Test Data Management Market by Component (Solutions and Services), Application (Data Subsetting, Data Masking, and Data Compliance and Security), Deployment Type, Organization Size, Vertical, and Region - Global Forecast to 2022

[120 Pages Report] The Test data management market to grow from USD 524.0 Million in 2016 to USD 1,060.9 Million by 2022 at a Compound Annual Growth Rate (CAGR) of 12.7% during the forecast period. The forecast period has been considered from 2017 to 2022, while 2016 is considered as the base year for estimating the market study.

Objectives of the Study:

The main objective of this report is to define, describe, and forecast the test data management market on the basis of segments: component, application, deployment type, organization size, vertical, and region. The report provides detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). The report forecasts the market size with respect to the 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The report profiles key players and comprehensively analyzes their core competencies. This report also tracks and analyzes the competitive developments, such as mergers and acquisitions, new product developments, and Research and Development (R&D) activities, in the test data management market.

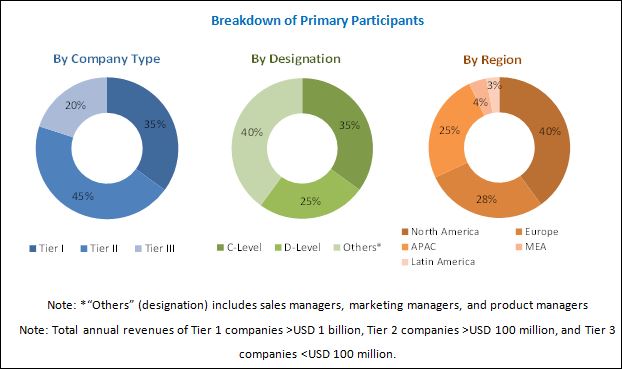

The research methodology used to estimate and forecast the test data management market begins with the collection and analysis of data on key vendor product offerings and business strategies from secondary sources, such as OneSource Business Browser, D&B Hoovers, 10K Wizard, Bloomberg, Thomson StreetEvents, Factiva, IT service providers, technology providers, press releases and investor presentations of companies, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the total market size of the test data management market from the revenues of the key market software tool providers and service providers. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives.

To know about the assumptions considered for the study, download the pdf brochure

Industry Ecosystem

The Test data management market vendors, such as CA Technologies (US), Cigniti Technologies (India), Compuware (US), DATPROF (the Netherlands), Delphix Corporation (US), Ekobit (Croatia), IBM (US), Informatica (US), Infosys (India), Innovative Routines International (US), MENTIS (US), Original Software Group (UK), and Solix Technologies (US). These Test Data Management Software Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of Test Data Management Software.

Key Target Audience

- TDM solution and service providers

- Software testing providers

- Third-party system integrators

- Consulting firms

- QA providers

- Resellers and distributors

Scope of the Report

The research report categorizes the test data management market to forecast revenues and analyze trends in each of the following submarkets:

By Component

- Solutions

- Services

- Implementation

- Consulting

- Support and maintenance

- Training and education

By Application

- Data subsetting

- Data masking

- Data profiling and analysis

- Data compliance and security

- Synthetic test data generation

- Others (data provisioning and data monitoring)

By Deployment Type

- On-Premises

- Cloud

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

By Vertical

- Information Technology (IT)

- Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and life sciences

- Government

- Retail

- Others (energy and utilities, manufacturing, and media and entertainment)

By Region

- North America

- Europe

- MEA

- APAC

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American Test Data Management market into countries

- Further breakdown of the European Test data management market into countries

- Further breakdown of the APAC market into countries

- Further breakdown of the MEA market into countries

- Further breakdown of the Latin American market into countries

Company Information

- Detailed analysis and profiling of additional market players

The test data management market is expected to grow from USD 584.6 Million in 2017 to USD 1,060.9 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 12.7%. Several factors such as the increased quality of test conditions and growing need for leveraging data integration tools, optimized storage and processing costs, better technical support to black-box testing teams are driving the Test data management market. The increased adoption of TDM solutions and services by several industry verticals, such as, IT, Telecom, BFSI, healthcare and life sciences, government, and retail have boosted the growth of the test data management market.

The global test data management market is segmented by component (solutions and services), application (data subsetting, data masking, data profiling and analysis, data compliance and security, synthetic data generation, and others), deployment type, organization size, vertical, and region. Synthetic data generation application is expected to grow at the highest CAGR during the forecast period because it helps to speed up the testing process and allows to reach higher volume levels of data.

The cloud deployment type is expected to grow at a higher CAGR during the forecast period. Cloud-based services reduces the overall costs, while providing highly flexible and scalable access to solutions. Companies are deploying TDM solutions on cloud to improve mobility, collaboration of data, and reduction of data loss during the transit. Security remains to be a critical issue that restricts its adoption; however, this issue is gradually being eradicated through rigorous security tests conducted to the highest standards by third parties. Due to these advantages, many vendors are switching from on-premises deployment mode to the SaaS-based software. Though the growth of cloud based TDM solution is comparatively slow with respect to other cloud based software applications, but it is expected to grow gradually.

