Agricultural Disinfectants Market by Type (Hypochlorites & Halogens, Quaternary Ammonium Compounds & Phenols, Oxidizing Agents & Aldehydes), Application Area (Surface, Aerial, Water Sanitizing), End Use, Form, and Region - Global Forecast to 2021

The agricultural disinfectants market was valued at USD 1.64 Billion in 2015 and is projected to grow at a CAGR of 4.3% from 2016, to reach USD 2.11 Billion by 2021. The main objectives of the report are to define, segment, and project the size of the global market with respect to type, application area, end use, form, and region, provide detailed information regarding the key factors influencing the growth of the market, and strategically profile key players and comprehensively analyze their core competencies.

Years considered for this report

2015 Base Year

2016 Estimated Year

2021 Projected Year

Research Methodology

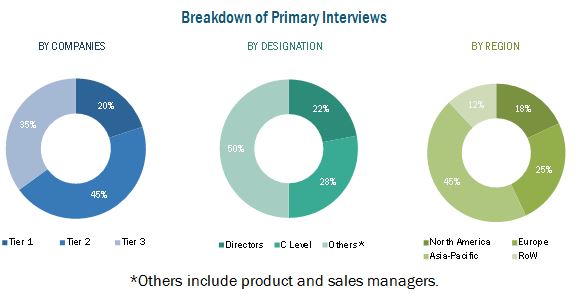

This research study involves the extensive usage of secondary sources such as Food and Agriculture Organization of the United Nations (FAO), FEFANA (EU Association of Specialty Feed Ingredients and their Mixtures), International Food and Agribusiness Management Association (IFAMA), and others to identify and collect information useful for this technical, market-oriented, and commercial study of the agricultural disinfectants market. The primary sources are mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, reimbursement providers, technology developers, alliances, and standard and certification organizations related to all the segments of this industrys value chain. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants among other experts to obtain and verify critical qualitative and quantitative information as well as to assess future prospects.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of agricultural disinfectants begins with R&D and product development, in which the selection of source and the quality of the product are determined by the requirement of the product. The value chain helps in bringing about coordination among stakeholders such as The Chemours Company (U.S.), Zoetis (U.S.), Nufarm Limited (U.S.), The Dow Chemical Company (U.S.), and Neogen Corporation (U.S.) for smooth business operations.

Target Audience

The key stakeholders for the report include:

- Agricultural disinfectant manufacturers

- Agricultural disinfectant importers and exporters

- Government regulatory authorities and research organizations

- Agricultural disinfectant associations and industry bodies

- Organic certification agencies

Scope of the Report

On the basis of Type, the market is segmented into:

- Hypochlorites & halogens

- Quaternary ammonium compounds & phenols

- Oxidizing agents & aldehydes

- Others (alcohols and acids)

On the basis of Application area, the market is segmented into:

- Surface

- Aerial

- Water sanitizing

On the basis of End Use, the market is segmented into:

- Livestock farms

- Agricultural farms

On the basis of Form, the market is segmented into:

- Liquid

- Powder

- Others (granular & gel forms)

On the basis of Region, the market is segmented into:

- North America

- Europe

- Asia-Pacific

- Latin America

- RoW

Key Take-Aways From This Report Include:

- Global market size in 2015; industry growth forecast from 2016 to 2021

- The quaternary ammonium compounds & phenols segment dominated the global market in 2015

- The North American agricultural disinfectants market was the dominant region in 2015

- Agricultural disinfectants market: Porters Five Forces Analysis, key drivers, and key opportunities

- Detailed company profiles of key agricultural disinfectant manufacturers

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The market size of agricultural disinfectants is projected to reach USD 2.11 Billion by 2021, growing at a CAGR of around 4.3% from 2016. The global agricultural disinfectants market has grown exponentially in the last few years. Increase in demand for animal products, emergence of greenhouse vegetable production and vertical farming, rising incidences of disease outbreaks among livestock, and ban on antibiotics in animal feed are the major driving factors for this market.

On the basis of type, the global market is segmented into hypochlorites & halogens, quaternary ammonium compounds & phenols, oxidizing agents & aldehydes, and others (alcohols and acids). The quaternary ammonium compounds & phenols segment accounted for the largest market share in 2015, followed by oxidizing agents & aldehydes. The quaternary ammonium compounds & phenols segment is projected to grow at the highest CAGR during the forecast period.

The agricultural disinfectants market, based on application area, is segmented into surface, aerial, and water sanitizing. The surface segment accounted for the largest share in the global agricultural disinfectant market in 2015. It helps to remove dirt, dust, manure, and other unwanted materials from the surface and disinfect the wooden, painted, and concrete surfaces in greenhouses and other crop production facilities.

