The study involved four major activities in estimating the current size of the mercury analyzers market. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Finally, both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research was conducted mainly to obtain key information about the industry’s supply chain, value chain of the market, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

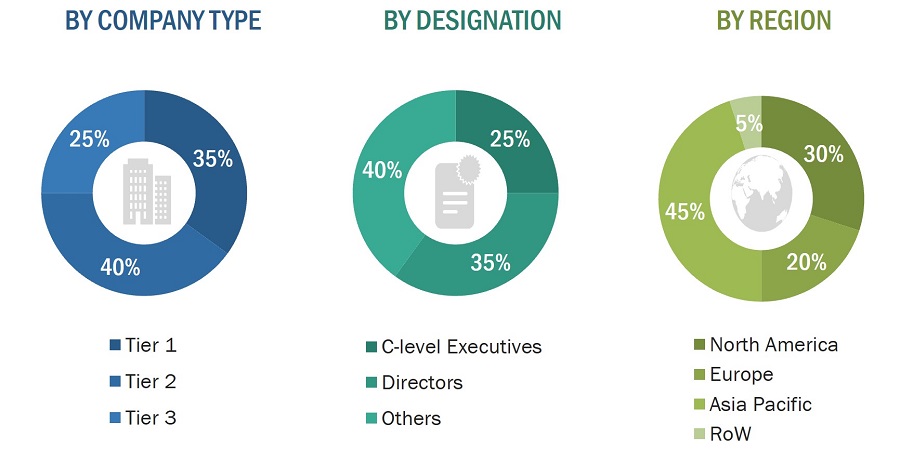

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include experts such as CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the mercury analyzer ecosystem. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

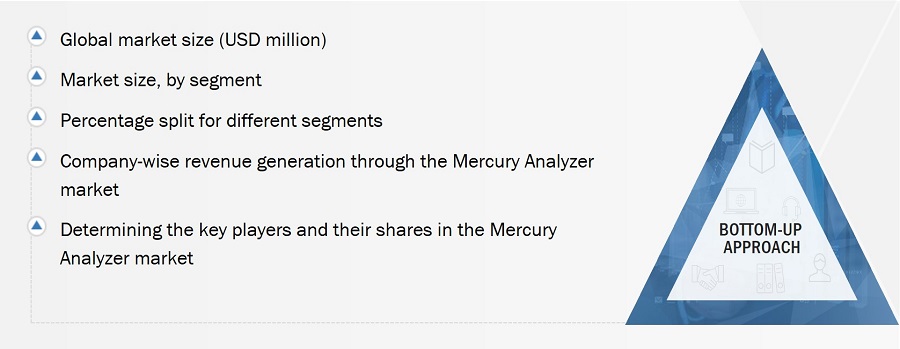

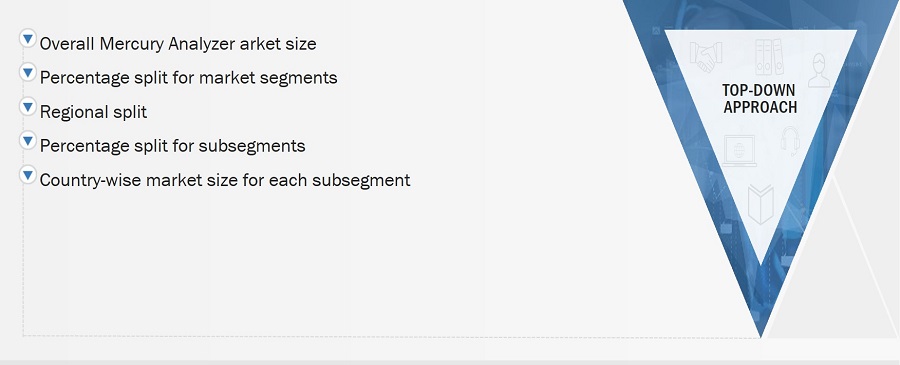

Both the top-down and bottom-up approaches were used to estimate and validate the size of the overall mercury analyzers market and the market based on segments. The research methodology used to estimate the market size was given below:

-

Major players operating in the mercury analyzer market were identified and considered for the report through extensive secondary research.

-

The supply chain and market size of the mercury analyzers market, both in terms of value and units, were estimated/determined through secondary and primary research processes.

-

All estimations and calculations, including percentage share, revenue mix, splits, and breakdowns, were determined through the use of secondary sources, which were further verified through primary sources.

Global Mercury Analyzer Market Size: Bottom-Up Approach

Global Mercury Analyzer Market Size: Top-Down Approach

Market Definition

A mercury analyzer is an instrument designed to detect and measure mercury (Hg) concentration in various sample types, including solids, liquids, and gases. The mercury analyzer utilizes techniques such as cold vapor atomic absorption and cold vapor atomic fluorescence spectrometry to separate atomic mercury from the sample's matrix. These analyzers are utilized across various sectors, including environmental monitoring of air, water, and soil; the food industry; oil, gas, and petrochemical industries; healthcare and cosmetics sectors; and research institutes and laboratories.

Key Stakeholders

-

Mercury analyzer product manufacturers

-

Mercury analyzer product traders/suppliers

-

Raw material suppliers and distributors

-

Associations, organizations, forums, and alliances related to mercury analysis

-

Government bodies such as regulatory authorities and policy-makers

-

Research laboratories and academic institutes

-

National and regional pollution control boards and organizations

-

Oil producing and distribution companies

-

Municipalities and municipal corporations

-

Sewage and wastewater treatment plants

-

Food industry

-

Healthcare establishments

-

Cosmetic manufacturers

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both top-down and bottom-up approaches.

Report Objectives:

-

To describe, and forecast the overall mercury analyzer market in terms of value and volume

-

To describe, and forecast the mercury analyzer market segmented on the basis of type, end-use industry, and region

-

To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific, and the RoW

-

To provide detailed information on the drivers, restraints, opportunities, and challenges influencing market growth

-

To provide a detailed overview of the supply chain and ecosystem, along with the average selling price of the mercury analyzer

-

To strategically analyze the regulatory landscape, standards, patents, Porter’s five forces, import and export scenarios, trade values, and case studies pertaining to the market under study

-

To strategically analyze micromarkets1 concerning individual growth trends, prospects, and contributions to the total market

-

To analyze the opportunities for stakeholders and details of the competitive landscape of the market

-

To analyze strategic developments such as product launches, partnerships, expansions, and contracts in the mercury analyzers market

-

To identify the key players operating in the mercury analyzer market and comprehensively analyze their market ranking and core competencies2

-

To analyze strategic developments such as product launches, partnerships, expansions, and contracts in the mercury analyzers market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Product Analysis

-

Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analysis and profiling of 25 key players

Samir

Apr, 2019

Continuous measurement of Mercury from coal-fired power plant flue gas emissions is getting mandatory. Over 90% of power plants in India are using our CEMs system for the measurement of CO,SO2,NOx, particulate matter parameters. Please suggest a reliable technique, make, model no. for the continuous measurement of Mercury. To measure - Elemental, Ionic & Total mercury, Measuring principle - Atomic absorption spectrometry Cold Vapor Atomic Fluorescence Automatic calibration facility..