Oxygen Therapy Equipment Market by Product (Oxygen Source (Concentrator, Cylinder), Delivery Devices), Portability (Stationary, Portable), Application (COPD, Asthma, Cystic Fibrosis, Pneumonia), End User (Hospital, Home Care) - Global Forecast to 2022

[175 Pages Report] The oxygen therapy equipment market is expected to reach USD 4.01 Billion by 2022 from USD 2.65 Billion in 2017, at a CAGR of 8.7% during the forecast period from 2017 to 2022.

The objectives of this study are as follows:

- To define, describe, and forecast the market on the basis of product, portability, application, end user, and region

- To provide detailed information regarding the major factors influencing growth of the market (drivers, restraints, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast revenue of the market segments with respect to four main regional segments, namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW)

- To profile key players and comprehensively analyze their market shares and core competencies in terms of market development and growth strategies

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; acquisitions; and product launches in the oxygen therapy equipment market

Research Methodology

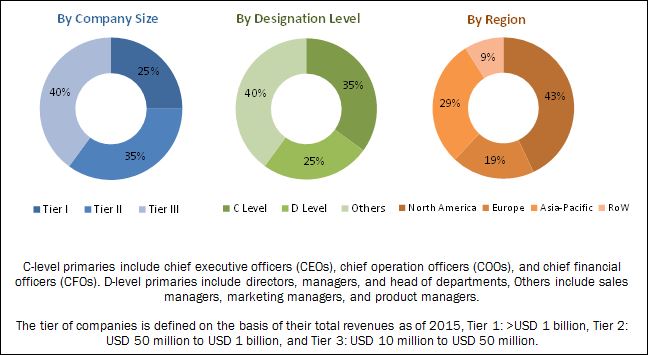

Top-down and bottom-up approaches were used to estimate and validate the size of the market and to estimate the size of various other dependent submarkets. The overall market size was used in the top-down approach to estimate the sizes of other individual markets (mentioned in the market segmentation by product, portability, application, end user, and region) through percentage splits from secondary and primary research. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues obtained. Various secondary sources such as World Health Organization (WHO), United Nations Department of Economic and Social Affairs (UN DESA), Organisation for Economic Co-operation and Development (OECD), Centers for Disease Control and Prevention (CDC), World Bank, Food and Drug Administration (FDA), American Association for Respiratory Care (AARC), European Respiratory Society (ERS), Centers for Medicare & Medicaid Services (CMS), COPD Foundation, American Thoracic Society (ATS), corporate filings such as annual reports, SEC filings, investor presentations, and financial statements have been used to identify and collect information useful for this extensive commercial study of the oxygen therapy equipment market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The key players in the oxygen therapy equipment market include Philips Healthcare (Netherlands), Linde Healthcare (Germany), Chart Industries, Inc. (U.S.), Invacare Corporation (U.S.), Becton, Dickinson and Company (U.S.), Smiths Medical (U.S.), Drägerwerk AG & Co. KGaA (Germany), Teleflex Incorporated (U.S.), Fisher & Paykel Healthcare Corporation Limited (New Zealand), Taiyo Nippon Sanso Corporation (Japan), Inogen, Inc. (U.S.), Heinen + Löwenstein GmbH & Co. KG (Germany), DeVilbiss Healthcare (U.S.), Essex Industries, Inc. (U.S.), HERSILL, S.L. (Spain), Weinmann Emergency Medical Technology GmbH + Co. KG (Germany), Messer Medical Austria GmbH (Germany), TECNO-GAZ S.p.A (Italy), HUM - Gesellschaft für Homecare und Medizintechnik mbH (Germany), medicap homecare GmbH (Germany), GCE Holding AB (Sweden), Allied Healthcare Products Inc. (U.S.), Medicop D.O.O. (Slovenia), Andreas Fahl Medizintechnik-Vertriebs GmbH (Germany), and Respan Products Inc. (Canada).

