API Management Market

API Management Market by Platform (API Gateways, API Lifecycle Management, API Security, API Analytics & Monitoring, API Developer Portal), Service (Integration & Implementation, Support & Maintenance, Training & Education) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

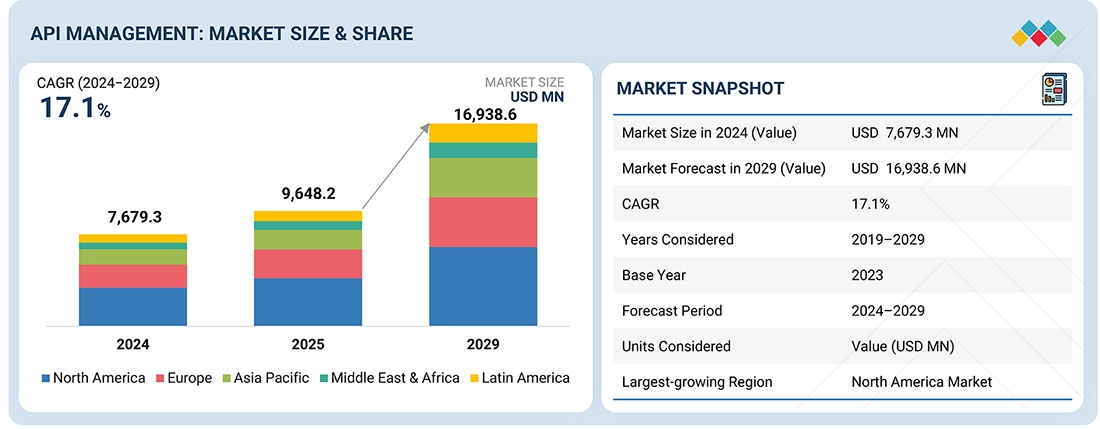

The global student information system market is expected to grow substantially, projected to rise from USD 7,679.3 million in 2024 to USD 16,938.6 million by 2029, reflecting a CAGR of 15.9%. The API management market is expanding rapidly as enterprises modernize their digital ecosystems, adopt microservices, and scale integrations across cloud, on-premise, and multicloud environments. Organizations in BFSI, IT & ITeS, retail, healthcare, and telecom increasingly rely on API gateways, security layers, and lifecycle governance to enable real-time connectivity and platform-driven innovation. API platforms deliver centralized control, strong security, advanced analytics, and seamless integration capabilities, aligning with the accelerating shift toward cloud-native, scalable, and automation-driven architectures. Key growth drivers include: Digital transformation initiatives demanding secure, real-time data exchange and automated API workflows I Rising adoption of microservices and multicloud environments requiring unified API governance and observability I Growing preference for AI-enabled API analytics, low-code development, and cloud-based API platforms that support ecosystem expansion and third-party integrations

KEY TAKEAWAYS

-

BY REGIONThe North America API management market accounted for a 42.1% revenue share in 2024.

-

BY OFFERINGBy offering, the services segment is expected to register the highest CAGR of 20.0%.

