Surge Protection Devices Market

Surge Protection Devices Market by Product (Hard-wired, Plug-in, Line Cord, Power Control Devices), by Technology (Type 1, Type 2, Type 3), by Nominal Discharge Current (Below 10kA, 10–25kA, Above 25kA), End-User, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

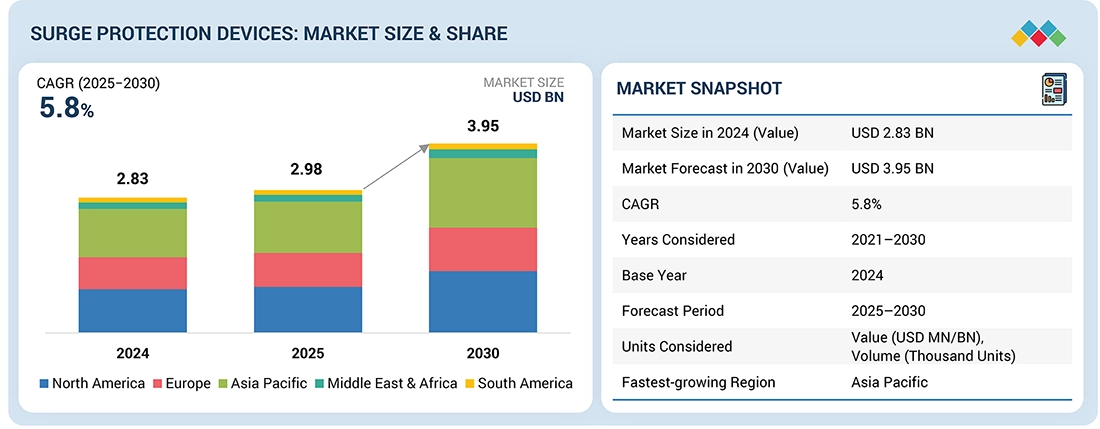

The global surge protection devices market is estimated to be valued at USD 2.98 billion in 2025 and is projected to reach USD 3.95 billion by 2030, growing at a CAGR of 5.8% for the forecast period. The demand for surge protection devices is driven by various drivers, including growing cases of power surges due to lightning, grid switching, and widespread use of sensitive electronic equipment in industries.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific is expected to grow at the highest CAGR of 6.2% during the forecast period, driven by industrial expansion, infrastructural development, and the demand for uninterrupted power supply.

-

BY PRODUCTIn 2024, the hard-wired segment held the largest share of 42.7% of the surge protection devices market, by product.

-

BY TECHNOLOGYIn 2024, the type 2 technology segment held 49.8% of the market, driven by rising urbanization and construction activity.

-

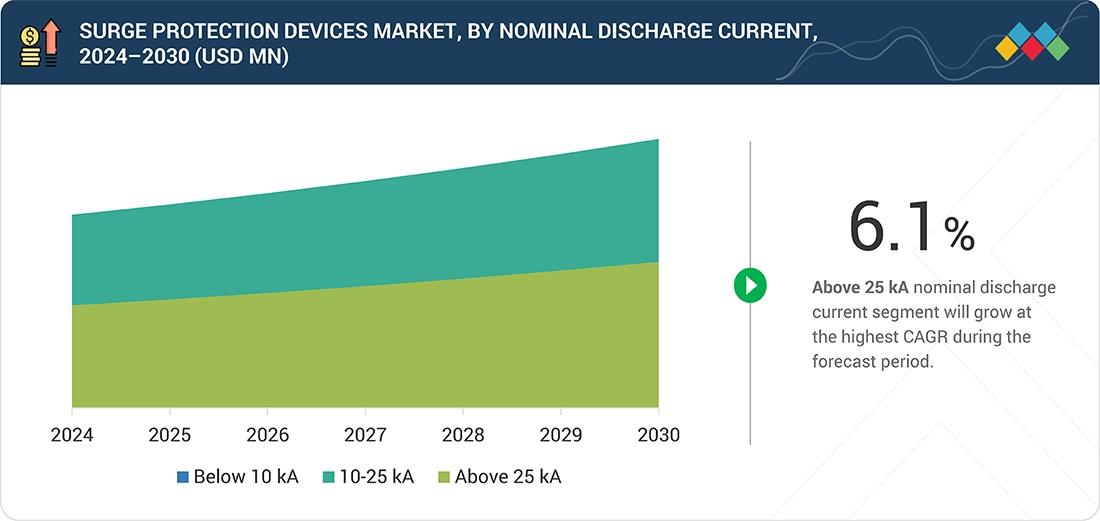

BY NOMINAL DISCHARGE CURRENTThe above 25 kA segment is projected to grow at the highest CAGR during the forecast period.

