Zeolites Market

Zeolites Market by Type (Natural, Synthetic), Function (lon-Exchange, Molecular Sieve, Catalyst), Synthetic Zeolites Application (Detergents, Absorbent, Catalysis), Natural Zeolites Application, Framework, Pore Size, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

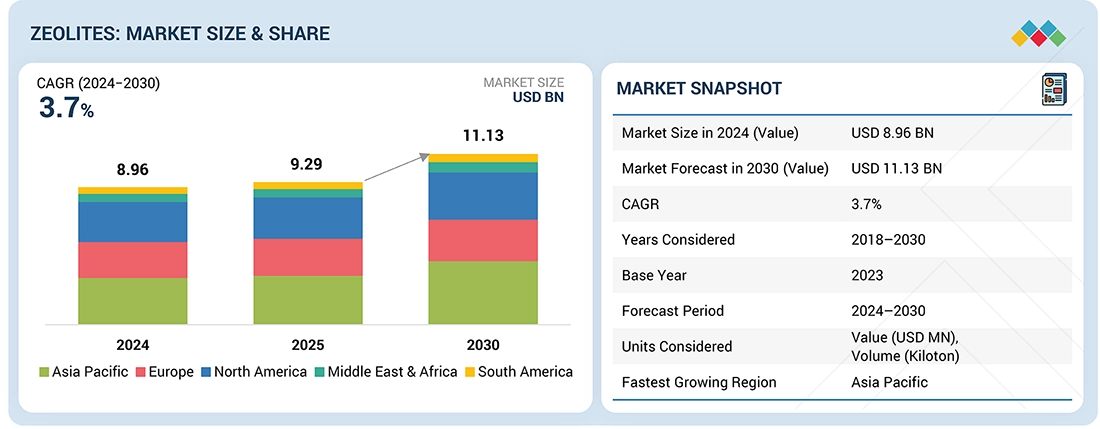

The global zeolites market is projected to grow from USD 8.96 billion in 2024 to USD 11.13 billion by 2030, at a CAGR of 3.7% during the forecast period. The zeolites market has grown significantly due to the increase in demand are the rising demand for synthetic zeolites from detergent industry, growing demand for natural zeolites from agricultural sector, and rising use of zeolites for catalytic cracking in petroleum industry, are the demand factors for the zeolites market.

KEY TAKEAWAYS

-

BY TYPEThe Types include Natural and Synthetic

-

BY PORE SIZEThe Pore Size include 3Å-7Å and 7Å-10Å

-

BY FRAMEWORKThe Framework includes Linde Type A, Faujasite, and MFI

-

BY FUNCTIONThe Function includes Ion Exchange, Molecular Sieve, and Catalyst

-

BY APPLICATION

- Synthetic Zeolite Applications: Detergent, Absorbents/Desiccants, Catalysis, and others

- Natural Zeolite Applications: Construction & Building Materials, Animal Feed, Wastewater Treatment, Soil Remediation, and Others

-

BY REGIONThe Zeolites Market covers Europe, North America, Asia Pacific, South America, and the Middle East & Africa.

-

COMPETITIVE LANDSCAPEBASF (Germany), Tosoh Corporation (Japan), W.R. Grace & Co. (US), Clariant (Switzerland), Honeywell International Inc. (US), and Arkema (France) are the key players with distribution networks spread across Asia Pacific, North America, Middle East & Africa, South America, and Europe. They aim to expand their geographic reach to meet consumer demand through expansions, agreements, acquisitions, and partnerships, which will help them gain new projects, enhance their product and service offerings, and tap into untapped markets

The zeolites market is experiencing robust growth, driven primarily by increasing demand for synthetic zeolites in the detergent industry, where they serve as key water softening agents. Meanwhile, natural zeolites are also seeing expanded use in agriculture, benefiting soil conditioning and livestock feed applications. Additionally, the adoption of zeolites in petroleum refining, especially for catalytic cracking processes, is significantly boosting market opportunities. These trends are propelled by rising environmental awareness, regulatory pressures on phosphates, and continued expansion in industrial and agronomic sectors. As manufacturers innovate and expand production, zeolites continue to see broader adoption across diverse market segments.

