Herbal Supplements Market by Source (Leaves, Barks, Fruits & Vegetables, and Roots), Application (Pharmaceuticals, Food & Beverage, and Personal Care), Function (Medicinal and Aroma), Form, and Region - Global Forecast to 2022

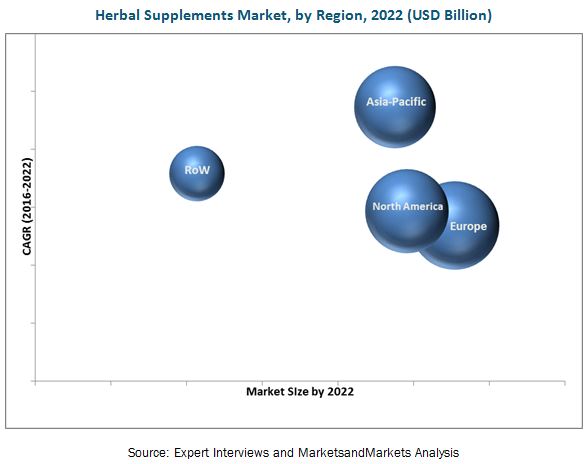

The herbal supplements market, in terms of value, is projected to reach around USD 86.74 Billion by 2022, at a CAGR of 6.8% from 2016 to 2022. The market for herbal supplements has been segmented on the basis of source, function, application, form, and region. The years considered for the study are as follows:

- Base year 2015

- Estimated year 2016

- Projected year 2022

- Forecast period 2016 to 2022

The objectives of the study includes:

- To define, segment, and project the global market for herbal supplements

- To understand the structure of the herbal supplements market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and their contribution to the total market

Research Methodology

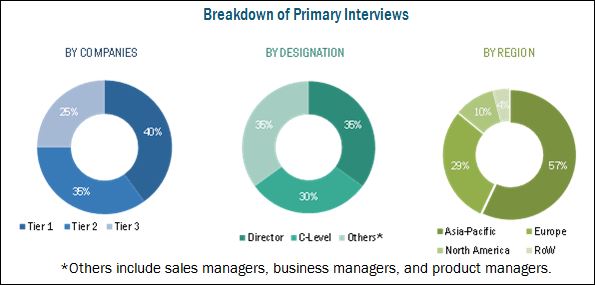

This report includes estimation of market sizes for value (USD million) and volume (tons). Both top-down and bottom-up approaches have been used to estimate and validate the size of the herbal supplements market and various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research, such as company websites, annual reports, and their market share in their respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

The herbal supplements market value chain players are Archer Daniels Midland Company (U.S.), Glanbia plc (Ireland), Herbalife International of America, Inc. (U.S.), Blackmores (Australia), and Nutraceutical International Corporation (U.S.) among others. Maximum value addition of a product in the global herbal supplements industry is observed in the stages of product manufacturing. In the initial stage, the raw materials, which in this case, are the natural herb ingredients, are used for the production of herbal supplements. Value addition in the marketing and sales stages varies with key players, addressable markets, manufacturing units, and end consumers. The key companies that offer herbal supplements mainly invest in new product developments and production expansions through acquisitions and the development of new facilities.

Target Audience:

- Suppliers

- R&D institutes

- Technology providers

- Food supplements manufacturers/suppliers

- Herbal supplements manufacturers/processors

- Intermediary suppliers

- Wholesalers

- Dealers

- Consumers

- End users

- Retailers

Scope of the Report

This research report categorizes the herbal supplements market based on source, function, form, application, and region.

Based on Source, the market has been segmented as follows:

- Leaves

- Barks

- Fruits & vegetables

- Roots

Based on Function, the market has been segmented as follows:

- Medicinal

- Aroma

Based on Form, the market has been segmented as follows:

- Capsules & tablets

- Powder

- Syrups

- Oils

Based on Application, the market has been segmented as follows:

- Pharmaceuticals

- Food & beverages

- Personal care

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW (Brazil, The Middle East, South Africa, and Rest of RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The global herbal supplements market has grown steadily in the last few years. The market size is projected to reach USD 86.74 Billion by 2022, at a CAGR of around 6.8% from 2016 to 2022. The growing awareness for preventive healthcare methods is the major driving factor of this market.

The global market based on sources has been segmented into leaves, barks, fruits & vegetables, and roots. The leaves segment accounted for the largest market share in 2015 as herbal supplements are largely made up of plant leaves. Leaves of herbal plants contain medicinal properties, which are extracted for the production of herbal supplements. Ginkgo biloba and Camellia sinensis (green tea) are some of the common leaf extracts used to make these supplements. The demand for herbal products in medicines, food & beverage, and cosmetics has led to the growth of the leaves segment in the market.