-

BY END USERIn 2024, industrial end users accounted for the largest share of the surge protection devices market.

-

COMPETITIVE LANDSCAPECompanies such as ABB, Schneider Electric, and Eaton are identified as key players in the surge protection devices market, with their wide presence, robust portfolios, and business reach.

Digitization and urbanization have raised the demand for high-quality power, and surge protection devices are instrumental in preventing equipment failure and operation downtime. Adopting regulatory compliance and international safety standards, including IEC 61643 and UL 1449, also drives the adoption of surge protection devices in industries. Growth in the market is also driven by smart grid innovation, renewable energy integration, and data center construction.

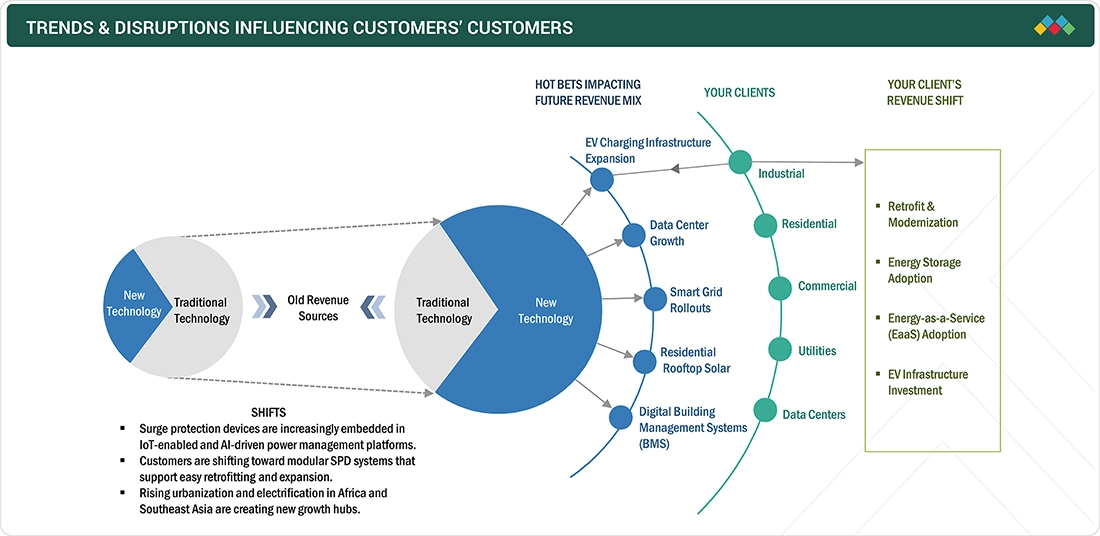

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The global surge protection devices market is undergoing a significant transformation as industries focus on enhancing electrical resilience, minimizing downtime, and protecting sensitive equipment in an increasingly digital and electrified world. The proliferation of smart devices, automation systems, and interconnected infrastructure has made surge protection a critical component of modern electrical systems across residential, commercial, industrial, and utility sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Integration of sensitive electronic equipment into residential, commercial, and industrial sectors

-

Expanding renewable energy infrastructure

Level

-

High initial cost of installation

-

Transition towards DC-based electrical systems

Level

-

Integration of SPDs with smart monitoring systems

-

Rapid expansion of data centers and cloud infrastructure

Level

-

Short lifespan in harsh environments

-

Complexities associated with switching operations and internal disturbance

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Integration of sensitive electronic equipment into residential, commercial, and industrial sectors

The modern world is witnessing an unprecedented increase in the integration of sensitive electronic equipment across residential, commercial, and industrial domains. This proliferation is being driven by multiple technological trends, including digitalization, automation, smart home adoption, industrial IoT, and cloud computing infrastructure. Equipment such as servers, control panels, programmable logic controllers (PLCs), smart TVs, HVAC systems, EV charging stations, medical devices, and high-end appliances are highly susceptible to voltage transients. These momentary overvoltages, commonly caused by lightning, switching operations, or utility grid disturbances, can damage sensitive circuits, shorten device lifespans, or even lead to catastrophic system failures. As such, the growing electronics ecosystem has made surge protection devices indispensable in modern electrical infrastructure.

