Transmission Repair Market by Component (Gasket & Seal, Fluid, O-ring, Transmission Filter, Gear, Clutch Plate, Pressure Plate, Oil Pump), Repair type (Transmission General Repair, Overhaul), Vehicle Type, and Region - Global Forecast to 2022

The transmission repair market is size was values at USD 186.33 Billion in 2016 and is projected to grow at a CAGR of 3.25% during the forecast period, to reach USD 233.70 Billion by 2022. The base year for the report is 2016 and the forecast period is 2017–2022.

The objective of the study is to analyze and forecast the market size, in terms of volume (units) and value (USD billion), of the market. The report segments the market by component, vehicle type, repair type, and region. A detailed study of various market leaders has been done, and opportunity analysis has been provided in the report.

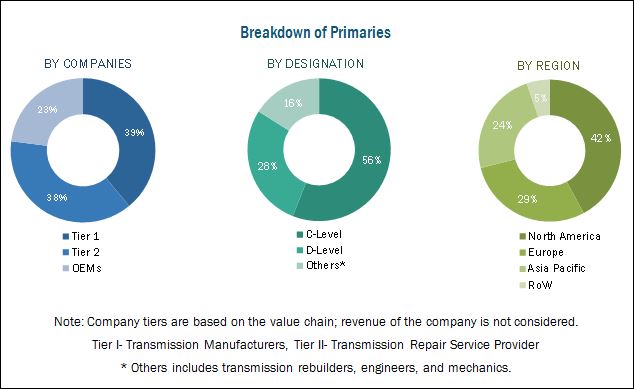

The secondary sources referred for this research study include auto industry organizations such as Organisation Internationale des Constructeurs d'Automobiles (OICA), Automatic Transmission Rebuilders Association (ATRA), Transmission Rebuilders Network Worldwide, Automotive Aftermarket Association Southeast (AAAS), Automotive Service Association (ASA), transmission component suppliers and transmission manufacture companies; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations useful for an extensive study of the market. Several primary interviews have been conducted with market experts from both the demand- (service centers & independent garages and transmission repair centers) and supply-side (transmission manufacturers, transmission component manufacturers, and aftermarket suppliers) players across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (Brazil and Russia). Primary interviews have been conducted to obtain and verify critical information as well as to assess future prospects and market estimations. The bottom-up approach has been used for market estimation and calculation of the market size. The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The transmission repair market consists of various transmission manufacturers such as Allison Transmission (US), ZF (Germany), BorgWarner (US), Schaeffler (Germany), AAMCO (US), and Continental (Germany) among others.

Target Audience

- Distributors and suppliers of automotive transmission components

- Manufacturers of automotive transmission

- OEM authorized service centers

- Transmission repair centers

- Industry associations and experts

- Automotive transmission repair workshops

- Automotive garages

Scope of the Report

-

By Components

- Gaskets and Seals

- Fluids

- Transmission Filters

- O-Rings

- Axles

- Flywheels

- Gears

- Clutch Plates

- Pressure Plates

- Oil Pumps

-

By Repair Type

- Transmission General Repair

- Transmission Overhaul

-

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

-

By Region

- North America

- Europe

- Asia Pacific

- RoW

Available Customizations

- Market, additional components, hybrid segment, additional countries

- Profiling of additional market players (Up to 3)

The market is projected to grow at a CAGR of 3.25% during the forecast period, from USD 199.16 Billion in 2017 to USD 233.70 Billion by 2022. Rising demand for commercial vehicles, larger vehicle parc, increasing vehicle sales, and the increasing average vehicle miles traveled every year have fueled the growth of the market globally.

While the emerging markets such as China, India, and Mexico are witnessing an increase in sales volume of passenger cars, developed markets such as the US, UK, Canada, and Germany among others are witnessing a growth of commercial vehicles. The growth is not only focused on new car sales but also in the aftermarket, which is expected to generate huge revenues and margins for transmission repair.

On the basis of repair type, the market is segmented into transmission general repair and transmission overhaul. The growth of the transmission general repair market can be attributed to the increasing adoption of preventive/periodic maintenance services for transmission in vehicles. Preventive/periodic maintenance not only increases the average vehicle age but also enhances fuel efficiency. The growth of the transmission overhaul market can be attributed to factors such as a worldwide increase in vehicle sales, improved infrastructure, and increased average vehicle miles traveled.

