Antimicrobial Coatings for Medical Devices Market by Type of Material (Metallic Coatings (Silver Coatings), Non-metallic Coatings (Polymeric Coatings) & Device Type (Catheters, Implantable Devices, Surgical Instruments) - Global Forecast to 2020

The antimicrobial coatings for medical devices market is segmented on the basis of type of material, device types, and regions. The global antimicrobial coatings for medical devices market is expected to grow at a CAGR of 14.2% from 2015 to 2020 to reach USD 1.17 Billion by 2020 from USD 0.61 Billion in 2015. Factors such as rising awareness about hospital-acquired infections, favorable research and funding environment, technological advancements in antimicrobial coatings, growing implantable devices market, increasing research and development activities for antimicrobial coated cardiovascular devices, high growth in geriatric population, and increasing burden of cardiovascular diseases across the globe are driving the growth of this market. Moreover, factors such as growing healthcare market in emerging economies, and increasing number of free trade agreements are likely to create significant growth opportunities for players operating in the antimicrobial coatings market for medical devices in the coming years.

However, factors such as limitations of silver coatings, presence of time and resource intensive processes for development and approval of antimicrobial coating products, and unfavorable healthcare reforms in the U.S. are hindering the growth of this market.

Some of the major players in the global antimicrobial coatings for medical devices market include BASF SE (Germany), AST Products, Inc. (U.S.), BioInteractions LTD (U.K.), Covalon Technologies LTD (Canada), Sciessent LLC (U.S.), Royal DSM (The Netherlands), Specialty Coating Systems, Inc. (U.S.), The Dow Chemical Company (U.S.), Hydromer, Inc. (U.S.), and PPG Industries, Inc. (U.S.).

Scope of the Report : Antimicrobial Coatings for Medical Devices Market

This research report categorizes the antimicrobial coatings market for medical devices into the following segments and sub segments:

Antimicrobial Coatings for Medical Devices Market, by Type of Material

- Metallic Coatings Market

- Silver Coatings

- Copper Coatings

- Other Metallic Coatings

- Non-Metallic Coatings Market

- Polymeric Coatings

- Organic Coatings

Antimicrobial Coatings for Medical Devices Market, by Device Type

- Catheters

- Implantable Devices

- Surgical Instruments

- Others

Antimicrobial Coatings for Medical Devices Market, by Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Rest of Europe (RoE)

- Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific (RoAPAC)

- Rest of the World (RoW)

Antimicrobial coatings are used in medical devices in order to destroy or inhibit the growth of microorganisms. The market for antimicrobial coatings for medical devices covers the type of materials used for coating, and the types of devices on with the antimicrobial coatings are embedded. The medical devices include catheters, implantable devices, surgical instruments, mandrels & molds, and elastomeric seals, among others.

The global antimicrobial coatings for medical devices market is segmented on the basis of types of materials, device types, and regions. Based on type of materials, the market is segmented into : Metallic Coatings and Non-Metallic Coatings. Metallic Coatings is further segmented into Silver Coatings, Copper Coatings, and Other Metallic Coatings (Zinc and Titanium coatings). Non-Metallic Coatings is categorized into Polymeric Coatings, and Organic Coatings. The Silver coatings segment is expected to have the largest share of the global metallic antimicrobial coatings for medical devices market in 2015.Whereas, the polymeric coatings segment is expected to have the largest share of the global non-metallic antimicrobial medical devices coatings market in 2015.

Based on device type, the market is segmented into catheter, implantable devices, surgical instruments, and others (mandrels & molds, guidewires, epidural needles, and elastomeric seals).

The key factors that are expected to spur the growth of this market are as rising awareness about hospital-acquired infections, favorable research and funding environment, technological advancements in antimicrobial coatings, growing implantable devices market, increasing research and development activities for antimicrobial coated cardiovascular devices, high growth in geriatric population, and increasing burden of cardiovascular diseases across the globe. Moreover, factors such as growing healthcare market in emerging economies, and increasing number of free trade agreements are likely to create significant growth opportunities for players operating in the antimicrobial for medical devices coatings market in the coming years. However, lack of FDA guidelines and regulations for antimicrobial coating techniques is likely to pose as a deterrent for the growth of this market.