-

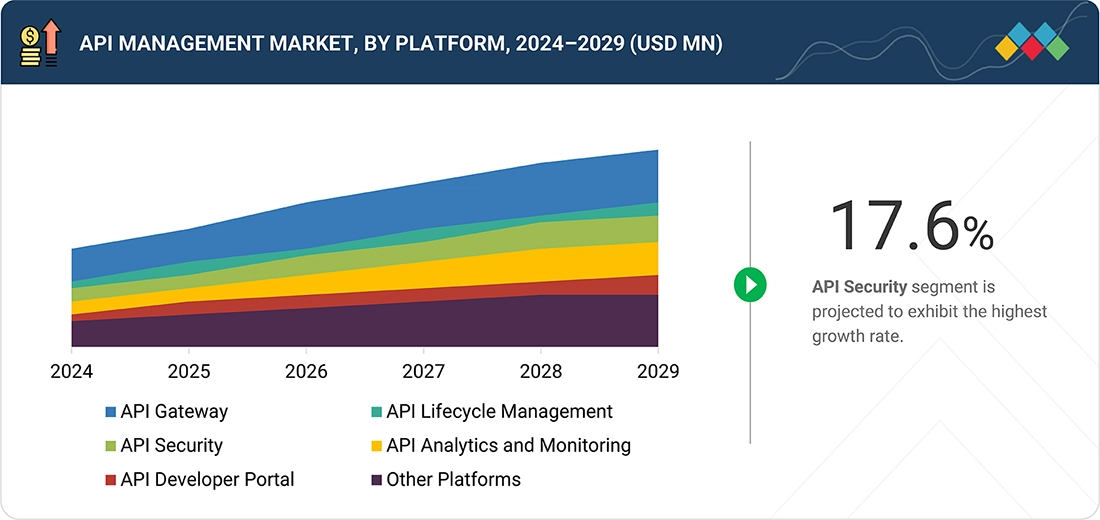

BY PLATFORMBy platform , API security segment is projected to grow at highest CAGR.

-

BY ORGANIZATION SIZEBy organization size, large enterprises segment will hold the largest market share.

-

BY DEPLOYMENT TYPEBy deployment type, the cloud segment is expected to dominate the API management market.

-

BY VERTICALBy vertical, the retail & e-commerce segment is projected to grow the at the fastest rate of 20.2% during the forecast period.

