Packaged Water Treatment System Market by Technology Type (Extended Aeration, MBR, MBBR, SBR, Reverse Osmosis), Application (Municipal Wastewater, Industrial Wastewater, and Drinking Water) and Region - Global Forecast to 2021

[158 Pages Report] Packaged Water Treatment System Market size was valued at USD 12.07 Billion in 2015, and is projected to reach USD 21.83 Billion by 2021, at a CAGR of 10.4% between 2016 and 2021.

The objectives of this study are:

- To analyze and forecast the size of the global packaged water treatment system market, in terms of value

- To define, describe, and forecast the global packaged water treatment system market by application, type, and region

- To forecast the size of the global packaged water treatment system market and its different submarkets in five regions, namely, Asia-Pacific, Europe, North America, the Middle East & Africa, and Latin America, in terms of value

- To identify significant trends and factors that may drive or restrain the growth of the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze competitive developments, such as expansions, contracts & acquisitions, and new product launches in the packaged water treatment system market.

- To strategically profile the key players and comprehensively analyze their growth strategies

The years considered for the study are:

- Base Year 2015

- Estimated Year 2016

- Projected Year 2021

- Forecast Period 2016 to 2021

For company profiles in the report, 2015 has been considered as the base year. Where information was unavailable for the base year, the years prior to the base year have been considered.

Research Methodology

This research study involved extensive usage of secondary sources, directories, and databases (Hoovers, Bloomberg, Businessweek, Factiva, and OneSource) to identify and collect useful information for this technical, market-oriented, and commercial aspects of packaged water treatment system market. Research methodology includes:

- Analysis of the technology type of packaged water treatment system and their consumption across different applications

- Analysis of country-wise consumption of packaged water treatment system across regions

- Analysis of market trends in various regions/countries

- Data triangulation and market estimation procedures were employed to determine the market size

- After arriving at the overall market size, the market was split into several segments and sub-segments.

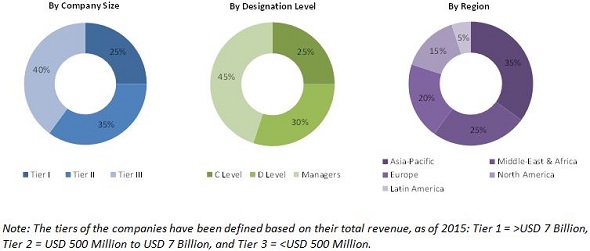

The figure below shows the break-down of the primaries on the basis of company, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Key players operational in the global packaged water treatment system market include Veolia Water Technologies (France), GE Water & Process Technologies (U.S.), RWL Water (U.S.), Westech Engineering Inc. (U.S.), Smith & Loveless Inc. (U.S.), Napier-Reid Ltd. (Canada), CST Wastewater Solutions Inc. (Australia), WPL International (U.K.), Enviroquip (U.S.), and Corix Water Systems (Canada). They supply different technology systems of packaged water treatment system to end users (municipal and industrial sectors). The municipal sector installs the equipment to supply water for drinking, daily use, and infrastructure development purposes. Industrial sector installs the equipment to meet the water quality standard required for various applications, as well as to treat the wastewater before disposal.

Target Audience

- Packaged water treatment system Suppliers and Distributors

- End-use Industries, Such as Oil & Gas, Pulp & Paper, etc.

- Government & Research Organizations

- Water Quality Associations

The study answers several questions for the stakeholders, primarily which market segments to focus on, in the next two-to-five years for prioritizing efforts and investments and competitive landscape of the market.

