Membrane Bioreactor Market

Membrane Bioreactor Market by Membrane Type (Hollow Fiber, Flat Sheet, Multi Tubular), System Configuration (Submerged Membrane Bioreactor System, External Membrane Bioreactor System), Capacity (Small, Medium, Large), Application (Municipal Wastewater Treatment, Industrial Wastewater Treatment), And Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

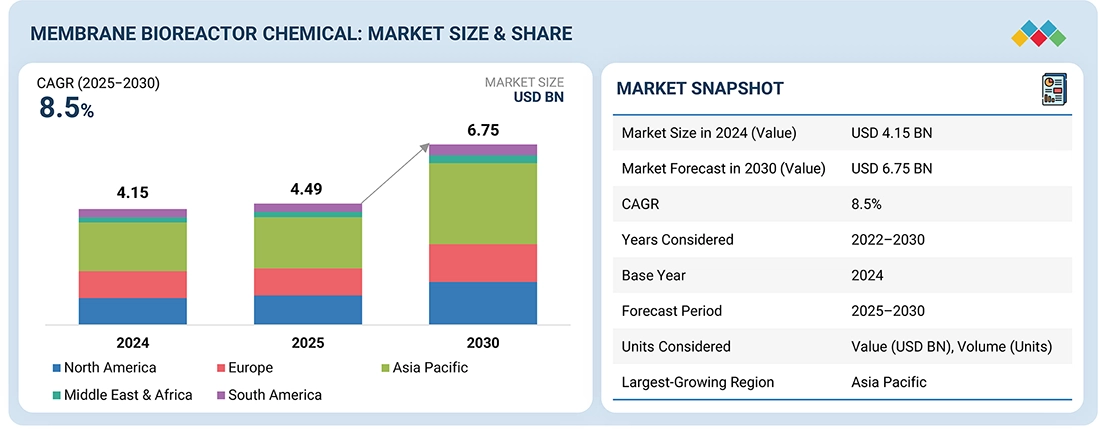

A membrane bioreactor is an advanced wastewater treatment system that combines biological treatment processes with filtration methods using membranes, including microfiltration and ultrafiltration. The global membrane bioreactor market size is projected to reach USD 6.75 billion in 2030 from USD 4.15 billion in 2024, at a CAGR of 8.5% during the forecast period. It is projected to grow significantly in the coming years.

KEY TAKEAWAYS

-

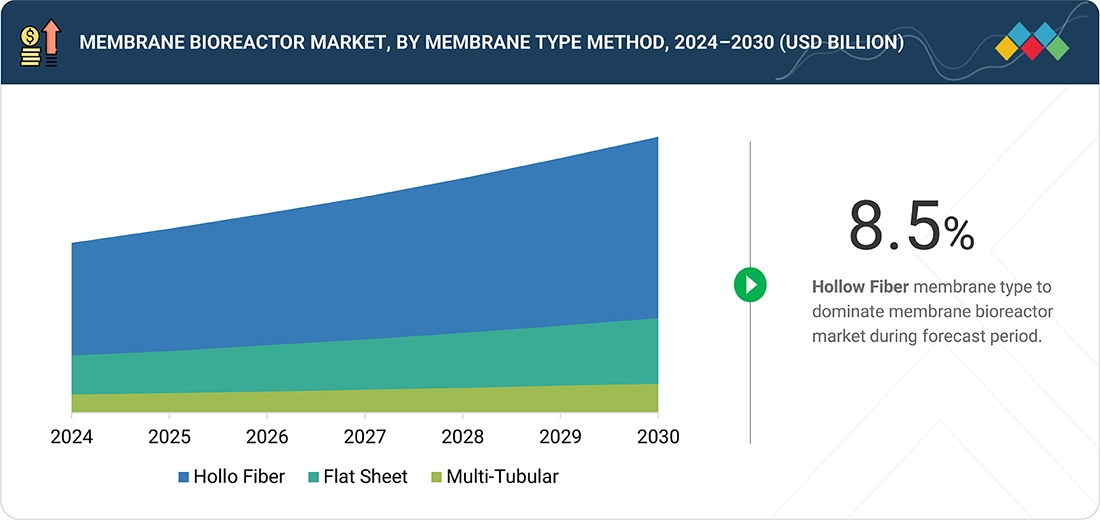

By Membrane TypeThe membrane bioreactor market comprises hollow fiber, flat sheet, and multi-tubular membranes. Flat sheet type is a rapidly growing membrane type in the membrane bioreactor market because it has a very strong structure and much easier maintenance, along with a lower risk of clogging or breakage than that of hollow fiber membranes.

