API Testing Market by Component (API Testing Software/Tools and API Testing Services), Deployment Type (Cloud Based and On-Premises), Vertical, and Region - Global Forecast to 2022

[124 Pages Report] The global API testing market size is expected to grow from USD 384.3 Million in 2016 to USD 1,099.1 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 19.69% from 2017 to 2022. The base year considered for the study is 2016 and the forecast period is 20172022.

The objectives of the report are to define, describe, and forecast the API testing market size on the basis of component, deployment type, vertical, and region; provide detailed information regarding key factors influencing the market growth (drivers, restraints, opportunities, and challenges); track and analyze the market scenario on the basis of technological developments, product launches, and mergers & acquisitions; and forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

This research study involves extensive usage of secondary sources, directories, and databases (such as D&B Hoovers, Bloomberg, Businessweek, and Factiva) to identify and collect information useful for this technical, market-oriented, and commercial aspect of the API testing software market size.

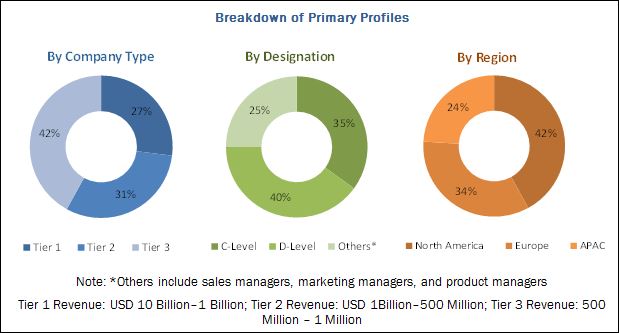

The research methodology used to estimate and forecast the market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure is employed to arrive at the overall market size of the API testing market from the revenues of the key players in the market. After arriving at the overall market size, the total market is split into several segments and subsegments, which are then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures are employed to complete the overall market engineering process and arrive at the exact statistics for all segments. The breakdown of primary profiles is depicted in the figure below:

The figure below shows the breakdown of primaries on the basis of company, designation, and region, conducted during the research study:

To know about the assumptions considered for the study, download the pdf brochure

The API testing market ecosystem comprises key vendors, Astegic (Virginia, US), Axway (Arizona, US), Bleum (Shanghai, China), CA Technologies (New York, US), Cigniti Technologies (Hyderabad, India), Cygnet Infotech (Ahmedabad, India), IBM (New York, US), Inflectra Corporation (Maryland,US), Infosys (Bengaluru, India), Load Impact (Stockholm, Sweden), LogiGear Corporation (California, US), Micro Focus(Formerly HPE) (Berkshire, UK), Nevatech (Georgia, US), Oracle (Apiary) Corporation (California, US), Parasoft Corporation (California, US), QASource (California, US), QSG Technologies (Bengaluru, India), QualityLogic (Idaho, US), SmartBear Software (Massachusetts, US), SendGrid, Inc. (Colorado, US), Sybrant Technologies (Chennai, India), Runscope (California, US), Trantor (California, US), Tricentis (Vienna, Austria), and Vector Software (Rhode Island, US).

Key Target Audience

- API platform providers

- API testing service provider

- Software testing solution providers

- Quality assurance solution and services providers

- Communication service providers

- Managed service providers

- Third-party system integrators

- Regulatory agencies

- Government

Scope of the Report

The API testing market report is broadly segmented into the following component, deployment type, verticals, and regions:

By Component

- API Testing Tools/ Software

- API Testing Services

By Deployment Type

- On-Premises

- Cloud-Based

By Vertical

- IT & Telecommunications

- BFSI

- Retail & e-commerce

- Media & Entertainment

- Healthcare

- Manufacturing

- Government

- Others

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the API testing market research report:

Geographic Analysis

- Further breakdown of the APAC market into countries contributing 75% to the regional market size

- Further breakdown of the North American market into countries contributing 75% to the regional market size

- Further breakdown of the Latin American market into countries contributing 75% to the regional market size

- Further breakdown of the MEA market into countries contributing 75% to the regional market size

- Further breakdown of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

MarketsandMarkets forecasts the API testing market to grow from 447.4 Million in 2017 to USD 1,099.1 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 19.69% from 2017 to 2022. Adoption of Agile and DevOps practices for software development and open API strategies by businesses are some of the driving factors of the market.

