GmbH

10.5 Infineon Technologies AG

10.6 Keihin Corporation

10.7 Magneti Marelli S.P.A.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 66)

11.1 Customization Options

11.1.1 Market Delivery Modes Matrix

11.1.2 Market Competitive Benchmarking

11.1.3 Market Vendor Landscaping

11.1.4 Market Data Tracker

11.1.5 Market Emerging Vendor Landscape

11.1.6 Market Channel Analysis

11.2 Related Reports

List of Tables (59 Tables)

Table 1 Injector Nozzle Market, 2013–2020 (USD Million)

Table 2 Market, 2013–2020 (Million Units)

Table 3 Market: Drivers and Restraints

Table 4 Market, By Fuel Type, 2013-2020 (Million Units)

Table 5 Market, By Fuel Type, 2013-2020 (USD Million)

Table 6 Passenger Cars, Market By Fuel Type, 2013-2020 (Million Units)

Table 7 Passenger Cars, Market By Fuel Type, 2013-2020 (USD Million)

Table 8 Light Commercial Vehicles, Market By Fuel Type, 2013-2020 (Million Units)

Table 9 Light Commercial Vehicles Market, By Fuel Type, 2013-2020 (USD Million)

Table 10 Heavy Commercial Vehicles Market, By Fuel Type, 2013-2020 (Million Units)

Table 11 Heavy Commercial Vehicles Market, By Fuel Type, 2013-2020 (USD Million)

Table 12 Market, By Vehicle Type, 2013-2020 (Million Units)

Table 13 Injector Nozzle Market, By Vehicle Type, 2013-2020 (USD Million)

Table 14 Asia-Oceania Market, By Vehicle Type, 2013-2020 (Million Units)

Table 15 Asia-Oceania Market, By Vehicle Type, 2013-2020 (USD Million)

Table 16 Europe Market, By Vehicle Type, 2013-2020 (Million Units)

Table 17 Europe Market, By Vehicle Type, 2013-2020 (USD Million)

Table 18 North America Market, By Vehicle Type, 2013-2020 (Million Units)

Table 19 North America Market, By Vehicle Type, 2013-2020 (USD Million)

Table 20 Rest of the World Market, By Vehicle Type, 2013-2020 (Million Units)

Table 21 Rest of the World Market, By Vehicle Type, 2013-2020 (USD Million)

Table 22 Gasoline Port Fuel Market, By Region, 2013-2020 (Million Units)

Table 23 Gasoline Port Fuel Market, By Region, 2013-2020 (USD Million)

Table 24 Gasoline Direct Market, By Region, 2013-2020 (Million Units)

Table 25 Gasoline Direct Market, By Region, 2013-2020 (USD Million)

Table 26 Diesel Direct Market, By Region, 2013-2020 (Million Units)

Table 27 Diesel Direct Market, By Region, 2013-2020 (USD Million)

Table 28 Injector Nozzle Market, By Region, 2013-2020 (Million Units)

Table 29 Market, By Region, 2013-2020 (USD Million)

Table 30 Asia-Oceania Market, By Country, 2013-2020 (Million Units)

Table 31 Asia-Oceania Market, By Country, 2013-2020 (USD Million)

Table 32 Europe Market, By Country, 2013-2020 (Million Units)

Table 33 Europe Market, By Country, 2013-2020 (USD Million)

Table 34 North America Market, By Country, 2013-2020 (Million Units)

Table 35 North America Market, By Country, 2013-2020 (USD Million)

Table 36 Rest of the World Market, By Country, 2013-2020 (Million Units)

Table 37 Rest of the World Market, By Country, 2013-2020 (USD Million)

Table 38 Market: Mergers & Acquisitions

Table 39 Market: Agreements & Expansions

Table 40 Injector Nozzle Market: New Product Launches

Table 41 Injector Nozzle Market: Agreements, Partnerships, and Collaborations

Table 42 Continental AG: Key Financials, 2011-2014 (USD MN)

Table 43 Continental AG: Revenue, By Region, 2011-2014 (USD MN)

Table 44 Continental AG: Revenue, By Business Segment, 2011-2014 (USD MN)

Table 45 Delphi Automotive PLC: Key Financials,2011-2014 (USD MN)

Table 46 Delphi Automotive PLC: Revenue, By Region, 2011-2014 (USD MN)

Table 47 Delphi Automotive PLC: Revenue, By Business Segment, 2011-2014 (USD MN)

Table 48 Denso Corporation: Key Financials, 2011-2014 (USD Million)

Table 49 Denso Corporation: Revenue, By Region, 2011-2014 (USD Million)

Table 50 Robert Bosch GmbH: Key Financials, 2012-2014 (USD Million)

Table 51 Robert Bosch GmbH: Revenue, By Region, 2012–2014 (USD Million)

Table 52 Robert Bosch GmbH: Revenue, By Business Segment, 2012-2014 (USD Million)

Table 53 Infineon Technologies AG: Key Financials, 2011–2014 (USD Million)

Table 54 Infineon Technologies AG: Revenue, By Region, 2011–2014 (USD Million)

Table 55 Infineon Technologies AG: Revenue, By Business Segment, 2011-2014 (USD Million)

Table 56 Keihin Corporation: Key Financials, 2011– 2014 (USD Million)

Table 57 Keihin Corporation: Revenue, By Region, 2011–2014 (USD Million)

Table 58 Keihin Corporation: Revenue, By Business Segment, 2011-2014 (USD Million)

Table 59 Magneti Marelli S.P.A: Key Financials, 2011-2014 (USD Million)

List of Figures (22 Figures)

Figure 1 Injector Nozzle Market: Segmentation and Coverage

Figure 2 Market: Integrated Ecosystem

Figure 3 Arriving at the Global Market Size : Top Down Approach

Figure 4 Arriving at the Global Market Size : Bottom-Up Approach

Figure 5 Vehicle Production, 2013 & 2014

Figure 6 Urbanization vs Passenger Cars Per 1,000 Individuals, 2010 & 2014

Figure 7 Market: Snapshot

Figure 8 Market, 2015 & 2020 (USD Million)

Figure 9 Market, 2015 & 2020 (Million Units)

Figure 10 Market: Drivers and Restraints

Figure 11 Market, By Fuel Type, 2015 & 2020 (USD Million)

Figure 12 Market, By Vehicle Type, 2015 & 2020 (USD Million)

Figure 13 Market, By Technology, 2015 & 2020 (USD Million)

Figure 14 Market: Growth Analysis, By Geography, 2015-2020 (USD Million)

Figure 15 Injector Nozzle: Company Product Coverage, By Component

Figure 16 Continental AG: Revenue Mix, 2014 (%)

Figure 17 Delphi Automotive PLC: Revenue Mix, 2014 (%)

Figure 18 Denso Corporation: Revenue Mix, 2014 (%)

Figure 19 Robert Bosch GmbH: Revenue Mix, 2014 (%)

Figure 20 Infineon Technologies AG: Revenue Mix, 2014 (%)

Figure 21 Keihin Corporation: Revenue Mix, 2014 (%)

Figure 22 Magneti Marelli S.P.A: Revenue Mix, 2013 (%)

Growth opportunities and latent adjacency in Injector Nozzle Market