-

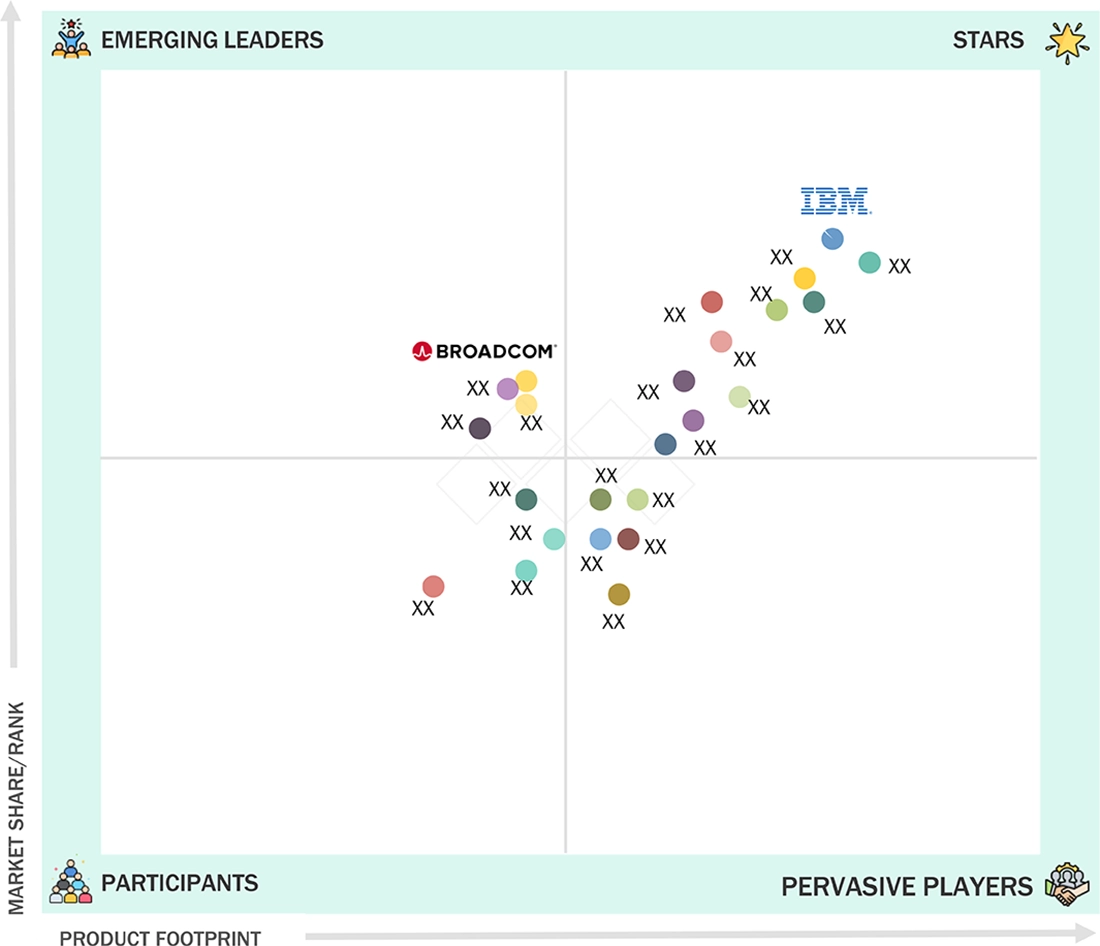

COMPETITIVE LANDSCAPECompany IBM, Microsoft, and Google were identified as some of the star players in the API management market (global), given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPECompanies Broadcom, Red Hat, and Boomi, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The rapid acceleration of digital transformation, microservices adoption, and multicloud strategies is strengthening the need for robust, scalable, and secure API management solutions. At the center of this shift, API management platforms are becoming essential to modern enterprise architectures by offering: Centralized governance, security, and lifecycle control for APIs across distributed systems I Real-time monitoring, analytics, and automation that optimize performance, detect anomalies, and ensure policy compliance across high-traffic environments I Seamless integration with cloud platforms, AI systems, third-party applications, and partner ecosystems, enabling faster innovation and ecosystem expansion I As organizations prioritize security, interoperability, and agility, vendors are investing in cloud-native gateways, unified API platforms, and AI-enhanced tooling to improve scalability and operational efficiency

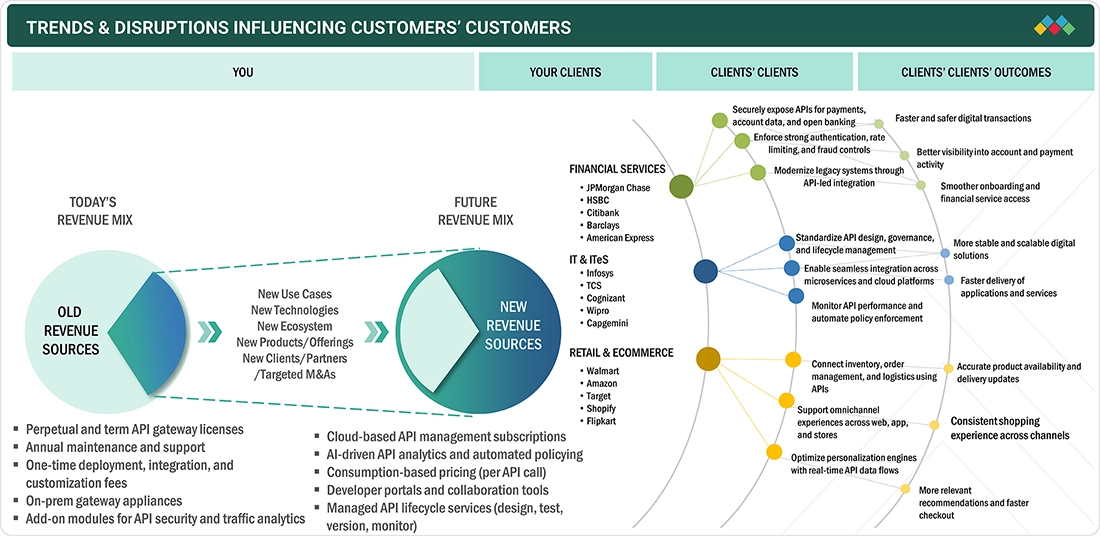

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Rising demand for real-time connectivity, secure data exchange, and scalable integrations is pushing enterprises to modernize their digital infrastructure. API management platforms, powered by centralized governance, automated workflows, and advanced analytics, help organizations streamline system interactions, reduce integration complexity, and support faster innovation. These solutions enhance performance visibility, strengthen security, and enable scalable digital growth. Shifts in cloud adoption, regulatory mandates, or ecosystem expansion directly shape these outcomes and drive demand for API management providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Streamlining microservices through effective API management

-

Surge in adoption of multicloud environments

Level

-

Complexity in implementation

Level

-

Rise in third-party and partner-facing APIs

-

Focus on integrating APIs with emerging technologies

Level

-

Security issues and lack of awareness

-

Lack of skilled workforce and inadequate management practices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Streamlining microservices through effective API management