Target Audience for this Report:

- Oxygen therapy equipment manufacturers and vendors

- Research associations related to oxygen therapy

- Healthcare institutions (hospitals, laboratories, medical schools, and outpatient clinics)

- Various research and consulting firms

- Distributors of oxygen therapy equipment

- Research Institutes

Scope of the Report:

This report categorizes the market into the following segments:

Oxygen Therapy Equipment Market, by Product

-

Oxygen Source Equipment

- Oxygen Concentrators

- Liquid Oxygen Devices

- Oxygen Cylinders

-

Oxygen Delivery Devices

- Oxygen Masks

- Nasal Cannulas

- Venturi Masks

- Non-rebreather Masks

- Bag-valve Masks

- Other Oxygen Delivery Devices

Oxygen Therapy Equipment Market, by Portability

- Stationary Devices

- Portable Devices

Oxygen Therapy Equipment Market, by Application

- COPD

- Asthma

- Cystic Fibrosis

- Respiratory Distress Syndrome

- Pneumonia

- Other Diseases

Oxygen Therapy Equipment Market, by Region

-

North America

- U.S.

- Canada

-

Europe

- France

- U.K.

- Germany

- Spain

- Italy

- Rest of Europe (RoE)

-

Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific (RoAPAC)

- Rest of the World (RoW)

Customization Options:

- Company Information: Detailed company profiles of five or more market players

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the market

The global oxygen therapy equipment market is expected to reach USD 4.01 Billion by 2022 from USD 2.65 Billion in 2017, at a CAGR of 8.7%.

A number of factors, such as increasing prevalence of respiratory disorders, rapid growth in the geriatric population, high prevalence of tobacco smoking, preference towards home-based oxygen therapy, and technological advancements are expected to drive the growth of this market.

The global market is segmented by product, portability, application, end users, and regions. By product, the market is segmented into oxygen source equipment and oxygen delivery devices. The oxygen source equipment segment is expected to lead the global market in 2017. The rising incidence of respiratory disorders and technical innovations in the field are key growth factors of this subsegment.

On the basis of portability, the market is classified into stationary devices and portable devices. Patients are mostly confined to their beds during treatment which drives the stationary oxygen therapy devices market and helps the segment hold the largest share of the market in 2017.

The oxygen therapy equipment market is segmented into chronic obstructive pulmonary disease (COPD), asthma, respiratory distress syndrome, cystic fibrosis, pneumonia, and other diseases/disorders, on the basis of applications. COPD accounts for the largest segment and is also the fastest growing application segment in the market. Cases of COPD are rising across the globe due to factors like the proliferation of tobacco smoking and increase in the geriatric population, which is in turn driving the growth of this segment.

On the basis of end users, the equipment market is segmented into home care settings, hospitals, and ambulatory surgical centers (ASCs) & physician offices. In 2017, the home care settings segment accounted for the greatest share and is projected to grow at the highest rate during the forecast period. Technological improvements and the growing usage of home-based therapy, especially in developed countries in North America and Europe are major factors fueling the market growth in this end-user segment.

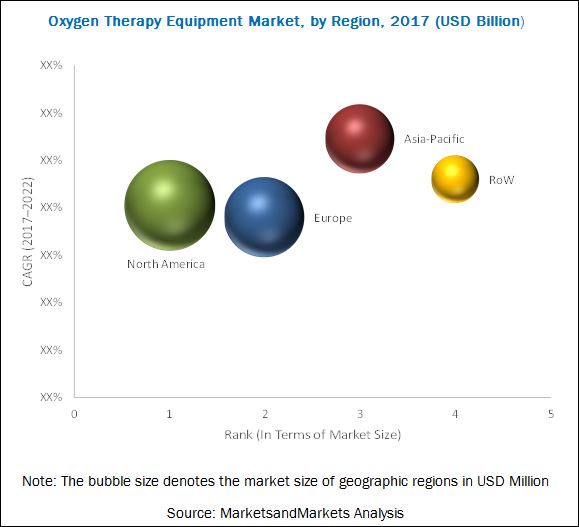

The global market is dominated by North America, followed by Europe. North America will continue to dominate the global market in the forecast period. However, Asia-Pacific is expected to witness the highest CAGR, with the growth in this market centered at China, Japan, and India. Increasing investment in healthcare, increase in healthcare expenditure, growth in disposable incomes, and an increase in healthcare insurance coverage are some factors propelling market growth in the APAC region.

