Microfluidics Market Size, Growth, Share & Trends Analysis

Microfluidics Market by Product (Chip, Sensor, Valve, Pump, Needle), Material (Silicon, Polymer), Application [Diagnostics (Clinical, PoC), Research (Proteomics, Genomics, Cell), Therapeutics (Drug Delivery Wearables)], End User – Global forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Microfluidics market, valued at US$23.71 billion in 2024, stood at US$24.96 billion in 2025 and is projected to advance at a resilient CAGR of 8.3% from 2025 to 2030, culminating in a forecasted valuation of US$37.19 billion by the end of the period. Several significant factors are driving the growth of the microfluidics market, thereby enhancing its expansion and applications. There is a growing demand for point-of-care diagnostics, which require fast, accurate, and cost-effective instruments. Moreover, the trend toward personalized medicine raises the requirement for precise biomarker analysis and high-throughput screening. An increase in research & development expenditure supports the research and investigation of novel and innovative technologies, which in turn supports market growth.

KEY TAKEAWAYS

-

By RegionNorth America accounted for the largest share of the global microfluidics market with a share of 40.6% in 2024.

-

By ProductIn 2024, the microfluidics-based devices segment accounted for the largest market share of 70.5%.

-

By ApplicationBy application, the in vitro diagnostics segment is expected to dominate the overall market.

-

By End UserBy end user, the hospitals and diagnostic centers segment is projected to register the highest growth during the forecast period.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSThermo Fisher Scientific, Illumina Inc., and Bio-Rad Laboratories Inc. are identified as key players in the microfluidics market, given their strong market share and extensive product footprint.

-

COMPETITIVE LANDSCAPE- OTHER PLAYERSQuidelOrtho Corporation, Hologic, Inc., and Aignep s.p.a. have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Several significant reasons are driving the growth of the microfluidics market. There is a rising demand for point-of-care diagnostics, which require fast, accurate, and cost-efficient instruments. Moreover, the trend toward personalized medicine raises the requirement for precise biomarker analysis and high-throughput screening. An increase in research & development expenditure supports the research and investigation of novel and innovative technologies, which in turn supports market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The microfluidics market is being reshaped by the convergence of miniaturization, automation, and digital integration across healthcare and research applications. Hospitals, academic institutions, and pharmaceutical companies are increasingly adopting microfluidic technologies for rapid diagnostics, precise drug discovery, and advanced cell-based studies. These systems enable faster results using minimal samples and reagents, thereby improving cost efficiency and laboratory sustainability. The shift toward portable and point-of-care testing is further disrupting traditional laboratory workflows, allowing quicker clinical decisions and broader access to diagnostics. Collectively, these advancements are enhancing research productivity, accelerating therapeutic innovation, and driving the evolution of a more connected, data-driven healthcare ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing requirement for point-of-care testing

-

Increasing focus on data precision and accuracy

Level

-

Stringent regulatory approval process

-

Integration of microfluidics into the current workflow

Level

-

Emergence of 3D cell culture systems

-

Growth potential of emerging economies

Level

-

Low adoption of microfluidic devices among end users

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising technological advancements

Technological advancements in microfluidic components aim to make healthcare industry operational processes more reliable. These technological advancements have increased the throughput of device production, improved rapid prototyping efforts, and enabled researchers to enhance the complexity and sophistication of experiments that can be performed on a microfluidic chip. With technological advancements, microfluidic components are rapidly becoming a key technology in an expanding range of fields, including medical sciences, pharmaceuticals, biosensing, bioactuation, and chemical synthesis. This indicates the transition of microfluidics from a promising R&D tool to being utilized in data collection with AI during clinical trials. Lab-on-a-chip technology is a powerful platform for constructing and implementing AI in a large-scale, cost-effective, high-throughput, automated, and multiplexed manner. 3D printing has significantly transformed the field of microfluidics, enabling the creation of innovative devices that are often unattainable with traditional methods. A research team led by Imperial College London (UK) pioneered a 3D-printed wearable microfluidic device, which integrates FDA-approved clinical microdialysis probes and needle-type biosensors to continuously monitor metabolite levels in human tissues. Organ-on-a-Chip systems are microfluidic devices designed to replicate an intricate physiological environment for culturing and controlling cells within a 2D or 3D structure that mimics a specific organ in the body. Paper-based microfluidics focuses on devices constructed from paper or other porous materials that transport fluids through capillary action. The continual evolution of new materials and fabrication methods is expanding the potential applications of microfluidics, driving ongoing growth and innovation in the market.