The global market, based on application, has been segmented into pharmaceuticals, food & beverages, and personal care. The pharmaceuticals segment accounted for the largest share of the herbal supplements market in 2015. The Latin American and Asia-Pacific regions are potential markets for herbal supplements in the pharmaceutical industry due to increased efficiency in research & development initiatives taken by manufacturers, as well as consumer preference toward herbal medications. The Asia-Pacific region is also expected to grow in the herbal drug market since consumers are demanding alternative medicinal products such as traditional Chinese and ayurvedic treatments.

In the function segment, the market has been segmented on the basis of medicinal, and aroma. The medicinal segment accounted for the largest share in 2015. The medicinal function of herbal plants have no side effects leading to its increased demand. Growth is also expected in developing regions such as Africa, which offers a considerable opportunity for growth of the herbal supplements market in developing regions due to high consumer acceptability.

On the basis of form, the herbal supplements market is segmented by capsules & tablets, powder, syrups, and oils. The capsules & tablets segment dominated the market. Consumers preference towards capsules & tablets due to its ease in consumption has led to its growth in the market. Moreover, high growth of the pharmaceutical industry in the developing countries, such as India and China have led to the demand for capsules & tablets in the herbal supplements industry.

The herbal supplements market in Asia-Pacific is projected to grow at the highest CAGR during the forecast period. The major driver for the growth of this market include consumer reliance on the safety and efficacy of herbal products. Regulatory impact on future growth of the market is the factor restraining the market growth.

The herbal supplements market is characterized by moderate competition due to the presence of a number of large- and small-scale firms. New product launches, acquisitions, and expansions are the key strategies adopted by these players to ensure their growth in the market. The market is dominated by players such as Archer Daniels Midland Company (U.S.), Glanbia plc (Ireland), Herbalife International of America, Inc. (U.S.), Blackmores (Australia), and Nutraceutical International Corporation (U.S.). Other major players in the market are NBTY, Inc.(U.S.), Arizona Natural Products (U.S.), Ricola (Switzerland), NaturaLife Asia Co., Ltd. (Korea), and Bio-Botanica Inc. (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Periodization

1.4 Currency

1.5 Units

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Opportunities in this Market

4.2 Key Herbal Supplements Markets

4.3 Life Cycle Analysis: Herbal Supplements Market, By Region

4.4 Market, By Function

4.5 Asia-Pacific Market, By Application

4.6 Prime Markets for Herbal Supplements, By Source

4.7 Market, By Region

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Source

5.2.2 By Application

5.2.3 By Form

5.2.4 By Function

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Aging Population

5.3.1.2 Growing Female Buyers for Herbal Supplements

5.3.1.3 Growing Use of Herbal Products By the Young Demographic

5.3.1.4 Increasing Consumer Awareness About Preventive Health Care Measures

5.3.2 Restraints

5.3.2.1 Regulatory Impact on Future Growth of the Herbal Supplements Market

5.3.3 Opportunities

5.3.3.1 Growth Potential in Emerging Markets

5.3.3.2 Increasing Incidence of Health Disorders

5.3.3.3 Side Effects of Allopathic Drugs

5.3.4 Challenges

5.3.4.1 High Cost of Raw Materials

5.4 Value Chain

6 Herbal Supplements Market, By Source (Page No. - 51)

6.1 Introduction

6.2 Leaves

6.3 Barks

6.4 Fruits & Vegetables

6.5 Roots

6.6 Others

7 Herbal Supplements Market, By Application (Page No. - 59)

7.1 Introduction

7.2 Pharmaceuticals

7.3 Food & Beverages

7.4 Personal Care

7.5 Others

8 Herbal Supplements Market, By Function (Page No. - 66)

8.1 Introduction

8.2 Medicinal

8.3 Aroma

8.4 Other Functions

9 Herbal Supplements Market, By Form (Page No. - 72)

9.1 Introduction

9.2 Capsules & Tablets

9.3 Powder

9.4 Syrups

9.5 Oils

9.6 Others

10 Regulatory Framework (Page No. - 76)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia-Pacific

10.5 RoW

11 Market, By Region (Page No. - 81)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia-Pacific

11.5 RoW

12 Competitive Landscape (Page No. - 105)

12.1 Overview

12.2 Competitive Situation & Trends

12.3 Expansions

12.4 Acquisitions

12.5 New Product Launches

12.6 Joint Ventures

13 Company Profiles (Page No. - 111)

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis, Key Strategies)*

13.1 Introduction

13.2 Archer Daniels Midland Company

13.3 Glanbia PLC

13.4 Herbalife International of America, Inc.

13.5 Blackmores Limited

13.6 Nutraceutical International Corporation

13.7 Nbty, Inc.

13.8 Arizona Natural Products

13.9 Ricola AG

13.10 Naturalife Asia Co., Ltd.

13.11 Bio-Botanica Inc.

*Details on Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis, Key Strategies Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 132)