-

By System ConfigurationThe membrane bioreactor market comprises submerged membrane bioreactor systems and external membrane bioreactor systems. The external membrane bioreactor system is the fastest-growing system configuration due to its flexibility and efficiency for large applications. In membrane modules, if the configuration is external, it is positioned outside the bioreactor, so easy access for monitoring and maintenance is provided.

-

BY CapacityThe capacity segment consists of small, medium, and large capacities. The large capacity segment holds the highest market share because large municipal utilities and high-volume industrial plants rely on membrane bioreactors to handle massive wastewater loads with strict discharge requirements, making large-scale installations the primary drivers of global demand.

-

By ApplicationApplication segments consist of municipal wastewater treatment and industrial wastewater treatment. Municipal wastewater treatment applications are the most critical in the membrane bioreactor market due to the emergence of a high demand for improved efficient sewer management as a result of increased urbanization and population growth.

-

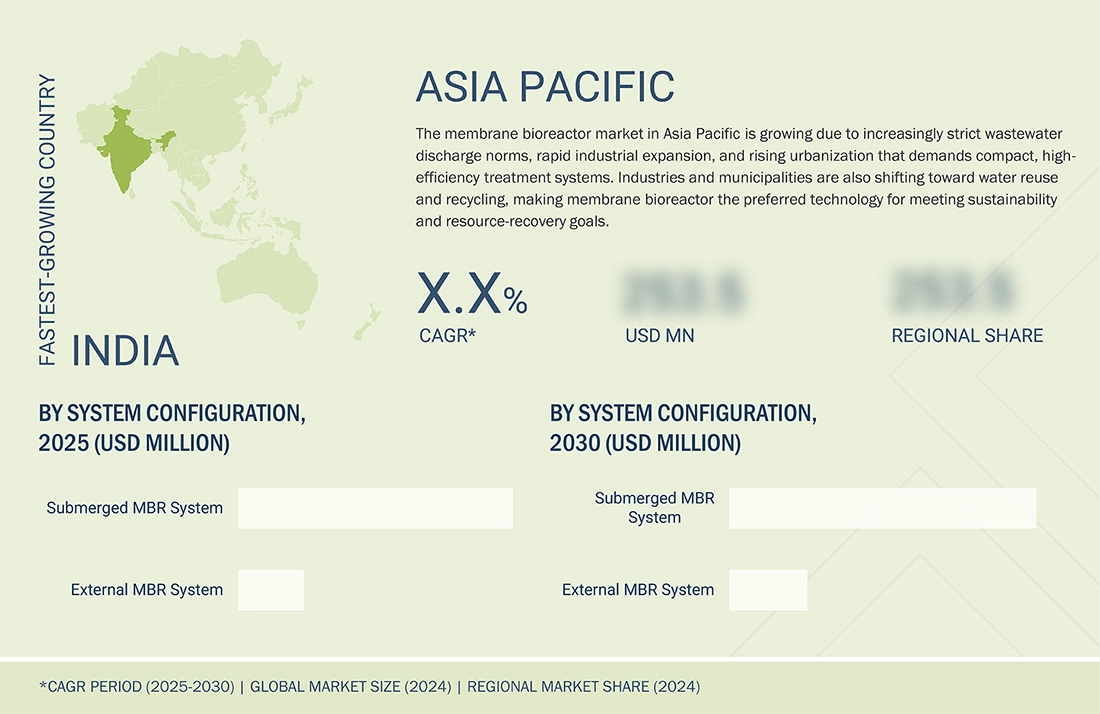

BY REGIONThe membrane bioreactor market in Asia Pacific is developing at a high rate, due to urbanization and extending industrial activity with stricter environmental constraint. China, India, Japan, and South Korea are applying membrane bioreactor technology for the treatment of increasingly higher volumes of wastewater, as well as for meeting tighter discharge standards.

