Wire and Cable Compound Market

Wire and Cable Compound Market by Type (Halogenated, Non-halogenated), Application (Building Wires, Power Cables, Submarine Cables, Communication Cables, Automotive Wiring), End-use Industry (Construction, Power, Communication, Automotive), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

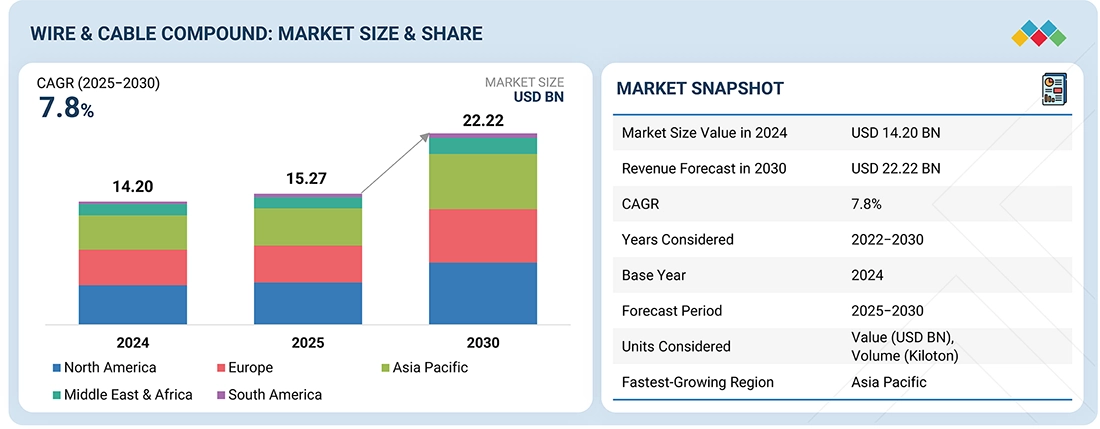

The wire & cable compound market is projected to reach USD 22.22 billion by 2030 from USD 15.26 billion in 2025, at a CAGR of 7.8% from 2025 to 2030. The wire & cable compound market is mainly driven by the growing use of wire and cable compounds in the construction, power, communication, and automotive industries. The growing need for safety, reliability, sustainability, and adaptability in electrification and connectivity is the key driver behind the surging demand for wire & cable compounds in construction, power, and automotive applications.

KEY TAKEAWAYS

-

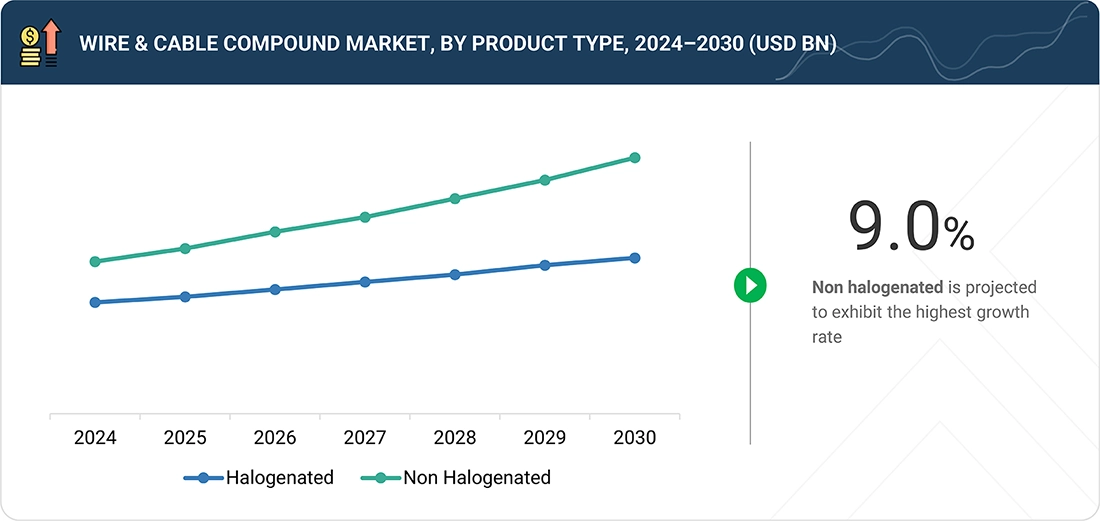

BY PRODUCT TYPEThe wire & cable compound market comprises halogenated and non-halogenated product types. The non-halogenated product type is expected to be the fastest-growing segment during the forecast period, driven by increasing regulatory pressure and demand for environmentally friendly products.