The availability of low-cost substitutes by local manufacturers, rigorous regulatory guidelines causing delays in product approvals, and Medicare reimbursement rate cuts for home oxygen therapy in the U.S. are expected to restrain the market growth to a certain extent.

Major industry players in Oxygen Therapy Equipment Market launched innovative products in the recent past and have plans to launch new products and expand across geographies via partnerships and acquisitions in the future. Philips Healthcare, Linde Healthcare and Chart Industries have been identified as the top players in this market. These companies have a broad product portfolio with comprehensive features and have also launched innovative products. Further, these leaders have products for all end users in this segment, a strong geographical presence, and more importantly focus on continuous product innovations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Approach

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Key Data From Primary Sources

2.3.2 Key Industry Insights

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown & Data Triangulation

2.6 Assumptions for the Study

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Oxygen Therapy Equipment: Market Overview

4.2 Geographic Analysis: Oxygen Source Equipment Market, By Type (2017)

4.3 Oxygen Delivery Devices Market, By Type, 2017–2022

4.4 Geographical Snapshot of the Oxygen Therapy Equipment Market

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Prevalence of Respiratory Disorders

5.2.1.1.1 Rapid Growth in the Geriatric Population

5.2.1.1.2 High Prevalence of Tobacco Smoking

5.2.1.1.3 Early Diagnosis of Respiratory Disorders is Increasing the Demand for Oxygen Therapy

5.2.1.2 Shift From Traditional Cylinders to Portable Concentrators

5.2.1.3 Preference Towards Home-Based Oxygen Therapy

5.2.1.4 Technological Advancements

5.2.2 Restraints

5.2.2.1 Availability of Low-Cost Alternatives By Local Manufacturers

5.2.2.2 Stringent Regulatory Guidelines Causing Delays in Product Approval

5.2.2.3 Medicare Reimbursement Rate Cuts for Home Oxygen Therapy in the U.S.

5.2.3 Opportunities

5.2.3.1 Increasing Focus of Industry Players on Emerging Markets

5.2.3.2 Increasing Usage of Telemedicine and Telemonitoring

6 Global Oxygen Therapy Equipment Market, By Product (Page No. - 45)

6.1 Introduction

6.2 Oxygen Source Equipment

6.2.1 Oxygen Concentrators

6.2.1.1 Fixed Oxygen Concentrators

6.2.1.2 Portable Oxygen Concentrators

6.2.2 Liquid Oxygen Devices

6.2.3 Oxygen Cylinders

6.3 Oxygen Delivery Devices

6.3.1 Oxygen Masks

6.3.2 Nasal Cannulas

6.3.3 Venturi Masks

6.3.4 Non-Rebreather Masks

6.3.5 Bag Valve Masks

6.3.6 Other Devices

7 Global Oxygen Therapy Equipment Market, By Portability (Page No. - 61)

7.1 Introduction

7.1.1 Stationary Oxygen Therapy Devices

7.1.2 Portable Oxygen Therapy Devices

8 Global Oxygen Therapy Equipment Market, By Application (Page No. - 65)

8.1 Introduction

8.1.1 COPD

8.1.2 Asthma

8.1.3 Cystic Fibrosis

8.1.4 Respiratory Distress Syndrome

8.1.5 Pneumonia

8.1.6 Other Diseases

9 Global Oxygen Therapy Equipment Market, By End User (Page No. - 72)

9.1 Introduction

9.1.1 Home Care Settings

9.1.2 Hospitals

9.1.3 Ambulatory Surgical Centers & Physician Offices

10 Global Oxygen Therapy Equipment Market, By Region (Page No. - 77)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 France

