Surface Disinfectant Market: Growth, Size, Share, and Trends

Surface Disinfectant Market by Composition (Alcohols, Chlorine, Quaternary Ammonium, H2O2), Type (Liquid, Wipes, Sprays), Application (Surface Disinfection), End User (Hospitals, Clinics, Diagnostic Laboratories), & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The surface disinfectant market is expected to grow from USD 3.04 billion in 2025 to USD 4.38 billion by 2030, registering a CAGR of 7.6% during the forecast period. Market expansion is primarily fueled by the heightened emphasis on infection prevention to reduce hospital-acquired infections and the increasing utilization of advanced disinfectant formulations for effective surface sanitization.

KEY TAKEAWAYS

-

BY COMPOSITIONBased on composition, the surface disinfectant market is categorized into alcohols, chlorine compounds, quaternary ammonium compounds, hydrogen peroxide, peracetic acid, phenolic compounds, and other compositions. The alcohols segment held the dominant share of the market driven by their broad-spectrum antimicrobial activity, rapid evaporation rate, and compatibility with a wide range of surfaces, making them ideal for both healthcare and commercial environments.

-

BY TYPEBased on type, the surface disinfectant market is segmented into liquids, wipes, and sprays. The liquids segment holds the largest share of the market, driven by its versatility, superior surface coverage, and ease of application across healthcare, commercial, and household settings.

-

BY APPLICATIONBased on application, the surface disinfectant market is segmented into surface disinfection, instrument disinfection, and other applications. The surface disinfection segment dominates the market, driven by the critical need to maintain hygiene and prevent healthcare-associated infections (HAIs) in medical and laboratory environments.

-

BY END USERBased on end user, the surface disinfectant market is segmented into hospitals, clinics & ambulatory surgical centers (ASCs), diagnostic laboratories, pharmaceutical and biotechnology companies, and research laboratories. The hospitals, clinics & ASCs segment holds the largest market share, driven by the high incidence of healthcare-associated infections (HAIs) and the implementation of strict infection prevention and control guidelines established by global health authorities such as the CDC and WHO.

-

BY REGIONBased on region, the surface disinfectant market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the market, driven by advanced healthcare infrastructure, stringent infection control regulations, and high adoption of modern disinfectant solutions.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including product launches, agreements, partnership, expansions, and collaborations. For instance, Reckitt Benckiser (UK) and The Clorox Copmany (US) have entered into a number of collaborations and agreements to cater to the growing demand for surface disinfectants across the applications.

The surface disinfectant market is witnessing steady growth, driven by the increasing focus on infection control measures to mitigate hospital-acquired infections and the rising adoption of advanced disinfectants for effective sanitization. Growing consumer awareness about hygiene across healthcare and community settings, along with the surge in surgical procedures, continues to strengthen market demand and enhance infection prevention standards. New deals and developments, including the shift toward eco-friendly and non-toxic disinfectant formulations, increasing healthcare expenditures in emerging economies, and innovations in sustainable, high-efficacy disinfection solutions, are reshaping the industry landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on end users in the surface disinfectant market is driven by increasing focus on infection control measures and growing awareness of hygiene across healthcare and public settings. Hospitals, clinics, and diagnostic laboratories, the primary consumers of surface disinfectants are responding to these trends by adopting advanced and eco-friendly disinfectant solutions. Shifts such as the rising preference for non-toxic, sustainable formulations and innovations in high-efficacy disinfectants are expected to alter the revenue mix for end users, influencing purchasing patterns and budgets. These changes, in turn, will impact the revenues of surface disinfectant manufacturers, creating opportunities for companies that can offer effective, safe, and environmentally friendly products in line with evolving market demands.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing focus on mitigating hospital-acquired infections

-

Rising adoption of advanced surface disinfectants for sanitization

Level

-

Potential consequences of chemical disinfectant use

-

Increasing adoption of alternative surface disinfection methods

Level

-

Rising healthcare expenditure in emerging economies

-

Shift toward eco-friendly and non-toxic disinfectants

Level

-

Strict regulatory requirements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing focus on mitigating hospital-acquired infections.

Hospital-acquired infections (HAIs) are infections acquired during a patient’s stay in healthcare facilities and can arise from contaminated medical devices or surfaces. Common HAIs include surgical-site infections, bloodstream infections, urinary tract infections, and pneumonia, often caused by bacteria such as MRSA, C. difficile, E. coli, and Klebsiella. The use of surface disinfectants in hospitals, clinics, and diagnostic facilities plays a critical role in reducing these infections, highlighting the ongoing need for effective disinfection practices to ensure patient safety and improve healthcare outcomes.

