Lateral Flow Assays Market Size, Growth, Share & Trends Analysis

Lateral Flow Assays Market by Product (Kits, Readers), Application (STI, HEP, TB, Cardiac Marker, Pregnancy, Drug Abuse, Food Safety), Sample (Blood, Urine, Saliva), Technique (Sandwich, Competitive), End User (Hospitals), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

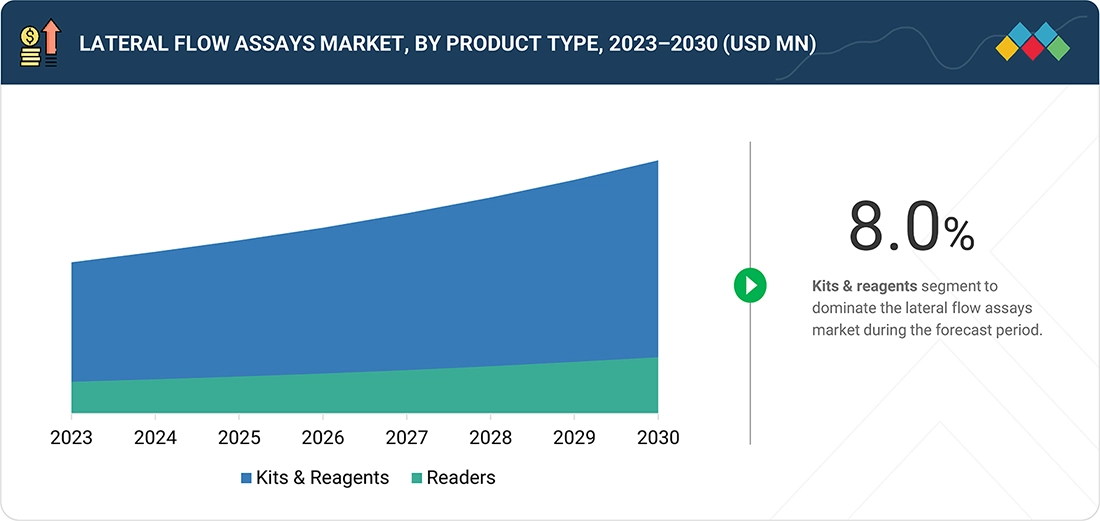

The lateral flow assays market is expected to grow from USD 8.51 billion in 2025 to USD 12.52 billion by 2030, registering a CAGR of 8.0% during the forecast period. The lateral flow assays market is witnessing steady progress due to the high prevalence of infectious diseases worldwide and the subsequent need for testing, rapid growth in the geriatric population, the rising use of home-based lateral flow assay devices, and the growing demand for POC testing. However, inconsistent accuracy compared to other methods, as well as the reluctance of doctors and patients to shift from traditional diagnostics, restrain the growth of the lateral flow assays market.

KEY TAKEAWAYS

-

By product typeBy product type, the kits & reagents segment dominated the market in 2024.

-

By applicationBy application, the clinical testing segment accounted for the largest share of the lateral flow assays market in 2024.

-

By techniqueBy technique, multiplex detection assays are projected to register the highest CAGR of 9.4% during the forecast period.

-

By Sample TypeBy sample type, the blood samples segment is projected to register the fastest growth rate of 8.6% during the forecast period.

-

By end usersBy end user, the hospitals & clinics segment accounted for the largest market share in 2024.

-

By regionThe Asia Pacific is projected to register the highest CAGR of 9.6% during the forecast period.

-

COMPETITIVE LANDSCAPEAbbott Laboratories (US), F. Hoffman-La Roche Ltd. (Switzerland), Danaher Corporation (US), and Becton, Dickinson and Company (US) were identified as some of the star players in the lateral flow assays market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPEDCN Diagnostics (US), Abingdon Health (UK), and Artron Laboratories, Inc. (Canada) were identified as some of the emerging leaders in the lateral flow assays market, given their strong market share and product footprint.

The lateral flow assays market is growing steadily due to the high prevalence of infectious diseases worldwide and the subsequent need for testing, rapid growth in the geriatric population, the rising use of home-based lateral flow assay devices, and the growing demand for POC testing are the major factors driving the growth of this market. However, inconsistent accuracy compared to other methods and the reluctance of doctors and patients to shift from traditional diagnostics are restraining the growth of the lateral flow assays market.

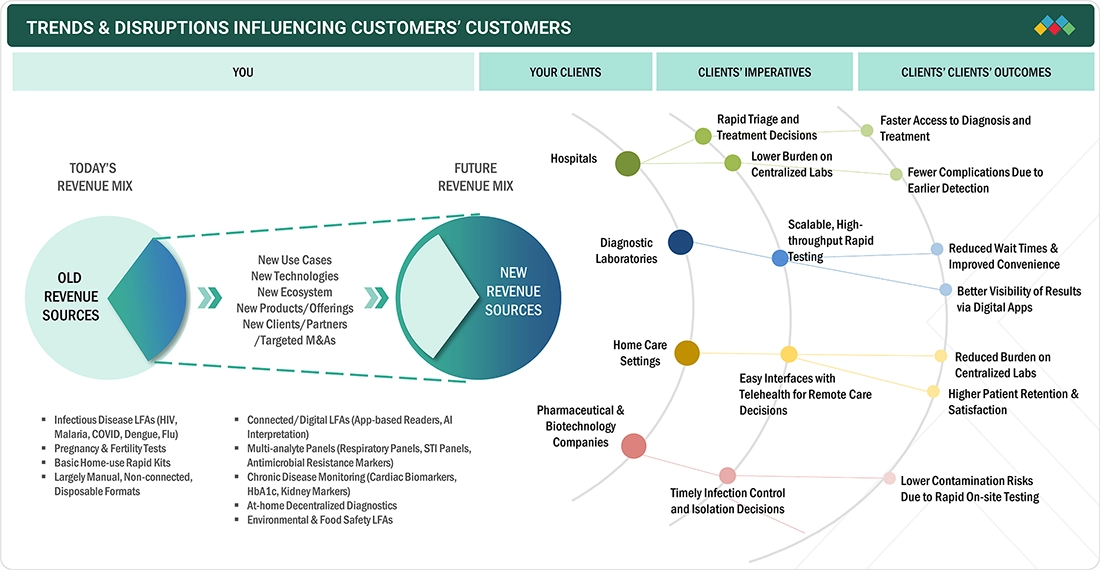

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on end users in the lateral flow assays market is driven by the rising demand for rapid, decentralized diagnostics and continuous technological improvements. Hospitals, clinics, urgent care centers, and home care settings are increasingly integrating next-generation LFA solutions due to the need for faster triage, the growing burden of infectious diseases, and the shift toward point-of-care testing. Trends such as higher-sensitivity assays, multiplex panels, reader-based systems, and connectivity with digital platforms are expected to influence procurement priorities over the next three to five years. These advancements will shape manufacturers’ revenue mix and create opportunities for companies delivering accurate, user-friendly, and scalable LFA solutions aligned with evolving clinical and consumer expectations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High prevalence of infectious diseases

-

Growing geriatric population

Level

-

Inconsistent results of lateral flow assay tests

Level

-

Evolving applications of lateral flow assays

-

Rising demand for lateral flow assays in food & beverage industry

Level

-

Limited reimbursements for lateral flow assay products

-

Difficulties in procuring quality raw materials to develop tests

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing geriatric population.

