Regulatory Environment and Impact Analysis- Sterile Packaging Market Standards & Regulations, Regional & National Regulatory Bodies - Market Analysis & Forecast to 2020

[121 Pages Report] The global economy and easy access to open and free trade between countries have increased the importance or requirement of having standards and test methods for achieving consistent performance parameters. Furthermore, along with the globally applicable standards, each country may have its own specific set of applications and environments in which the product needs to perform. Having multiple standards for same performance parameters may create confusion and can also act as a trade barrier for manufacturers of the product. Hence, in order to avoid this, harmonization between these standards and test methods is necessary for which proper regulatory framework is required. In addition to this, the growing demand for the sterile medical packaging also highlights the need to implement an efficient regulatory framework in the industry.

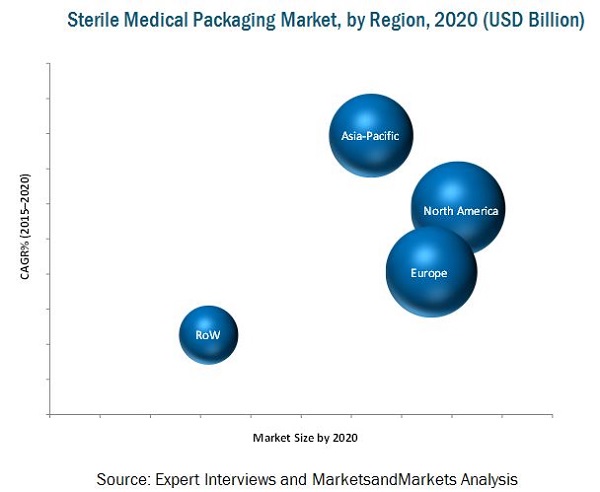

The market for sterile medical packaging is estimated to grow from USD 26.55 Billion in 2015 to reach USD 35.07 Billion by 2020, at an estimated CAGR of 5.72%. The segmentation considered for this report is based on region. The region consists of North America, Europe, Asia-Pacific, and Rest of the World (RoW). The base year considered for the study is 2014 and the market size is projected from 2015 to 2020.

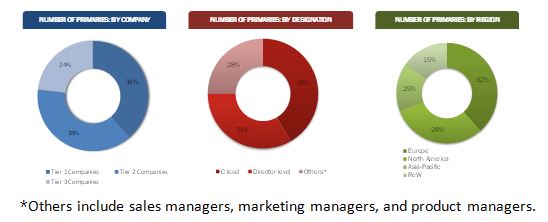

The research methodology used to estimate and forecast the market size was with the help of the top-down and bottom-up approaches. The total market size of sterile medical packaging was calculated based on the percentage split of different materials used in sterile packaging types. This allotment and calculation was done on the basis of extensive primary interviews and secondary research. Primary research involved in this report includes extensive interviews with key people such as CEOs, VPs, directors, and executives. After arriving at the overall market size, the total market was split into regional segments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for the regions. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

Target audience

- Raw material suppliers and producers

- Medical packaging material importers and exporters

- Regulatory bodies

- Environmental protection bodies

- Local government

- End users

- Market research and consulting firms

Scope of the Report

- The research report includes the rules & regulation related to sterile medical packaging for respective regions

- The research report provides a detailed profiling of various organizations and associations formulating and implementing various laws & legislations related to the sterile medical packaging in the key countries and regions

- The research report segments the sterile medical packaging market into the following submarkets:

By Region:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the client-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further analysis of the sterile medical packaging market for additional countries

MarketsandMarkets projects that the market for sterile medical packaging will grow from USD 26.55 Billion in 2015 to USD 35.07 Billion by 2020, at an estimated CAGR of 5.72%. The sterile medical packaging market has been growing in accordance with the growth in the packaging industry. Factors such as increasing aging population, growing demand from the healthcare sector, and the popularity of using reliable packaging are driving the demand for sterile medical packaging.

The growing demand in the sterile packaging market highlights the need to implement an efficient regulatory framework. The European regulatory framework is stronger, effective, and organized. Countries such as France, Germany, Italy, and the U.K. have been considered for the study. The EU has implemented standards & regulations such as Medical Device Directive, which is applicable in the European Union and eliminates the trade barrier and significantly improves the processes involved in the sterile medical packaging industry.

On the basis of key regions, the market for sterile medical packaging is segmented into North America, Europe, Asia-Pacific, and Rest of the World (RoW). The Asia-Pacific region is projected to be the fastest growing region, by 2020. This is mainly due to emerging economies in China and India, coupled with rising consumer spending power and the growing middle-class population. The regulatory framework in the sterile packaging market is complex and varies from region to region. However, in order to avoid confusion among manufacturers and ease the trade barrier, continuous efforts are made to harmonize the multiple standards and regulations to form global standards.