Restraint: Potential consequences of chemical disinfectant use.

While chemical disinfectants are effective in controlling microorganisms and preventing infections, their improper or excessive use can pose health, environmental, and material risks. Prolonged exposure may lead to respiratory issues or skin irritation, while improper disposal can harm ecosystems. Overuse can also contribute to antimicrobial resistance, and frequent application on surfaces may cause corrosion or material deterioration, affecting equipment longevity and effectiveness.

Opportunity: Shift toward eco-friendly and non-toxic disinfectants.

The growing demand for eco-friendly and non-toxic surface disinfectants presents significant opportunities for market expansion. These alternatives reduce environmental pollution and minimize health risks associated with traditional chemical disinfectants. Innovations such as citric acid-based and pH-neutral formulations are gaining traction, offering effective cleaning without harming sensitive surfaces or ecosystems. With increasing regulatory support and consumer awareness, manufacturers have the opportunity to develop biodegradable, plant-based, and safe disinfectant solutions that meet both efficacy and sustainability standards.

Challenge: Strict regulatory requirements.

The surface disinfectant market faces challenges due to stringent regulatory guidelines governing product formulation, usage, and labeling. In many countries, agencies such as the EPA, OSHA, and FDA enforce strict compliance for disinfectants used on surfaces and medical devices. Users must follow precise instructions regarding dilution, contact time, and application methods, with non-compliance potentially leading to legal action. Similar regulations are being adopted in emerging markets, making adherence to rigorous disinfection standards a critical challenge for manufacturers and end users alike.

Surface Disinfectant Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides EPA-registered disinfectants such as Lysol Professional solutions for institutional hygiene across healthcare, offices, and public spaces. | Delivers broad-spectrum disinfection; trusted performance in high-traffic environments; supports infection control protocols across industries. |

|

Offers professional-grade disinfectants like Microban 24 Professional and Comet cleaner products for commercial and institutional environments. | Provides continuous antibacterial protection; supports efficient facility hygiene; enhances staff and guest safety with long-lasting efficacy. |

|

Develops EPA-registered disinfectants including 3M Quat Disinfectant Cleaner for healthcare facilitities cleaning. | Offers fast-acting broad coverage; integrates with dilution control systems for safety and efficiency; supports infection prevention in critical settings. |

|

Supplies disinfectant wipes, RTU sprays, and concentrated systems like Disinfectant 1 and Peroxide Multi Surface Cleaner for healthcare disinfection. | Delivers hospital-grade efficacy with 1-minute kill time; reduces labor time with ready-to-use formats; ensures regulatory compliance and safety. |

|

Provides CloroxPro product line including germicidal bleach, hydrogen peroxide disinfectants, and electrostatic sprayers for professional use. | Offers high-efficacy disinfection against pathogens including C. difficile; adaptable for diverse surface types; trusted in hospitals and institutions. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The surface disinfectant market ecosystem consists of manufacturers, distributors, end users, investors, and regulatory bodies. Manufacturers engage in research, product development, optimization, and the launch of various disinfectant formulations, including alcohols, chlorine compounds, quaternary ammonium compounds, hydrogen peroxide, peracetic acid, phenolic compounds, and others. Distributors, including third-party suppliers and e-commerce platforms, connect manufacturers with the market, ensuring broad availability of products. End users, such as hospitals, clinics, diagnostic laboratories, and research facilities, drive demand for surface disinfectants to maintain hygiene and prevent infections. Meanwhile, investors and health regulatory authorities play a critical role in influencing product standards, adoption, and market growth. Collaboration across this value chain is essential to drive innovation, regulatory compliance, and adoption of advanced disinfectant solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Surface Disinfectant Market , By Composition

In 2024, the alcohols segment held the largest share of the surface disinfectant market. This dominance is driven by broad-spectrum antimicrobial efficacy, rapid action, and widespread availability. Alcohol-based disinfectants are highly effective against bacteria, viruses, and fungi, making them ideal for healthcare, laboratory, and commercial environments. Their fast evaporation rate, ease of application, and compatibility with various surfaces further reinforce their leading position. Additionally, the growing adoption of ethanol- and isopropanol-based formulations in response to infection control concerns has strengthened the segment’s market leadership.