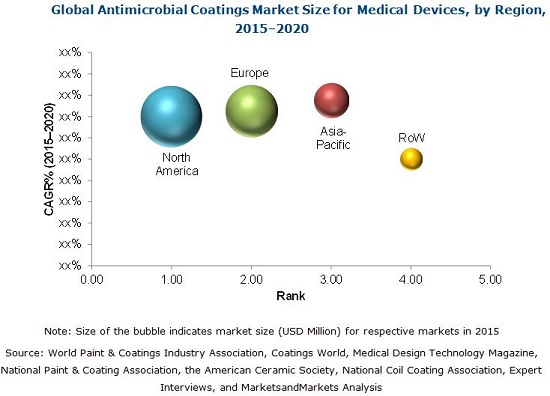

On the basis of regions, this market is classified into North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

The global antimicrobial coatings for medical devices market is expected to grow at a CAGR of 14.2% from 2015 to 2020 to reach USD 1.17 Billion by 2020 from USD 0.61 Billion in 2015. The market is dominated by North America, followed by Europe, Asia-Pacific, and the Rest of the World (RoW). Asia-Pacific is expected to grow at the fastest rate during the forecast period.

Some of the major players in the global antimicrobial coatings for medical devices market include BASF SE (Germany), AST Products, Inc. (U.S.), BioInteractions LTD (U.K.), Covalon Technologies LTD (Canada), Sciessent LLC (U.S.), Royal DSM (The Netherlands), Specialty Coating Systems, Inc. (U.S.), The Dow Chemical Company (U.S.), Hydromer, Inc. (U.S.), and PPG Industries, Inc. (U.S.).

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Methodology Steps

2.2 Secondary and Primary Research Methodology

2.2.1 Secondary Research

2.2.2 Primary Research

2.2.2.1 Key Industry Insights

2.2.2.2 Key Data From Primary Sources

2.2.2.3 Key Insights From Primary Sources

2.3 Market Size Estimation Methodology

2.4 Research Design

2.5 Market Data Validation and Triangulation

2.6 Assumptions for the Study

3 Executive Summary (Page No. - 31)

3.1 Introduction

3.2 Current Scenario

3.3 Future Outlook

3.4 Conclusion

4 Premium Insights (Page No. - 36)

4.1 Overview

4.2 Global Antimicrobial Coatings for Medical Devices Market, By Type of Material

4.3 Geographic Analysis of the Market, By Device Type

4.4 Metallic Antimicrobial Coatings for Medical Devices Market, By Type

4.5 Geographical Snapshot

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Awareness About Hospital-Acquired Infections

5.2.1.2 Favorable Research and Funding Environment

5.2.1.2.1 Grants By Australian Government to the University of New South Wales

5.2.1.2.2 Funding By the European Union for Projects on Antimicrobial Resistance Fp5-Fp7

5.2.1.2.3 Funding By Innovate Uk for Accentus Medicals Antimicrobial Project

5.2.1.2.4 Grant By the European Commission to the Institute of Biomaterial

5.2.1.2.5 Funding By the European Union for the Nomorfilm Consortium

5.2.1.2.6 Grants By Small Business Innovation Research (SBIR) for Isurtecs Antimicrobial Technologies

5.2.1.3 Technological Advancements in Antimicrobial Coatings

5.2.1.3.1 Parylene Technology By Specialty Coating Systems

5.2.1.3.2 Nanocomposite Coating Technology By the University of Dundee (U.K.)

5.2.1.3.3 Novel Coating Technology By the University of South Australia

5.2.1.4 Growing Implantable Devices Market

5.2.1.5 Increasing Research and Development Activities for Antimicrobial Coated Cardiovascular Devices

5.2.1.6 High Growth in Geriatric Population

5.2.1.7 Increasing Burden of Cardiovascular Diseases Across the Globe

5.2.2 Restraints

5.2.2.1 Limitations of Silver Ion Coatings

5.2.2.2 Presence of Time- and Resource-Intensive Processes for Development and Approval of Antimicrobial Coating Products

