Thermoplastic Polyurethane (TPU) Market Raw Material (Diisocyanates, Polyols, Diols), Type (Polyester, Polyether, Polycaprolactone), End-Use Industry (Footwear, Industrial, Machinery, Automotive, Electronics, Medical), and Region - Global Forecast to 2027

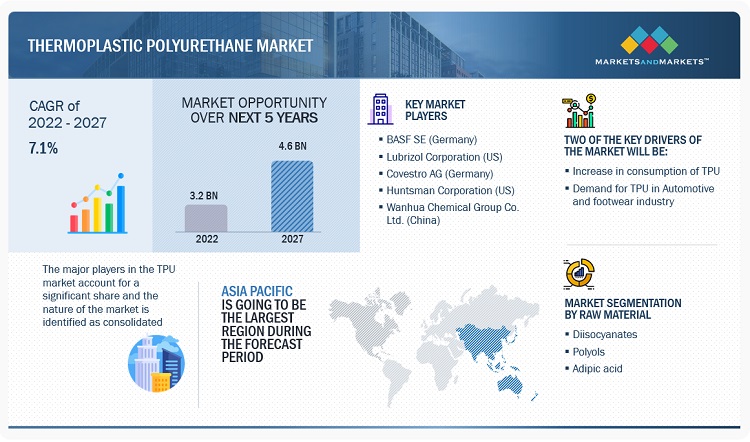

The TPU market is supposed to go up to USD 4.6 billion by 2027 with a CAGR of 7.1% which will be from USD 3.2 billion in 2022. The market is mainly driven by the relatively wide use of TPU in different end-use industries. The retail sector in emerging countries like India, Brazil, and China is preparing itself. This is due to the fact that TPU displays rubber and plastic characteristics such as temperature flexibility at low-level, biocompatible, hydrolytic stability, optical clarity, flame-retardancy, high tensile strength, high elongation, elasticity, microbicidal ability, as well as oil, grease, chemical, and abrasion resistance. As the environmental problems become more severe, the companies are seeking green options to replace the existing plastic models. The major benefit of TPU is that it is biodegradable and non-toxic, so it fits perfectly with sustainability goals. As a result, it is preferred in packaging, consumer goods, and some other applications.

Attractive Opportunities in the TPU Market

To know about the assumptions considered for the study, Request for Free Sample Report

TPU Market Dynamics

Driver: Increasing demand from the footwear industry

TPU derives its growth in the footwear industry from its special features, additional resistance to slip and abrasion. The need for TPU in the footwear sphere is being determined by diverse factors. TPU is the most durable material that can be used in manufacturing various sorts of shoes for so long. Flexibility, along with its excellent resistance to chemicals, wear, and abrasion, makes it a perfect option to be used in many different footwear applications, including outsoles, midsoles, toe caps, etc. On the one hand, it is portable and provides pleasant cushioning for sports and athletic shoes which will in turn lead to the reduction of shoe weight and thus better personal comfort and efficiency.

Restraint: Higher cost of TPU than conventional material

TPU is commonly manufactured with huge investments and challenges when compared to other traditional raw materials like polyethylene, PVC, Rubbers and Polyurethanes. TPU is made under excessively high temperatures and requires a significant level of technical know-how. High investments and complicated manufacturing procedures have influenced the price increase for this material. The higher production costs limit its application areas especially in high-end segments. Thus, other classes like compounded types of polyethylene, polypropylene, Acrylonitrile butadiene styrene, etc.produced at lower prices are made available which possess similar properties to that of TPU. Therefore it faces stiff competition from such products in certain end-use areas including machinery, real estate construction and electronics. On another note, an increase in raw material prices ultimately affects prices of TPU.

Opportunity: Substitute for PVC in medical applications

TPU can be utilized in various medical applications like catheters, medical devices, orthodontic products, and even wound care products. As some of the medical products are inserted into human bodies, the choice of materials for medical products is guided by the need for safety and comfort. The selection of materials considers factors that are friendly to patients such as flexibility and biocompatibility. TPU is known to have a good combination of chemical and mechanical traits plus biocompatibility which are crucial for use in medicine. Additionally, TPU possesses better abrasion resistance, low temperature resistance, oil and chemical resistance and resilience when compared with PVC. The temperature responsiveness of TPU makes it capable of being stiff on insertion but flexible once inside the body. These properties have increased the use of TPU in medical industry.

Challenge: Volatility in raw material prices

Raw material price volatility has led to TPU price instability. One polyester polyol used to produce TPU is adipic acid. Globally 15% of adipic acid production is for TPU while 85% goes to nylon. The increased demand for nylon alongside rising standards of living in emerging markets like China and India has created an imbalance in adipic acid supply. As a result, TPU prices have risen even further. Since TPU raw materials originate from petroleum-based products, changes in crude oil prices directly influence the costs of these essential inputs. Consequently unpredictable pricing on TPU market exists due to crude oil price volatility posing challenges for manufacturers who strive to maintain steady profit margins at all times. Natural calamities, international conflicts and pandemics are examples of events that lead to supply chain disruptions; hence, leading to shortages or delays in raw materials supplies thus resulting into extended lead times and high costs.