Restraint: Integration of microfluidics into the current workflow

End users face various technical issues while incorporating microfluidic devices into existing workflows. Owing to this, the adoption of microfluidics into regularized drug screening and drug discovery processes is limited. Currently, microfluidics technology presents significant opportunities for the further miniaturization and integration of instruments and exhibits the potential for greater automation and cost reduction in drug discovery and development processes. However, as per a few industry experts in the market, although microfluidics adds value to the process and instruments, it will likely take about 10 to 15 years before this technology completely replaces conventional macro-scale research instrumentation. Until such a scenario presents itself, the market will witness irregular installments of microfluidic devices, owing to which conventional technology providers will sideline manufacturers to some extent.

Opportunity: Emergence of 3D cell culture systems

The organ-on-a-chip (OoC) represents a fascinating advancement in science and technology, combining biological systems with microtechnology to replicate essential features of human physiology. This device is a microfluidic system equipped with intricate networks of ultra-fine microchannels designed to control and manipulate minimal volumes of fluids, ranging from picoliters to milliliters. Recent advances in microfluidics for 3D cell culture have enabled the development of microenvironments that support tissue differentiation and replicate the tissue-tissue interface, spatiotemporal chemical gradients, and mechanical microenvironments of living organs. Organs-on-chips (OoCs) feature engineered or natural miniature tissues cultivated within microfluidic chips. These chips are designed to replicate human physiology by controlling cellular microenvironments and preserving tissue-specific functions. By integrating advancements in tissue engineering and microfabrication, OoCs have emerged as a cutting-edge experimental platform for exploring human pathophysiology and assessing the impact of therapeutics within the body. Given its potential, several research studies are being conducted to evaluate the performance of microfluidic chips in pharmaceutical studies. There are different types of organ-on-a-chip systems, such as lung-on-a-chip, liver-on-a-chip, heart-on-a-chip, brain-on-a-chip, and gut-on-a-chip models. A group of researchers developed U-IMPACT, a 3D microfluidic cell culture platform, a 96-well microfluidic platform engineered for culturing cells and spheroids, facilitating research on tumor microenvironments and neural cell development. Another team developed a hydrogel-based microfluidic cell culture platform, which enables the assessment of drug diffusion and efficacy, including for drugs such as temozolomide and carmustine, by producing dose-response curves and replicating the glioblastoma microenvironment for in vitro experimentation. The increasing applications of microfluidics in 3D cell culture will offer an array of opportunities for the growth of the microfluidics market.

Challenge: Low adoption of microfluidic devices among end users

Customer acceptance and market adoption are the two key factors that affect the commercialization of any product or technology in the market. There are academic publications providing proof of concept for microfluidic technology-embedded medical devices and equipment. Still, the incorporation of this technology in end-use products has been limited due to inadequate standards of microfluidic devices. The high costs associated with developing and producing microfluidic devices create financial hurdles, making them less accessible to smaller labs or organizations. The intricate design and manufacturing processes demand specialized knowledge and expertise, which can deter users from using the necessary resources. Additionally, a lack of awareness and understanding of the advantages and functions of microfluidic technology contributes to its slow adoption. Finally, concerns about the reliability and performance of these devices may lead users to hesitate, especially if the technology appears untested or more complicated than traditional methods. The limited adoption of microfluidic devices is owing to the development costs, complex manufacturing, regulatory challenges, integration difficulties, insufficient awareness, performance concerns, and the high cost of adoption for many users.

