Aseptic Packaging Market by Material (Plastic, Glass & Wood, Metal, Paper & Paperboard), Type (Cartons, Bottles & Cans, Bags & Pouches), Application (Food and Beverage), and Region - Global Forecast to 2022

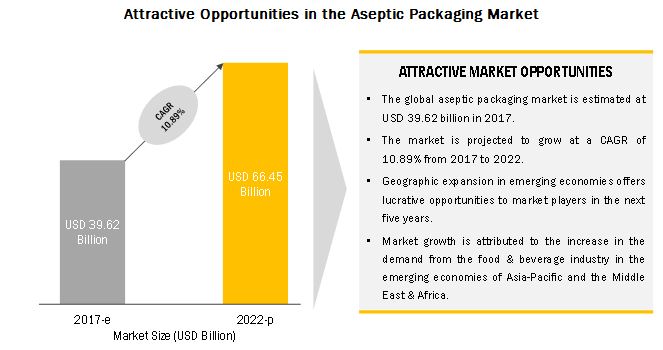

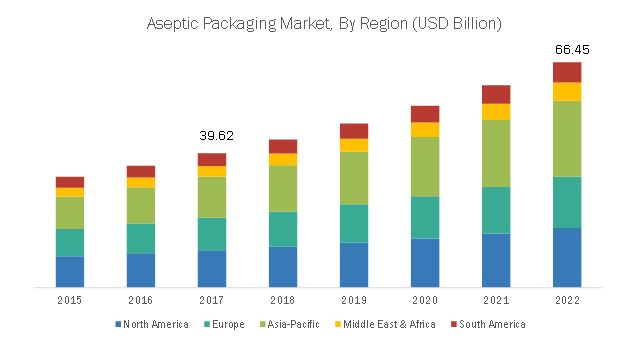

[182 Pages Report] MarketsandMarkets forecasts the aseptic packaging Market to grow from USD 39.6 billion in 2017 to USD 66.5 billion by 2022, at a CAGR of 10.89% during the forecast period. The aseptic packaging market is witnessing high growth, owing to the rise in demand for ready-to-eat food products. Increased urbanization and growth of the packaging industry have led to an increase in demand for aseptic packaging, particularly in the emerging economies of Asia Pacific and South America.

Source: Investor Presentation, Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

By application industry Beverage - the largest application industry of aseptic packaging

Beverage is estimated to be the largest application industry of aseptic packaging. The aseptic packaging market is driven by factors such as an increase in the demand for convenience and quality food products, and the growth of the dairy beverages market. Emerging markets, such as the Asia-Pacific region, have contributed to an increase in the application of aseptic packaging in beverage products. Cost-to-benefit ratio to small manufacturers and high research & development investment are the restraining factors for the aseptic packaging market.

Bottles & cans segment, by type, projected to grow at the highest CAGR during the forecast period.

The bottles & cans segment, by type, is projected to grow at the highest CAGR between 2017 and 2022. The increasing demand from the food and beverage packaging industries is driving the usage of bottles & cans in the aseptic packaging market. The growth of this market is attributed to the increasing demand for beverages, especially from the dairy and juice packaging market. The cans segment is influenced by the growth of tinned meat, seafood & fruit products, and ready-to-serve markets. Cans are sealed with a double seam and are air tight and tamperproof to ensure that food is preserved, has a long shelf life, and remains fresh.

Source: Investor Presentation, Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

Asia-Pacific to gain maximum traction during the forecast period.

The Asia-Pacific region is projected to be the fastest-growing market during the forecast period, followed by

Middle East & Africa. In Asia-Pacific, China is the largest consumer for aseptic packaging, followed by India. China, with its growing food and beverage industries, is expected to drive the aseptic packaging market. India, with its growing inclination toward convenient products packaging, is expected to drive the aseptic packaging market in the Asia-Pacific region.

