The study involved four major activities in estimating the size for VCSEL market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources such as press releases, annual reports, investor presentations of companies, articles, and white papers by recognized authors were referred to. Secondary research was done to obtain key information about the market’s value chain, supply chain, pool of key players, and segmentation according to industry trends, regions, and developments from both technology and market perspectives.

Primary Research

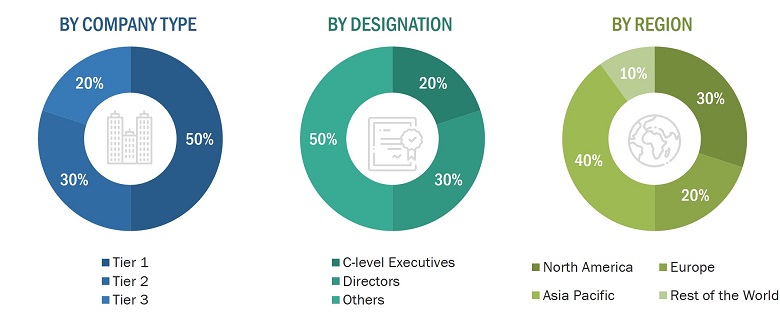

Extensive primary research has been conducted after acquiring knowledge about the VCSEL market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply sides across four major geographies: North America, Europe, Asia Pacific, and RoW (the Middle East, Africa, and South America). Approximately 60% and 40% of primary interviews were conducted with both the supply and demand sides, respectively. This primary data has been collected through emails, questionnaires, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to perform the market size estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been conducted on the complete market engineering process to list the key information/insights throughout the report.

The key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top players as well as extensive interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) on the VCSEL market. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

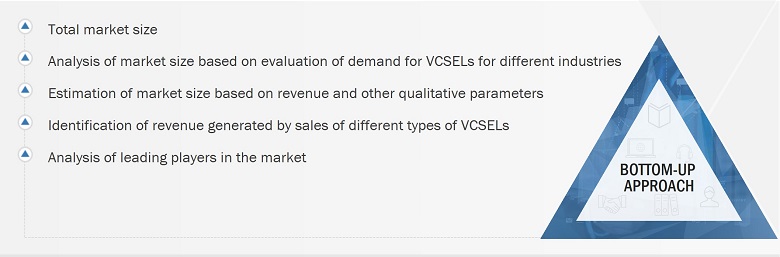

VCSEL Market: Bottom-Up Approach

The bottom-up procedure has been employed to arrive at the overall size of the VCSEL market. From the revenues of the key players (companies), the size of the VCSEL market has been estimated at the first stage. The market has been further narrowed to obtain splits for various VCSEL types, wavelengths, materials, applications, data rates, industries, and regions. These splits have been validated through primary interviews with industry stakeholders and subject-matter experts.

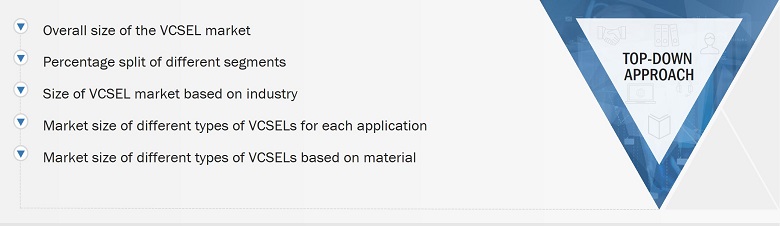

VCSEL Market: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. For the calculation of the size of specific market segments, the size of the most appropriate parent market was considered to implement the top-down approach. The bottom-up approach was also implemented for data extracted from secondary research to validate the market size of different segments.

The market share of each company was estimated to verify the revenue share used in the bottom-up approach earlier. With data triangulation and data validation through primaries, the size of the parent market and each segment was determined and confirmed in this study. The data triangulation procedure used for this study has been explained in the next section.

Data Triangulation

After arriving at the overall size of the VCSEL market through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Definition

A vertical-cavity surface-emitting laser (VCSEL) is a monolithic semiconductor laser diode in which the laser beam is emitted perpendicularly/vertically to its top surface. VCSELs are made of gallium arsenide (GaAs) and indium phosphide (InP) with single-mode and multimode functionalities. VCSELs are highly efficient and cost-effective for use in various applications, such as data communication and 3D sensing. The increasing application of 3D sensing in smartphones is projected to be a significant factor driving the growth of the VCSEL market.

Key Stakeholders

-

Raw material & wafer suppliers

-

Foundry & fabless players

-

Integrated device manufacturers (IDMS)

-

VCSEL manufacturers

-

Equipment providers

-

Original equipment manufacturers (OEMS)

-

Assembling, testing, and packaging vendors

-

Technology, service, and solution providers

-

Suppliers and distributors

-

Government and other regulatory bodies

-

Research institutes and organizations

-

Market research and consulting firms

Report Objectives

-

To define, describe, segment, and forecast the size of the VCSEL market, in terms of value, based on type, material, wavelength, application, data rate, vertical, and region

-

To forecast the market size, in terms of value, for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

-

To define, describe, segment, and forecast the size of the VCSEL market, in terms of volume, based on vertical

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, investment and funding scenario, and regulations pertaining to the market

-

To provide a detailed overview of the value chain analysis of the VCSEL ecosystem

-

To strategically analyze micro markets with regard to individual growth trends, prospects, and contributions to the total market

-

To analyze opportunities for stakeholders by identifying high-growth segments of the market

-

To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies, and provide a competitive landscape of the market

-

To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the VCSEL market

-

To study and analyze the impact of the recession on the VCSEL market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 7)

Wenjie

Sep, 2018

Hi, I am interested in purchasing this report. But I would need to understand your methodology first. Does your market size refer to VCSEL chip or VCSEL module? Did you add up revenue from suppliers or use the volume x price methodology?.

Jack

Aug, 2019

I've been a VCSEL pioneer and developer for over 30 years. I give presentations on VCSEL history and markets. Most people still don't know what a VCSEL is. Market reports including volumes and sales by application, with past and projected growth aid greatly in increasing public awareness. So would like to get a report brochure and few insights about applications so that I can integrate this information in my presentations. Also, I will cite MarketsandMarkets wherever I include the information sourced from your research..

Alex

Apr, 2019

Currently, I am doing research about the VCSEL market and relevant companies in this industry. As the reports from your company are highly recommended, I searched through your website and have found your report to be most relevant. Can you share the report brochure and few more data pointers about the VCSEL market. Does the report include few use cases of VCSEL? If yes, can I have a look at those too?.

don

Jun, 2016

Does the report break the CMP equipment data into various applications such as integrated circuits, MEMs & NEMs, and compound semiconductors? If not, are there any provisions for customization?.

Laurent

May, 2017

I am interested in - VCSEL Market in general - TAM, business evolution, on going market consolidation, foundry model, technology roadmap.

Delamarre

Feb, 2019

I am active in academic research on optoelectronic devices. I am interested in knowing the trend and challenges of current technologies, in order to give the best orientation to my research..