This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the tea extract market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process for the tea extract market, multiple sources were referred to for gathering data and insights. These included reputable organizations such as the International Specialty Tea Association (ISTA), World Organisation for Animal Health (OIE), Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), and European Food Safety Authority (EFSA). These sources provided key information on market trends and industry dynamics. In addition, secondary sources such as industry journals, scientific studies, white papers, company annual reports, investor presentations, certified publications, expert articles, regulatory bodies, and trade directories were utilized to enhance the comprehensiveness of this research. Paid databases were also consulted to provide a holistic view of the tea extract market.

Secondary research was conducted to obtain essential information on the tea extract market's supply chain, identify the total pool of market participants, and classify and segment the market based on global and regional trends. This research provided critical insights into the market's development and its strategic direction at both global and regional levels.

Primary Research

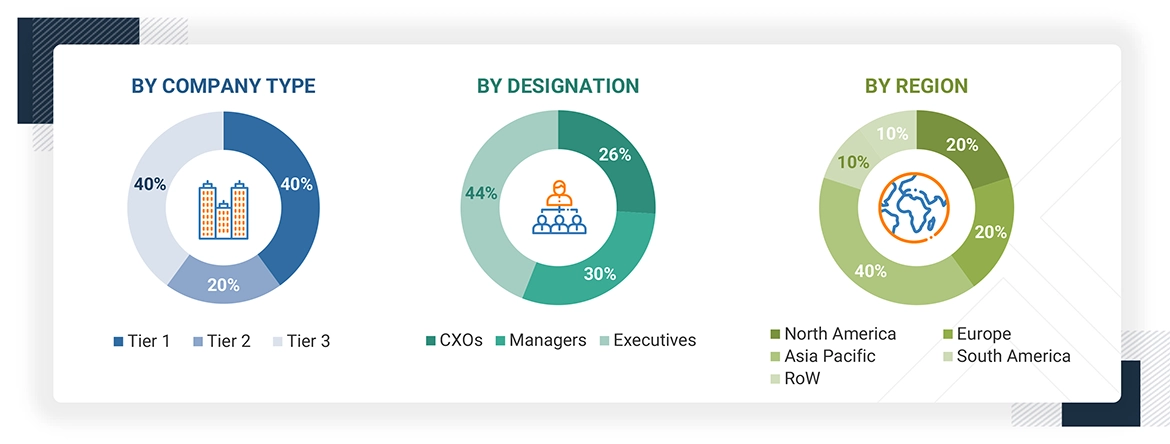

Primary research in the tea extract market involved several stakeholders across the supply chain, including raw material suppliers, tea extract manufacturers, and R&D experts. Key primary data collection methods were used on both the supply and demand sides to gain qualitative and quantitative insights. On the supply side, primary interviews were conducted with manufacturers and material suppliers involved in tea extracts, while on the demand side, insights were gathered from distributors, importers, exporters, and various end-users, such as the beverage industry and nutraceutical sectors. This comprehensive research approach ensured a thorough understanding of market dynamics, trends, and potential growth opportunities within the tea extract industry.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the tea extract market. These approaches were extensively to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

Tea Extract Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall tea extract market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The Tea Extract market involves the production and distribution of extracts derived from various tea sources, including green tea, black tea, oolong tea, and other lesser-known tea varieties. These extracts are widely utilized across multiple industries due to their health-promoting properties, such as antioxidants, polyphenols, and catechins, which support cardiovascular health, weight management, and skin care. The market is segmented by source, application, form, category, technology, and region.

Tea extract applications are diverse, spanning food and beverages, where they enhance the nutritional value of functional drinks and confectioneries; pharmaceuticals and dietary supplements, where they are used in health supplements; and cosmetics and personal care, where they offer skin-soothing and anti-aging benefits. Forms of tea extract include powder, liquid, and encapsulated variants, which cater to different processing needs across industries. With the rising demand for natural and clean-label products, the tea extract market is growing rapidly. Technological advancements in extraction methods are improving the quality and yield of tea extracts, making them more cost-effective and accessible to a broader range of industries. Furthermore, the market is expanding regionally, driven by increasing health-consciousness and consumer preferences for plant-based ingredients.

Stakeholders

MARKET INTELLIGENCE

-

To define, segment, and estimate the size of the tea extract market with respect to its material source, form, category, application, technology and region ranging from 2025 to 2030

-

To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To analyze the complete value chain and the influence of all key stakeholders, such as manufacturers, suppliers, and end users

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the total market

COMPETITIVE INTELLIGENCE

-

To identify and profile the key players in the tea extract market

-

To provide a comparative analysis of market leaders on the basis of the following:

-

Product offerings

-

Business strategies

-

Strengths and weaknesses

-

Key financials

-

To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

-

To analyze the value chain and products across the key regions and their impact on the prominent market players

-

To provide insights on key product innovations and investments in the tea extract market

Report Objectives

-

Tea extract raw material suppliers and manufacturers

-

Tea extract material importers and exporters

-

Tea extract traders and distributors

-

Government and research organizations

-

Associations and industrial bodies

-

Food and Agriculture Organization (FAO)

-

United States Department of Agriculture (USDA)

-

European Food Safety Authority (EFSA)

-

International Tea Committee (ITC)

-

Tea Board of India

-

China Tea Marketing Association (CTMA)

-

Sri Lanka Tea Board (SLTB)

-

United States Tea Association

-

Kenya Tea Development Agency (KTDA)

-

Tea and Herbal Association of Canada

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

-

Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

-

Further breakdown of the Rest of Europe market for tea extract into the Czech Republic, The Netherlands, Belgium, Hungary, Romania, and Ireland

-

Further breakdown of the Rest of South America market for tea extract into Chile, Colombia, Paraguay, and Peru

-

Further breakdown of other countries in the RoW market for tea extract into the Middle East & Africa

Company Information

-

Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Tea Extract Market