Scope of the Report:

This research report categorizes the global packaged water treatment system market on the basis of application, technology type, and region, and forecasts the market size, in terms of value. The report has also analyzed the market based on the following sub-segments:

On the basis of Technology Type:

- Extended Aeration

- Moving Bed Biofilm Reactor (MBBR)

- Reverse Osmosis (RO)

- Membrane Bioreactor (MBR)

- Sequential Batch Reactor (SBR)

- Others

On the basis of Application

- Municipal Wastewater Treatment

- Industrial Wastewater Treatment

- Drinking Water Treatment

On the basis of Region:

- Middle East & Africa

- North America

- Europe

- Asia-Pacific

- Latin America

The following Customization options are available for the report:

- Further Breakdown of Rest of Asia-Pacific, Rest of Europe, and Rest of Middle East & Africa

- Detailed Analysis and Profiling of the Additional Market Players (Up to 5)

- Detailed Porters Model Analysis

- Supply Chain Analysis

- Product Matrix

- Further breakdown of Industrial and Municipal Wastewater Treatment Application Segment

The global market was valued at USD 12.07 Billion in 2015, and is projected to reach USD 21.83 Billion by 2021, at a CAGR of 10.4% between 2016 and 2021. The market is projected to witness significant growth in the coming years, owing to the rising demand of fresh water due to the increasing population, urbanization, and industrialization.

The municipal wastewater treatment segment of the global packaged water & wastewater market is expected to witness significant growth during the forecast period. Municipal waste water treatment is used in cities and towns by housing estates and domestic & public service enterprises. The volume of waste water generation has increased rapidly due to the growing population and urbanization in most parts of the world. To reclaim water and fulfill the water needs of the urban as well as the rural population, municipal waste water treatment is being utilized globally.

The extended aeration, moving bed biofilm reactor (MBBR), reverse osmosis, membrane bioreactor (MBR), and sequential batch reactor (SBR) segments contributed a major share to the global packaged water & wastewater treatment. Extended aeration is expected to be the fastest-growing application segment of the market, mainly due to its relatively lower initial costs and investments involved. It is followed by MBBR and reverse osmosis. The stringent regulatory and sustainability mandate concerning the environment is paving way for a substitute technologies to chemical-based water and wastewater treatment systems like extended aeration, MBBR, RO, MBR, and SBR, which further boosts the market for these technologies.

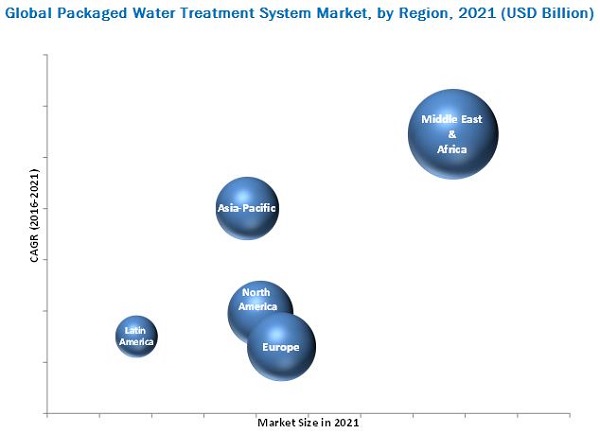

Middle East & Africa is expected to be the fastest-growing market for packaged water treatment system, owing to the increasing demand for fresh water by industries. The high quality living standards of Middle East region and lack of surface/underground fresh water sources makes it imperative to reclaim waste water. To meet the need of fresh water, packaged wastewater treatment is used to treat wastewater and make water available for reuse.

Unstable market & economic conditions leads to low investment in packaged water treatment system systems by industries and governments, which is a restraint for the market. Lack of skilled labor for operating technically complex packaged water treatment system systems is a restraining factor for the growth of the market in the short term.

Some of the major players involved in the packaged water treatment system market include Veolia Water Technologies (France), GE Water & Process Technologies (U.S.), RWL Water (U.S.), WPL International (U.K.), Smith & Loveless INC. (U.S.), and others. These companies have been focusing on new product launch & product development to cater to the diverse needs of customers. Companies are also adopting expansions and acquisitions strategies to increase their geographic presence and help them achieve growth in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Regional Scope

1.2.2 Markets Covered

1.2.3 Years Considered for the Study

1.3 Currency & Pricing

1.4 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.3.1 Key Industry Insights