Age-related physiological changes and metabolic inefficiencies often result in chronic diseases such as cystic fibrosis, hepatitis, cardiovascular disorders, and cancer. Geriatric individuals (65 years and above) are more susceptible to these diseases and infectious diseases due to weakened immune systems. According to a report by The Lancet, there were 1.1 billion individuals aged 60 years or older in 2022, accounting for 13.9% of the global population of 7.9 billion. This senior population is predicted to double in the next thirty years, reaching 2.1 billion by 2050, or 22% of the world’s total population. All regions are expected to experience an increase in the size of the older population between 2020 and 2050.

Restraint: Inconsistent results of lateral flow assay tests

While lateral flow assay (LFA) tests offer the benefits of rapid results, ease of use, and cost-effectiveness, one of their primary limitations remains variability in accuracy and reliability, particularly in comparison to laboratory-based diagnostic methods such as ELISA or PCR. LFA tests often face challenges in sensitivity and specificity, especially in cases where analyte concentrations are close to the detection limit or when samples are collected or handled improperly. This can lead to false-negative or false-positive results, which significantly compromise clinical decision-making and patient outcomes. In tuberculosis screening, certain lateral flow-based antigen detection tests have shown limited sensitivity in HIV-positive individuals due to low bacterial loads, resulting in underdiagnosis. Similarly, in malaria testing, some LFA devices have demonstrated reduced performance in detecting low-parasite-density infections, which is critical in low-transmission or elimination settings.

Opportunity: Evolving applications of lateral flow assays

Lateral flow assays have evolved rapidly in the last two decades and are routinely used in POC and diagnostic applications. Although lateral flow tests are widely used for infectious disease diagnostics, cardiac disease diagnosis, and veterinary applications, their use has expanded into several new areas over the past few years. Saliva diagnostics, behavioral health, agriculture (genetically modified organism detection and crop quality testing), biowarfare (anthrax detection), environmental testing (detection of contaminating enzymes in manufacturing plants), and food microbiology (detection of E. coli O157, Salmonella, Listeria, and other food spoilage organisms) have emerged as new application areas for lateral flow assays.

Challenge: Limited reimbursements for lateral flow assay products

Owing to reimbursement issues, lateral flow assay-based diagnostic tests have witnessed limited adoption in several countries across the globe. The rise in healthcare expenditure is compelling insurance payers to question and analyze the necessity of new diagnostic tests. Also, payers are moving from fee-for-service reimbursement systems toward fee-for-value-based reimbursement systems. As a result, a diagnostic test that enables a clinician to decide whether to go for a particular treatment does not receive adequate reimbursement and is abandoned or underinvested.

LATERAL FLOW ASSAYS MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The BinaxNOW and Panbio lateral flow assay platforms are used in hospitals, pharmacies, airports, and community testing centers for the rapid detection of infectious diseases such as influenza, malaria, HIV, and RSV. | These assays deliver accurate results within 15–20 minutes, enabling fast clinical decisions and reducing dependency on centralized laboratories. Their scalability supports mass-screening programs, and digital connectivity features allow seamless reporting and public health surveillance. |

|

Roche’s rapid antigen and multimarker LFA tests, including Influenza A/B tests, are used in hospitals, urgent care centers, and corporate or community screening setups for rapid infectious disease identification. | These products offer high diagnostic accuracy validated across global healthcare networks, helping clinicians reduce misdiagnosis and streamline infection-control protocols. Their rapid turnaround enhances outbreak response and minimizes patient waiting times. |

|

Cepheid collaborates on LFA-compatible workflows for decentralized infectious disease and respiratory testing in settings where molecular platforms are not feasible. | These solutions support hybrid testing pathways where LFAs provide quick initial screening followed by confirmatory molecular tests, improving diagnostic efficiency in low-resource or high-volume environments. |

|

The BD Veritor Plus System is used in hospitals, clinics, pharmacies, schools, and occupational health centers for rapid antigen testing, including influenza A/B, RSV, and Group A Strep. | The system’s analyzer-based interpretation improves accuracy, minimizes user error, and provides connectivity for electronic medical record (EMR) integration and large-scale surveillance. |

|

The Sofia Flu A+B and Strep A lateral flow assays are used across hospitals, urgent care centers, and physician offices with the Sofia Analyzer for rapid respiratory and infectious disease diagnostics. | Their fluorescent immunoassay technology provides higher sensitivity than traditional LFAs, while the analyzer automates result interpretation and supports rapid “test-and-treat” decision-making. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The lateral flow assays market ecosystem includes manufacturers, distributors, end users, investors, and regulatory bodies. Manufacturers focus on developing and launching implant systems and accessories, while distributors such as third-party suppliers and online platforms ensure product availability. End users, including hospitals, ENT clinics, ASCs, and cochlear implant centers drive demand through diagnosis, implantation, and rehabilitation services. Investors and regulatory agencies influence product standards, funding, and market adoption. Together, these stakeholders support innovation, compliance, and the overall growth of the lateral flow assays market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Lateral Flow Assays Market, by Product Type

Based on product, the lateral flow assays market is segmented into lateral flow readers and kits & reagents. The kits & reagents segment dominated the market in 2024. The large share of this segment can be attributed to the increasing application of lateral flow kits & reagents for POC testing, the growing burden of chronic diseases, the increasing use of lateral flow kits in home care, and the convenience and ease of use of kits & reagents.

Lateral Flow Assays Market, by Application

Based on application, the lateral flow assays market is segmented into clinical testing, veterinary diagnostics, food safety & environmental testing, and drug development & quality testing. The clinical testing segment accounted for the largest share of the lateral flow assays market in 2024. The large share of this application segment can be attributed to the rising prevalence of chronic diseases and infectious diseases worldwide, the growing geriatric population, increasing patient awareness about rapid test options, the growing pressure to reduce healthcare costs, and the increasing demand for patient-centric care.

Lateral Flow Assays Market, by Technique

Based on technique, the lateral flow assay kits and reagents market is segmented into competitive, sandwich, and multiplex detection assays. Sandwich assays dominated the market in 2024. The large share of this segment can be attributed to the better assay sensitivity and specificity associated with sandwich assays and their extensive application in the measurement of critical analytes (such as cardiac and hepatitis markers).

Lateral Flow Assays Market, by Sample Type

Based on sample type, the lateral flow assays market is segmented into blood, urine, saliva, and other samples (nasal swabs, throat swabs, and vaginal fluid). Blood samples accounted for the largest market share in 2024. The extensive use of blood samples in lateral flow tests and the easy detection of disease antibodies from blood samples are the key factors driving the growth of this market segment.