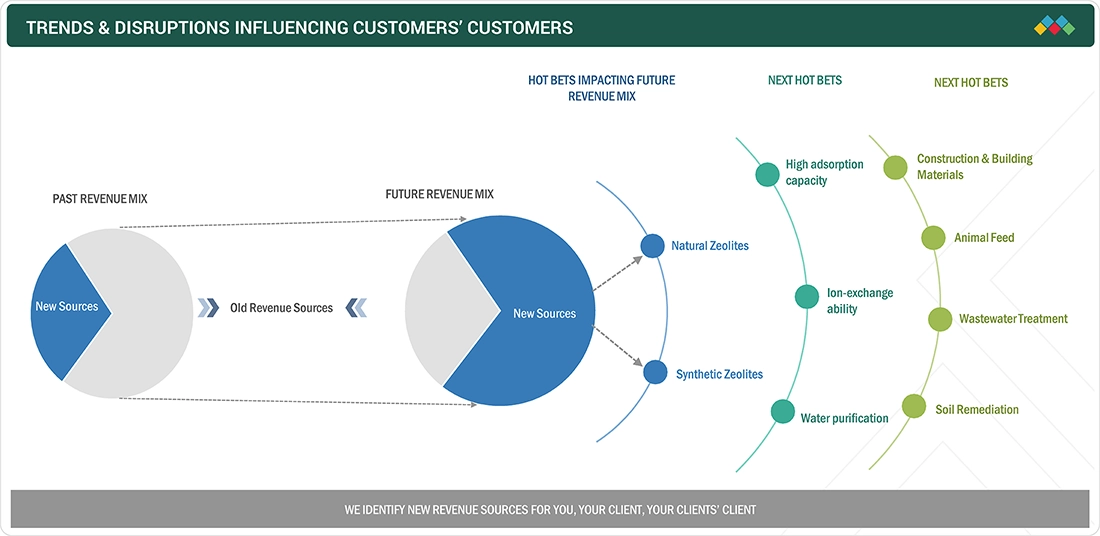

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The zeolites market is experiencing rapid growth, The end use significantly drives the growth of the zeolites market. Zeolites enhance adsorption, ion exchange, and catalytic activity, making them highly effective in construction & building materials, gas separation, water purification, and petrochemical refining.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for synthetic zeolites from detergent industry.

-

Growing demand for natural zeolites from agriculture sector.

Level

-

Toxic nature of synthetic zeolites

Level

-

Growing demand for environmentally friendly adsorbents.

-

Growth in lithium extraction and battery recycling

Level

-

Availability of alternative adsorbents and catalysts

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for synthetic zeolites from detergent industry

Synthetic zeolites are used more and more, particularly in the detergent sector. They form part of the new detergents and are less environmentally hazardous than phosphates, which are being restricted owing to environmental factors. Ion exchange softens the water and enables the detergent to be more effective in removing grime and stains. One of the main drivers of this need is the worldwide shift towards eco-friendly and biodegradable detergents. Governments and regulators worldwide have imposed regulations against phosphate detergents, and detergent manufacturers have responded by incorporating synthetic zeolites into their products. Customers are also becoming more environmentally conscious about the price of household items, compelling companies to reformulate their detergents into greener and safer products. Another factor contributing to the high demand is that washing machines are increasingly being utilized, particularly in developing nations. As increasingly more households are equipped with sophisticated washing machines, demand rises for efficient detergents that will soften water. Synthetic zeolites such as Zeolite A are highly efficient at softening water, which is cleaner even when the water is hard. Emerging advancements in zeolites production techniques have already begun to provide benefits in terms of cost and efficiency in the manufacturing industry. As a result, detergent producers throughout the world are investing more in synthetic zeolites and developing higher quality products that meet environmental standards. These factors support a growth in demand for synthetic zeolite in the detergent market in forecast years.