-

BY APPLICATIONThe applications of wire and cable compounds include building wires, power cables, submarine cables, submarine cables, automotive wiring, and other applications. The building wire segment is expected to have the highest CAGR due to rapid urbanization, rising construction activities, and increasing demand for residential and commercial infrastructure.

-

BY END-USE INDUSTRYKey end-use industries of wire and cable compound span across construction, power, communication, automotive, and other end-use industries. In 2024, the construction sector generated the highest demand for wire and cable compounds, especially due to the growing infrastructure developments in developing countries.

-

BY REGIONThe wire & cable compound market covers Europe, North America, Asia Pacific, South America, and the Middle East & Africa. North America is the largest market for wire and cable compounds due to its well-established power infrastructure, rapid adoption of renewable energy projects, and continuous upgrades in transmission and distribution networks. The region has strong demand from construction, automotive (particularly EVs), oil & gas, and telecommunications sectors, all of which rely heavily on advanced cable materials.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Borealis GmbH (Austria), Syensqo (Belgium), and Evonik Industries (Germany) have entered a number of agreements and partnerships to cater to the growing demand for wire and cable compounds across innovative applications.

The growing necessity for precise high-performance components in the aerospace, healthcare, and electronic industries serves as a major factor pushing the 3D printing ceramics market forward. Ceramic 3D printing demonstrates the capability to create intricate shapes and minimize material usage while enabling personalized solutions, which drives its increasing adoption. The increasing adoption of artificial intelligence (AI) by companies enables them to boost both their operational efficiency and product quality. For instance, 3DCeram launched the CERIA Set, which uses AI technology to enhance part design while optimizing placement and scraping parameters to achieve perfect prints with minimal waste.

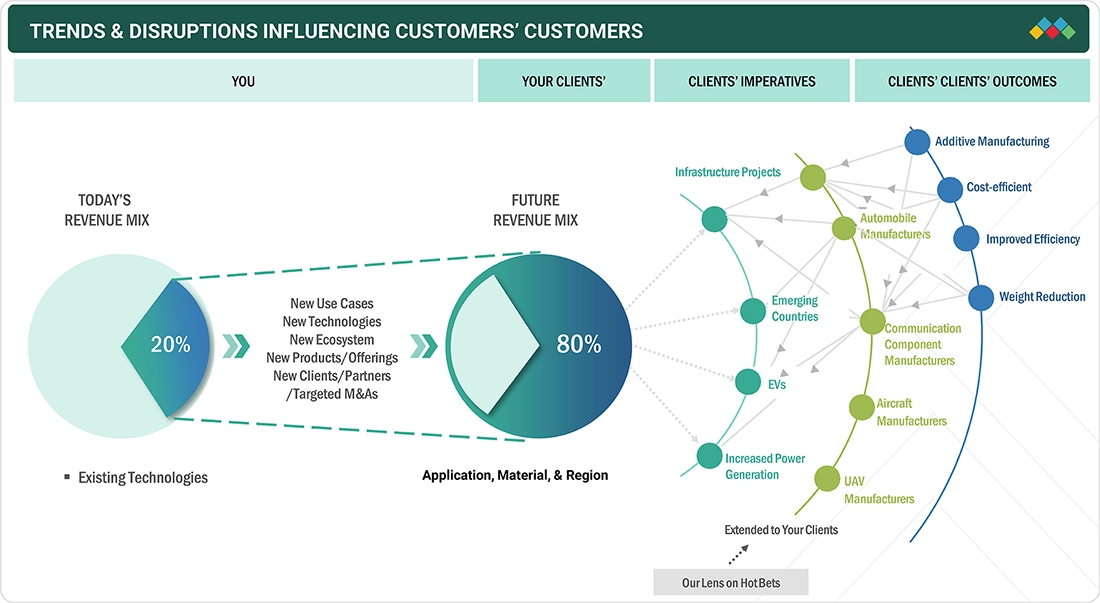

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of wire and cable compound manufacturers, and target applications are clients of wire and cable manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of wire and cable compound manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increased government and private sector spending for development of renewable energy resources