TPU Market Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Diisocyanate was the largest raw material for TPU market in 2021, in terms of value"

Diisocyanate accounted for the largest market share in the global TPU market, in terms of value, in 2021. plays an important part in TPU production as this compound is highly reactive with polyols, leading to a formation of polyurethane with desirable properties. Methylene diphenyl diisocyanate (MDI) is the most common raw material used to make TPU because it provides excellent mechanical characteristics including high strength, resistance to abrasion and elasticity. Consequently, such features make MDI - based TPU appropriate for various industries such as automotive, foot wears and industrial coatings. The versatility of diisocyanates allows manufacturers to customize their formulations of TPUs according to desired performances thus increasing its demand. In conclusion, although diisocyanate dominated the market both in terms of value and growth rate projection over the next few years due to its significance in producing TPUs and continuously expanding uses of TPUs across different industries.

"Footwear was the largest end-use industry for TPU market in 2021, in terms of value"

In footwear applications, thermoplastic polyurethane (TPU) accounted for the largest market share in the global TPU market in value terms in 2021 as a result of the unique properties of TPU that meet the demands of the footwear sector. TPU is known for its durability, flexibility and abrasion resistance, making it suitable for different parts of shoes including outsoles, midsoles and toe caps. Due to its light weight; it makes shoes comfortable while its ability to absorb shock and provide cushioning are essential for athletic and performance footwear hence reducing fatigue and enhancing overall performance among the feet. Besides that, TPU can be easily modified in terms of design thus giving manufacturers an opportunity to come up with appealing designs that include user preferences.

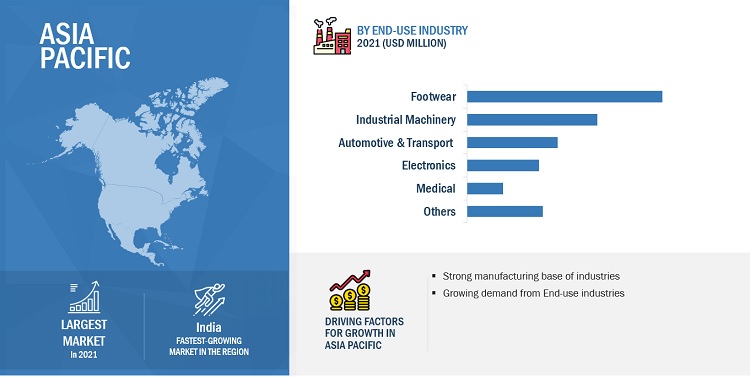

"Asia Pacific was the largest market for TPU in 2021, in terms of value."

Asia Pacific was the largest market for global TPU market, in terms of value, in 2021. China is the largest market in Asia Pacific. Asia Pacific with strong manufacturing industries and increasing disposable incomes have resulted in heightened demand for high-end goods using TPU in the automotive, footwear and medical sectors. This is caused by the unique properties of TPU like flexibility, toughness and resistance against wear that come with it. Moreover, recent technological advancements and changes in TPUs have expanded its possible areas of utilization, thus attracting manufacturers’ attention towards this product. The main condition for the development of this industry was its emerging role as both domestic and global supplier of TPU materials which are highly needed in China. The transition toward sustainable resources is taking place throughout this region by mainly referring to TPUs due to their greater eco-friendliness as opposed to traditional plastics. The major players operating in Asia pacific region includes Wanhua Chemical Group Co. Ltd. (China) and Mitsui Chemicals, Inc. (Japan), among others.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market BASF SE (Germany), The Lubrizol Corporation (US), Covestro AG (Germany), Huntsman Corporation (US), Wanhua Chemical Group Co. Ltd. (China), American Polyfilm, Inc. (US), Epaflex Polyurethanes SpA (Italy), COIM Group (Italy), Mitsui Chemicals, Inc. (Japan), and Avient Corporation (US). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of TPU have opted for new product launches to sustain their market position.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2018-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (KT); Value (USD Million) |

|

Segments |

Type, Technology, Raw Material, End-use Industries, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

BASF SE (Germany), The Lubrizol Corporation (US), Covestro AG (Germany), Huntsman Corporation (US), Wanhua Chemical Group Co. Ltd. (China), American Polyfilm, Inc. (US), Epaflex Polyurethanes SpA (Italy), COIM Group (Italy), Mitsui Chemicals, Inc. (Japan), and Avient Corporation (US) are the key players in the TPU market. |

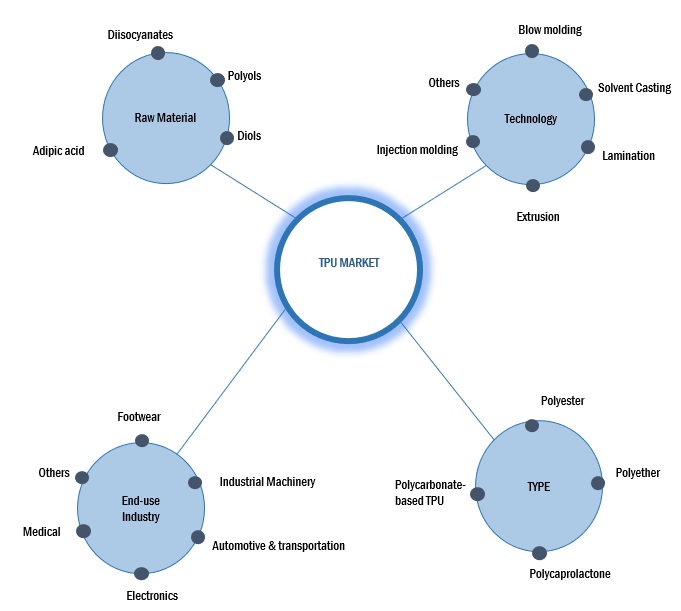

This report categorizes the global TPU market based on technology, type, raw material, end-use industry, and region.