On the basis of end use, the global market is segmented into livestock farms and agricultural farms. Disinfectants are used by livestock farmers on newborn animals that are highly vulnerable to diseases and infections, due to their immature immune systems.

On the basis of form, the agricultural disinfectants market is segmented into liquid, powder, and others (granular and gel). The liquid formulation is projected to grow at the highest CAGR during the forecast period. Liquid agricultural disinfectants are gaining popularity as they are of low cost, less visible on the treated surfaces, and can be applied easily.

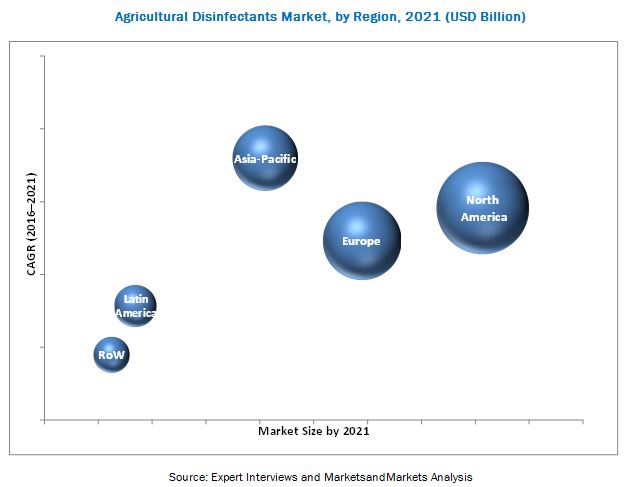

The Asia-Pacific region is projected to grow at the highest CAGR during the forecast period owing to the increasing demand for animal products in the region. Growth in population, rise in disposable incomes, progressive urbanization in the Asia-Pacific region, and an increase in demand for quality meat products have driven the demand for agricultural disinfectants. Growth is majorly witnessed in China, India, and Japan due to increase in the purchasing power of the population.

The major restraints of the agricultural disinfectants market include harmful effects of disinfectants, lack of awareness, and low adoption rate. The agricultural disinfectant market has a number of large- and small-scale firms. New product developments, agreements, and investments are the key strategies adopted by market players to ensure their growth in this market. Players such as The Chemours Company (U.S.), Zoetis (U.S.), Nufarm Limited (U.S.), The Dow Chemical Company (U.S.), and Neogen Corporation (U.S.) collectively accounted for the largest portion of this market till July 2016.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Periodization Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in this Market

4.2 Agricultural Disinfectants Market, By Key Country, 2016

4.3 Life Cycle Analysis: Agricultural Disinfectant Market, By Region

4.4 Market, By Application Area

4.5 Market, By Type & Region, 2015

4.6 North America: the Largest Market for Agricultural Disinfectants

4.7 Agricultural Disinfectant Market, By Type

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Macroindicators

5.2.1 Increase in the Global Population

5.2.2 GDP: Agricultural Sector

5.2.3 Decrease in Arable Land Per Capita

5.3 Market Segmentation

5.3.1 By Type

5.3.2 By Application Area

5.3.3 By End Use

5.3.4 By Form

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increase in Demand for Animal Products