The shift toward microservices is accelerating demand for advanced API management platforms. As applications are decomposed into independent services, enterprises need reliable mechanisms to control, secure, and optimize the APIs connecting them. Effective API management enables: Centralized governance and secure API gateway capabilities I Traffic control, authentication, and policy enforcement across distributed services I Real-time monitoring and analytics to maintain performance and reliability I This trend aligns with vendor offerings that streamline microservices communication, reduce integration complexity, and support scalable, cloud-native application delivery

Restraint:Rise in third-party and partner-facing APIs

Despite its benefits, complexity in implementation remains a major restraint for API management adoption. Organizations often struggle to deploy full-scale API platforms due to: Integration challenges arising from diverse systems, legacy environments, and inconsistent data formats I High technical effort required to configure gateways, security policies, and monitoring frameworks I Increased deployment time, cost, and operational disruption caused by fragmented development practices I Vendors and enterprises must simplify implementation through scalable architectures, strong planning, and user-friendly tooling to ensure smoother adoption and long-term effectiveness

Opportunity:Integration with emerging technologies

The rise in third-party and partner-facing APIs is creating strong opportunities for API management platforms. As enterprises expand digital collaborations and integrate external services, API management enables: Secure onboarding and governance of external APIs across ecosystems I Real-time monitoring, performance insights, and policy enforcement to ensure reliable interactions I Streamlined partner integration that accelerates innovation and expands digital business models I This aligns with vendor strategies centered on ecosystem connectivity, secure API exchanges, and scalable multienterprise integration.

Challenge:Security issues and lack of awareness

Security issues and lack of awareness remain major barriers to effective API management. Key issues include: Persistent vulnerabilities in production APIs, highlighted by the Salt survey where 95% of organizations reported security incidents I Limited visibility and preparedness, with Traceable noting that 40% operate without API security solutions and 29% are unsure of their security posture I Rising breach exposure, as 23% experienced API-related breaches due to inadequate threat detection and weak governance I Extremely low adoption of structured API testing and threat modeling, with only 7.5% implementing dedicated programs, leaving critical gaps in protection I These security and awareness challenges hinder safe API expansion, increase operational risk, and slow adoption of comprehensive API management platforms

API MANAGEMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cisco Meraki modernized its lead management by using MuleSoft’s Anypoint Platform as its core API management layer, connecting Salesforce, Tableau, and Slack into a unified ecosystem. APIs automated lead capture from emails, ensured accurate real-time routing, and eliminated six fragmented systems. This API-driven architecture reduced manual work, improved data accuracy, and boosted sales team responsiveness. | Lead routing accuracy increased to 92% I 641 support hours saved annually through automation I 37% reduction in deal-routing support cases I Consolidated two IT teams into one, enabling focus on higher-value initiatives |

|

Axis Bank modernized its corporate onboarding by deploying IBM API Connect as the core API management layer, supported by IBM Cloud Integration services. The solution digitized document handling, streamlined API onboarding, and unified performance monitoring. With automated flows replacing manual steps, the bank accelerated onboarding, strengthened partner integration, and delivered a smoother, fully digital customer experience. | Reduced onboarding time through removal of manual handoffs I Higher operational efficiency and improved customer satisfaction I Surge in API traffic, payouts, and service requests showing deeper engagement |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

