The study involved four major activities in estimating the current size of the emission monitoring system market. Exhaustive secondary research has been done to collect information on the market, peer, and parent markets. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the emission monitoring system market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred emission monitoring system providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

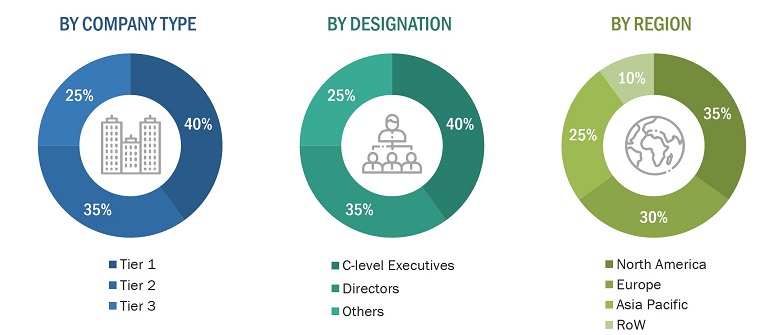

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from emission monitoring system providers, such as ABB (Switzerland), AMETEK. Inc. (US), Emerson Electric Co. (US), Siemens (Germany), and Thermo Fisher Scientific Inc. (US); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the emission monitoring system market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

-

Major players in the industry and markets have been identified through extensive secondary research.

-

The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

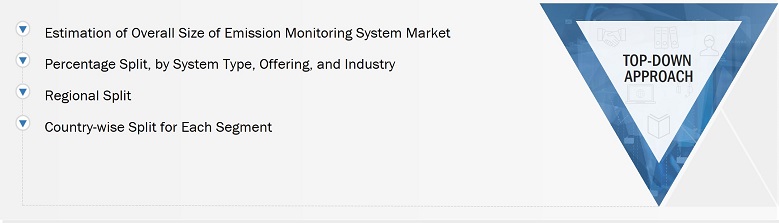

Top-down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual market segments (mentioned in market segmentation) through percentage splits from secondary and primary research. For specific market segments, the size of the most appropriate immediate parent market has been used to implement the top-down approach. The bottom-up approach has also been implemented for data obtained from secondary research to validate the market size of various segments.

Emission Monitoring System Market: Top-down Approach

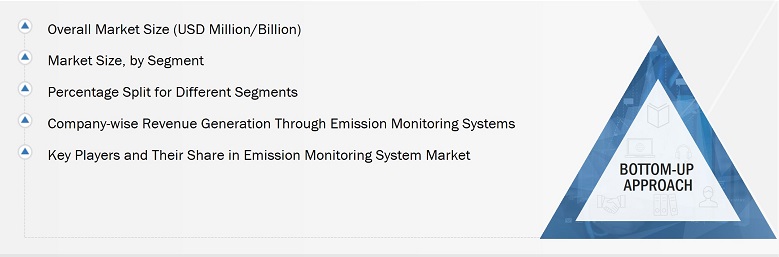

Bottom-Up Approach

The bottom-up approach has been used to arrive at the overall size of the emission monitoring system market from the revenues of the key players and their market shares. Calculations based on revenues of key companies identified in the market led to the estimation of their overall market size.

Emission Monitoring System Market: Bottom-up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

An emission monitoring system (EMS) determines the concentrations of toxic gases or particulate matter emitted during industrial operations. It is used in industries such as power generation, oil & gas, pharmaceuticals, and chemicals. Emission monitoring systems should comply with emission standards imposed by organizations such as the United States Environmental Protection Agency (US EPA).

Key Stakeholders

-

Component manufacturers

-

Distributors and traders

-

End-user industries such as power generation, pharmaceuticals, and oil & gas

-

Government and research organizations

-

Original equipment manufacturers

-

EMS manufacturers and suppliers

-

Research institutions and organizations

Research Objectives

-

To define and forecast the emission monitoring system market regarding offering, system type, and industry.

-

To describe and forecast the emission monitoring system market and its value segments for four regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries.

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To strategically analyze micro-markets concerning individual growth trends, prospects, and contributions to the overall market

-

To study the complete value chain of the emission monitoring system market

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

-

To strategically profile key players and comprehensively analyze their market position regarding ranking and core competencies, along with a detailed market competitive landscape.

-

To analyze strategic approaches such as agreements, collaborations, and partnerships in the emission monitoring system market

-

To provide an analysis of the recession impact on the growth of the market and its segments

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

venkataraman

Apr, 2022

Wish to know more about PEMS..

Sam

Apr, 2022

I am looking for the market potential of (satellite-based) (CO2, NH3, NOx, and SO2) emission monitoring systems, both in the Netherlands and globally..

Fabian

Apr, 2022

I am interested in this market report. Please send me a free sample. Thank you best Regards Fabian Bong .

User

Sep, 2019

The use of emission monitoring systems has been regulated and mandated because of the increasing regulations for environmental pollution control. Does this report cover all the legal and environmental regulations pertaining to the emission monitoring system market?.

User

Sep, 2019

Cement, oil & gas, and power plants and combustion industries, among others, emit tons of hazardous gases that impact the environment and human health. Governments of many European countries are undertaking environmental regulation policies and initiating environment protection acts to protect the environment and sustain human life and natural resources. I am looking for emission monitoring systems market in major European countries and the impact of government policies on the market growth..

User

Sep, 2019

Rapid industrialization and rising concerns related to the air quality are the major factors impacting the adoption of emission monitoring systems in the APAC region. Can you provide the emission monitoring market growth and development in APAC with countries having the major share?.

User

Sep, 2019

The emission monitoring ecosystem has witnessed a lot of product innovations. Companies such as Emerson, ABB, and AMETEK have launched new products. Can you provide growth opportunities for manufacturers in the emission monitoring system market ?.

User

May, 2019

The emission monitoring systems market is highly fragmented with a large number of big, medium-sized and small players. Can you provide the competitive landscape for players across the regions ?.