On the basis of technology, the TPU market has been segmented as follows:

- Blow Molding

- Solvent Casting

- Lamination

- Extrusion

- Injection Molding

- Others

On the basis of type, the TPU market has been segmented as follows:

- Polyester

- Polyether

- Polycaprolactone

- Polycarbonate-based TPU

On the basis of raw material, the TPU market has been segmented as follows:

- Diisocyanates

- Polyols

- Diols

- Adipic acid

On the basis of end-use industry, the TPU market has been segmented as follows:

- Footwear

- Industrial Machinery

- Automotive & transportation

- Electronics

- Medical

- Others

On the basis of region, the TPU market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2023, Wanhua Chemical Group Co. Ltd. developed polyether-based medical-grade TPU and radiopaque-grade TPU to provide solutions for medical applications such as extrusion tubes, injection MOLDING accessories, and cast films.

- In December 2022, The Lubrizol Corporation launched a new thermoplastic polyurethane (TPU) production line at its Songjiang manufacturing site in Shanghai, China. This helped Lubrizol Engineered Polymers to expand its TPU production capacity and strengthened the regional business.

- In April 2022, Covestro AG expaned its production capacities for thermoplastic polyurethane (TPU) Films in the Platilon range, as well as the associated infrastructure and logistics. This helped the company to plan new projects for 2023.

- In August 2020, BASF SE collaborated with Maincal, the leading company in the manufacture of safety footwear in Argentina. The two companies collaborated for the launch of South America's first safety shoe made with Infinergy.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the TPU market?

The forecast period for the TPU market in this study is 2022-2027. The TPU market is expected to grow at a CAGR of 7.1%, in terms of value, during the forecast period.

Who are the major key players in the TPU market?

BASF SE (Germany), The Lubrizol Corporation (US), Covestro AG (Germany), Huntsman Corporation (US), Wanhua Chemical Group Co. Ltd. (China), American Polyfilm, Inc. (US), Epaflex Polyurethanes SpA (Italy), COIM Group (Italy), Mitsui Chemicals, Inc. (Japan), and Avient Corporation (US) are the leading manufacturers of TPU.

What are the major regulations of the TPU market in various countries?

ECHA-Industrial use of processing aids in processes and products, not becoming part of articles. Industrial use of processing aids in continuous processes or batch processes applying dedicated or multi-purpose equipment, either technically controlled or operated by manual interventions.

What are the drivers and opportunities for the TPU market?

The increased demand from footwear, automotive, and medical industries is driving the market during the forecast period. Substitute for PVC in medical applications acts as an opportunity during the forecast period.

Which are the key technology trends prevailing in the TPU market?

The key technologies prevailing in the TPU market include advancements in polymer synthesis, compounding, and processing techniques such as extrusion, injection molding, and 3D printing. Additionally, there is ongoing research and development in areas such as functional additives and recycling technologies to improve the performance and sustainability of TPUs. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand from footwear industry- Rising demand from automotive and medical industries- Recovery from impact of COVID-19 and growing penetration of EVs- Replacement of conventional materials with TPURESTRAINTS- Higher cost of TPU than conventional materialsOPPORTUNITIES- Substitute for PVC in medical applications- Emerging market for biobased TPUCHALLENGES- Volatility in raw material prices- Environmental concerns of TPU

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACRO INDICATOR ANALYSISINTRODUCTIONTRENDS AND FORECAST OF GDPTRENDS IN AUTOMOTIVE INDUSTRYTRENDS IN FOOTWEAR INDUSTRY

-

5.5 VALUE CHAINRAW MATERIAL SUPPLIERSMANUFACTURERSCOMPOUNDERSDISTRIBUTORSEND CONSUMERS

-

5.6 TRADE ANALYSISIMPORT-EXPORT SCENARIO OF TPU MARKET

-

5.7 TECHNOLOGY TRENDSSUSTAINABLE TPUHIGH-PERFORMANCE TPU3D PRINTING OF TPUINTELLIGENT TPURECYCLABLE TPU

-

5.8 PRICING ANALYSISAVERAGE SELLING PRICE BASED ON REGIONAVERAGE SELLING PRICE BASED ON RAW MATERIAL

-

5.9 ECOSYSTEM

- 5.10 YC & YCC SHIFT

-

5.11 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.12 CASE STUDY ANALYSISBASF SETHE LUBRIZOL CORPORATIONCOVESTRO AG

