Medical Coating Market

Medical Coating Market by Coating Type (Active, Passive), Material (Polymers, Metals), Application (Medical Devices, Medical Implants, Medical Equipment & Tools), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

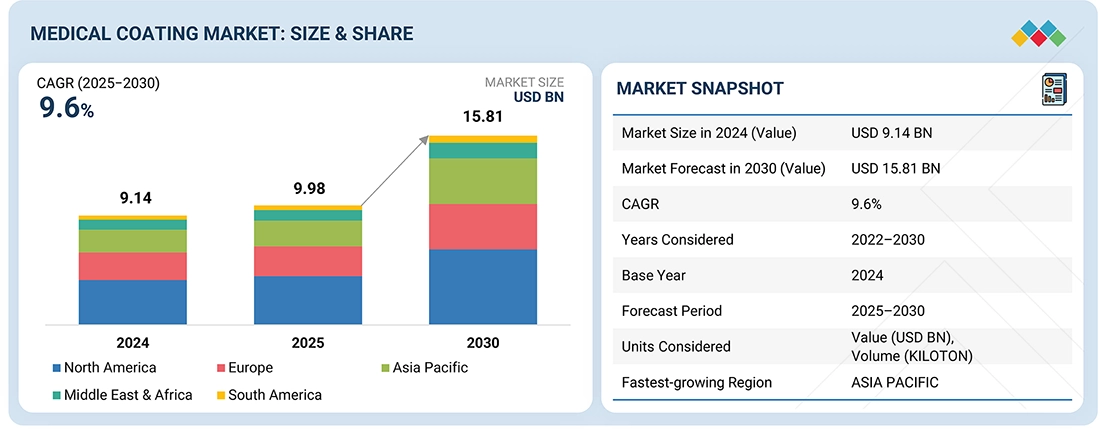

The medical coating market is projected to reach USD 15.81 billion by 2030 from USD 9.98 billion in 2025, at a CAGR of 9.6% from 2025 to 2030. The global medical coatings market is growing due to rising demand for advanced, safe, and infection-resistant medical devices.Technological innovations and expanding healthcare infrastructure in emerging markets are further accelerating this growth.

KEY TAKEAWAYS

-

BY COATING TYPEThe medical coating market by coating type include active coating & passive coating. Passive coatings dominate the medical coatings market as they provide essential surface protection, biocompatibility, and corrosion resistance without altering device function. Their widespread use in implants, catheters, and surgical instruments makes them the preferred choice across diverse medical applications.