Market Dynamics

Driver: Shift in consumer preference against the use of food preservatives

There is a growing demand for convenience food products with long shelf life, which are either free of or can delay bacterial contamination. Food preservatives are vastly used in food production to increase the shelf life and preserve the quality of the product. However, people are growing increasingly aware of the ill-effects of consuming processed foods with additives. According to a paper published by The Royal Society of Chemistry, in 2011, titled Food & Functions, there is a growing requirement to replace artificial preservatives by natural food ingredients with antimicrobial activity. However, natural ingredients are comparatively expensive, and aseptic packaging is preferred for the packaging of expensive products, as they promise extended shelf life. Aseptic packaging also complements the use of natural ingredients, allowing a manufacturer to produce a completely natural product, and make them increasingly shelf stable.

Aseptic packaging is a concentrated process where both the package and the product are sterilized separately before filling. This decreases the probability of presence of germs and makes the food safer and healthier. Hence, aseptic packaging is gaining awareness among people. The increasing number of government regulations against the use of food preservatives, especially in developed countries, is driving the use of aseptic packaging.

Restraint: Need for greater technological understanding than required for other packaging forms

The technological know-how and expertise required to set up a plant for packaging products aseptically, is another restraint for the growth of the market. Extensive knowledge pertaining to this type of packaging and the sector of end use being catered to, is required for establishing an aseptic packaging plant, as this needs careful handling at every step. Hence, manufacturers are not encouraged to enter the aseptic packaging business. This aspect of aseptic packaging becomes a hindrance for the expansion of the market. Technological developments are helping this market to simplify operational procedures without human interference; however, this would be available at a very high cost.

Opportunity: Electronic logistics processing

Electronic business processing links the entire supply chain of the packaging industry, starting from raw material suppliers, manufacturers, and packaging users, to retailers and consumers. This provides immediate and accurate information, reduction in costs and time delays, simplicity in logistics & inventory operations, and provides a better response to consumer demands. This will help increase the speed of delivery of the product, which is very crucial for a company. As aseptic packaging has a similar supply chain, which is becoming increasingly dependent on electronic tracking and logistics, it finds opportunity for growth in this process. Aseptic packages are also e-tracking-friendly as they allow high-quality printability, which helps in the use of codes, and is also supportive of the use of RFID. Hence, with the development in electronic logistical systems, the market for aseptic packaging is expected to growth.

Challenge: Variations in environmental mandates across regions

Environmental mandates regarding the packaging industry vary across countries; this makes it very difficult for companies to adjust to the packaging materials used according to the regulations applicable in that specific country/region. Not just the manufacturers, the environmental mandates affect the consumer, government, and commercial entities as well. Consumers are showing more interest toward biodegradable and eco-friendly materials; the commercial sector tries to ensure that the packaging of the product does not increase the cost of the product to a large extent such that they lose out on market share. Retailers are also skeptical about the raw materials being used in the preparation of boxes and bags and make sure that they are eco-friendly. Governments in Europe, North America, and North Asia have developed regulations strictly pertaining to the packaging industry with regard to their recycling rates, container deposits, and packaging levies. Such variations in the mandates across regions are posing as a challenge to the manufacturers, importers, and exporters in this market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Aseptic Packaging Market by Material (Plastic, Glass, Wood, Metal, Paper & Paperboard), Type (Cartons, Bottles & Cans, Bags & Pouches), Application (Food, Beverage and Pharmaceutical), and Region - Global Forecast to 2022 |

|

Geographies covered |

North America, Europe, APAC, MEA, and South America |

|

Companies covered |

E.I. du Pont de Nemours and Company (US), Robert Bosch GmbH (Germany), Tetra Laval International S.A. (Switzerland), Reynolds Group Holdings Limited (New Zealand), Amcor Limited (Australia), Becton, Dickinson and Company (US), Bemis Company, Inc. (US), Greatview Aseptic Packaging Co., Ltd. (China), IMA S.P.A (Italy), and Schott AG (Germany) and 15 others. |

The research report categorizes the Aseptic Packaging to forecast the revenues and analyze the trends in each of the following sub-segments:

Aseptic Packaging by Type

- Cartons

- Bags & pouches

- Bottles & cans

- Ampoules

- Others (bag-in-box packaging, cups, trays, and containers)

Aseptic Packaging by Material

- Plastic

- Paper & paperboard

- Metal

- Glass

- Wood

Aseptic Packaging by Application

- Food

- Beverage

- Pharmaceutical

- Others

Aseptic Packaging by Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Key Market Players

E.I. du Pont de Nemours and Company (US), Robert Bosch GmbH (Germany), Tetra Laval International S.A. (Switzerland), Reynolds Group Holdings Limited (New Zealand), Amcor Limited (Australia), Becton, Dickinson and Company (US), Bemis Company, Inc. (US), Greatview Aseptic Packaging Co., Ltd. (China), IMA S.P.A (Italy), and Schott AG (Germany) and 15 others.

Recent Developments

- In December 2016, Amcor acquired Detmold Flexibles (Australia) for USD 500 million. This acquisition enabled Amcors flexible packaging business to further improve the customer value proposition in the packaging market.

- In December 2015, Bemis Company, Inc. acquired Emplal Participaηυes S.A. (Brazil), a manufacturer of rigid plastics for food and consumption applications. The acquisition enhanced the companys position in South America and strengthened its product portfolio.

- In March 2015, Bosch Packaging Technology established a regional service hub for South America in Sao Paulo, Brazil. This hub provides a comprehensive support for pharmaceutical, food, and processing equipment.

- In September 2014, DuPont announced its plans to increase its ethylene copolymer assets at its Texas manufacturing facilities to meet the growing market demand. Its plans included an investment of USD 100 million and is expected to be completed in the next 3 years.

- In February 2017, Tetra Pak announced an investment of USD 25.3 million for its plant for packaging closure in Southeast Asia. The investment would help the company to expand its business in the emerging Asian market.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the Aseptic Packaging market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of The Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Regional Scope

