Hollow Fiber Ultrafiltration Market

Hollow Fiber Ultrafiltration Market by Type (Polymeric, Ceramic, Hybrid,), Application (Municipal, Industrial (Pharmaceutical, Chemicals, Oil & Gas), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The hollow fiber ultrafiltration market size is projected to grow from USD 2.39 billion in 2025 to USD 4.85 billion by 2030, registering a CAGR of 15.2% during the forecast period. Hollow fiber is the most widely used ultrafiltration module. It utilizes numerous long porous filaments inside the body. Owing to the shape of the module, the membrane has a large surface area, which allows it to filter large volumes while utilizing minimal space and energy. The filaments inside the body of the module are very narrow in diameter and are flexible. Owing to the small strand diameter, the module has a high packing density. These modules are more likely to break under high strain as they are flexible. The major disadvantages of the module are irreversible fouling and easy breakage.

KEY TAKEAWAYS

-

BY TYPEThe types of hollow fiber ultrafiltration primarily involve polymeric, ceramic ultrafiltration, hybrid, and other types. Polymeric, ceramic, and hybrid ultrafiltration membranes are widely used across water and industrial treatment applications due to their high contaminant rejection, long service life, chemical resistance, and adaptability to varying water qualities. Polymer-based hollow fiber ultrafiltration membranes dominate the market due to their high efficiency, cost-effectiveness, and versatility across municipal and industrial water treatment applications.

-

BY APPLICATIONHollow fiber ultrafiltration is primarily applied in municipal and industrial water treatment, including drinking water purification, wastewater reuse, and process water filtration. It ensures safe, high-quality water, meets regulatory standards, improves operational efficiency, and supports sustainability by reducing chemical usage and enabling water recycling in industries such as food & beverage, and pharmaceuticals. Municipal water and wastewater treatment lead the market, driven by increasing urbanization, stricter regulatory standards, and growing investment in sustainable water infrastructure.

-

BY REGIONThe Asia Pacific region is projected to be the fastest-growing in the hollow fiber ultrafiltration market, driven by rapid industrialization, water scarcity challenges, and expanding urban infrastructure. Countries like China, India, Japan, and South Korea are investing heavily in water recycling, desalination, and industrial wastewater management. Supportive government initiatives, rising adoption of membrane-based treatment, and ongoing investments in smart water infrastructure are accelerating regional growth.

-

COMPETITIVE LANDSCAPEKey players in the hollow fiber ultrafiltration market are pursuing organic and inorganic growth strategies, including strategic partnerships, technology innovations, and capacity expansions. Companies such as Toray Industries, Inc. (Japan), Asahi Kasei Corporation (Japan), DuPont (US), Veolia (France), and Hydranautics (US) are strengthening their portfolios with PVDF, PES, and ceramic membranes to serve municipal, industrial, and desalination markets.

Hollow fiber ultrafiltration (UF) membranes serve as a crucial technology in advanced water and wastewater treatment, offering high separation efficiency, low energy consumption, and compact system design. These membranes are extensively used across municipal, industrial, and commercial sectors for processes such as drinking water purification, wastewater recycling, and pretreatment for reverse osmosis systems. Regulatory initiatives by agencies such as the U.S. Environmental Protection Agency (EPA) and the European Union’s Water Framework Directive are promoting stricter water quality standards, accelerating the adoption of UF systems. Moreover, increasing demand for sustainable, low-fouling, and high-permeability membrane materials is driving innovation in polymeric, ceramic, and hybrid hollow fiber technologies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The effects on consumer businesses in the hollow fiber ultrafiltration market are shaped by shifts in customer trends and industry disruptions. Key end users include municipal water utilities, food & beverage processors, pharmaceutical manufacturers, and industrial water treatment operators, while target applications cover drinking water purification, wastewater reuse, process water filtration, and industrial effluent management. Changes such as stricter water quality regulations, increasing demand for sustainable and energy-efficient filtration solutions, and the push for high-reliability, low-maintenance systems directly impact the operational costs and revenues of these end users. These shifts in end-user requirements, in turn, influence the sales and adoption strategies of UF membrane suppliers, requiring them to enhance product performance, expand service capabilities, and innovate solutions to meet evolving regulatory, sustainability, and industry-specific needs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Public awareness about clean water necessities

