Extensive secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource have been used to identify and collect information for this technical, market-oriented, and commercial study of the sterile medical packaging market. In-depth interviews were conducted with various primary respondents, which included key industry participants, subject matter experts (SMEs), C-level executives of key industry players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers; publications from recognized websites; and databases. Secondary research has mainly been used to obtain key information about the supply chain of the industry, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

The market size of sterile medical packaging has been estimated based on secondary data available through paid and unpaid sources and by analyzing the product portfolios of key companies. This data has been further validated through various primary sources.

Primary Research

The sterile medical packaging market comprises various stakeholders in the supply chain and includes suppliers, manufacturers, and end-users. Various primary sources from the supply and demand sides of the sterile medical packaging market have been interviewed to obtain qualitative and quantitative information. Primary participants from the supply side include key opinion leaders, executives, vice presidents, and CEOs of companies in the market. Primary sources from the demand side include experts from end-use industries, associations and institutions involved in the market, and key opinion leaders.

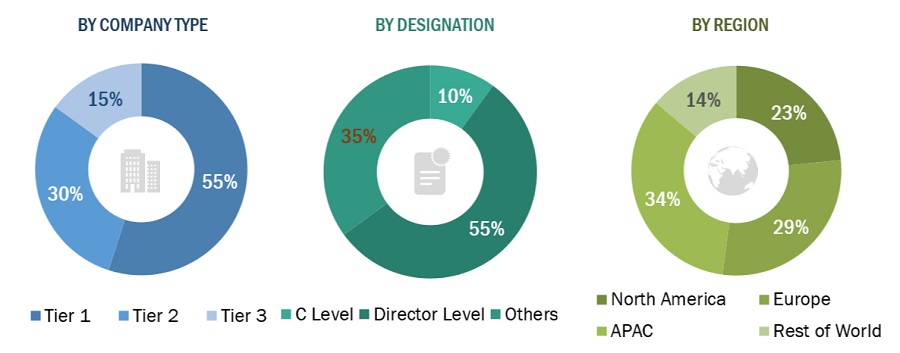

Following is the breakdown of primary respondents

Notes: *Others include sales, marketing, and product managers.

Tier 1: >USD 5 Billion; Tier 2: USD 1 Billion– USD 5 Billion; and Tier 3: <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The supply-side and demand-side approaches have been extensively used, along with several data triangulation methods, for market size estimation and forecast of the overall market segments listed in this report. Extensive qualitative and quantitative data were analyzed to list key information/insights throughout the report. The research methodology used to estimate the market size includes the following:

-

The key players in the industry were identified through extensive secondary research.

-

The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

-

All percentage shares split and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

The research includes the study of annual reports, reviews, sterile medical packaging associations, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

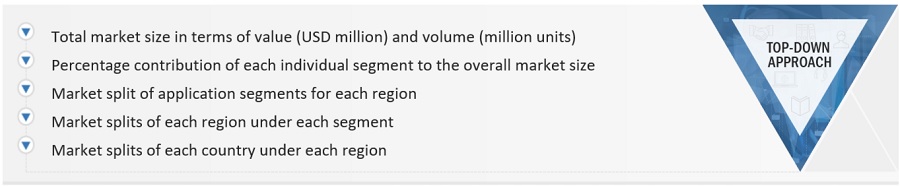

Approach 1 : Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

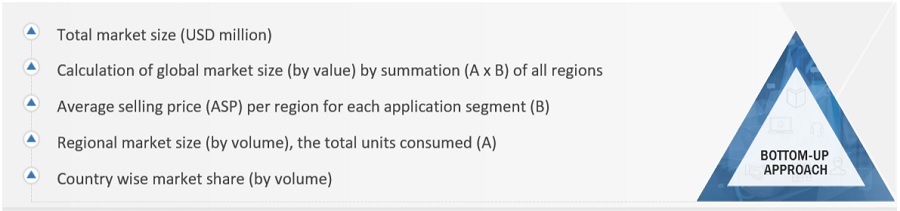

Approach 2 : Bottom-Up Approach

Data Triangulation

After arriving at the total market size, the overall market has been split into several segments. The data triangulation and market breakdown procedures have been used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments. The data has been triangulated by studying various factors and trends from the demand and supply sides. Also, the market size has been validated using both top-down and bottom-up approaches and then verified through primary interviews.

Market Definition

Sterile medical packaging provides a microbial barrier allowing aseptic presentation to products at the point of use. Medical products packaging is a complex process because of its molecular and chemical structures. By type, the sterile medical packaging market is segmented into thermoform trays, sterile bottles & containers, vials & ampoules, pre-fillable inhalers, sterile closures, pre-filled syringes, blister & clamshells, bags & pouches, and wraps. Sterile medical packaging is widely used in pharmaceutical & biological, surgical & medical instruments, in vitro diagnostic products, and medical implants applications.

Key stakeholders

-

Raw material suppliers and producers

-

Sterile medical packaging manufacturers, dealers, and suppliers

-

Regulatory bodies

-

Sterile medical packaging distributors/suppliers

-

Local government

-

Industry associations

-

Investment banks

-

Consulting companies/Consultants in Medical Packaging Sectors

-

Raw material providers

-

Medical packaging fabricators and suppliers

Report Objectives

-

To estimate and forecast the sterile medical packaging market, in terms of value and volume.

-

To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing market growth.

-

To define, describe, and forecast the market size, based on type, material, application, sterilization method, and region.

-

To forecast the market size, along with segments and submarkets, in key regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their key countries

-

To strategically analyze micromarkets, with respect to individual growth trends, prospects, and their contribution to the market.

-

To analyze opportunities in the market for stakeholders and draw a competitive landscape of market leaders.

-

To strategically profile key players and comprehensively analyze their core competencies

-

To analyze competitive developments such as expansions, acquisitions, new product developments, and investments, in the sterile medical packaging market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

-

Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

-

Further breakdown of the Rest of the Asia Pacific, sterile medical packaging market

-

Further breakdown of the Rest of Europe, sterile medical packaging market

-

Further breakdown of the Rest of South America, sterile medical packaging market

-

Further breakdown of the Rest of Middle East & Africa, sterile medical packaging market

Company Information:

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Sterile Medical Packaging Market