Microfluidic Components Market by Product (Valve, Solenoid Valve, Check Valve, Nozzle, Tubing, Micropump, Microneedle, Shuttle Valve), Industry (Automotive, Aerospace & Defense, Healthcare, Consumer Electronics, Oil & Gas) - Global Forecast to 2024

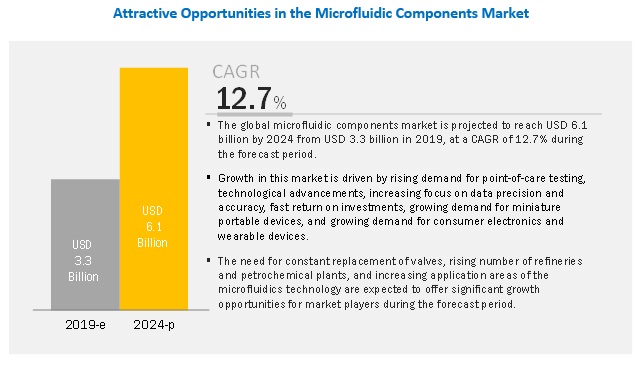

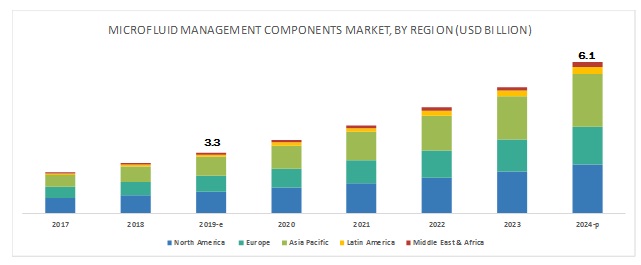

[163 Pages Report] The global microfluidic components market is projected to reach USD 6.1 billion by 2024 from USD 3.3 billion in 2019, at a CAGR of 12.7%. Growth in this market is driven by rising demand for point-of-care testing, technological advancements, increasing focus on data precision and accuracy, fast return on investments, growing demand for miniature portable devices, and growing demand for consumer electronics and wearable devices.

The flow and pressure sensors segment is expected to account for the largest share of the microfluidic components market in 2019

Flow and pressure sensors are expected to be the largest revenue contributor to the microfluidic components market in 2019. The large share of this segment is attributed to their diverse application in pressure sensing, pH measurement, microfluidics conductivity measurement, and microfluidic biosensors.

Solenoid valves segment is expected to grow at a higher CAGR

Based on valve type, the microfluidic components market is segmented into solenoid valves, flow control valves, check valves, shuttle valves, pressure relief valves, proportional valves, and other valves. Solenoid valves are expected to grow at the highest CAGR during the forecast period due to factors like increased application scope in the automotive industry, the shift towards renewable sources for power generation, growing investments in various industries, and increasing government regulations on end-use industries across developing economies.

The healthcare segment is expected to account for the largest share of the microfluidic components market in 2019

The healthcare industry segment accounted for the largest share of the market in 2019. The large share of this segment can be attributed to factors such as, high healthcare spending, growing demand for process automation, rising government funding in the healthcare sector, growing demand for point-of-care testing, and demand for enhanced safety.

The Asia Pacific region is expected to grow at the highest rate in the microfluidic components market in 2019

The microfluidic components market in the Asia Pacific is estimated to grow at the highest CAGR during the forecast period. Increasing industrialization, investments in water infrastructure, growth in various industries (such as chemicals, power & energy, and aerospace), increasing number of infrastructural development projects (especially in China and India), rising standard of living, and growing urbanization are factors driving the adoption of microfluidic components in the Asia Pacific.

Key Market Players

The prominent players in the global microfluidic components market are Parker Hannifin Corporation (US), IDEX Corporation (US), Fluigent SA (France), Staiger GmbH & Co. KG (Germany), SMC Corporation (Japan), Camozzi Automation Spa Società Unipersonale (Italy), Aignep s.p.a. (Italy), FIM Valvole Srl (Italy), Humphrey Products Corporation (US), The Lee Company (US), Dolomite Microfluidics (UK), Cellix Ltd. (Ireland), Elveflow (France), and Christian Bürkert GmbH & Co. KG (Germany).