-

Increasing adoption of low-pressure, high-efficiency UF membranes

Level

-

High sensitivity to feed water quality and contaminants

-

Surge in manufacturing costs of PVDF and PES

Level

-

Growing water shortages in emerging economies

-

Industrial demand for freshwater due to scarcity

Level

-

Fragility and maintenance issues in hollow fiber ultrafiltration systems

-

Scalability and performance limitations in high-solid environments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Public awareness about clean water necessities

Water is essential for human life and plays a critical role in industrial development. The increasing population and industrialization have created a greater need for hollow fiber ultrafiltration in water and wastewater treatment processes. Concerns about wastewater discharge and drinking water quality have become a significant factor for market growth. Increasing awareness of personal hygiene is likely to boost the demand for drinking water, leading to more opportunities for hollow fiber ultrafiltration water treatment adoption. The scarcity of water has created new avenues for hollow fiber ultrafiltration systems in the purification of brackish water and desalination plants. The pressure to meet environmental requirements and standards of high-purity drinking water and industrial wastewater also stirred large-scale development involving ultrafiltration systems in treatment processes. For example, the current US law grants rights to access enough clean water, while the EU has standards for bathing water quality, part of a larger set of policies that aim to ensure public health. These international policies will trigger more activities pertaining to water and wastewater treatment processes, consequently driving the market for hollow fiber ultrafiltration.

Restraint: High sensitivity to feed water quality and contaminants

The increasing sensitivity of UF membranes to complex feed water compositions, particularly with the rise of emerging contaminants such as pharmaceutical residues, microplastics, and industrial nanomaterials, acts as a significant factor restraining market growth. While UF membranes excel at removing suspended solids, bacteria, and some organic matter, they often struggle with high concentrations of dissolved organics, heavy metals, and micropollutants, which can lead to rapid membrane fouling and performance degradation. Advanced industrial wastewater streams from pharmaceuticals, chemicals, and semiconductor industries contain high levels of bio–refractory organics and nanomaterials that challenge the efficacy and longevity of UF membranes. The emergence of highly persistent micropollutants has also increased the need for pretreatment solutions, such as activated carbon adsorption or oxidation processes, before UF systems can operate effectively. This raises the overall capital and operational costs, making UF systems less attractive for budget-sensitive industries and municipalities.

Opportunity: Growing water shortages in emerging economies

The rising scarcity of freshwater in developing countries, particularly in regions like the Middle East, North America, and South America, has led to an increased need for seawater desalination and brackish water treatment. Hollow fiber ultrafiltration is a leading technology for desalination and is gaining prominence due to its lower energy consumption compared to other methods. The demand for potable water in areas like Asia Pacific and the Middle East is driving the growth of membrane technologies in water treatment, with countries such as China facing severe water shortages and focusing on water recycling and reuse to address these challenges. Industries also face mounting pressure to manage water resources efficiently as fresh water becomes scarcer. Industrialization is expected to boost the need for ultrafiltration systems, as companies will increasingly be required to recycle and reuse water to meet stringent environmental regulations and achieve zero discharge goals.

Challenge: Fragility and maintenance issues in hollow fiber ultrafiltration systems

Hollow fiber ultrafiltration modules, while effective for various filtration applications, face several lifespan-related challenges that can impact their performance and longevity. One of the primary issues is fouling, where particles accumulate on the membrane surface, leading to a decrease in efficiency and necessitating more frequent maintenance and cleaning, which can increase operational costs. Additionally, hollow fibers are known for their fragility; improper handling or excessive pressure can lead to fiber breakage, further reducing their lifespan. The chemical resistance of hollow fiber membranes is another concern, as exposure to certain chemicals can degrade the membrane material, affecting its filtration capabilities. Typically, the service life of hollow fiber ultrafiltration membranes ranges from three to seven years, although this can vary based on operational conditions and maintenance practices. It provides a large surface area for filtration, complicating the cleaning processes, particularly for the inner surfaces of the fibers, which can lead to performance degradation over time if not properly maintained.

