Hybrid Integration Platform Market by Integration Type (Application Integration, Data Integration, B2B Integration, and Cloud Integration), Service Type, Organization Size (Large Enterprises and SMEs), Vertical, and Region - Global Forecast to 2022

[159 Pages Report] The hybrid integration platform market size is expected to grow from USD 15.00 Billion in 2016 to USD 33.60 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 14.4%. The growing need of integrating on-premises and cloud applications for driving the digital business transformation, hybrid integration platforms capabilities to tackle the business challenges, and the increasing demand for hosting apps, data, and services on the cloud are some of the factors that are said to be driving the growth of the market. The base year considered for this study is 2016 and the forecast period considered is 20172022.

Objectives of the Study

- To describe and forecast the global hybrid integration platform market on the basis of integration types, service types, organization sizes, verticals, and regions

- To forecast the market size of the 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the subsegments with respect to the individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of competitive landscape for the major players

- To profile key players and comprehensively analyze their core competencies and positioning

- To track and analyze competitive developments, such as mergers and acquisitions; new product developments; and partnerships, agreements, and collaborations in the Hybrid Integration Platform Market

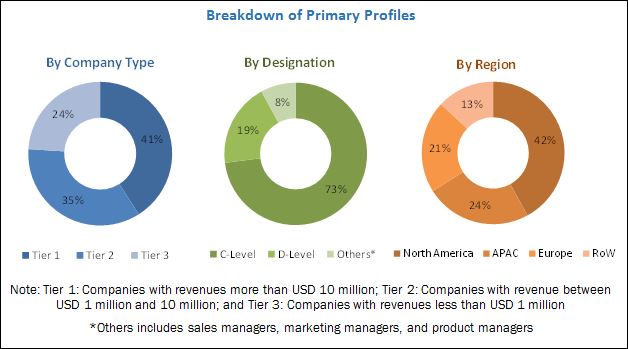

The research methodology used to estimate and forecast the hybrid integration platform market began with capturing the data on key vendor revenues through secondary research, such as IT services associations, IT services journals, and databases, including D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the market. Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments. The breakdown of primary profiles is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The hybrid integration platform market comprises service providers, such as Software AG (Darmstadt, Germany), Informatica (California, US), Dell Boomi (Pennsylvania, US), MuleSoft (California, US), IBM (New York, US), TIBCO Software (California, US), Oracle (California, US), Liaison Technologies (Georgia, US), WSO2 (California, US), SnapLogic (California, US), Red Hat (North Carolina, US), Axway (Puteaux, France), SEEBURGER (Bretten, Germany), Microsoft (Washington, US), RoboMQ (Virginia, US), Fiorano Software (California, US), Attunity (Israel), Cleo (Illinois, US), Actian (California, US), Adeptia (Illinois, US), Talend (California, US), Scribe Software (New Hampshire, US), elastic.io (Bonn, Germany), Built.io (California, US), and DBSync (Tennessee, US). These Hybrid Integration Platform Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of Hybrid Integration Platform.

Target audience for the Hybrid Integration Platform Market

- Hybrid integration platform technology providers

- Data integration providers

- System integrators/migration service providers

- Consultants/consultancies/advisory firms

- Training and education service providers

- Support and maintenance service providers

- Networking and Communication Service Providers (CSPs)

The research study answers several questions for the stakeholders, primarily which market segments to focus in the next 25 years for prioritizing the efforts and investments.