Restraint: High initial cost of installation

One of the critical restraints limiting the broader adoption of surge protection devices (SPDs), particularly in industrial and commercial settings, is the high initial cost of installation. While SPDs provide long-term protection against transient surges that can damage or destroy sensitive electronic equipment, the upfront capital required—especially for high-performance, multi-stage, or system-integrated devices—can be substantial. In advanced industrial applications, SPDs are not simply plug-and-play components. Instead, they often need to be tailored to specific system voltages, configurations (e.g., AC vs. DC), and risk profiles. This requires custom engineering, site audits, professional installation, and coordination with other electrical protection systems, which further elevates costs. In cases where SPDs are installed within control panels, substations, or distributed energy resources (like solar PV systems or wind farms), additional expenses are incurred for panel modifications, compliance testing, and labor.

Opportunity: Integration of SPDs with smart monitoring systems

The integration of surge protection devices (SPDs) with smart monitoring systems represents a significant opportunity in the evolving power infrastructure landscape. With the rise of IoT (Internet of Things), Industry 4.0, and smart grid ecosystems, the conventional role of SPDs as passive protective components is transforming into that of intelligent, connected devices capable of real-time surveillance, diagnostics, and communication. This shift aligns with the growing demand from industries, utilities, and infrastructure developers for more proactive and preventive electrical safety solutions. Traditionally, SPD failures were often detected only after equipment damage had occurred. However, smart SPDs equipped with sensors and communication modules enable continuous condition monitoring, event logging, and predictive maintenance, reducing downtime and operational risks.

Challenge: Short lifespan in harsh environments

One of the most pressing challenges in the surge protection devices market is the reduced lifespan of SPDs when deployed in harsh electrical environments, particularly in areas prone to frequent voltage spikes or lightning strikes. SPDs are designed to absorb and redirect excess voltage away from sensitive equipment. However, in high-surge regions—such as those located in tropical climates or along lightning-prone corridors—the frequency and intensity of these electrical surges can significantly accelerate the wear and tear of SPD components. Most SPDs are built with metal oxide varistors (MOVs) or gas discharge tubes (GDTs), which are inherently sacrificial elements. Every time an SPD suppresses a surge, it consumes a portion of its protective capacity. This degradation is slow in moderate environments, allowing the device to last for many years. However, the SPD can reach its end of life much sooner than expected in areas that experience regular transient overvoltages, such as utility switching surges, nearby lightning events, or sudden changes in heavy industrial loads.

Surge Protection Devices Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The company supported a drill pipe manufacturer in Texas by deploying surge protection devices (SPDs) to prevent equipment failures caused by transient voltage surges. | Prevented equipment damage and saved approximately USD 180,000 in repair and downtime costs |

|

The company supported a food processing unit in Indore by assessing and upgrading its Lightning Protection System to ensure optimal safety and compliance. | Mitigated lightning-related risks, ensuring equipment safety and uninterrupted operations |

|

The company supported a Texas manufacturing facility by providing a custom SASD-based surge protection solution for CNC milling machines. | Reduced equipment failures and downtime, improving operational efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The surge protection devices market ecosystem is undergoing rapid changes as part of the broader transition to digitalization. Key stakeholders in this ecosystem include field device manufacturers, component providers, distributors, and end users. Prominent companies in this market include ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Eaton (Ireland), and Emerson Electric Co (US), which are the market leaders.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Surge Protection Devices, By Product

The hard-wired segment held the largest market share in 2024, primarily driven by its widespread use in industrial, commercial, and utility-scale applications where comprehensive, system-wide protection is critical. These devices are permanently installed at key points in the electrical infrastructure, such as service entrances, distribution panels, and sub-panels, offering high-capacity defense against transient overvoltages caused by lightning strikes, switching operations, or grid disturbances.

Surge Protection Devices, By Technology

The Type 2, by technology segment, held the largest share in 2024 as it gains significant momentum in the commercial, residential, and industrial sectors, which increasingly prioritize mid-level protection for downstream electrical systems. Installed at distribution board levels, Type 2 SPDs are essential for shielding sensitive electronic equipment from residual surges that primary protection or internally generated transient voltages cannot stop.