Ultrafiltration Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implements ZeeWeed 500 hollow fiber UF membranes for municipal water treatment, wastewater recycling, and high-quality drinking water production. | Ensures safe, reliable drinking water, expands plant capacity without additional footprint, and meets regulatory standards. |

|

Uses Microza hollow fiber UF membranes for municipal water treatment, wastewater reuse, and industrial filtration in biopharmaceuticals, food, and chemicals. | Provides high-quality water, reduces chemical use, and enhances sustainability in industrial and municipal applications. |

|

Employs PVDF hollow fiber UF membrane modules for surface water treatment in municipal drinking water plants. | Delivers clean, safe drinking water, meets stringent water quality standards, and improves operational reliability. |

|

Deploys IntegraTec PVDF hollow fiber UF modules for tertiary wastewater treatment and aquifer recharge. | Enhances water reuse capabilities, ensures compliance with environmental regulations, and supports sustainable water management. |

|

Implements HYDRAsub and HYDRAsub MAX hollow fiber UF modules in municipal and industrial wastewater treatment, including chemical, textile, food & beverage, and palm oil industries. | Offers high permeate quality, low energy consumption, reduces downtime, and provides reliable filtration across diverse industrial applications. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The hollow fiber ultrafiltration ecosystem includes raw material suppliers (Arkema, Solvay S.A., Kuraray Group), manufacturers (DuPont, Toray Industries, Hydranautics), distributors (Sterlitech Corporation, Arvind Envisol Pvt. Ltd., Pure Aqua Inc.), and end users (Danone, Lagunitas Brewing Company, ITC Ltd.). Key inputs such as fluoropolymers, polyamide (PA), polypropylene (PP), polysulfones (PS), ceramics, metals & alloys, and cellulosic materials are supplied by specialized manufacturers. Hollow fiber UF manufacturers convert these materials into membrane modules under strict quality, regulatory, and environmental standards. Distributors manage storage, logistics, and delivery to ensure timely supply and localized support. End users span water & wastewater treatment, food & beverage, pharmaceuticals, pulp & paper, textiles, oil & gas, and chemical & petrochemical industries, where hollow fiber UF membranes serve as critical filtration solutions for producing high-quality water and process fluids efficiently.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Hollow Fiber Ultrafiltration Market, By Type

Polymeric hollow fiber ultrafiltration are microporous films that act as semi-permeable barriers to separate two different mediums. The permeation properties of polymeric hollow fiber ultrafiltration are strongly influenced by the preparative route used and the final configuration (asymmetric and isotropic). The different types of polymeric hollow fiber ultrafiltration materials considered in this report are polysulfone & polyether sulfone (PS & PES), polyvinylidene fluoride (PVDF), and others. Polymer selection for a separation process is based on its compatibility with the membrane technology and intended application. At times, the polymer to be used may require a low affinity toward the permeate while sometimes it may need to withstand harsh cleaning conditions due to membrane fouling. Accordingly, chain rigidity, functional group polarity, and stereoisomerism are considered during the manufacture of polymeric membranes.

Hollow Fiber Ultrafiltration Market, By Application

The hollow fiber ultrafiltration UF technology has been in use for municipal water treatment applications since the 1960s. Initially, it was considered to be highly expensive for this application and was only applied under special circumstances. This scenario changed during the 1990s with the emergence of several drivers, such as legislation to achieve improved treatment standards and water resource scarcity, which ultimately created the demand for ultrafiltration for saline or wastewater treatment. Hollow fiber ultrafiltration is used in water & wastewater treatment plants for the removal of microbes, desalination of seawater, sewage treatment, and household wastewater treatment, processing of natural mineral water, production of potable water, and treatment of brackish water. Membrane Bioreactors (MBR) that use hollow fiber ultrafiltration are an integral part of wastewater treatment, creating high-quality water for reuse.

REGION

Asia Pacific to be the fastest-growing region in the global phosphorus trichloride market during the forecast period

The Asia Pacific region is expected to be the fastest-growing segment in the hollow fiber ultrafiltration market, driven by rising demand for clean water, wastewater treatment, and industrial process water purification. Countries such as China, India, Japan, and Southeast Asian nations are investing heavily in municipal water infrastructure, desalination projects, and industrial water reuse initiatives. Regional governments are supporting water security and sustainability programs, promoting adoption of advanced filtration technologies like hollow fiber UF membranes. Initiatives such as China’s “Water Ten Plan” and India’s Jal Jeevan Mission encourage deployment of high-efficiency ultrafiltration systems across urban and industrial applications, boosting regional market growth during the forecast period.