-

COMPETITIVE LANDSCAPEMajor market players are pursuing both organic and inorganic growth strategies, including partnerships, collaborations, and investments, to strengthen their market presence. For instance, Veolia (France), KUBOTA Corporation (Japan), TORAY INDUSTRIES, INC. (Japan), Xylem (US) a,nd Mann+Hummel (Germany) have engaged in multiple agreements and strategic initiatives to address the rising demand for membrane bioreactors across municipal and industrial wastewater treatment applications.

The membrane bioreactor market is gaining strong momentum as increasing regulatory pressure for cleaner effluent discharge encourages municipalities and industries toward more advanced treatment solutions. Membrane bioreactor systems are inherently space-efficient, requiring a much smaller footprint compared to conventional treatment technologies, making them ideal for deployment in dense urban environments. In addition, their ability to recover valuable resources from wastewater aligns perfectly with sustainability objectives and circular economy goals.

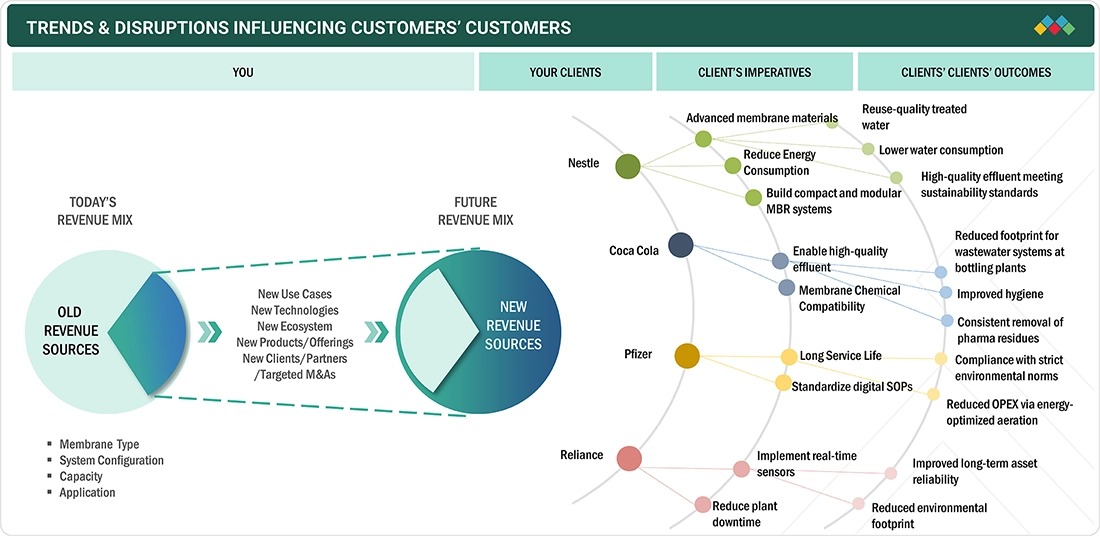

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Membrane bioreactors are used in various applications, such as municipal wastewater treatment and industrial wastewater treatment in the food & beverage, oil & gas, pulp & paper, pharmaceutical, and textile industries. The demand for membrane bioreactors is increasing in the food & beverage, oil and gas, and pharmaceutical industries due to stringent environmental regulations, technological advancements, sustainability initiatives, and the need for high-quality effluent.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising stringent environmental regulations and standards

-

Growing concern regarding water scarcity

Level

-

Reduced system efficiency and increased operational costs due to membrane fouling