14.1 Primary Insights

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Company Developments

14.4.1 Expansions

14.5 Introducing RT: Real Time Market Intelligence

14.6 Available Customizations

14.7 Related Reports

14.8 Author Details

List of Tables (75 Tables)

Table 1 Consumption of Herbal Supplements, By Age Group, 20142022 (Million Tons)

Table 2 Consumption of Herbal Supplements By Gender, 20142022 (Million Tons)

Table 3 Consumption of Herbal Supplements, By Age Group, 20142022 (Tons)

Table 4 Herbal Supplements Market Size, By Source, 20142022 (USD Billion)

Table 5 Market Size, By Source, 20142022 (Tons)

Table 6 Leaves Market Size, By Region, 20142022 (USD Billion)

Table 7 Leaves Market Size, By Region, 20142022 (Tons)

Table 8 Barks Market Size, By Region, 20142022 (USD Billion)

Table 9 Barks Market Size, By Region, 20142022 (Tons)

Table 10 Fruits & Vegetables Market Size, By Region, 20142022 (USD Billion)

Table 11 Fruits & Vegetables Market Size, By Region, 20142022 (Tons)

Table 12 Roots Market Size, By Region, 20142022 (USD Billion)

Table 13 Roots Market Size, By Region, 20142022 (Tons)

Table 14 Other Sources Market Size, By Region, 20142022 (USD Billion)

Table 15 Other Sources Market Size, By Region, 20142022 (Tons)

Table 16 Herbal Supplements Market Size, By Application, 20142022 (USD Billion)

Table 17 Market Size, By Application, 20142022 (Tons)

Table 18 Herbal Supplements: Pharmaceuticals Market Size, By Region, 20142022 (USD Billion)

Table 19 Herbal Supplements: Pharmaceuticals Market Size, By Region, 20142022 (Tons)

Table 20 Herbal Supplements: Food & Beverages Market Size, By Region, 20142022 (USD Billion)

Table 21 Herbal Supplements: Food & Beverages Market Size, By Region, 20142022 (Tons)

Table 22 Herbal Supplements: Personal Care Market Size, By Region, 20142022 (USD Billion)

Table 23 Herbal Supplements: Personal Care Market Size, By Region, 20142022 (Tons)

Table 24 Other Market Size for Herbal Supplements, By Region, 20142022 (USD Billion)

Table 25 Other Market Size for Herbal Supplements, By Region, 20142022 (Tons)

Table 26 Herbal Supplements Market Size, By Function, 20142022 (USD Billion)

Table 27 Market Size, By Function, 20142022 (Tons)

Table 28 Herbal Supplements: Medicinal Market Size, By Region, 20142022 (USD Billion)

Table 29 Medicinal Market Size for Herbal Supplements, By Region, 20142022 (Tons)

Table 30 Aroma: Market Size, By Region, 20142022 (USD Billion)

Table 31 Aroma: Market Size, By Region, 20142022 (Tons)

Table 32 Other Functions: Market Size, By Region, 20142022 (USD Billion)

Table 33 Other Functions: Market Size, By Region, 20142022 (Tons)

Table 34 Herbal Supplements Market Size, By Form, 20142022 (USD Billion)

Table 35 Market Size, By Form, 20142022 (Tons)

Table 36 Market Size, By Region, 20142022 (USD Billion)

Table 37 Market Size, By Region, 20142022 (Tons)

Table 38 North America: Herbal Supplements Market Size, By Country, 20142022 (USD Billion)

Table 39 North America: Market Size, By Country, 20142022 (Tons)

Table 40 North America: Market Size, By Source, 20142022 (USD Billion)

Table 41 North America: Market Size, By Source, 20142022 (Tons)

Table 42 North America: Market Size, By Application, 20142022 (USD Billion)

Table 43 North America: Market Size, By Application, 20142022 (Tons)

Table 44 North America: Market Size, By Function, 20142022 (USD Billion)

Table 45 North America: Market Size, By Function, 20142022 (Tons)

Table 46 Europe: Market Size, By Country, 20142022 (USD Billion)

Table 47 Europe: Market Size, By Country, 20142022 (Tons)

Table 48 Europe: Market Size, By Source, 20142022 (USD Billion)

Table 49 Europe: Market Size, By Source, 20142022 (Tons)

Table 50 Europe: Market Size, By Application, 20142022 (USD Billion)

Table 51 Europe: Market Size, By Application, 20142022 (Tons)

Table 52 Europe: Market Size, By Function, 20142022 (USD Billion)

Table 53 Europe: Market Size, By Function, 20142022 (Tons)

Table 54 Asia-Pacific: Herbal Supplements Market Size, By Country, 20142022 (USD Billion)

Table 55 Asia-Pacific: Market Size, By Country, 20142022 (Tons)

Table 56 Asia-Pacific: Market Size, By Source, 20142022 (USD Billion)