Parker Hannifin Corporation

Parker Hannifin is a leading manufacturer of motion & control technologies and systems that provide precision-engineered solutions for the commercial, mobile, industrial, and aerospace markets. The company has engineering expertise in a broad range of core technologies, which helps it to solve various engineering challenges. The company has a strong geographical presence and sells its products across the globe. To expand its territorial reach, the company sells its products in Asia and the Middle East through its strong distribution network. It focuses on various strategies like product launches and enhancements to increase its revenue and expand its presence in the market. Its diverse range of products makes Parker the leading supplier of microfluidic components that meet and exceed market demands. The company provides standard products, as well as custom products, which are engineered and produced to original equipment manufacturers' specifications for application to particular end products. Both standard and custom products are also used in the replacement of original products.

IDEX Corporation

IDEX is one of the leading players in the microfluidics components market, owing to its broad range of offerings in the valves, micropumps, and sensors segments. It is involved in the design, production, and distribution of small-scale & highly precise fluidics components and sub-assemblies used in analytical and diagnostics instruments, as well as medical equipment and implantable devices. The firm largely focuses on acquiring and partnering with companies that complement its fluidics and microfluidics businesses. IDEX Health & Science has an international network of direct sales professionals and distribution partners in many countries across the globe. The company has manufacturing operations in more than 20 countries.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Product, Industry, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and the Middle East & Africa |

|

Companies covered |

Parker Hannifin Corporation (US), IDEX Corporation (US), Fluigent SA (France), Staiger GmbH & Co. KG (Germany), SMC Corporation (Japan), Camozzi Automation Spa Società Unipersonale (Italy), Aignep s.p.a. (Italy), FIM Valvole Srl (Italy), Humphrey Products Corporation (US), The Lee Company (US), Dolomite Microfluidics (UK), Cellix Ltd. (Ireland), Elveflow (France), and Christian Bürkert GmbH & Co. KG (Germany) |

The research report categorizes the market into the following segments and subsegments:

Microfluidic Components Market, by Product

- Valves

- Solenoid Valves

- Flow Control Valves

- Check Valves

- Shuttle Valves

- Pressure Relief Valves

- Proportional Valves

- Other Valves (Ball Valves, Safety Valves, Plug Valves, and Diaphragm Valves)

- Flow and Pressure Controllers

- Flow and Pressure Sensors

- Micropumps

- Nozzles

- Microneedles

- Other Components (Tubing, Connectors)

Microfluidic Components Market, by Industry

- Oil & Gas

- Healthcare

- Aerospace & Defense

- Consumer Electronics

- Automotive

- Other Industries (Chemicals, Food & Beverages Testing, Environmental Testing)

Microfluidic Components Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of APAC

- Latin America

- Middle East and Africa

Recent developments

- In December 2017, Parker launched VSO LowPro GC, a microfluidic valve.

- In 2018 Parker Aerospace, a business segment of Parker Hannifin Corporation, opened its second global Customer Response Center (CRC) in Singapore, with the aim to provide more local insights and potentially faster resolution of issues.

- In December 2017, IDEX Health and Science acquired thinXXS, a manufacturer of disposable microfluidic components for the point of care, veterinary and life science markets.

Critical questions the report answers:

- Where will all these developments take the industry in the medium to long-term?

- What are the application areas of the microfluidic components market?

- Which are the major microfluidic components?

- Which geographies are likely to grow at the highest CAGR?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Approach

2.2 Research Design

2.2.1 Secondary Research

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Research

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Breakdown of Primaries

2.2.2.3 Key Industry Insights

2.3 Market Size Estimation

2.4 Data Triangulation Approach

2.5 Market Players Ranking Analysis

2.6 Assumptions for the Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Microfluidic Components: Market Overview

4.2 Microfluidic Components Market: Geographic Growth Opportunities

4.3 Regional Mix: Microfluidic Components Market (2019–2024)

4.4 Microfluidic Components Market: Developed vs. Developing Markets, 2019 vs. 2024

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Demand for Point-Of-Care Testing

5.2.1.2 Technological Advancements

5.2.1.3 Increasing Focus on Data Precision and Accuracy

5.2.1.4 Fast Returns on Investments

5.2.1.5 Growing Demand for Consumer Electronics and Wearable Devices

5.2.1.6 Growing Demand for Miniature Portable Devices

5.2.2 Restraints

5.2.2.1 Complex Regulatory Approval Process

5.2.3 Opportunities

5.2.3.1 Emergence of Microfluidics-Based 3d Cell Culture

5.2.3.2 Regenerative Medicine- an Alternative To Organ Transplantation

5.2.3.3 Increasing Application Areas of Microfluidics Technology

5.2.4 Challenges

5.2.4.1 Standardization and Commercialization of Components

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Process Automation in End-Use Industries

