Electric 3 Wheeler Market

Electric 3 Wheeler Market by End Use (Passenger Carriers, Load Carriers), Range (Less than 50 miles, above 50 miles), Battery Type (Lead Acid, Lithium-ion), Battery Capacity, Motor Type, Motor Power, Payload Capacity, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

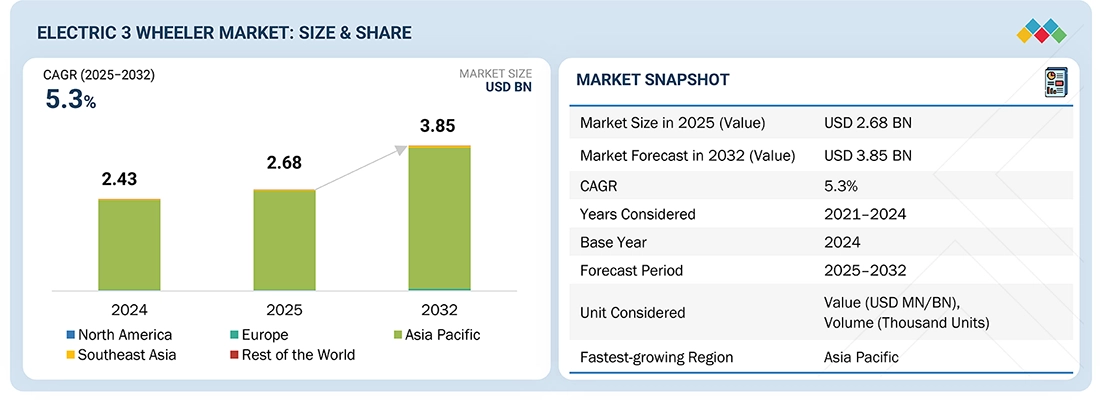

The electric 3 wheeler market is projected to grow from USD 2.68 billion in 2025 to USD 3.85 billion by 2032, registering a CAGR of 5.3%. Electric 3-wheelers are rapidly gaining traction as mainstream fleet assets, driven by strong policy support and rising demand for affordable passenger and last-mile transportation. With total ownership costs nearly 30–40% lower than those of ICE models, supported by advances in battery swapping, connectivity, and access to financing, they are becoming the preferred choice for logistics and passenger mobility across emerging markets.