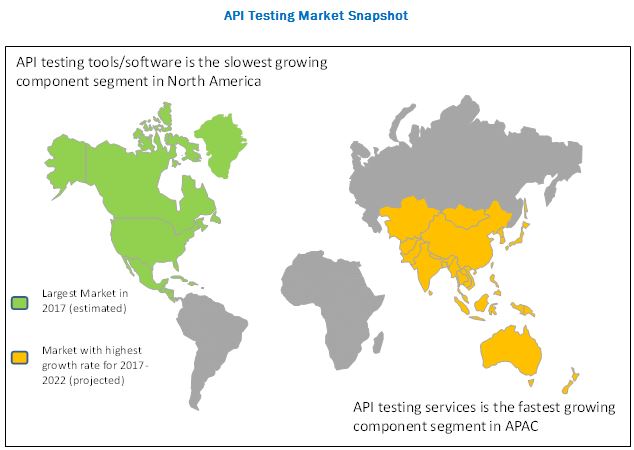

The objectives of the report are to define, describe, and forecast the API testing market size on the basis of component, deployment type, vertical, and region. Based on the component in market, API testing tools/software is projected to hold the largest market share in the market during the forecast period. The API testing services segment is expected to grow at the highest growth rate during the forecast period, as the businesses turn to QA vendors for their testing requirements.

In the API testing deployment type, the cloud-based solution is expected to grow at the highest CAGR during the forecast period, because cloud-based solution has ease of deployment, reduced cost of ownership, and improved service Testing-as-a-Service (TaaS). The API testing on-premises is expected to have a larger market share during the forecast period. This is due to the businesses refraining from adopting cloud-based platforms to test their APIs, as exposing the public and internal APIs to cloud platform involves high data security risks.

In the API testing market, the BFSI vertical is expected to grow at the highest rate during the forecast period. The Open API movement in the banking industry which exposes a wide range of banking APIs with other businesses is driving the API business in the banking industry.

North America is expected to hold the largest market share in the API testing market during the forecast period, as APIs enable businesses across industries to monetize their services by exposing their APIs to the external world. North America is at the forefront in the adoption of such APIs that enable businesses to create value by offering their APIs. APAC is expected to grow at a highest CAGR during the forecast period, as the region has the presence of creditable organizations that are gradually enabling the adoption of advance technologies.

The increasing innovative advancement in IoT, AI, and machine learning are benefiting all the stakeholders present in the API testing market. However, data policies and regulations APIs is a restraining factor that may hamper business critical functions in the market.

The major vendors in the API testing market are Astegic (Virginia, US), Axway (Arizona, US), Bleum (Shanghai, China), CA Technologies (New York, US), Cigniti Technologies (Hyderabad, India), Cygnet Infotech (Ahmedabad, India), IBM (New York, US), Inflectra Corporation (Maryland,US), Infosys (Bengaluru, India), Load Impact (Stockholm, Sweden), LogiGear Corporation (California, US), Micro Focus(Formerly HPE) (Berkshire, UK), Nevatech (Georgia, US), Oracle (Apiary) Corporation (California, US), Parasoft Corporation (California, US), QASource (California, US), QSG Technologies (Bengaluru, India), QualityLogic (Idaho, US), SmartBear Software (Massachusetts, US), SendGrid, Inc. (Colorado, US), Sybrant Technologies (Chennai, India), Runscope (California, US), Trantor (California, US), Tricentis (Vienna, Austria), and Vector Software (Rhode Island, US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Microquadrant Research Methodology

2.3.1 Vendor Inclusion Criteria

2.4 Research Assumptions and Limitation

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 21)

4 Premium Insights (Page No. - 25)

4.1 Attractive Market Opportunities in the API Testing Market

4.2 Market, By Component

4.3 Market: Market Share of Top 3 Verticals and Regions, 2017

4.4 Market: Regional Analysis

4.5 Life Cycle Analysis, By Region, 2017

5 Market Overview and Industry Trends (Page No. - 28)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Adoption of Agile and Devops Practices for Software Development