Lateral Flow Assays Market, by End User

Based on end users, the lateral flow assays market is segmented into hospitals & clinics, diagnostic laboratories, home care settings, pharmaceutical & biotechnology companies, and others. The hospitals and clinics segment accounted for the largest market share in 2024. Technological advancements, increasing adoption of point-of-care testing, and the growing inclination toward fast and early diagnosis are driving the growth of the hospitals & clinics segment.

REGION

Asia Pacific to be fastest-growing region in global lateral flow assays market during forecast period

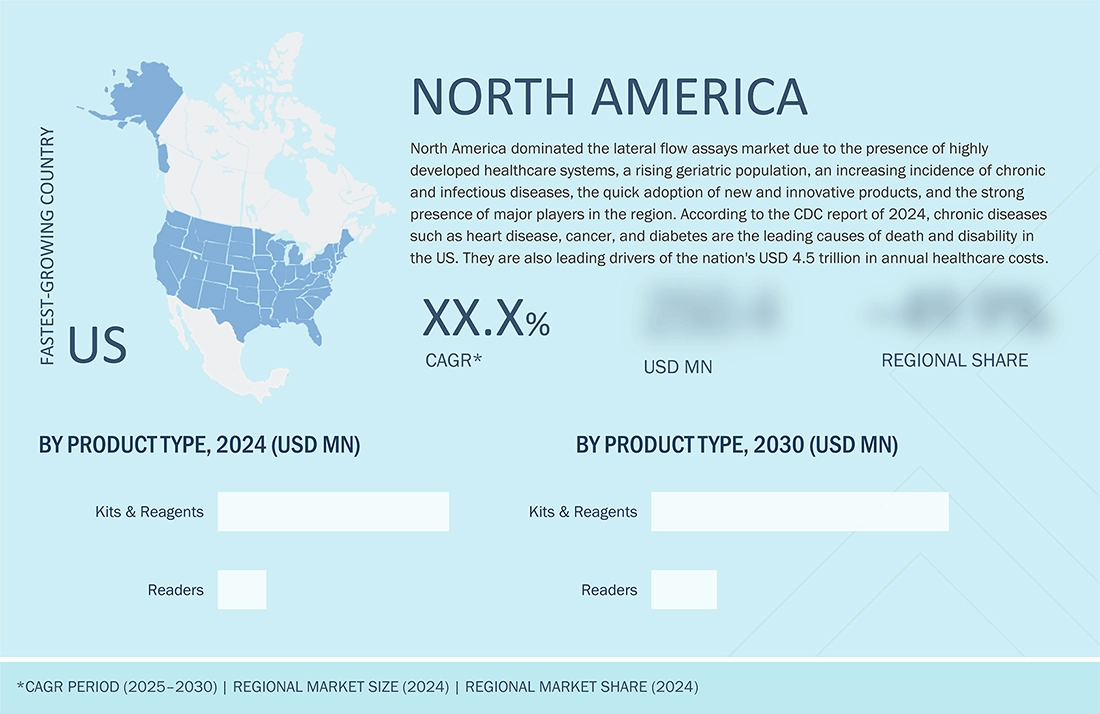

The lateral flow assays market shows notable regional diversity, with North America leading due to its strong diagnostic infrastructure, high adoption of rapid point-of-care testing, and continuous investment in infectious disease surveillance. Europe remains a key contributor as well, supported by established screening programs, rising healthcare digitization, and widespread use of decentralized testing solutions. Meanwhile, the Asia Pacific region is expanding quickly as growing healthcare spending, government-led disease control initiatives, and increasing uptake of home-based diagnostics improve access to rapid testing across developing countries.

LATERAL FLOW ASSAYS MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

In the lateral flow assays market matrix, Abbott (US) and Roche (Switzerland) emerge as the Star players, driven by their broad global reach, extensive rapid diagnostic portfolios, and continuous advancements in assay sensitivity, digital connectivity, and point-of-care integration. Danaher (US), through its diagnostics subsidiaries and strategic collaborations, maintains a strong position by leveraging its technology-driven approach and diversified presence in clinical and decentralized testing ecosystems. While Abbott and Roche lead through scale, manufacturing depth, and high adoption across infectious disease testing programs, Danaher shows strong potential to expand further by accelerating innovation in multiplex assays and strengthening its footprint in emerging point-of-care diagnostic markets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 7.93 Billion |

| Market Forecast in 2030 (Value) | USD 12.52 Billion |

| Growth Rate | CAGR of 8.0% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa, and GCC Countries |

WHAT IS IN IT FOR YOU: LATERAL FLOW ASSAYS MARKET: GROWTH, SIZE, SHARE, AND TRENDS REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- May 2024 : Surmodics announced that it has entered into a definitive agreement to be acquired by GTCR, a leading private equity firm with a long track record of investment expertise across healthcare and healthcare technology.

- July 2022 : At MedLab 2022, Abbott showcased a new range of LFA-based immunochromatographic rapid tests for HCV antibodies, H. pylori antibodies, and hepatitis B surface antigens, all with high sensitivity in finger-stick formats.

- July 2022 : Merck has officially begun construction on its first lateral flow membrane production facility in the US, a project valued at USD 136.7 million. This initiative is funded by the US Department of Defense and the Department of Health and Human Services (HHS) at its Sheboygan site. The facility will manufacture Hi Flow Plus membranes, which are essential components used in lateral flow assay (LFA) kits, including those for pregnancy tests, infectious disease detection, and drug screening.

Table of Contents

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- High prevalence of infectious diseases- Rising geriatric population- Growing use of home-based lateral flow assay devices- Growing demand for POC testingRESTRAINTS- Inconsistent results of lateral flow assay testsOPPORTUNITIES- Evolving applications of lateral flow assays- Rising demand for lateral flow assays in food & beverage industry- Emergence of Omicron COVID variantCHALLENGES- Limited reimbursements for lateral flow assay products- Difficulties in procuring quality raw materials to develop tests

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY APPLICATIONAVERAGE SELLING PRICE TREND, BY REGION

-

5.5 ECOSYSTEM

-

5.6 SUPPLY CHAIN ANALYSISPROMINENT COMPANIESSMALL & MEDIUM-SIZED COMPANIESEND USERS

-

5.7 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR LATERAL FLOW ASSAYSTOP APPLICANTS (COMPANIES) OF LATERAL FLOW ASSAY PATENTSJURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS IN LATERAL FLOW ASSAYS MARKET

- 5.8 VALUE CHAIN ANALYSIS

-

5.9 TECHNOLOGY ANALYSISKEY TECHNOLOGY: LATERAL FLOW ASSAYSADJACENT TECHNOLOGY: ELISA (ENZYME-LINKED IMMUNOSORBENT ASSAYS)

-

5.10 CASE STUDY ANALYSISCASE STUDY 1: QUIDEL LAUNCHES NEW TEST WITH BROADER DETECTION WINDOWCASE STUDY 2: ABINGTON OFFERS HIGH-SENSITIVITY TESTS FOR GREATER QUALITYCASE STUDY 3: SIEMENS OFFERS HIGH-SENSITIVITY TROPONIN I ASSAY TO RAPIDLY DETECT ACUTE MYOCARDIAL INFARCTION