1.3.2 Years Considered For The Study

1.4 Currency

1.5 Units

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Share Estimation

2.4 Data Triangulation

2.5 Research Assumptions & Limitations

3 Executive Summary

4 Premium Insights

4.1 Developing Economies To Witness Higher Demand For Aseptic Packaging

4.2 Aseptic Packaging Market, By Type

4.3 Aseptic Packaging Market, By Application

4.4 Aseptic Packaging Market, By Material

4.5 Asia-Pacific: Aseptic Packaging Market

4.6 Aseptic Packaging Market: Regional Snapshot

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase In Urban Population

5.2.1.2 Shift In Consumer Preference Against The Use of Food Preservatives

5.2.1.3 Growth of The Dairy Beverage Market

5.2.1.4 Growth In Demand For Convenience And Quality Food Products

5.2.1.5 Growth of The Parent Industry

5.2.2 Restraints

5.2.2.1 High Initial Capital Investment Involved

5.2.2.2 Need For Greater Technological Understanding Than Required For Other Packaging Forms

5.2.3 Opportunities

5.2.3.1 Emergence of New Product Developments

5.2.3.2 Electronic Logistics Processing

5.2.4 Challenges

5.2.4.1 Variations In Environmental Mandates Across Regions

5.2.4.2 Cost-To-Benefit Ratio A Concern To Small Manufacturers

5.2.4.3 High Research & Development Investment

6 Technological Overview

6.1 Introduction

6.2 Aseptic Packaging Process

6.2.1 Sterile Manufacturing Environment

6.2.2 Sterilization of The Products Before Filling

6.2.2.1 Ultra-High Temperature (Uht)

6.2.2.1.1 Indirect Uht System

6.2.2.1.2 Direct Uht System

6.2.2.2 Pasteurization (For Liquids)

6.2.3 Methods Used For Sterilizing Aseptic Packaging

6.3 Porters Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Bargaining Power of Buyers

6.3.3 Threat of New Entrants

6.3.4 Threat of Substitutes

6.3.5 Intensity of Competi Tive Rivalry

7 Aseptic Packaging Market, By Material

7.1 Introduction

7.1.1 Key Market Trend

7.1.2 Market Size And Forecast

7.2 Plastic

7.3 Metal

7.4 Glass

7.5 Wood

7.6 Paper & Paperboard

8 Aseptic Packaging Market, By Type

8.1 Introduction

8.1.1 Key Market Trend

8.1.2 Market Size And Forecast

8.2 Cartons

8.3 Bottles & Cans

8.4 Bags & Pouches

8.5 Ampoules

8.6 Others

9 Aseptic Packaging Market, By Application

9.1 Introduction

9.1.1 Key Market Trend

9.1.2 Market Size And Forecast

9.2 Beverage

9.2.1 Milk And Other Dairy Beverages

9.2.2 Ready-To-Drink Beverages

9.2.3 Fruit Beverages

9.3 Food

9.3.1 Dairy Foods

9.3.2 Processed Foods, Fruits And Vegetables

9.3.3 Soups And Broths

9.3.4 Baby Food

9.3.5 Rest of Food Industry

9.3.6 Meat & Sea Food

9.3.7 Fruits & Vegetables

9.4 Pharmaceutical

9.4.1 Prefillable Syringes

9.4.2 Bottles

9.4.3 Vials And Ampoules

9.4.4 Iv Bags

9.5 Others

10 Macroeconomic Overview

10.1 Introduction

10.1.1 Rising Population

10.1.2 Increase In Middle-Class Population, 2009-2030

10.1.3 Developing Economics, GDP (Purchasing Power Parity),2015

10.2 GDP By Country

10.3 Region Wise Forecast of Food Packaging Industry

11 Aseptic Packaging Market, By Region

11.1 Introduction

11.1.1 Key Market Trend

11.1.2 Market Size And Forecast

11.2 North America

11.2.1 North America: Aseptic Packaging Market, By Country

11.2.2 North America: Aseptic Packaging Market, By Type

11.2.3 North America: Aseptic Packaging Market, By Application

11.2.4 U.S.

11.2.4.1 U.S.: Aseptic Packaging Market, By Type

11.2.4.2 U.S.: Aseptic Packaging Market, Application

11.2.5 Canada

11.2.5.1 Canada: Aseptic Packaging Market, By Type

11.2.5.2 Canada: Aseptic Packaging Market, Application

11.2.6 Mexico

11.2.6.1 Mexico: Aseptic Packaging Market, By Type

11.2.6.2 Mexico: Aseptic Packaging Market, Application

11.3 Asia-Pacific

11.3.1 Asia-Pacific: Aseptic Packaging Market, By Country

11.3.2 Asia-Pacific: Aseptic Packaging Market, By Type

11.3.3 Asia-Pacific: Aseptic Packaging Market, By Application

11.3.4 China

11.3.4.1 China: Aseptic Packaging Market, By Type

11.3.4.2 China: Aseptic Packaging Market, By Application

