Medical Gas and Equipment Market Size, Growth, Share & Trends Analysis

Medical Gas and Equipment Market by Type [Medical Gas (Oxygen, Nitrous Oxide), Medical Gas Equipment (Flowmeter, Others)], Application [Therapeutics, Diagnostics], End User (Hospital, Home Healthcare]-Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

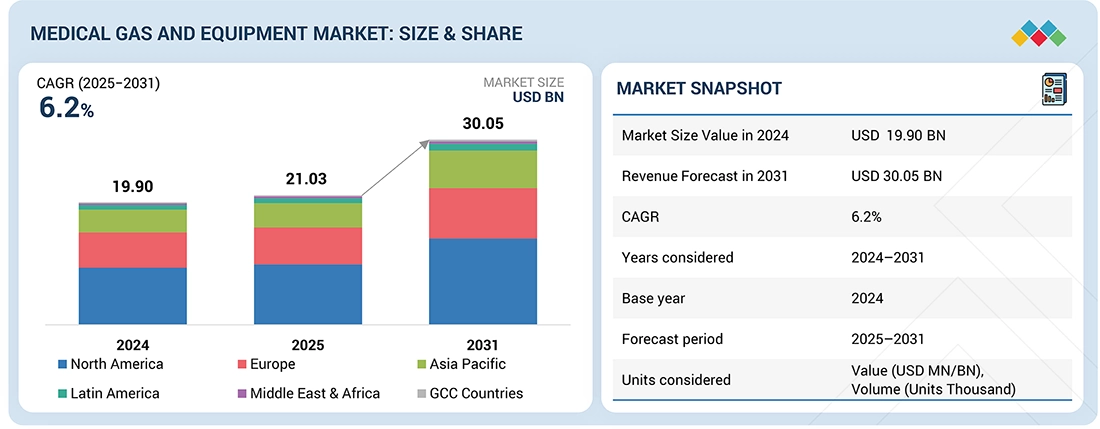

The medical gas and equipment market, valued at US$19.90 billion in 2024, stood at US$21.03 billion in 2025 and is projected to advance at a resilient CAGR of 6.2% from 2025 to 2031, culminating in a forecasted valuation of US$30.05 billion by the end of the period. The medical gas and equipment market is witnessing constant growth as a result of the rising demand for advanced healthcare services through hospitals, clinics, and homecare settings. On one hand, the increasing rates of chronic respiratory and cardiovascular diseases, coupled with an aging population, have drastically boosted the of medical gases like oxygen and their delivery systems. Also, the development and refurbishment of healthcare facilities, especially in developing countries, have been facilitating new medical gas pipeline systems and equipment installations and upgrades. Furthermore, innovations in gas delivery, monitoring, and portable equipment, as well as the trend of home healthcare and long, term oxygen therapy, are continuously driving the market forward. Altogether, these elements have been leading to the long, term growth of the medical gas and equipment market.