2.3.2 Assumptions

2.3.3 Limitations

3 Executive Summary (Page No. - 26)

3.1 Introduction

3.2 Historical Backdrop

3.3 Current Scenario

3.4 Conclusion

4 Premium Insights (Page No. - 32)

4.1 Significant Growth Opportunities in the Global Packaged Water Treatment System Market (2016 & 2021)

4.2 Middle East & Africa to Lead the Global Packaged Water Treatment System Market

4.3 Packaged Water Treatment System Market, By Country

4.4 Global Packaged Water Treatment System Market, By Technology Type

4.5 Global Packaged Water Treatment System Market: Developed Markets and Developing Markets

4.6 Life Cycle Analysis, By Application

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rising Importance of Packaged Water and Wastewater Treatment

5.3.1.2 Stringent Regulatory and Sustainability Mandates Concerning the Environment

5.3.1.3 Rising Population and Rapid Urbanization in Emerging Economics

5.3.2 Restraint

5.3.2.1 Unstable Market and Economic Situation

5.3.2.2 Advanced Technologies Require Skilled Workers

5.3.3 Opportunities

5.3.3.1 Technological Advancement in Packaged Water and Wastewater Treatment Systems

5.3.3.2 Investment By Developed Countries in Developing Or Underdeveloped Countries

5.3.4 Challenge

5.3.4.1 Need for Eco-Friendly Formulations

5.3.4.2 Meeting the Demand for Fresh Water

5.3.4.3 Zero Liquid Discharge (ZLD)

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Policy & Regulations

6.2.1 North America

6.2.1.1 Clean Water Act (CWA)

6.2.1.2 Safe Drinking Water Act (SDWA)

6.2.2 Europe

6.2.2.1 The Urban Wastewater Treatment Directive (1991)

6.2.2.2 The Drinking Water Directive (1998)

6.2.2.3 The Water Framework Directive (2000)

6.2.3 Asia (China)

6.2.3.1 Environmental Protection Law

6.2.3.2 The Water Resources Law

6.2.3.3 Water Pollution Prevention & Control Law (WPL)

6.3 Porters Five Forces Analysis

7 Packaged Water Treatment System Market, By Technology Type (Page No. - 47)

7.1 Introduction

7.2 Extended Aeration

7.3 Moving Bed Biofilm Reactor (MBBR)

7.4 Membrane Bioreactor (MBR)

7.5 Sequential Batch Reactor (SBR)

7.6 Reverse Osmosis (RO)

7.7 Other Technologies

8 Packaged Water Treatment System Market, By Application (Page No. - 62)

8.1 Introduction

8.2 Municipal Wastewater

8.3 Industrial Wastewater

8.4 Drinking Water

9 Packaged Water Treatment System Market, By Region (Page No. - 69)

9.1 Introduction

9.2 Middle East & Africa

9.2.1 Saudi Arabia

9.2.2 UAE

9.2.3 Qatar

9.2.4 South Africa

9.2.5 Rest of Middle East & Africa

9.3 Europe

9.3.1 Germany

9.3.2 Italy

9.3.3 France

9.3.4 U.K.

9.3.5 Russia

9.3.6 Netherlands

9.3.7 Rest of Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 Asia-Pacific

9.5.1 China

9.5.2 India

9.5.3 Japan

9.5.4 South Korea

9.5.5 Vietnam

9.5.6 Indonesia

9.5.7 Australia

9.5.8 Rest of Asia-Pacific

9.6 Latin America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of Latin America

10 Competitive Landscape (Page No. - 125)

10.1 Overview

10.2 Acquisitions

10.3 Expansions

10.4 New Product & Technology Launch

10.5 Product Development

10.6 Supply Contracts

11 Company Profiles (Page No. - 130)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Regional Revenue Mix of Key Market Players

11.2 Veolia Water Technologies

11.3 GE Water & Process Technologies

11.4 RWL Water

11.5 Westech Engineering Inc.

11.6 Smith & Loveless Inc.

11.7 Napier-Reid Ltd.

11.8 CST Wastewater Solutions Inc.

11.9 WPL International

11.10 Enviroquip

11.11 Corix Water Systems

11.12 Metito

11.13 Other Market Players

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 152)