Implementation services is expected to hold the largest market size and also grow at a highest CAGR during forecast period. Implementing and deploying TDM services ensure the successful installation of the test data management solution. For the implementation services, vendors cover all the phases of the solution implementation, right from planning and deploying until support, either through vendors or through partners. Implementation services include the solution integration in an Enterprise Resource Planning (ERP) and independent solution integration in the system.

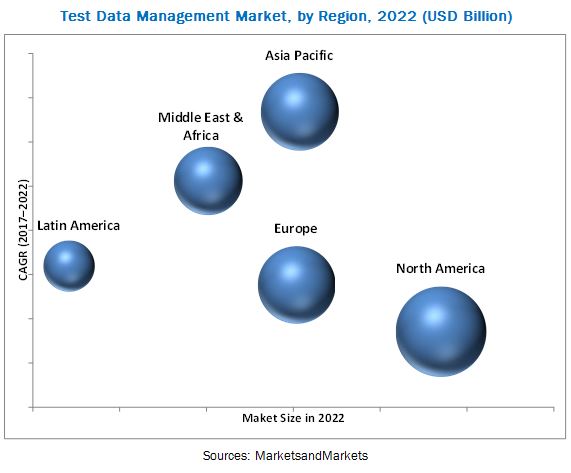

The global test data management market has been segmented on the basis of regions into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America to provide a region-specific analysis in the report. North America is expected to have the largest market share and is projected to dominate the market during the forecast period. This North American region is rapidly adopting emerging technologies, such as big data and cloud platforms. Due to this, companies are willingly investing in the North American region. Most TDM solution vendors have an eminent presence in the North American region, and therefore, the competition is stiff among the major market players.

Lack of standardization and regulatory compliances are hindering the growth of the test data management market. However, the recent developments, including new product launches and acquisitions, undertaken by the major market players are boosting the growth of the market.

The study measures and evaluates the offerings and key strategies undertaken by the major TDM players, including CA Technologies (US), Cigniti Technologies (India), Compuware (US), DATPROF (the Netherlands), Delphix Corporation (US), Ekobit (Croatia), IBM (US), Informatica (US), Infosys (India), Innovative Routines International (US), MENTIS (US), Original Software Group (UK), and Solix Technologies (US).These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to enhance their position in the test data management market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions and Limitations

2.3.1 Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Market Opportunities in the Test Data Management Market

4.2 Market By Vertical and Region

4.3 Market By Deployment Type

4.4 Market By Component

4.5 Market By Organization Size

4.6 Life Cycle Analysis, By Region, 2017

5 Market Overview and Industry Trends (Page No. - 29)

5.1 Innovation Spotlight

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Quality of Test Conditions and Growing Need for Leveraging Data Integration Tools

5.2.1.2 Optimized Storage and Processing Costs

5.2.1.3 Better Technical Support to Black Box Testing Teams

5.2.2 Restraints

5.2.2.1 Lack of Standardization

5.2.2.2 Stringent Regulatory Compliances

5.2.3 Opportunities

5.2.3.1 Optimized Data Provisioning Time

5.2.3.2 Maximum Utilization of Knowledge and Skills

5.2.4 Challenges

5.2.4.1 Many IT Organizations Do Not Have TDM Tools

5.2.4.2 Data Integrity Issues in Test Environments

6 Test Data Management Market Analysis, By Component (Page No. - 33)

6.1 Introduction

6.2 Solutions

6.3 Services

6.3.1 Implementation

6.3.2 Consulting

6.3.3 Support and Maintenance

6.3.4 Training and Education

7 Market Analysis, By Application (Page No. - 40)

7.1 Introduction

7.2 Data Subsetting

7.3 Data Masking

7.4 Data Profiling and Analysis

7.5 Data Compliance and Security

7.6 Synthetic Test Data Generation

7.7 Others

8 Test Data Management Market Analysis, By Deployment Type (Page No. - 48)

8.1 Introduction

8.2 Cloud

8.3 On-Premises

9 Market Analysis, By Organization Size (Page No. - 52)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.3 Large Enterprises

10 Test Data Management Market Analysis, By Vertical (Page No. - 56)

10.1 Introduction

10.2 Information Technology

10.3 Telecom

10.4 Banking, Financial Services, and Insurance

10.5 Healthcare and Life Sciences

10.6 Government

10.7 Retail

10.8 Others

11 Geographic Analysis (Page No. - 63)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Company Profiles (Page No. - 81)

12.1 CA Technologies

(Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments)*

12.2 Cigniti

12.3 Compuware

12.4 Datprof

12.5 Delphix

12.6 Ekobit

12.7 IBM

12.8 Informatica

12.9 Infosys

12.1 IRI

12.11 Mentis

12.12 Original Software

12.13 Solix

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 110)

13.1 Industry Excerpts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introduction RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (61 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Test Data Management Market Size, By Component, 20152022 (USD Million)

Table 3 Solutions: Market Size, By Region, 20152022 (USD Million)