10.3.2 U.K.

10.3.3 Germany

10.3.4 Spain

10.3.5 Italy

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Rest of Asia-Pacific

10.5 Rest of the World

11 Competitive Landscape (Page No. - 132)

11.1 Introduction

11.1.1 Vanguards

11.1.2 Innovators

11.1.3 Dynamic Players

11.1.4 Emerging Players

11.2 Competitive Benchmarking

11.2.1 Product Offerings (For All 25 Players)

11.2.2 Business Strategy (For All 25 Players)

*Top 25 Companies Analyzed for This Study are - Philips Healthcare (A Division of Koninklijke Philips N.V.), Linde Healthcare (A Division of Linde Group), Becton, Dickinson and Company, Taiyo Nippon Sanso Corporation, Smiths Medical (A Division of Smiths Group PLC), Drägerwerk AG & Co. KGaA, Teleflex Incorporated, Invacare Corporation, Chart Industries, Inc., Fisher & Paykel Healthcare Corporation Limited, Inogen, Inc., Allied Healthcare Products Inc., Heinen + Löwenstein GmbH & Co. Kg, Drive Devilbiss Healthcare, Esex Industries, Inc., Hersill S.L., Weinmann Emergency Medical Technology GmbH + Co. Kg, Messer Medical Austria GmbH, Tecno-Gaz S.P.A., Hum Gesellschaft Für Homecare Und Medizintechnik Mbh, Medicop D.O.O., Andreas Fahl Medizintechnik - Vertrieb GmbH, Medicap Home Care GmbH, Gce Holding Am, Respan Products Inc

12 Company Profiles (Page No. - 136)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

12.1 Philips Healthcare (A Division of Koninklijke Philips N.V.)

12.2 Linde Healthcare (A Division of Linde Group)

12.3 Becton, Dickinson and Company

12.4 Taiyo Nippon Sanso Corporation

12.5 Smiths Medical (A Division of Smiths Group PLC)

12.6 Drägerwerk AG & Co. KGaA

12.7 Teleflex Incorporated

12.8 Invacare Corporation

12.9 Chart Industries, Inc.

12.10 Fisher & Paykel Healthcare Corporation Limited

12.11 Inogen, Inc.

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

13 Key Innovators (Page No. - 164)

13.1 Drive Devilbiss Healthcare

13.1.1 Innovations

13.2 Gce Holding Ab

13.2.1 Innovations

14 Appendix (Page No. - 165)

14.1 Industry Insights

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (148 Tables)

Table 1 Oxygen Therapy Equipment: Market Snapshot

Table 2 Oxygen Therapy Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 3 Oxygen Source Equipment Market Size, By Region, 2015–2022 (USD Million)

Table 4 Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 5 Oxygen Concentrators Market Size, By Region, 2015–2022 (USD Million)

Table 6 Oxygen Concentrators Market Size, By Type, 2015–2022 (USD Million)

Table 7 Fixed Oxygen Concentrators Market Size, By Region, 2015–2022 (USD Million)

Table 8 Portable Oxygen Concentrators Market Size, By Region, 2015–2022 (USD Million)

Table 9 Liquid Oxygen Devices Market Size, By Region, 2015–2022 (USD Million)

Table 10 Oxygen Cylinders Market Size, By Region, 2015–2022 (USD Million)

Table 11 Oxygen Delivery Devices Market Size, By Region, 2015–2022 (USD Million)

Table 12 Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 13 Oxygen Masks Market Size, By Region, 2015–2022 (USD Million)

Table 14 Nasal Cannulas Market Size, By Region, 2015–2022 (USD Million)

Table 15 Venturi Masks Market Size, By Region, 2015–2022 (USD Million)

Table 16 Non-Rebreather Masks Market Size, By Region, 2015–2022 (USD Million)

