Power Quality Equipment Market

Power Quality Equipment Market by Equipment (UPS, Harmonic Filters, Surge Protection Devices, Voltage Regulators, Power Conditioner Units, Synchronous Condenser, Power Quality Meters), Phase (Single, Three), End User, Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global power quality equipment market is projected to reach a value of approximately USD 52.47 million by 2030, registering a CAGR of 6.6% from 2025 TO 2030. The market is witnessing strong growth, particularly in regions such as North America, Europe, and the Asia Pacific, where industrial automation, urbanization, and infrastructure modernization projects are expanding. The integration of renewable energy sources such as solar and wind into the power grid has further increased the demand for power quality equipment to manage voltage stability and frequency fluctuations. Additionally, the rising focus on energy efficiency and government regulations promoting power quality standards are key factors boosting market expansion.

KEY TAKEAWAYS

-

BY EQUIPMENTKey equipment segments include Surge protection devices, Surge Arrester, Static VAR Compensator, Synchronous Condenser, Voltage Regulator, Digital Static Transfer Switches, Harmonic Filters, Uninterruptable Power Supply, Isolation Transformer, Power Quality Meter, Power Conditioner Units, Power Distribution Units. The uninterruptible power supply (UPS) segment is expected to account for the largest share of the overall power quality equipment market during the forecast period. This is due to the rising demand for reliable and uninterrupted power across critical sectors such as data centers, healthcare, industrial automation, and commercial facilities. The increasing reliance on digital infrastructure, cloud computing, and IoT-driven applications has heightened the need for robust backup power solutions to prevent data loss and operational disruptions.

-

BY END USERKey end user segments include Industrial & Manufacturing, Commercial, Utilities, Transportation, and Residential. The industrial & manufacturing segment is expected to dominate the power quality equipment market from 2025 to 2030 due to the rising demand for stable and efficient power supply in industries such as automotive, electronics, steel, chemicals, pharmaceuticals, and food & beverage. With increasing automation, robotics, and digitalization in manufacturing processes, industries require uninterrupted and high-quality power to prevent equipment failures, production downtime, and financial losses.

-

BY PHASEKey phase segments include single and three. The three-phase segment is projected to account for the largest share of the power quality equipment market during the forecast period. This is attributed to its widespread adoption in industrial, commercial, and utility applications. Three-phase power systems are preferred for their higher efficiency, better power distribution, and ability to handle larger loads compared to single-phase systems.

-

BY REGIONThe Power Quality Equipment market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific held the largest share of the global power quality equipment market in 2024. The market in the region is driven by rapid industrialization, urbanization, and increasing investments in energy infrastructure across countries such as China, India, Japan, and South Korea. The region's booming manufacturing, data centers, telecommunications, and commercial sectors have significantly increased the demand for uninterruptible power supplies (UPS), voltage regulators, harmonic filters, and static VAR compensators (SVCs) to ensure stable and reliable power distribution.

-

COMPETITIVE LANDSCAPEThe market is moderately competitive, with Key players such as ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Eaton (US), and General Electric (US) focusing on developing energy-efficient and sustainable power quality solutions to cater to the growing demand from industries. These companies are also leveraging strategic partnerships, mergers, and acquisitions to expand their market presence and technological capabilities.

The global power quality equipment market is poised for significant growth in the coming years, driven by the increasing demand for reliable and efficient power distribution systems across various industries. Power quality equipment plays a crucial role in ensuring the stability and efficiency of electrical systems by mitigating voltage fluctuations, harmonics, transients, and other power disturbances. The growing adoption of sensitive electronic devices in industrial, commercial, and residential applications has heightened the need for high-quality power. Key end-use industries, including manufacturing, data centers, healthcare, and utilities, are investing in advanced power quality solutions to enhance operational efficiency and minimize equipment failures caused by poor power conditions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from surging demand for reliable, high-quality power amidst accelerating energy transitions and technological change. Utilities and industrial users remain key clients for power quality equipment manufacturers; their requirements are rapidly evolving as digitalization, automation, and renewable integration reshape the operating landscape. Downstream applications now span commercial, residential, and smart infrastructure sectors, with data centers, healthcare, and transportation driving new investments in advanced power quality solutions. As grids modernize and distributed generation grows, market opportunities for equipment suppliers expand, not only in traditional sectors, but also across emerging applications demanding real-time monitoring, voltage stability, and harmonic suppression to maintain operational reliability and efficiency.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for uninterrupted power supply