KEY TAKEAWAYS

-

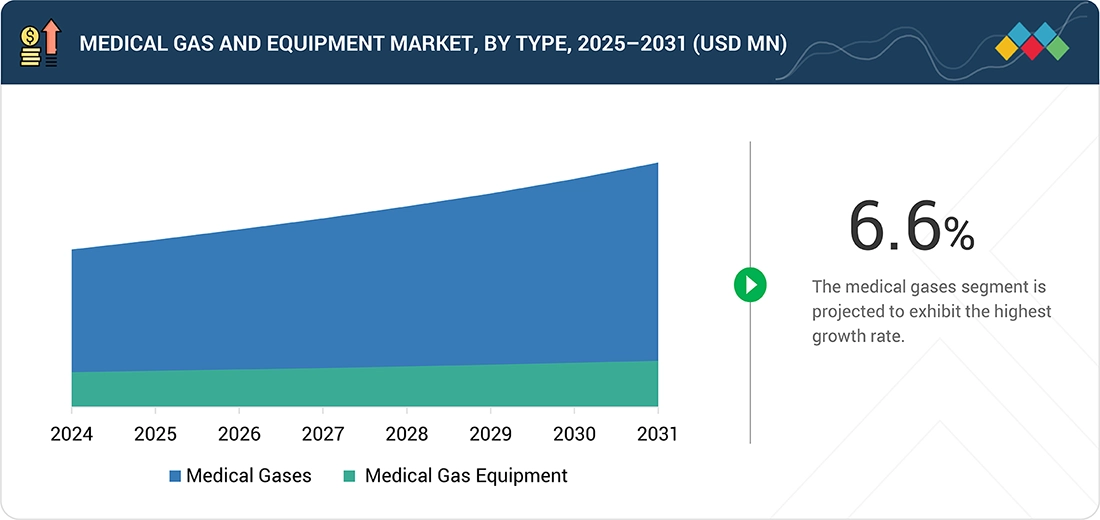

By TypeBased on type, the medical gases segment accounted for a larger share of 80-85% of the medical gas and equipment market in 2024.

-

By ApplicationBased on application, in 2024, the therapeutic applications segment accounted for the largest share of the medical gas and equipment market.

-

By End UserBased on end user, the hospitals & clinics segment held the largest share of 61-65% in the medical gas and equipment market during the forecast period

-

COMPETITIVE LANDSCAPEAir Liquide and Linde Plc were recognized as star players due to their established strong product portfolio.

-

COMPETITIVE LANDSCAPE- STARTUPSCompanies such as NOVAIR USA Corp among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The US medical gas and equipment market growth is largely driven by a rising global burden of chronic respiratory diseases (such as COPD and asthma). Among the key factors driving medical gases and equipment demand in the U. S. are the aging population requiring long, term oxygen therapy and an increasing number of surgical and critical care procedures using anesthetic and respiratory gases. The expansion and modernization of healthcare facilities, increased healthcare spending, and the growing trend of home healthcare by means of portable oxygen concentrators and other respiratory devices, are some of the factors, which, in addition to each other, are enabling demand growth.