KEY TAKEAWAYS

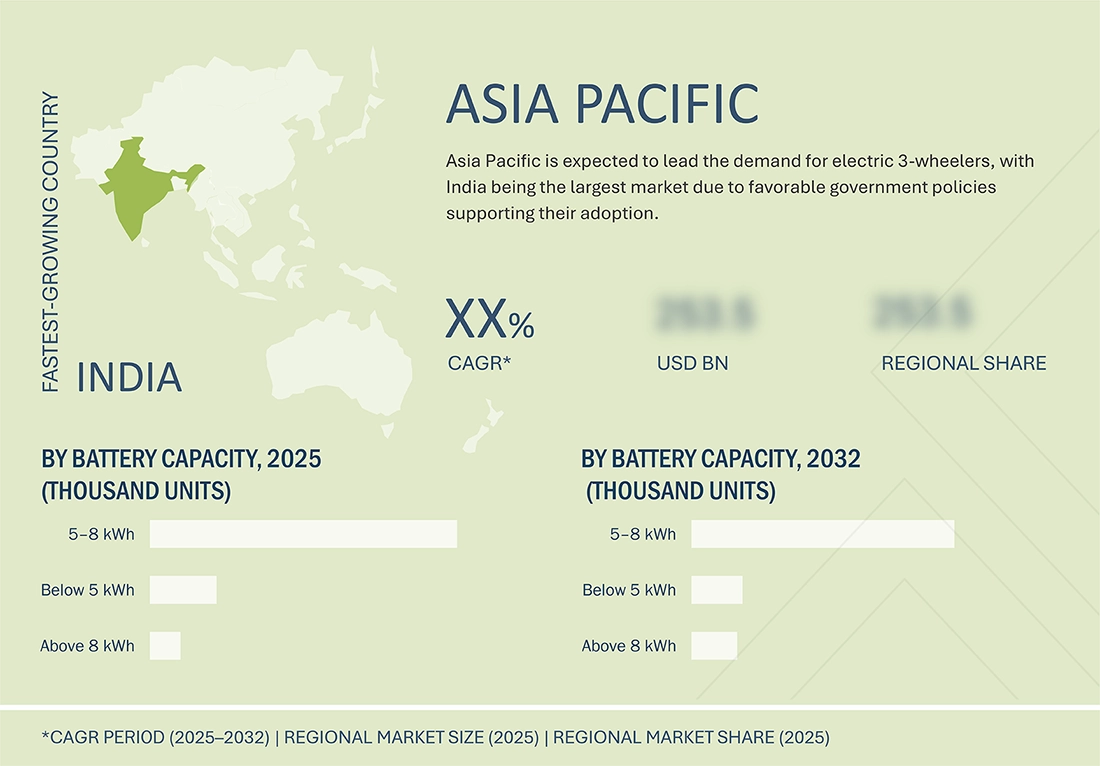

- Asia Pacific is expected to reach USD 3.74 billion in 2032, with a CAGR of 5.2%.

- The below 5 kWh segment is expected to reach 223,391 units by 2032.

-

Lithium-ion batteries is expected to record a CAGR of 10.6% during the forecast period.

- The mid motors segment is estimated to reach 1,082,553 units in 2025.

- The electric 3 wheeler market is dominated by established players, such as Mahindra & Mahindra Ltd. (India), YC Electric Vehicle (India), Saera Electric Auto Pvt. Ltd. (India), Piaggio Group (Italy), and Bajaj Auto Ltd. (India).

Electric 3-wheelers are becoming a reliable and economical option for short-distance travel and urban freight movement across global markets. Their growing use is advancing sustainable mobility, particularly in emerging nations, while also gaining traction in European and African cities. This shift is supported by lower running costs, expanding urban populations, and increasing government efforts to promote cleaner transport systems.

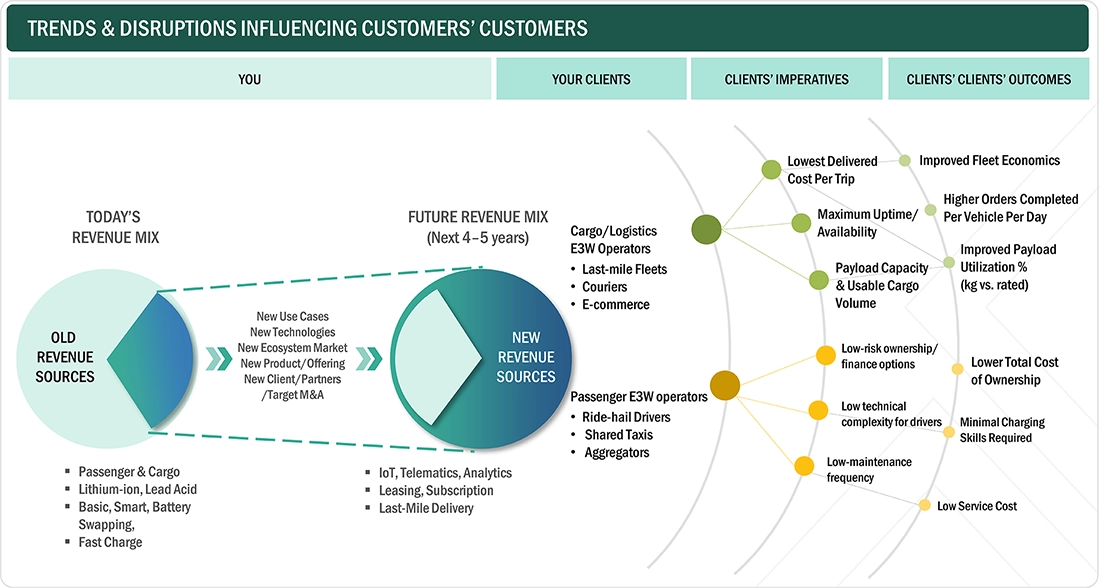

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Electric 3-wheelers are becoming essential for both cargo logistics and passenger transport in urban and semi-urban areas. Logistics companies and shared mobility operators are adopting them to cut operating costs and emissions while increasing daily use. The vehicles provide efficient last-mile delivery for goods and affordable, short-distance commuting for passengers. Government incentives, low maintenance needs, and the expansion of charging and swapping infrastructure are encouraging wider adoption. The growing use of fleet-based and financed ownership models is also boosting operational efficiency, making electric 3-wheelers a preferred choice for both goods and passenger movement.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advancements in battery technology coupled with reducing battery prices