-

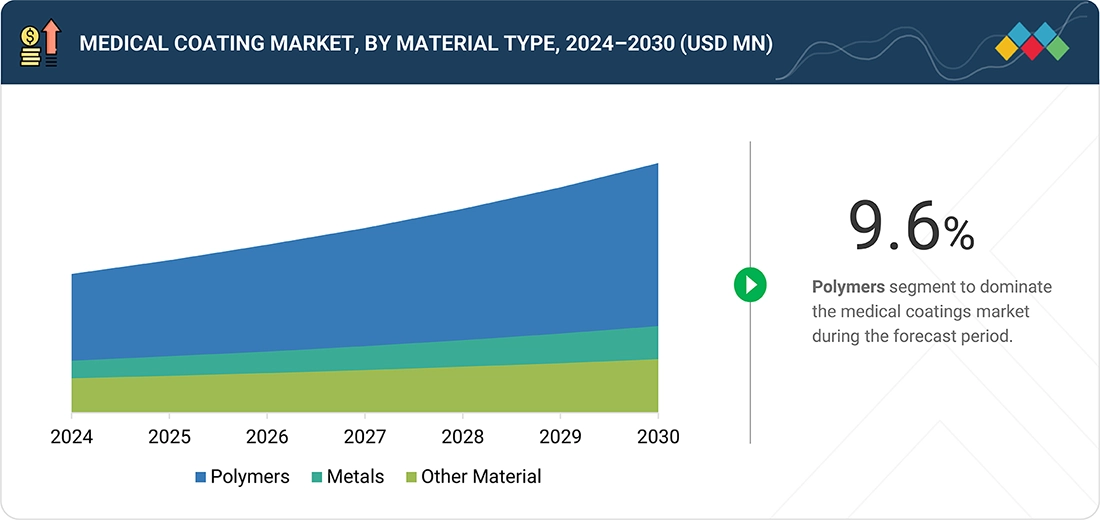

BY MATERIAL TYPEThe medical coating market by material type include polymers, metals and other materials. Polymer-based coatings lead the medical coatings market due to their versatility, biocompatibility, and ability to provide lubricity, flexibility, and chemical resistance. They are extensively applied to catheters, guidewires, and implants to enhance device performance and patient safety

-

BY SUBSTRATEThe medical coatingn market by substrate type include metals, ceramics, polymers, composites, and glass. Metal type is growing fastest in the market.

-

BY APPLICATIONThe medical coatingn market by application type include medical devices, medical implants, medical equipment & tools, protective clothing, and other applications. Medical device application lead the medical coating market.

-

BY REGIONThe medical coating market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. North America leads the medical coating market due to advanced healthcare infrastructure, high healthcare spending, and the presence of major medical device manufacturers..

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. Hydromer (US), DSM-Firmenich (Netherlands), Surmodics (US), Biocoat Incorporated (US), AST Products Inc (US), Covalon Technologies (Canada), Freudenberg Medical (US), Harland Medical Systems, Inc (US), Merit Medical Systems (US), Applied Medical Coatings (US), PPG Industries, Inc. (US) and The Sherwin-Williams Company (US) are som of the major players in the medical coating market.

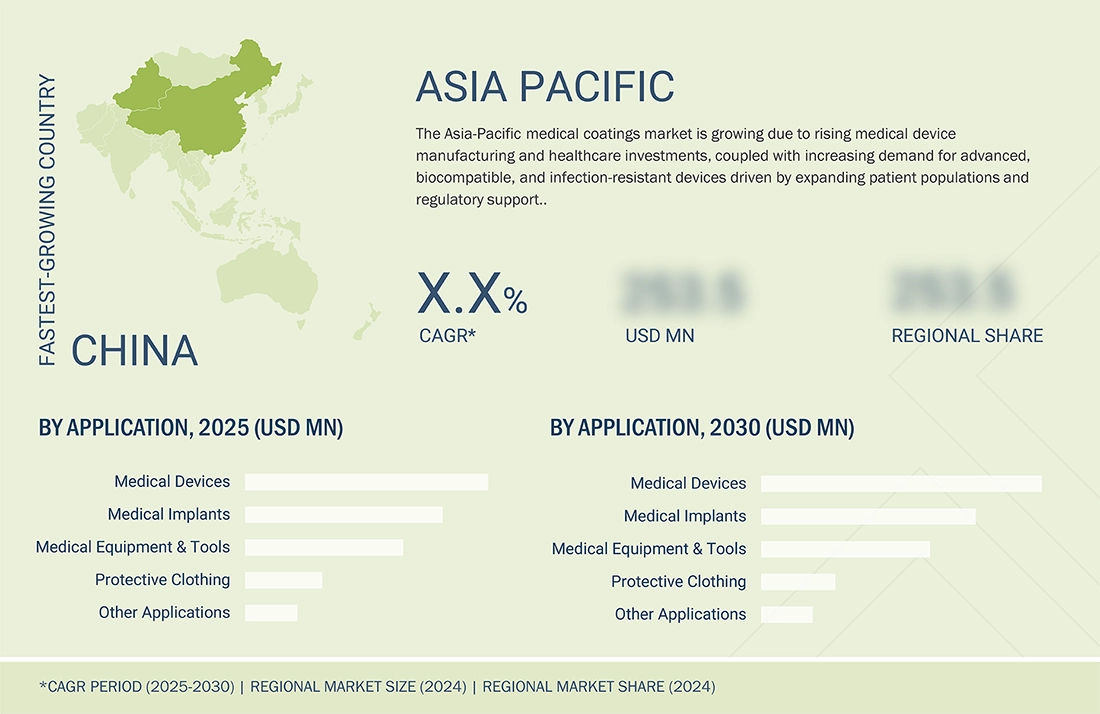

The global medical coatings market is expanding rapidly, driven by growing demand for advanced, infection-resistant medical devices and continuous coating innovations. In regions like China and India, growth is fueled by rising healthcare investments, expanding medical device manufacturing, and stronger regulatory emphasis on patient safety.