-

5.11 REGULATORY ANALYSISREGULATORY LANDSCAPE- North America- Europe- AsiaREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Latin America- Rest of the world

-

5.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.13 ADJACENT MARKET ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.15 TRADE ANALYSISIMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTSEXPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS

-

5.16 INDUSTRY TRENDSDETECTION OF HIV WITH LATERAL FLOW ASSAYSINCREASING ADOPTION OF QUANTITATIVE LATERAL FLOW ASSAYS DUE TO AVAILABILITY OF LFA READERS

-

5.17 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.18 LATERAL FLOW ASSAYS MARKET: IMPACT OF INFLATION AND RECESSION

- 5.19 ARTIFICIAL INTELLIGENCE (AI) IN LATERAL FLOW ASSAY MARKET

- 5.20 UNMET NEEDS/END-USER EXPECTATIONS

- 5.21 INVESTMENT/VENTURE CAPITAL

- 6.1 INTRODUCTION

-

6.2 KITS & REAGENTSRISING DEMAND FOR POC TESTING TO DRIVE MARKET

-

6.3 READERSDIGITAL/HANDHELD READERS- Technological evolutions and accuracy to drive adoptionBENCHTOP READERS- Lower diagnosis cost per patient to drive adoptionINSIGHTS ON DISPOSABLE AND REUSABLE LATERAL FLOW ASSAY READERSLATERAL FLOW READERS MARKET FOR CLINICAL DIAGNOSTICS, BY TYPE

- 7.1 INTRODUCTION

-

7.2 CLINICAL TESTINGINFECTIOUS DISEASE TESTING- Mosquito-borne diseases- COVID-19- Influenza- Sexually transmitted infections- Hepatitis- Tuberculosis- Other infectious diseasesCARDIAC MARKER TESTING- Troponin I & T- CK-MB- BNP & NT-proBNP- Myoglobin- D-Dimer- Other cardiac marker testsPREGNANCY & FERTILITY TESTING- Pregnancy testing- Fertility testingCHOLESTEROL/LIPID TESTING- Lifestyle changes, rising obesity prevalence to drive marketDRUGS-OF-ABUSE TESTING- Technological advancements and rising focus on workplace drug testing to drive marketOTHER CLINICAL TESTS

-

7.3 VETERINARY DIAGNOSTICSINFECTIOUS DISEASE OUTBREAKS TO DRIVE MARKET

-

7.4 FOOD SAFETY & ENVIRONMENT TESTINGHIGH SENSITIVITY AND EASE OF USE TO BOOST DEMAND FOR ASSAYS

-

7.5 DRUG DEVELOPMENT & QUALITY TESTINGINCREASING FOCUS ON PRODUCT SAFETY AND QUALITY ASSURANCE TO SUPPORT MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 SANDWICH ASSAYSWIDE APPLICATIONS IN CLINICAL TESTING TO SUPPORT MARKET GROWTH

-

8.3 COMPETITIVE ASSAYSREDUCED SELECTIVITY AND SENSITIVITY COMPARED TO SANDWICH ASSAYS TO HAMPER GROWTH

-

8.4 MULTIPLEX DETECTION ASSAYSINCREASING ADOPTION OF MULTI-ANALYTE ASSAYS AMONG CLINICIANS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 BLOOD SAMPLESINCREASING USE OF BLOOD SAMPLES FOR INFECTIOUS DISEASE TESTING TO DRIVE MARKET

-

9.3 URINE SAMPLESGROWING USE OF URINE SAMPLES FOR PREGNANCY AND DRUGS-OF-ABUSE TESTING TO DRIVE MARKET

-

9.4 SALIVA SAMPLESEASY AND LOW-COST COLLECTION, TRANSPORT, AND ANALYSIS OF SALIVA SAMPLES TO SUPPORT ADOPTION

- 9.5 OTHER SAMPLES

- 10.1 INTRODUCTION

-

10.2 HOSPITALS & CLINICSINCREASING USE OF POC TESTS TO DRIVE MARKET

-

10.3 HOME CARE SETTINGSGROWING ACCEPTANCE OF REMOTE MONITORING TO PROPEL MARKET

-

10.4 DIAGNOSTIC LABORATORIESLABORATORY TESTING LARGELY PREFERRED OVER PROFESSIONAL SETTINGS FOR URINE AND BLOOD TESTING

-

10.5 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESINCREASING FOCUS ON PRODUCT SAFETY TO DRIVE ADOPTION OF LATERAL FLOW ASSAYS

- 10.6 OTHER END USERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- US to hold largest market share of global market, by countryCANADA- Availability of research funding and implementation of favorable government initiatives to drive market

-

11.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Growing number of POC diagnostics centers to drive demandFRANCE- High prevalence of age-related chronic diseases and infectious diseases to drive marketUK- Rising prevalence of obesity to propel marketITALY- Growing initiatives toward decentralization of medical services to support market growthSPAIN- Increasing focus of international organizations and domestic players on developing POC products to aid market growthREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Growing adoption of lateral flow assays in veterinary diagnostics and drug development to drive marketJAPAN- Increasing prevalence of age-related illnesses to drive marketINDIA- Growing healthcare concerns and rising income levels to propel market growthAUSTRALIA- Increasing prevalence of infectious diseases, especially influenza, to drive marketSOUTH KOREAREST OF ASIA PACIFIC

-

11.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTBRAZIL- High private healthcare expenditure and rising geriatric population to drive marketMEXICO- High prevalence of obesity and related chronic diseases to propel marketARGENTINA- Availability of health insurance to favor market growthREST OF LATIN AMERICA

-

11.6 MIDDLE EAST & AFRICASIGNIFICANT SUPPORT FROM GOVERNMENTS AND GLOBAL FIRMS TO DRIVE MARKETMIDDLE EAST & AFRICA: RECESSION IMPACTGCC COUNTRIES- GCC countries: Recession impact

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE SHARE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

-

12.5 COMPANY EVALUATION MATRIX: KEY PLAYERSSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSCOMPANY FOOTPRINT

-

12.6 COMPANY EVALUATION MATRIX: SMES & STARTUPSPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESCOMPETITIVE BENCHMARKING

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHES & APPROVALSDEALSEXPANSIONSOTHER DEVELOPMENTS

- 12.8 R&D ASSESSMENT OF KEY PLAYERS

- 12.9 INVESTMENT LANDSCAPE

- 12.10 VALUATION AND FINANCIAL MATRICES

-

13.1 KEY PLAYERSABBOTT LABORATORIES- Business overview- Products offered- Recent developments- MnM viewF. HOFFMANN-LA ROCHE LTD.- Business overview- Products offered- Recent developments- MnM viewQUIDELORTHO CORPORATION- Business overview- Products offered- Recent developments- MnM viewDANAHER CORPORATION- Business overview- Products offered- Recent developments- MnM viewSIEMENS AG- Business overview- Products offered- Recent developments- MnM viewBECTON, DICKINSON AND COMPANY- Business overview- Products offered- Recent developmentsBIOMÉRIEUX SA- Business overview- Products offered- Recent developmentsTHERMO FISHER SCIENTIFIC INC.- Business overview- Products offered- Recent developmentsPERKINELMER INC.- Business overview- Products offered- Recent developmentsQIAGEN N.V.- Business overview- Products offered- Recent developments