Ultrafiltration Market: COMPANY EVALUATION MATRIX

In the landscape of the hollow fiber ultrafiltration market, DuPont (Star) holds a significant market share, offering a broad portfolio of UF membranes and modules for applications across municipal water treatment, industrial process water, and wastewater reuse, primarily through direct sales to large-scale industrial and municipal consumers. Hyflux (Emerging Leader) is gaining recognition with its focus on innovative UF technologies and specialized membrane solutions, launching niche products and expanding its adoption in industrial and commercial water filtration applications. While DuPont leads through scale, diversified product offerings, and global reach, Pentair shows strong potential to move toward the leaders’ quadrant as demand for high-efficiency, sustainable, and low-energy ultrafiltration solutions continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.08 Billion |

| Market Forecast in 2030 (value) | USD 4.85 Billion |

| Growth Rate | CAGR of 15.2 % from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Quantity) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Ultrafiltration Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Hollow Fiber Ultrafilter Manufacturer | Detailed profiles of leading hollow fiber UF manufacturers (financials, product portfolio, regulatory compliance, sustainability initiatives) |

|

| Polymeric Membrane Manufacturer |

|

|

| Hybrid & Ceramic UF Membrane Manufacturer | Comparative benchmarking of hybrid and ceramic UF membranes by application (water treatment, industrial filtration, wastewater reuse, food & beverage, pharmaceutical processes) |

|

RECENT DEVELOPMENTS

- March 2023 : Hanmee Entec Co., Ltd. is a leading water treatment facility operation and maintenance company in South Korea. The acquisition of this company by Toray aims to enhance sewage and wastewater treatment processes by integrating Toray's advanced filter membrane technologies with Hanmee Entec's operational expertise. The initiative is set to improve efficiency in quality for industrial and agricultural use, thereby promoting better water resource management.

- April 2020 : KSS announced a 50% expansion of the production capacity of the PURON-reinforced hollow fiber membrane technology, which will strengthen the company’s global footprint.

- January 2020 : Hydranautics launched IMSDesign Cloud, the world’s first cloud-based membrane projection software. This integrated software simulates membrane projections in various combinations and will be useful in MF, UF, NF, and RO membranes.

- January 2020 : Pentair acquired Pleatco, a US filter company that manufactures water filtration and purification products for pools, spas, and industrial applications. The acquisition helped Pentair expand its product range and strengthen its position in the water treatment industry.

- October 2019 : DuPont acquired the Memcor business, which includes ultrafiltration and membrane biofiltration technologies from Evoqua Water Technologies Corp. The addition of the ultrafiltration portfolio broadens DuPont’s solutions to membrane bioreactors, submerged and pressurized ultrafiltration systems, and other new applications.