MICROFLUIDICS MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The QuantStudio Absolute Q Digital PCR System leverages Microfluidic Array Plate (MAP) technology to deliver precise partitioning and analysis in a single, integrated workflow. | Streamlined digital PCR with higher accuracy, reproducibility, and ease of use | Reduced hands-on time and error rates through automated background correction and false-positive rejection |

|

It introduced the JSY3000-L/P valve manifold series with up to 64 stations for centralized control of solenoid valves and electro-pneumatic regulators. | Simplified control architecture with reduced wiring and assembly time, saving up to 28% space | Enhanced reliability through IP65/IP67 protection and remote diagnostics for higher uptime and easier maintenance |

|

It launched the Illumina Complete Long Read technology, enabling both long- and short-read sequencing on a single NovaSeq X Series platform. | Simplified sequencing workflow with high precision (F1 score 99.87%), reduced cost, and minimal sample requirements |

|

It enabled rapid, decentralized diagnostics with high accuracy and minimal hands-on time. It improved antibiotic stewardship and patient management by providing targeted results at the point of care. | Enabled rapid, decentralized diagnostics with high accuracy and minimal hands-on time |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The microfluidics market brings together a wide network of innovators—from manufacturers and researchers to distributors and end users—all working to transform diagnostics and analytical testing. Manufacturers develop and refine instruments, chips, and consumables, often partnering with contract developers and production specialists to scale new technologies efficiently. Research and product development are powered by academic labs, CROs, and in-house R&D teams that explore new applications, optimize designs, and push performance boundaries. Distributors, including third-party suppliers and online platforms, play a key role in connecting these innovations to global customers quickly and effectively. On the demand side, hospitals, diagnostic labs, and pharmaceutical and biotech companies rely on microfluidic systems for rapid testing, precision analysis, and drug discovery. Supporting this ecosystem are investors, funding agencies, and regulatory bodies that ensure quality, guide innovation, and help shape market direction. Together, they form a dynamic environment that continues to drive the evolution of microfluidic technologies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Microfluidics Market, By Product

Based on product, the microfluidics market is segmented into microfluidics-based devices and microfluidic components. Microfluidics-based devices are advanced instruments that can regulate and analyze small volumes of fluids. They accurately manage fluid flow by etching or molding micro-scale channels and chambers into substrates. These devices are also used in organ-on-a-chip (OOC) platforms, which replicate human organ functions to aid in drug testing and disease-related research, as well as lab-on-a-chip (LoC) systems that combine multiple laboratory procedures into a single chip. These devices also include assays and microfluidic sensors that offer precise detection of pathogens, biomolecules, and other chemical compounds.

Microfluidics Market, By Application

In vitro diagnostics (IVD) have the ability to accurately regulate and analyze minute fluid volumes due to their integration with microfluidic technology. This inclusion increases the speed of the test, while also making it cheaper, more accurate, and more automated in IVD systems. This technique can be helpful for diagnostic purposes, from standard blood and urine tests to sophisticated assays for infectious and cancerous disorders. Furthermore, the growing demand for point-of-care testing is enhancing the use of microfluidics in IVD.

Microfluidics Market, By End User

Due to their potential to generate requirements for advanced diagnostic and analytical techniques, hospitals and diagnostic centers are the key end users of microfluidics. Faster, precise, and efficient testing is carried out by microfluidic devices, which is crucial in healthcare settings where faster results can significantly impact patient care. These instruments offer precise, high-throughput results with less volume of sample for numerous uses, such as point-of-care testing and disease diagnostics. Improved patient outcomes result from the application of microfluidics in workflows, which enhances the potential to conduct intricate assays and screenings. Hospitals and diagnostic centers play a significant role in the expansion and advancement of the microfluidics market due to their increasing application of microfluidic technologies.