- 5.13 KEY CONFERENCES & EVENTS IN 2022-2023

-

5.14 PATENT ANALYSISINTRODUCTIONMETHODOLOGY- Document typeINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

5.15 KEY FACTORS AFFECTING BUYING DECISIONSQUALITYSERVICE

- 6.1 INTRODUCTION

-

6.2 INJECTION MOLDINGVERSATILE AND COST-EFFECTIVE PROCESS

-

6.3 EXTRUSIONUSED FOR A WIDE RANGE OF PRODUCTS

-

6.4 BLOW MOLDINGWIDELY USED PROCESS IN PACKAGING INDUSTRY

-

6.5 SOLVENT CASTINGENABLES MANUFACTURING HIGH-QUALITY AND HIGH-PERFORMANCE PRODUCTS

-

6.6 LAMINATIONTPU LAMINATES HAVE WIDE RANGE OF PROPERTIES

- 6.7 OTHERS

- 7.1 INTRODUCTION

-

7.2 POLYOLSWATER SOLUBILITY, REACTIVITY, AND COMPATIBILITY PROPERTIES

-

7.3 DIISOCYANATESPROVIDE REACTIVITY AND CURING PROPERTIES TO TPU

-

7.4 DIOLSUSED TO MAKE TPU TOUGHER

-

7.5 ADIPIC ACIDHELPS PRODUCE HIGH-QUALITY AND HIGH-PERFORMANCE POLYMER

- 8.1 INTRODUCTION

-

8.2 POLYESTERCOST-EFFECTIVENESS AND HIGH RESISTANCE PROPERTY TO DRIVE MARKET

-

8.3 POLYETHERSUPERIOR IMPINGEMENT ABRASION RESISTANCE AND GOOD HYDROLYTIC STABILITY TO BOOST MARKET

-

8.4 POLYCAPROLACTONEINHERENT TOUGHNESS AND GOOD ABRASION RESISTANCE TO DRIVE MARKET

-

8.5 POLYCARBONATE-BASED TPUHIGH IMPACT, CHEMICAL, AND TEMPERATURE RESISTANCE TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 FOOTWEARDEMAND FOR COMFORT, PERFORMANCE, AND DURABILITY TO DRIVE MARKETSHOESSOLESSLIPPERS

-

9.3 INDUSTRIAL MACHINERYHIGH ABRASION RESISTANCE AND IMPACT STRENGTH IN DEMANDING SITUATIONS TO DRIVE MARKETSEALS & GASKETSWHEELS & ROLLERSHOSES & TUBESBELTS & PROFILES

-

9.4 AUTOMOTIVE & TRANSPORTATIONHIGH-PERFORMANCE MATERIALS SUCH AS TPU AND CFRTP TO BOOST MARKETINTERIOR AUTOMOTIVE PARTSEXTERIOR AUTOMOTIVE PARTS

-

9.5 ELECTRONICSFLAME RETARDANT PROPERTIES OF TPU TO FUEL MARKETWIRES & CABLESTELECOMMUNICATIONSELECTRICAL DEVICES

-

9.6 MEDICALRESISTANCE TO MICROBIAL ACTIVITY AND PLASTICIZER-FREE PROPERTY TO DRIVE MARKETCATHETERSMEDICAL DEVICESWOUND CARE PRODUCTS

- 9.7 OTHERS

- 9.8 LIMITATIONS & RISKS ASSOCIATED WITH TPU MARKET

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Demand from various manufacturing sectors to drive marketCANADA- Rising demand for strong, lightweight material in automotive manufacturing to boost marketMEXICO- Growth of automotive and construction industries to drive market

-

10.3 SOUTH AMERICABRAZIL- Increased automobile sales to positively impact marketARGENTINA- Footwear sector to be largest end user of TPUREST OF SOUTH AMERICA

-

10.4 MIDDLE EAST & AFRICASAUDI ARABIA- Growing manufacturing sector and diversifying economy to positively impact market growthSOUTH AFRICA- Strong manufacturing sector to drive marketUAE- Growing automotive industry to boost demand for TPUREST OF MIDDLE EAST & AFRICA

-

10.5 ASIA PACIFICCHINA- High presence of TPU manufacturers to drive marketINDIA- Growth of footwear industry due to favorable economic growthJAPAN- Well-established automotive sector to fuel market growthTHAILAND- Increased investments in automotive sector to support market growthINDONESIA- Significant growth of footwear industry to lead to market growthSOUTH KOREA- Strong electronics sector to support market growthTAIWAN- Strong industrial manufacturing sector to influence market growthREST OF ASIA PACIFIC

-

10.6 EUROPEGERMANY- Presence of leading TPU manufacturers and growing automotive sector to fuel marketFRANCE- Presence of large automotive, industrial manufacturing, and chemical sectors to boost market growthUK- Growing manufacturing sector to spur demand for TPUITALY- Rising footwear production to propel marketSPAIN- Increased manufacture of automotive, electronics, and pharmaceuticals to fuel demand for TPURUSSIA- Economic growth and infrastructural developments to fuel market growthTURKEY- Presence of large automotive manufacturers to increase demand for TPUPOLAND- Flourishing automotive industry to drive TPU marketPORTUGAL- Favorable trading policies to fuel market growthCZECH REPUBLIC- Shift toward sustainable and biobased materials to lead to market growthREST OF EUROPE