-

Rise in last-mile delivery

Level

-

Limited power output, range, and speed

-

Battery disposal and recycling concerns

Level

-

Partnership with delivery and logistics fleet operators

-

Battery swapping offerings

Level

-

Limited battery capacity

-

Lack of compatibility, interchangeability, and standardization

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advancements in battery technology coupled with reducing battery prices

Advances in battery technology and steadily falling battery prices are accelerating the adoption of electric 3-wheelers, especially in budget-conscious markets. Improvements in lithium-ion chemistry, increased energy density, and better thermal management are enabling longer driving ranges, faster charging, and longer battery life. These advancements help address two main barriers: range anxiety and operating downtime, which are particularly crucial for commercial users.

Restraint: Limited power output, range, and speed

Limited power output, range, and speed continue to limit electric 3-wheelers, especially in high-load and long-duty tasks. Their average range of 80–120 km per charge and lower torque decrease operational flexibility and trip frequency, impacting overall fleet productivity. While OEMs are developing higher-capacity batteries and mid-drive motors to boost performance, these upgrades increase costs, keeping performance constraints a major challenge for large-scale commercial use.

Opportunity: Partnerships with delivery and logistics fleet operators

As the demand for efficient and eco-friendly transportation increases, fleet operators are increasingly adopting electric vehicles to fulfill their needs. This move toward sustainability not only supports environmental objectives but also provides substantial cost savings and operational benefits for businesses.

Challenge: Limited battery capacity

Current EV batteries have low capacities and cover limited distances per charge. The performance and lifespan of batteries directly impact the overall performance and cost of electric vehicles. Lithium-ion batteries are gradually replacing lead-acid ones due to their longer lifespan and higher energy density. However, the capacity of lithium-ion batteries remains too low to match the standards of conventional vehicles.

asia-pacific-electric-3-wheeler-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

High-volume passenger and cargo electric 3-wheelers such as the Treo range (Treo, Treo Yaari, Treo Zor, e-Alfa Mini and e-Alfa Cargo) deployed for last-mile urban transport and goods movement across Indian cities. | Significant operating-cost savings compared to CNG/diesel alternatives (e.g., Treo Zor offers fuel-cost savings of ?2.10/km over diesel models) Large service network and brand reliability reducing downtime and maintenance risk. Strong market share (e.g., FY22 market share 73.4 %) indicating acceptance and scalability. |

|

Entry-level electric 3-wheelers (e-rickshaws) such as the Yatri Super, Yatri Deluxe, Yatri and cargo variants (E-Loader, Yatri Cart) targeted at small fleets and individual drivers for intra-city passenger transport and micro-logistics. | Lower upfront cost (passenger models from ?1.25 lakh to ?1.70 lakh) enabling lower-income operators to adopt EVs. Simpler vehicle architecture and charger infrastructure suited for short-haul urban/peri-urban routes. Enabling cleaner mobility in dense urban areas with narrow roads and high vehicle turnover. |

|

Electric 3-wheelers including both passenger and cargo models (under Mayuri brand and through JV Keto) built for small commercial loads and fleet deployments, particularly in urban and semi-urban segments. | Manufacturing capacity geared for scale (e.g., new plant in Bawal with capacity ~36,000 e3Ws per annum) Lower total cost of ownership compared to ICE counterparts due to lower energy and maintenance costs. Flexibility in cargo and passenger use enables operators to optimize asset utilization. |

|

Electric 3-wheelers for both passenger (Apé E-City FX Max) and cargo (Apé E-Xtra FX Max) applications with a business model that includes innovative battery-finance/ subscription schemes for ease of ownership. | Battery subscription/financing reduces upfront cost burden and mitigates battery-replacement risk for operators. Proven readiness for structural shift to electric e3Ws (aiming for ~50 % penetration of L5 segment by 2028) Dual passenger-cargo capability allows fleet owners to deploy vehicles flexibly across transport segments. |

|

Electric 3-wheelers under GoGo series (variants P5009, P5012, P7012) launched for both passenger and cargo use, including premium features such as two-speed automated transmission and extended range (~251 km) to cater to high-utilization fleet operations. | Long driving range on single charge (up to ~251 km) reduces charging downtime and increases daily utilization for operators. Advanced features (Hill Hold Assist, Anti-Roll Detection) improve safety and driver comfort, helping fleet-uptime and retention. Rapid market share capture (36 % share in L5 e3W in April 2025) indicates strong fleet adoption and brand trust. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