Scope of the Market

The research report categorizes the hybrid integration platform market to forecast the revenues and analyze the trends in each of the following submarkets:

Hybrid Integration Platform Market By Integration

- Application integration

- Data integration

- Business-to-Business (B2B) integration

- Cloud integration

Hybrid Integration Platform Market By Service

- Digital business services

- Data integration tools

- Application Program Interface (API) management

- Integration platform as a service

- Managed file transfer

- Enterprise service bus

- Software as a service

- Endpoint integration

- Communication gateway services

- B2B gateway

- Message-oriented middleware

- Professional services

- Training and consulting

- Support and maintenance

Hybrid Integration Platform Market By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

Hybrid Integration Platform Market By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Retail

- Government and public sector

- Manufacturing

- Telecommunication, IT, and IT-Enabled Services (ITES)

- Others (education, healthcare, media and entertainment, transport and logistics, and travel and hospitality)

Hybrid Integration Platform Market By Region

- North America

- Europe

- MEA

- APAC

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the APAC market into countries contributing 75% to the regional market size

- Further breakdown of the North American market into countries contributing 75% to the regional market size

- Further breakdown of the Latin American market into countries contributing 75% to the regional market size

- Further breakdown of the MEA market into countries contributing 75% to the regional market size

- Further breakdown of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

The hybrid integration platform market size is expected to grow from USD 17.14 Billion in 2017 to USD 33.60 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 14.4%. The growing need for integrating on-premises and cloud applications for driving digital business transformation, the increasing demand for hosting apps, data, and services on the cloud, and the hybrid integration platforms capabilities to tackle the business challenges are said to be some of the driving factors for the growth of this market.

The hybrid integration platform market report has been broadly classified on the basis of integration type into application integration, data integration, B2B integration, and cloud integration; on the basis of service types into digital business services (data integration tools, Application Programming Interface (API) management, iPaaS, MFT, ESB, SaaS, endpoint integration, and communication gateway services) and professional services (training and consulting, and support and maintenance); on the basis of organization sizes (Small and Medium-sized Enterprises (SMEs), and Large enterprises); on the basis of verticals (Banking, Financial Services, and Insurance (BFSI), retail, government and public sector, manufacturing, telecommunication, IT, and IT-Enabled Services (ITES)) and on the basis of regions into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

The application integration type is expected to have the fastest growth rate during the forecast period. Application integration combines data and functions from one application program with another to simplify and automate business processes to the greatest extent possible. This integration framework forms a middleware and a collection of technologies and services that enable the integration of systems and applications across an enterprise. This has resulted in improving the overall business efficiency, enhancing the scalability, and reducing the IT costs.

The endpoint integration service is expected to have the fastest growth rate during the forecast period. The growth is attributed to the use of a widely interconnected mesh of heterogeneous devices, located across varied geographical regions, communications protocols, multiple applications, and separate networks. Endpoint integration services have been instrumental in streamlining and exchanging data among multiple components with ease and provide a unified view of metrics and data to the relevant stakeholders. Endpoint integration services focus on areas, such as business consulting and architecture advisory, cloud integrations services, business analytics, and decision and business support systems, along with network management services, and volume and block storage services.

The telecommunication, IT, and ITES vertical is expected to gain the highest traction in the hybrid integration platform market during the forecast period. The amount of data generated across this vertical is very huge, due to the voluminous data generated daily. The IT sector uses cloud-based solutions for activities, such as project management, maintenance of operational schedules, connecting developers and customers, and digital data management. The hybrid integration platform allows operators and security administrators to automatically deploy security policies and functions in cloud networks to save the Operating Expenditure (OPEX) and substantially reduce the manual workload.