11.3.5 Japan

11.3.5.1 Japan: Aseptic Packaging Market, By Type

11.3.5.2 Japan: Aseptic Packaging Market, By Application

11.3.6 Australia

11.3.6.1 Australia: Aseptic Packaging Market, By Type

11.3.6.2 Australia: Aseptic Packaging Market, By Application

11.3.7 India

11.3.7.1 India: Aseptic Packaging Market, By Type

11.3.7.2 India: Aseptic Packaging Market, By Application

11.3.8 Rest of Asia-Pacific

11.3.8.1 Rest of Asia-Pacific: Aseptic Packaging Market, By Type

11.3.8.2 Rest of Asia-Pacific: Aseptic Packaging Market, By Application

11.4 Europe

11.4.1 Europe: Aseptic Packaging Market, By Country

11.4.2 Europe: Aseptic Packaging Market, By Type

11.4.3 Europe: Aseptic Packaging Market, By Application

11.4.4 Germany

11.4.4.1 Germany: Aseptic Packaging Market, By Type

11.4.4.2 Germany: Aseptic Packaging Market, By Application

11.4.5 U.K.

11.4.5.1 U.K.: Aseptic Packaging Market, By Type

11.4.5.2 U.K.: Aseptic Packaging Market, By Application

11.4.6 France

11.4.6.1 France: Aseptic Packaging Market, By Type

11.4.6.2 France: Aseptic Packaging Market, By Application

11.4.7 Italy

11.4.7.1 Italy: Aseptic Packaging Market, By Type

11.4.7.2 Italy: Aseptic Packaging Market, By Application

11.4.8 Russia

11.4.8.1 Russia: Aseptic Packaging Market, By Type

11.4.8.2 Russia: Aseptic Packaging Market, By Application

11.4.9 Rest of Europe

11.4.9.1 Rest of Europe: Aseptic Packaging Market, By Type

11.4.9.2 Rest of Europe: Aseptic Packaging Market, By Application

11.5 Middle East & Africa

11.5.1 Middle East & Africa: Aseptic Packaging Market, By Country

11.5.2 Middle East & Africa: Aseptic Packaging Market, By Type

11.5.3 Middle East & Africa: Aseptic Packaging Market, By Application

11.5.4 Turkey

11.5.4.1 Turkey: Aseptic Packaging Market, By Type

11.5.4.2 Turkey: Aseptic Packaging Market, By Application

11.5.5 UAE

11.5.5.1 UAE: Aseptic Packaging Market, By Type

11.5.5.2 UAE: Aseptic Packaging Market, By Application

11.5.6 Saudi Arabia

11.5.6.1 Saudi Arabia: Aseptic Packaging Market, By Type

11.5.6.2 Saudi Arabia: Aseptic Packaging Market, By Application

11.5.7 Rest of The Middle East & Africa

11.5.7.1 Rest of The Middle East & Africa: Aseptic Packaging Market, By Type

11.5.7.2 Rest of The Middle East & Africa: Aseptic Packaging Market, By Application

11.6 South America

11.6.1 South America: Aseptic Packaging Market, By Country

11.6.2 South America: Aseptic Packaging Market, By Type

11.6.3 South America: Aseptic Packaging Market, By Application

11.6.5 Brazil

11.6.5.1 Brazil: Aseptic Packaging Market, By Pack

11.6.5.2 Brazil: Aseptic Packaging Market, By Application

11.6.5.3 Brazil: Aseptic Packaging Market, By Application

11.6.6 Argentina

11.6.6.1 Argentina: Aseptic Packaging Market, By Type

11.6.6.2 Argentina: Aseptic Packaging Market, By Application

11.6.6.3 Argentina: Aseptic Packaging Market, By Application

11.6.7 Chile

11.6.7.1 Chile: Aseptic Packaging Market, By Type

11.6.7.2 Chile: Aseptic Packaging Market, By Application

11.6.7.3 Chile: Aseptic Packaging Market, By Application

11.6.8 Rest of South America

11.6.8.1 Rest of South America: Aseptic Packaging Market, By Type

11.6.8.2 Rest of South America: Aseptic Packaging Market, By Application

11.6.8.3 Rest of South America: Aseptic Packaging Market, By Application

12 Competitive Landscape

12.1 Introduction

12.2 Dynamic, Innovators, Vanguards, And Emerging

12.2.1 Dynamic

12.2.2 Innovators

12.2.3 Vanguards

12.2.4 Emerging

12.3 Competitive Benchmarking

12.3.1 Analysis of Product Portfolio of Major Players In The Aseptic Packaging Market (25 Players)

12.3.2 Business Strategies Adopted By Major Players In The Aseptic Packaging Market (25 Players)

12.4 Market Share Analysis

12.4.1 Market Share of Key Players

12.4.2 Tetra Laval International S.A.

12.4.3 Robert Bosch Gmbh

12.4.4 Greatview Aseptic Packaging Co. Ltd.

12.4.5 Amcor Limited

12.4.6 Bemis Company

13 Company Profiles

(Overview, Products & Services, Strategies & Insights, Developments And MNM View)*