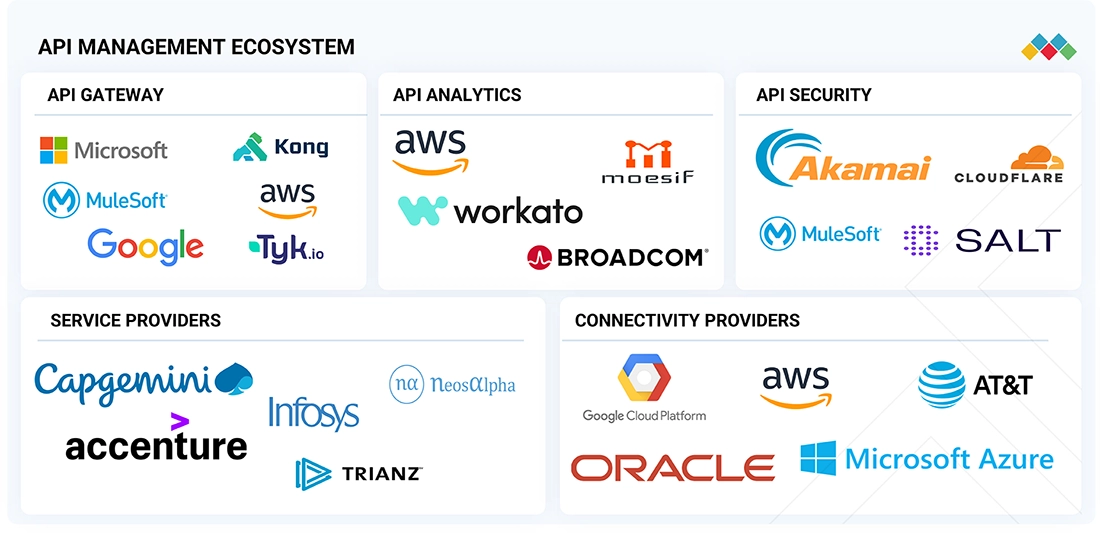

MARKET ECOSYSTEM

Prominent API management vendors support end-to-end lifecycle needs across industries, covering API gateways, API analytics, API security, service delivery, and connectivity enablement. Providers in this space include gateway vendors that streamline traffic management, rate limiting, and protocol translation; analytics platforms that deliver real-time visibility into API performance and usage patterns; and security specialists offering threat detection, authentication, authorization, and runtime protection. Service providers contribute through implementation, integration, and managed API operations, ensuring scalability and governance. Connectivity providers enhance ecosystem interoperability by enabling seamless communication across applications, microservices, hybrid clouds, and partner networks, strengthening digital integration and operational efficiency.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

API Management Market, By Offering

The platform segment is expected to hold the largest share of the API management market as organizations increasingly rely on unified, scalable solutions to support expanding API ecosystems. Demand is driven by the need for: Centralized control over API creation, publishing, lifecycle management, and policy enforcement | End-to-end security capabilities including authentication, authorization, threat detection, and runtime protection | Real-time analytics to monitor performance, usage patterns, and compliance | Seamless integration with microservices, cloud-native architectures, DevOps pipelines, and hybrid environments. These capabilities help enterprises accelerate digital initiatives, streamline governance, and improve interoperability. Vendors continue enhancing platform offerings with modular components, automation features, and advanced analytics to support growing API volumes and complex integration requirements.

API Management Market, By Platform

API security platforms are expected to grow at the fastest rate as organizations face rising threats across expanding digital ecosystems. This growth is driven by the need for: Continuous protection against API-specific attacks such as injection, credential abuse, and unauthorized access | Advanced threat detection powered by machine learning and behavioral analytics | Centralized enforcement of authentication, authorization, and encryption policies | Real-time monitoring of API traffic across distributed, microservices-based environments. This segment is gaining rapid adoption as businesses modernize applications, increase third-party integrations, and expose more APIs across cloud and hybrid infrastructures. API security solutions enable: Automated risk assessment and anomaly detection | Compliance with data protection regulations | Scalable protection aligned with growing API volumes | Seamless integration with API gateways, WAFs, and DevSecOps pipelines. These capabilities position API security as a critical investment for securing modern digital architectures.

API Management Market, By Deployment Type

Cloud deployment in the API management market is expected to record the highest growth as enterprises accelerate cloud-first strategies and modernize integration architectures. This shift is driven by the need for: Rapid, scalable API deployment without infrastructure constraints | Cost-efficient operations through subscription-based models and reduced maintenance overhead | Real-time elasticity to support fluctuating API traffic across distributed applications | Seamless integration with cloud-native services, microservices platforms, and multi-cloud environments. Key advantages include: Centralized policy enforcement and runtime security across cloud workloads | Automated updates, analytics, and monitoring for improved reliability | Faster onboarding for developers through self-service portals and CI/CD alignment | High availability and global reach enabled by cloud infrastructure. These capabilities make cloud-based API management essential for organizations adopting modern architectures and expanding digital ecosystems.