Restraint: Toxic nature of synthetic zeolites

Most industries demand synthetic zeolites increasingly, but their toxicity is the largest issue for expansion in the market. Although used in numerous applications such as detergents, petrochemicals, and water treatment, research has been concerned with the impact they have on the environment and human health, particularly when they exist in very small particle sizes. The major issue is risk of inhaling zeolite powder. Exposure to zeolite dust for longer period may cause respiratory issues, lung inflammation, and potential long-term ailments. These issues have been addressed by regulatory agencies, and that implies manufacturers will need to pay more to comply with regulations. In addition, synthetic zeolites are more eco-friendly compared to phosphates in detergents, but research indicates synthetic zeolites are still likely to lead to environmental accumulation. They are non-biodegradable and can pollute water and land in the long run, impacting ecosystems and aquatic organisms. Due to these environmental concerns, scientists and policymakers seek more sustainable alternatives, which could decelerate the market growth of synthetic zeolites. To overcome such challenges, market players are developing safer recipes and improved safety features. The growing concern regarding potential toxicity is a major factor that prohibits the use of synthetic zeolites on a wider scale, forcing manufacturers to overcome such obstacles with new concepts and obtaining regulatory approvals.

Opportunity: Growing demand for environmentally friendly adsorbents

The increasing demand for environment-friendly adsorbents will lead the zeolite market. In the shifting scenario of sustainable and nontoxic materials, both synthetic and natural zeolites have been appreciated for their ability to adsorb excellently along with their chemical stability and eco-friendliness. These metals are widely considered for use in different sectors including water purification, air filtration, and industrial waste management, as they absorb pollutants and heavy metals and volatile organic compounds (VOCs). This worldwide trend in tightening environmental regulations is a big driver for this purpose. The industries are themselves switching to greener technologies, since governments and other regulatory bodies have enforced more stringent pollution controls. Non-toxic and highly efficient are zeolites in trapping contaminants, thus making them a perfect long-term solution for adsorbents, such as activated carbon and silica gel. Zeolites plays a role in abundant wastewater treatment plants and gas separation processes, too, thus promoting cleaner processes in the industrial aspect. The growing awareness in consumers and businesses about sustainable practices also pushes the need for eco-friendly adsorbents for household and commercial applications. Zeolites have used increasingly in air purifiers, refrigeration systems, and even personal care products to enhance safety and environmental usability. Additional improvement in making zeolite and developing technology continues to broaden the market aspect for zeolites. Thus, zeolites will be an important component in this transition toward sustainable industrial practice.

Challenges: Availability of alternative adsorbents and catalysts

The zeolites market has a significant issue since there are other adsorbents and catalysts are already present. Zeolites are known for being able to retain substances and remain stable under heat. Other materials such as metal-organic frameworks (MOFs), silica gel, activated carbon, and plant based adsorbents are competing intensely in various applications. One of the most significant advantages of these alternatives is that they can be more precisely tuned and perform better in specific applications. For instance, MOFs possess a greater surface area and more adaptable pore structure than conventional zeolites and, therefore, are extremely efficient at gas separation, carbon capture, and catalysis. Similarly, activated carbon, a popular adsorbent, remains a favorite among those who want to purify water and air because it is cheap and easily accessible. In catalysis, zeolites are facing stiff competition from more effective metal-based and enzyme catalysts. Alternatives tend to work better in certain conditions, and petrochemical and pharmaceutical industries are hence reducing their reliance on zeolites. Also, research and developments in bio-based adsorbents and nanotechnology are increasing market competition. To remain competitive, zeolites manufacturers must embrace newer ideas and cost efficiency and develop specialty zeolite products that fulfills the changing needs of of various industries.