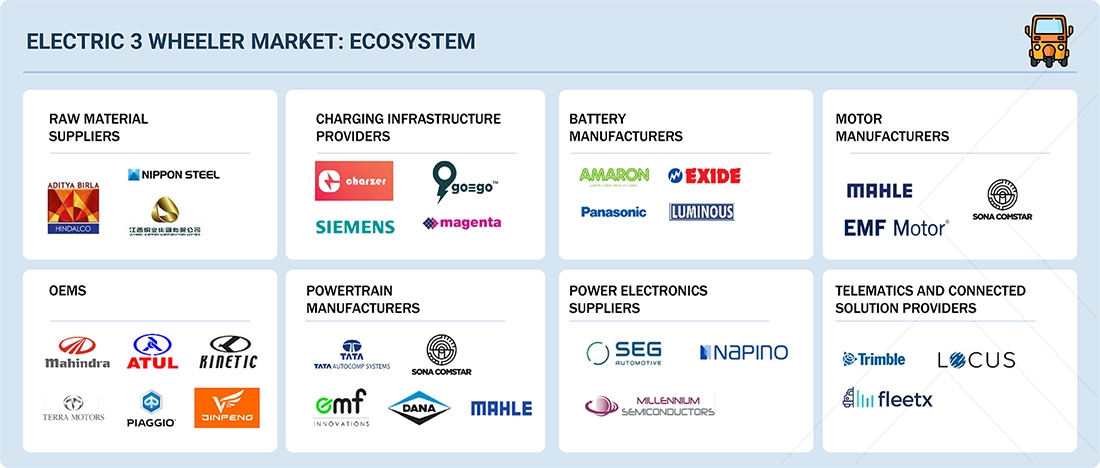

MARKET ECOSYSTEM

The ecosystem analysis highlights various players in the electric 3 wheeler market, which is primarily represented by raw material suppliers, battery manufacturers, OEMs, powertrain manufacturers, component manufacturers, and charging infrastructure providers. Some of the major electric 3-wheeler OEMs are Mahindra & Mahindra Ltd. (India), YC Electric Vehicle (India), Saera Electric Auto Pvt. Ltd. (India), Piaggio Group (Italy), and Bajaj Auto Ltd. (India).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

ELECTRIC 3 WHEELER SEGMENT, BY RANGE

The electric 3 wheeler market has been segmented based on range into below 50 miles and above 50 miles. Electric 3-wheelers generally have limited range because they lack tanks, and battery capacity can be a concern for extending range. With increased investments in R&D and technological progress, manufacturers are now shifting toward electric 3-wheelers with higher ranges.

ELECTRIC 3 WHEELER SEGMENT, BY BATTERY CAPACITY

The electric 3 wheeler market has been segmented by battery capacity into below 5 kWh, 5–8 kWh, and above 8 kWh. The batteries used in electric 3-wheelers differ depending on these vehicles’ power needs and uses. E-rickshaws need low-powered batteries, while electric auto rickshaws in the passenger and cargo categories require high-powered batteries. Load carriers are built to carry heavier loads than passenger carriers.

ELECTRIC 3 WHEELER SEGMENT, BY BATTERY TYPE

The electric 3 wheeler market has been segmented based on battery type into lead acid, lithium-ion, and others. For any electric 3-wheeler, the most crucial part of the system is its battery. The performance, efficiency, and cost of electric 3-wheelers depend on the battery installed. However, 3-wheeler manufacturers are focused on developing new electric 3-wheelers with more advanced lithium-ion batteries to address the disadvantages of lead-acid batteries.