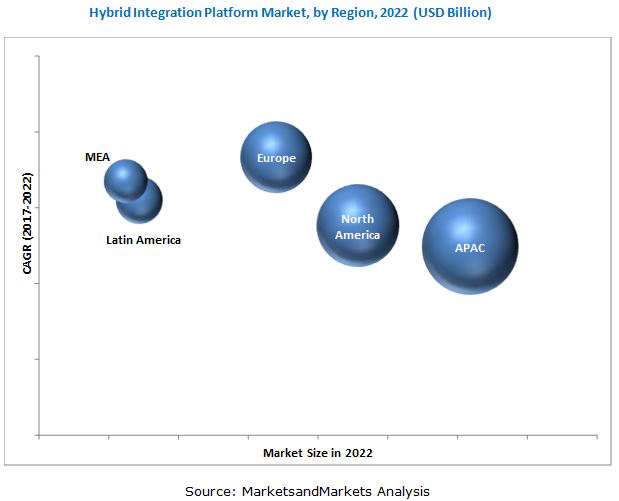

North America is expected to hold the largest market share and dominate the hybrid integration platform market from 2017 to 2022. The region has been extremely responsive toward adopting the latest technological advancements, such as data integration tools, API management, iPaaS, MFT, and ESB. The major growth drivers for this region are the large scale investments in the hybrid integration platform and the need for integrating on-premises and cloud applications for digital business transformation. The APAC region is in the initial growth phase; however, it is the fastest-growing region in the global market. The growth is likely to be driven by factors, such as the increased spending on improving the infrastructure and the emergence of advanced and secured cloud-based solutions.

The market faces the challenge of the large usage of ESB technology as an alternative for the hybrid integration platform. The major factor that is said to be restraining the growth of the hybrid integration platform market is the amount of risks and security threats posed by open source integration and the interoperability issues faced during the integration of different platforms.

Some of the key vendors in the hybrid integration platform market are Software AG (Darmstadt, Germany), Informatica (California, US), Dell Boomi (Pennsylvania, US), MuleSoft (California, US), IBM (New York, US), TIBCO Software (California, US), Oracle (California, US), Liaison Technologies (Georgia, US), WSO2 (California, US), SnapLogic (California, US), Red Hat (North Carolina, US), Axway (Puteaux, France), SEEBURGER (Bretten, Germany), Microsoft (Washington, US), RoboMQ (Virginia, US), Fiorano Software (California, US), Attunity (Israel), Cleo (Illinois, US), Actian (California, US), Adeptia (Illinois, US), Talend (California, US), Scribe Software (New Hampshire, US), elastic.io (Bonn, Germany), Built.io (California, US), and DBSync (Tennessee, US). These players have adopted various strategies, such as new product developments, acquisitions, and partnerships to serve the market. Continuous technology innovation is an area of focus for these players to maintain their competitive positions in the market and promote customer satisfaction.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.1.1 Business Intelligence

1.1.2 Competitive Intelligence

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Breakdown of Primaries

2.1.2 Key Industry Insights

2.2 Hybrid Integration Platform Market Size Estimation

2.3 Research Assumptions and Limitations

2.3.1 Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the Hybrid Integration Platform Market

4.2 Market By Region, 2017

4.3 Market By Integration Type, 2017 vs 2022

4.4 Market By Service, 2017 vs 2022

4.5 Market By Digital Business Service, 20152022

4.6 Market By Organization Size, 2017 vs 2022

4.7 Market By Vertical, 2017 vs 2022

4.8 Lifecycle Analysis, By Region, 2017

4.9 Market Investment Scenario

5 Hybrid Integration Platform Market Overview and Industry Trends (Page No. - 34)

5.1 Introduction

5.2 Vendor Ecosystem

5.3 Hybrid Integration Platform Architecture

5.4 Hybrid Integration Platform Capabilities

5.5 Spaghetti Model

5.6 Market Dynamics

5.6.1 Drivers

5.6.1.1 Growing Need of Integrating On-Premises and Cloud Applications for Driving Digital Business Transformation

5.6.1.2 Increasing Demand for Hosting Apps, Data, and Services on the Cloud

5.6.1.3 Hybrid Integration Platforms Capabilities to Tackle the Business Challenges

5.6.2 Restraints

5.6.2.1 Risks in Open Source Integration

5.6.2.2 Interoperability

5.6.3 Opportunities

5.6.3.1 Advent of Business User-Friendly Hybrid Integration Platform Offerings

5.6.3.2 Need of Interconnecting IoT Devices/Infrastructure Endpoints With Enterprise Applications to Help in Making Real-Time Decisions