The report studies and covers sterile packaging regulations and legislations in North America, Europe, Asia-Pacific, and RoW. The regions have been further studied based on laws prevalent in the top countries. The countries studied in the report include the U.S., Canada, Mexico, Germany, France, the U.K., Italy, China, Japan, India, Australia, Brazil, Argentina, and South Africa.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Periodization Considered for the Sterile Medical Packaging Market

1.4 Currency Considered for the Sterile Medical Packaging Market

1.5 Unit Considered for the Sterile Medical Packaging Market

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.1.1 Breakdown of Primaries By Company Type, Designation & Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Overview of Parent Industry

2.2.3 Demand-Side Analysis

2.2.3.1 Rising Population

2.2.3.1.1 Increase in the Middle-Class Population, 2009–2030

2.2.3.2 Increasing Urban Population

2.2.3.3 Developing Economies: Gdp (Purchasing Power Parity)

2.2.4 Supply-Side Analysis

2.2.4.1 Fluctuation in Raw Material Prices

2.2.4.2 Increasing Investment in Research & Development to Develop Innovative Technologies

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 29)

3.1 Introduction

3.2 Regulatory Scenario

3.2.1 Regulatory Framework in North America

3.2.2 Regulatory Framework in Asia-Pacific

3.2.3 Regulatory Framework in Europe

3.2.4 Regulatory Framework in RoW

3.3 Medical Device Approval Process in Key Countries

3.4 Impact Analysis

3.4.1 Case Study: Medical Device Recall & Its Impact

3.4.2 Need for Harmonization of Global Standards & Regulations

4 Market Overview of Sterile Medical Packaging (Page No. - 40)

4.1 Introduction

4.2 Evolution

4.3 Market Dynamics

4.3.1 Drivers

4.3.1.1 Increased Health Awareness

4.3.1.2 Growing Demand From Healthcare Industry

4.3.1.3 Aging Population

4.3.2 Restraints

4.3.2.1 Stringent Regulations

4.3.3 Opportunities

4.3.3.1 New Product Development and Continuous Innovations in Pharmaceuticals

4.3.3.2 Developing New Sustainable Packaging Options

4.3.4 Challenges

4.3.4.1 Maintaining Medical Packaging Integrity

4.3.4.2 Rise in Healthcare Cost

4.4 Sterile Medical Package Development

4.5 Functions of A Sterile Medical Package

4.5.1 Protection

4.5.2 Ease of Use

4.5.3 Identification

4.5.4 Processability

4.5.5 Special Applications

5 International Governing Bodies (Page No. - 49)

5.1 Introduction

5.2 American Society for Testing and Materials (ASTM)

5.2.1 ASTM Committee D10

5.2.1.1 D10.13

5.2.1.2 D10.19

5.2.1.3 D10.27

5.2.1.4 D10.32

5.2.2 ASTM Committee F02

5.2.2.1 F02.10

5.2.2.2 F02.15

5.2.2.3 F02.20

5.2.2.4 F02.40

5.2.2.5 F02.50

5.3 International Organization of Standardization (ISO)

5.3.1 Developing ISO Standards

5.3.1.1 Preliminary Stage

5.3.1.2 Proposal Stage

5.3.1.3 Preparatory Stage

5.3.1.4 Committee Stage

5.3.1.5 Enquiry Stage

5.3.1.6 Approval Stage

5.3.1.7 Publication Stage

5.3.2 Standards Related to Sterile Medical Packaging

5.3.2.1 ISO 16775

5.3.2.2 ISO 11607

5.3.2.2.1 Application

5.3.2.2.2 Limitation

5.3.2.3 ISO 11607-1

5.3.2.4 ISO 11607-2

5.4 U.S. Food and Drug Administration (FDA)

5.5 International Medical Device Regulatory Forum (IMDRF)

6 Regulatory Framework for Sterile Medical Packaging in North America (Page No. - 66)

6.1 North America

6.2 North America: Sterile Medical Packaging Market Size, By Country

6.2.1 U.S.

6.2.2 Key Governing Bodies in the U.S.

6.2.2.1 FDA

6.2.2.1.1 Overview

6.2.2.1.2 Responsibilities

6.2.3 Canada

6.2.4 Key Governing Bodies in Canada

6.2.4.1 Health Canada (HC)

6.2.4.1.1 Overview

6.2.4.1.2 Responsibilities

6.2.5 Mexico

6.2.6 Key Governing Bodies in Mexico

6.2.6.1 Federal Commission for the Protection Against Sanitary Risk (COFEPRIS)