The market has been segmented by vehicle type into passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger car segment is estimated to hold the largest share, in terms of value and volume, of the market in 2017. The increasing average vehicle miles traveled and increased sales of passenger cars in developing countries such as China, India, Russia, Brazil, and Mexico are expected to drive the growth of the market in this vehicle segment.

On the basis of component, the fluids segment is estimated to be the fastest growing market, in terms of value. The adoption of preventive/periodic maintenance services for transmission is expected to drive the market for fluids during the forecast period. The average fluid consumption is 5 to 7 quarts. The OE companies are focusing on high-quality oil for increasing transmission efficiency and also to reduce the frequent change of oil in the transmission.

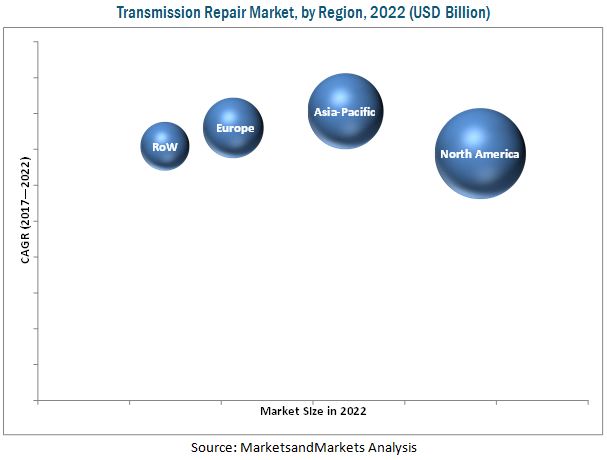

North America is expected to dominate the market during the forecast period. Increasing commercial vehicle sales, developed infrastructure, and increased average vehicle miles traveled are propelling the growth of the market in the region. Asia Pacific is estimated to be the fastest growing market during the forecast period due to the increase in vehicle sales and larger vehicle parc.

The key factors restraining the growth of the transmission repair market include the use of motor generators in electric vehicles. The market is dominated by many international as well as domestic players such as Allison (US), ZF (Germany), BorgWarner (US), Schaeffler (Germany), and Continental (Germany) among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Transmission Repair Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency Exchange Rates