12.1 Discussion Guide

12.2 Introducing Rt: Real Time Market Intelligence

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Available Customizations

12.5 Related Reports

List of Tables (87 Tables)

Table 1 Global Packaged Water Treatment System Market Snapshot

Table 2 Packaged Water and Wastewater Treatment Market, By Technology Type

Table 3 Packaged Water and Wastewater Treatment Market, By Application

Table 4 Packaged Water Treatment System Market, By Type, 20142021 (USD Million)

Table 5 Extended Aeration Packaged Water Treatment System Market, By Region, 20142021 (USD Million)

Table 6 Moving Bed Biofilm Reactor (MBBR) Packaged Water Treatment System Market, By Region, 20142021 (USD Million)

Table 7 Membrane Bioreactor (MBR) Packaged Water Treatment System Market, By Region, 20142021 (USD Million)

Table 8 Sequential Batch Reactor Packaged Water Treatment System Market, By Region, 20142021 (USD Million)

Table 9 Reverse Osmosis (RO) Packaged Water Treatment System Market, By Region, 20142021 (USD Million)

Table 10 Other Technologies Packaged Water Treatment System Market, By Region, 20142021 (USD Million)

Table 11 Global Packaged Water Treatment System Market, By Application, 2014-2021 (USD Million)

Table 12 Municipal Wastewater Treatment Market , By Region, 20142021 (USD Million)

Table 13 Industrial Wastewater Treatment Market, By Region, 20142021 (USD Million)

Table 14 Drinking Water Treatment Market, By Region, 20142021 (USD Million)

Table 15 PWWT Market Size, By Region, 2014-2021 (USD Million)

Table 16 Middle East & Africa Packaged Water Treatment System Market, By Country, 20142021 (USD Million)

Table 17 Middle East & Africa Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 18 Middle East & Africa Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 19 Saudi Arabia Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 20 Saudi Arabia Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 21 UAE Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 22 UAE Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 23 Qatar Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 24 Qatar Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 25 South Africa Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 26 South Africa Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 27 Rest of Middle East & Africa Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 28 Rest of Middle East & Africa Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 29 Europe Packaged Water Treatment System Market, By Country, 20142021 (USD Million)

Table 30 Europe Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 31 Europe Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 32 Germany Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 33 Germany Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 34 Italy Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 35 Italy Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 36 France Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 37 France Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 38 U.K. Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 39 U.K. Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 40 Russia Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 41 Russia Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 42 Netherlands Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 43 Netherlands Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 44 Rest of Europe Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 45 Rest of Europe Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 46 North America Packaged Water Treatment System Market, By Country, 20142021 (USD Million)

Table 47 North America Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 48 North America Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 49 U.S. Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 50 U.S. Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 51 Canada Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 52 Canada Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 53 Mexico Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 54 Mexico Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 55 Asia-Pacific Packaged Water Treatment System Market, By Country, 20142021 (USD Million)

Table 56 Asia-Pacific Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 57 Asia-Pacific Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 58 China Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 59 China Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 60 India Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 61 India Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 62 Japan Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 63 Japan Packaged Water &And Wastewater Treatment Market, By Application, 20142021 (USD Million)

Table 64 South Korea Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 65 South Korea Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 66 Vietnam Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 67 Vietnam Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 68 Indonesia Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 69 Indonesia Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 70 Australia Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 71 Australia Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 72 Rest of Asia-Pacific Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 73 Rest of Asia-Pacific Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 74 Latin America Packaged Water Treatment System Market, By Region, 20142021 (USD Million)

Table 75 Latin America Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 76 Latin America Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 77 Brazil Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 78 Brazil Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 79 Argentina Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 80 Argentina Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 81 Rest of Latin America Packaged Water Treatment System Market, By Technology Type, 20142021 (USD Million)

Table 82 Rest of Latin America Packaged Water Treatment System Market, By Application, 20142021 (USD Million)

Table 83 Acquisitions, 20122015

Table 84 Expansions, 20132015

Table 85 New Product & Technology Launch, 20112016

Table 86 Product Development, 2013

Table 87 Supply Contracts, 2015

List of Figures (45 Figures)