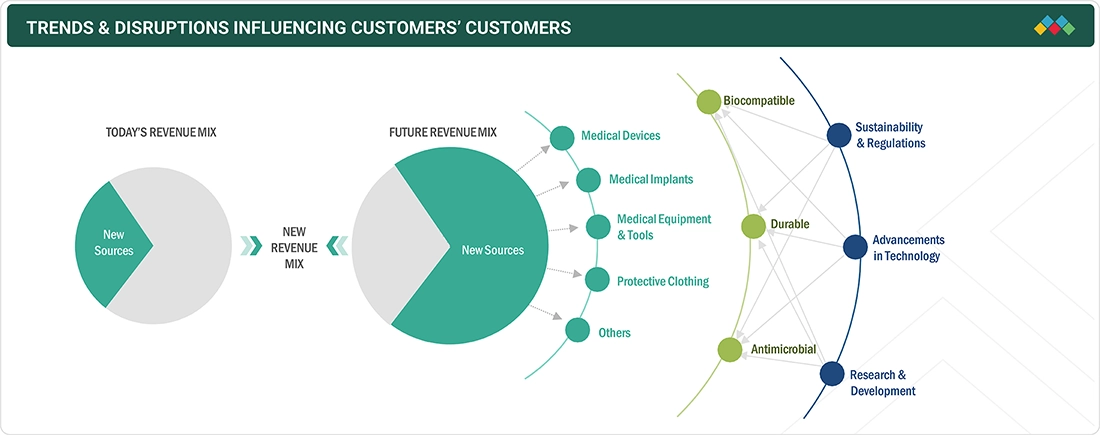

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of medical coating products suppliers, which, in turn, impacts the revenues of medical coating product manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing Prevalence of Chronic Diseases and Aging Population

-

Growth in minimally invasive surgeries and medical device usage.

Level

-

Short shelf life and durability issue

-

Raw material price volatility and high costs

Level

-

Rise in demand for antimicrobial and drug-eluting coatings

-

Technological advancements and nanotechnology

Level

-

Biocompatibility and durability concerns

-

Complex applications and quality control

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Increasing Prevalence of Chronic Diseases and Aging Population

The growth of the medical coating market is primarily driven by the high prevalence of chronic diseases and an aging population. Chronic diseases are conditions lasting a year or more that require ongoing medical care, such as diabetes, cardiovascular diseases, and arthritis. These conditions often need specialized treatments involving coated devices to ensure safe and effective patient outcomes, including stents, catheters, and diagnostic devices. Many of these devices use coatings that are biocompatible, lubricious, antimicrobial, or a combination of these qualities, which can enhance device performance and increase patient safety. Globally, the average age of populations aged 30 and older is around 59.8%, and in emerging economies like India, China, and Brazil, the older population will lead to a higher demand for medical procedures and surgeries, including minimally invasive surgeries, which often rely on coated devices. Coatings improve patient outcomes by reducing complications, increasing device durability, and supporting advancements in healthcare technology. The market opportunity in Asia-Pacific countries is especially significant, with rising chronic disease rates and investments in healthcare infrastructure; companies like Hydromer and Surmodics are developing innovative coatings that offer enhanced durability