-

13.2 OTHER PLAYERSMERCK KGAAHOLOGIC, INC.ABCAM PLCSURMODICS INC.CHEMBIO DIAGNOSTICS, INC. (BIOSYNEX)ORASURE TECHNOLOGIESDCN DIAGNOSTICSPOLYSCIENCES INC.ABINGDON HEALTHORANOXIS INC.AESKU.GROUP GMBHBIO GROUP MEDICAL SYSTEM S.R.LPHARMACT GMBHDIESSE DIAGNOSTICA SENESE S.P.A.XIAMEN BIOTIME BIOTECHNOLOGY CO., LTD.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 PREVALENCE OF HIV WORLDWIDE (2017 VS. 2021)

- TABLE 3 LIST OF COMMERCIALLY AVAILABLE SALIVA LFA PRODUCTS

- TABLE 4 EPIDEMIOLOGICAL UPDATE ON OMICRON VARIANT

- TABLE 5 EXAMPLES OF LATERAL FLOW ASSAY KITS AVAILABLE TO DETECT OMICRON

- TABLE 6 AVERAGE SELLING PRICE OF LATERAL FLOW ASSAYS (KITS & REAGENTS), BY COMPANY AND APPLICATION, 2021–2023

- TABLE 7 AVERAGE SELLING PRICE OF LATERAL FLOW ANALYZERS, BY REGION, 2020 VS. 2022

- TABLE 8 LATERAL FLOW ASSAYS MARKET: ECOSYSTEM ANALYSIS (2022)

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATERAL FLOW ASSAYS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 15 LATERAL FLOW ASSAYS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 16 IMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 17 EXPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 18 US: HIV PREVALENCE RATE, 2016–2021

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 20 POTENTIAL APPLICATIONS OF AI IN LATERAL FLOW ASSAYS

- TABLE 21 LATERAL FLOW ASSAYS MARKET: UNMET NEEDS/END-USER EXPECTATIONS

- TABLE 22 LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 23 LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 24 LATERAL FLOW READERS OFFERED, BY COMPANY

- TABLE 25 INDICATIVE LIST OF LATERAL FLOW ASSAY KITS & REAGENTS: WITH AND WITHOUT ANALYZERS

- TABLE 26 LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 27 LATERAL FLOW READERS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 28 DIGITAL/HANDHELD LATERAL FLOW READERS MARKET, BY COUNTRY, 2021–2029 (USD MILLION).

- TABLE 29 BENCHTOP LATERAL FLOW READERS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 30 PRODUCT PORTFOLIO ANALYSIS OF LATERAL FLOW READERS FOR CLINICAL DIAGNOSTICS

- TABLE 31 LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 32 LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 33 LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 34 LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 35 LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 36 MAJOR PRODUCTS: DENGUE TESTING

- TABLE 37 LATERAL FLOW ASSAYS MARKET FOR MOSQUITO-BORNE DISEASES, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 38 COVID-19 (ANTIGEN AND ANTIBODY) LATERAL FLOW ASSAY TESTS

- TABLE 39 LATERAL FLOW ASSAYS MARKET FOR COVID-19, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 40 LATERAL FLOW ASSAYS MARKET FOR INFLUENZA, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 41 LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 42 LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 43 LATERAL FLOW ASSAYS MARKET FOR HIV, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 44 LATERAL FLOW ASSAYS MARKET FOR HPV, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 45 LATERAL FLOW ASSAYS MARKET FOR CHLAMYDIA, BY COUNTRY, 2021–2029

- TABLE 46 LATERAL FLOW ASSAYS MARKET FOR GONORRHEA, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 47 LATERAL FLOW ASSAYS MARKET FOR SYPHILIS, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 48 LATERAL FLOW ASSAYS MARKET FOR OTHER SEXUALLY TRANSMITTED INFECTIONS, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 49 LATERAL FLOW ASSAYS MARKET FOR HEPATITIS, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 50 LATERAL FLOW ASSAYS MARKET FOR TUBERCULOSIS, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 51 LATERAL FLOW ASSAYS MARKET FOR OTHER INFECTIOUS DISEASES, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 52 LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 53 LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 54 LATERAL FLOW ASSAYS MARKET FOR TROPONIN I & T TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 55 LATERAL FLOW ASSAYS MARKET FOR CK-MB TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 56 LATERAL FLOW ASSAYS MARKET FOR BNP & NT-PROBNP TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 57 LATERAL FLOW ASSAYS MARKET FOR MYOGLOBIN TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 58 LATERAL FLOW ASSAYS MARKET FOR D-DIMER TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 59 LATERAL FLOW ASSAYS MARKET FOR OTHER CARDIAC MARKER TESTS, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 60 LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 61 LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 62 LATERAL FLOW ASSAYS MARKET FOR PREGNANCY TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 63 LATERAL FLOW ASSAYS MARKET FOR FERTILITY TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 64 LATERAL FLOW ASSAYS MARKET FOR CHOLESTEROL/LIPID TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 65 LATERAL FLOW ASSAYS MARKET FOR DRUGS-OF-ABUSE TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 66 LATERAL FLOW ASSAYS MARKET FOR OTHER CLINICAL TESTS, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 67 LATERAL FLOW ASSAYS MARKET FOR VETERINARY DIAGNOSTICS, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 68 LATERAL FLOW ASSAYS MARKET FOR FOOD SAFETY & ENVIRONMENTAL TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 69 LATERAL FLOW ASSAYS MARKET FOR DRUG DEVELOPMENT & QUALITY TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 70 LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 71 LATERAL FLOW SANDWICH ASSAYS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 72 LATERAL FLOW COMPETITIVE ASSAYS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 73 LATERAL FLOW MULTIPLEX DETECTION ASSAYS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 74 LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 75 LATERAL FLOW ASSAYS MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 76 LATERAL FLOW ASSAYS MARKET FOR URINE SAMPLES, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 77 LATERAL FLOW ASSAYS MARKET FOR SALIVA SAMPLES, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 78 LATERAL FLOW ASSAYS MARKET FOR OTHER SAMPLES, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 79 LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 80 LATERAL FLOW ASSAYS MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 81 LATERAL FLOW ASSAYS MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 82 LATERAL FLOW ASSAYS MARKET FOR DIAGNOSTIC LABORATORIES, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 83 LATERAL FLOW ASSAYS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 84 LATERAL FLOW ASSAYS MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 85 LATERAL FLOW ASSAYS MARKET, BY REGION, 2021–2029 (USD MILLION)

- TABLE 86 NORTH AMERICA: MACROECONOMIC INDICATORS

- TABLE 87 NORTH AMERICA: LATERAL FLOW ASSAYS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 89 NORTH AMERICA: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 90 NORTH AMERICA: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 91 NORTH AMERICA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 92 NORTH AMERICA: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 94 NORTH AMERICA: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 96 NORTH AMERICA: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 97 NORTH AMERICA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 99 US: MACROECONOMIC INDICATORS