5.4.1.2 Emergence of Greenhouse Vegetable Production and Vertical Farming

5.4.1.3 Increasing Incidences of Disease Outbreaks Among Livestock

5.4.1.4 Ban on Antibiotics in Animal Feed

5.4.2 Restraints

5.4.2.1 Lack of Awareness & Low Adoption Rate

5.4.2.2 Harmful Effects of Disinfectants

5.4.3 Opportunities

5.4.3.1 Developing Countries Expected to Witness Strong Demand

5.4.4 Challenges

5.4.4.1 Poor Infrastructure in Developing Regions

6 Industry Trends (Page No. - 53)

6.1 Value Chain Analysis

6.2 Supply Chain Analysis

6.2.1 Prominent Companies

6.2.2 Small & Medium Enterprises

6.2.3 End Users

6.2.4 Key Influencers

6.3 Porters Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Bargaining Power of Suppliers

6.3.3 Bargaining Power of Buyers

6.3.4 Threat of New Entrants

6.3.5 Threat of Substitutes

6.4 Regulatory Environment

6.4.1 Registration of Disinfectants

6.4.2 Laws on Disinfectants Use

6.5 Patent Analysis

7 Agricultural Disinfectants Market, By Type (Page No. - 61)

7.1 Introduction

7.2 Hypochlorites & Halogens

7.3 Oxidizing Agents & Aldehydes

7.4 Quaternary Ammonium Compounds & Phenols

7.5 Others

8 Agricultural Disinfectants Market, By Application Area (Page No. - 69)

8.1 Introduction

8.2 Surface

8.3 Aerial

8.4 Water Sanitizing

9 Agricultural Disinfectants Market, By Form (Page No. - 76)

9.1 Introduction

9.2 Liquid

9.3 Powder

9.4 Others

10 Agricultural Disinfectants Market, By End Use (Page No. - 83)

10.1 Introduction

10.2 Livestock Farms

10.3 Agricultural Farms

11 Agricultural Disinfectants Market, By Region (Page No. - 89)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Russia

11.3.2 Germany

11.3.3 France

11.3.4 Italy

11.3.5 Spain

11.3.6 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 Australia

11.4.5 Rest of Asia-Pacific

11.5 Latin America

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Rest of Latin America

11.6 Rest of the World (RoW)

11.6.1 Africa

11.6.2 Middle East

12 Competitive Landscape (Page No. - 121)

12.1 Overview

12.2 Competitive Situations & Trends

12.2.1 New Product Launches

12.2.2 Agreements & Investments

12.2.3 Acquisitions

12.2.4 Expansions

13 Company Profiles (Page No. - 126)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 The Chemours Company

13.3 Zoetis

13.4 Nufarm Limited

13.5 Stepan Company

13.6 The DOW Chemical Company

13.7 Neogen Corporation

13.8 Fink TEC GmbH

13.9 Quat-Chem Ltd.

13.10 Thymox Technology

13.11 Entaco NV

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 150)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Other Developments

14.5 Introducing RT: Real-Time Market Intelligence

14.6 Available Customizations

14.7 Related Reports

List of Tables (71 Tables)

Table 1 List of Approved Disinfectants

Table 2 Patents Related to Disinfectants

Table 3 Agricultural Disinfectants Market Size, By Type, 20142021 (USD Million)

Table 4 Market Size, By Type, 20142021 (KT)

Table 5 Hypochlorites & Halogens Market Size, By Region, 20142021 (USD Million)

Table 6 Oxidizing Agents & Aldehydes Market Size, By Region, 20142021 (USD Million)

Table 7 Quaternary Ammonium Compounds & Phenols Market Size, By Region, 20142021 (USD Million)

Table 8 Other Disinfectants Market Size, By Region, 20142021 (USD Million)

Table 9 Market Size for Agricultural Disinfectants, By Application Area, 20142021 (USD Million)

Table 10 Market Size, By Application Area, 20142021 (KT)

Table 11 Surface Agricultural Disinfectant Market Size, By Region, 20142021 (USD Million)

Table 12 Aerial Agricultural Disinfectants Market Size, By Region, 20142021 (USD Million)

Table 13 Water Sanitizing Market Size, By Region, 20142021 (USD Million)

Table 14 Market Size for Agricultural Disinfectants, By Form, 20142021 (USD Million)

Table 15 Market Size, By Form, 20142021 (KT)

Table 16 Liquid Agricultural Disinfectants Market Size, By Region, 20142021 (USD Million)

Table 17 Powdered Agricultural Disinfectant Market Size, By Region, 20142021 (USD Million)

Table 18 Other Agricultural Disinfectants Market Size for Other Forms, By Region, 20142021 (USD Million)

Table 19 Agricultural Disinfectants Market Size, By End Use, 20142021 (USD Million)

Table 20 Market Size, By End Use, 20142021 (KT)

Table 21 Livestock Farms Market Size, By Region, 2014-2021 (USD Million)

Table 22 Livestock Farms Market Size, By Type, 2014-2021 (USD Million)

Table 23 Agricultural Farms Market Size, By Region, 2014-2021 (USD Million)

Table 24 Agricultural Farms Market Size, By Type, 2014-2021 (USD Million)

Table 25 Agricultural Disinfectants Market Size, By Region, 20142021 (USD Million)

Table 26 Market Size, By Region, 20142021 (KT)

Table 27 North America: Agricultural Disinfectant Market Size, By Country, 20142021 (USD Million)

Table 28 North America: Market Size, By Type, 20142021 (USD Million)

Table 29 North America: Market Size, By Application Area, 20142021 (USD Million)

Table 30 North America: Market Size, By End-Use, 20142021 (USD Million)

Table 31 North America: Market Size, By Form, 20142021 (USD Million)

Table 32 U.S.: Agricultural Disinfectant Market Size, By Type, 20142021 (USD Million)