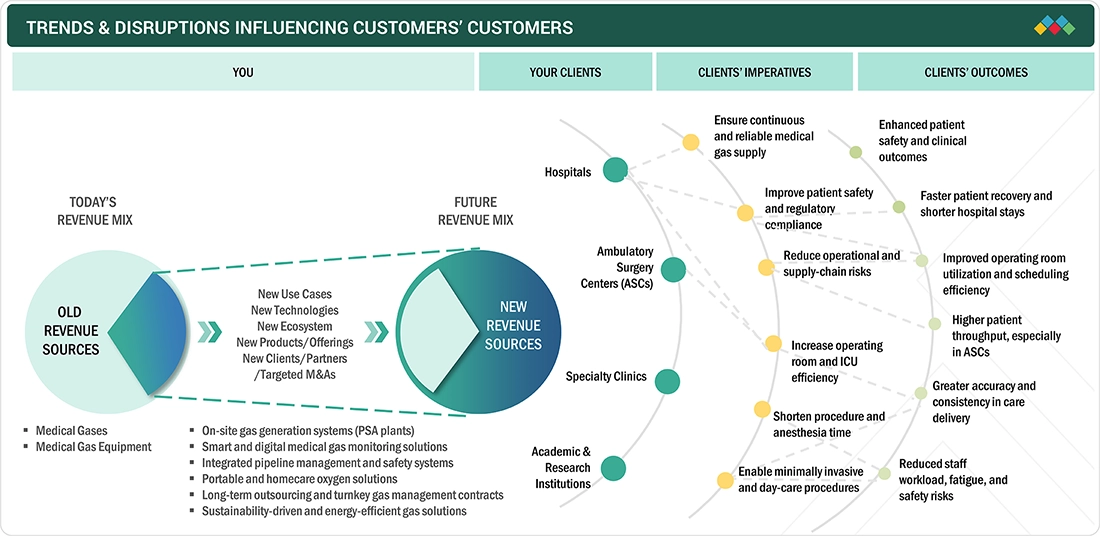

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The medical gas and equipment market is essential in enabling modern healthcare delivery through the provision of safe, dependable, and uninterrupted supply of crucial gases and associated systems in hospitals, ambulatory surgery centres, specialty clinics, and research institutions. The market includes a wide range of products such as medical gases including oxygen, nitrous oxide, and medical air; gas delivery devices, pipeline infrastructure, monitoring systems, and on, site gas generation solutions. Market growth is driven by the increasing requirements for respiratory care, anesthesia and critical care, along with the increase in the number of surgeries and the rise of outpatient and day, care procedures. On the other hand, healthcare facilities are gradually shifting their focus towards enhancing patient safety, regulatory compliance, operational efficiency and supply chain reliability, thus they are fast adopting smart gas management systems, integrated pipeline solutions, and portable oxygen technologies. These factors, together with the continuous development of healthcare infrastructure and technological progress, are determining the changing scene of the medical gas and equipment market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for medical oxygen

-

Increasing number of surgeries

Level

-

Declining reimbursements for respiratory therapies

-

Global helium shortage

Level

-

Expansion of healthcare industry

-

Rising demand for pain management

Level

-

Limited availability of medical gases

-

High cost of medical gas equipment

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for medical oxygen

The escalating demand for medical oxygen is the primary driver of expansion in the medical gas and equipment market. This is largely because medical oxygen is essential to the treatment of numerous acute and chronic health conditions. Specifically, medical oxygen is a must-have element for the treatment of patients with diseases such as COPD, asthma, pneumonia, and cardiovascular diseases, alongside other treatment methods like respiratory therapy, intensive care, anesthesia, emergency treatment, and post-surgical recovery. The carbon dioxide footprint associated with the rising incidence of respiratory diseases, the increasing elderly population, and the surge in hospital and ICU admissions have all led to a significant increase in the demand for oxygen at healthcare facilities. Moreover, the rapid evolution of home healthcare and the rising trend of long-term oxygen therapy have led to higher demand for portable oxygen concentrators and delivery systems. Additionally, ongoing investment in hospital infrastructure, the installation of on-site oxygen generation systems, and enhanced supply chain resilience are contributing to the growing demand for medical oxygen. Overall, medical oxygen remains a significant driver of growth in the medical gas and equipment market.

Restraint: Declining reimbursements for respiratory therapies

Reduced payments for respiratory therapies have been the main challenge to the expansion of the medical gas and equipment market, as reimbursement cuts for oxygen therapy and other respiratory care directly affect the profitability of these treatments. Cost containment efforts by government and private payers in many advanced healthcare systems have resulted in lower reimbursement rates for home oxygen therapy, ventilatory support, and the equipment that goes with them. This situation forces hospitals, durable medical equipment suppliers, and homecare businesses to limit spending on state-of-the-art gas delivery systems and monitoring tools. In addition, lower reimbursement can undermine the use of new, higher-cost respiratory equipment that has shown clinical benefits, as providers are forced to concentrate on cost reduction rather than technology upgrades. Therefore, lower reimbursement levels slow market growth, especially in mature markets where respiratory therapies account for a significant share of medical gas and equipment usage.

Opportunity: Expansion of healthcare industry

The expanding healthcare sector is a key driver of increased market sales of medical gases and equipment. Market growth is supported by rising investments in healthcare infrastructure and the scaling of service capacity across healthcare and related sectors in both developed and emerging economies. The growing number of new hospitals, clinics, ambulatory surgical centers, and diagnostic facilities significantly contributes to demand for medical gas pipeline systems, as well as bulk gas storage and delivery equipment. In addition, the upgrading and capacity or volume expansion of existing healthcare facilities are helping to breathe new life into these facilities and to provide higher safety, regulatory, and operational standards, which is the main reason behind the replacement of outdated gas systems. Increasing access to healthcare services, rising healthcare expenditure, and the expansion of health insurance coverage are multiple factors leading to an increase in patient volumes. High patient turnover and a high volume of medical procedures are two features of healthcare services that are the most direct contributors to increased consumption of medical gases and related equipment. Overall, the continuous expansion of the healthcare sector is a significant factor in positive market sentiment and long-term growth prospects for the medical gas and equipment industry, including manufacturers and service providers.