Surge Protection Devices, By Nominal Discharge Current

10–25 kA held the largest share in 2024, as it is gaining strong traction across commercial, industrial, and data center applications due to the growing need for mid-range protection against moderate to high transient overvoltages. These devices strike a balance between cost and performance, offering robust surge mitigation in environments exposed to frequent switching transients and voltage disturbances.

Surge Protection Devices, By End User

The industrial segment held the largest market share in 2024, driven by the escalating need to protect critical machinery, automation equipment, and sensitive electronics from voltage surges and power fluctuations that can cause costly downtime and equipment failure. Industrial end users are increasingly adopting advanced hard-wired surge protection solutions, which offer comprehensive and permanent protection for entire electrical systems, including power distribution panels and process control networks.

REGION

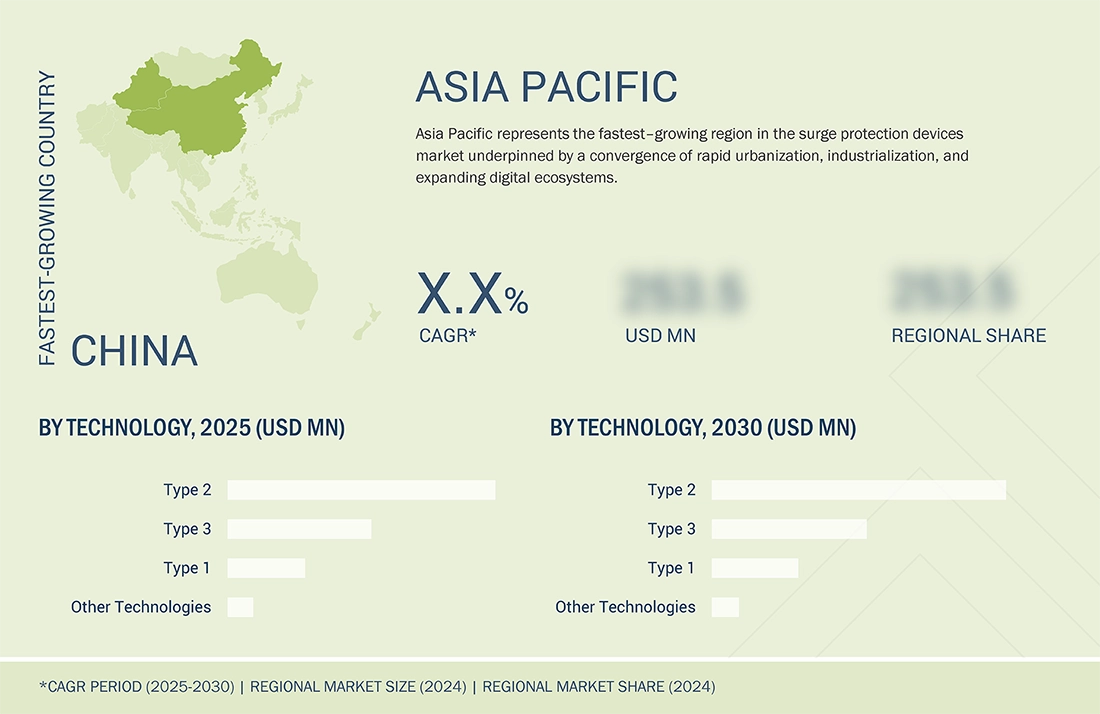

Asia-Pacific to be fastest-growing region in global surge protection devices market during forecast period

Asia Pacific is emerging as the fastest-growing region in the global surge protection devices market, driven by rapid urbanization, industrial expansion, and significant infrastructure development in power distribution and transmission networks. Countries including China, India, Japan, South Korea, and members of ASEAN are experiencing a surge in the installation of smart grids and renewable power sources, which necessitate enhanced surge protection mechanisms.