API Management Market, By Vertical

The financial services segment is expected to hold the largest market share in the API management market as institutions increasingly rely on APIs to modernize operations and deliver secure, real-time digital services. Banks, insurance providers, and fintech firms require solutions that: Enable seamless integration with core banking, payment gateways, credit systems, and regulatory platforms | Support open banking initiatives and third-party developer ecosystems | Provide strong authentication, authorization, and encryption to safeguard sensitive financial data | Ensure high performance, low latency, and continuous availability for mission-critical transactions. API management platforms help financial institutions accelerate digital transformation, launch new products faster, and comply with evolving regulatory mandates such as open finance and PSD2-like frameworks. Key drivers include large transaction volumes, the rise of digital payments, rapid fintech partnerships, and the need for secure, standardized API ecosystems.

REGION

North America is expected to hold largest market share in the API management market during the forecast period.

North America is emerging as a dominant region in the global API management market, led by the United States, which is expected to account for the largest share in 2025. API adoption is accelerating across industries as enterprises modernize applications, embrace cloud-native architectures, and expand digital ecosystems. Key factors driving growth include: Technology-Driven Enterprises & Early Cloud Adoption: Organizations in the US rapidly adopt cloud-native architectures, microservices, and containerized environments, increasing the need for scalable and secure API management platforms | Strong Focus on Security & Regulatory Compliance: Financial services, healthcare, and government entities rely on API management to meet data protection standards, ensure secure API access, and maintain compliance with frameworks such as HIPAA and open banking-related mandates | Mature Vendor Ecosystem & Advanced Integration Needs: Leading providers such as Google, IBM, Microsoft, and MuleSoft support enterprises with end-to-end platforms that enable API creation, deployment, monitoring, and lifecycle governance These capabilities help organizations streamline digital workflows, enhance customer experiences, and support high-performance integrations across diverse applications and partners, solidifying North America’s position as a key market for API management.

API MANAGEMENT MARKET: COMPANY EVALUATION MATRIX

IBM (Star) leads the API management market with a strong global presence and a mature platform offering advanced API creation, security, analytics, and lifecycle governance. Its capabilities in hybrid and multi-cloud environments make it a top choice for large enterprises. Broadcom (Emerging Leader) is gaining traction with its Layer7 API Management platform, known for strong security, policy control, and interoperability. While IBM dominates through scale and innovation, Broadcom shows solid growth with focused, security-driven API management solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Google (US)

- IBM (US)

- AWS (US)

- Microsoft (US)

- MuleSoft (US)

- Axway (France)

- Software AG (Germany)

- WSO2 (US)

- Broadcom(US)

- TIBCO Software (US)

- Akamai Technologies (US)

- Oracle (US)

- Red Hat (US)

- SAP(Germany)

- Torry Harris Business Solutions (US)

- Sensedia(Brazil)

- Postman(US)

- Workato(US)

- Boomi(US)

- Kong(US)

- Tray.io(US)

- Tyk Technologies(UK)

- OpenLegacy(US)

- TeejLab(Canada)

- Nevatech(US)

- PrestoAPI(US)

- Stoplight(US)

- Gravitee(US)

- DreamFactory(US)

- KrakenD(Spain)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 7,679.3 MN |