-

High initial capital investment

Level

-

Increasing focus on sustainability

-

Integration of MBR technology with other advanced treatment processes

Level

-

Technical complexity associated with membrane bioreactor systems

-

High energy consumption

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Rising stringent environmental regulations and standards

The increasing implementation of stringent environmental regulations is a major factor driving the demand for effective wastewater treatment solutions and the growth of the membrane bioreactor market. With the growing global awareness regarding water pollution and scarcity, regulatory bodies are imposing strict guidelines for wastewater discharge and pollution control. These regulations are forcing industries to adopt advanced technologies capable of meeting stringent purification standards. Membrane bioreactors, which combine biological treatment with membrane filtration, are well-suited for this purpose, producing high-quality effluent that meets regulatory requirements. In regions such as Europe and North America, regulations require wastewater treatment facilities to achieve specific quality standards before releasing treated water into the environment. For instance, the US Environmental Protection Agency (EPA) enforces the Clean Water Act, which compels significant investment in technologies such as MBRs to maintain compliance. This regulatory pressure is amplified by increasing urbanization and industrialization, which raise the volume of wastewater and the need for efficient treatment solutions.

Restraint: Reduced system efficiency and increased operational costs due to membrane fouling

Membrane fouling is a major restraint for the membrane bioreactor market, affecting system efficiency, increasing operational costs, and complicating feasibility. Fouling occurs when particles, microorganisms, and organic matter accumulate on or within the membrane, reducing its performance. This buildup leads to increased filtration resistance, decreasing the membrane’s permeability and reducing the flow rate of treated water. As a result, operators must frequently clean or replace membranes to maintain performance, leading to higher maintenance costs and operational disruptions. The complexity of membrane fouling is exacerbated by its varied nature, as it can result from different foulants, such as suspended solids, extracellular polymeric substances (EPS), and soluble microbial products (SMP). These substances can significantly impair MBR efficiency, increasing energy consumption for pumping and cleaning. Biofouling is a significant issue involving the formation of microbial biofilms on the membrane surface. This fouling reduces membrane flux and requires more determined cleaning methods, which can damage the membranes over time.

Opportunity: Integration of MBR technology with other advanced treatment processes

Integrating membrane bioreactor technology with other advanced treatment processes significantly boosts the efficiency and quality of wastewater treatment. Membrane bioreactor systems combine biological treatment—typically through an activated sludge process—with membrane filtration, resulting in more effective removal of organic matter, suspended solids, and micropollutants than traditional methods. This dual approach enhances overall treatment performance and produces high-quality effluent suitable for various reuse applications, including irrigation and industrial uses. Membrane bioreactor systems can target contaminants such as nitrogen and trace organic compounds by incorporating additional advanced processes like nitrification, denitrification, or oxidation. For instance, adding anoxic zones allows for simultaneous nitrogen removal, which is crucial for meeting stringent discharge standards. Integrating technologies such as reverse osmosis or ultraviolet disinfection after MBR treatment can further refine effluent quality, ensuring it meets the strictest requirements for reuse or discharge.

Challenge: Technical complexity associated with MBR systems

The technical complexity associated with membrane bioreactor systems poses a significant challenge to market growth. MBR systems require careful integration of biological processes and advanced membrane filtration, which demands specialized knowledge and expertise to design, operate, and maintain effectively. Managing the biological processes to optimize conditions for microbial activity while ensuring the membrane’s longevity and performance can be complex. This balancing act involves controlling parameters such as sludge concentration, aeration rates, and membrane flux to avoid common issues such as membrane fouling or system inefficiencies. Moreover, membrane bioreactor systems rely heavily on automated controls and monitoring to maintain optimal operation, increasing initial capital investments and the need for skilled operators. Handling equipment such as aerators, pumps, sensors, and automated cleaning systems adds another layer of technical complexity.