5.6.3.3 Acclimatization of Digital Open API Economy and Microservices

5.6.4 Challenges

5.6.4.1 Usage of ESB Technology as an Alternative

6 Hybrid Integration Platform Market Analysis, By Integration Type (Page No. - 44)

6.1 Introduction

6.2 Application Integration

6.3 Data Integration

6.4 B2B Integration

6.5 Cloud Integration

7 Hybrid Integration Platform Market Analysis, By Service Type (Page No. - 50)

7.1 Introduction

7.2 Digital Business Services

7.2.1 Data Integration Tools

7.2.2 Application Programming Interface Management

7.2.3 Integration Platform as A Service

7.2.4 Managed File Transfer

7.2.5 Enterprise Service Bus

7.2.6 Software as A Service

7.2.7 Endpoint Integration

7.2.8 Communication Gateway Services

7.2.8.1 B2B Gateway

7.2.8.2 Message-Oriented Middleware

7.3 Professional Services

7.3.1 Training and Consulting

7.3.2 Support and Maintenance

8 Hybrid Integration Platform Market Analysis, By Organization Size (Page No. - 63)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.3 Large Enterprises

9 Hybrid Integration Platform Market Analysis, By Vertical (Page No. - 67)

9.1 Introduction

9.2 Banking, Finance Services, and Insurance

9.3 Retail

9.4 Government and Public Sector

9.5 Manufacturing

9.6 Telecommunication, IT, and ITes

9.7 Others

10 Geographic Analysis (Page No. - 77)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia Pacific

10.5 Middle East and Africa

10.6 Latin America

11 Company Profiles (Page No. - 102)

(Overview, Products, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments*

11.1 Software AG

11.2 Informatica

11.3 Dell Boomi

11.4 Liaison Technologies

11.5 Mulesoft

11.6 IBM

11.7 TIBCO Software

11.8 Oracle

11.9 WSO2

11.10 Snaplogic

11.11 Red Hat

11.12 Axway

*Details on Overview, Products, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

11.13 Key Innovators

11.13.1 Built.Io

11.13.1.1 Overview

11.13.1.2 Products

11.13.2 Robomq

11.13.2.1 Overview

11.13.2.2 Products

11.13.3 Babelway

11.13.3.1 Overview

11.13.3.2 Products

11.13.4 Flowgear

11.13.4.1 Overview

11.13.4.2 Products

12 Appendix (Page No. - 152)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customization

12.5 Related Reports

12.6 Author Details

List of Tables (74 Tables)

Table 1 United States Dollar Exchange Rate, 20142017

Table 2 Hybrid Integration Platform Market Size, By Integration Type, 20152022 (USD Billion)

Table 3 Integration Types: Market Size, By Region, 20152022 (USD Billion)

Table 4 Application Integration: Market Size, By Region, 20152022 (USD Billion)

Table 5 Data Integration: Market Size, By Region, 20152022 (USD Billion)

Table 6 B2B Integration: Market Size, By Region, 20152022 (USD Billion)

Table 7 Cloud Integration: Market Size, By Region, 20152022 (USD Billion)

Table 8 Hybrid Integration Platform Market Size, By Service Type, 20152022 (USD Billion)

Table 9 Service Types: Market Size, By Region, 20152022 (USD Billion)

Table 10 Digital Business Services: Market Size, By Type, 20152022 (USD Billion)

Table 11 Digital Business Services: Market Size, By Region, 20152022 (USD Billion)

Table 12 Data Integration Tools: Market Size, By Region, 20152022 (USD Billion)

Table 13 API Management: Hybrid Integration Platform Market Size, By Region, 20152022 (USD Billion)

Table 14 Integration Platform as A Service: Hybrid Integration Platform Market Size, By Region, 20152022 (USD Billion)

Table 15 Managed File Transfer: Market Size, By Region, 20152022 (USD Billion)

Table 16 Enterprise Service BUS: Market Size, By Region, 20152022 (USD Billion)

Table 17 Software as A Service: Market Size, By Region, 20152022 (USD Billion)