6.3 Emergence of Piezo-Actuated Technology

6.4 Universities Actively Generating Microfluidic Startups

6.5 Increasing Popularity of Smart Valves

7 Microfluidic Components Market, By Product (Page No. - 45)

7.1 Introduction

7.2 Flow and Pressure Sensors Market

7.2.1 Increasing Application Areas in the Healthcare Industry To Drive Market Growth

7.3 Flow and Pressure Controllers

7.3.1 High Accuracy and Control Stability Make Pressure Controllers Suitable References in Fluid Measurement

7.4 Micropumps

7.4.1 Growing Demand in the Healthcare Vertical and Advantages Over Traditional Pumps Will Drive the Market

7.5 Valves

7.5.1 Solenoid Valves

7.5.1.1 Shift From Conventional Laboratory Techniques To Automated Techniques is A Key Factor in the High Adoption of Solenoid Valves

7.5.2 Flow Control Valves

7.5.2.1 Demand for Flow Control Valves is High in the Life Science Research and Laboratory Applications

7.5.3 Check Valves

7.5.3.1 Broad Range Functionality of the Check Valves To Drive Market Growth

7.5.4 Shuttle Valves

7.5.4.1 Growing Healthcare & Aerospace Industry To Propel Market Growth

7.5.5 Pressure Relief Valves

7.5.5.1 Rising Demand for Smart Valves and Growing Digitalization Have Supported Market Demand

7.5.6 Proportional Valves

7.5.6.1 Low Weight and Energy Consumption are Some Advantages of Proportional Valves

7.5.7 Other Valves

7.6 Nozzles

7.6.1 Growing Automobile Industry and Need for Better Fuel Efficiency are Boosting the Nozzles Market

7.7 Microneedles

7.7.1 Growing Demand for Safer Alternative To Conventional Hypodermic Injections has Driven Market Growth

7.8 Other Components

8 Microfluidic Components Market, By Industry (Page No. - 66)

8.1 Introduction

8.2 Healthcare Industry

8.2.1 The Healthcare Industry is Estimated To Grow at the Highest CAGR of 24.9% During the Forecast Period

8.3 Aerospace & Defense Industry

8.3.1 The Increasing Requirement for Commercial, Passenger, and Military Aircrafts is Expected To Drive Market Growth

8.4 Consumer Electronics Industry

8.4.1 Growing Trends Towards Miniaturization and High Demand for Consumer Electronics is Expected To Boost Market Growth

8.5 Automotive Industry

8.5.1 Growing Production of Commercial and Passenger Vehicles To Drive Marketd Growth

8.7 Oil & Gas Industry

8.7.1 Increasing Research on Applications of Microfluidics in the Oil and Gas Industry To Support Market Growth

8.8 Other Industries

9 Microfluidic Components Market, By Region (Page No. - 77)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Well Established Healthcare and Aerospace Industries are Contributing To US’s High Market Share

9.2.2 Canada

9.2.2.1 Growing Healthcare Industry in the Country To Drive Market Growth

9.3 Asia Pacific

9.3.1 China

9.3.1.1 Growing Industrialization and Increasing Initiatives for Infrastructural Development To Support Market Growth

9.3.2 Japan

9.3.2.1 Established Manufacturing and Automobile Sectors To Drive Market Growth

9.3.3 India

9.3.3.1 Prominent Consumer Electronics Industry To Drive the Demand for Microfluidic Components

9.3.4 Rest of Asia Pacific

9.4 Europe

9.4.1 Germany

9.4.1.1 Advanced Manufacturing Capabilities To Support Market Growth

9.4.2 France

9.4.2.1 Government Initiatives To Promote Healthcare is Likely To Boost the Adoption of Microfluidic Components in France