Table 17 Bag Valve Masks Market Size, By Region, 2015–2022 (USD Million)

Table 18 Other Oxygen Delivery Devices Market Size, By Region, 2015–2022 (USD Million)

Table 19 Market Size, By Portability, 2015–2022 (USD Million)

Table 20 Stationary Oxygen Therapy Devices Market Size, By Region, 2015–2022 (USD Million)

Table 21 Portable Oxygen Therapy Devices Market Size, By Region, 2015–2022 (USD Million)

Table 22 Market Size, By Application, 2015–2022 (USD Million)

Table 23 Market Size for COPD, By Region, 2015–2022 (USD Million)

Table 24 Market for Oxygen Therapy Equipment: Size for Asthma, By Region, 2015–2022 (USD Million)

Table 25 Oxygen Therapy Equipment Market Size for Cystic Fibrosis, By Region, 2015–2022 (USD Million)

Table 26 Market Size for Respiratory Distress Syndrome, By Region, 2015–2022 (USD Million)

Table 27 Market Size for Pneumonia, By Region, 2015–2022 (USD Million)

Table 28 Market Size for Other Diseases, By Region, 2015–2022 (USD Million)

Table 29 Market Size, By End User, 2015–2022 (USD Million)

Table 30 Global Market for Oxygen Therapy Equipment: Size for Home Care Settings, By Region, 2015–2022 (USD Million)

Table 31 Global Oxygen Therapy Equipment Market Size for Hospitals, By Region, 2015–2022 (USD Million)

Table 32 Global Market Size for Ambulatory Surgical Centers and Physician Offices, By Region, 2015–2022 (USD Million)

Table 33 Market Size, By Region, 2015–2022 (USD Million)

Table 34 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 35 North America: Market Size, By Product, 2015–2022 (USD Million)

Table 36 North America: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 37 North America: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 38 North America: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 39 North America: Market Size, By Portability, 2015–2022 (USD Million)

Table 40 North America: Market for Oxygen Therapy Equipment: Size, By Application, 2015–2022 (USD Million)

Table 41 North America: Market for Oxygen Therapy Equipment: Size, By End User, 2015–2022 (USD Million)

Table 42 U.S.: Oxygen Therapy Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 43 U.S.: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 44 U.S.: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 45 U.S.: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 46 U.S.: Market Size, By Portability, 2015–2022 (USD Million)

Table 47 U.S.: Market Size, By Application, 2015–2022 (USD Million)

Table 48 U.S.: Market for Oxygen Therapy Equipment: Size, By End User, 2015–2022 (USD Million)

Table 49 Canada: Market Size, By Product, 2015–2022 (USD Million)

Table 50 Canada: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 51 Canada: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 52 Canada: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 53 Canada: Oxygen Therapy Equipment Market Size, By Portability, 2015–2022 (USD Million)

Table 54 Canada: Market Size, By Application, 2015–2022 (USD Million)

Table 55 Canada: Market Size, By End User, 2015–2022 (USD Million)

Table 56 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 57 Europe: Market Size, By Product, 2015–2022 (USD Million)

Table 58 Europe: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 59 Europe: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 60 Europe: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 61 Europe: Market Size, By Portability, 2015–2022 (USD Million)

Table 62 Europe: Market Size, By Application, 2015–2022 (USD Million)

Table 63 Europe: Market for Oxygen Therapy Equipment: Size, By End User, 2015–2022 (USD Million)

Table 64 France: Oxygen Therapy Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 65 France: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 66 France: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 67 France: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 68 France: Market Size, By Portability, 2015–2022 (USD Million)

Table 69 France: Market Size, By Application, 2015–2022 (USD Million)

Table 70 France: Market Size, By End User, 2015–2022 (USD Million)

Table 71 U.K.: Oxygen Therapy Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 72 U.K.: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 73 U.K.: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 74 U.K.: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 75 U.K.: Market Size, By Portability, 2015–2022 (USD Million)