- 11.1 OVERVIEW

- 11.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS OF TOP PLAYERS

- 11.5 MARKET EVALUATION MATRIX

-

11.6 COMPANY EVALUATION MATRIX, 2022 (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

- 11.8 COMPANY END-USE INDUSTRY FOOTPRINT

- 11.9 COMPANY REGION FOOTPRINT

- 11.10 STRENGTH OF PRODUCT PORTFOLIO

- 11.11 BUSINESS STRATEGY EXCELLENCE

-

11.12 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE LUBRIZOL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- Deals- MnM viewCOVESTRO AG- Business overview- Products/Solutions/Services offered- Recent developments- Deals- MnM viewHUNTSMAN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWANHUA CHEMICAL GROUP CO. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- Other developments- MnM viewAMERICAN POLYFILM, INC.- Business overview- Products/Solutions/Services offered- MnM viewEPAFLEX POLYURETHANES SPA- Business overview- Products/Solutions/Services offered- MnM viewCOIM GROUP- Business overview- Products/Solutions/Services offered- MnM viewMITSUI CHEMICALS, INC.- Business overview- Products/Solutions/Services offered- MnM viewAVIENT CORPORATION- Business overview- Products/Solutions/Services offered- MnM view

-

12.2 OTHER PLAYERSTHE KURARAY GROUPHEXPOL TPENOVOTEX ITALIANA S.P.A.ULTIMAKERGREAT EASTERN RESINS INDUSTRIAL CO. LTD.RAVAGOMIRACLL CHEMICALS CO. LTD.SONGWON INDUSTRIAL GROUPTAIWAN PU CORPORATIONSANYO CORPORATION OF AMERICASAN FANG CHEMICAL INDUSTRY CO. LTD.ALLIANCE POLYMER AND SERVICESSHANDONG INOV POLYURETHANE CO. LTD.KURMY CORPORATIONS PRIVATE LIMITEDTEKNOR APEX COMPANY

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 IMPACT OF PORTER’S FIVE FORCES ON TPU MARKET

- TABLE 2 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2019–2027

- TABLE 3 AUTOMOBILE PRODUCTION, BY REGION, 2018-2021

- TABLE 4 TOP 10 FOOTWEAR CONSUMERS (QUANTITY), 2021

- TABLE 5 IMPORT TRADE DATA FOR POLYURETHANES IN PRIMARY FORMS

- TABLE 6 EXPORT TRADE DATA FOR POLYURETHANES IN PRIMARY FORMS

- TABLE 7 AVERAGE SELLING PRICE BASED ON RAW MATERIAL (USD/KG)

- TABLE 8 THERMOPLASTIC POLYURETHANES ECOSYSTEM

- TABLE 9 YC & YCC SHIFT FOR TPU MARKET

- TABLE 10 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 12 GRANTED PATENTS ACCOUNT FOR 19% OF TOTAL COUNT IN LAST 10 YEARS

- TABLE 13 LIST OF PATENTS BY BASF

- TABLE 14 LIST OF PATENTS BY LUBRIZOL

- TABLE 15 TOP PATENT OWNERS IN LAST 10 YEARS

- TABLE 16 TPU MARKET, BY TECHNOLOGY, 2018–2021 (KILOTON)

- TABLE 17 TPU MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 18 TPU MARKET, BY TECHNOLOGY, 2022–2027 (KILOTON)

- TABLE 19 TPU MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 20 TPU MARKET, BY RAW MATERIAL, 2018–2021 (KILOTON)

- TABLE 21 TPU MARKET, BY RAW MATERIAL, 2018–2021 (USD MILLION)

- TABLE 22 TPU MARKET, BY RAW MATERIAL, 2022–2027 (KILOTON)

- TABLE 23 TPU MARKET, BY RAW MATERIAL, 2022–2027 (USD MILLION)

- TABLE 24 TPU MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 25 TPU MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 26 TPU MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 27 TPU MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 28 TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 29 TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 30 TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 31 TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 32 WORLD FOOTWEAR CONSUMPTION, 2021 (IN MILLION PAIRS)

- TABLE 33 AUTOMOTIVE R&D CAPEX (REVENUE SHARE)

- TABLE 34 TPU MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 35 TPU MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 36 TPU MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 37 TPU MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 38 DEVELOPMENTS IN AUTOMOTIVE SECTOR IN NORTH AMERICA (2021)

- TABLE 39 NORTH AMERICA: TPU MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 40 NORTH AMERICA: TPU MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 41 NORTH AMERICA: TPU MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 42 NORTH AMERICA: TPU MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: TPU MARKET, BY RAW MATERIAL, 2018–2021 (KILOTON)

- TABLE 44 NORTH AMERICA: TPU MARKET, BY RAW MATERIAL, 2018–2021 (USD MILLION)

- TABLE 45 NORTH AMERICA: TPU MARKET, BY RAW MATERIAL, 2022–2027 (KILOTON)

- TABLE 46 NORTH AMERICA: TPU MARKET, BY RAW MATERIAL, 2022–2027 (USD MILLION)

- TABLE 47 NORTH AMERICA: TPU MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 48 NORTH AMERICA: TPU MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 49 NORTH AMERICA: TPU MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 50 NORTH AMERICA: TPU MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 52 NORTH AMERICA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 53 NORTH AMERICA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 54 NORTH AMERICA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 55 US: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 56 US: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 57 US: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 58 US: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 59 CANADA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 60 CANADA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 61 CANADA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 62 CANADA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 63 MEXICO: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 64 MEXICO: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 65 MEXICO: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 66 MEXICO: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 67 SOUTH AMERICA: TPU MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 68 SOUTH AMERICA: TPU MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 69 SOUTH AMERICA: TPU MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 70 SOUTH AMERICA: TPU MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 71 SOUTH AMERICA: TPU MARKET, BY RAW MATERIAL, 2018–2021 (KILOTON)