-

Increasing demand for lightweight and fuel-efficient vehicles

Level

-

Government regulations restricting use of halogenated polymers

-

Global trade war escalation

Level

-

Growing demand for cables in EV infrastructure

-

Rising demand from emerging markets

Level

-

Increasing wireless communication technology

-

Difficulty in enhancing insulation durability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased government and private sector spending for development of renewable energy resources

The renewable energy resources (e.g., solar power plants and windmill-powered plants) market is growing at a fast pace because of the high energy prices and limited energy resources. Power demand is growing at a fast rate due to growing infrastructure, industrialization, and urbanization. Recently, over 190 nations have signed the Paris Agreement, in which every nation submits reports of its own contribution toward controlling global warming. For instance, India pledged to produce 40% of its electricity from non-fossil fuels by 2030. Every nation is working toward producing energy from renewable energy sources because of the need for low maintenance and operating costs, as well as for sustainable development. The market for wires and cables used in the power sector, i.e., medium voltage (MV), high voltage (HV), and extra high voltage (EHV), is estimated to expand rapidly during the forecast period. The expansion is due to the increasing power sector globally, which is anticipated to fuel the market for wire and cable compounds. Seven nations have introduced legislation to implement net-zero emissions, and over 120 nations have vowed to do the same. The commitment by nations is anticipated to be a turning point in the market growth for renewable energy resources. It will increase the demand for lightweight, fuel-efficient mobility, leading to a surge in the requirement for next-generation and technologically advanced wire and cable compounds.

Restraint: Government regulations restricting use of halogenated polymers

The European Union’s Construction Products Regulation (CPR) is a comprehensive piece of legislation that addresses different elements of any type of building material available for sale in the European Economic Area (EEA). The CPR is designed to ensure the consistency of material performance information through the use of standards and standard test methods. These test procedures measure the performance of cables in terms of important factors like ease of ignition of the cable, rate and distance with which fire travels through the cable, amount of smoke caused by cable combustion, toxicity of cable combustion by-products, and corrosivity of cable combustion by-products. This regulation curbs the use of halogenated compounds in the wire & cable sector. The EU construction sector has been instructed to employ non-halogenated wires & cables, because of which the market for halogenated polymers is witnessing sluggish growth in the region.

Opportunity: Growing demand for cables in EV infrastructure

The growth of electric vehicle (EV) infrastructure is greatly influencing the wire & cable compound market, triggering a growing demand for specialized EV-specific cables able to fulfill the requirements of EV charging networks. With the increasing popularity of electric vehicles, the demand for efficient and durable charging networks increases accordingly. This also involves the need for high-current and high-voltage capable charging cables, which can handle these efficiently and safely. For different charging standards like Level 1, Level 2, and DC fast charging (DCFC), cables have to accommodate high amperage and voltages, in many cases up to 800 volts for DC fast chargers. These cables are constructed using high-grade thermoplastic elastomers (TPE) or cross-linked polyethylene (XLPE) insulation for durability and flexibility, supporting repeated use and exposure to the environment.

Challenge:Enhancing insulation durability under harsh conditions

The durability of insulation is a significant concern in the wire and cable sector, particularly for submarine cables. These cables are laid on the ocean floor and traverse deep, often turbulent waters, requiring insulation materials that can endure extreme pressure, high salinity, and temperature fluctuations. As time passes, such conditions will result in degradation of insulation that may cause potential failure or diminished performance. Keeping insulation intact and functional over the long life of a cable is important for maintaining operational reliability and limiting expensive repairs or replacements. This problem requires ongoing improvements in material science and engineering to create more durable insulation materials that can withstand the harsh underwater environment. Moisture ingress is a persistent threat, significantly reducing insulation resistance and potentially causing electrical failure. Impurities, coarse additives, or heavy metals in the compounds can also degrade insulating properties. Developing compounds that combine all necessary properties, thermal and chemical resistance, mechanical strength, flame retardancy, and long-term durability without excessive cost or environmental impact is technically complex and requires advanced formulations and manufacturing precision.