Zeolites Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

BASF produces zeolites used in fluid catalytic cracking (FCC) catalysts and emission control systems. It's designed to boost light olefins production, particularly propylene, in units processing resid or gasoil feedstocks. | Enhances fuel yield, improves catalyst efficiency, and reduces emissions during petroleum refining operations. |

|

Tosoh manufactures molecular sieves and zeolites for Drying and purification of various gases & and liquids, automobile catalysts, VOC traps, oil refineries, and the petrochemical industry. | Tosoh’s ZEOLUM, known for its exceptional selective adsorption capacity and offers superior adsorption performance compared to activated alumina or silica gel and is commonly used for drying and purifying various gases and liquids. Tosoh’s HSZ boasts a higher silica-to-alumina ratio than ZEOLUM, offering exceptional thermal and acid stability. |

|

Grace develops FCC catalysts solution, Catalyst carriers and binders, and Chemical catalysts used in cracking larger FCC feed molecules, coke selectivity, and refining, Silica component of the catalyst support, zeolite, or molecular sieves, and others. | These are used for refining technologies for cracking large FCC molecules, superior coke selectivity, and others. LUDOX colloidal silica, with its high purity and precise particle size, serves as an ideal silica source for zeolite synthesis. Additionally, it binds other catalyst components in various applications. |

|

Clariant supplies specialty zeolite catalysts used in environmental applications such as VOC abatement, NOx reduction, and adsorption systems. | Improves air quality and ensures compliance with environmental regulations through advanced catalytic performance. |

|

Honeywell (UOP division) manufactures zeolite-based adsorbents and catalysts | Ensures high purification efficiency and durability in industrial gas processing, reducing energy consumption and operational costs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The zeolites market ecosystem consists of raw material suppliers, manufacturers, and end users. Prominent companies in this market include well-established and financially stable manufacturers of zeolites. These companies have been operating in the market for several years and possess diversified product portfolios and strong global sales and marketing networks. Prominent companies in this market include BASF (Germany), W.R. Grace & Co. (US), Clariant (Switzerland), Honeywell International Inc. (US), and among others