5.2.1.2 Open API Strategies Adopted By Businesses

5.2.2 Restraints

5.2.2.1 Data Regulations and Policies

5.2.3 Opportunities

5.2.3.1 Advancements in Iot, Ai, and Machine-Learning Technologies

5.2.3.2 Government Directives for Open API Strategies in the Banking Industry

5.2.4 Challenges

5.2.4.1 Data Security Concerns

5.2.4.2 Lack of Awareness

5.3 Innovation Spotlight

5.4 Regulations

5.4.1 The Second Payment Services Directive (PSD2)

6 Market Analysis, By Component (Page No. - 33)

6.1 Introduction

6.2 API Testing Tools/Software

6.3 API Testing Services

6.3.1 Services By Type

6.3.1.1 Managed Services

6.3.1.2 Professional Services

7 Market Analysis, By Deployment Type (Page No. - 39)

7.1 Introduction

7.2 On-Premises

7.3 Cloud

8 API Testing Market Analysis, By Vertical (Page No. - 43)

8.1 Introduction

8.2 IT and Telecommunication

8.3 Banking, Financial Services, and Insurance

8.4 Retail and Ecommerce

8.5 Media and Entertainment

8.6 Healthcare

8.7 Manufacturing

8.8 Government

8.9 Others

9 Geographic Analysis (Page No. - 53)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 United Kingdom

9.4 Asia Pacific

9.4.1 Japan

9.4.2 China

9.4.3 India

9.5 Middle East and Africa

9.6 Latin America

10 Competitive Landscape (Page No. - 79)

10.1 Microquadrant Overview

10.1.1 Visionary Leaders

10.1.2 Innovators

10.1.3 Dynamic Differentiators

10.1.4 Emerging Companies

10.2 Competitive Benchmarking

10.2.1 Strength of Product Portfolio in the API Testing Market (25 Players)

10.2.2 Business Strategy Excellence Adopted in the Market (25 Players)

11 Company Profiles (Page No. - 83)

11.1 IBM

(Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments)*

11.2 Micro Focus (Formerly HPE Software)

11.3 Smartbear Software

11.4 Parasoft

11.5 Tricentis

11.6 Cigniti

11.7 CA Technologies

11.8 Infosys

11.9 Oracle

11.10 Qualitylogic

11.11 Runscope

11.12 Bleum

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 116)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (73 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Evaluation Criteria

Table 3 API Testing Market Size, By Component, 20152022 (USD Million)

Table 4 Component: Tools/Software Market Size, By Region, 20152022 (USD Million)

Table 5 Component: Services Market Size, By Region, 2015-2022 (USD Million)

Table 6 API Testing Services Market Size, By Type, 20152022 (USD Million)

Table 7 Managed Services Market Size, By Region, 20152022 (USD Million)

Table 8 Professional Services Market Size, By Region, 20152022 (USD Million)

Table 9 Market Size, By Deployment Type, 20152022 (USD Million)

Table 10 On-Premises: Market Size, By Region, 20152022 (USD Million)

Table 11 Cloud: Market Size, By Region, 20152022 (USD Million)

Table 12 API Testing Market Size, By Vertical, 20152022 (USD Million)

Table 13 IT and Telecommunication: Market Size, By Region, 20152022 (USD Million)

Table 14 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 15 Retail and Ecommerce: Market Size, By Region, 20152022 (USD Million)

Table 16 Media and Entertainment: Market Size, By Region, 20152022 (USD Million)

Table 17 Healthcare: Market Size, By Region, 20152022 (USD Million)

Table 18 Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 19 Government: Market Size, By Region, 20152022 (USD Million)

Table 20 Others: Market Size, By Region, 20152022 (USD Million)

Table 21 API Testing Market Size, By Region, 20152022 (USD Million)

Table 22 North America: Market Size, By Component, 20152022 (USD Million)

Table 23 North America: Market Size, By Service, 20152022 (USD Million)

Table 24 North America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 25 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 26 North America: Market Size, By Country, 20152022 (USD Million)

Table 27 United States: Market Size, By Component, 20152022 (USD Million)

Table 28 United States: Market Size, By Service, 20152022 (USD Million)

Table 29 United States: Market Size, By Deployment Type, 20152022 (USD Million)

Table 30 United States: Market Size, By Vertical, 20152022 (USD Million)

Table 31 Canada: Market Size, By Component, 20152022 (USD Million)

Table 32 Canada: Market Size, By Service, 20152022 (USD Million)

Table 33 Canada: Market Size, By Deployment Type, 20152022 (USD Million)

Table 34 Canada: Market Size, By Vertical, 20152022 (USD Million)

Table 35 Europe: API Testing Market Size, By Component, 20152022 (USD Million)

Table 36 Europe: Market Size, By Service, 20152022 (USD Million)