5.2.2.3 Unfavorable Healthcare Reforms in the U.S.

5.2.3 Opportunities

5.2.3.1 Growing Healthcare Market in Emerging Economies

5.2.3.2 Increasing Number of Free Trade Agreements

5.2.4 Burning Issues

5.2.4.1 Lack of FDA Guidelines and Regulations for Antimicrobial Coating Techniques

6 Regulatory Assessment- Antimicrobial Coated Medical Devices (Page No. - 51)

6.1 Introduction

6.2 U.S.

6.2.1 Introduction

6.2.2 FDA Devices Classification

6.2.3 The Regulatory Process

6.2.4 The U.S. Regulatory Approval Timeline Assesment

6.2.5 Major Hurdle in the Regulatory Process

6.3 Europe

6.3.1 Introduction

6.3.2 Environmental Protection Agency (EPA) Devices Classification

6.3.3 The Regulatory Process

6.3.4 European Regulatory Approval Timeline Assesment

6.3.5 Major Hurdle in the Regulatory Process

6.4 Japan

6.4.1 Introduction

6.4.2 Pmda Devices Classification

6.4.3 The Regulatory Process

6.4.4 Japanese Regulatory Approval Timeline Assesment

6.4.5 Major Hurdle in the Regulatory Process

6.5 China

6.5.1 Introduction

6.5.2 Cfda Devices Classification

6.5.3 The Regulatory Process

6.5.4 Chinese Regulatory Approval Timeline Assesment

6.5.5 Major Hurdle in the Regulatory Process

6.6 India

6.6.1 Introduction

6.6.2 The Regulatory Process

6.6.3 Indian Regulatory Approval Timeline Assesment

6.6.4 Major Hurdle in the Regulatory Process

6.7 Australia

6.7.1 Introduction

6.7.2 Atg Devices Classification

6.7.3 The Regulatory Process

6.7.4 Australian Regulatory Approval Timeline Assesment

6.7.5 Major Hurdle in the Regulatory Process

7 Antimicrobial Coating Market for Medical Devices, By Type of Material (Page No. - 69)

7.1 Introduction

7.2 Metallic Coatings

7.2.1 Silver

7.2.2 Copper

7.2.3 Other Metallic Coatings

7.3 Non-Metallic Coatings

7.3.1 Polymeric Coatings

7.3.2 Organic Coatings

8 Antimicrobial Coatings Market for Medical Devices, By Device Type (Page No. - 81)

8.1 Introduction

8.2 Catheters

8.3 Implantable Devices

8.4 Surgical Instruments

8.5 Other Devices

9 Antimicrobial Coatings Market for Medical Devices, By Region (Page No. - 88)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.1.1 Rising Prevalence of Hospital-Acquired Infections in the U.S.