REGION

By region, Asia Pacific is projected to grow at a significant CAGR during the forecast period

The microfluidics market in the Asia Pacific region is expanding significantly. This is attributed to the rapid infrastructure development in this region and the growing demand for advanced diagnostic and analytical technologies. The countries in this region are heavily investing in the advancement of their healthcare systems and the application of innovative medical technologies, like microfluidic devices. The growing prevalence of chronic disorders and the need for efficient diagnostic instruments are further propelling the growth of this market. The region has strong manufacturing capacity and can provide microfluidic technology at an affordable rate. Moreover, significant research and development initiatives, when combined with supportive financial help and governmental policies, foster innovation and accelerate market growth.

MICROFLUIDICS MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMPANY EVALUATION MATRIX

In the microfluidics market, leading companies are advancing miniaturized fluid-handling technologies that enable high-precision diagnostics, molecular analysis, and drug discovery applications. Thermo Fisher Scientific, Illumina Inc., and Bio-Rad Laboratories have established dominant positions through integrated microfluidic platforms for PCR, sequencing, and lab-on-chip diagnostics, supported by robust global distribution and R&D capabilities. Emerging players, such as QuidelOrtho Corporation, Hologic Inc., and Aignep S.p.A., are differentiating themselves through focused innovations in cartridge-based assays, portable testing modules, and fluid-control systems. Together, these players are shaping the evolution of microfluidic technologies—driving faster, more automated, and cost-efficient analytical solutions across research and clinical settings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Abbott Laboratories (US)

- Agilent Technologies Inc. (US)

- Aignep S.P.A (Italy)

- bioMérieux (France)

- BD (US)

- Bio-Rad Laboratories Inc. (US)

- Danaher Corporation (US)

- Illumina Inc. (US)

- Parker Hannifin Corporation (US)

- Thermo Fisher Scientific Inc. (US)

- SMC Corporation (Japan)

- IDEX Corporation (US)

- Fortive Corporation (US)

- PerkinElmer Inc. (US)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Standard BioTools Inc. (US)

- QuidelOrtho Corporation (US)

- Hologic Inc. (US)

- Dolomite Microfluidics (UK)

- Elveflow (France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 24.96 BN |

| Market Forecast in 2030 (Value) | USD 37.19 BN |

| Growth Rate | CAGR of 8.3% from 2025-2030 |

| Years Considered | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Procedure) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Products (Microfluidics-Based Devices, Microfluidics Components), Application (IVD, Pharma & Life Science Research, Therapeutics), and End-user (Hospitals and Diagnostic Centers, Academia & Research Institutes, and Pharmaceutical & Biotechnology Companies) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: MICROFLUIDICS MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Evaluate commercialization pathways for lab-on-chip systems | Delivered a breakdown of commercialization models across diagnostic, pharma, and industrial segments, mapping product maturity, IP transfer mechanisms, and scalability barriers | Enabled the client to identify high-feasibility business models and partnership entry points for transitioning academic prototypes into market-ready solutions |

| Assess integration potential of AI and digital microfluidics |

|

Provided forward-looking intelligence on digital convergence, enabling the client to anticipate automation opportunities in next-generation device development |

RECENT DEVELOPMENTS

- 7/1/2024 12:00:00 AM : Illumina. Inc. (US) acquired Fluent BioSciences (US) to enhance its ability for single-cell analysis.

- 12/1/2023 12:00:00 AM : Danaher Corporation (US) acquired Abcam plc (UK) to expand its reach in the proteomics area.

- 6/1/2024 12:00:00 AM : bioMérieux (France) introduced the BIOFIRE SPOTFIRE R/ST Panel Mini, which is a specialized multiplex PCR test that identifies five of the most prevalent viral & bacterial pathogens responsible for respiratory or sore throat infections, delivering results in approximately 15 minutes.

- 3/1/2023 12:00:00 AM : Danaher (US) partnered with UPenn to develop new technologies that are expected to improve the consistency of clinical outcomes for patients. This partnership is also expected to overcome manufacturing bottlenecks in the delivery of next-gen engineered cell products.