9.4.3 UK

9.4.3.1 High Demand for Home Healthcare and Poc Testing To Boost the Adoption of Microfluidic Components

9.4.4 Italy

9.4.4.1 Huge Aerospace and Consumer Electronics Industries To Propel the Adoption of Microfluidic Components

9.4.5 Spain

9.4.5.1 Large Pharma Industry and Improving Healthcare Infrastructure To Boost Market Growth

9.4.6 Rest of Europe

9.5 Latin America

9.5.1 High Growth Opportunities in the Manufacturing Sector To Drive Market Growth

9.6 Middle East & Africa

9.6.1 Mea Region Offers Lucrative Opportunities for Medical Device Manufacturers

10 Competitive Landscape (Page No. - 120)

10.1 Overview

10.2 Market Ranking

10.2.1 Microfluidic Components Market, By Key Player, 2018

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Companies

10.4 Competitive Situation and Trends

10.4.1 Product Launches

10.4.2 Expansions

10.4.3 Acquisitions

11 Company Profiles (Page No. - 127)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Parker Hannifin Corporation

11.2 Fluigent SA

11.3 Staiger GmbH & Co. Kg

11.4 SMC Corporation

11.5 Camozzi Automation Spa Società Unipersonale

11.6 Idex Corporation

11.7 Aignep S.P.A.

11.8 FIM Valvole SRL

11.9 Humphrey Products Corporation

11.10 The LEE Company

11.11 Dolomite Microfluidics

11.12 Cellix Ltd.

11.13 Elveflow

11.14 Christian Bürkert GmbH & Co. Kg

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 154)

12.1 Insights of Industry Experts

12.2 Market Sizing & Validation Approach

12.3 Discussion Guide

12.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (91 Tables)

Table 1 Microfluidic Components Market: Impact Analysis of Drivers, Restraints, Opportunities, and Challenges

Table 2 List of University Startups in the Microfluidics Market

Table 3 Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 4 Flow and Pressure Sensors Market: Product Offerings

Table 5 Flow and Pressure Sensors Market, By Country, 2017–2024 (USD Million)

Table 6 Flow and Pressure Controllers Market: Product Offerings

Table 7 Flow and Pressure Controllers Market, By Country, 2017–2024 (USD Million)

Table 8 Micropumps Market: Product Offerings

Table 9 Micropumps Market, By Country, 2017–2024 (USD Million)

Table 10 Valves Market: Product Offerings

Table 11 Valves Market, By Type, 2017–2024 (USD Million)

Table 12 Valves Market, By Country, 2017–2024 (USD Million)

Table 13 Solenoid Valves Market, By Country, 2017–2024 (USD Million)

Table 14 Flow Control Valves Market, By Country, 2017–2024 (USD Million)

Table 15 Check Valves Market, By Country, 2017–2024 (USD Million)

Table 16 Shuttle Valves Market, By Country, 2017–2024 (USD Million)

Table 17 Pressure Relief Valves Market, By Country, 2017–2024 (USD Million)

Table 18 Proportional Valves Market, By Country, 2017–2024 (USD Million)

Table 19 Other Valves Market, By Country, 2017–2024 (USD Million)

Table 20 Nozzles Market: Product Offerings

Table 21 Nozzles Market, By Country, 2017–2024 (USD Million)

Table 22 Microneedles Market: Product Offerings

Table 23 Microneedles Market, By Country, 2017–2024 (USD Million)

Table 24 Other Components Market, By Country, 2017–2024 (USD Million)

Table 25 Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 26 Microfluidic Components Market for Healthcare Industry, By Country/Region, 2017–2024 (USD Million)

Table 27 Microfluidic Components Market for Aerospace and Defense Industry, By Country/Region, 2017–2024 (USD Million)

Table 28 Microfluidic Components Market for Consumer Electronics Industry, By Country, 2016–2023 (USD Million)

Table 29 Microfluidic Components Market for Automotive Industry, By Country/Region, 2017–2024 (USD Million)

Table 30 Microfluidic Components Market for Oil & Gas Industry, By Country/Region, 2017–2024 (USD Million)

Table 31 Microfluidic Components Market for Other Industries, By Country/Region, 2017–2024 (USD Million)

Table 32 Microfluidic Components Market, By Region, 2017–2024 (USD Million)

Table 33 North America: Microfluidic Components Market, By Country, 2017–2024 (USD Million)

Table 34 North America: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 35 North America: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 36 North America: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 37 US: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 38 US: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 39 US: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 40 Canada: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 41 Canada: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 42 Canada: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 43 Asia Pacific: Microfluidic Components Market, By Country, 2017–2024 (USD Million)

Table 44 Asia Pacific: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 45 Asia Pacific: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 46 Asia Pacific: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 47 China: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 48 China: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 49 China: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 50 Japan: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 51 Japan: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 52 Japan: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 53 India: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 54 India: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 55 India: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 56 RoAPAC: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 57 RoAPAC: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 58 RoAPAC: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 59 Europe: Microfluidic Components Market, By Country, 2017–2024 (USD Million)