Figure 1 Packaged Water Treatment System: Market Segmentation

Figure 2 Packaged Water Treatment System Market, Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Global Packaged Water Treatment System Market: Data Triangulation

Figure 6 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 7 Extended Aeration Segment is Estimated to Grow at the Highest CAGR During the Forecast Period

Figure 8 Municipal Wastewater Segment to Grow at the Highest CAGR During the Forecast Period

Figure 9 Middle East & Africa to Lead the PWWT Market During the Forecast Period

Figure 10 Global Packaged Water Treatment System Market to Grow at A High CAGR Between 2016 and 2021

Figure 11 The Industrial Wastewater Segment of the PWWT Market in Mea is Estimated to Account for the Largest Share in 2016

Figure 12 Saudi Arabia to Grow at the Highest CAGR Between 2016 and 2021

Figure 13 Extended Aeration Segment to Account for the Largest Market Share in 2016

Figure 14 China to Emerge as A Lucrative Market

Figure 15 Industrial and Municipal Wastewater Segments are Projected to Drive the Market During the Forecast Period

Figure 16 Packaged Water and Wastewater Treatment Market, By Region

Figure 17 Drivers, Restraints, Opportunities, and Challenges in the Global Packaged Water and Wastewater Treatment Market

Figure 18 Porters Five Forces Analysis

Figure 19 General Process Overview of Water & Wastewater Treatment Plants Components

Figure 20 Wastewater Technologies

Figure 21 Extended Aeration Technology Segment Dominates the Packaged Water Treatment System Market

Figure 22 Extended Aeration Packaged Water Treatment System Market Snapshot, By Region, 2016 & 2021

Figure 23 Types of Moving Bed Biofilm Reactor Technology

Figure 24 Moving Bed Biofilm Reactor (MBBR) Packaged Water Treatment System Market Snapshot, By Region, 2016 & 2021

Figure 25 Types of Membrane Bioreactor Systems

Figure 26 Membrane Bioreactor (MBR) Packaged Water Treatment System Market, By Region, 2016 & 2021

Figure 27 General Sequential Batch Reactor Process: Overview

Figure 28 Sequential Batch Reactor (SBR) Packaged Water Treatment System Market Snapshot, By Region, 2016 & 2021

Figure 29 Reverse Osmosis (RO) Packaged Water Treatment System Market Snapshot, By Region, 2016 & 2021

Figure 30 Other Technologies Packaged Water Treatment System Market Snapshot, By Region, 2016 & 2021

Figure 31 Global Packaged Water Treatment System Market, By Application, 2016 & 2021

Figure 32 Municipal Wastewater Treatment : General Overview

Figure 33 Municipal Wastewater Treatment Market, By Region, 2016 & 2021

Figure 34 Industrial Wastewater Treatment Market, By Region, 2016 & 2021

Figure 35 Drinking Water Treatment Market, By Region, 2016 & 2021

Figure 36 Regional Snapshot (2015): Rapidly Growing Markets are Emerging as Strategic Destinations

Figure 37 Middle East & Africa Market Snapshot: the Region is A Dominant Market for Packaged Water Treatment System

Figure 38 Europe Packaged Water 7 Wastewater Market Snapshot: Germany to Continue to Dominate the Market

Figure 39 North American Market Snapshot: the Region is A Moderately Growing Market for Packaged Water Treatment System

Figure 40 Asia-Pacific Market Snapshot: the Region is the Second-Fastest Growing PWWT Market

Figure 41 Latin America Market Snapshot: Brazil Dominates the Latin America Packaged Water Treatment System Market

Figure 42 Companies Adopted New Product & Technology Launch as the Key Growth Strategy Between 2011-2016

Figure 43 Battle for Market Share: New Product & Technology Launch Have Been the Key Strategy Adopted By the Companies

Figure 44 Veolia Water Technologies: Company Snapshot

Figure 45 GE Water: Company Snapshot

Growth opportunities and latent adjacency in Packaged Water Treatment System Market