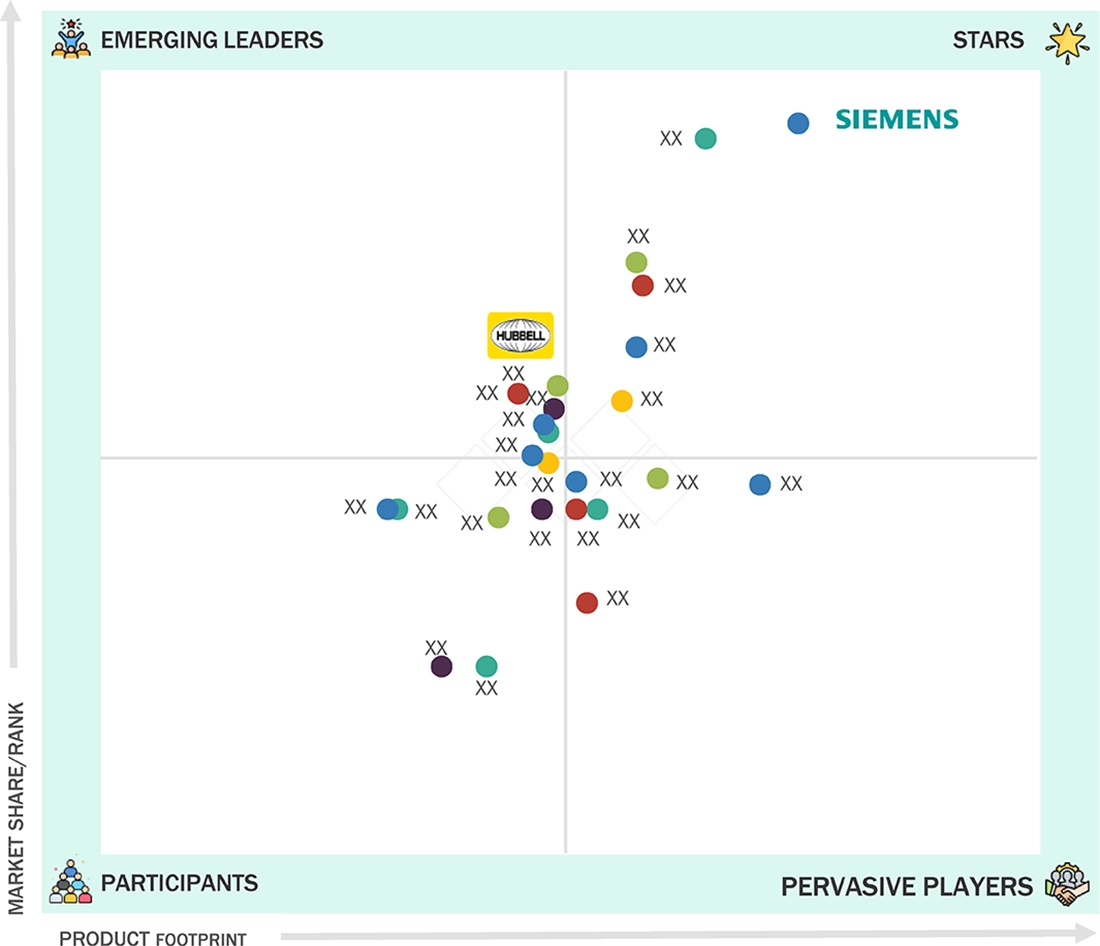

Surge Protection Devices Market: COMPANY EVALUATION MATRIX

In the surge protection devices market matrix, Siemens (Star) holds a large market share due to its advanced product portfolio integrating smart monitoring, strong global presence, and continuous innovation in energy management and industrial safety solutions. Hubbell (Emerging Leader) shows a growing focus on developing integrated power protection solutions for residential and commercial applications, supported by strategic acquisitions and expansion.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.83 Billion |

| Market Forecast in 2030 (Value) | USD 3.95 Billion |

| Growth Rate | CAGR of 5.8% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