Table of Contents

Methodology

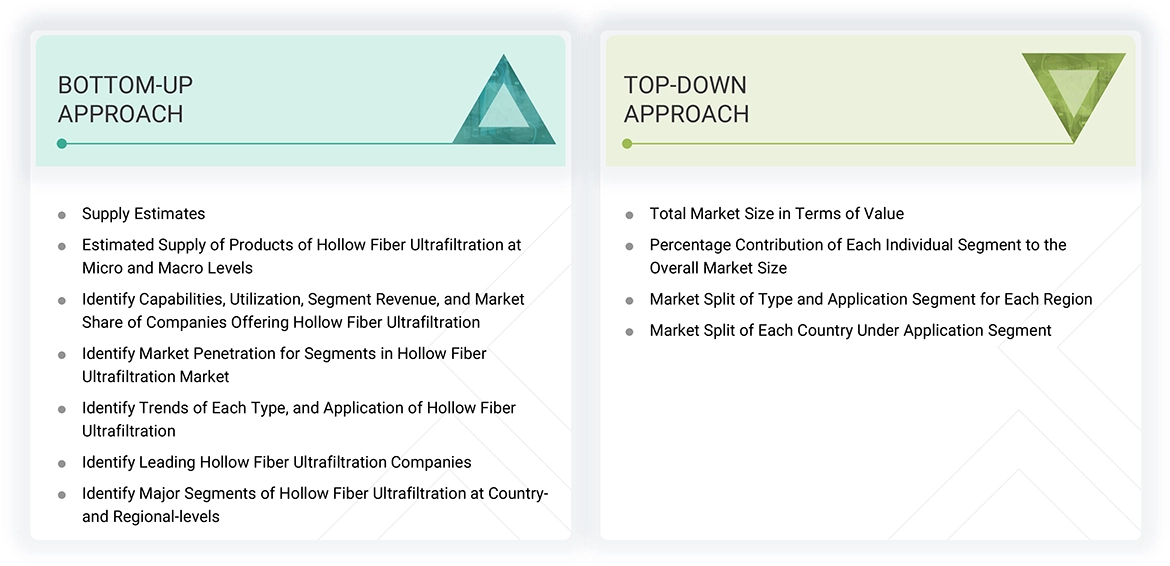

The study involved four major activities in estimating the market size of the hollow fiber ultrafiltration market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key hollow fiber ultrafiltration, market classification, and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The hollow fiber ultrafiltration market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the hollow fiber ultrafiltration market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the hollow fiber ultrafiltration industry.

Interviews with experts were conducted to gather insights such as market statistics, data of revenue collected from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on suppliers, products, component providers, and their current usage of hollow fiber ultrafiltration and the future outlook of their business, which will affect the overall market.

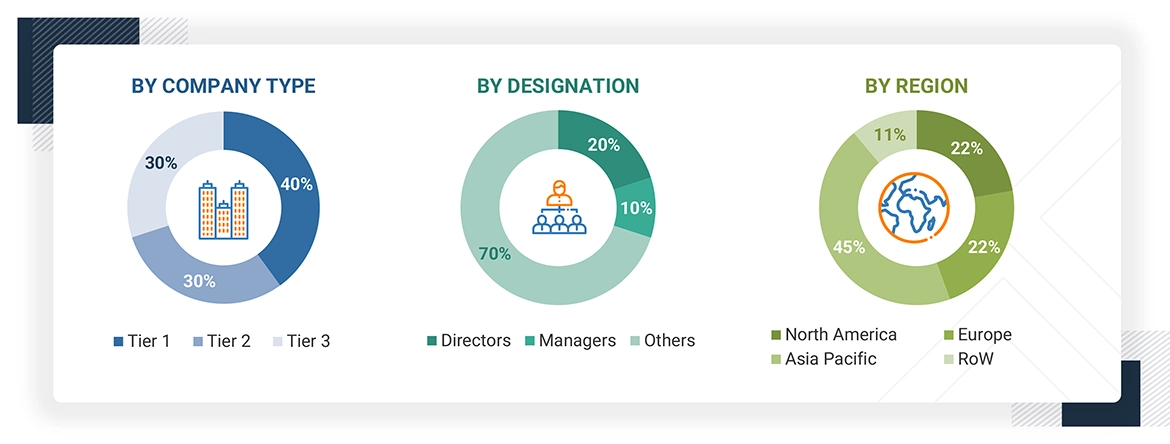

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for hollow fiber ultrafiltration for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on type, application, and region were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

The market size includes the following:

Data Triangulation

After arriving at the total market size from the estimation process hollow fiber ultrafiltration above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size has been validated by using both, the top-down and bottom-up approaches and interviews with experts. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and interviews with experts. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Hollow fiber is the most widely used ultrafiltration module. It utilizes numerous long porous filaments inside the body. Owing to the shape of the module, the membrane has a large surface area, which allows it to filter large volumes while utilizing minimal space and energy. The filaments inside the body of the module are very narrow in diameter and are flexible. Owing to the small strand diameter, the module has a high packing density. These modules are more likely to break under high strain as they are flexible. The major disadvantages of the module are irreversible fouling and easy breakage. High membrane packing density resulting in high throughput, controlled flow hydraulics, and tangential flow feed limiting membrane fouling are the major advantages of the hollow fiber ultrafiltration module.

Stakeholders

- Hollow Fiber Ultrafiltration Manufacturers

- Hollow Fiber Ultrafiltration Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the hollow fiber ultrafiltration market size in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the hollow fiber ultrafiltration market

- To analyze and forecast the market based on type, application, and region

- To describe and forecast the market with respect to five main regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their key countries

- To analyze opportunities for stakeholders by identifying the high-growth segments of the hollow fiber ultrafiltration market

- To strategically analyze the ecosystem, Porter’s Five Forces, technology analysis, tariffs and regulations, patent landscape, trade landscape, key conferences and events, and case studies/use cases pertaining to the market under study

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as investments & expansions and mergers & acquisitions

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Hollow Fiber Ultrafiltration Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Hollow Fiber Ultrafiltration Market