9.2.1.2 Development of Newer Technologies By U.S. Companies

9.2.1.3 Stringent Regulations on Antimicrobial-Coated Medical Devices in the U.S.

9.2.1.4 Growing Number of Cardiovascular Diseases

9.2.1.5 Rising Prevalence of Chronic Diseases and Increasing Aging Population in the U.S.

9.2.1.6 Rising Prevalence of Diabetes in the U.S. to Drive the Market for Diabetic Foot Medical Equipment

9.2.2 Canada

9.2.2.1 Growing Medical Devices Industry in Canada

9.2.2.2 Rising Incidences of Hospital-Acquired Infections in Canada

9.3 Europe

9.3.1 Increasing Funding for Antimicrobial Coatings in Europe

9.3.2 Rapidly Aging Population in Europe

9.3.3 Germany

9.3.3.1 Expansions and Innovations in Antimicrobial Coatings

9.3.3.2 The Growing Medical Device Industry in Germany

9.3.3.3 Rising Cases of Hip and Knee Replacement in Germany

9.3.4 U.K.

9.3.4.1 Research Activities in the U.K.

9.3.5 France

9.3.5.1 Rising Prevalence of Diabetes

9.3.6 Rest of Europe (RoE)

9.4 Asia-Pacific

9.4.1 Increasing Number of Hospitals in India and China

9.4.2 Japan

9.4.2.1 Japans Growing Healthcare Industry

9.4.3 China

9.4.3.1 Growing Number of Cardiovascular Diseases and Increasing Aging Population

9.4.3.2 Licensing Agreement and Expansion Strategies Adopted By Coating Manufacturers in China

9.4.3.3 Chinas Increasing Demand for High-Quality Medical Devices

9.4.4 India

9.4.4.1 Increasing Number of Endoscopic Surgeries

9.4.4.2 Increasing Geriatric Population in India

9.4.5 Rest of Asia-Pacific (RoAPAC)

9.4.5.1 Increasing Research Activities in Singapore & Australia

9.4.5.2 Indonesian Medical Devices Market Faces Stringent Regulations

9.5 Rest of the World (RoW)

9.5.1 Increasing Aging Population and the Subsequent Rise in Age-Related Disorders in the Middle East

9.5.2 Favorable Business Environment in Middle East

9.5.3 Rising Obesity in Mexico, Chile, Panama, Argentina, and Costa Rica

9.5.4 The Healthcare System in Brazil Offers Various Opportunities for Medical Device Manufacturers

9.5.5 Market Scenario in Argentina, Latin America, and South Africa

10 Competitive Landscape (Page No. - 129)

10.1 Overview

10.2 Competitive Situation and Trends

10.2.1 Agreements, Collaborations, and Partnerships

10.2.2 Expansion

10.2.3 Marketing & Promotion

10.2.4 Others

10.3 Empirical Assessment of Growth Strategies

10.3.1 Route to Growth: Organic Or Inorganic Strategies

10.3.1.1 Organic Growth Strategies

10.3.1.2 Inorganic Growth Strategies

10.4 Competitive Developments Mapping

11 Company Profiles (Page No. - 136)

11.1 Introduction

11.2 BASF SE

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.3 Covalon Technologies Ltd.

11.3.1 Business Overview

11.3.2 Products & Services

11.3.3 Recent Developments

11.4 Royal DSM

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 MnM View

11.5 The DOW Chemical Company

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.6 Hydromer, Inc.

11.6.1 Business Overview

11.6.2 Products and Services

11.6.3 Recent Developments

11.6.4 MnM View

11.7 PPG Industries, Inc.

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments

11.7.4 MnM View

11.8 AST Products, Inc.

11.8.1 Business Overview

11.8.2 Financials

11.8.3 Products & Services

11.8.4 MnM View

11.9 Biointeractions Ltd

11.9.1 Business Overview

11.9.2 Financials

11.9.3 Products Offered

11.9.4 Recent Developments

11.10 Sciessent LLC

11.10.1 Business Overview

11.10.2 Financials

11.10.3 Products Offered

11.10.4 Recent Developments

11.11 Specialty Coating Systems, Inc.

11.11.1 Business Overview

11.11.2 Financials

11.11.3 Product & Services

11.11.4 Recent Developments

11.11.5 MnM View

12 Appendix (Page No. - 155)

12.1 Discussion Guide

12.2 Company Developments (20122015)

12.2.1 Specialty Coatings System, Inc.

12.2.2 Hydromer, Inc.

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Report

List of Tables (84 Tables)

Table 1 Rising Awareness About Hospital-Acquired Infections is Propelling the Growth of This Market

Table 2 Limitations of Silver Ion Coatings Restrain the Growth of This Market

Table 3 The Growing Healthcare Market in Emerging Regions to Offer Huge Opportunity for the Market

Table 4 Lack of FDA Guidelines and Regulations for Antimicrobial Coatings Techniques- A Burning Issue

Table 5 Global Antimicrobial Coatings for Medical Devices Market Size, By Type of Material, 2013-2020 (USD Million)

Table 6 Global Metallic Antimicrobial Coatings for Medical Devices Market Size, By Type, 2013-2020 (USD Million)

Table 7 Global Metallic Antimicrobial Coatings for Medical Devices Market Size, By Region, 2013-2020 (USD Million)

Table 8 Global Silver Antimicrobial Coatings for Medical Devices Market Size, By Region, 2013-2020 (USD Million)

Table 9 Global Copper Antimicrobial Coatings for Medical DevicesMarket Size , By Region, 2013-2020 (USD Million)

Table 10 Global Other Metallic Antimicrobial Coatings for Medical Devices Market Size, By Region, 2013-2020 (USD Million)

Table 11 Global Non-Metallic Antimicrobial Coatings for Medical Devices Market Size, By Type, 2013-2020 (USD Million)

Table 12 Global Non-Metallic Antimicrobial Coatings for Medical Devices Market Size, By Region, 2013-2020 (USD Million)

Table 13 Polymers Used for Medical Devices

Table 14 Global Polymeric Antimicrobial Coatings for Medical Devices Market Size, By Region, 2013-2020 (USD Million)

Table 15 Global Organic Antimicrobial Coatings for Medical Devices Market Size, By Region, 2013-2020 (USD Million)

Table 16 Antimicrobial Coatings for Medical Devices Market, By Device Type, 2013-2020 (USD Million)

Table 17 Antimicrobial Coatings Market Size for Catheters, By Region, 2013-2020 (USD Million)

Table 18 Market Sizef or Implantable Devices, By Region, 2013-2020 (USD Million)

Table 19 Market Size for Surgical Instruments, By Region, 2013-2020 (USD Million)

Table 20 Market Size for Other Devices, By Region, 2013-2020 (USD Million)