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand Side Analysis

2.4.2.1 Increase in Disposable Income of the Consumers

2.4.3 Supply-Side Analysis

2.4.3.1 Increasing Sales of Electric Vehicles

2.4.3.2 Increasing Vehicle Population

2.4.3.3 Technological Advancements in Automotive Industry

2.5 Transmission Repair Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in the Transmission Repair Market

4.2 Market, By Vehicle Type, 2017–2022

4.3 Market, By Component Type, 2017–2022

4.4 Market, By Repair Type, 2017–2022

4.5 Market, By Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Transmission Repair Market Dynamics

5.2.1 Drivers

5.2.1.1 Availability of Cost-Effective Measures for Transmission Repair

5.2.1.2 Larger Vehicle Parc

5.2.1.3 Extended Warranty

5.2.1.4 Growth of Ride Sharing

5.2.1.5 Increased Average Vehicle Age

5.2.2 Restraints

5.2.2.1 Motor Generators Used in Electric Vehicles

5.2.3 Opportunities

5.2.3.1 Franchise for Transmission Repair

5.2.3.2 Gradual Growth of the Average Miles Driven

5.2.4 Challenges

5.2.4.1 Healthcare Concerns Being A Deterrent to the Transmission Repair Industry

5.2.4.2 Lack of Skilled Technicians in Transmission Repair Aftermarket

6 Technology Overview (Page No. - 47)

6.1 Transmission Industry Outlook

6.2 Average Vehicle Age - North America vs Europe (2016)

6.3 Transmission Repair Market Outlook

6.3.1 Transmission Repair Types

6.3.1.1 Rebuilt

6.3.1.2 Remanufactured

6.3.1.3 Repaired

6.3.1.4 Used

6.4 Automatic Transmission Outlook

6.5 AMT, CVT, and DCT Outlook

6.6 Sustainable Transport Outlook

6.7 Advanced Technologies in Transmission

6.7.1 Triple Clutch Transmission

6.7.2 Hybrid Transmission

6.7.3 Single Speed Electric Vehicle Transmission

7 Transmission Repair Market, By Component (Page No. - 52)

7.1 Introduction

7.2 Transmission General Repair

7.2.1 Gasket & Seal

7.2.2 Fluid (Quart)

7.2.3 Transmission Filter

7.2.4 O-Ring

7.3 Transmission Overhaul

7.3.1 Axle

7.3.2 Flywheel

7.3.3 Gear

7.3.4 Clutch Plate

7.3.5 Pressure Plate

7.3.6 Oil Pump

8 Transmission Repair Market, By Vehicle Type (Page No. - 74)

8.1 Introduction

8.2 Passenger Car (PC)

8.3 Light Commercial Vehicle (LCV)

8.4 Heavy Commercial Vehicle (HCV)

9 Market, By Repair Type (Page No. - 82)

9.1 Introduction

9.2 Transmission General Repair (TGRM)

9.3 Transmission Overhaul (TOM)

10 Transmission Repair Market, By Region (Page No. - 89)

10.1 Introduction

10.2 Market, By Region

10.3 North America

10.3.1 US

10.3.1.1 Transmission General Repair

10.3.1.2 Transmission Overhaul

10.3.2 Mexico

10.3.2.1 Transmission General Repair

10.3.2.2 Transmission Overhaul

10.3.3 Canada

10.3.3.1 Transmission General Repair

10.3.3.2 Transmission Overhaul

10.4 Europe

10.4.1 Germany

10.4.1.1 Transmission General Repair

10.4.1.2 Transmission Overhaul

10.4.2 France

10.4.2.1 Transmission General Repair

10.4.2.2 Transmission Overhaul

10.4.3 UK

10.4.3.1 Transmission General Repair

10.4.3.2 Transmission Overhaul

10.4.4 Italy

10.4.4.1 Transmission General Repair

10.4.4.2 Transmission Overhaul

10.5 Asia Pacific

10.5.1 China

10.5.1.1 Transmission General Repair

10.5.1.2 Transmission Overhaul

10.5.2 Japan

10.5.2.1 Transmission General Repair

10.5.2.2 Transmission Overhaul

10.5.3 India

10.5.3.1 Transmission General Repair

10.5.3.2 Transmission Overhaul

10.5.4 South Korea

10.5.4.1 Transmission General Repair

10.5.4.2 Transmission Overhaul

10.6 RoW

10.6.1 Brazil

10.6.1.1 Transmission General Repair

10.6.1.2 Transmission Overhaul

10.6.2 Russia

10.6.2.1 Transmission General Repair

10.6.2.2 Transmission Overhaul

11 Competitive Landscape (Page No. - 141)

11.1 Introduction

11.2 Market Ranking Analysis

11.3 Competitive Scenario

11.3.1 New Product Developments

11.3.2 Collaboration/Joint Venture/Supply Contracts

11.3.3 Expansion and Partnership

11.3.4 Merger & Acquisition, 2016-2017

12 Company Profiles (Page No. - 145)

(Business Overview, Recent Developments, SWOT Analysis, MnM View)*

12.1 Schaeffler

12.2 Allison Transmission

12.3 Borgwarner

12.4 ZF

12.5 Continental

12.6 Mister Transmission

12.7 Aamco Transmissions

12.8 Lee Myles Autocare & Transmission

12.9 Cottman Transmission and Total Auto Care

12.10 Firestone Complete Auto Care

*Details on Business Overview, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 165)

13.1 Key Industry Insights

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (132 Tables)

Table 1 Transmission Repair Market Size, By Repair Type, 2015–2022 (Million Units)

Table 2 Market Size, By Repair Type, 2015–2022 (USD Billion)

Table 3 Transmission Genaral Repair Market Size, By Component, 2015–2022 (Million Units)

Table 4 Market Size, By Component, 2015–2022 (USD Billion)

Table 5 Gasket & Seal: Transmission General Repair Market Size, By Region, 2015–2022 (Million Units)

Table 6 Gasket & Seal: Transmission General Repair Market Size, By Region, 2015–2022 (USD Billion)