membrane-bioreactor-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Food & beverage washwater, CIP effluent; onsite treatment for reuse & compliance | High-quality reuse water, compact footprint, stable operation, strong demand for modular membrane bioreactor chemicals |

|

Bottling plant rinse water; many small/medium sites needing consistent effluent quality | Ideal for decentralized, skid-based membrane bioreactor systems; recurring membrane cleaning chemicals and service demand |

|

Pharma wastewater with organics & trace actives requiring reliable treatment | Drives demand for premium, high-performance membrane bioreactors, long-term service, and specialized cleaning chemicals |

|

Refinery & petrochemical wastewater; high volume and variable loads | Boosts market for large, robust industrial membrane bioreactors; heavy-duty membranes, pretreatment integration, and O&M contracts |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The membrane bioreactor market ecosystem is shaped by a tightly connected value chain of raw material suppliers, manufacturers, distributors, and end users. Kubota, Mitsubishi Chemical Group, and Aquatech supply essential membrane materials, polymers, and filtration components that serve as the backbone for advanced membrane bioreactor systems. These materials are engineered into full-scale membrane modules and wastewater treatment solutions by leading manufacturers such as Veolia, Kovalus Separation Solutions, Toray and Xylem, each offering differentiated designs, energy-efficient configurations, and high-performance membrane technologies. Distributors including Sperta, Huber Technology, and Pentair ensure market reach through regional stock availability, system integration support, installation services, and after-sales maintenance. On the demand side, major industrial end users such as Nestle, Coca cola, Pfizer, and Reliance rely on membrane bioreactor systems for consistent effluent quality, regulatory compliance, water reuse, and operational efficiency across their manufacturing operations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Membrane Bioreactor Market, by System Configuration

Membrane bioreactor market, by system configuration, is segmented into Submerged MBR System and External (Side Stream) MBR System. Submerged MBR system holds the largest market share due to its efficiency and cost-effectiveness. In this design, the membrane modules are immersed directly in the biological treatment tank, simplifying the process by combining biological treatment and filtration in a single step. This setup reduces the need for additional equipment and space, making it more compact and easier to install. Submerged systems also operate at lower transmembrane pressures, which reduces energy consumption compared to external configurations.

Membrane Bioreactor Market, by Membrane Type

The membrane bioreactor market, by membrane type, is segmented into hollow fiber, flat sheet, and multi-tubular. Globally, hollow fiber membranes command the largest market share in the membrane bioreactor market. The hollow fiber membrane bioreactor market holds the largest share due to its high surface area, resistance to membrane fouling, excellent filtration performance, enhanced solids management, flexible system design, and longer hydraulic retention time. Hollow fiber membrane bioreactor produce high-quality effluent suitable for water reuse purpose and provide efficient and reliable treatment.

Membrane Bioreactor Market, by Application

Industrial wastewater treatment is the fastest-growing application in the membrane bioreactor market due to several factors. Stricter environmental regulations require industries to effectively manage wastewater and reduce pollutants, driving demand for advanced treatment technologies. Many sectors, including pharmaceuticals, food and beverages, and textiles, produce complex wastewater that membrane bioreactors can efficiently treat by removing suspended solids and harmful substances, resulting in high-quality effluent suitable for reuse or discharge. The focus on sustainability and resource recovery encourages industries to adopt solutions that not only treat wastewater but also recover valuable resources, such as water and nutrients.

REGION

Asia Pacific to be fastest-growing region in global membrane bioreactor market during forecast period

Asia Pacific is the fastest-growing market for membrane bioreactors, fueled by rapid urbanization, population growth, and rising industrial activity in countries, such as China and India. Increased demand for efficient wastewater treatment, combined with government investments in infrastructure to address water scarcity and pollution, is driving the adoption of membrane bioreactors. Their ability to produce high-quality, reusable effluent makes them essential in water-stressed areas, contributing to the market's expansion. Growing environmental awareness in Asia Pacific is driving governments to invest in advanced water treatment technologies, such as membrane bioreactor systems.