6.2.6.1.1 Overview

6.2.6.1.2 Responsibilities

7 Regulatory Framework for Sterile Medical Packaging in Europe (Page No. - 72)

7.1 Europe

7.2 Europe: Sterile Medical Packaging Market Size, By Country

7.3 Governing Bodies in Europe

7.3.1 European Committee for Standardization (CEN)

7.3.1.1 Overview

7.3.1.2 Standards Developed By CEN

7.3.1.2.1 Harmonization of En 868-1 and ISO 11607

7.3.1.2.2 En 868-2:2009

7.3.1.2.3 En 868-3:2009

7.3.1.2.4 En 868-4:2009

7.3.1.2.5 En 868-5:2009

7.3.1.2.6 En 868-6:2009

7.3.1.2.7 En 868-7:2009

7.3.1.2.8 En 868-8:2009

7.3.1.2.9 En 868-9:2009

7.3.1.2.10 En 868-10:2009

7.3.2 Sterile Barrier Association (SBA)

7.3.2.1 Overview

7.3.2.2 SBA Member Categories

7.3.2.3 Administering Activities

7.4 Medical Device Regulations in Europe

7.4.1 Introduction

7.4.2 Medical Device Directive (93/42/EEC)

7.5 Impact of Medical Device Regulations in Europe

7.5.1 CE Marking- A Gateway to Access European Market

7.5.2 Impact of Harmonization Between En and ISO

7.6 Key Countries in Europe

7.6.1 Germany

7.6.2 Key Governing Bodies in Germany

7.6.2.1 Federal Ministry of Health

7.6.2.1.1 Overview

7.6.2.1.2 Administering Activities

7.6.2.2 German Institute for Standardization (DIN)

7.6.2.2.1 Overview

7.6.2.2.2 Organizational Structure

7.6.2.2.3 Administering Activities

7.6.3 U.K.

7.6.4 Key Governing Bodies in the U.K.

7.6.4.1 Medicines and Healthcare Products Regulatory Agency (MHRA)

7.6.4.1.1 Overview

7.6.4.1.2 Responsibilities

7.6.4.2 Department of Health (DH)

7.6.4.2.1 Overview

7.6.4.2.2 Responsibilities

7.6.4.3 Association of British Healthcare Industries (ABHI)

7.6.4.3.1 Overview

7.6.4.3.2 Responsibilities

7.6.4.4 The British Standards Institution (BSI)

7.6.4.4.1 Overview

7.6.4.4.2 Responsibilities

7.6.5 France

7.6.6 Key Governing Bodies in France

7.6.6.1 National Agency for the Safety of Medicine and Health Products (ANMS)

7.6.6.1.1 Overview

7.6.6.1.2 Responsibilities

7.6.7 Italy

7.6.8 Key Governing Bodies in Italy

7.6.8.1 Ministry of Health (MOH)

7.6.8.1.1 Overview

7.6.8.1.2 Responsibilities

7.6.8.2 Italian Medicines Agency

7.6.8.2.1 Overview

7.6.8.2.2 Responsibilities

8 Regulatory Framework for Sterile Medical Packaging in Asia-Pacific (Page No. - 104)

8.1 Asia-Pacific

8.2 Asia-Pacific: Sterile Medical Packaging Market Size, By Country

8.2.1 China

8.2.2 Key Governing Bodies in China

8.2.2.1 China Food and Drug Administration (CFDA)

8.2.2.1.1 Overview

8.2.2.1.2 Responsibilities

8.2.3 Japan

8.2.4 Key Governing Bodies in Japan

8.2.4.1 Ministry of Health, Labor and Welfare (MHLW)

8.2.4.1.1 Overview

8.2.4.1.2 Responsibilities

8.2.5 India

8.2.6 Key Governing Bodies in India

8.2.6.1 CENtral Drugs Standard Control Organization (CDSCO)

8.2.6.1.1 Overview

8.2.6.1.2 Responsibilities

8.2.7 Australia

8.2.8 Key Governing Bodies in Australia

8.2.8.1 Therapeutic Goods Administration (TGA)

8.2.8.1.1 Overview

8.2.8.1.2 Responsibilities

9 Regulatory Framework for Sterile Medical Packaging in RoW (Page No. - 111)

9.1 RoW

9.2 RoW: Sterile Medical Packaging Market Size, By Country

9.2.1 Brazil

9.2.2 Key Governing Bodies in Brazil

9.2.2.1 National Health Surveillance Agency (ANVISA)

9.2.2.1.1 Overview

9.2.2.1.2 Responsibilities

9.2.3 Argentina

9.2.4 Key Governing Bodies in Argentina

9.2.4.1 National Administration of Drugs, Foodstuffs, and Medical Technology (ANMAT)

9.2.4.1.1 Overview

9.2.4.1.2 Responsibilities

9.2.5 South Africa

9.2.6 Key Governing Bodies in South Africa

9.2.6.1 Medicines Control Council (MCC)

9.2.6.1.1 Overview

9.2.6.1.2 Responsibilities

10 Appendix (Page No. - 116)

10.1 Insights of Industry Experts

10.2 Discussion Guide

10.3 Introducing RT: Real Time Market Intelligence

10.4 Available Customizations

10.5 Related Reports

List of Tables (33 Tables)