Table 7 Fluid: Transmission General Repair Market Size, By Region, 2015–2022 (Million Units)

Table 8 Fluid: Transmission General Repair Market Size, By Region, 2015–2022 (USD Billion)

Table 9 Transmission Filter: Transmission General Repair Market Size, By Region, 2015–2022 (Million Units)

Table 10 Transmission Filter: Transmission General Repair Market Size, By Region, 2015–2022 (USD Billion)

Table 11 O-Ring: Transmission General Repair Market Size, By Region, 2015–2022 (Million Units)

Table 12 O-Ring: Transmission General Repair Market Size, By Region, 2015–2022 (USD Billion)

Table 13 Transmission Overhaul Market Size, By Component, 2015–2022 (Million Units)

Table 14 Transmission Overhaul Market Size, By Component, 2015–2022 (USD Billion)

Table 15 Axle: Transmission Overhaul Market Size, By Region, 2015–2022 (Million Units)

Table 16 Axle: Transmission Repair Market Size, By Region, 2015–2022 (USD Billion)

Table 17 Flywheel: Transmission Overhaul Market Size, By Region, 2015–2022 (Million Units)

Table 18 Flywheel: Transmission Overhaul Market Size, By Region, 2015–2022 (USD Billion)

Table 19 Gear: Transmission Overhaul Market Size, By Region, 2015–2022 (Million Units)

Table 20 Gear: Transmission Overhaul Market Size, By Region, 2015–2022 (USD Billion)

Table 21 Clutch Plate: Transmission Overhaul Market Size, By Region, 2015–2022 (Million Units)

Table 22 Clutch Plate: Transmission Overhaul Market Size, By Region, 2015–2022 (USD Billion)

Table 23 Pressure Plate: Transmission Overhaul Market Size, By Region, 2015–2022 (Million Units)

Table 24 Pressure Plate: Transmission Overhaul Market Size, By Region, 2015–2022 (USD Billion)

Table 25 Oil Pump: Transmission Overhaul Market Size, By Region, 2015–2022 (Million Units)

Table 26 Oil Pump: Transmission Overhaul Market Size, By Region, 2015–2022 (USD Billion)

Table 27 Transmission Repair Market, By Vehicle Type, 2015–2022 (Million Units)

Table 28 Market, By Vehicle Type, 2015–2022 (USD Billion)

Table 29 Passenger Car (PC) Market Size, By Region, 2015–2022 (Million Units)

Table 30 Passenger Car (PC) Market Size, By Region, 2015–2022 (USD Billion)

Table 31 Light Commercial Vehicle (LCV) Market Size, By Region, 2015–2022 (Million Units)

Table 32 Light Commercial Vehicle (LCV) Market Size, By Region, 2015–2022 (USD Billion)

Table 33 Heavy Commercial Vehicle (HCV) Market Size, By Region, 2015–2022 (Million Units)

Table 34 Heavy Commercial Vehicle (HCV) Market Size, By Region, 2015–2022 (USD Billion)

Table 35 Market Size, By Repair, 2015–2022 (Million Units)

Table 36 Market Size, By Repair, 2015–2022 (USD Billion)

Table 37 Transmission General Repair Market Size, By Region, 2015–2022 (Million Units)

Table 38 Transmission General Repair Market Size, By Region, 2015–2022 (USD Billion)

Table 39 Transmission Overhaul Market Size, By Region, 2015–2022 (Million Units)

Table 40 Transmission Overhaul Market Size, By Region, 2015–2022 (USD Billion)

Table 41 Transmission Repair Market, By Region, 2015–2022 (Million Units)

Table 42 Market, By Region, 2015–2022 (USD Billion)

Table 43 North America: Market, By Country, 2015–2022 (Million Units)

Table 44 North America: Market, By Country, 2015–2022 (USD Billion)

Table 45 US: Market, By Repair Type, 2015–2022 (Million Units)

Table 46 US: Market, By Repair Type, 2015–2022 (USD Billion)

Table 47 US: Transmission General Repair Market, By Component, 2015–2022 (Million Units)

Table 48 US: Transmission General Repair Market, By Component, 2015–2022 (USD Million)

Table 49 US: Transmission Overhaul Market, By Component, 2015–2022 (Million Units)