13.1 Amcor Limited

13.1.1 Business Overview

13.1.2 Products Offered

13.1.3 Recent Developments

13.1.4 Swot Analysis

13.1.5 MNM View

13.2 Bemis Company, Inc.

13.2.1 Business Overview

13.2.2 Products Offered

13.2.3 Recent Developments

13.2.4 Swot Analysis

13.2.5 MNM View

13.3 Robert Bosch Gmbh

13.3.1 Business Overview

13.3.2 Products Offered

13.3.3 Recent Developments

13.3.4 Swot Analysis

13.3.5 MNM View

13.4 E.I. Du Pont De Nemours And Company

13.4.1 Business Overview

13.4.2 Products Offered

13.4.3 Recent Developments

13.4.4 Swot Analysis

13.4.5 MNM View

13.5 Tetra Laval International S.A.

13.5.1 Business Overview

13.5.2 Products Offered

13.5.3 Recent Developments

13.5.4 Swot Analysis

13.5.5 MNM View

13.6 Becton, Dickinson And Company

13.6.1 Business Overview

13.6.2 Products Offered

13.6.3 Recent Developments

13.6.4 Swot Analysis

13.6.5 MNM View

13.7 Greatview Aseptic Packaging Co., Ltd.

13.7.1 Business Overview

13.7.2 Products Offered

13.7.3 Recent Developments

13.7.4 Swot Analysis

13.7.5 MNM View

13.8 Industria Macchine Automatiche S.P.A

13.8.1 Business Overview

13.8.2 Products Offered

13.8.3 Recent Developments

13.8.4 Swot Analysis

13.8.5 MNM View

13.9 Reynolds Group Holding

13.9.1 Business Overview

13.9.2 Products Offered

13.9.3 Recent Developments

13.9.4 Swot Analysis

13.9.5 MNM View

13.1 Schott Ag

13.10.1 Business Overview

13.10.2 Products Offered

13.10.3 Recent Developments

13.10.4 Swot Analysis

13.10.5 MNM View

13.11 Ds Smith Plc

13.12 Sealed Air Corporation

13.13 Elopak Group

13.14 Ecolean Ab

13.15 Sig Combibloc Group Ag

13.16 Jpak Group Incorporated

13.17 Printpack, Inc.

13.18 Scholle Ipn

13.19 Lamican International Oy

13.2 Ipi Srl

13.21 Molopak Llc

13.22 Agropur Cooperative

13.23 Krones Ag

13.24 Shanghai Skylong Packaging Machinery Co., Ltd.

13.25 Goglio S.P.A

*Details On Overview, Products & Services, Strategies & Insights, Developments And MNM View Might Not Be Captured In Case of Unlisted Companies.

14 Appendix

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Introducing Rt: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (140 Tables)

Table 1 Asia-Pacific Urbanization Prospects

Table 2 Classification of Clean Areas

Table 3 Aseptic Packaging Market Size, By Material, 20152022 (USD Billion)

Table 4 Aseptic Packaging Market Size, By Material, 20152022 (Billion Units)

Table 5 Aseptic Packaging Market Size, Type, 20152022 (USD Billion)

Table 6 Aseptic Packaging Market Size, Type, 20152022 (Billion Units)

Table 7 Aseptic Packaging Market Size, Application, 20152022 (USD Billion)

Table 8 Aseptic Packaging Market Size, Application, 20152022 (Billion Units)

Table 9 Aseptic Packaging Market Size, By Food Sub-Application, 20152022 (USD Billion)

Table 10 Aseptic Packaging Market Size, By Food Sub-Application, 20152022 (Billion Units)

Table 11 Aseptic Packaging Market Size, By Beverage Sub-Application, 20152022 (USD Billion)

Table 12 Aseptic Packaging Market Size, By Beverage Sub-Application, 20152022 (Billion Units)

Table 13 Aseptic Packaging Market Size, By Pharmaceutical Sub-Application, 20152022 (USD Billion)