Challenge: Limited availability of medical gases

One of the significant problems in the medical gas and equipment market is the limited availability of medical gases, especially in regions with poor healthcare infrastructure or unstable supply chains. Factors such as low production capacity, reliance on a few large factories, transportation problems, and shortages of cylinders and storage systems can disrupt the continuous supply of essential gases like oxygen and medical air. These issues become even more acute during periods of increased demand, for example, during a public health crisis or when hospital admissions increase drastically, putting healthcare providers under great pressure to deliver continuous patient care. In addition, the high costs of gas production, storage, and distribution, combined with strict regulatory and safety requirements, can keep remote and low-income communities practically out of the market. Consequently, scarcity of medical gases may delay treatment and even limit overall market growth, underscoring the importance of locally manufactured solutions and stronger, more resilient supply networks.

MEDICAL GAS AND EQUIPMENT MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Air Liquide offers high purity medical gases such as oxygen, nitrogen, nitrous oxide, and medical air that are used in hospitals, clinics, and home healthcare facilities. These gases are required for respiratory therapy, anesthesia delivery, intensive care, emergency medicine, and diagnostic procedures. The company also provides support for integrated gas pipeline systems as well as bulk/packaged supply solutions to ensure that there is no interruption in availability. | Pure medical gases are the means to patient safety and clinical effectiveness as they comply with strict pharmacopeial and regulatory standards. A dependable oxygen supply is the basis of both acute and chronic respiratory care, while medical air and nitrogen are used to ensure that medical devices operate safely. Continuity in gas quality and supply alleviate clinical risks, elevate patient outcomes, and increase the hospital's operational efficiency. |

|

Linde offers medical gas mixtures of speciality like one of the components in the mixture is Helium. This mixture is called Heliox. Respiratory care patients suffering from asthma, COPD, and upper airway obstruction are the main users of Heliox. In ICUs, emergency departments, and neonatal care units, Heliox is used to minimize airway resistance and facilitate breathing. | Heliox has a flow capacity that is better than that of the air or oxygen separately, since it is of a lower density. Consequently, the device can relieve respiratory distress, promote patient comfort, and potentially lessen the necessity for invasive ventilation. Also, its application is instrumental in the rapid stabilization of patients and thus, great productivity in the acute and critical respiratory care settings is achieved. |

|

Taiyo Nippon Sanso provides medical cryogenic gases including liquid oxygen, liquid nitrogen, and liquid carbon dioxide that are used for bulk hospital storage, cryosurgery, biological sample preservation, and medical research. These cryogens are the main components of large healthcare facilities, blood banks, laboratories, and biopharmaceutical applications. | Cryogenic solutions provide very high-volume, low-cost gas storage with stable purity and temperature that can be controlled. Liquid oxygen is used to ensure the supply is uninterrupted in high-demand hospital environments, and liquid nitrogen is used for long-term storage of biological samples and for advanced medical procedures. Thus hospital reliability is enhanced, research continuity is supported, and the overall care delivery efficiency is improved. |

|

Air Products provides cryogenic products and storage systems that are specifically designed for healthcare and life sciences applications. This includes liquid oxygen systems for hospitals and cryogenic solutions for pharmaceutical manufacturing and laboratory use. Their equipment is capable of supporting the storage, vaporization, and distribution of medical gases in a safe manner. | Cryogenic systems can ensure the secure handling of gases as well as provide continuous availability of these gases even during times of peak demand. The high degree of system reliability that is available most of the time therefore, contributes to a decrease in the risk of system downtime and in turn, patient safety is promoted in critical care environments. Besides, effective cryogenic healthcare technology can also help to cut operational costs while at the same time making it easier to comply with safety and quality standards in healthcare institutions. |