Table 50 US: Transmission Overhaul Market, By Component, 2015–2022 (USD Million)

Table 51 Mexico: Market, By Repair Type, 2015–2022 (Million Units)

Table 52 Mexico: Market, By Repair Type, 2015–2022 (USD Billion)

Table 53 Mexico: Transmission General Repair Market, By Component, 2015–2022 (Million Units)

Table 54 Mexico: Transmission General Repair Market, By Component, 2015–2022 (USD Million)

Table 55 Mexico: Transmission Overhaul Market, By Component, 2015–2022 (Million Units)

Table 56 Mexico: Transmission Overhaul Market, By Component, 2015–2022 (USD Million)

Table 57 Canada: Transmission Repair Market, By Repair Type, 2015–2022 (Million Units)

Table 58 Canada: Market, By Repair Type, 2015–2022 (USD Billion)

Table 59 Canada: Transmission General Repair Market, By Component, 2015–2022 (Million Units)

Table 60 Canada: Transmission General Repair Market, By Component, 2015–2022 (USD Million)

Table 61 Canada: Transmission Overhaul Market, By Component, 2015–2022 (Million Units)

Table 62 Canada: Transmission Overhaul Market, By Component, 2015–2022 (USD Million)

Table 63 Europe: Market, By Country, 2015–2022 (Million Units)

Table 64 Europe: Market, By Country, 2015–2022 (USD Billion)

Table 65 Germany: Market, By Repair Type, 2015–2022 (Million Units)

Table 66 Germany: Market, By Repair Type, 2015–2022 (USD Billion)

Table 67 Germany: Transmission General Repair Market, By Component, 2015–2022 (Million Units)

Table 68 Germany: Transmission General Repair Market, By Component, 2015–2022 (USD Million)

Table 69 Germany: Transmission Overhaul Market, By Component, 2015–2022 (Million Units)

Table 70 Germany: Transmission Overhaul Market, By Component, 2015–2022 (USD Million)

Table 71 France: Transmission Repair Market, By Repair Type, 2015–2022 (Million Units)

Table 72 France: Market, By Repair Type, 2015–2022 (USD Billion)

Table 73 France: Transmission General Repair Market, By Component, 2015–2022 (Million Units)

Table 74 France: Transmission General Repair Market, By Component, 2015–2022 (USD Million)

Table 75 France: Transmission Overhaul Market, By Component, 2015–2022 (Million Units)

Table 76 France: Transmission Overhaul Market, By Component, 2015–2022 (USD Million)

Table 77 UK: Market, By Repair Type, 2015–2022 (Million Units)

Table 78 UK: Market, By Repair Type, 2015–2022 (USD Billion)

Table 79 UK: Transmission General Repair Market, By Component, 2015–2022 (Million Units)

Table 80 UK: Transmission General Repair Market, By Component, 2015–2022 (USD Million)

Table 81 UK: Transmission Overhaul Market, By Component, 2015–2022 (Million Units)

Table 82 UK: Transmission Overhaul Market, By Component, 2015–2022 (USD Million)

Table 83 Italy: Market, By Repair Type, 2015–2022 (Million Units)

Table 84 Italy: Market, By Repair Type, 2015–2022 (USD Billion)

Table 85 Italy: Transmission Repair Transmission General Repair Market, By Component, 2015–2022 (Million Units)

Table 86 Italy: Transmission General Repair Market, By Component, 2015–2022 (USD Million)

Table 87 Italy: Transmission Overhaul Market, By Component, 2015–2022 (Million Units)

Table 88 Italy: Transmission Overhaul Market, By Component, 2015–2022 (USD Million)

Table 89 Asia Pacific: Transmission Repair Market, By Country, 2015–2022 (Million Units)

Table 90 Asia Pacific: Market, By Country, 2015–2022 (USD Billion)

Table 91 China: Market, By Repair Type, 2015–2022 (Million Units)

Table 92 China: Market, By Repair Type, 2015–2022 (USD Billion)

Table 93 China: Transmission General Repair Market, By Component, 2015–2022 (Million Units)

Table 94 China: Transmission General Repair Market, By Component, 2015–2022 (USD Million)

Table 95 China: Transmission Overhaul Market, By Component, 2015–2022 (Million Units)