Table 14 Aseptic Packaging Market Size, By Pharmaceutical Sub-Application, 20152022 (Billion Units)

Table 15 North America: GDP, By Country, 20142021 (USD Billion)

Table 16 Europe: GDP, By Country, 20142021 (USD Billion)

Table 17 Asia-Pacific: GDP, By Country, 20142021 (USD Billion)

Table 18 Middle East & Africa: GDP, By Country, 20142021 (USD Billion)

Table 19 South America: GDP, By Country, 20142021 (USD Billion)

Table 20 Contribution of Food Industry In Packaging, By Region, 20142021 (USD Billion)

Table 21 Aseptic Packaging Market Size, By Region, 20152022 (USD Billion)

Table 22 Aseptic Packaging Market Size, By Region, 20152022 (Billion Units)

Table 23 North America: Aseptic Packaging Market Size, By Country, 20152022 (USD Billion)

Table 24 North America: Aseptic Packaging Market Size, By Country, 20152022 (Billion Units)

Table 25 North America: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 26 North America: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 27 North America: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 28 North America: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 29 U.S.: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 30 U.S.: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 31 U.S.: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 32 U.S.: Aseptic Packaging Market Size, Application, 20152022 (Billion Units)

Table 33 Canada: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 34 Canada: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 35 Canada: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 36 Canada: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 37 Mexico: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 38 Mexico: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 39 Mexico: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 40 Mexico: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 41 Asia-Pacific: Aseptic Packaging Market Size, By Country, 20152022 (USD Billion)

Table 42 Asia-Pacific: Aseptic Packaging Market Size, By Country, 20152022 (Billion Units)

Table 43 Asia-Pacific: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 44 Asia-Pacific: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 45 Asia-Pacific: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 46 Asia-Pacific: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 47 China: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 48 China: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 49 China: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 50 China: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 51 Japan: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 52 Japan: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 53 Japan: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 54 Japan: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 55 Australia: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 56 Australia: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 57 Australia: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 58 Australia: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 59 India: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 60 India: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 61 India: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 62 India: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 63 Rest of Asia-Pacific: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 64 Rest of Asia-Pacific: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 65 Rest of Asia-Pacific: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 66 Rest of Asia-Pacific: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 67 Europe: Aseptic Packaging Market Size, By Country, 20152022 (USD Billion)

Table 68 Europe: Aseptic Packaging Market Size, By Country, 20152022 (Billion Units)

Table 69 Europe: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 70 Europe: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 71 Europe: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 72 Europe: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 73 Germany: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 74 Germany: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 75 Germany: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 76 Germany: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 77 U.K.: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 78 U.K.: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 79 U.K.: Aseptic Packaging Market, By Application, 20152022 (USD Billion)

Table 80 U.K.: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 81 France: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 82 France: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 83 France: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 84 France: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 85 Italy: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 86 Italy: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 87 Italy: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 88 Italy: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 89 Russia: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 90 Russia: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 91 Russia: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 92 Russia: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 93 Rest of Europe: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 94 Rest of Europe: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 95 Rest of Europe: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 96 Rest of Europe: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 97 Middle East & Africa: Aseptic Packaging Market Size, By Country, 20152022 (USD Billion)

Table 98 Middle East & Africa: Aseptic Packaging Market Size, By Country, 20152022 (Billion Units)

Table 99 Middle East & Africa: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 100 Middle East & Africa: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 101 Middle East & Africa: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 102 Middle East & Africa: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 103 Turkey: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 104 Turkey: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 105 Turkey: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 106 Turkey: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 107 UAE: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 108 UAE: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 109 UAE: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 110 UAE: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 111 Saudi Arabia: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 112 Saudi Arabia: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 113 Saudi Arabia: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 114 Saudi Arabia: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 115 Rest of The Middle East & Africa: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 116 Rest of The Middle East & Africa: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 117 Rest of The Middle East & Africa: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 118 Rest of Middle East & Africa: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 119 South America: Aseptic Packaging Market Size, By Country, 20152022 (USD Billion)