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

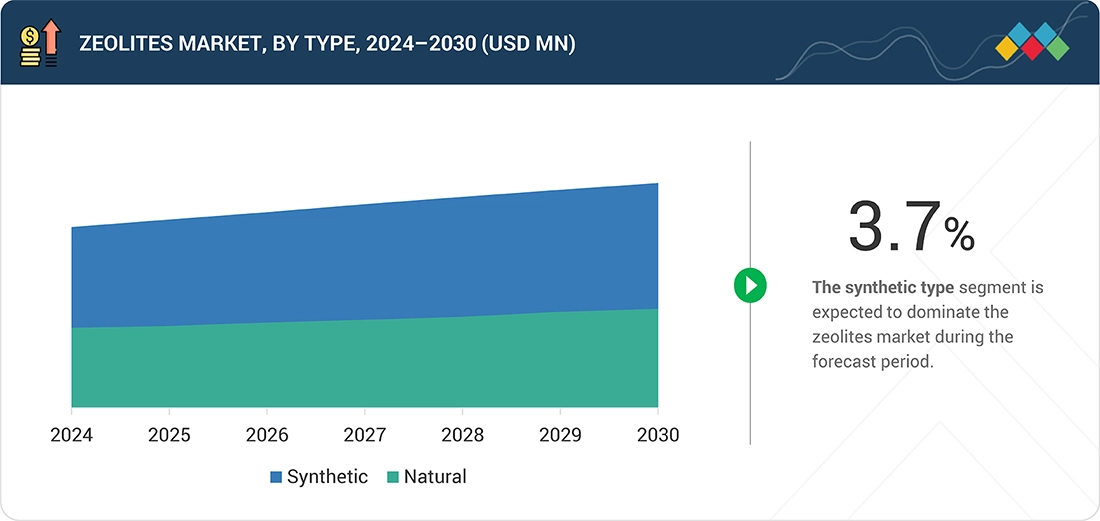

Zeolites Market, By Type

Synthetic zeolites are expected to witness significant growth at a notable CAGR during forecast period. These materials will surface in many more industries. Zeolites are super-tiny, extremely versatile, spongelike materials with practically much uses. Several synthetic zeolites are fabricated for special needs. Zeolite A, for instance, is a detergent superstar that replaces toxic phosphates and allows us to wash our clothes greener. With governments tightening the screws on phosphate pollution, demands for Zeolite A will only keep soaring. Then there are Zeolite X and Zeolite Y, which are workhorses in the field. Their exceptional ability to adsorption and catalytic properties makes them indispensable in petroleum refining and petrochemical production. Demand for these zeolites is certainly high on the rise as the focus now shifts to cleaner-burning fuels and are really efficient refining. Another star shining brightly is zeolite ZSM-5, notably targeting the biofuels and specialty-chemical industries. Its special shape-selectivity makes it ideally suited for the production of these sustainable substitutes for conventional fuels and chemicals. ZSM-5 is going to get its share of limelight with the growing trend of working towards a greener world. At least for some applications, synthetic zeolites are being proposed for gas purification, water-waste removal, and agro-chemical application. Others are in consideration for more innovative technologies, such as carbon-emission capture. Overall, the market for synthetic zeolites is growing. From cleaning our laundry to cleaner fuels and being sustainable developments, they are simply becoming priceless. As companies weigh efficiency and sustainability, demand will surely keep on thriving.

Zeolites Market, By Function

Molecular sieves, as a one of the key function of synthetic zeolites are projected to grow at a significant CAGR during the forecast period. Micro and mesoporous materials are in greater demand due to their characteristic versatility. Petrochemical, pharmaceutical, water treatment, and gas-separation industries depend upon the adsorbent and separation capabilities of these syntactical zeolites. New developments in the oil and gas sector would witness growth in demand for molecular sieves. Molecular sieves are used for natural gas dehydration by filtering out any moisture and impurity that could otherwise corrode pipeline equipment and interfere with processing. Therefore, more efficient gas purification processes are being required, owing to the growing energy demand internationally and increasing environmental regulations. Moisture control in drug formulations and packages is another application of molecular sieve chemicals in the pharmaceutical sector. With an increase in production for developed economies, the use of molecular sieves in the future is anticipated to increase. Producing high-purity heavy-oxygen and nitrogen separation from the air is another significant application for molecular sieves, for the demand in the fields of health care, metallurgy, and industry gas production. Various applications of molecular sieves in carbon capture and for VOC removal in environmental applications can provide further stimulation for market growth.

REGION

Asia Pacific is to be fastest-growing region in global zeolites market during forecast period

In the forecast period, growth in zeolites will be significantly influenced in the Asia-Pacific region with a projected significant CAGR due to increasing industrial applications, environmental concerns, and rapid urbanization. The detergent industry is growing strong in China, India, and Indonesia, which is one of the main growth engines in this region. Demand for household and industrial detergents is increasing. The oil and gas industry is major contributor to the growth the market. Countries like China and India are expanding its refining capacities, where zeolites are major component in fluid catalytic cracking (FCC) and hydrocracking processes. Apart from this, zeolites find large application in the dehydration of natural gas, which is concomitant with soaring energy demand in the region. Government regulations concerning wastewater treatments have been tightening, leading to a demand for zeolite-based absorbents and filtration media. The fast-growing use of natural zeolites in animal feed, especially in countries with heavy livestock populations, favors the market growth.