-

. Increasing adoption of renewable energy sources

Level

-

High initial investment & maintenance costs

-

. Competition from alternative technologies

Level

-

Surge in battery energy storage systems

-

. Growing demand for modular & scalable solutions

Level

-

Interoperability issues in smart grid systems

-

. Growing preference for cloud-based energy management

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for uninterrupted power supply

The global demand for uninterrupted power supply is rising significantly due to the growing dependence on reliable electricity across industries such as IT & telecom, manufacturing, healthcare, and data centers. These industries require high-quality power to ensure seamless operations, prevent downtime, and maintain productivity. Any disruptions, voltage fluctuations, or power outages can result in financial losses, compromised safety, and operational inefficiencies. As a result, businesses and institutions are increasingly investing in power quality equipment such as uninterruptible power supply (UPS) systems, voltage regulators, power conditioners, and harmonic filters to mitigate risks associated with power disturbances. According to the IEA, investment in new data centers has surged over the past two years, driven by growing digitalization and the uptake of artificial intelligence (AI), which is expected to continue accelerating. Much of the spending is concentrated in the US, where annual investment in data center construction has doubled in the past two years alone, although other major economies, such as China and the European Union, are also witnessing an increase in activity. In 2023, overall capital investment by Google, Microsoft, and Amazon, which are industry leaders in AI adoption and data center installation, was higher than that of the entire US oil & gas industry – totaling around 0.5% of the US GDP.

Restraint: High initial investment & maintenance costs

The high initial investment cost associated with advanced power quality equipment, such as static VAR compensators (SVCs) and synchronous condensers, is a significant restraint to the market growth. These devices play a crucial role in mitigating power disturbances, enhancing voltage stability, and ensuring the smooth operation of electrical networks. However, their high procurement, installation, and maintenance costs make them less accessible, particularly for small and medium-sized enterprises (SMEs) and industries with budget constraints. One of the primary reasons for the high capital expenditure (CAPEX) of power quality equipment is the complexity of the technology involved. Devices like SVCs and synchronous condensers require advanced semiconductor materials, high-precision components, and sophisticated control systems to regulate reactive power and minimize power fluctuations. The research and development (R&D) efforts required to design, test, and commercialize these technologies further contribute to their high cost. Additionally, the integration of these systems with existing electrical infrastructure demands specialized engineering expertise, increasing installation and commissioning expenses.

Opportunity: Surge in battery energy storage systems

The rapid expansion of battery energy storage systems (BESS) presents a significant opportunity for the global power quality equipment market. As industries, commercial enterprises, and utilities strive to enhance grid stability and ensure uninterrupted power supply, the integration of energy storage solutions with power quality equipment such as uninterruptible power supplies (UPS) and power conditioners is becoming increasingly crucial. One of the key advantages of integrating BESS with power quality equipment is the ability to mitigate power fluctuations and voltage instability. Renewable energy sources like solar and wind are inherently intermittent, leading to fluctuations in power generation. This variability can cause voltage sags, surges, and frequency deviations, negatively impacting industrial machinery, data centers, and sensitive electronic equipment. By combining BESS with voltage regulators, harmonic filters, and power conditioners, businesses can maintain a stable power supply, ensuring consistent and high-quality electricity. This integration allows for real-time voltage and frequency regulation, minimizing disruptions and improving overall power reliability.