Table 120 South America: Aseptic Packaging Market Size, By Country, 20152022 (Billion Units)

Table 121 South America: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 122 South America: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 123 South America: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 124 South America: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 125 Brazil: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 126 Brazil: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 127 Argentina: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 128 Brazil: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 129 Argentina: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 130 Argentina: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 131 Argentina: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 132 Argentina: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 133 Chile: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 134 Chile: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 135 Chile: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 136 Chile: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

Table 137 Rest of South America: Aseptic Packaging Market Size, By Type, 20152022 (USD Billion)

Table 138 Rest of South America: Aseptic Packaging Market Size, By Type, 20152022 (Billion Units)

Table 139 Rest of South America: Aseptic Packaging Market Size, By Application, 20152022 (USD Billion)

Table 140 Rest of South America: Aseptic Packaging Market Size, By Application, 20152022 (Billion Units)

List of Figures (41 Figures)

Figure 1 Aseptic Packaging Market Segmentation

Figure 2 Aseptic Packaging Market, By Region

Figure 3 Aseptic Packaging Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Aseptic Packaging: Data Triangulation

Figure 7 Assumptions

Figure 8 Limitations

Figure 9 Cartons Is Projected To Remain The Largest Type Segment Through 2022

Figure 10 Beverage Segment Projected To Account For The Largest Share Through 2022

Figure 11 Plastic Segment Is Expected To Lead The Market For Aseptic Packaging Through 2022

Figure 12 Asia-Pacific Was The Largest Market For Aseptic Packaging In 2016

Figure 13 Emerging Economies Offer Attractive Opportunities In The Aseptic Packaging Market

Figure 14 Cartons Segment To Lead The Global Market Through 2022

Figure 15 Aseptic Packaging of Beverages To Grow At The Highest Cagr In Asia-Pacific Through 2022

Figure 16 Paper & Paperboard To Grow At The Highest Rate During The Forecast Period

Figure 17 Cartons Segment Captured The Largest Share In The Asia-Pacific Market In 2016

Figure 18 Market In China Is Projected To Grow At The Highest Rate from 2017 To 2022

Figure 19 Aseptic Packaging Market Dynamics

Figure 20 Aseptic Packaging: Process Flow

Figure 21 Porters Five Forces Analysis

Figure 22 Paper & Paperboard Is Projected To Grow At The Highest Rate from 2017 To 2022

Figure 23 Bottles & Cans Is Projected To Grow At The Highest Rate from 2017 To 2022

Figure 24 The Beverage Segment Is Projected To Account For A Larger Share from 2017 Through 2022

Figure 25 Projected GDP Per Capita, By Country

Figure 26 Geographic Snapshot: Market In China Is Projected To Grow At The Highest Rate, In Terms of Value (20172022)

Figure 27 Asia-Pacific Aseptic Packaging Market Snapshot: China Is Projected To Be The Fastest-Growing Market Between 2017 & 2022

Figure 28 Dive Chart

Figure 29 Aseptic Packaging Market Share, By Key Player, 2016

Figure 30 Amcor Limited: Company Snapshot

Figure 31 Bemis Company, Inc.: Company Snapshot

Figure 32 Robert Bosch Gmbh: Company Snapshot

Figure 33 E.I. Du Pont De Nemours And Co.: Company Snapshot

Figure 34 Tetra Laval Intsernational S.A.: Company Snapshot

Figure 35 Becton, Dickinson And Company: Company Snapshot

Figure 36 Greatview Aseptic Packaging Co., Ltd.: Company Snapshot

Figure 37 Industria Macchine Automatiche S.P.A: Company Snapshot

Figure 38 Reynolds Group Holding: Company Snapshot

Figure 39 Schott Ag: Company Snapshot

Figure 40 Ds Smith Plc: Company Snapshot

Figure 41 Sealed Air Corporation: Company Snapshot

Growth opportunities and latent adjacency in Aseptic Packaging Market