Wire and Cable Compound Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses Low Smoke Zero Halogen (LSZH) and flame-retardant compounds in its building and telecom cables, widely used in smart city projects and data centers | Enhances fire safety, reduces toxic emissions, and ensures compliance with stringent EU building and telecom regulations |

|

Uses halogen-free and high-performance polymer compounds in rail and marine cables for metro projects (e.g., Paris Metro, shipboard wiring) | Provides safety in confined transport environments, reduces smoke/toxicity in emergencies, and meets global transport safety standards |

|

Uses flame-retardant and halogen-free compounds for telecom and data communication cables, including fiber optic systems | Ensures reliability in high-speed communication networks and compliance with global telecom standards |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The wire & cable compound market ecosystem consists of raw material manufacturer (Dow,LyondellBasell), wire and cable compound manufacturer (Borealis, Evonik Industries), Distributors (Nexeo Plastics, Westlake Compounds), and end users (Balden, Fujikura). The raw material suppliers provide polymers to wire and cable compound manufacturers. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Wire and Cable Compound Market, by Product Type

The non-halogenated segment will hold the larger market share in 2030. Non-halogenated wire & cable compounds are used in the wire & cable industry mainly because of their increased safety, environmental friendliness, and high performance. Non-halogenated (halogen-free) compounds emit no toxic gases (like hydrogen chloride or dioxins) or heavy smoke when burned, like the by-products from halogenated cables. This significantly reduces health risks and allows for safer, clearer emergency escape paths. Halogen-free cables are designed to be fire resistant, retarding the rate of fire propagation. They give off much less smoke and prevent toxic acid fumes from being formed, which is particularly important in public areas with limited ventilation, business buildings, hospitals, and transport systems. With no halogens, the cables do not release corrosive products when burning.

Wire and Cable Compound Market, by Application

Construction wires held the greatest market share in the wire and cable compounds market due to the continuous and bulk demand from residential, commercial, and industrial construction activities. Construction wires are critical to electrical wiring within buildings, spanning applications such as power distribution, illumination, and control systems, making them an integral and repeating need across the globe. Their consumption is also increased by rapid urbanization, modernization of infrastructure, and housing initiatives by the government, while demand for compounds that promote fire resistance, insulation, and durability enhances their grip on the other application segments.

Wire and Cable Compound Market, by End-use Industry

The construction industry is expected to dominate the market during the forecast period. The wire & cable compound market within the construction end-use industry is growing rapidly due to the sector’s high demand for safe, reliable, and durable wiring solutions across residential, commercial, and industrial buildings. Current construction demands large quantities of electrical wiring for the distribution of power, lighting, telecommunication, security systems, and building automation. Wire and cable compounds offer the necessary insulation and protection required for these purposes, thus being essential parts in new construction as well as in renovation. Construction wiring compounds should provide mechanical strength, electrical insulation, high thermal resistance, good insulation, and low smoke and toxic combustion products emission. These properties enable compliance with aggressive building codes and fire safety standards, particularly for high-rise buildings and densely populated buildings. Urbanization, growth in commercial property investments, and the spread of smart buildings are stimulating demand for wire and cable compounds.