Table 60 Europe: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 61 Europe: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 62 Europe: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 63 Germany: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 64 Germany: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 65 Germany: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 66 France: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 67 France: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 68 France: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 69 UK: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 70 UK: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 71 UK: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 72 Italy: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 73 Italy: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 74 Italy: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 75 Spain: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 76 Spain: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 77 Spain: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 78 RoE: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 79 RoE: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 80 RoE: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 81 Latin America: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 82 Latin America: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 83 Latin America: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 84 Middle East & Africa: Microfluidic Components Market, By Product, 2017–2024 (USD Million)

Table 85 Middle East & Africa: Microfluidic Components Market for Valves, By Type, 2017–2024 (USD Million)

Table 86 Middle East & Africa: Microfluidic Components Market, By Industry, 2017–2024 (USD Million)

Table 87 Microfluidic Valves Market Ranking, By Key Player, 2018

Table 88 Micropumps Market Ranking, By Key Player, 2018

Table 89 Product Launches, 2016–2019

Table 90 Expansions, 2016–2019

Table 91 Acquisitions, 2016–2019

List of Figures (24 Figures)

Figure 1 Breakdown of Primary Interviews: By Company Type, Designations, and Region

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Data Triangulation Methodology

Figure 5 Microfluidic Components Market, By Product, 2019 vs. 2024 (USD Million)

Figure 6 Microfluidic Components Market, By Industry, 2019 vs. 2024 (USD Million)

Figure 7 Geographical Snapshot of the Microfluidic Components Market

Figure 8 Growing Demand for Poc Testing is One of the Key Factors Driving Market Growth

Figure 9 India is Expected To Grow at the Highest CAGR During the Forecast Period

Figure 10 Asia Pacific To Grow at the Highest Growth Rate During the Forecast Period

Figure 11 Developing Markets To Register A Higher Growth Rate Between 2019 & 2024

Figure 12 Flow and Pressure Sensors Segment To Dominate the Microfluidic Components Market During the Forecast Period

Figure 13 Healthcare Industry Segment Dominated the Microfluidic Component Market in 2018

Figure 14 Passenger Traffic Carried By Scheduled Carriers From 2007-2008 To 2016-2017

Figure 15 Global Defense Expenditure (2014-2018)

Figure 16 Oil Production and Consumption Trend (2000-2016)

Figure 17 Microfluidic Components Market: Geographical Growth Opportunities

Figure 18 Figure: North America: Microfluidic Components Market Snapshot

Figure 19 Asia Pacific: Microfluidic Components Market Snapshot

Figure 20 Europe: Microfluidic Components Market Snapshot

Figure 21 Microfluidic Components Market: Competitive Leadership Mapping (2018)

Figure 22 Parker Hannifin Corporation: Company Snapshot (2018)

Figure 23 SMC Corporation: Company Snapshot (2018)

Figure 24 Idex Corporation: Company Snapshot (2018)

In this report, the global market size for microfluidic components was arrived at after the assessment of major product segments and their share in the overall market. For this purpose, the share of major product segments was determined through various insights gathered during the primary and secondary research. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases such as D&B Hoovers, Bloomberg Business, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global microfluidic components market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

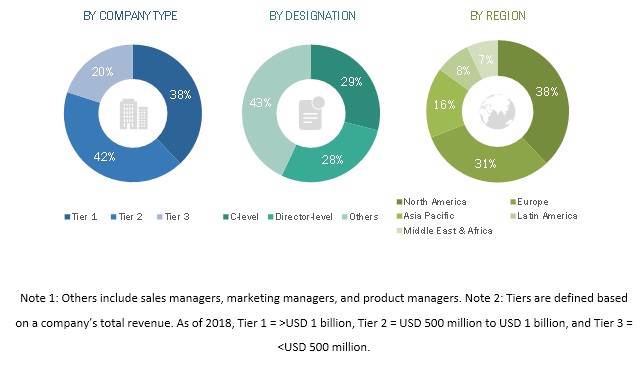

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the global microfluidic components market. The primary sources from the demand side included purchase and sales managers from research organizations and various end-user industries of microfluidic components.

Primary research was conducted to validate the market segmentation, identify the key players in the market, and gather insights on the key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product, industry, and region).

Data Triangulation

After arriving at the market size, the total microfluidic components market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, and forecast the microfluidic components market by product, industry, and region

- To provide detailed information about the major factors influencing market growth (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall microfluidic components market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies in the microfluidic components market

- To track and analyze competitive developments such as mergers & acquisitions, product developments, and geographical expansions in the microfluidic components market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- A further breakdown of the Latin American microfluidic components market into Brazil, Mexico, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microfluidic Components Market