- 6/1/2024 12:00:00 AM : The US FDA granted 510(k) clearance to Thermo Fisher Scientific's (US) SeCore CDx HLA A Sequencing System for use as a companion diagnostic with Adaptimmune's recently approved TCR therapy, TECELRA (afamitresgene autoleucel), targeting adults with unresectable or metastatic synovial sarcoma.

Table of Contents

Methodology

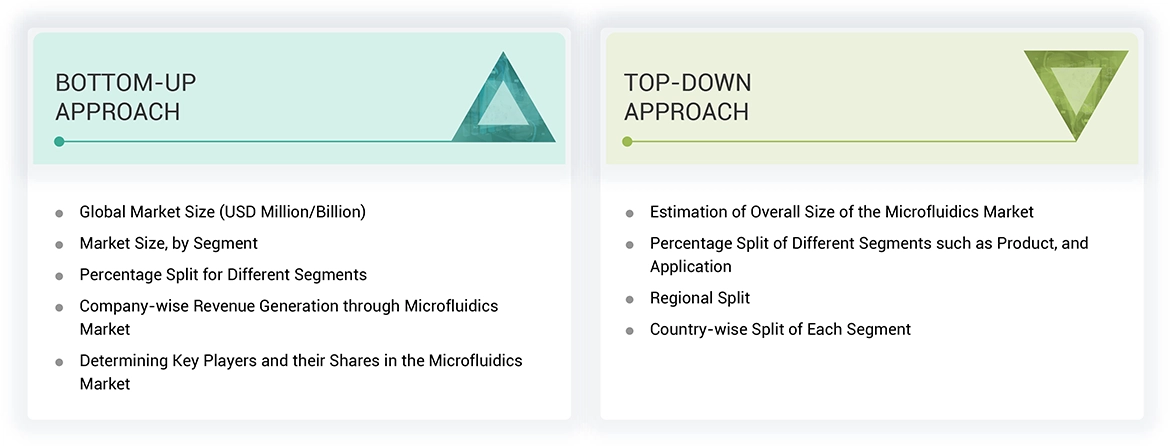

Four main studies were done to estimate the market size of microfluidics. Secondary research was carried out to obtain data associated with the market, peer markets, and parent markets. After that, data was obtained from 3-5 secondary sources; the findings, assumptions, and sizing were confirmed through primary sources. Top-down and bottom-up approaches were utilized to gain insights on complete market size. After that, market breakdown and data triangulation were used to determine the market size of segments and subsegments.

Secondary Research

Directories, databases like D&B Hoovers, Factiva, white papers, Bloomberg Businessweek, annual reports, SEC filings, business filings and investor presentations are few of the important sources used in the secondary research. This helps in gaining fundamental details about prominent companies and market segmentation as per the industry trends at numerous levels and technological viewpoints related with the Microfluidics market.

Primary Research

The primary research compromised performing interviews from both the supply and demand sides to obtain quantitative and qualitative data. CEOs, area sales managers, territory sales managers, regional sales managers and other important officials from top businesses are the primary sources from the supply side. Physicians, researchers, department heads, and staff members from diagnostic centers, hospitals and research institutes were the primary sources from the demand side. The target of this study was to verify the conclusions and assumptions from secondary research by interacting with stakeholders directly.