|

Atlas Copco provides medical-grade air and gas compressors, which are the main devices used to deliver medical air and support gas pipeline systems in hospitals and clinics. Such compressors are the most necessary ventilators, anesthesia machines, surgical tools, and other pneumatic medical equipment. | Medical air compressors are the sources of clean, oil-free, and contaminant-free air that complies with healthcare standards. Their reliability ensures the uninterrupted operation of life-supporting devices, thus, maintenance requirements are lowered, and energy-saving is increased. As a result, this contributes to patient safety, makes hospital administration easier and the hospital's operational costs are reduced in the long run. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The medical gas and equipment market ecosystem is a tightly integrated network of manufacturers, distributors, end users, and regulatory bodies, all of whom are key to the safe and efficient delivery of medical gases to healthcare settings. Manufacturers primarily refer to global industrial gas companies and equipment providers involved in the production of medical gases, gas delivery systems, and related infrastructure. At the other end of the chain, distributors facilitate smooth logistics operations, supplying facilities on-site and providing after-sales support to healthcare facilities. End users, such as hospitals, health systems, and specialized healthcare providers, require an uninterrupted supply of gases to support facilities for respiratory care, anesthesia, critical care, and surgical procedures. Regulatory bodies, as the overseers of this ecosystem, create and enforce standards and regulations related to the quality, safety, and compliance aspects of medical gas production, distribution, and utilization. Thus, these closely linked players cooperate to ensure smooth operations, patient safety, and a reliable supply in the medical gas and equipment market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Medical Gas and Equipment Market, By Type

Medical gases account for the largest share of the medical gas and equipment market by type, owing to their indispensable, continuous use across all levels of healthcare delivery. Gases such as oxygen, medical air, nitrous oxide, nitrogen, and carbon dioxide are essential for respiratory therapy, anesthesia, intensive care, emergency treatment, and a wide range of diagnostic and therapeutic procedures. Unlike equipment, which is typically purchased on a one-time or periodic replacement basis, medical gases are consumables that require an uninterrupted, recurring supply, resulting in consistently high demand. Rising prevalence of chronic respiratory and cardiovascular diseases, increasing surgical volumes, and growing ICU admissions further drive consumption of medical gases. Additionally, the expansion of home healthcare services and long-term oxygen therapy, along with strict regulatory requirements mandating continuous gas availability in healthcare facilities, continue to reinforce the dominant share of medical gases in the medical gas and equipment market.

Medical Gas and Equipment Market, By Application

Therapeutic uses represent the largest share of the medical gas and equipment market segment, as medical gases are essential to the treatment and management of various acute and chronic diseases. Gases such as oxygen, nitrous oxide, and medical air are widely used in respiratory therapy, critical care, emergency medicine, anesthesia, and pain relief across hospital, clinic, and home care settings. With rising rates of chronic respiratory and cardiovascular disorders and an aging population, demand for therapeutic gases for continuous, long-term use has surged. In addition to higher patient admissions and surgical procedures, the growing trend toward home health care and the use of long-term oxygen therapy are further driving demand for therapeutic applications. As a result, the frequent and high consumption of medical gases in patient care remains the main reason for the dominance of therapeutic applications in the medical gas and equipment market segment.

Medical Gas and Equipment Market, By End User

Hospitals and clinics account for the largest share of the medical gas and equipment market from the end-user perspective, primarily because they are at the core of delivering acute, chronic, and critical care services. These healthcare facilities experience high patient turnover and perform a wide variety of medical procedures, including operations, emergency care, intensive care, and respiratory therapies, all of which require a continuous and dependable supply of medical gases such as oxygen, nitrous oxide, and medical air. Hospitals and clinics are major spenders on medical gas pipeline systems, bulk storage, and monitoring equipment that support operating rooms, ICUs, neonatal units, and recovery wards. The escalating prevalence of chronic diseases, the upsurge in hospital admissions, and the increase in surgical procedures are factors that drive higher demand from this segment. In addition, strict regulatory and safety requirements compel hospitals and clinics to maintain an uninterrupted and compliant medical gas infrastructure, which, in turn, accounts for their dominant share in the medical gas and equipment market.