Restraint: Short Shelf Life and Durability Issues

One of the major limitations in the development of the medical coatings market is the imposed shelf life and durability of various coatings. Medical coatings are expected to perform effectively over time during storage and after being applied to medical device surfaces. Many coatings, especially those containing bioactive agents, hydrophilic properties, or drug-eluting capabilities, are sensitive to environmental factors such as temperature, humidity, and light. These sensitivities can shorten shelf life, requiring strict storage conditions and rapid usage, which increases operational complexity and costs for manufacturers and healthcare providers. Similarly, coatings used on medical devices are designed to withstand sterilization methods (like autoclaving, gamma radiation, or ethylene oxide), exposure to bodily fluids, and mechanical stress during use. Since some patients are more vulnerable to harsh conditions, inadequate durability to withstand sterilization procedures, environmental factors, or physical changes can reduce coating performance or, worse, lead to adverse effects on patient safety, such as particle release or delamination. This issue can arise with implantable devices or other medical devices—whether implanted or not—such as catheters or reusable surgical instruments—where long-term reliability is essential

Opportunity: Rise in Demand for Antimicrobial and Drug-eluting Coating

There is a growing demand for antimicrobials and drug-eluting coatings, which represent a large and expanding segment of the medical coatings market. Healthcare-associated infections (HAIs) raise concerns worldwide, leading to longer hospital stays, higher costs for healthcare systems, and increased mortality rates. These challenges have driven a rising preference for antimicrobial coatings on medical devices, such as catheters, implants, surgical instruments, and topical dressings. Ultimately, these coatings on medical devices suppress or prevent bacterial colonization and biofilm formation on surfaces, effectively reducing the risk of infections and improving patient outcomes. Drug-eluting coatings have gained significant attention in recent years because they enable the localized delivery of therapeutic agents precisely at the time of implantation or intervention. In some cases, this can be highly beneficial for the patient, especially in cardiovascular applications. For example, drug-eluting stents can aid patients at risk of coronary occlusion by providing an immediate anti-proliferative dose to the arterial wall and helping to prevent (or at least minimize) stent restenosis. Similar considerations apply to orthopedic implants, where drug-eluting coatings may help reduce the risk of peri-operative inflammation or infection and promote a faster recovery. There is burgeoning demand for coatings that enable to delivery of active agents where recommended care includes the patients co-morbidity, an aging global population, and/or increasing volume of surgical procedures. To this extent, as device functionality increases with the deliberation of less invasive and implantable therapies through medical technology, so does the emergence of antimicrobial and drug-eluting coatings

Challenge:Biocompatibility and Durability Concerns

Biocompatibility and durability challenges continue to be obstacles in the medical coatings market, directly affecting safety, performance, and regulatory approval. Medical coatings are used on devices that directly contact body tissues, fluids, or organs. Therefore, the coating must not trigger a biological response, such as toxicity, inflammation, allergic reactions, or rejection by the immune system. Balancing biocompatibility and functionality is complex because the chemistries of the coatings must be designed to ensure safety while still performing their intended functions. For instance, many antimicrobial and drug-eluting coatings may contain active agents or additives that could pose biocompatibility risks if not properly regulated. Similarly, although some hydrophilic and lubricious coatings can enhance mobility and comfort for patients, they may delaminate under physiological conditions, potentially generating debris or flake particulates that could cause inflammation or device failure. These issues present critical safety concerns, especially for any implantable or long-term devices. As medical devices become more sophisticated and multifunctional, ensuring coating stability, durability, and compatibility with human biology will be essential. Future progress depends on a continued commitment to materials science innovation and the development of advanced formulation technologies to demonstrate long-term safety and efficacy

Medical Coating Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Applies biocompatible and hemocompatible coatings on cardiovascular implants and catheters. | Enhances blood compatibility, minimizes thrombosis risk, and improves long-term implant performance.. |

|

Uses drug-eluting and antimicrobial coatings for stents and catheters | Reduces restenosis and infection risk; ensures faster healing and longer device life. |

|

Uses bioactive hydroxyapatite coatings on joint and dental implants | Improves tissue bonding, accelerates osseointegration, and enhances implant stability. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The medical coating ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material supplies, equipment suppliers, manufacturers, distributors, and end users. The raw material suppliers provide polymers, agents, additives and others to medical coating manufacturers. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Medical coating Market, By Material Type