Table 76 U.K.: Market Size, By Application, 2015–2022 (USD Million)

Table 77 U.K.: Market Size, By End User, 2015–2022 (USD Million)

Table 78 Germany: Oxygen Therapy Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 79 Germany: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 80 Germany: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 81 Germany: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 82 Germany: Market Size, By Portability, 2015–2022 (USD Million)

Table 83 Germany: Market Size, By Application, 2015–2022 (USD Million)

Table 84 Germany: Market for Oxygen Therapy Equipment: Size, By End User, 2015–2022 (USD Million)

Table 85 Spain: Oxygen Therapy Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 86 Spain: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 87 Spain: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 88 Spain: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 89 Spain: Market Size, By Portability, 2015–2022 (USD Million)

Table 90 Spain: Market Size, By Application, 2015–2022 (USD Million)

Table 91 Spain: Market Size, By End User, 2015–2022 (USD Million)

Table 92 Italy: Oxygen Therapy Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 93 Italy: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 94 Italy: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 95 Italy: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 96 Italy: Market Size, By Portability, 2015–2022 (USD Million)

Table 97 Italy: Market for Oxygen Therapy Equipment: Size, By Application, 2015–2022 (USD Million)

Table 98 Italy: Market Size, By End User, 2015–2022 (USD Million)

Table 99 RoE: Market Size, By Product, 2015–2022 (USD Million)

Table 100 RoE: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 101 RoE: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 102 RoE: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 103 RoE: Market Size, By Portability, 2015–2022 (USD Million)

Table 104 RoE: Market Size, By Application, 2015–2022 (USD Million)

Table 105 RoE: Market Size, By End User, 2015–2022 (USD Million)

Table 106 APAC: Oxygen Therapy Equipment Market Size, By Country, 2015–2022 (USD Million)

Table 107 APAC: Market Size, By Product, 2015–2022 (USD Million)

Table 108 APAC: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 109 APAC: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 110 APAC: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 111 APAC: Market Size, By Portability, 2015–2022 (USD Million)

Table 112 APAC: Market Size, By Application, 2015–2022 (USD Million)

Table 113 APAC: Market for Oxygen Therapy Equipment: Size, By End User, 2015–2022 (USD Million)

Table 114 China: Oxygen Therapy Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 115 China: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 116 China: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 117 China: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 118 China: Market Size, By Portability, 2015–2022 (USD Million)

Table 119 China: Market Size, By Application, 2015–2022 (USD Million)

Table 120 China: Market Size, By End User, 2015–2022 (USD Million)

Table 121 Japan: Market Size, By Product, 2015–2022 (USD Million)

Table 122 Japan: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 123 Japan: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 124 Japan: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 125 Japan: Market Size, By Portability, 2015–2022 (USD Million)

Table 126 Japan: Market Size, By Application, 2015–2022 (USD Million)

Table 127 Japan: Market for Oxygen Therapy Equipment: Size, By End User, 2015–2022 (USD Million)

Table 128 India: Oxygen Therapy Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 129 India: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 130 India: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 131 India: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 132 India: Market Size, By Portability, 2015–2022 (USD Million)

Table 133 India: Market Size, By Application, 2015–2022 (USD Million)

Table 134 India: Market Size, By End User, 2015–2022 (USD Million)

Table 135 RoAPAC: Oxygen Therapy Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 136 RoAPAC: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 137 RoAPAC: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 138 RoAPAC: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 139 RoAPAC: Market Size, By Portability, 2015–2022 (USD Million)

Table 140 RoAPAC: Market Size, By Application, 2015–2022 (USD Million)

Table 141 RoAPAC: Market Size, By End User, 2015–2022 (USD Million)

Table 142 RoW: Market Size, By Product, 2015–2022 (USD Million)

Table 143 RoW: Oxygen Source Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 144 RoW: Oxygen Concentrators Market Size, By Portability, 2015–2022 (USD Million)

Table 145 RoW: Oxygen Delivery Devices Market Size, By Type, 2015–2022 (USD Million)