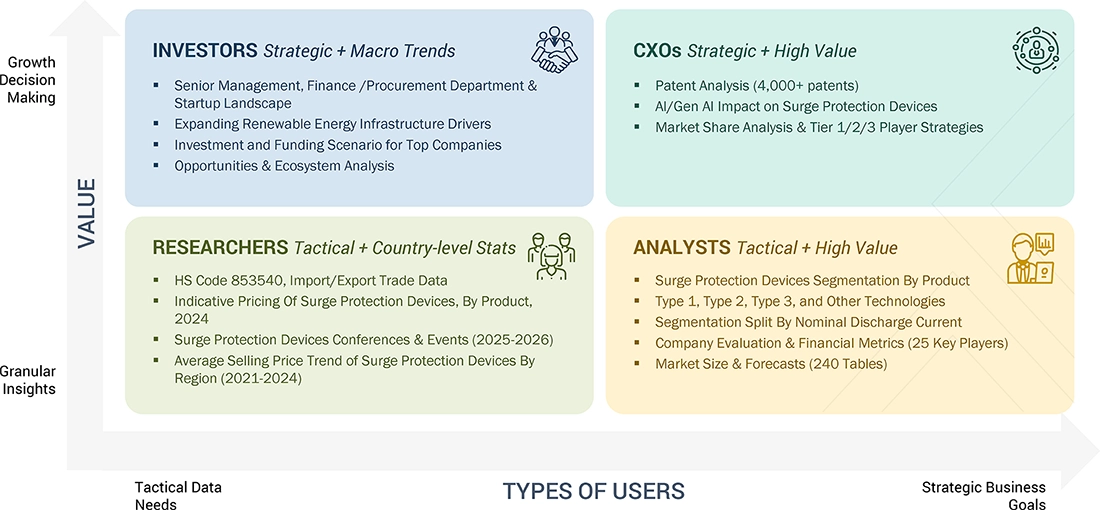

WHAT IS IN IT FOR YOU: Surge Protection Devices Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- April 2025 : Eaton acquired Fibrebond, a leading modular electrical and data center infrastructure provider. This strategic move enhances Eaton's capabilities in delivering engineered-to-order enclosures that integrate power distribution and backup systems. The acquisition strengthens Eaton's position in the data center, utility, and industrial markets, aligning with its focus on resilient, scalable, and protected power solutions.

- March 2025 : Schneider Electric announced a landmark investment of over USD 700 million in its US operations, marking the company's largest-ever capital commitment in the region. This investment, set to be deployed through 2027, will support the expansion and modernization of eight manufacturing sites across states, including Texas, Tennessee, Ohio, North Carolina, Massachusetts, and Missouri. The initiative is aimed at meeting the surging demand for data centers, energy infrastructure, and automation solutions, driven largely by the rapid growth of artificial intelligence and digitalization.

- December 2024 : Bourns introduced the GDT21 Series, a compact 1206 chip-size surface-mount gas discharge tube (GDT) surge protector. Designed for space-sensitive applications, it offers excellent protection against lightning and AC-induced voltage transients. With tight voltage limiting during fast surges and the ability to safely handle 500 A pulses, this robust 2-electrode device ensures reliable performance without damaging downstream components.

- June 2024 : ABB announced a USD 35 million investment in a new manufacturing and R&D facility in Nottingham, UK, dedicated to producing Furse earthing and lightning protection solutions. This facility aims to meet the growing demand for electrical protection systems across various sectors, including buildings, wind turbines, and data centers.

Table of Contents

Methodology

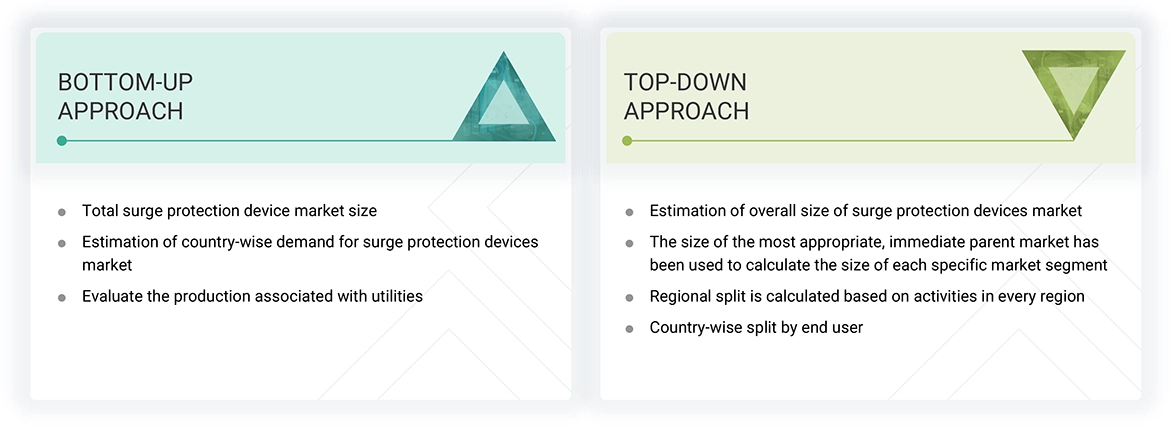

This study involved major activities in estimating the current size of the surge protection devices market. Comprehensive secondary research was done to collect information on the market, peer, and parent markets. The next step involved was the validation of these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from recognized authors, and databases of various companies and associations. Secondary research has been mainly used to obtain key information about the industry’s supply chain to identify the key players offering various products and services, market classification and segmentation according to the offerings of major players, industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts, such as chief executive officers (CEO), vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the surge protection devices market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