Table 96 China: Transmission Overhaul Market, By Component, 2015–2022 (USD Million)

Table 97 Japan: Market, By Repair Type, 2015–2022 (Million Units)

Table 98 Japan: Market, By Repair Type, 2015–2022 (USD Billion)

Table 99 Japan: Transmission General Repair Market, By Component, 2015–2022 (Million Units)

Table 100 Japan: Transmission General Repair Market, By Component, 2015–2022 (USD Million)

Table 101 Japan: Transmission Overhaul Market, By Component, 2015–2022 (Million Units)

Table 102 Japan: Transmission Overhaul Market, By Component, 2015–2022 (USD Million)

Table 103 India: Transmission Repair Market, By Repair Type, 2015–2022 (Million Units)

Table 104 India: Market, By Repair Type, 2015–2022 (USD Billion)

Table 105 India: Transmission General Repair Market, By Component, 2015–2022 (Million Units)

Table 106 India: Transmission General Repair Market, By Component, 2015–2022 (USD Million)

Table 107 India: Transmission Overhaul Market, By Component, 2015–2022 (Million Units)

Table 108 India: Transmission Overhaul Market, By Component, 2015–2022 (USD Million)

Table 109 South Korea: Market, By Repair Type, 2015–2022 (Million Units)

Table 110 South Korea: Market, By Repair Type, 2015–2022 (USD Billion)

Table 111 South Korea: Transmission General Repair Market, By Component, 2015–2022 (Million Units)

Table 112 South Korea: Transmission General Repair Market, By Component, 2015–2022 (USD Million)

Table 113 South Korea: Transmission Overhaul Market, By Component, 2015–2022 (Million Units)

Table 114 South Korea: Transmission Overhaul Market, By Component, 2015–2022 (USD Million)

Table 115 RoW: Market, By Country, 2015–2022 (Million Units)

Table 116 RoW: Market, By Country, 2015–2022 (USD Billion)

Table 117 Brazil: Market, By Repair Type, 2015–2022 (Million Units)

Table 118 Brazil: Transmission Repair Market, By Repair Type, 2015–2022 (USD Billion)

Table 119 Brazil: Transmission General Repair Market, By Component, 2015–2022 (Million Units)

Table 120 Brazil: Transmission General Repair Market, By Component, 2015–2022 (USD Million)

Table 121 Brazil: Transmission Overhaul Market, By Component, 2015–2022 (Million Units)

Table 122 Brazil: Transmission Overhaul Market, By Component, 2015–2022 (USD Million)

Table 123 Russia: Market, By Repair Type, 2015–2022 (Million Units)

Table 124 Russia: Market, By Repair Type, 2015–2022 (USD Billion)

Table 125 Russia: Transmission General Repair Market, By Component, 2015–2022 (Million Units)

Table 126 Russia: Transmission General Repair Market, By Component, 2015–2022 (USD Million)

Table 127 Russia: Transmission Overhaul Market, By Component, 2015–2022 (Million Units)

Table 128 Russia: Transmission Repair Transmission Overhaul Market, By Component, 2015–2022 (USD Million)

Table 129 New Product Development, 2016–2017

Table 130 Collaboration/Joint Venture/Supply Contracts, 2015–2017

Table 131 Expansion and Partnership, 2015–2017

Table 132 Merger & Acquisition, 2017

List of Figures (57 Figures)

Figure 1 Automotive Market: Transmission Repair Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Automotive Maintenance and Repair Spends, 2002-2012

Figure 6 Global EV Sales

Figure 7 Global Passenger Car Sales Data, 2005-2016

Figure 8 Market Size Estimation Methodology for Transmission General Repair Market: Bottom-Up Approach

Figure 9 Market Size Estimation Methodology for Transmission Overhaul Market: Bottom-Up Approach

Figure 10 Key Countries in the Market: China is Estimated to Be the Fastest Growing Market By 2022 (USD Billion)

Figure 11 North America is Estimated to Be the Largest Market for Market 2017 vs 2022 (USD Billion)

Figure 12 Transmission Overhaul is Estimated to Hold the Largest Share of the Market, 2017 vs 2022 (USD Billion)

Figure 13 Passenger Car Segment is Estimated to Hold the Largest Share of the Market, 2017 vs 2022 (USD Billion)