Table 57 Asia-Pacific: Market Size, By Source, 20142022 (Tons)

Table 58 Asia-Pacific: Market Size, By Application, 20142022 (USD Billion)

Table 59 Asia-Pacific: Market Size, By Application, 20142022 (Tons)

Table 60 Asia-Pacific: Market Size, By Function, 20142022 (USD Billion)

Table 61 Asia-Pacific: Market Size, By Function, 20142022 (Tons)

Table 62 RoW: Herbal Supplements Market Size, By Country/ Region, 20142022 (USD Billion)

Table 63 RoW: Market Size, By Country/ Region, 20142022 (Tons)

Table 64 RoW: Market Size, By Source, 20142022 (USD Billion)

Table 65 RoW: Market Size, By Source, 20142022 (Tons)

Table 66 RoW: Market Size, By Application, 20142022 (USD Billion)

Table 67 RoW: Market Size, By Application, 20142022 (Tons)

Table 68 RoW: Market Size, By Function, 20142022 (USD Billion)

Table 69 RoW: Market Size, By Function, 20142022 (Tons)

Table 70 Rank of Key Companies as Per Revenue (2015)

Table 71 R&D Expenditure of Key Companies. 2015 (USD Million)

Table 72 Expansions, 20112015

Table 73 Acquisitions, 2012-2015

Table 74 Product/ Service/ Technology Launches, 2014-2016

Table 75 Expansions, 20112016

List of Figures (46 Figures)

Figure 1 Market Segmentation

Figure 2 Herbal Supplements Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Herbal Supplements Market Snapshot, By Application, (2016 vs 2022) (USD Billion)

Figure 7 Market Size, By Region, 20162022 (USD Billion)

Figure 8 Market Size, By Function, 20162022 (USD Billion)

Figure 9 Market Size, By Source and Form (USD Billion)

Figure 10 Market Share (Value), By Region, 2015

Figure 11 Aging Population & Consumer Awareness Regarding Benefits of Herbs are Expected to Drive the global Market

Figure 12 Emerging Markets in the Global Markets, 2016

Figure 13 Asia-Pacific Poised for Robust Growth, 2016 to 2022

Figure 14 Medicinal Herbal Supplements are Projected to Record High Growth Between 2016 & 2022

Figure 15 Pharmaceuticals are Expected to Account for the Largest Share in the Market in Asia-Pacific, 2015

Figure 16 Leaves Segment Dominated the Market in 2015

Figure 17 Europe is Projected to Be the Largest Market for Herbal Supplements During the Forecast Period

Figure 18 Market, By Source

Figure 19 Market, By Application

Figure 20 Market, By Form

Figure 21 Market, By Function

Figure 22 Market, By Region

Figure 23 Market Dynamics: Herbal Supplements

Figure 24 People Aged Above 60 Years: Developed vs Developing Countries (19902050)

Figure 25 Value Chain: Herbal Supplements Market

Figure 26 Leaves to Lead the Market for Herbal Supplements By 2022 (USD Billion)

Figure 27 Pharmaceuticals Segment is Expected to Lead the Market By 2022 (USD Billion)

Figure 28 Medicinal Segment is Expected to Lead the Market By 2022 (USD Billion)

Figure 29 Capsules & Tablets Segment is Projected to Dominate the Herbal Supplements Market Through to 2022 in Terms of Value

Figure 30 Europe is Expected to Dominate the Herbal Supplements Market Between 2016 and 2022 (USD Billion)

Figure 31 Italy is Expected to Witness the Fastest Growth in the European Herbal Supplements Market By 2022 (USD Billion)

Figure 32 Europe: Germany is Expected to Drive the Market Growth for Herbal Supplements

Figure 33 Asia-Pacific: Consumer Preference for Herbal Ingredients is Set to Drive Consumption of Herbal Supplements

Figure 34 India is Expected to Witness Fastest Growth in the Asia-Pacific Herbal Supplements Market (USD Billion)

Figure 35 Companies Adopted Expansions and Acquisitions as the Key Growth Strategies Between 2011 & 2016

Figure 36 Number of Developments Between 2013 and 2016

Figure 37 Archer Daniels Midland Company: Company Snapshot

Figure 38 Archer Daniels Midland Company: SWOT Analysis

Figure 39 Glanbia PLC: Company Snapshot

Figure 40 Glanbia PLC: SWOT Analysis

Figure 41 Herbalife International of America, Inc.: Company Snapshot

Figure 42 Herbalife International of America, Inc.: SWOT Analysis

Figure 43 Blackmores : Company Snapshot

Figure 44 Blackmores : SWOT Analysis

Figure 45 Nutraceutical International Corporation: Company Snapshot

Figure 46 Nutraceutical International Corporation: SWOT Analysis

Growth opportunities and latent adjacency in Herbal Supplements Market