- TABLE 72 SOUTH AMERICA: TPU MARKET, BY RAW MATERIAL, 2018–2021 (USD MILLION)

- TABLE 73 SOUTH AMERICA: TPU MARKET, BY RAW MATERIAL, 2022–2027 (KILOTON)

- TABLE 74 SOUTH AMERICA: TPU MARKET, BY RAW MATERIAL, 2022–2027 (USD MILLION)

- TABLE 75 SOUTH AMERICA: TPU MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 76 SOUTH AMERICA: TPU MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 77 SOUTH AMERICA: TPU MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 78 SOUTH AMERICA: TPU MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 79 SOUTH AMERICA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 80 SOUTH AMERICA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 81 SOUTH AMERICA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 82 SOUTH AMERICA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 83 BRAZIL: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 84 BRAZIL: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 85 BRAZIL: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 86 BRAZIL: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 87 ARGENTINA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 88 ARGENTINA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 89 ARGENTINA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 90 ARGENTINA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 91 REST OF SOUTH AMERICA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 92 REST OF SOUTH AMERICA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 93 REST OF SOUTH AMERICA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 94 REST OF SOUTH AMERICA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: TPU MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 96 MIDDLE EAST & AFRICA: TPU MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: TPU MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 98 MIDDLE EAST & AFRICA: TPU MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: TPU MARKET, BY RAW MATERIAL, 2018–2021 (KILOTON)

- TABLE 100 MIDDLE EAST & AFRICA: TPU MARKET, BY RAW MATERIAL, 2018–2021 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: TPU MARKET SIZE, BY RAW MATERIAL, 2022–2027 (KILOTON)

- TABLE 102 MIDDLE EAST & AFRICA: TPU MARKET, BY RAW MATERIAL, 2022–2027 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: TPU MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 104 MIDDLE EAST & AFRICA: TPU MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: TPU MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 106 MIDDLE EAST & AFRICA: TPU MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 108 MIDDLE EAST & AFRICA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 110 MIDDLE EAST & AFRICA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 111 SAUDI ARABIA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 112 SAUDI ARABIA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 113 SAUDI ARABIA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 114 SAUDI ARABIA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 115 SOUTH AFRICA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 116 SOUTH AFRICA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 117 SOUTH AFRICA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 118 SOUTH AFRICA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 119 UAE: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 120 UAE: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 121 UAE: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 122 UAE: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 123 REST OF MIDDLE EAST & AFRICA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 124 REST OF MIDDLE EAST & AFRICA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 125 REST OF MIDDLE EAST & AFRICA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 126 REST OF MIDDLE EAST & AFRICA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 127 ASIA PACIFIC: TPU MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 128 ASIA PACIFIC: TPU MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 129 ASIA PACIFIC: TPU MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 130 ASIA PACIFIC: TPU MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 131 ASIA PACIFIC: TPU MARKET, BY RAW MATERIAL, 2018–2021 (KILOTON)

- TABLE 132 ASIA PACIFIC: TPU MARKET, BY RAW MATERIAL, 2018–2021 (USD MILLION)

- TABLE 133 ASIA PACIFIC: TPU MARKET, BY RAW MATERIAL, 2022–2027 (KILOTON)

- TABLE 134 ASIA PACIFIC: TPU MARKET, BY RAW MATERIAL, 2022–2027 (USD MILLION)

- TABLE 135 ASIA PACIFIC: TPU MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 136 ASIA PACIFIC: TPU MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 137 ASIA PACIFIC: TPU MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 138 ASIA PACIFIC: TPU MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 139 ASIA PACIFIC: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 140 ASIA PACIFIC: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 141 ASIA PACIFIC: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 142 ASIA PACIFIC: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 143 CHINA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 144 CHINA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 145 CHINA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 146 CHINA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 147 INDIA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 148 INDIA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 149 INDIA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 150 INDIA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 151 JAPAN: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 152 JAPAN: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 153 JAPAN: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 154 JAPAN: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 155 THAILAND: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 156 THAILAND: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 157 THAILAND: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 158 THAILAND: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 159 INDONESIA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 160 INDONESIA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 161 INDONESIA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 162 INDONESIA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 163 SOUTH KOREA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 164 SOUTH KOREA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 165 SOUTH KOREA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 166 SOUTH KOREA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 167 TAIWAN: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 168 TAIWAN: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 169 TAIWAN: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 170 TAIWAN: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 172 REST OF ASIA PACIFIC: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 174 REST OF ASIA PACIFIC: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 175 EUROPE: TPU MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 176 EUROPE: TPU MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 177 EUROPE: TPU MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 178 EUROPE: TPU MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 179 EUROPE: TPU MARKET, BY RAW MATERIAL, 2018–2021 (KILOTON)

- TABLE 180 EUROPE: TPU MARKET, BY RAW MATERIAL, 2018–2021 (USD MILLION)

- TABLE 181 EUROPE: TPU MARKET, BY RAW MATERIAL, 2022–2027 (KILOTON)

- TABLE 182 EUROPE: TPU MARKET, BY RAW MATERIAL, 2022–2027 (USD MILLION)