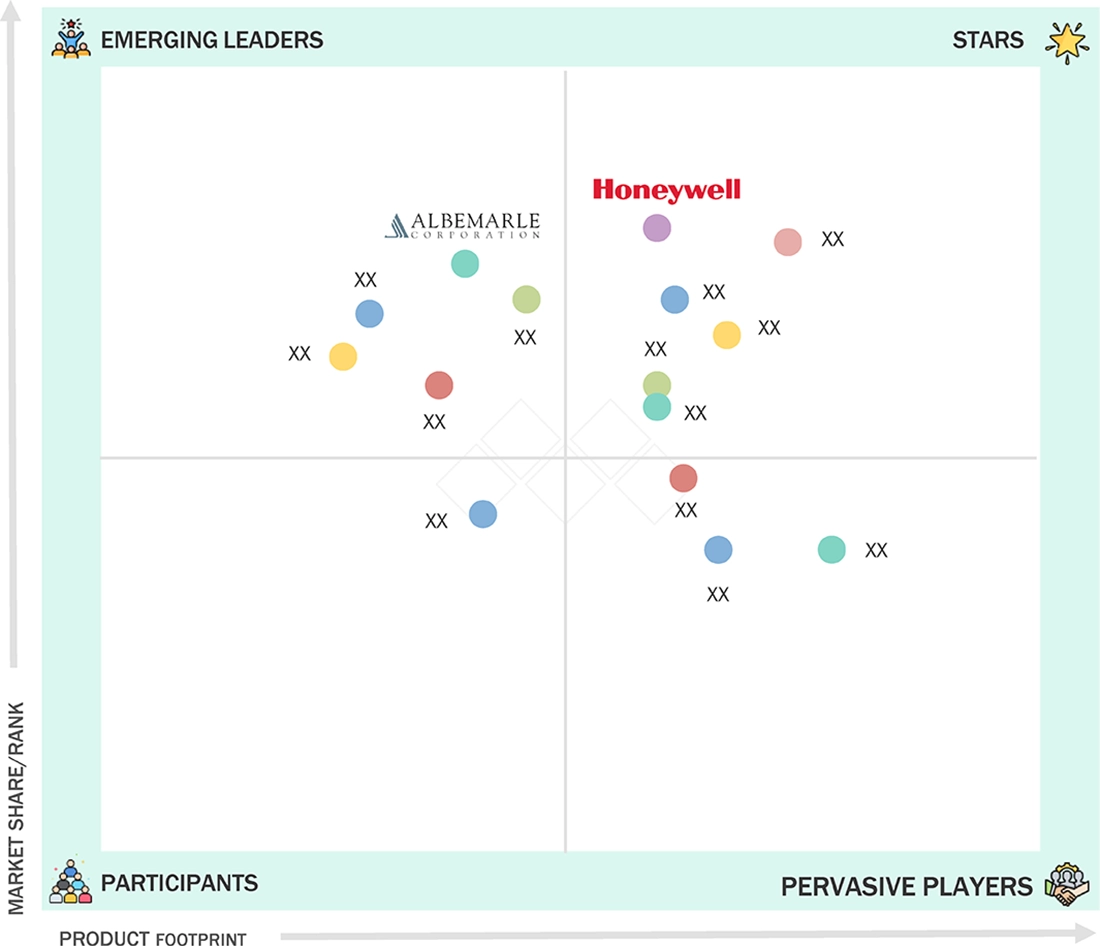

Zeolites Market: COMPANY EVALUATION MATRIX

In the zeolites market matrix, BASF (Star) maintains a solid position in the zeolites market, which is supported by its strong brand reputation. The company’s strategically positioned research centers, extensive global presence, and commitment to operational excellence contribute to its future growth. Albemarle Corporation (Emerging Leader) has a significant presence across the globe, positioning it well to capture a larger market share. The company provides zeolites and other catalysts through its catalysts segment, catering to diverse applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 8.96 BN |

| Market Forecast in 2030 (value) | USD 11.13 BN |

| Growth Rate | CAGR 3.7% from 2025-2030 |

| Years Considered | 2018-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD MN), Volume (Kiloton) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | Europe, North America, Asia Pacific, South America, and Middle East & Africa. |