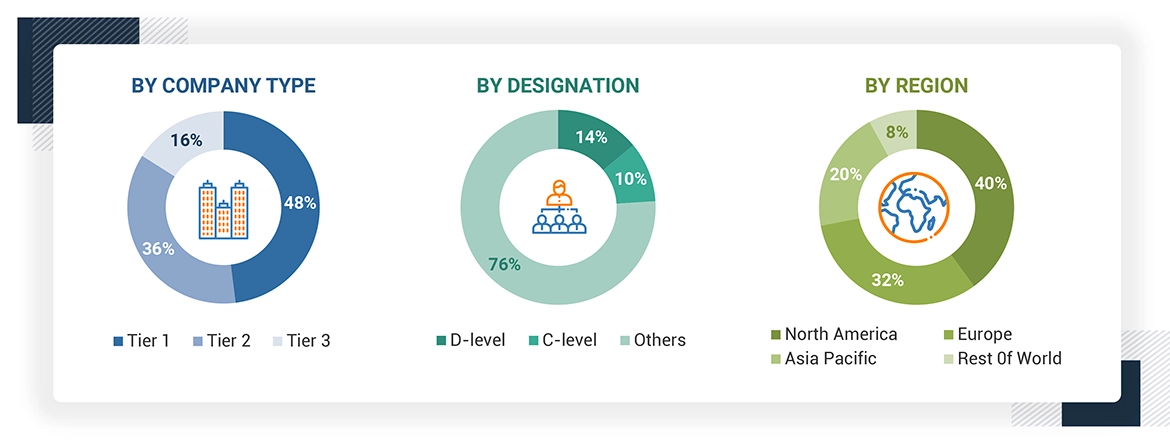

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 1 billion, Tier 2 = < USD 500 million, and Tier 3 = < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The revenue share analysis of the major key players for the size of the Microfluidics market is given in this study. Primary and secondary research are used to find prominent players in the Microfluidics and to gain insights of their financials and market share. The primary research approach comprises extremely in-depth interviews with CEOs, directors, and senior marketing executives, while the secondary research procedure mostly relied on the annual and financial reports of major players. Segment-based technique was used to determine the global market value. The revenue details of significant solution and service suppliers was then applied to source these segmented revenues.

The steps in the procedure are

- List the key global companies that are associated with the Microfluidics industry. Note the annual revenues of the players in the Microfluidics industry or the product category/business division.

- As of 2024, it represents an important portion of the market based on revenue mapping of the key competitors. Extrapolation to the global value for the Microfluidics market.

Data Triangulation

The Microfluidics market was categorized into various segments and subsegments with the help of the above procedure. Then, data triangulation and the market segmentation process are carried out to ensure the accuracy of the data for each segment. Factors and trends from demand and supply sides were studied . Top-down and bottom-up approaches provide the outcome from the analysis of the Microfluidics market.

Market Definition

The microfluidics market includes products and technologies that are developed to analyse and regulate fluid volume through microfluidic devices and components. The market covers both the microfluidics components that are important for the working of microfluidics-based devices, such as lab-on-a-chip systems and diagnostic assays, as well as the devices. Microneedles, micropumps, flow and pressure sensors, controllers, and microfluidic valves are some of the important components of microfluidics-based device.Polymers, silicon, and glass are most often used in the development of these components. The market provides innovative technologies for effective and precise fluid management and analysis, which have beneficial applications in research and diagnostics.

Stakeholders

- Microfluidic product manufacturers

- Microfluidic product distributors

- Pharmaceutical companies

- IVD manufacturers

- In vitro diagnostic test (IVD) distributors

- Research institutes

- Contract manufacturing organizations (CMOs)

- Contract research organizations (CROs)

- Healthcare institutions (hospitals, medical schools, and outpatient clinics)

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, and forecast the microfluidics market by product, application, end-user, and region

- To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, challenges, and industry trends

- To strategically analyze the regulatory scenario, Porter’s five force analysis, value chain analysis, supply chain analysis, ecosystem map, and patent analysis

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the microfluidics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile the prominent players in this market and comprehensively analyze their market shares and core competencies

- To strategically analyze the microfluidics market in five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To track and analyze competitive developments such as acquisitions, product launches, product approvals, partnerships, and expansions in the microfluidics market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Microfluidics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Microfluidics Market

Farrah

May, 2022

Which material segment led the global microfluidics market?.

Kahlill

May, 2022

Which application accounted for the largest microfluidics market share?.

Alex

Nov, 2022

Which technology accounted for the highest share in the microfluidics market?.

James

Nov, 2022

What is the global microfluidics market's expected compound annual growth rate during the forecast period of 2022-2030?.

Philip

Mar, 2022

Which are the key challenges faced by global players of the Microfluidics Market?.