REGION

Asia Pacific to be fastest-growing region in global medical gas and equipment market during forecast period

Asia Pacific holds the top position as the fastest, growing region in the global market for medical gases and equipment. Rapid healthcare infrastructure development and increased healthcare demand in the leading economies of China, India, and the Southeast Asian countries are the main factors behind this phenomenon. Additionally, the mix of rising population, increased prevalence of chronic respiratory and cardiovascular diseases, and quick population aging results in a great demand for medical gases and the equipment that can supply them. Major investments in hospital construction, healthcare facility modernization, and critical care capacity expansion are being made by governments throughout the region. Consequently, this is prompting the installation of medical gas pipeline systems and gas production equipment at the local level. This trend is further supported by the improving accessibility of healthcare services, increase in healthcare spending, and the growing popularity of home healthcare and use of long, term oxygen therapy. Moreover, the rising presence of global players in the medical gas supply sector and innovations in medical gas delivery and monitoring technologies also make it feasible for Asia Pacific to achieve a strong position in the medical gas and equipment market.

MEDICAL GAS AND EQUIPMENT MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

In the medical gas and equipment market matrix, Air Liquide (France) (Star) and Linde Plc (Germany) (Star) lead with their unmatched global presence, strong brand recognition, and comprehensive portfolios of medical gas and equipment products. Atlas Copco AB (Sweden) (Emerging Leader) is rapidly gaining traction with its versatile products, which provide medical gas and equipment for various therapeutic and diagnostic applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Air Liquide (France)

- Linde Plc (Germany)

- Taiyo Nippon Sanso Corporation (Japan)

- Air Products and Chemicals Inc. (US)

- Atlas Copco AB (Sweden)

- GCE Group (Sweden)

- Messer SE & Co. KGaA (Germany)

- Rotarex (Europe)

- Norco Inc (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 21,035.90 Million |

| Revenue Forecast in 2031 | USD 30,052.60 Million |

| Growth Rate | CAGR of 6.2% from 2025-2031 |

| Actual data | 2024-2031 |

| Base year | 2024 |

| Forecast period | 2025-2031 |

| Units considered | Value (USD Million), Volume (Thousands Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

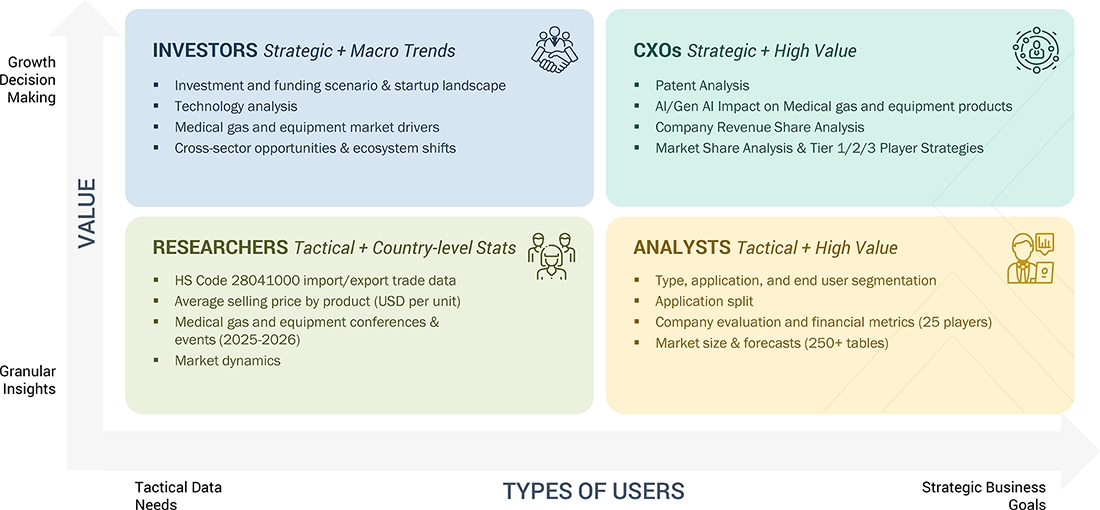

WHAT IS IN IT FOR YOU: MEDICAL GAS AND EQUIPMENT MARKET: GROWTH, SIZE, SHARE, AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Volume Analysis | Market assessment by volume (units) for dental equipment used in digital dentures ecosystem |