Table 33 Canada: Market Size for Agricultural Disinfectants, By Type, 20142021 (USD Million)

Table 34 Mexico: Market Size, By Type, 20142021 (USD Million)

Table 35 Europe: Agricultural Disinfectants Market Size, By Country, 20142021 (USD Million)

Table 36 Europe: Market Size, By Type, 20142021 (USD Million)

Table 37 Europe: Market Size, By Application Area, 20142021 (USD Million)

Table 38 Europe: Market Size, By End-Use, 20142021 (USD Million)

Table 39 Europe: Market Size, By Form, 20142021 (USD Million)

Table 40 Russia: Agricultural Disinfectant Market Size, By Type, 20142021 (USD Million)

Table 41 Germany: Market Size, By Type, 20142021 (USD Million)

Table 42 France: Market Size, By Type, 20142021 (USD Million)

Table 43 Italy: Market Size, By Type, 20142021 (USD Million)

Table 44 Spain: Market Size, By Type, 20142021 (USD Million)

Table 45 Rest of Europe: Agricultural Disinfectant Market Size, By Type, 20142021 (USD Million)

Table 46 Asia-Pacific: Agricultural Disinfectant Market Size, By Type, 20142021 (USD Million)

Table 47 Asia-Pacific: Market Size, By End Use, 20142021 (USD Million)

Table 48 Asia-Pacific: Market Size, By Form, 20142021 (USD Million)

Table 49 Asia-Pacific: Market Size, By Country, 20142021 (USD Million)

Table 50 China: Agricultural Disinfectant Market Size, By Type, 20142021 (USD Million)

Table 51 Japan: Market Size, By Type, 20142021 (USD Million)

Table 52 India: Market Size, By Type, 20142021 (USD Million)

Table 53 Australia: Agricultural Disinfectant Market Size, By Type, 20142021 (USD Million)

Table 54 Rest of Asia-Pacific: Agricultural Disinfectant Market Size, By Type, 20142021 (USD Million)

Table 55 Latin America: Agricultural Disinfectant Market Size, By Type, 20142021 (USD Million)

Table 56 Latin America: Market Size, By End Use, 20142021 (USD Million)

Table 57 Latin America: Market Size, By Form, 20142021 (USD Million)

Table 58 Latin America: Market Size, By Country, 20142021 (USD Million)

Table 59 Brazil: Agricultural Disinfectant Market Size, By Type, 20142021 (USD Million)

Table 60 Argentina: Market Size, By Type, 20142021 (USD Million)

Table 61 Rest of Latin America: Agricultural Disinfectant Market Size, By Type, 20142021 (USD Million)

Table 62 RoW: Agricultural Disinfectant Market Size, By Region, 20142021 (USD Million)

Table 63 RoW: Market Size, By Type, 20142021 (USD Million)

Table 64 RoW: Market Size, By End Use, 20142021 (USD Million)

Table 65 RoW: Market Size, By Form, 20142021 (USD Million)

Table 66 Africa: Agricultural Disinfectant Market Size, By Type, 20142021 (USD Million)

Table 67 Middle East: Agricultural Disinfectant Market Size, By Type, 20142021 (USD Million)

Table 68 New Product Launches, 20142016

Table 69 Agreements & Investments, 20122016

Table 70 Acquisitions, 2015-2016

Table 71 Expansions & Investments, 2016

List of Figures (72 Figures)

Figure 1 Agricultural Disinfectants Market Segmentation

Figure 2 Agricultural Disinfectants: Research Design

Figure 3 Breakdown of Primary Interviews, By Company, Designation, and Region

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Market Size for Agricultural Disinfectants, By Type, 2016 vs 2021 (USD Million)

Figure 8 Market Size for Agricultural Disinfectants, By End Use, 2016 vs 2021 (USD Million)

Figure 9 Agricultural Disinfectants Market, By Form: Liquid Segment is Projected to Dominate the Market Between 2016-2021

Figure 10 Market, By Application Area: Surface Segment is Projected to Dominate the Market Between 2016 & 2021

Figure 11 Agricultural Disinfectants Market Trend, By Region, 20142021 (USD Million)

Figure 12 Asia-Pacific is Projected to Be the Fastest-Growing Region for Agricultural Disinfectants Market From 2016 to 2021

Figure 13 Agricultural Disinfectants: an Emerging Market With Promising Growth Potential

Figure 14 China is Growing at Highest Rate in Agricultural Disinfectants Market, 2016 to 2021

Figure 15 Agricultural Disinfectants Market in Asia-Pacific is Experiencing High Growth

Figure 16 The Surface Segment is Projected to Be the Largest & the Fastest-Growing Segment By 2021