- TABLE 100 US: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 101 US: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 102 US: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 103 US: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 104 US: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 105 US: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 106 US: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 107 US: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 108 US: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 109 US: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 110 US: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029USD MILLION)

- TABLE 111 CANADA: MACROECONOMIC INDICATORS

- TABLE 112 CANADA: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 113 CANADA: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 114 CANADA: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 115 CANADA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 116 CANADA: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 117 CANADA: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 118 CANADA: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 119 CANADA: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 120 CANADA: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 121 CANADA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 122 CANADA: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029USD MILLION)

- TABLE 123 EUROPE: LATERAL FLOW ASSAYS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 124 EUROPE: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 125 EUROPE: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 126 EUROPE: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 127 EUROPE: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 128 EUROPE: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 129 EUROPE: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 130 EUROPE: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 131 EUROPE: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 132 EUROPE: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 133 EUROPE: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 134 EUROPE: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 135 GERMANY: MACROECONOMIC INDICATORS

- TABLE 136 GERMANY: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 137 GERMANY: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 138 GERMANY: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 139 GERMANY: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 140 GERMANY: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 141 GERMANY: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 142 GERMANY: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 143 GERMANY: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 144 GERMANY: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 145 GERMANY: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 146 GERMANY: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 147 FRANCE: MACROECONOMIC INDICATORS

- TABLE 148 FRANCE: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 149 FRANCE: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 150 FRANCE: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 151 FRANCE: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 152 FRANCE: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 153 FRANCE: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 154 FRANCE: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 155 FRANCE: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 156 FRANCE: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 157 FRANCE: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 158 FRANCE: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 159 UK: MACROECONOMIC INDICATORS

- TABLE 160 UK: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 161 UK: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 162 UK: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 163 UK: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 164 UK: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 165 UK: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 166 UK: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 167 UK: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 168 UK: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 169 UK: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 170 UK: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 171 ITALY: MACROECONOMIC INDICATORS

- TABLE 172 ITALY: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 173 ITALY: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 174 ITALY: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 175 ITALY: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 176 ITALY: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 177 ITALY: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 178 ITALY: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 179 ITALY: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 180 ITALY: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 181 ITALY: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 182 ITALY: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 183 SPAIN: MACROECONOMIC INDICATORS

- TABLE 184 SPAIN: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 185 SPAIN: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 186 SPAIN: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 187 SPAIN: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 188 SPAIN: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 189 SPAIN: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 190 SPAIN: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 191 SPAIN: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 192 SPAIN: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 193 SPAIN: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 194 SPAIN: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 195 REST OF EUROPE: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 196 REST OF EUROPE: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 197 REST OF EUROPE: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 198 REST OF EUROPE: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 199 REST OF EUROPE: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 200 REST OF EUROPE: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 201 REST OF EUROPE: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 202 REST OF EUROPE: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 203 REST OF EUROPE: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 204 REST OF EUROPE: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 205 REST OF EUROPE: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 206 ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 207 ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 208 ASIA PACIFIC: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 209 ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 210 ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 211 ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 212 ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 213 ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 214 ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 215 ASIA PACIFIC: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 216 ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 217 ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 218 CHINA: MACROECONOMIC INDICATORS

- TABLE 219 CHINA: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 220 CHINA: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 221 CHINA: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 222 CHINA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 223 CHINA: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 224 CHINA: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 225 CHINA: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 226 CHINA: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 227 CHINA: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 228 CHINA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 229 CHINA: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 230 JAPAN: MACROECONOMIC INDICATORS

- TABLE 231 JAPAN: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 232 JAPAN: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 233 JAPAN: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 234 JAPAN: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 235 JAPAN: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 236 JAPAN: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 237 JAPAN: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 238 JAPAN: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 239 JAPAN: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 240 JAPAN: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 241 JAPAN: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 242 INDIA: MACROECONOMIC INDICATORS

- TABLE 243 INDIA: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 244 INDIA: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 245 INDIA: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 246 INDIA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 247 INDIA: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 248 INDIA: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 249 INDIA: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 250 INDIA: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 251 INDIA: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 252 INDIA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 253 INDIA: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 254 AUSTRALIA: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 255 AUSTRALIA: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 256 AUSTRALIA: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 257 AUSTRALIA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 258 AUSTRALIA: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 259 AUSTRALIA: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 260 AUSTRALIA: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 261 AUSTRALIA: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 262 AUSTRALIA: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 263 AUSTRALIA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 264 AUSTRALIA: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 265 SOUTH KOREA: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 266 SOUTH KOREA: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 267 SOUTH KOREA: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 268 SOUTH KOREA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 269 SOUTH KOREA: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 270 SOUTH KOREA: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 271 SOUTH KOREA: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 272 SOUTH KOREA: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 273 SOUTH KOREA: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 274 SOUTH KOREA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 275 SOUTH KOREA: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 276 REST OF ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 277 REST OF ASIA PACIFIC: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 278 REST OF ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 279 REST OF ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 280 REST OF ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 281 REST OF ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 282 REST OF ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 283 REST OF ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 284 REST OF ASIA PACIFIC: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 285 REST OF ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 286 REST OF ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 287 LATIN AMERICA: LATERAL FLOW ASSAYS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

- TABLE 288 LATIN AMERICA: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 289 LATIN AMERICA: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 290 LATIN AMERICA: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 291 LATIN AMERICA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 292 LATIN AMERICA: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 293 LATIN AMERICA: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 294 LATIN AMERICA: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 295 LATIN AMERICA: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 296 LATIN AMERICA: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 297 LATIN AMERICA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 298 LATIN AMERICA: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 299 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 300 BRAZIL: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 301 BRAZIL: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 302 BRAZIL: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 303 BRAZIL: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 304 BRAZIL: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 305 BRAZIL: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 306 BRAZIL: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 307 BRAZIL: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 308 BRAZIL: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 309 BRAZIL: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 310 BRAZIL: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 311 MEXICO: MACROECONOMIC INDICATORS

- TABLE 312 MEXICO: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 313 MEXICO: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 314 MEXICO: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 315 MEXICO: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 316 MEXICO: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 317 MEXICO: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 318 MEXICO: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 319 MEXICO: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 320 MEXICO: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 321 MEXICO: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 322 MEXICO: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 323 ARGENTINA: MACROECONOMIC INDICATORS