Note: “Others” include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500

million–1 billion, and Tier 3:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the solid biomass feedstock market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Surge Protection Devices Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

The surge protection devices market refers to the global industry focused on designing, manufacturing, and distributing devices that protect electrical systems and equipment from transient overvoltage events, commonly known as power surges. These surges are typically caused by lightning strikes, grid switching, short circuits, tripped breakers, or turning on and off industrial equipment. Surge protection devices are engineered to limit the voltage supplied to an electrical device by blocking or shorting to ground any unwanted voltages above a safe threshold. By doing so, SPDs prevent damage to sensitive electronics, ensure system reliability, and extend the lifespan of connected equipment.

SPDs are broadly categorized by type (Type 1, Type 2, and Type 3) based on their installation location and application. Type 1 devices are installed at the service entrance and provide protection against external surges, including lightning; Type 2 devices are typically located at distribution panels and protect against internal surges from switching operations, while Type 3 devices offer point-of-use protection for end equipment. The market serves a range of end users across residential, commercial, industrial, data centers, and utility sectors, all of which require surge protection to prevent costly downtime, equipment failure, and fire hazards.

Driven by the increasing adoption of sensitive electronic devices, the growing reliance on automation, the expansion of data centers, and rising concerns around electrical safety and power quality, the SPD market has seen steady growth. Technological advancements, including integration with IoT and smart monitoring features and stricter regulatory norms on equipment protection, are further propelling market development. In the face of evolving power infrastructure and increased frequency of electrical disturbances due to climate-induced weather events, surge protection is becoming a critical global component of modern electrical systems.

Stakeholders

- Government & research organizations

- Institutional investors

- Investors/Shareholders

- Environmental research institutes

- Manufacturers’ associations

- Surge protection devices manufacturers, dealers, and suppliers

- Organizations, forums, alliances, and associations

- Renewable power generation and equipment manufacturing companies

- Public & private power generation, transmission & distribution companies (utilities)

- Smart grid project developers

- State and national regulatory authorities

- Venture capital firms

Report Objectives

- To define, describe, segment, and forecast the surge protection devices market, by product, technology, nominal discharge current, and end user, in terms of value.

- To define, describe, and forecast the surge protection devices market, by region, in terms of volume

- To forecast the market size for five regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their key countries

- To provide a detailed overview of the supply chain, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, average selling price (ASP) analysis, AI/gen AI impact analysis, Porter’s five forces analysis, macroeconomic outlook, and regulations pertaining to the surge protection devices market

- To provide detailed information about the key factors, including drivers, restraints, opportunities, and challenges, influencing the growth of the surge protection devices market

- To strategically analyze the sub-segments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and the details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies1.

- To track and analyze competitive developments, such as investments, agreements, acquisitions, partnerships, and expansions, in the surge protection devices market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the surge protection device market, by country

Company Information

- Detailed analyses and profiling of additional market players

Key Questions Addressed by the Report

What is the current size of the surge protection devices market in 2024?

The current market size of the global surge protection devices market is USD 2.83 billion in 2024.

What are the major drivers for the surge protection devices market?

Growing dependence on sensitive electronics and expansion of renewable energy infrastructure are significant factors driving the surge protection devices market.

Which is the largest region during the forecast period in the surge protection devices market?

The Asia Pacific region is estimated to be the largest market during the forecast period.

By technology, which is the fastest-growing segment during the forecast period in the surge protection device market?

The Type 1 segment is estimated to be the fastest-growing segment during the forecast period.

What can be restraints for the surge protection device market to grow?

The rise of DC-based electrical systems/evolving electrical architectures is one of the key restraints for the growth of the market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Surge Protection Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Surge Protection Devices Market