REGION

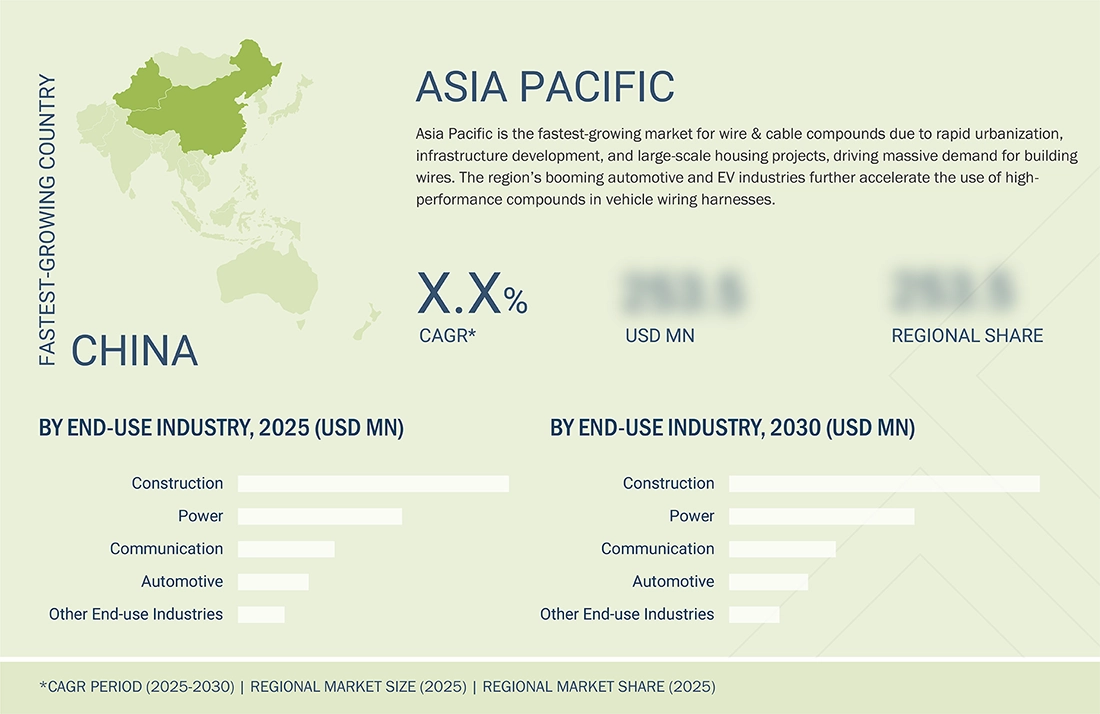

Asia Pacific to be fastest-growing region in global wire and cable compound market during forecast period

The rapidly growing construction, automotive, and electronics sectors in Asia Pacific are significant users of wire and cable compounds. For instance, China and India are the world leaders in car manufacturing and are experiencing enhanced uptake of electric cars, which need sophisticated and specialized wiring systems. The region is putting a lot of investment in power generation, smart grids, and renewable energy (solar and wind schemes). These advances require contemporary, high-performance cable materials for power transmission, dependability, and security. Massive deployment of fiber optic cable for 5G and broadband expansion is driving demand for compounds that facilitate high-speed, error-free data transmission across the region. The region’s huge and growing population, combined with rising access to electricity and digital services, increases the need for high-quality, resilient wire and cable systems in urban and rural areas.