Table 146 RoW: Market Size, By Portability, 2015–2022 (USD Million)

Table 147 RoW: Market Size, By Application, 2015–2022 (USD Million)

Table 148 RoW: Market for Oxygen Therapy Equipment: Size, By End User, 2015–2022 (USD Million)

List of Figures (46 Figures)

Figure 1 Oxygen Therapy Equipment Market : Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Market Size, By Product, 2017 vs 2022 (USD Million)

Figure 7 Market Size, By Portability, 2017 vs 2022 (USD Million)

Figure 8 Market Size, By Application, 2017 vs 2022 (USD Million)

Figure 9 Market Size, By End User, 2017 vs 2022 (USD Million)

Figure 10 Oxygen Therapy Equipment Market Size, By Region, 2017 vs 2022 (USD Million)

Figure 11 Rising Prevalence of Respiratory Disorders—Major Factor Driving Market Growth

Figure 12 Oxygen Concentrators to Account for the Largest Market Share in 2017

Figure 13 Nasal Cannulas Segment to Register the Highest CAGR During the Forecast Period

Figure 14 Asia-Pacific to Register the Highest CAGR Between 2017 & 2022

Figure 15 Market: Drivers, Restraints, and Opportunities

Figure 16 Number of Hospital Admissions for Asthma and COPD in 2013

Figure 17 Smoking Prevalence (% of Total Population) in Various Countries (2015 vs 2025)

Figure 18 Oxygen Source Equipment to Dominate the Market During the Forecast Period

Figure 19 Oxygen Concentrators to Dominate the Oxygen Source Equipment Market, 2017–2022

Figure 20 Oxygen Masks to Dominate the Oxygen Delivery Devices Market, 2017–2022

Figure 21 Stationary Oxygen Therapy Devices to Dominate the Market During the Forecast Period

Figure 22 COPD Will Continue to Dominate the Oxygen Therapy Equipment Market Until 2022

Figure 23 Home Care Settings to Dominate the Oxygen Therapy Market During the Forecast Period

Figure 24 APAC is Estimated to Be the Fastest-Growing Regional Segment in the Global Oxygen Therapy Equipment Market During the Forecast Period

Figure 25 North America: Market Snapshot

Figure 26 Oxygen Source Equipment to Account for the Larger Market Share in 2017

Figure 27 Oxygen Concentrators to Account for the Largest Share of the U.S. Oxygen Source Equipment Market in 2017

Figure 28 Europe: Oxygen Therapy Equipment Market Snapshot

Figure 29 COPD to Account for the Largest Share of the U.K. Market in 2017

Figure 30 COPD Burden in European Countries

Figure 31 Asia-Pacific: Oxygen Therapy Equipment Market Snapshot

Figure 32 COPD is the Largest Application Segment in the Asia-Pacific Market

Figure 33 Oxygen Source Equipment Segment to Dominate the Oxygen Therapy Equipment Market in Japan

Figure 34 Home Care Settings to Dominate the Oxygen Therapy Equipment End-Users Market in India

Figure 35 Dive Chart

Figure 36 Philips Healthcare: Company Snapshot (2016)

Figure 37 Linde Healthcare: Company Snapshot (2016)

Figure 38 Becton, Dickinson and Company: Company Snapshot (2016)

Figure 39 Taiyo Nippon Sanso Corporation: Company Snapshot (2016)

Figure 40 Smiths Medical: Company Snapshot (2016)

Figure 41 Drägerwerk AG & Co. KGaA: Company Snapshot (2016)

Figure 42 Teleflex Incorporated: Company Snapshot (2016)

Figure 43 Invacare Corporation: Company Snapshot (2016)

Figure 44 Chart Industries, Inc.: Company Snapshot (2016)

Figure 45 Fisher & Paykel Healthcare Corporation Limited: Company Snapshot (2016)

Figure 46 Inogen, Inc.: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Oxygen Therapy Equipment Market