- TABLE 183 EUROPE: TPU MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 184 EUROPE: TPU MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 185 EUROPE: TPU MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 186 EUROPE: TPU MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 187 EUROPE: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 188 EUROPE: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 189 EUROPE: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 190 EUROPE: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 191 GERMANY: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 192 GERMANY: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 193 GERMANY: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 194 GERMANY: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 195 FRANCE: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 196 FRANCE: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 197 FRANCE: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 198 FRANCE: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 199 UK: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 200 UK: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 201 UK: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 202 UK: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 203 ITALY: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 204 ITALY: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 205 ITALY: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 206 ITALY: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 207 SPAIN: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 208 SPAIN: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 209 SPAIN: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 210 SPAIN: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 211 RUSSIA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 212 RUSSIA: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 213 RUSSIA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 214 RUSSIA: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 215 TURKEY: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 216 TURKEY: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 217 TURKEY: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 218 TURKEY: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 219 POLAND: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 220 POLAND: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 221 POLAND: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 222 POLAND: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 223 PORTUGAL: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 224 PORTUGAL: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 225 PORTUGAL: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 226 PORTUGAL: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 227 CZECH REPUBLIC: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 228 CZECH REPUBLIC: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 229 CZECH REPUBLIC: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 230 CZECH REPUBLIC: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 231 REST OF EUROPE: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (KILOTON)

- TABLE 232 REST OF EUROPE: TPU MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 233 REST OF EUROPE: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

- TABLE 234 REST OF EUROPE: TPU MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 235 DEGREE OF COMPETITION

- TABLE 236 REVENUE ANALYSIS (USD)

- TABLE 237 MARKET EVALUATION MATRIX

- TABLE 238 PRODUCT LAUNCHES, 2018–2022

- TABLE 239 DEALS, 2018—2022

- TABLE 240 OTHER DEVELOPMENTS, 2018–2022

- TABLE 241 BASF SE: COMPANY OVERVIEW

- TABLE 242 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 BASF SE: DEALS

- TABLE 244 BASF SE: OTHERS

- TABLE 245 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

- TABLE 246 THE LUBRIZOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 THE LUBRIZOL CORPORATION: PRODUCT LAUNCHES

- TABLE 248 THE LUBRIZOL CORPORATION: DEALS

- TABLE 249 THE LUBRIZOL CORPORATION: OTHERS

- TABLE 250 COVESTRO AG: COMPANY OVERVIEW

- TABLE 251 COVESTRO AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 COVESTRO AG: PRODUCT LAUNCHES

- TABLE 253 COVESTRO AG: DEALS

- TABLE 254 COVESTRO AG: OTHERS

- TABLE 255 HUNTSMAN CORPORATION: COMPANY OVERVIEW

- TABLE 256 HUNTSMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 HUNTSMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 258 HUNTSMAN CORPORATION: OTHERS

- TABLE 259 WANHUA CHEMICAL GROUP CO. LTD.: COMPANY OVERVIEW

- TABLE 260 WANHUA CHEMICAL GROUP CO. LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 261 WANHUA CHEMICAL GROUP CO. LTD.: PRODUCT LAUNCHES

- TABLE 262 WANHUA CHEMICAL GROUP CO. LTD.: OTHER DEVELOPMENTS

- TABLE 263 AMERICAN POLYFILM, INC.: COMPANY OVERVIEW

- TABLE 264 AMERICAN POLYFILM, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 EPAFLEX POLYURETHANES SPA: COMPANY OVERVIEW

- TABLE 266 EPAFLEX POLYURETHANES SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 COIM GROUP: COMPANY OVERVIEW

- TABLE 268 COIM GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 MITSUI CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 270 MITSUI CHEMICALS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 AVIENT CORPORATION: COMPANY OVERVIEW

- TABLE 272 AVIENT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

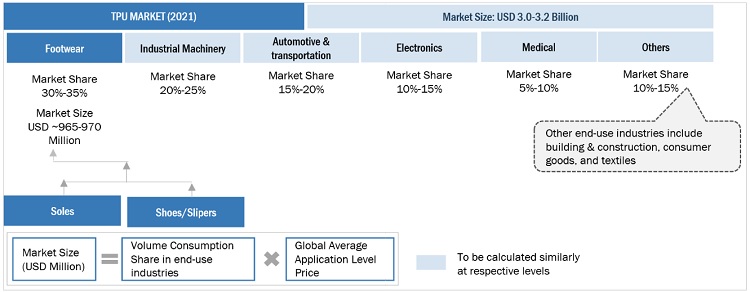

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: APPROACH 1

- FIGURE 3 MARKET SIZE ESTIMATION: APPROACH 2

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TPU MARKET: DATA TRIANGULATION

- FIGURE 7 POLYESTER TYPE SEGMENT ACCOUNTED FOR LARGEST SHARE OF TPU MARKET IN 2022

- FIGURE 8 DIISOCYANATES RAW MATERIAL SEGMENT TO GROW AT HIGHEST CAGR IN TPU MARKET DURING FORECAST PERIOD

- FIGURE 9 FOOTWEAR WAS LARGEST END-USE INDUSTRY OF TPU MARKET IN 2022

- FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF TPU MARKET IN 2021

- FIGURE 11 GROWING FOOTWEAR AND AUTOMOTIVE INDUSTRIES TO DRIVE TPU MARKET

- FIGURE 12 DIISOCYANATES SEGMENT TO DOMINATE TPU MARKET DURING FORECAST PERIOD

- FIGURE 13 POLYESTER TYPE TO BE LARGEST SEGMENT IN TPU MARKET DURING FORECAST PERIOD

- FIGURE 14 INJECTION MOLDING TO BE LEADING TECHNOLOGY SEGMENT IN TPU MARKET DURING FORECAST PERIOD

- FIGURE 15 MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 FOOTWEAR SEGMENT AND CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN TPU MARKET