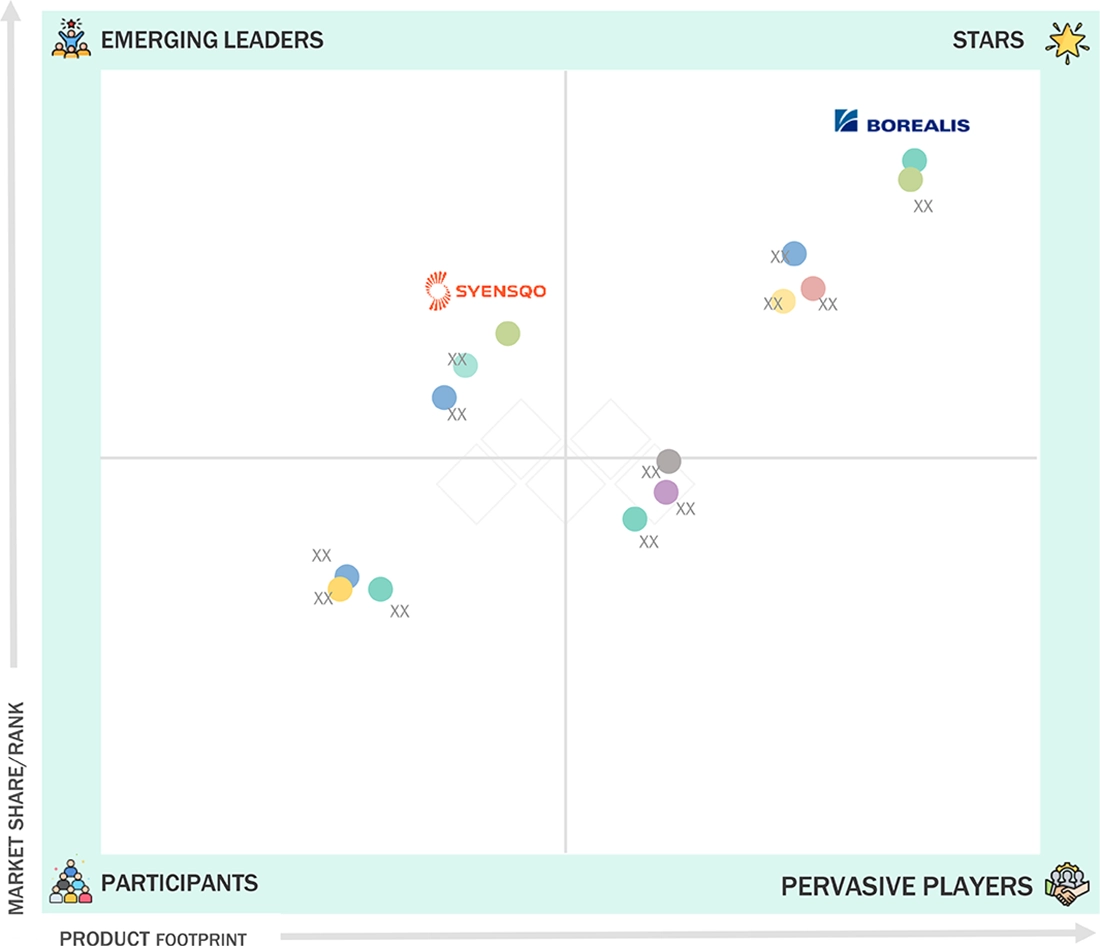

Wire and Cable Compound Market: COMPANY EVALUATION MATRIX

In the wire & cable compound market, Borealis GmbH (Star) leads with a strong market share and extensive product footprint, driven by its collaborations and partnerships with end users. Syensqo (Emerging Leader) is gaining visibilty because it is one of the newer specialty-polymers players spun off from Solvay, giving it a strong R&D base along with advanced polymer technologies for high-performance needs. While Borealis GmbH dominates through scale and a diverse portfolio,Syensqo shows significant potential to move toward the leaders’ quadrant as demand for wire and cable compound continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 14.20 Billion |

| Market Forecast in 2030 (value) | USD 22.22 Billion |

| Growth Rate | CAGR of 7.8% from 2025–2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

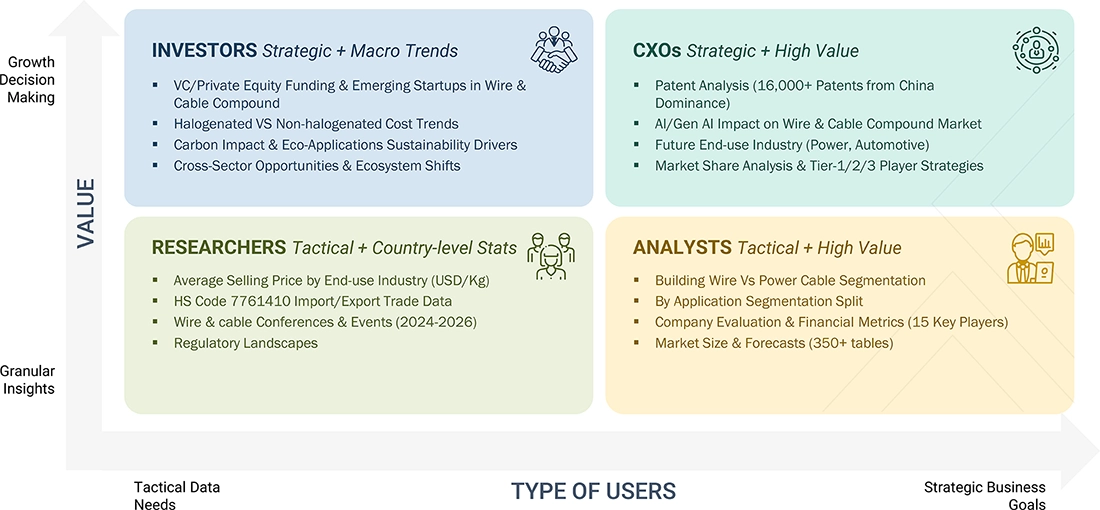

WHAT IS IN IT FOR YOU: Wire and Cable Compound Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Raw Material Supplier |