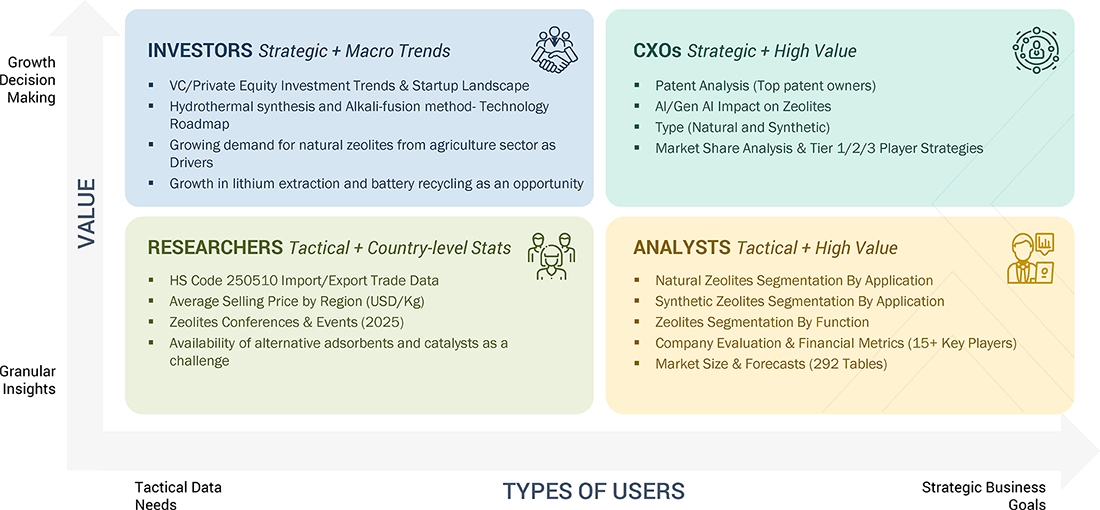

WHAT IS IN IT FOR YOU: Zeolites Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Detergent Manufacturer | Selection and benchmarking of synthetic zeolites for water softening, formulation compatibility studies | Enhances cleaning efficiency, supports phosphate-free product positioning, improves environmental credentials |

| Petrochemical Refinery | Evaluation of zeolite-based catalysts for fluid catalytic cracking and hydrocracking | Boosts process yields, increases fuel quality, and reduces hazardous waste |

| Water Treatment Company | Technology mapping for natural zeolites in ion-exchange and adsorption applications | Removes heavy metals and pollutants, ensures regulatory compliance, and increases operational sustainability |

| Agricultural Input Supplier | Assessment of zeolite soil conditioners, feed additives, and fertilizer carriers | Improves nutrient availability, soil health, and crop yields; enhances livestock feed quality |

| Construction Materials Producer | Comparison of zeolite additives in cement/asphalt, performance benchmarking | Lowers energy usage, improves durability, and strengthens eco-friendly market appeal |

RECENT DEVELOPMENTS

- May 2024 : Zeochem, part of the CPH Chemie + Papier Group, acquired Sorbead India and Swambe Chemicals, finalizing the transaction in April 2024. The companies will now operate as Sorbchem India Pvt. Ltd. under Zeochem’s Chemistry division. This strategic acquisition strengthens Zeochem’s presence in the Indian chemicals and pharmaceutical markets while expanding its product portfolio to include molecular sieves, packaging materials, and chromatography gels.

- January 2023 : Albemarle Corporation has officially launched Ketjen, its wholly owned subsidiary specializing in advanced catalyst solutions for the petrochemical, refining, and specialty chemicals industries. Ketjen will operate as a distinct brand, continuing to support customers in their energy transition efforts across fluidized catalytic cracking, clean fuels, hydro-processing, organometallics, and curatives.

- March 2022 : BASF’s Fourtitude is a new FCC catalyst that maximizes butylene from resid feedstocks. Using award-winning MFT technology, Fourtitude offers superior butylene selectivity while maintaining high catalyst activity.