ELECTRIC 3 WHEELER SEGMENT BY MOTOR POWER

The electric 3 wheeler market has been segmented based on motor power into below 1,500 W, 1,500–3,500 W, and above 3,500 W. Electric 3-wheelers with a motor capacity below 1,500 W are generally classified as low-powered electric vehicles (LPEVs). These vehicles are commonly used for short-distance travel within cities and cargo transportation. In electric 3-wheeler load carriers, the motor power ranges from 1500 W to 3500 W, and speeds range from 23 km/h to 30 km/h. 1500–3,500 W motors are more expensive than motors below 1,500 W.

ELECTRIC 3 WHEELER SEGMENT, BY MOTOR TYPE

The electric 3 wheeler market is segmented by motor type into hub motors, mid motors, and others, each engineered to support distinct operational requirements. Hub motors, integrated into the wheel hub, deliver direct and responsive propulsion while minimizing mechanical complexity and maintenance needs, making them an optimal configuration for urban delivery and passenger mobility. Centrally located mid-motors further refine vehicle stability and handling by optimizing weight distribution and power transmission via a mechanical linkage, supporting diverse modular battery arrangements and scalable use cases.?

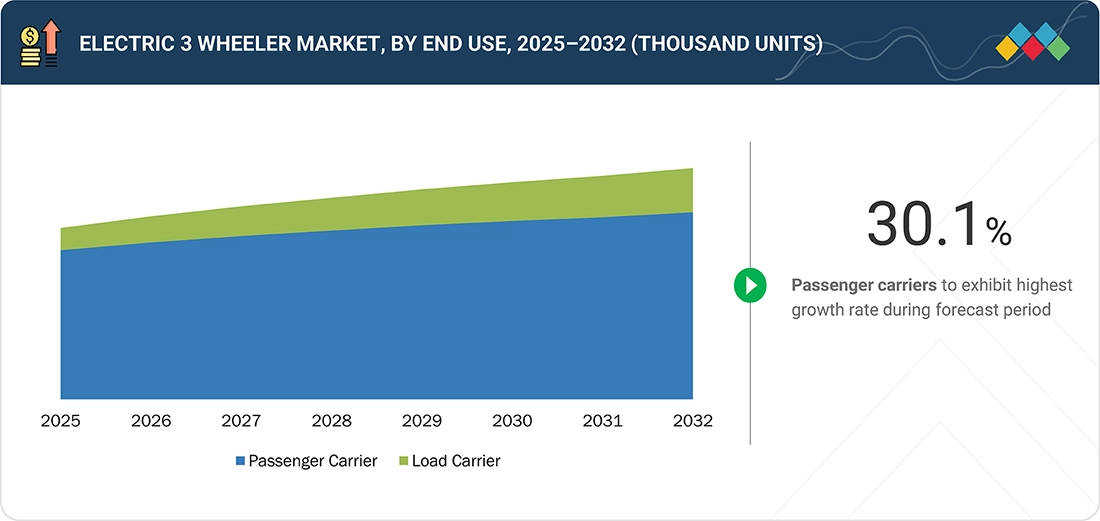

ELECTRIC 3 WHEELER SEGMENT, BY END USE

The electric 3 wheeler market is segmented by end use into passenger carriers and load carriers. Passenger carriers are electric 3-wheelers used to transport passengers, with seating capacities of up to 4 passengers, including the driver. Prominent models include Mahindra Treo, Atul Elite Cargo, Comfort Plus, and Standard Deluxe. Electric 3-wheeler load carriers are used for goods transportation. Models currently available on the market are Treo Zor, Atul Elite Cargo, Piaggio Ape Electrik, Electric Tricycle (DLS III 150), Electric Logistic Cart, and Erick.