Polymers represent the largest segment of the medical coatings market by material type due to their flexibility, biocompatibility, and ability to meet various functional needs. Polymer-based medical coatings are most commonly used to give medical devices desirable properties such as flexibility, lubricity, chemical resistance, and durability. Their flexibility allows polymers to be manufactured for passive uses, like hydrophilic and anti-thrombogenic coatings, as well as active uses, such as drug-eluting or antimicrobial coatings. A primary reason for polymers' popularity is their compatibility with a variety of substrates used in medical devices, including metals, plastics, and ceramics. Additionally, different coating methods—such as dip coating, spray coating, and spin coating—can be used with polymers, resulting in less expensive and scalable manufacturing processes. Commonly used polymers include polyurethane, PTFE, polyethylene glycol (PEG), and polyvinylpyrrolidone (PVP), as these have proven safety records and effective performance in the medical device industry. The rising demand for minimally invasive devices, implantable systems, and long-term indwelling catheters has driven increased use of polymer coatings that ensure patient safety and comfort. As advancements in nanotechnology continue to evolve biomedical polymers, these materials are well-positioned to remain the leading choice within the medical coatings market for the foreseeable future

Medical Coating Market, By Coating Type

Passive coatings constitute the largest segment in the medical coatings market because they are versatile, inexpensive, and safe. Since passive coatings act as barriers to protect the surface of implants or devices, they improve surface features such as lubricity, corrosion resistance, and biocompatibility without actively releasing any agents. An example of a passive coating that draws attention in the medical market is hydrophilic coatings. Increased surface lubricity results in less force needed to insert a device like a catheter, guidewire, or endoscope into a patient's body, reducing tissue trauma or damage and enhancing patient comfort. Passive coatings remain inert and chemically stable across a wide range of applications, covering nearly all medical devices: surgical instruments, implants, diagnostic equipment, and more. Compared to active coatings (such as antimicrobial or drug-eluting), passive coatings avoid the complexities of drug release, which include additional regulatory hurdles and manufacturing challenges. These obstacles often make production simpler and allow for easier integration into high-value or high-volume applications

REGION

Asia Pacifi to be fastest-growing region in global medical coating market during forecast period

Asia Pacific is the fastest-growing region in the medical coating market during the forecast period. Governments across the Asia-Pacific region are actively promoting the growth of domestic medical technology markets through initiatives like China's "Made in China 2025" and India's "Make in India" campaign, focusing on producing locally manufactured high-value medical equipment, including coated devices. This dedication to expanding local manufacturing capacity drives strong demand for medical coatings that enhance safety, performance, and device longevity. The region offers additional benefits such as lower manufacturing costs and a large skilled labor force, attracting more global medical device developers and manufacturers to establish production facilities there. Increased adoption of minimally invasive procedures and the development of innovative coatings, like hydrophilic and antimicrobial options, are also boosting overall market growth. Rising awareness of infection control, a growing patient population, and ongoing innovation in devices and coatings will ensure that Asia Pacific continues to grow rapidly, making it the fastest-growing region for medical coatings in the coming years

Medical Coating Market: COMPANY EVALUATION MATRIX

In the medical coting market matrix, DSM-Firmenich (Star), a Netherlands based company, leads the market through its high-quality medical coating products, which find extensive applications in various applications such as devics, implnts and others.Applied Metal Coatings (Emerging Leader) is gaining traction with its technological advancements in medical coatings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 9.14 Billion |

| Market Forecast in 2030 (Value) | USD 15.81 Billion |

| Growth Rate | CAGR of 9.6% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