Surface Disinfectant Market , By Type

In 2024, liquids dominated the market among surface disinfectant types. Their versatility, ability to cover large surface areas, and suitability for multiple cleaning methods make them preferred across healthcare facilities, laboratories, and industrial settings. Liquids can be applied manually or through automated systems, ensuring thorough surface coverage. Their ease of formulation with active ingredients such as alcohols, chlorine compounds, and hydrogen peroxide also supports their widespread adoption, contributing to their strong market share.

Surface Disinfectant Market , By Application

The surface disinfection segment accounted for the largest share in 2024. Maintaining hygienic, pathogen-free surfaces in healthcare and diagnostic facilities is critical to preventing hospital-acquired infections (HAIs). High-touch areas such as patient beds, countertops, surgical equipment, and diagnostic tools require frequent and effective disinfection, driving consistent demand for surface disinfectants. The emphasis on infection prevention protocols and regulatory compliance reinforces the leading position of this application segment.

Surface Disinfectant Market , By End User

In 2024, hospitals, clinics, and ambulatory surgical centers (ASCs) dominated the end-user segment. This is primarily due to the high risk of HAIs and stringent infection control measures mandated by health authorities. Continuous disinfection practices in patient care areas, surgical suites, and high-touch zones ensure that these facilities remain major consumers of surface disinfectants. The segment’s dominance is further supported by ongoing investments in infection prevention technologies and adoption of advanced disinfectant formulations.

REGION

North America to be fastest-growing region in global Surface Disinfectant Market during forecast period

In 2024, North America held the largest share of the surface disinfectant market. The region’s dominance is driven by advanced healthcare infrastructure, strict regulatory standards, and high adoption of modern disinfectant solutions. Hospitals, clinics, and diagnostic laboratories rely heavily on surface disinfectants to maintain hygiene and prevent healthcare-associated infections (HAIs). The emphasis on infection control protocols, patient safety, and compliance with agencies such as the CDC, FDA, and EPA further reinforces the region’s leading position in the market.

Surface Disinfectant Market: COMPANY EVALUATION MATRIX

In the surface disinfectant market matrix, Reckitt Benckiser (UK) and Procter & Gamble (US) lead as Star players, driven by their strong product portfolios, extensive global reach, and consistent innovation in hygiene and disinfection solutions. Ecolab (US) and 3M (US) also hold prominent positions, leveraging their advanced technologies and strong customer base in healthcare and commercial sectors. The Clorox Company (US) continues to maintain a robust presence through its trusted consumer disinfectant brands and high brand recall. While Reckitt Benckiser and Procter & Gamble dominate the market through scale and brand strength, Ecolab and 3M demonstrate significant potential to advance further through technological innovation and expansion in institutional hygiene applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.04 Billion |

| Market Forecast in 2030 (Value) | USD 4.38 Billion |

| Growth Rate | CAGR of 7.6% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units Mn) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Surface Disinfectant Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- January 2025 : Reckitt Benckiser announced the expansion of its R&D capabilities with the establishment of a Global R&D Science and Innovation Centre in Shanghai, China, scheduled to launch in 2026. This initiative reinforces the company’s commitment to developing advanced product solutions and enhancing local innovation capacity for the Chinese market.

- September 2023 : Paul Hartmann AG introduced the Bacillol Zero Tissues across Germany, Austria, and the Netherlands, marking a step toward sustainable and eco-friendly surface disinfection solutions that align with the growing demand for environmentally responsible products.

- November 2022 : Reckitt Benckiser partnered with Essity to launch a co-branded range of disinfection products for professional hygiene customers, combining the strength of the Dettol and Tork brands. Available since January 2023 in the UK, Ireland, Germany, and Austria, this collaboration enhances their joint presence in the professional hygiene segment.