| Revenue Forecast in 2029 | USD 16,938.6 MN |

| Growth Rate | CAGR of 17.1% from 2024-2029 |

| Actual data | 2019-2029 |

| Base year | 2023 |

| Forecast period | 2024-2029 |

| Units considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

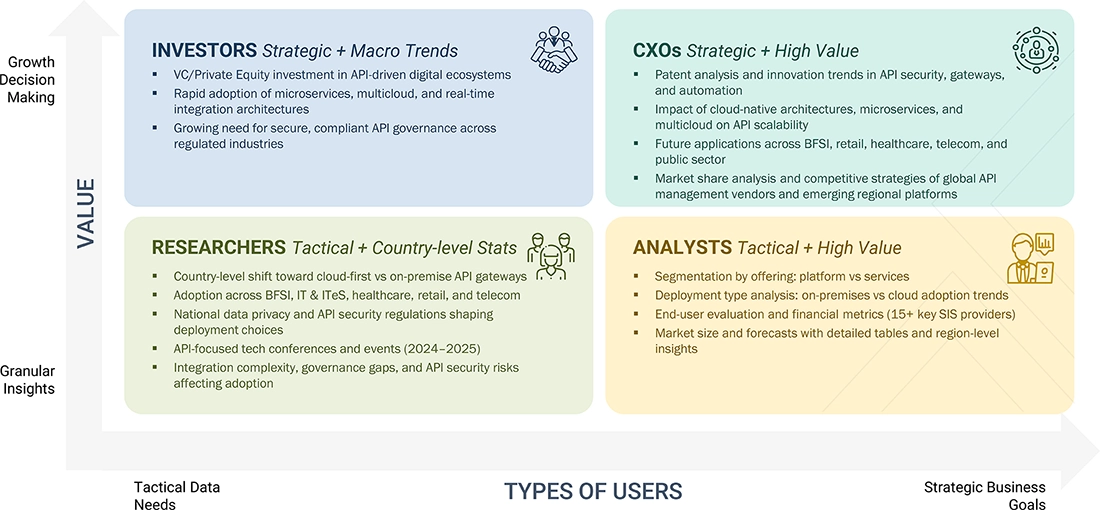

WHAT IS IN IT FOR YOU: API MANAGEMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | In-depth segmentation of the North American API management market and extended regional breakdowns for Europe, Asia Pacific, Middle East & Africa, and Latin America. |

|

| Leading Solution Provider (EU) |

|

|

RECENT DEVELOPMENTS

- August 2024 : Microsoft announced the general availability of workspaces in Azure API Management. This feature allows organizations to manage APIs with greater productivity, security, and reliability through a federated approach.With workspaces, API teams gain increased autonomy, enabling them to create, manage, and publish APIs more quickly, reliably, securely, and efficiently within the API Management service.

- July 2024 : Amazon API Gateway expanded the availability of WebSocket APIs to seven more AWS Regions: Asia Pacific (Jakarta), Europe (Zurich and Spain), Asia Pacific (Hyderabad and Melbourne), Israel (Tel Aviv), and Canada West (Calgary). This expansion allows customers to build APIs with real-time, bi-directional communication across all commercial AWS Regions.

- May 2024 : IBM introduced AI Gateway for IBM API Connect, which became generally available in June. This new feature provided a unified control point for accessing AI services via APIs, ensuring secure connectivity between internal applications and third-party AI APIs. It also offered centralized management of AI API usage and key analytics for faster decision-making on LLM choices.

- June 2023 : Axway partnered with Akoya to enhance how customer information is securely shared with third-party applications. Both companies standardized their APIs to the FDX standard, ensuring secure and transparent data sharing without screen scraping. This was in line with upcoming CFPB rules on Personal Financial Data rights.