Table 18 Endpoint Integration: Market Size, By Region, 20152022 (USD Billion)

Table 19 Communication Gateway Services: Hybrid Integration Platform Market Size, By Type, 20152022 (USD Billion)

Table 20 Communication Gateway Services: Market Size, By Region, 20152022 (USD Billion)

Table 21 B2B Gateway Market Size, By Region, 20152022 (USD Billion)

Table 22 Message-Oriented Middleware Market Size, By Region, 20152022 (USD Billion)

Table 23 Professional Services: Market Size, By Type, 20152022 (USD Billion)

Table 24 Professional Services: Market Size, By Region, 20152022 (USD Billion)

Table 25 Training and Consulting Market Size, By Region, 20152022 (USD Billion)

Table 26 Support and Maintenance: Market Size, By Region, 20152022 (USD Billion)

Table 27 Hybrid Integration Platform Market Size, By Organization Size, 20152022 (USD Billion)

Table 28 Organization Size: Market Size, By Region, 20152022 (USD Billion)

Table 29 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Billion)

Table 30 Large Enterprises: Market Size, By Region, 20152022 (USD Billion)

Table 31 Verticals: Hybrid Integration Platform Market Size, By Type, 20152022 (USD Billion)

Table 32 Verticals: Market Size, By Region, 20152022 (USD Billion)

Table 33 Banking, Finance Services, and Insurance: Market Size, By Region, 20152022 (USD Billion)

Table 34 Retail: Hybrid Integration Platform Market Size, By Region, 20152022 (USD Billion)

Table 35 Government and Public Sector: Market Size, By Region, 20152022 (USD Billion)

Table 36 Manufacturing: Market Size, By Region, 20152022 (USD Billion)

Table 37 Telecommunication, IT, and ITes: Market Size, By Region, 20152022 (USD Billion)

Table 38 Others: Market Size, By Region, 20152022 (USD Billion)

Table 39 Hybrid Integration Platform Market Size, By Region, 20152022 (USD Billion)

Table 40 North America: Hybrid Integration Platform Market Size, By Integration Type, 20152022 (USD Billion)

Table 41 North America: Market Size By Service Type, 20152022 (USD Billion)

Table 42 North America: Market Size By Digital Business Service, 20152022 (USD Billion)

Table 43 North America: Market Size By Communication Gateway Service, 20152022 (USD Billion)

Table 44 North America: Market Size By Professional Service, 20152022 (USD Billion)

Table 45 North America: Market Size By Organization Size, 20152022 (USD Billion)

Table 46 North America: Market Size By Vertical, 20152022 (USD Billion)

Table 47 Europe: Hybrid Integration Platform Market Size, By Integration Type, 20152022 (USD Billion)

Table 48 Europe: Market Size By Service Type, 20152022 (USD Billion)

Table 49 Europe: Market Size By Digital Business Service, 20152022 (USD Billion)

Table 50 Europe: Market Size By Communication Gateway Service, 20152022 (USD Billion)

Table 51 Europe: Market Size By Professional Service, 20152022 (USD Billion)

Table 52 Europe: Market Size By Organization Size, 20152022 (USD Billion)

Table 53 Europe: Market Size By Vertical, 20152022 (USD Billion)

Table 54 Asia Pacific: Hybrid Integration Platform Market Size, By Integration Type, 20152022 (USD Billion)

Table 55 Asia Pacific: Market Size By Service Type, 20152022 (USD Billion)

Table 56 Asia Pacific: Market Size By Digital Business Service, 20152022 (USD Billion)

Table 57 Asia Pacific: Market Size By Communication Gateway Service, 20152022 (USD Billion)

Table 58 Asia Pacific: Market Size By Professional Service, 20152022 (USD Billion)

Table 59 Asia Pacific: Market Size By Organization Size, 20152022 (USD Billion)

Table 60 Asia Pacific: Market Size By Vertical, 20152022 (USD Billion)