REGION

Asia Pacific to be largest region in global electric 3 wheeler market during forecast period

Asia Pacific holds the largest share in the electric 3-wheeler market due to its high reliance on 3-wheelers for daily commuting and goods movement across densely populated developing economies. This is complemented by strong government incentives for electrification aimed at reducing urban pollution and fuel imports. The region’s widespread use of 3-wheelers as a primary mode of transportation creates a significant base for electric conversion, making Asia Pacific the leader worldwide in both production and adoption. India and China together account for over 85% of global electric 3-wheeler sales, driven by aggressive electrification initiatives and robust local manufacturing capacity.

asia-pacific-electric-3-wheeler-market: COMPANY EVALUATION MATRIX

Micro-quadrants provide information about the major players in the electric 3 wheeler market, outline the findings, and analyze how well each market player performs within the predefined micro-quadrant criteria. Mahindra & Mahindra, recognized as a market leader, combines advanced R&D, national scale, and diverse products such as the Treo, Treo Zor, and e-Alfa Plus, which deliver robust range, competitive torque, and reliable battery options, while Mini Metro EV LLP stands out as a high-growth player with strong dealership alliances, efficient local manufacturing, and sizable sales volumes, making both companies key benchmarks in India’s electric 3 wheeler market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Mahindra&Mahindra Ltd. (India)

- YC Electric Vehicle (India)

- Bajaj Auto Ltd (India)

- Saera Electric Auto Pvt. Ltd. (India)

- Piaggio Group (Italy)

- CityLife Electric Vehicles (India)

- Kinetic Green (India)

- Mini Metro EV LLP (India)

- Atul Auto Ltd. (India)

- Terra Motors Corporation (Japan)

- Lohia Auto Industries (India)

- Omega Seiki Mobility (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 2.68 BN |

| Market Forecast in 2032 (Value) | USD 3.85 BN |

| Growth Rate | CAGR of 5.3% from 2025 to 2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD MN/BN), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Company Share, Growth Factors and Trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Southeast Asia, North America, Europe, Rest of the World |

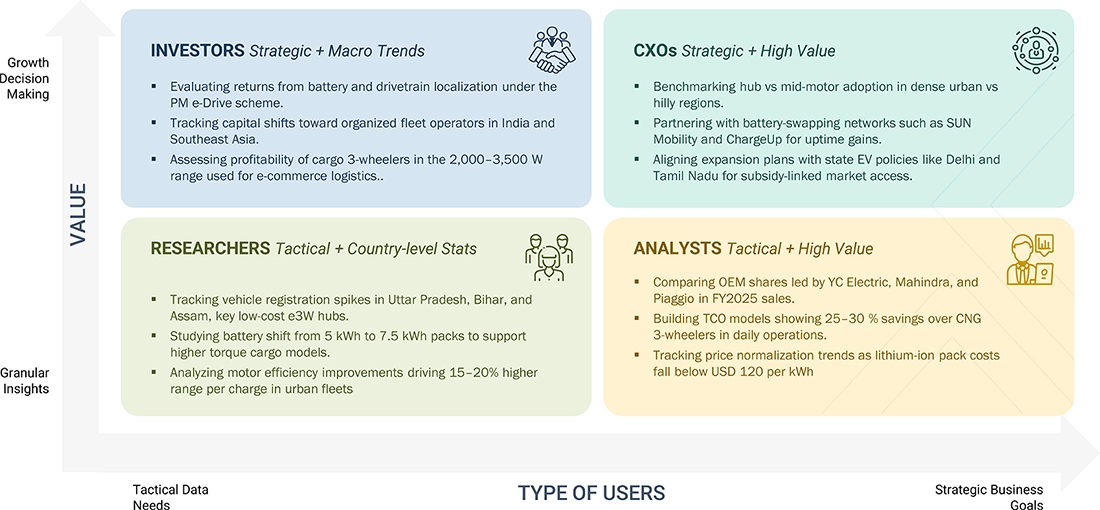

WHAT IS IN IT FOR YOU: asia-pacific-electric-3-wheeler-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Fit Assessment (OEMs) | Payload, range, charging, segment benchmarking | Market-relevant models, faster adoption, product-market fit |

| Price Sensitivity Analysis | TCO calculators, upfront vs running cost tools | Data-driven pricing, improved value communication |

| Fleet Electrification Feasibility | Route mapping, charging/swapping planning | Reduced transition risks, optimal fleet deployment |

| Charging Ecosystem Strategy | Urban/rural charger placement, infrastructure mapping | Higher uptime, minimized downtime, smarter investments |

| Regulatory & Compliance Mapping | State/local incentive matrix, homologation checks | Faster approvals, better policy leverage |

| Maintenance/Aftermarket Insights | Service network, spare part turnaround, reliability scorecard | Lower downtime, improved customer retention |

| Financing & Ownership Models | Lease/EMI scenario comparison, resale outlooks | Affordable procurement, wider market access |

| Operator/Driver Training Needs | Skill gap analysis, tailored training modules | Increased efficiency, reduced misuse/accidents |