Figure 17 North America Accounted for the Largest Share in the Livestock Farms Segment in 2015

Figure 18 Increasing Demand for Animal Products Strengthened the Demand for Agricultural Disinfectants in the North American Region

Figure 19 Quaternary Ammonium Compounds & Phenols Segment is Projected to Be the Largest Market, By Type, 2016- 2021

Figure 20 Global Population Projected to Reach ~9.5 Billion By 2050

Figure 21 GDP: Contribution From Agricultural Sectors of Key Countries (2011-2015)

Figure 22 Decreasing Arable Land Per Capita

Figure 23 Agricultural Disinfectants Market, By Type

Figure 24 Market, By Application Area

Figure 25 Market, By End Use

Figure 26 Market, By Form

Figure 27 Market Dynamics

Figure 28 Global Demand for Meat, Growth Trend, 20002030

Figure 29 Global Increase in Consumption of Milk, 20132022

Figure 30 PE Capita Egg Consumption, 2010-2014

Figure 31 Global Greenhouse Vegetable Area Under Production, 2011-2016

Figure 32 Developing Countries Dominate the World Consumption (%), 2013-22

Figure 33 Value Chain for Agricultural Disinfectants

Figure 34 Supply Chain for Agricultural Disinfectants

Figure 35 Porters Five Forces Analysis: Agricultural Disinfectants Market

Figure 36 Quaternary Ammonium Compounds & Phenols Projected to Be the Fastest-Growing Segment During the Forecast Period

Figure 37 Hypochlorites & Halogens Market Size, By Region, 2016 vs 2021

Figure 38 Oxidizing Agents & Aldehydes Market Size, By Region, 2016 vs 2021

Figure 39 Quaternary Ammonium Compounds & Phenols Market Size, By Region, 2016 vs 2021

Figure 40 Other Disinfectants Market Size, By Region, 2016 vs 2021

Figure 41 Surface Segment Projected to Be the Fastest-Growing Segment Between 2016 and 2021

Figure 42 Asia-Pacific is Projected to Be the Fastest-Growing Market During the Forecast Period (2016-2021)

Figure 43 Europe is Projected to Be the Fastest-Growing Market During the Forecast Period (2016-2021)

Figure 44 North America is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 45 Liquid Segment is Projected to Be the Fastest-Growing Segment in Terms of Value

Figure 46 Asia-Pacific is Projected to Be the Fastest-Growing Segment During the Forecast Period (2016-2021)

Figure 47 Asia-Pacific is Projected to Be the Fastest-Growing Market During the Forecast Period (2016-2021)

Figure 48 North America is Projected to Grow at the Highest Rate During the Forecast Period (2016-2021)

Figure 49 Livestock Farms Projected to Be the Fastest-Growing Segment Between 2016 and 2021

Figure 50 Asia-Pacific is Projected to Dominate the Livestock Farms Segment During the Forecast Period (2016-2021)

Figure 51 Asia-Pacific is Projected to Grow at the Highest Rate During the Forecast Period (2016-2021)

Figure 52 Geographic Snapshot (20162021): China is Projected to Grow at the Highest Rate and is Emerging as A New Hotspot

Figure 53 North America: Agricultural Disinfectant Market Snapshot

Figure 54 Europe: Agricultural Disinfectant Market Snapshot

Figure 55 Asia-Pacific Agricultural Disinfectant Market: Snapshot

Figure 56 Latin America: Agricultural Disinfectant Market Snapshot

Figure 57 Key Strategies Adopted By Top Fivecompanies From 2012 to 2016

Figure 58 New Product Launches Have Promoted Growth & Innovation in this Market

Figure 59 New Product Launches: the Key Strategy of Companies, 20122016

Figure 60 Annual Developments in the Agricultural Disinfectants Market, 20122016

Figure 61 Geographical Revenue Mix of Top Four Market Players

Figure 62 The Chemours Company: Company Snapshot

Figure 63 The Chemours Company: SWOT Analysis

Figure 64 Zoetis: Company Snapshot

Figure 65 Zoetis: SWOT Analysis

Figure 66 Nufarm Limited: Company Snapshot

Figure 67 Nufarm Limited: SWOT Analysis

Figure 68 Stepan Company: Company Snapshot

Figure 69 Stepan Company: SWOT Analysis

Figure 70 The DOW Chemical Company: Company Snapshot

Figure 71 The DOW Chemical Company: SWOT Analysis

Figure 72 Neogen Corporation: Company Snapshot

Growth opportunities and latent adjacency in Agricultural Disinfectants Market