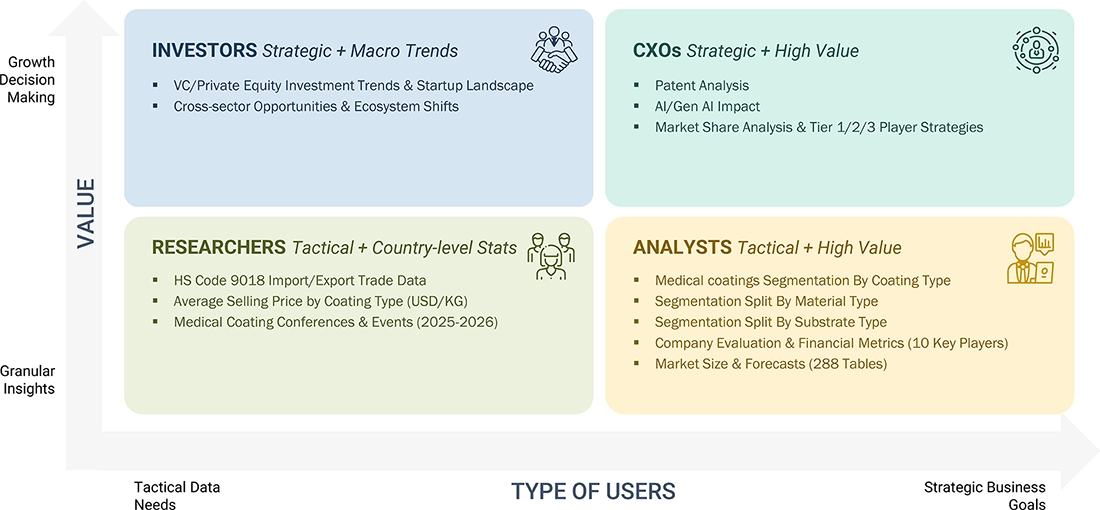

WHAT IS IN IT FOR YOU: Medical Coating Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Medical Coating Produts Supplier |

|

Supported go-to-market strategy and positioning vs competitors |

| Country-level insights for high-growth regions | Provided detailed market sizing and forecasts for the U.S., Germany, China, India, and Japan | Helped the client identify region-specific growth hotspots and investment opportunities |

RECENT DEVELOPMENTS

- January 2025 : Hydromer introduced PFAS-free hydrophilic coatings for medical devices

- June 2024 : Hydromer launched HydroThrombX, an advanced version of its legacy F200t thromboresistant coating

- September 2023 : Harland Medical Systems opened a new office in Caesarea, Israel, further strengthening its international presence

- March 2022 : Biocoat, Inc. expanded into the design and delivery of hydrophilic dip coating equipment with the launch of its EMERSE product line

- Feburary 2023 : Biocoat, Inc. introduced HYDAK UV, a new version of its original HYDAK hydrophilic coating, engineered for curing with ultraviolet (UV) light.