Table 37 Europe: Market Size, By Deployment Type, 20152022 (USD Million)

Table 38 Europe: Market Size, By Vertical, 20152022 (USD Million)

Table 39 Europe: Market Size, By Country, 20152022 (USD Million)

Table 40 Germany: Market Size, By Component, 20152022 (USD Million)

Table 41 Germany: Market Size, By Service, 20152022 (USD Million)

Table 42 Germany: Market Size, By Deployment Type, 20152022 (USD Million)

Table 43 Germany: Market Size, By Vertical, 20152022 (USD Million)

Table 44 United Kingdom: Market Size, By Component, 20152022 (USD Million)

Table 45 United Kingdom: Market Size, By Service, 20152022 (USD Million)

Table 46 United Kingdom: Market Size, By Deployment Type, 20152022 (USD Million)

Table 47 United Kingdom: Market Size, By Vertical, 20152022 (USD Million)

Table 48 Asia Pacific: API Testing Market Size, By Component, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 50 Asia Pacific: Market Size, By Deployment Type, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size, By Vertical, 20152022 (USD Million)

Table 52 Asia Pacific: Market Size, By Country, 20152022 (USD Million)

Table 53 Japan: Market Size, By Component, 20152022 (USD Million)

Table 54 Japan: Market Size, By Service, 20152022 (USD Million)

Table 55 Japan: Market Size, By Deployment Type, 20152022 (USD Million)

Table 56 Japan: Market Size, By Vertical, 20152022 (USD Million)

Table 57 China: Market Size, By Component, 20152022 (USD Million)

Table 58 China: Market Size, By Service, 20152022 (USD Million)

Table 59 China: Market Size, By Deployment Type, 20152022 (USD Million)

Table 60 China: Market Size, By Vertical, 20152022 (USD Million)

Table 61 India: Market Size, By Component, 20152022 (USD Million)

Table 62 India: Market Size, By Service, 20152022 (USD Million)

Table 63 India: Market Size, By Deployment Type, 20152022 (USD Million)

Table 64 India: Market Size, By Vertical, 20152022 (USD Million)

Table 65 Middle East and Africa: API Testing Market Size, By Component, 20152022 (USD Million)

Table 66 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 67 Middle East and Africa: Market Size, By Deployment Type, 20152022 (USD Million)

Table 68 Middle East and Africa: Market Size, By Vertical, 20152022 (USD Million)

Table 69 Latin America: Market Size, By Component, 20152022 (USD Million)

Table 70 Latin America: Service Market Size, By Type, 20152022 (USD Million)

Table 71 Latin America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 72 Latin America: Market Size, By Vertical, 20152022 (USD Million)

Table 73 Market Ranking for the Market, 2017

List of Figures (30 Figures)

Figure 1 API Testing Market: Market Segmentation

Figure 2 Regional Scope

Figure 3 Market: Research Design

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 API Testing Market: Assumptions

Figure 8 API Testing Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 9 Banking, Financial Services, and Insurance Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 10 Cloud Deployment Model is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 11 North America is Estimated to Hold the Largest Market Share in 2017

Figure 12 Adoption of Agile and Devops Practices for Software Development is Pushing the API Testing Market

Figure 13 API Testing Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 14 Banking, Financial Services, and Insurance, and North America are Estimated to Hold the Largest Market Shares in the API Testing Market in 2017

Figure 15 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 North America and Europe are the Fastest-Growing Regions Due to the High Adoption of Agile and Devops Practices in These Regions

Figure 17 API Testing Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 API Testing Services Segment is Expected to Exhibit the Highest Growth Rate During the Forecast Period

Figure 19 Cloud-Based Deployment Segment is Expected to Exhibit the Highest Growth Rate During the Forecast Period

Figure 20 Banking, Financial Services, and Insurance Vertical is Expected to Exhibit the Highest Growth Rate During the Forecast Period

Figure 21 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Regional Snapshot: Asia Pacific is Expected to Exhibit the Highest Growth Rate in the API Testing Market in the Forecast Period.

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 API Testing Market (Global) Competitive Leadership Mapping, 2017

Figure 26 IBM: Company Snapshot

Figure 27 Cigniti: Company Snapshot

Figure 28 CA Technologies: Company Snapshot

Figure 29 Infosys: Company Snapshot

Figure 30 Oracle: Company Snapshot

Growth opportunities and latent adjacency in API Testing Market