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 DISTRIBUTION OF FOOTWEAR PRODUCTION, BY CONTINENT (QUANTITY), 2021

- FIGURE 21 AVERAGE SELLING PRICE BASED ON REGION (USD/KG)

- FIGURE 22 NEXT-GEN MOBILITY, LIGHTWEIGHTING, DIGITALIZATION, AND IMPROVED MEDICAL DEVICES EXPECTED TO CHANGE FUTURE REVENUE MIX OF SUPPLIERS

- FIGURE 23 PUBLICATION TRENDS OVER LAST TEN YEARS

- FIGURE 24 PATENTS: LEGAL STATUS

- FIGURE 25 TOP JURISDICTION-BY DOCUMENT

- FIGURE 26 KEY APPLICANTS: TOP COMPANIES

- FIGURE 27 SUPPLIER SELECTION CRITERION

- FIGURE 28 INJECTION MOLDING SEGMENT TO GROW AT HIGHEST CAGR IN TPU MARKET

- FIGURE 29 DIISOCYANATES SEGMENT TO GROW AT HIGHEST CAGR IN TPU MARKET

- FIGURE 30 POLYESTER SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 31 AUTOMOTIVE TO BE FASTEST-GROWING END-USE INDUSTRY OF TPU

- FIGURE 32 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING TPU MARKET

- FIGURE 33 TPU MARKET IN INDIA TO GROW AT HIGHEST RATE

- FIGURE 34 ASIA PACIFIC: TPU MARKET SNAPSHOT

- FIGURE 35 COMPANIES ADOPTED INVESTMENTS & EXPANSIONS AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2022

- FIGURE 36 RANKING OF TOP FIVE PLAYERS IN TPU MARKET, 2022

- FIGURE 37 TPU MARKET SHARE, BY COMPANY (2022)

- FIGURE 38 COMPANY EVALUATION MATRIX, 2022

- FIGURE 39 STARTUP AND SME MATRIX, 2022

- FIGURE 40 BASF SE: COMPANY SNAPSHOT

- FIGURE 41 COVESTRO AG: COMPANY SNAPSHOT

- FIGURE 42 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 WANHUA CHEMICAL GROUP CO. LTD.: COMPANY SNAPSHOT

- FIGURE 44 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT

- FIGURE 45 AVIENT CORPORATION: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the TPU market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

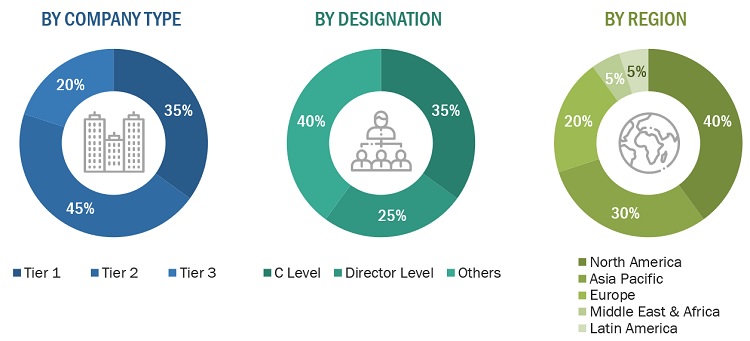

Primary Research

The TPU market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the TPU market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the TPU industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, raw material, type, end-use industries, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of TPU and future outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

BASF |

Individual Industry Expert |

|

Covestro |

Sales Manager |

|

Lubrizol |

Director |

|

Huntsman Corporation |

Marketing Manager |

|

Wanhua |

R&D Manager |

|

|

|

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the TPU market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

TPU Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

TPU Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Thermoplastic Polyurethane (TPU) is a thermoplastic elastomer that possesses characteristics of both, plastic and rubber; it is soft and processable when heated and hard when cooled. TPU can be reprocessed multiple times without losing its structural integrity due to the linkages between its soft and hard block structures. The soft block contains polyol and a diisocyanate, whereas the hard block is formed of a chain extender and diisocyanate.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the TPU market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on technology, raw material, type, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thermoplastic Polyurethane (TPU) Market

Thermoplastic Polyurethane Market by End-Industry (Automotive, Building & Construction, Engineering, Footwear, Hose & Tube, Medical, and Wire & Cable) & Geography - Trends & Forecasts to 2019

Need raw material analysis and market intelligence on Thermoplastic Polyurethane by end-use industries, with data in volume terms in various applications.

Specific information onTPU in US and Canada to understand competition and applications in unconventional energy sector

Executive summary and TOC for the report

Supply demand analysis for all major regions and market estimation for major applications of TPU market

Market data on Global TPU market and breakbown of the data for European Market

Interested in Thermoplastic Polyurethane report

Thermoplastic Polyurethane industry, more specifically, the Expanded Thermoplastic Polyurethane industry.

I want to purchase a corporate user license. What is the procedure?