- TABLE 324 ARGENTINA: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 325 ARGENTINA: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 326 ARGENTINA: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 327 ARGENTINA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 328 ARGENTINA: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 329 ARGENTINA: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 330 ARGENTINA: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 331 ARGENTINA: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 332 ARGENTINA: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 333 ARGENTINA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 334 ARGENTINA: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 335 REST OF LATIN AMERICA: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 336 REST OF LATIN AMERICA: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 337 REST OF LATIN AMERICA: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 338 REST OF LATIN AMERICA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 339 REST OF LATIN AMERICA: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 340 REST OF LATIN AMERICA: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 341 REST OF LATIN AMERICA: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 342 REST OF LATIN AMERICA: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 343 REST OF LATIN AMERICA: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 344 REST OF LATIN AMERICA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 345 REST OF LATIN AMERICA: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 346 MIDDLE EAST & AFRICA: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 347 MIDDLE EAST & AFRICA: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 348 MIDDLE EAST & AFRICA: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 349 MIDDLE EAST & AFRICA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 350 MIDDLE EAST & AFRICA: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 351 MIDDLE EAST & AFRICA: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 352 MIDDLE EAST & AFRICA: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 353 MIDDLE EAST & AFRICA: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 354 MIDDLE EAST & AFRICA: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 355 MIDDLE EAST & AFRICA: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 356 MIDDLE EAST & AFRICA: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 357 GCC COUNTRIES: LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

- TABLE 358 GCC COUNTRIES: LATERAL FLOW READERS MARKET, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 359 GCC COUNTRIES: LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

- TABLE 360 GCC COUNTRIES: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 361 GCC COUNTRIES: LATERAL FLOW ASSAYS MARKET FOR INFECTIOUS DISEASE TESTING, BY DISEASE TYPE, 2021–2029 (USD MILLION)

- TABLE 362 GCC COUNTRIES: LATERAL FLOW ASSAYS MARKET FOR SEXUALLY TRANSMITTED INFECTIONS, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 363 GCC COUNTRIES: LATERAL FLOW ASSAYS MARKET FOR CARDIAC MARKER TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 364 GCC COUNTRIES: LATERAL FLOW ASSAYS MARKET FOR PREGNANCY & FERTILITY TESTING, BY TYPE, 2021–2029 (USD MILLION)

- TABLE 365 GCC COUNTRIES: LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2021–2029 (USD MILLION)

- TABLE 366 GCC COUNTRIES: LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2021–2029 (USD MILLION)

- TABLE 367 GCC COUNTRIES: LATERAL FLOW ASSAYS MARKET, BY END USER, 2021–2029 (USD MILLION)

- TABLE 368 OVERVIEW OF STRATEGIES ADOPTED BY MAJOR PLAYERS IN LATERAL FLOW ASSAYS MARKET

- TABLE 369 LATERAL FLOW ASSAYS MARKET: DEGREE OF COMPETITION

- TABLE 370 PRODUCT FOOTPRINT (25 COMPANIES)

- TABLE 371 TECHNIQUE FOOTPRINT (25 COMPANIES)

- TABLE 372 APPLICATION FOOTPRINT (25 COMPANIES)

- TABLE 373 SAMPLE TYPE FOOTPRINT (25 COMPANIES)

- TABLE 374 END-USER FOOTPRINT (25 COMPANIES)

- TABLE 375 REGIONAL FOOTPRINT (25 COMPANIES)

- TABLE 376 LATERAL FLOW ASSAY MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 377 LATERAL FLOW ASSAY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- TABLE 378 LATERAL FLOW ASSAYS MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2020–DECEMBER 2023

- TABLE 379 LATERAL FLOW ASSAYS MARKET: DEALS, JANUARY 2020–DECEMBER 2023

- TABLE 380 LATERAL FLOW ASSAYS MARKET: EXPANSIONS (JANUARY 2020–DECEMBER 2023)

- TABLE 381 LATERAL FLOW ASSAYS MARKET: OTHER DEVELOPMENTS, JANUARY 2020–DECEMBER 2023

- TABLE 382 ABBOTT LABORATORIES: COMPANY OVERVIEW

- TABLE 383 ABBOTT LABORATORIES: PRODUCTS OFFERED

- TABLE 384 ABBOTT LABORATORIES: PRODUCT LAUNCHES & APPROVALS (JANUARY 2020–DECEMBER 2023)

- TABLE 385 ABBOTT LABORATORIES: DEALS (JANUARY 2020–DECEMBER 2023)

- TABLE 386 F. HOFFMANN-LA ROCHE LTD.: COMPANY OVERVIEW

- TABLE 387 F. HOFFMAN-LA ROCHE: PRODUCTS OFFERED

- TABLE 388 F. HOFFMAN-LA ROCHE: PRODUCT LAUNCHES & APPROVALS (JANUARY 2020–DECEMBER 2023)

- TABLE 389 F. HOFFMAN-LA ROCHE: DEALS (JANUARY 2020–DECEMBER 2023)

- TABLE 390 F. HOFFMAN-LA ROCHE: EXPANSIONS (JANUARY 2020–DECEMBER 2023)

- TABLE 391 QUIDELORTHO CORPORATION: COMPANY OVERVIEW

- TABLE 392 QUIDELORTHO CORPORATION: PRODUCTS OFFERED

- TABLE 393 QUIDELORTHO CORPORATION: PRODUCT LAUNCHES & APPROVALS (JANUARY 2020–DECEMBER 2023)

- TABLE 394 QUIDELORTHO CORPORATION: DEALS (JANUARY 2020–DECEMBER 2023)

- TABLE 395 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 396 DANAHER CORPORATION: PRODUCTS OFFERED

- TABLE 397 DANAHER CORPORATION: DEALS (JANUARY 2020–DECEMBER 2023)

- TABLE 398 SIEMENS AG: COMPANY OVERVIEW

- TABLE 399 SIEMENS AG: PRODUCTS OFFERED

- TABLE 400 SIEMENS AG: PRODUCT LAUNCHES & APPROVALS (JANUARY 2020–DECEMBER 2023)

- TABLE 401 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 402 BECTON, DICKINSON AND COMPANY: PRODUCTS OFFERED

- TABLE 403 BECTON, DICKINSON AND COMPANY: PRODUCT LAUNCHES & APPROVALS (JANUARY 2020–DECEMBER 2023)

- TABLE 404 BECTON, DICKINSON AND COMPANY: DEALS (JANUARY 2020–DECEMBER 2023)

- TABLE 405 BECTON, DICKINSON AND COMPANY: OTHER DEVELOPMENTS (JANUARY 2020–DECEMBER 2023)

- TABLE 406 BIOMÉRIEUX SA: COMPANY OVERVIEW

- TABLE 407 BIOMÉRIEUX SA: PRODUCTS OFFERED

- TABLE 408 BIOMÉRIEUX SA: DEALS (JANUARY 2020–DECEMBER 2023)

- TABLE 409 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 410 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 411 THERMO FISHER SCIENTIFIC INC.: PRODUCT APPROVALS (JANUARY 2020–DECEMBER 2023)

- TABLE 412 THERMO FISHER SCIENTIFIC INC.: DEALS (JANUARY 2020–DECEMBER 2023)

- TABLE 413 PERKINELMER INC.: COMPANY OVERVIEW

- TABLE 414 PERKINELMER INC.: PRODUCTS OFFERED

- TABLE 415 PERKINELMER INC.: PRODUCT LAUNCHES (JANUARY 2020–DECEMBER 2023)

- TABLE 416 PERKINELMER INC.: DEALS (JANUARY 2020–DECEMBER 2023)