RECENT DEVELOPMENTS

- July 2025 : Piaggio launched the Apé E-City Ultra, which comes with a 10.2 kWh LFP battery and intelligent telematics. It offers a range of 236km, peak power of 9.55kW, with a top speed of 55km/h and a torque of 45Nm

- July 2025 : Piaggio launched the Apé E-City FX Maxx, which has a range of 174 km per charge, a peak motor power of 7.4 kW, and a torque output of 30 Nm.

- February 2025 : Bajaj GoGo is a new brand of electric autos available in three variants: P5009, P5012, and P7012. In the naming system, ‘P’ stands for Passenger, ‘50’ and ‘70’ indicate size, and ‘09’ and ‘12’ represent battery capacities of 9 kWh and 12 kWh, respectively.

- December 2024 : Mahindra Last Mile Mobility Limited (MLMML), a subsidiary of Mahindra & Mahindra Ltd., collaborated with Vidyut to offer Battery-as-a-Service (BaaS) financing for Zor Grand and Treo Plus electric 3-wheelers.

- August 2024 : Mahindra & Mahindra Ltd. launched the e-Alfa Plus with a 150 Ah lead-acid battery, producing 1.95 kW at 2600 rpm and a maximum torque of 26.9 Nm at 200 rpm, with a range of over 100 kilometers on a single charge.

- August 2024 : Amara Raja collaborated with Piaggio India to develop and supply LFP (lithium iron phosphate) lithium-ion (Li-ion) cells and chargers for its electric vehicles, while also developing cells and battery packs for their upcoming products.

- April 2024 : Piaggio is investing approximately USD 112 million to produce a new range of electric engines designed for next-generation zero-emission vehicles, along with five industrial research and experimental development projects focusing on components and systems for electric vehicles.

Table of Contents

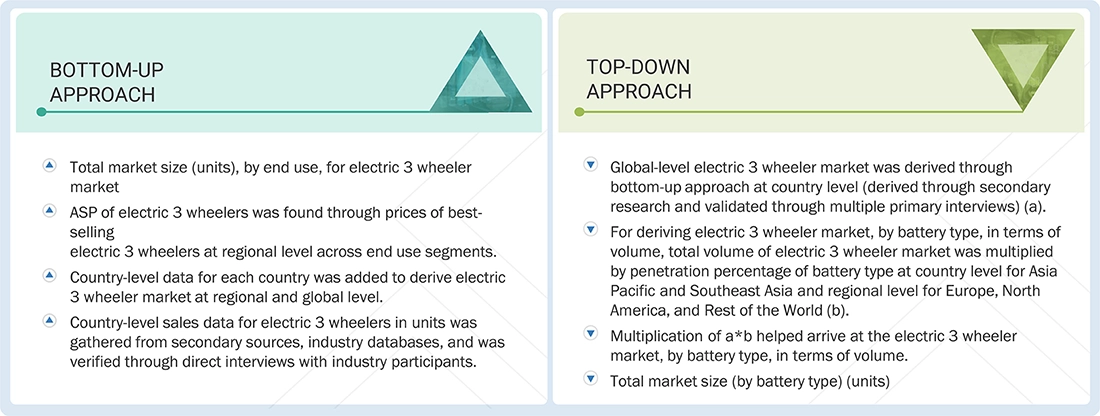

Methodology

The study involved four major activities in estimating the current size of the electric 3 wheeler market. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, European Alternative Fuels Observatory (EAFO), China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), International Energy Association (IEA)], articles, directories, technical handbooks, trade websites, technical articles, and databases (for instance, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the electric 3 wheeler market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the electric 3 wheeler market scenario through secondary research. Several primary interviews were conducted with market experts from both the supply (automotive OEMs and E3W component providers across major regions, namely, Asia Pacific, Southeast Asia, Europe, North America, and Rest of the World. Approximately 10% and 90% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were also conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the in-house subject matter experts’ opinions, led to the findings described in the remainder of this report.