Table 61 Middle East and Africa: Hybrid Integration Platform Market Size, By Integration Type, 20152022 (USD Billion)

Table 62 Middle East and Africa: Market Size By Service Type, 20152022 (USD Billion)

Table 63 Middle East and Africa: Market Size By Digital Business Service, 20152022 (USD Billion)

Table 64 Middle East and Africa: Market Size By Communication Gateway Service, 20152022 (USD Billion)

Table 65 Middle East and Africa: Market Size By Professional Service, 20152022 (USD Billion)

Table 66 Middle East and Africa: Market Size By Organization Size, 20152022 (USD Billion)

Table 67 Middle East and Africa: Market Size By Vertical, 20152022 (USD Billion)

Table 68 Latin America: Hybrid Integration Platform Market Size, By Integration Type, 20152022 (USD Billion)

Table 69 Latin America: Market Size By Service Type, 20152022 (USD Billion)

Table 70 Latin America: Market Size By Digital Business Service, 20152022 (USD Billion)

Table 71 Latin America: Market Size By Communication Gateway Service, 20152022 (USD Billion)

Table 72 Latin America: Market Size By Professional Service, 20152022 (USD Billion)

Table 73 Latin America: Market Size By Organization Size, 20152022 (USD Billion)

Table 74 Latin America: Hybrid Integration Platform Market Size By Vertical, 20152022 (USD Billion)

List of Figures (38 Figures)

Figure 1 Global Hybrid Integration Platform Market: Market Segmentation

Figure 2 Global Market: Research Design

Figure 3 Research Methodology

Figure 4 Data Triangulation

Figure 5 Hybrid Integration Platform Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Top 3 Fastest-Growing Segments in the Market in 2017 - 2022

Figure 8 North America is Estimated to Hold the Largest Market Share - 2017

Figure 9 Increasing Need for Digital Business Transformation is Expected to Drive the Growth of the Hybrid Integration Platform Market

Figure 10 North America is Expected to Hold the Largest Market Share - 2017

Figure 11 Application Integration Type is Expected to Grow at the Highest CAGR

Figure 12 Digital Business Services Segment is Expected to Hold A Larger Market Share

Figure 13 Integration Platform as A Service is Expected to Witness the Highest Growth Rate

Figure 14 Large Enterprises Segment is Expected to Witness A Higher Growth Rate

Figure 15 Banking, Financial Services, and Insurance Vertical is Expected to Hold the Largest Market Share

Figure 16 Asia Pacific is Expected to Exhibit A High Growth Potential

Figure 17 APAC is the Best Market to Invest in Forecast Period

Figure 18 Hybrid Integration Platform Market: Vendor Ecosystem

Figure 19 Hybrid Integration Platform: Integration Capabilities

Figure 20 Hybrid Integration Platform: Integration Platform vs Integration Deployment

Figure 21 Hybrid Integration Platform: Integration Platforms vs Integration Endpoints

Figure 22 Hybrid Integration Platform Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 The Application Integration Type Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 The Digital Business Services Segment is Expected to Grow at the Higher CAGR During the Forecast Period

Figure 25 The Large Enterprises Segment is Projected to Hold the Largest Market Share During the Forecast Period

Figure 26 The Telecommunication, IT, and ITes Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 27 North America is Expected to Hold the Largest Market Share During the Forecast Period

Figure 28 Asia Pacific: Hotspot for Hybrid Integration Platform Market, 2017-2022

Figure 29 North America: Market Snapshot

Figure 30 Asia Pacific: Market Snapshot

Figure 31 Software AG: Company Snapshot

Figure 32 Mulesoft: Company Snapshot

Figure 33 IBM: Company Snapshot

Figure 34 Oracle: Company Snapshot

Figure 35 Red Hat: Company Snapshot

Figure 36 Axway: Company Snapshot

Figure 37 Robomq: Company Snapshot

Figure 38 Flowgear: Company Snapshot

Growth opportunities and latent adjacency in Hybrid Integration Platform Market