Challenge: Interoperability issues in smart grid systems

Interoperability issues in smart grid systems present a significant challenge in the global power quality equipment market. As utilities and industries transition to modern, digital infrastructure, ensuring seamless integration between legacy power systems and advanced smart grid technologies has become a critical concern. Traditional power grids were primarily designed for unidirectional power flow, whereas modern smart grids incorporate bidirectional energy exchange, distributed energy resources (DERs), and digital monitoring systems. This disparity in design creates compatibility issues, affecting the efficiency and reliability of power quality equipment such as voltage regulators, harmonic filters, and power conditioning units. One of the primary challenges is the integration of digital control and monitoring systems with existing electromechanical infrastructure. Many power utilities still rely on outdated substations, transformers, and switchgear that lack real-time data communication capabilities. When new power quality solutions, such as digital static transfer switches (DSTS) and power quality meters, are introduced, they require standardized communication protocols to interact with legacy devices. However, variations in protocols, such as IEC 61850, Modbus, DNP3, and proprietary formats, hinder seamless interoperability.

power quality equipment market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Modernization of emergency/standby power using bypass isolation ATS for 42 legacy units; emphasis on uptime, maintenance without power interruption, and integration with existing HMI remote management. | Increased power reliability for critical healthcare services, simplified maintenance without downtime, enhanced worker safety, and seamless integration with old infrastructure and centralized monitoring. |

|

Deployment of high-capacity (up to 2,000 kVA) UNIPARA-UP2001i UPS series in large data centers with space-saving and energy-efficient design, network-based remote management, and 24/7 support. | Achieves high (up to 97%) energy efficiency, reduces UPS footprint by 40%, ensures uninterrupted uptime, lowers operational costs, and enables sustainable, scalable IT infrastructure. |

|

Integration of ADF Power Tuning active harmonic filters to maintain <5% THD on marine vessels during dynamic positioning, ensuring compact implementation for limited onboard space and compliance with strict marine regulations. | Significantly lowers voltage THD for class compliance, improves vessel power quality and efficiency, ensures reliable operations in energy-intensive modes, and optimizes space and costs. |

|

Implementation of switched PDUs in global colocation data centers to enable remote rack-level power management, automated recovery, and condition monitoring for over 10,000 media clients. | Ensures rapid remote recovery from server faults, increases uptime, reduces need for on-site support, cuts operational costs, and delivers robust, scalable monitoring for continued business growth. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Power Quality Equipment market ecosystem is built on a collaborative network connecting raw material suppliers, leading manufacturers, distributors, and high-impact end users to address the demands of next-generation electrical systems. Material providers such as DuPont, 3M, and BASF supply advanced polymers and specialty components essential for manufacturing high-performance power quality devices. Top manufacturers like Schneider Electric, Eaton, ABB, and Siemens engineer a wide spectrum of power quality solutions, including UPS, voltage regulators, and harmonic filters, optimized for industrial, utility, and commercial applications. Distributors such as Graybar, Sonepar, and Rexel ensure efficient product delivery and regional support, serving as critical links between suppliers and operational environments. End users, including Tesla, ExxonMobil, and GM, rely on these integrated technologies to safeguard operations, improve energy efficiency, and enable digital transformation within data centers, automotive, and oil & gas sectors.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Power Quality Equipment Market, By Equipment

The uninterruptible power supply (UPS) segment is expected to account for the largest share of the overall power quality equipment market during the forecast period. This is due to the rising demand for reliable and uninterrupted power across critical sectors such as data centers, healthcare, industrial automation, and commercial facilities. The increasing reliance on digital infrastructure, cloud computing, and IoT-driven applications has heightened the need for robust backup power solutions to prevent data loss and operational disruptions. Additionally, the growing adoption of renewable energy sources and grid modernization initiatives has further fueled the demand for UPS systems, which help stabilize power fluctuations and ensure seamless energy transitions. With businesses prioritizing energy efficiency and regulatory compliance, advanced UPS systems with high energy efficiency, lithium-ion battery technology, and real-time monitoring capabilities are gaining traction.