Table of Contents

Methodology

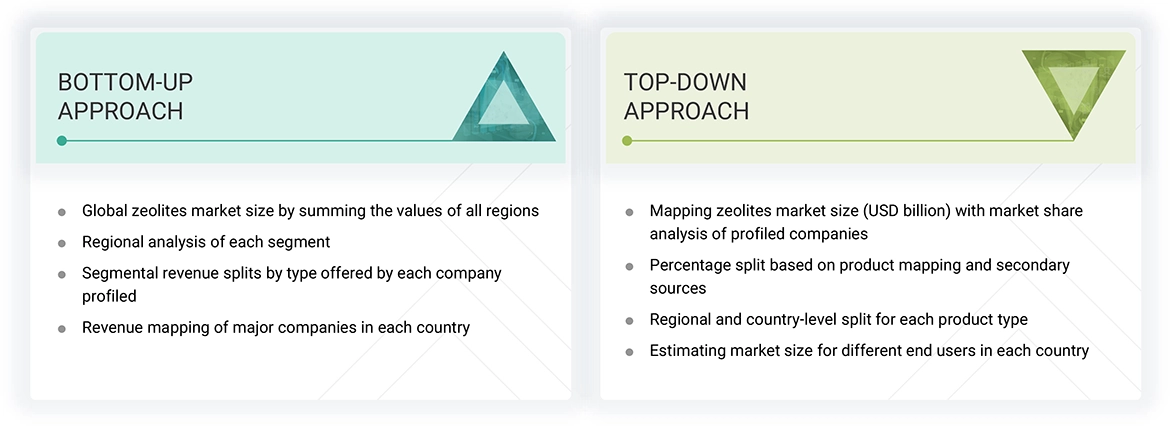

The study involved four major activities in estimating the current size of the zeolites market—exhaustive secondary research collected information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across the zeolites value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; zeolites manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain critical information about the industry’s supply chain, the pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The zeolites market comprises several stakeholders, such as raw material manufacturers and suppliers, manufacturers, traders, distributors, suppliers, contract manufacturing organizations, institutions, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the zeolites market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, and related key executives from various companies and organizations operating in the zeolites market. Primary sources from the demand side included directors, marketing heads, and purchase managers from multiple end-use industries.

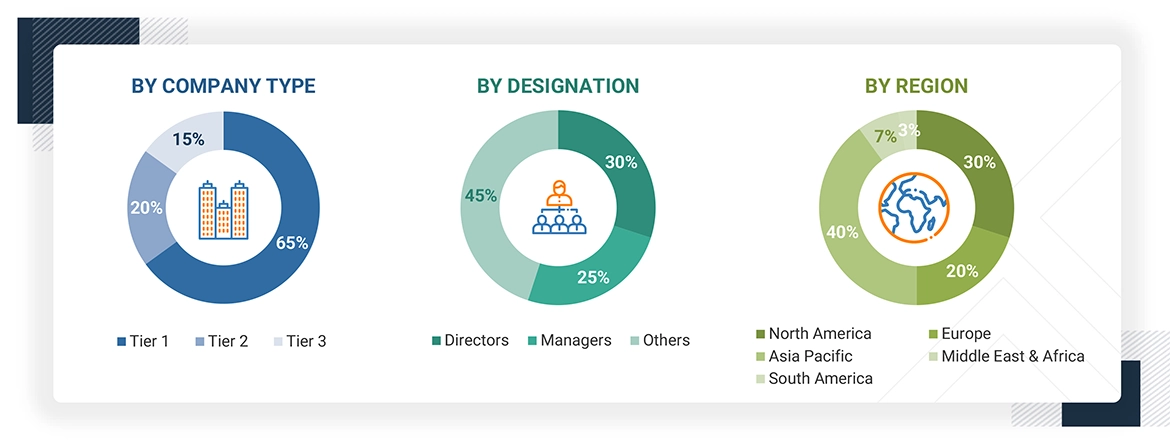

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the total size of the zeolites market. These approaches have also been used extensively to estimate the size of various dependent market subsegments. The research methodology used to estimate the market size included the following:

- The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the zeolites market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying the annual and financial reports of the top market players and interviewing industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Data Triangulation

After arriving at the overall market size, using the market size estimation processes explained above, the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the zeolites market size based on type, end use, applications, and region.

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing market growth.

- To forecast the size of the various segments of the zeolites market based on five regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each region.

- To analyze the opportunities in the market for stakeholders and present a competitive landscape for the market leaders.

- To analyze recent developments, such as expansions, agreements, new product developments, and acquisitions in the zeolites market.

- To strategically profile the key players in the market and comprehensively analyze their core competencies.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Zeolites Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Zeolites Market

Jack

Nov, 2022

Need specific information about Zeolites used in detergents, both natural and synthetic. .