Table of Contents

Methodology

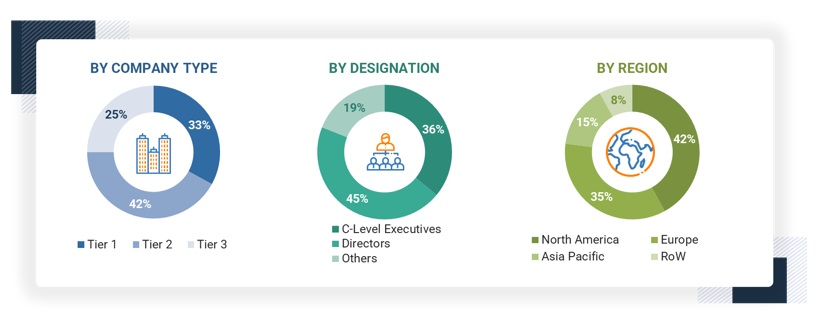

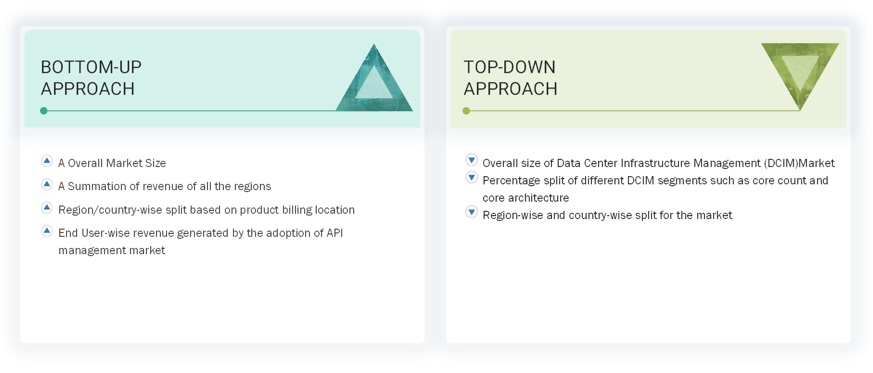

The study comprised four main activities to estimate the API management market size. We conducted significant secondary research to gather data on the market, the competing market, and the parent market. The following stage involved conducting primary research to confirm these conclusions and hypotheses and sizing with industry experts throughout the value chain. The overall market size was evaluated using a blend of top-down and bottom-up approach methodologies. After that, we estimated the market sizes of the various API management market segments using the market breakup and data triangulation techniques.

Secondary Research

We determined the size of companies offering API management platform and services based on secondary data from paid and unpaid sources. We also analyzed the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the spending of various countries on the API management market was extracted from the respective sources. We used secondary research to obtain the critical information related to the industry's value chain and supply chain to identify the key players based on platform, services, market classification, and segmentation according to components of the major players, industry trends related to components, users, and regions, and the key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, we interviewed various primary sources from the supply and demand sides of the API management market to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from vendors providing offerings, associated service providers; and is operating in the targeted countries. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), we conducted extensive primary research to gather information and verify and validate the critical numbers arrived at. The primary research also helped identify and validate the segmentation, industry trends, key players, competitive landscape, and market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies. In the complete market engineering process, the bottom-up approach and several data triangulation methods were extensively used to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. We conducted an extensive qualitative and quantitative analysis of the complete market engineering process to list the key information/insights throughout the report.

Market Size Estimation

The API management market and related submarkets were estimated and forecasted using top-down and bottom-up methodologies. We used the bottom-up method to determine the market's overall size, using the revenues and product offerings of the major market players. This research ascertained and validated the precise value of the total parent market size through data triangulation techniques and primary interview validation. Next, using percentage splits of the market segments, we utilized the overall market size in the top-down approach to estimate the size of other individual markets.

The research methodology used to estimate the market size included the following:

- We used primary and secondary research to determine the revenue contributions of the major market participants in each country after secondary research helped identify them.

- Throughout the process, we obtained critical insights by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- We used primary sources to verify all percentage splits and breakups, which we calculated using secondary sources.

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

Considering the views of various sources and associations, the API management market refers to the sector focused on solutions, tools, and platforms that enable organizations to create, publish, secure, monitor, and manage application programming interfaces (APIs) in a scalable and controlled manner. These solutions are designed to help businesses expose their services and data to internal and external developers, partners, and other stakeholders, while ensuring security, performance, and compliance.

According to Google, the design, development, testing, deployment, governance, security, monitoring, and monetization of APIs have become an important part of the software development lifecycle (SDLC), and a large and growing sector of the technology ecosystem. API management is the set of software and processes that support all stages of an API’s - and an API consumer’s - life cycle.

Key Stakeholders

- API Management Vendors

- Cloud Solution Providers

- Service Providers

- System Integrators (SIs)

- Resellers and Distributors

- Research Organizations

- Government Agencies

- Enterprise Users

- Technology Providers

Report Objectives

- To define, describe, and forecast the API management market by offering (platform and services), deployment type, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the market size with respect to five main regions—North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements, product launches, acquisitions, partnerships, and collaborations, in the API management market globally

Available Customizations

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report:

Product analysis

- The product matrix provides a detailed comparison of each company's portfolio.

Geographic analysis

- Further breakup of the API management market

Company information

- Detailed analysis and profiling of five additional market players

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the API Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in API Management Market