Power Quality Equipment Market, By End user

The industrial & manufacturing segment is expected to dominate the power quality equipment market from 2025 to 2030 due to the rising demand for stable and efficient power supply in industries such as automotive, electronics, steel, chemicals, pharmaceuticals, and food & beverage. With increasing automation, robotics, and digitalization in manufacturing processes, industries require uninterrupted and high-quality power to prevent equipment failures, production downtime, and financial losses. Additionally, the growing adoption of Industry 4.0 technologies, including AI, IoT, and machine learning, further amplifies the need for power conditioning and voltage regulation solutions. The expansion of renewable energy integration in industrial setups and the push for energy efficiency and sustainability are also key drivers for the segment's growth. Moreover, stringent government regulations on power reliability, safety, and carbon footprint reduction are prompting industries to invest in power quality equipment such as uninterruptible power supplies (UPS), harmonic filters, voltage regulators, and static VAR compensators (SVCs). This strong demand, coupled with increasing industrialization in emerging economies, will solidify the segment's leading position in the power quality equipment market.

Power Quality Equipment Market, By Phase

The three-phase segment is projected to account for the larger share of the power quality equipment market during the forecast period. Three-phase power systems are preferred for their higher efficiency, better power distribution, and ability to handle larger loads compared to single-phase systems. Industries such as manufacturing, oil & gas, data centers, healthcare, and transportation heavily rely on three-phase power for operating heavy machinery, motors, HVAC systems, and critical infrastructure. Additionally, the increasing penetration of renewable energy sources, such as wind and solar farms, is driving the need for three-phase power quality equipment to ensure stable voltage levels and minimize power disruptions. Governments and utilities worldwide are also focusing on grid modernization and industrial expansion, further boosting the demand for three-phase UPS systems, voltage regulators, harmonic filters, and static VAR compensators (SVCs). With growing industrialization and urbanization, particularly in emerging economies, the three phase segment is expected to maintain its dominance in the market.

REGION

Asia Pacific to be the fastest and largest region in the global Power Quality Equipment market during the forecast period

Asia Pacific held the largest share of the global power quality equipment market in 2024. The market in the region is driven by rapid industrialization, urbanization, and increasing investments in energy infrastructure across countries such as China, India, Japan, and South Korea. The region's booming manufacturing, data centers, telecommunications, and commercial sectors have significantly increased the demand for uninterruptible power supplies (UPS), voltage regulators, harmonic filters, and static VAR compensators (SVCs) to ensure stable and reliable power distribution. Additionally, expanding renewable energy projects, particularly solar and wind power, require advanced power quality solutions to manage voltage fluctuations and grid stability. Government initiatives focused on grid modernization, smart cities, and industrial automation further fuel the market growth. With a rising number of infrastructure projects, growing energy consumption, and increasing awareness of power reliability, Asia Pacific is expected to remain the dominant region in the power quality equipment market throughout the forecast period.

power quality equipment market: COMPANY EVALUATION MATRIX

Siemens is the Star Player in the Power Quality Equipment market, leading with innovative, broad-based solutions and a strong global footprint serving industrial, utility, and infrastructure clients. Toshiba is the Emerging Leader, gaining momentum with energy-efficient UPS systems and digital power quality technologies tailored for renewables, data centers, and mission-critical applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 35.99 BN |

| Revenue Forecast in 2030 | USD 52.47 BN |

| Growth Rate | 6.60% |

| Actual data | 2021–2030 |

| Base year | 2024 |

| Forecast period | 2025–2030 |

| Units considered | Value (USD BN), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: power quality equipment market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| End User & Application Segmentation | Comprehensive list of power quality equipment customers segmented by utilities, industrial, commercial, transportation, and residential end users. | Insights into demand, growth drivers, and technology adoption, plus addressable market size and opportunity breakdown across each end-user segment. |

RECENT DEVELOPMENTS

- September 2024 : Siemens announced its agreement to acquire California-based Trayer Engineering Corporation (Trayer), a leader in the design and manufacturing of medium-voltage secondary distribution switchgear suitable for outdoor and below-ground applications.