Table 4 Services: Market Size, By Type, 20152022 (USD Million)

Table 5 Services: Market Size, By Region, 20152022 (USD Million)

Table 6 Implementation Market Size, By Region, 20152022 (USD Million)

Table 7 Consulting Market Size, By Region, 20152022 (USD Million)

Table 8 Support and Maintenance Market Size, By Region, 20152022 (USD Million)

Table 9 Training and Education Market Size, By Region, 20152022 (USD Million)

Table 10 Test Data Management Market Size, By Application, 20152022 (USD Million)

Table 11 Data Subsetting: Market Size, By Region, 20152022 (USD Million)

Table 12 Data Masking: Market Size, By Region, 20152022 (USD Million)

Table 13 Data Profiling and Analysis: Market Size, By Region, 20152022 (USD Million)

Table 14 Data Compliance and Security: Market Size, By Region, 20152022 (USD Million)

Table 15 Synthetic Test Data Generation: Market Size, By Region, 20152022 (USD Million)

Table 16 Others: Market Size, By Region, 20152022 (USD Million)

Table 17 Test Data Management Market Size, By Deployment Type, 20152022 (USD Million)

Table 18 Cloud: Market Size, By Region, 20152022 (USD Million)

Table 19 On-Premises: Market Size, By Region, 20152022 (USD Million)

Table 20 Market Size, By Organization Size, 20152022 (USD Million)

Table 21 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 22 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 23Market Size, By Vertical, 20152022 (USD Million)

Table 24 Information Technology: Market Size, By Region, 20152022 (USD Million)

Table 25 Telecom: Test Data Management Market Size, By Region, 20152022 (USD Million)

Table 26 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 27 Healthcare and Life Sciences: Market Size, By Region, 20152022 (USD Million)

Table 28 Government: Market Size, By Region, 20152022 (USD Million)

Table 29 Retail: Market Size, By Region, 20152022 (USD Million)

Table 30 Others: Market Size, By Region, 20152022 (USD Million)

Table 31 Test Data Management Market Size, By Region, 20152022 (USD Million)

Table 32 North America: Market Size, By Component, 20152022 (USD Million)

Table 33 North America: Market Size, By Service, 20152022 (USD Million)

Table 34 North America: Market Size, By Application, 20152022 (USD Million)

Table 35 North America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 36 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 37 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 38 Europe: Test Data Management Market Size, By Component, 20152022 (USD Million)

Table 39 Europe: Market Size, By Service, 20152022 (USD Million)

Table 40 Europe: Market Size, By Application, 20152022 (USD Million)

Table 41 Europe: Market Size, By Deployment Type, 20152022 (USD Million)

Table 42 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 43 Europe: Market Size, By Vertical, 20152022 (USD Million)

Table 44 Asia Pacific: Market Size, By Component, 20152022 (USD Million)

Table 45 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 46 Asia Pacific: Market Size, By Application, 20152022 (USD Million)

Table 47 Asia Pacific: Market Size, By Deployment Type, 20152022 (USD Million)

Table 48 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size, By Vertical, 20152022 (USD Million)

Table 50 Middle East and Africa: Test Data Management Market Size, By Component, 20152022 (USD Million)

Table 51 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 52 Middle East and Africa: Market Size, By Application, 20152022 (USD Million)

Table 53 Middle East and Africa: Market Size, By Deployment Type, 20152022 (USD Million)

Table 54 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 55 Middle East and Africa: Market Size, By Vertical, 20152022 (USD Million)

Table 56 Latin America: Test Data Management Market Size, By Component, 20152022 (USD Million)

Table 57 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 58 Latin America: Market Size, By Application, 20152022 (USD Million)

Table 59 Latin America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 60 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 61 Latin America: Market Size, By Vertical, 20152022 (USD Million)

List of Figures (27 Figures)

Figure 1 Test Data Management Market Segmentation

Figure 2 Market Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Top 3 Segments for the Test Data Management Market During the Forecast Period

Figure 7 North America is Estimated to Hold the Largest Market Share in 2017

Figure 8 Synthetic Data Generation for Test Data Management is Expected to Have Attractive Market Opportunities During the Forecast Period

Figure 9 Information Technology Vertical and North America are Estimated to Hold the Largest Market Shares in 2017

Figure 10 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 11 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 12 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 13 Asia Pacific, and Middle East and Africa are the Fastest Growing Regions in the Test Data Management Market

Figure 14 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 16 Synthetic Data Generation Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 18 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 19 Banking, Financial Services, and Insurance Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 North America is Expected to Have the Largest Market Size in the Test Data Management Market During the Forecast Period

Figure 21 Regional Snapshot: Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 North America: Market Snapshot

Figure 23 Asia Pacific: Market Snapshot

Figure 24 CA Technologies: Company Snapshot

Figure 25 Cigniti: Company Snapshot

Figure 26 IBM: Company Snapshot

Figure 27 Infosys: Company Snapshot

Growth opportunities and latent adjacency in Test Data Management Market