|

|

| wire and cable compound manufacturers |

|

|

| wire and cable manufacturers |

|

|

| End -user |

|

|

RECENT DEVELOPMENTS

- May 2025 : Syensqo and Sinopec signed a strategic partnership framework agreement to foster collaboration in advanced materials and specialty chemicals. The partnership is set to explore business development opportunities and application development in various sectors, including commercial aerospace, transportation, energy, electronics, and industrial fields. By leveraging their combined expertise, Syensqo and Sinopec aim to empower innovation and deliver sustainable solutions that meet the evolving demands of these industries.

- February 2025 : Avient Corporation announced an expansion of its ECCOH XL Cross-Linkable Flame-Retardant Solutions with the launch of ECCOH XL 8054. Developed for low-smoke and fume wire and cable insulation, this solution can meet stringent electrical and electronic fire safety regulations in Europe.

- June 2023 : Borealis GmbH acquired Rialti S.p.A., a leading European producer of recycled polypropylene compounds. This investment strengthened Borealis’ circular portfolio by adding 50,000 tons of recycled compounding capacity and meeting growing customer demand for sustainable solutions.

Table of Contents

Methodology

The study involves two major activities in estimating the current market size for the wire and cable compound market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering wire and cable compounds and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the wire and cable compound market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the wire and cable compound market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), business development/marketing directors, product development/innovation teams, related key executives from the wire and cable compound industry, system integrators, component providers, distributors, and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to product type, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customers/end users who use wire and cables, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of wire and cable compound and future outlook of their business which will affect the overall market.

Breakdown of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the wire and cable compound market includes the following details. The market size was determined from the demand side. The market was upsized based on the demand for wire and cable compounds in different applications at the regional level. These procurements offer insights into the demand side of the wire and cable compound industry for each end-use sector. For every end-use sector, all relevant segments of the wire and cable compound market have been integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Wire and cable compounds are specialty application materials used to formulate insulation and jacketing materials for wires & cables. They are also used in manufacturing semi-conductive shields for cables. These wire & cable compounds offer enhanced quality and performance standards, which include new standards for safety, sustainability, and reliability as they provide high insulation properties. These wire & cable compounds are used in construction, power, communication, and automotive industries. Wire & cable compounds have a major role in coating wires & cables as they provide safety insulation to conducting wires.

Stakeholders

- Wire and Cable Compound Manufacturers

- Wire and Cable Compound Distributors and Suppliers

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the wire and cable compound market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global wire and cable compound market by source, application, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major players in the wire and cable compound market? What key strategies have market players adopted to strengthen their market presence?

Major players include Borealis GmbH (Austria), Dow (US), Syensqo (Belgium), Evonik Industries AG (Germany), DuPont (US), Avient Corporation (US), Eastman Chemical Company (US), Exxon Mobil Corporation (US), Hanwha Solutions Corporation (South Korea), SCG (Thailand), and others.

What are the drivers and opportunities for the wire and cable compound market?

Increased public and private investment in renewable energy, and growing demand for lightweight, fuel-efficient vehicles in the automotive sector are key market drivers and opportunities.

Which region is expected to hold the largest market share?

North America is projected to hold the largest market share, driven by demand from construction, power, communication, automotive, and other end-use industries.

What is the projected growth rate of the wire and cable compound market over the next five years?

The market is expected to grow at a CAGR of 7.8% during the forecast period.

How is the wire and cable compound market aligned for future growth?

The market is growing rapidly, fueled by rising demand from a broad range of industries including energy, construction, automotive, and telecommunications.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Wire and Cable Compound Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Wire and Cable Compound Market