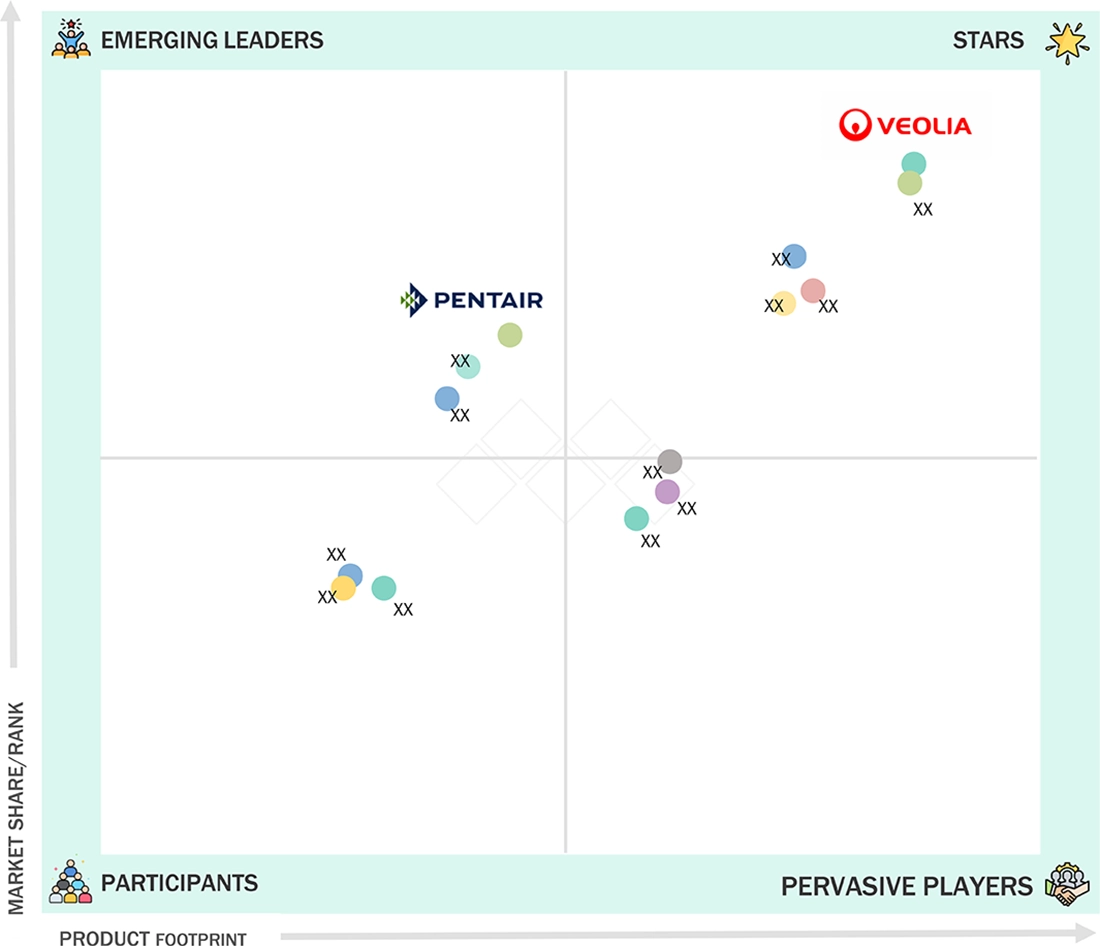

membrane-bioreactor-market: COMPANY EVALUATION MATRIX

In the membrane bioreactor market landscape, Veolia (Star) holds a leading position with a substantial installed base, a broad membrane portfolio, and end-to-end wastewater treatment capabilities. Its systems are widely deployed across municipal utilities, industrial complexes, and high-load sectors such as food & beverage, petrochemicals, and pharmaceuticals, strengthening its dominance through scale, technology depth, and global project execution strength. Pentair (Emerging Leader), meanwhile, is steadily gaining traction with its specialized membrane bioreactor configurations, innovative membrane technologies, and customized solutions designed for compact, high-efficiency treatment across diverse industrial users. Although Veolia currently commands the market with its comprehensive offerings and global footprint, Pentair is well-positioned to progress toward the leaders’ quadrant as demand increases for advanced, space-efficient, and resource-recovery-focused membrane bioreactor systems globally.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Veolia (France)