Table of Contents

Methodology

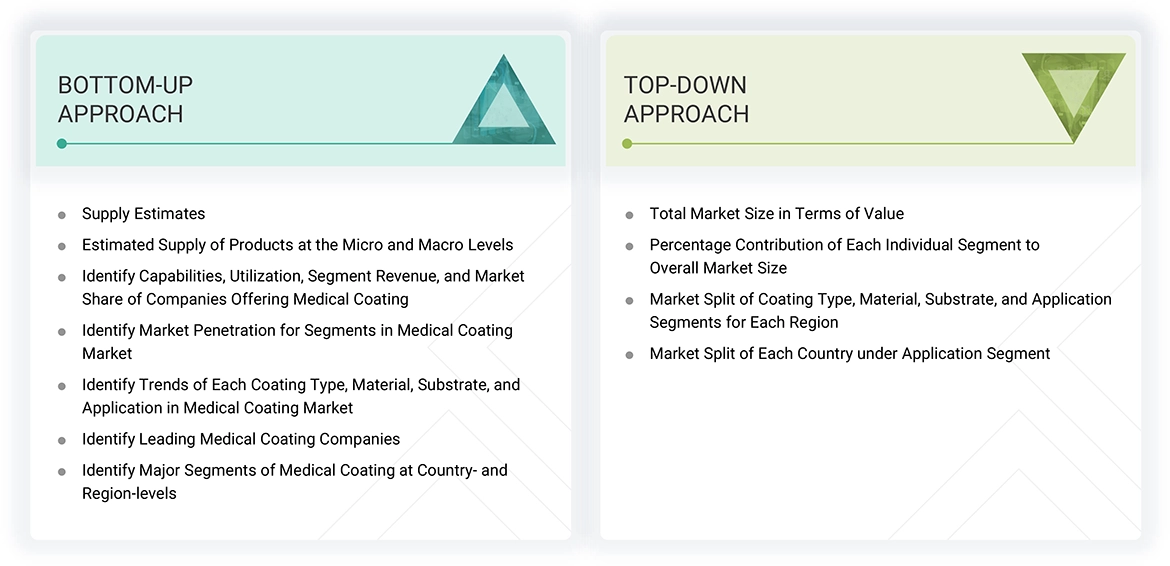

The study involved four main activities to estimate the market size of the medical coating industry. Extensive secondary research was conducted to gather information on the market, the peer market, and the larger market segments. The next step was to validate these findings, assumptions, and size estimates with industry experts across the supply chain through primary research. Both top-down and bottom-up approaches were used to calculate the overall market size. Then, market segmentation and data triangulation methods were applied to estimate the sizes of segments and subsegments.

Secondary Research

During the secondary research process, various sources were referenced to gather information for this study. These sources include annual reports, press releases, investor presentations from companies, white papers, certified publications, trade directories, articles by recognized authors, reputable websites, and databases. Secondary research helped identify key details about the industry’s value chain, market monetary chain, the complete list of key players, market classification and segmentation based on industry trends down to the regional level. It also provided insights into major developments from a market-oriented perspective.

Primary Research

The medical coating market includes several stakeholders in the value chain, such as manufacturers and end users. Various primary sources from both the supply and demand sides of the market have been interviewed to collect qualitative and quantitative information. On the demand side, key opinion leaders in industrial sectors were interviewed, while on the supply side, manufacturers, associations, and institutions involved in the medical coating industry were engaged. These primary interviews provided insights into market statistics, revenue data, market breakdowns, market size estimates, projections, and data triangulation. They also helped in understanding trends related to coating type, material type, substrate type, application, and region. Stakeholders from the demand side, including CIOs, CTOs, and CSOs, were interviewed to gain perspectives on suppliers, products, current usage of medical coatings, and business outlook, all of which influence the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the medical coating market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Data Triangulation

After estimating the total market size, the overall market was divided into several segments and sub-segments. To complete the market engineering process and determine precise statistics for each segment and sub-segment, data triangulation and market breakdown methods were used where applicable. The data was triangulated by analyzing various factors and trends from both demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches, along with primary interviews. Therefore, for each data segment, three sources were used—top-down approach, bottom-up approach, and expert interviews. The data was considered accurate when the values from all three sources aligned.

Market Definition

Medical coatings are specialized layers or films applied to medical devices, instruments, and implants to reduce risks, improve performance, and enhance their longevity and durability. They are designed to provide benefits such as inhibiting the growth of microorganisms (e.g., anti-microbial), resisting corrosion, increasing lubricity, and improving biocompatibility. These features help devices function reliably within the body while meeting strict legal and regulatory standards. Medical coatings are essential for lowering infection risks and improving health outcomes.

Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

- Manufacturers

- Raw Material Suppliers

Report Objectives

- To define, describe, and forecast the size of the medical coating market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on coating type, material, substrate, application, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies.

Key Questions Addressed by the Report

What is the current size of the global medical coating market?

The medical coating market is projected to reach USD 15,813.6 million by 2030 from USD 9,983.0 million in 2025, at a CAGR of 9.6% during the forecast period.

Who are the key players in the global medical coating market?

Key players include Hydromer (US), DSM-Firmenich (Netherlands), Surmodics (US), Biocoat Incorporated (US), AST Products Inc (US), Covalon Technologies (Canada), Freudenberg Medical (US), Harland Medical Systems (US), Merit Medical Systems (US), Applied Medical Coatings (US), PPG Industries (US), and The Sherwin-Williams Company (US). These companies have strong potential to expand their product portfolios and compete in the global market.

What are some of the drivers for market growth?

Growth is driven by rising healthcare expenditure, increasing geriatric population, prevalence of chronic diseases, and growing demand for minimally invasive surgeries.

What are the different coating types used in medical coating?

Active and passive coatings are the most commonly used types in the medical coating market.

What are the major materials in the medical coating market?

The primary materials used are polymers and metals.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Medical Coating Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Medical Coating Market