Table of Contents

Methodology

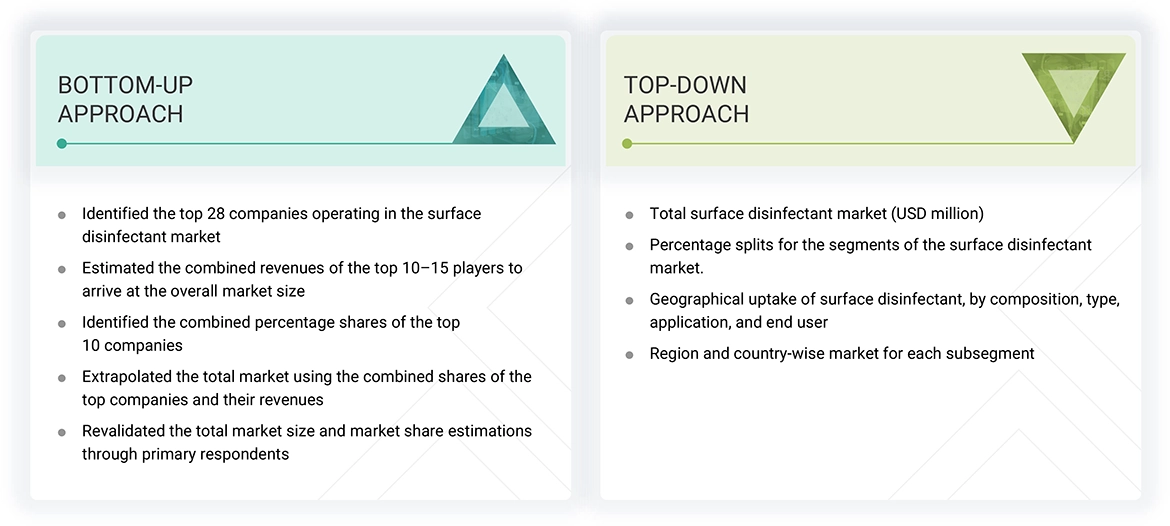

This study involved the extensive use of primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, investor presentations, SEC filings of companies and publications from government sources such as National Institutes of Health (NIH), US FDA, World Health Organization (WHO), International Trade Administration (ITA), US Census Bureau, and Centers for Medicare and Medicaid Services (CMS) were referred to identify and collect information for the global surface disinfectant market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research phase, a comprehensive approach was employed, involving the interviewing of several sources from the supply and demand sides. These interviews aimed to obtain the quantitative and qualitative information needed to put up this report. Industry experts from core and associated industries, as well as preferred manufacturers, distributors, suppliers, technological innovators, and organizations involved in all facets of this industry's value chain, served as the primary information sources. Numerous primary respondents, including important industry participants, subject-matter specialists, C-level executives of the major market companies, and industry advisers, were the focus of extensive inquiry. The objective was to comprehensively evaluate potential futures and collect and validate significant qualitative and quantitative insights.

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global surface disinfectant market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/subsegments was done for the major players. The global surface disinfectant market was split into various segments and sub-segments based on:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various surface disinfectant manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from surface disinfectant (or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global surface disinfectant market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall size of the global surface disinfectant market through the above-mentioned methodology, this market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

A surface disinfectant is an antimicrobial agent applied to the surface of objects to eliminate microorganisms. Surface disinfectants play a vital role in removing pathogens and germs, thereby ensuring effective protection against infections. Surface disinfectants are primarily used to clean walls, floors, and other surfaces in hospitals, as well as to disinfect medical devices and instruments.

Stakeholders

- Manufacturers and Vendors of surface disinfectants

- Pharmaceutical & Biopharmaceutical Companies

- Distributors of Surface Disinfectants

- Healthcare Institutions

- Government Bodies/Municipal Corporations

- Regulatory Bodies

- Business Research and Consulting Service Providers

- Venture Capitalists and Investors

- Market Research and Consulting Firms

- Healthcare Providers

Report Objectives

- To describe, analyze, and forecast the surface disinfectant market by composition, type, application, end user, and region

- To describe and forecast the surface disinfectant market in key regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To profile key players and comprehensively analyze their market shares and core competencies2 in the surface disinfectant market

- To analyze competitive developments such as product launches, agreements, partnerships, expansions, collaborations, and other developments in the surface disinfectant market

- To analyze the impact of AI/Gen AI on the surface disinfectant market in terms of its capabilities, potential, use cases, and future

Key Questions Addressed by the Report

- Hospitals, Clinics, and ASCs

- Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

- Research Laboratories.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Surface Disinfectant Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Surface Disinfectant Market

Steven

Mar, 2022

Which is the fastest growing market of Surface Disinfectant Market?.

Andrew

Mar, 2022

Can you enlighten us with your market intelligence to grow and sustain in Surface Disinfectant Market?.

Paul

Mar, 2022

What are the growth estimates for Surface Disinfectant Market till 2026?.