- October 2024 : Siemens signed an agreement to acquire Altair Engineering Inc., a leading provider of software in the industrial simulation and analysis market. Altair shareholders will receive USD 113 per share, representing an enterprise value of approximately USD 10 billion. The offer price represents a 19% premium to Altair's unaffected closing price on October 21, 2024, the last trading day prior to media reports regarding a possible transaction. With this acquisition, Siemens strengthens its position as a leading technology company and its leadership in industrial software.

- December 2024 : ABB India announced that it had signed an agreement to acquire the power electronics business of Gamesa Electric in Spain, a subsidiary of Siemens Gamesa. This strategic acquisition aims to strengthen ABB’s position in the rapidly growing market for high-powered renewable power conversion technology.

- November 2023 : Schneider Electric, the global leader in the digital transformation of energy management and automation, announced that it had entered into exclusive negotiations with Atos Group. It has finalized the acquisition of EcoAct SAS (“EcoAct”), an international leader in climate consulting and net zero solutions headquartered in Paris, France. The completion of the transaction follows consultation with the relevant employee representative bodies and approval from the competent regulatory authorities.

Table of Contents

Methodology

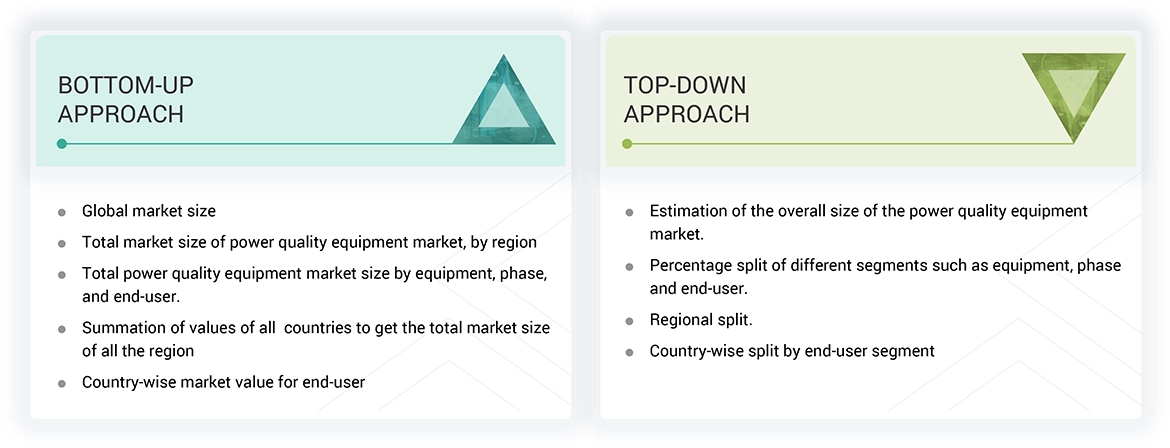

The study involved major activities in estimating the current size of the power quality equipment market. Exhaustive secondary research was done to collect information on the peer markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the power quality equipment market. In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report.