Note: Others include sales, managers, and product managers. Tier I suppliers supply components to OEMs, while Tier II suppliers supply raw materials and components to Tier I suppliers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the electric 3 wheeler market. In this approach, vehicle production statistics for each end use were considered at the country level. The penetration of each end use at the country level was identified through model mapping to determine the electric 3 wheeler market size in terms of volume. Then, the penetration of each end use for all countries was applied to obtain the volume of the electric 3 wheeler market. The country-level volume for each end use was multiplied by the average OE price of each end use to derive the market size in terms of volume. Extensive secondary and primary research was conducted to understand the market scenario for the end use in the automotive industry. Several primary interviews were conducted with key opinion leaders related to electric vehicle developments, including OEMs, Tier-1 suppliers, and applications. Qualitative aspects such as drivers, restraints, opportunities, and challenges were considered while calculating and forecasting the market size.

To derive the market for the electric 3 wheeler market, by battery type, in terms of volume, the adoption rate of all segments was identified at the country level. To derive the market in terms of value, the cost breakup percentage of the end use segment at the regional level was applied to the global value of the electric 3 wheeler market. This gives the electric 3 wheeler market, by battery type, in terms of volume and value. Mapping was done at the regional level for battery type to understand the contribution by type of component. The market size was derived at the regional level in terms of volume. The total volume of the electric 3 wheeler market was multiplied by the % breakdown of each component at the country level.

Electric 3 Wheeler Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was divided into several segments and subsegments. To complete the overall market engineering process and determine the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed, as applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Electric 3-wheelers are plug-in 3-wheeled vehicles that use electric motors to achieve locomotion. The electricity is stored in a rechargeable battery, which powers the electric motor. These vehicles are zero-emission electric motor-driven vehicles. The operating and top speeds of electric 3-wheelers are based on battery technology and its type.

Key Stakeholders

- Automotive Component Manufacturers

- Automotive OEMs

- Companies Operating in the Electric 3-wheeler Ecosystem

- Distributors and Retailers

- Electric 3 Wheeler Component Manufacturers

- EV Battery Manufacturers

- EV Motor Manufacturers

- Fleet Operators

- Legal and Regulatory Authorities

- Manufacturers of Electric 3-wheelers

- Raw Material Suppliers for Electric 3-wheelers or their Components

- Technology Providers

- Transport Authorities

Report Objectives

- To analyze the electric 3 wheeler market and forecast its size, in terms of volume (units) and value (USD million), from 2025 to 2032

-

To segment the market by end use, payload capacity, motor type, motor power, battery type, battery capacity, range, and region

-

To segment the market and forecast its size by volume (units) based on motor type

(hub motors and mid motors) -

To segment the market and forecast its size by volume (units) based on motor power

(below 1,500 W, 1,500–3,500 W, and above 3,500 W) - To segment the market and forecast its size by volume (units) based on battery capacity (below 5 kWh, 5–8 kWh, and above 8 kWh)

- To segment the market and forecast its size by volume (units) and value (USD million) based on end use (passenger carriers and load carriers)

- To segment the market and forecast its size by volume (units) based on a range (less than 50 miles and above 50 miles)

- To segment the market and forecast its size by volume (units) based on battery type (lead acid, lithium-ion, and others)

- To segment the market and forecast its size by volume (units) and value (USD million) based on payload capacity (up to 300 kg, 300–500 kg, and above 500 kg).

- To segment the market and forecast its size by volume (units) and value (USD million) based on region (Asia Pacific, Southeast Asia, Europe, North America, and Rest of the World)

-

To segment the market and forecast its size by volume (units) based on motor type

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze the technological developments impacting the market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Value Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Case Study Analysis

- Patent Analysis

- Buying Criteria

- TCO Analysis

- BOM Analysis

- Strategic Insights on Electric 3-wheeler Offerings

- Business Models

- Key OEM Strategies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product developments, and other activities carried out by key industry participants

Customization Options

With the given market data, MarketsandMarkets offers customizations tailored to company-specific needs.

- Electric 3 Wheeler Market, by Battery Type, at Country Level (for countries covered in report)

- Electric 3 Wheeler Market, by Battery Capacity, at Country Level (for countries covered in report)

Company Information

- Profiling of Up to Five Additional Market Players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electric 3 Wheeler Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electric 3 Wheeler Market