- KUBOTA Corporation (Japan)

- Mann+Hummel (Germany)

- TORAY INDUSTRIES, INC. (Japan)

- Xylem (US)

- Kovalus Separation Solutions (US)

- Dupont (US)

- Mitsubishi Chemical Corporation (Japan)

- Pentair (UK)

- ALFA LAVAL (Sweden)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.15 Billion |

| Market Forecast in 2030 (value) | USD 6.75 Billion |

| Growth Rate | CAGR of 8.5% from 2025-2030 |

| Years Considered | 2022-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | By Membrane Type: Hollow Fiber, Flat Sheet, and Multi Tubular By System Configuration: Submerged Membrane Bioreactor Systems and External Membrane Bioreactor Systems By Capacity: Small Capacity, Medium Capacity, and Large Capacity By Application: Municipal Wastewater Treatment and Industrial Wastewater Treatment |

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

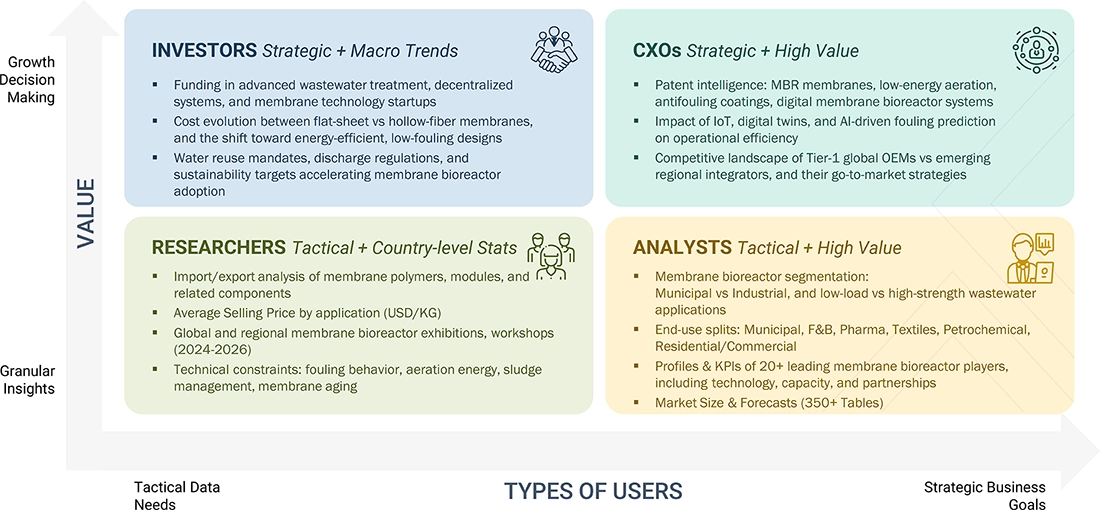

WHAT IS IN IT FOR YOU: membrane-bioreactor-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Membrane Bioreactor System Manufacturer |

|

|

| Industrial Water Treatment EPC Working with MBRs |

|

|

| Global OEM for Water Infrastructure |

|

|

| European Raw Material Supplier (Membrane Polymers) |

|

|

| Industrial End User Adopting MBRs |

|

|

RECENT DEVELOPMENTS

- August 2025 : DuPont, in partnership with Watercare and the Waikato District Council in New Zealand, implemented its MemPulse membrane bioreactor technology for a new 6.0 MLD wastewater treatment plant serving Raglan. This deployment marks a significant advancement in wastewater treatment, with MemPulse MBR providing high-quality effluent that supports stricter environmental discharge standards, especially by lowering total nitrogen levels when combined with OxyMem MABR technology.

- December 2024 : True Water and Kubota Water and Environment Europe took notable new steps to strengthen their strategic partnership in wastewater treatment with a recent visit to Tokyo aimed at deepening collaboration and technology transfer. One of the partnership’s recent advances involves True Water receiving approval as an Independent Water Utility in Australia, enabling the joint delivery of sustainable wastewater solutions for communities up to 5,000 people. The partners are now focusing on integrating Kubota’s latest membrane bioreactor innovations and compact modular onsite treatment plants, combining Japanese engineering and ISO-certified systems with True Water’s operational experience for deployment in the Australian market.