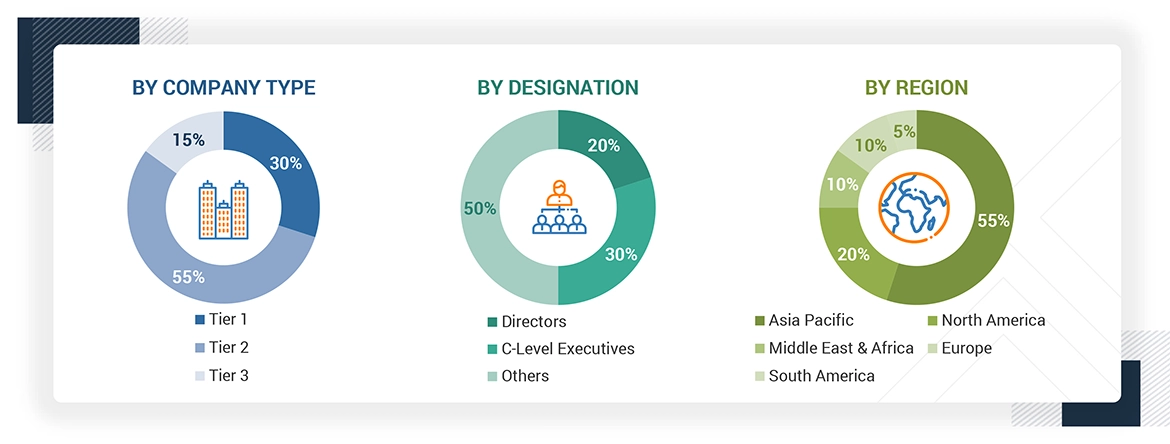

Following is the breakdown of primary respondents:

Note: Other designations include sales managers, engineers, and regional managers.

The tier of the companies is defined based on their total revenue; as of 2023: Tier 1 = > USD 1 billion, Tier 2 = From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the power quality equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

Power quality equipment is a collection of devices and solutions intended to ensure efficient, stable, and reliable transmission and distribution of electrical power by preventing problems like voltage fluctuations, harmonic distortion, transients, and power outages. These problems cause equipment failure, energy wastage, and higher operational costs, hence the need for power quality management in industrial, commercial, and utility applications. Power quality equipment consists of devices like uninterruptible power supplies (UPS), voltage regulators, power conditioners, harmonic filters, surge protection devices, and static VAR compensators, all of which ensure optimal voltage levels, reduce interruptions, and enhance overall power efficiency. As more industries are now depending on automation, digitalization, and green power sources, power quality solutions have seen an unprecedented increase in demand to assist critical processes, guard sensitive electronics, and make grids more stable. With the convergence of smart grid technology and evolving energy storage systems, power quality equipment today encompasses digital monitoring, predictive maintenance, as well as real-time power analytics for maximizing energy usage and minimizing downtime, making it a critical component of new power infrastructure.

Stakeholders

- Government & research organizations

- Institutional investors

- Investors/Shareholders

- Environmental research institutes

- Manufacturers’ associations

- Power quality equipment manufacturers, dealers, and suppliers

- Organizations, forums, alliances, and associations

- Renewable power generation and equipment manufacturing companies

- Public & private power generation, transmission & distribution companies (utilities)

- Smart grid project developers

- Government and research organizations

- Universities and Research institutes

Report Objectives

- To define, describe, segment, and forecast the power quality equipment market by equipment, phase, end-user, and region, in terms of value

- To forecast the power quality equipment market by region, in terms of volume

- To forecast the market size for four key regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America along with their country-level market sizes, in terms of value

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To provide value chain analysis, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, average selling price (ASP) analysis, Porter’s five forces analysis, and regulations pertaining to the power quality equipment market

- To analyze opportunities for stakeholders in the power quality equipment market and draw a competitive landscape for market players

- To strategically analyze the ecosystem, regulations, patents, and trading scenarios pertaining to the power quality equipment market

- To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business and product strategies

- To compare key market players with respect to their market share, product specifications, and applications

- To strategically profile key players and comprehensively analyze their market rankings and core competencies2

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, partnerships, and collaborations, in the power quality equipment market

- To study the impact of AI/Gen AI on the market under study, along with the global macroeconomic outlook

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Power Quality Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Power Quality Equipment Market