Figure 14 Fluid is Estimated to Hold the Largest Share in the Transmission General Repair Market, 2017 vs 2022 (USD Billion)

Figure 15 Flywheel is Estimated to Hold the Largest Share in the Transmission Overhaul Market, 2017 vs 2022 (USD Billion)

Figure 16 The Increase in the Vehicle Miles Travelled is Expected to Drive the Market

Figure 17 Passenger Cars to Hold the Largest Share, By Value, in the Market By Vehicle Type

Figure 18 Fluid to Hold the Largest Share, By Value, in the Transmission Repair Market By Component Type

Figure 19 Transmission Overhaul to Hold the Largest Share, By Value, in the Market, By Repair Type

Figure 20 North America to Hold the Largest Market Share in the Market, 2017 vs 2022 (USD Billion)

Figure 21 Automotive Market: Market Dynamics

Figure 22 Quarterly Growth Percentage of Rideshare, Taxi and Rental Car in the US (2014–2015)

Figure 23 Average Age of Passenger Cars and Light Trucks in the US 1995–2016

Figure 24 Yearly Vehicle Miles Traveled in the US

Figure 25 Yearly Retail Gasoline and Diesel Prices

Figure 26 Transmission Repair Market, By Repair Type, 2017 vs 2022 (USD Billion)

Figure 27 Transmission General Repair Market, By Component, 2017 vs 2022 (USD Billion)

Figure 28 Transmission General Repair Gasket & Seal Market, By Region, 2017 vs 2022 (USD Billion)

Figure 29 Transmission General Repair Fluid Market, By Region, 2017 vs 2022 (USD Billion)

Figure 30 Transmission General Repair Transmission Filter Market, By Region, 2017 vs 2022 (USD Billion)

Figure 31 Transmission General Repair O-Ring Market, By Region, 2017 vs 2022 (USD Billion)

Figure 32 Transmission Overhaul Market, By Component, 2017 vs 2022 (USD Billion)

Figure 33 Transmission Overhaul Axle Market, By Region, 2017 vs 2022 (USD Billion)

Figure 34 Transmission Overhaul Flywheel Market, By Region, 2017 vs 2022 (USD Billion)

Figure 35 Transmission Overhaul Gear Market, By Region, 2017 vs 2022 (USD Billion)

Figure 36 Transmission Overhaul Clutch Plate Market, By Region, 2017 vs 2022 (USD Billion)

Figure 37 Transmission Overhaul Pressure Plate Market, By Region, 2017 vs 2022 (USD Billion)

Figure 38 Transmission Overhaul Oil Pump Market, By Region, 2017 vs 2022 (USD Billion)

Figure 39 Transmission Repair Market, By Vehicle, 2017 vs 2022 (USD Billion)

Figure 40 PC: Asia Pacific Region to Hold the Largest Market Share, By Value, 2017 vs 2022

Figure 41 LCV: North America Region to Hold the Largest Market Share, By Value, 2017 vs 2022

Figure 42 HCV: Asia Pacific Region to Hold the Largest Market Share, By Value, 2017 vs 2022

Figure 43 Market, By Repair, 2017 vs 2022 (USD Billion)

Figure 44 Transmission General Repair: North America Region to Hold the Largest Market Share, By Value, 2017 vs 2022

Figure 45 Transmission Overhaul: North America Region to Hold the Largest Market Share, By Value, 2017 vs 2022

Figure 46 China to Be the World’s Fastest-Growing Market for Transmission Repair During the Forecast Period (2017–2022)

Figure 47 North America: Market Snapshot, 2017–2022

Figure 48 Europe: Market Snapshot, 2017–2022

Figure 49 Asia Pacific: Market Snapshot, 2017–2022

Figure 50 RoW: Market, 2017vs 2022 (USD Billion)

Figure 51 Key Development By Leading Players in Market for 2015-2017

Figure 52 Transmission Repair Market Ranking: 2017

Figure 53 Schaeffler: Company Snapshot

Figure 54 Allison Transmission: Company Snapshot

Figure 55 Borgwarner: Company Snapshot

Figure 56 ZF: Company Snapshot

Figure 57 Continental: Company Snapshot

Growth opportunities and latent adjacency in Transmission Repair Market