- June 2024 : SUEZ and VINCI Construction Grands Projects have signed an agreement with the Serbian government to construct the first wastewater treatment plant in Belgrade. This helped the company to protect the Danube and Sava rivers and reduce water pollution by improving the quality of life for the population.

- January 2023 : Xylem, a leading global water technology company, acquired Evoqua Water Technologies LLC. This combined entity became the world’s largest pure-play water technology company. The acquisition helped to strengthen Xylem’s ability to tackle critical water challenges, such as scarcity and quality, by incorporating Evoqua’s cutting-edge treatment solutions and services.

- January 2023 : Kovalus Separation Solutions (KSS) partnered with Aqana to offer anaerobic wastewater treatment technology to industrial customers in North America. The combined experience of Aqana and KSS will allow customers to benefit from moving bed biofilm reactors (MBBR), membrane bioreactor, and reverse osmosis (RO) to meet the demands of different industrial wastewater treatment challenges.

Table of Contents

Methodology

The study involves two major activities in estimating the current market size for the membrane bioreactor market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Following this, market breakdown and data triangulation were used to determine the market size of each segment and its subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering membrane bioreactor and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. Secondary data were collected and analyzed to determine the overall size of the membrane bioreactor market, which primary respondents subsequently validated.

Primary Research

Extensive primary research was conducted following the collection of information regarding the membrane bioreactor market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. Primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from membrane bioreactor industry vendors; material providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to membrane type, system configuration, capacity, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking membrane bioreactor services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of membrane bioreactor and future outlook of their business, which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the membrane bioreactor market includes the following details. The market sizing was undertaken from the demand side. The market was upsized based on the demand for membrane bioreactors in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the membrane bioreactor industry for each end-use industry. For each end use, all possible segments of the membrane bioreactor market were integrated and mapped.

Membrane Bioreactor Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall size from the market size estimation process explained above, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

A membrane bioreactor is an advanced wastewater treatment technology that combines biological processes with membrane filtration. It integrates a suspended growth bioreactor, where microorganisms decompose organic matter, with microfiltration or ultrafiltration membranes that separate solids from liquids. This setup efficiently removes suspended solids, bacteria, and other contaminants, producing high-quality effluent suitable for reuse. MBR systems are gaining popularity in municipal and industrial applications due to their compact design, smaller footprint compared to traditional methods, and ability to maintain higher biomass concentrations, enhancing treatment efficiency and performance.

Key Stakeholders

- Membrane Bioreactor Manufacturers

- Membrane Bioreactor Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the membrane bioreactor market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and forecast the market by membrane type, system configuration, capacity application, and region

- To forecast the market size concerning five main regions (along with country-level data): North America, Europe, Asia Pacific, Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, partnerships & collaborations, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Customization Options

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the membrane bioreactor market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Membrane Bioreactor Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Membrane Bioreactor Market

Aftab

Dec, 2016

Technical support for MBR treatment process based on ASP & TF..

Tony

Sep, 2020

Report needed for Membrane Bioreactor Systems Market.

Phil

Jul, 2014

General information on membrane market.

Richard

Mar, 2013

Market Size and forecast on the Municipal & Industrial Wastewater Treatment .

Richard

Mar, 2013

General information on Municipal & Industrial Wastewater Treatment.

Bonan

Jul, 2018

Global wastewater treatment market and market share of MBR applications mainly in US/China/Japan/EU..

Richard

Apr, 2012

Membrane Bioreactor Systems Market.

Richard

Apr, 2012

Report needed for Membrane Bioreactor Systems Market .

Richard

Apr, 2012

Looking for more information on Membrane Bioreactor Systems Market .

Evina

Mar, 2016

Recent developments in energy reduction, fouling control, novel configurations, LCA and market of (MBR) technology .