- TABLE 417 QIAGEN N.V.: COMPANY OVERVIEW

- TABLE 418 QIAGEN N.V.: PRODUCTS OFFERED

- TABLE 419 QIAGEN N.V.: DEALS (JANUARY 2020–DECEMBER 2023)

- FIGURE 1 LATERAL FLOW ASSAYS MARKET SEGMENTATION

- FIGURE 2 REGIONAL SCOPE

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE APPROACH: REVENUE SHARE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2022)

- FIGURE 7 SUPPLY-SIDE ANALYSIS: LATERAL FLOW ASSAYS MARKET (2022)

- FIGURE 8 APPROACH 3: DEMAND-SIDE APPROACH, BASED ON MALARIA LATERAL FLOW TESTING MARKET SIZE (2022)

- FIGURE 9 APPROACH 4: TOP-DOWN APPROACH

- FIGURE 10 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2023–2029): IMPACT ON MARKET GROWTH AND CAGR

- FIGURE 11 CAGR PROJECTIONS

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2023 VS. 2029 (USD MILLION)

- FIGURE 14 LATERAL FLOW ASSAY KITS & REAGENTS MARKET, BY TECHNIQUE, 2023 VS. 2029 (USD MILLION)

- FIGURE 15 LATERAL FLOW ASSAYS MARKET, BY APPLICATION, 2023 VS. 2029 (USD MILLION)

- FIGURE 16 LATERAL FLOW ASSAYS MARKET FOR CLINICAL TESTING, BY SAMPLE TYPE, 2023 VS. 2029 (USD MILLION)

- FIGURE 17 LATERAL FLOW ASSAYS MARKET, BY END USER, 2023 VS. 2029 (USD MILLION)

- FIGURE 18 LATERAL FLOW ASSAYS MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 19 HIGH PREVALENCE OF INFECTIOUS DISEASES TO DRIVE MARKET

- FIGURE 20 ASIA PACIFIC TO REGISTER HIGHEST CAGR OVER FORECAST PERIOD

- FIGURE 21 CLINICAL TESTING SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 22 CHINA TO REGISTER HIGHEST GROWTH OVER FORECAST PERIOD

- FIGURE 23 EMERGING ECONOMIES TO OFFER HIGH GROWTH OPPORTUNITIES IN FORECAST PERIOD

- FIGURE 24 LATERAL FLOW ASSAYS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 GERIATRIC POPULATION, BY REGION, 2020 VS. 2050 (MILLION)

- FIGURE 26 GERIATRIC POPULATION, BY REGION, 2022 VS. 2030 VS. 2050 (% OF TOTAL POPULATION)

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 GLOBAL PATENT PUBLICATION TRENDS IN LATERAL FLOW ASSAYS MARKET, 2013–2023

- FIGURE 29 TOP COMPANIES THAT APPLIED FOR LATERAL FLOW ASSAY PATENTS, 2016–2022

- FIGURE 30 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR LATERAL FLOW ASSAY PATENTS, 2016–2022

- FIGURE 31 LATERAL FLOW ASSAYS MARKET: VALUE CHAIN ANALYSIS (2022)

- FIGURE 32 LATERAL FLOW ASSAYS: OVERVIEW OF ADJACENT MARKETS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 35 LATERAL FLOW ASSAYS MARKET: INVESTMENT/VENTURE CAPITAL SCENARIO, 2018–2022

- FIGURE 36 PRODUCT PORTFOLIO ANALYSIS OF LATERAL FLOW READERS FOR CLINICAL DIAGNOSTICS (2022)

- FIGURE 37 NORTH MARKET SIZING FOR COVID-19: SCENARIO-BASED FORECASTING

- FIGURE 38 CHINA TO WITNESS HIGHEST GROWTH IN FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: LATERAL FLOW ASSAYS MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: LATERAL FLOW ASSAYS MARKET SNAPSHOT

- FIGURE 41 REVENUE SHARE ANALYSIS FOR KEY PLAYERS IN PAST FIVE YEARS

- FIGURE 42 LATERAL FLOW ASSAYS MARKET SHARE ANALYSIS, BY KEY PLAYER (2022)

- FIGURE 43 LATERAL FLOW ASSAYS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022

- FIGURE 44 COMPANY FOOTPRINT (25 COMPANIES)

- FIGURE 45 LATERAL FLOW ASSAYS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2022

- FIGURE 46 R&D EXPENDITURE: MAJOR PLAYERS IN LATERAL FLOW ASSAYS MARKET, 2021 VS. 2022

- FIGURE 47 LATERAL FLOW ASSAY MARKET FUNDING SOARED IN 2022

- FIGURE 48 MOST VALUED LATERAL FLOW ASSAY FIRMS IN 2022 (USD BILLION)

- FIGURE 49 LATERAL FLOW ASSAYS MARKET: VALUATION AND FINANCIAL MATRICES

- FIGURE 50 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

- FIGURE 51 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 52 QUIDELORTHO CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 53 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 54 SIEMENS AG: COMPANY SNAPSHOT (2022)

- FIGURE 55 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- FIGURE 56 BIOMÉRIEUX SA: COMPANY SNAPSHOT (2022)

- FIGURE 57 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- FIGURE 58 PERKINELMER INC.: COMPANY SNAPSHOT (2022)

- FIGURE 59 QIAGEN N.V.: COMPANY SNAPSHOT (2022)

Methodology

The study involved major activities in estimating the current market size for the global lateral flow assays market.

Exhaustive secondary research was done to collect information on the lateral flow assays industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the lateral flow assays market.

The four steps involved in estimating the market size are:

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases, white papers, annual reports, investor presentations, SEC filings of companies and publications from government sources [such as US Food and Drug Administration, World Health Organization (WHO), Centers for Disease Control and Prevention, International Organization for Standardization (ISO), Agency for Healthcare Research and Quality, were referred to identify and collect information for the global lateral flow assays market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends, to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the lateral flow assays market. The primary sources from the demand side include hospitals, clinics, diagnostic laboratories, pharmaceutical and biotechnology companies. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

The following is a breakdown of the primary respondents:

Note 1: Other designations include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2024, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = < USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global lateral flow assays market. All the major service providers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players. The global lateral flow assays market was split into various segments and sub-segments based on:

- List of major players operating in the market at the regional and/or country level

- Product mapping of lateral flow assay providers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from lateral flow assays (or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global lateral flow assays market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size by applying the process mentioned above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Lateral flow assays, or lateral flow immunochromatographic assays, are simple-to-use diagnostic devices to confirm the presence or absence of a target analyte, such as pathogens or biomarkers in humans or animals, or contaminants in water supplies, without requiring specialized equipment.

Stakeholders

- Lateral flow assay product manufacturers

- Lateral flow assay vendors and distributors

- Hospitals

- Clinical and diagnostic laboratories

- Pharmaceutical and biotechnological companies

- Venture capitalists and investors

Report Objectives

- To define, describe, analyze, and forecast the lateral flow assays (LFA) market by product, application, technique, sample type, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall lateral flow assays market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries.

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product excellence

- To study the impact of AI/Gen AI on the market, along with the macroeconomic outlook for each region

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You