|

| Product Analysis | Further breakdown of other applications in the market | Insights on other applications involved in the market |

| Company Information |

|

Insights on market share analysis by country |

| Geographic Analysis |

|

Country level demand mapping for new product launches and localization strategy planning |

RECENT DEVELOPMENTS

- June 2025 : ESAB Corporation (GCE) has improved its medical gas equipment portfolio by purchasing Delta P Gas Equipment, a company located in Italy, and by making a decision to buy Aktiv Technologies in India. The acquisitions allow ESAB to provide more complete medical central gas systems solutions, have a better global presence, and be more safety and regulatory compliance oriented in their gas control equipment offering.

- June 2024 : Messer Americas successfully completed its purchase of the Federal Helium System from the U.S. Bureau of Land Management (BLM), marking the transition of this critical national resource from federal to private ownership. The Federal Helium System comprising the Federal Helium Reserve, the Cliffside Field and wells, the 423 mile crude helium pipeline, and related operational assets has historically played a central role in helium supply for sectors including healthcare (eg, MRI machines and breathing gas mixtures), research, aerospace, and manufacturing

Table of Contents

Methodology

This study involved four major activities in estimating the current medical gas and equipment market size. Exhaustive secondary research was done to collect information on the market, peer market and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the prefilled syringes market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the medical gas and equipment market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents for the medical gas and equipment market is provided below:

Note 1: C-level primaries include CEOs, COOs, and CTOs.

Note 2: Others include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2023: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=<USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

The research methodology used to estimate the size of the market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the medical gas and equipment was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall medical gas and equipment market was obtained from secondary data and validated by primary participants to arrive at the total medical gas and equipment market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by medical gas and equipment and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall medical gas and equipment and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Medical gases and equipment are significant elements in medical centers (such as acute care, hospitals, surgery centers, and emergency medical services), life sciences (pharmaceutical, biotech, and life science R&D), long-term care (like nursing homes and home healthcare), and laboratories (including analytical, commercial, life sciences, and university laboratories). The market covers medical pure gases, medical gas mixtures, and various equipment used for the storage, transportation, and delivery of medical gases.

Key Stakeholders

- Medical gas manufacturers

- Medical gases equipment manufacturing companies

- Medical gases and equipment distributors

- Healthcare institutions (hospitals, laboratories, medical schools, and outpatient clinics)

- Pharmaceutical and biotechnology companies

- Research institutes and academic centers

- Contract research organizations (CROs)

- Government associations

- Home-healthcare services providers

- Market research and consulting firms

- Venture capitalists and investors

Objectives of the Study

- To describe, analyze, and forecast the medical gas and equipment market by type, application, end user and region

- To describe and forecast the medical gas and equipment market for key regions—North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the medical gas and equipment market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To profile key players and comprehensively analyze their market shares and core competencies2 in the medical gas and equipment market

- To analyze competitive developments such as partnerships, collaborations, agreements & acquisitions, product launches, expansions, and R&D activities in the medical gas and equipment market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe medical gas and equipment market into Belgium, Russia, the Netherlands, Switzerland, and other countries.

- Further breakdown of the Rest of Asia Pacific medical gas and equipment market into Indonesia, Philippines, Vietnam, Hong Kong, and other countries

- Further breakdown of the Rest of Latin America medical gas and equipment into Colombia, Peru, and other countries

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Medical Gas and Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Medical Gas and Equipment Market