Table 1 Asia-Pacific: Urbanization Prospects

Table 2 Technical Subcommittees

Table 3 Technical Subcommittees

Table 4 Annex

Table 5 ISO 11607-1

Table 6 ISO 11607-2

Table 7 North America: Sterile Medical Packaging Market Size, By Country, 2013–2020 (USD Million)

Table 8 North America: Sterile Medical Packaging Market Size, By Country, 2013–2020 (Million Units)

Table 9 Europe: Sterile Medical Packaging Market Size, By Country, 2013-2020 (USD Million)

Table 10 Europe: Sterile Medical Packaging Market Size, By Country, 2013-2020 (Million Units)

Table 11 En 868-2:2009

Table 12 Implementation of En 868-2:2009 in European Countries

Table 13 En 868-3:2009

Table 14 Implementation of En 868-3:2009 in European Countries

Table 15 En 868-4:2009

Table 16 Implementation of En 868-4:2009 in European Countries

Table 17 En 868-5:2009

Table 18 Implementation of En 868-5:2009 in European Countries

Table 19 En 868-6:2009

Table 20 Implementation of En 868-6:2009 in European Countries

Table 21 En 868-7:2009

Table 22 Implementation of En 868-7:2009 in European Countries

Table 23 En 868-8:2009

Table 24 Implementation of En 868-8:2009 in European Countries

Table 25 En 868-9:2009

Table 26 Implementation of En 868-9:2009 in European Countries

Table 27 En 868-10:2009

Table 28 Implementation of En 868-10:2009 in European Countries

Table 29 Standards Published By Na 063-04-04 Aa

Table 30 Asia-Pacific: Sterile Medical Packaging Market Size, By Country, 2013–2020 (USD Million)

Table 31 Asia-Pacific: Sterile Medical Packaging Market Size, By Country, 2013–2020 (Million Units)

Table 32 RoW: Sterile Medical Packaging Market Size, By Country, 2013–2020 (USD Million)

Table 33 RoW: Sterile Medical Packaging Market Size, By Country, 2013–2020 (Million Units)

List of Figures (39 Figures)

Figure 1 Global Population Projected to Reach 9.5 Billion By 2050

Figure 2 Middle-Class Population, 2009-2030

Figure 3 Projected GDP Per Capita, By Country

Figure 4 Fluctuations in Price of Natural Gas From 2008 to 2015

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 North America Dominated the Sterile Medical Packaging Market in 2014

Figure 8 Medical Devices Approval Process in Europe

Figure 9 Medical Devices Approval Process in China

Figure 10 Medical Devices Approval Process in Australia

Figure 11 Process to Supply Imported Medical Devices in Australia

Figure 12 Medical Devices Approval Process in Japan

Figure 13 Medical Devices Approval Process in Brazil

Figure 14 Reasons for Medical Device Product Recalls

Figure 15 Evolution of Sterile Medical Packaging

Figure 16 Sterile Medical Packaging Market Dynamics

Figure 17 Revenue Generated By Pharmaceuticals and Medicines in the U.S.

Figure 18 Global Aging Population, 2010-2015

Figure 19 Number of Recalls, 2010-2012

Figure 20 Spending on Retail Prescription Drugs

Figure 21 ISO Standards Portfolio, By Sector, 2014

Figure 22 Development Process for ISO Standards

Figure 23 Medical Device Circle

Figure 24 Medical Devices Approval Process By FDA

Figure 25 FDA: Organization Chart

Figure 26 Health Canada: Organization Chart

Figure 27 Federal Commission for the Protection Against Sanitary Risk: Organization Structure

Figure 28 Federal Ministry of Health: Organization Chart

Figure 29 Medicines and Healthcare Products Regulatory Agency: Organizational Structure

Figure 30 Department of Health: Organization Chart

Figure 31 Association of British Healthcare Industries: Organization Structure

Figure 32 The British Standards Institution: Organization Structure

Figure 33 National Agency for the Safety of Medicine and Health Products: Organization Chart

Figure 34 Ministry of Health: Organization Structure

Figure 35 Italian Medicines Agency: Organization Chart

Figure 36 Ministry of Health, Labor and Welfare: Organization Structure

Figure 37 Central Drugs Standard Control Organization: Organization Structure

Figure 38 Therapeutic Goods Administration: Organization Structure

Figure 39 Medicines Control Council: Organization Structure

Growth opportunities and latent adjacency in Regulatory Environment and Impact Analysis- Sterile Packaging Market