Table 21 for Medical Devices Market Size, By Region, 20132020 (USD Million)

Table 22 North America: Antimicrobial Medical Devices Coatings Market Size, By Country, 20132020 (USD Million)

Table 23 North America: Antimicrobial for Medical Devices Coatings Market Size, By Type of Material, 20132020 (USD Million)

Table 24 North America: Metallic Antimicrobial for Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 25 North America: Non-Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 26 North America: Antimicrobial Medical Devices Coatings Market Size, By Device Type, 20132020 (USD Million)

Table 27 U.S.: Antimicrobial Medical Devices Coatings Market Size, By Type of Material, 20132020 (USD Million)

Table 28 U.S.: Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 29 U.S.: Non-Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 30 U.S.: Antimicrobial Medical Devices Coatings Market Size, By Device Type, 20132020 (USD Million)

Table 31 Canada: Antimicrobial Medical Devices Coatings Market Size, By Type of Material, 20132020 (USD Million)

Table 32 Canada: Metallic Antimicrobial Coatings for Medical Devices Market Size, By Type, 20132020 (USD Million)

Table 33 Canada: Non-Metallic Antimicrobial Coatings for Medical Devices Market Size, By Type, 20132020 (USD Million)

Table 34 Canada: Antimicrobial Medical Devices Coatings Market Size, By Device Type, 20132020 (USD Million)

Table 35 Europe: Antimicrobial Medical Devices Coatings Market Size, By Country, 20132020 (USD Million)

Table 36 Europe: Antimicrobial Medical Devices Coatings Market Size, By Type of Material, 20132020 (USD Million)

Table 37 Europe: Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 38 Europe: Non-Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 39 Europe: Antimicrobial Medical Devices Coatings Market Size, By Device Type, 20132020 (USD Million)

Table 40 Germany: Antimicrobial Medical Devices Coatings Market, By Type of Material, 20132020 (USD Million)

Table 41 Germany: Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 42 Germany: Non-Metallic Antimicrobial Coatings for Medical Devices Market Size, By Type, 20132020 (USD Million)

Table 43 Germany: Market Size, By Device Type, 20132020 (USD Million)

Table 44 U.K.: Market Size, By Type of Material, 20132020 (USD Million)

Table 45 U.K.: Metallic Antimicrobial Coatings for Medical Devices Market Size, By Type, 20132020 (USD Million)

Table 46 U.K.: Non-Metallic Antimicrobial Coatings for Medical Devices Market Size, By Type, 20132020 (USD Million)

Table 47 U.K.: Market Size, By Device Type, 20132020 (USD Million)

Table 48 France: Antimicrobial Medical Devices Coatings Market Size, By Type of Material, 20132020 (USD Million)

Table 49 France: Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 50 France: Non-Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 51 France: Antimicrobial Medical Devices Coatings Market Size, By Device Type, 20132020 (USD Million)

Table 52 RoE: Antimicrobial Medical Devices Coatings Market Size, By Type of Material, 20132020 (USD Million)

Table 53 RoE: Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 54 RoE: Non-Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 55 RoE: Antimicrobial Medical Devices Coatings Market Size, By Device Type, 20132020 (USD Million)

Table 56 Asia-Pacific: Market Size, By Country, 20132020 (USD Million)

Table 57 Asia-Pacific: Market Size, By Type of Material, 20132020 (USD Million)

Table 58 Asia-Pacific: Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 59 Asia-Pacific: Non-Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 60 Asia-Pacific: Antimicrobial for Medical Devices Coatings Market Size, By Device Type, 20132020 (USD Million)

Table 61 Japan: Antimicrobial Coatings for Medical Devices Market Size, By Type of Material, 20132020 (USD Million)

Table 62 Japan: Metallic Antimicrobial Coatings for Medical Devices Market Size, By Type, 20132020 (USD Million)

Table 63 Japan: Non-Metallic Antimicrobial Coatings for Medical Devices Market Size, By Type, 20132020 (USD Million)

Table 64 Japan: Market Size, By Device Type, 20132020 (USD Million)

Table 65 China: Market Size, By Type of Material, 20132020 (USD Million)

Table 66 China: Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 67 China: Non-Metallic Antimicrobial Coatings for Medical Devices Market Size, By Type, 20132020 (USD Million)

Table 68 China: Antimicrobial Medical Devices Coatings Market Size, By Device Type, 20132020 (USD Million)

Table 69 India: Antimicrobial Medical Devices Coatings Market Size, By Type of Material, 20132020 (USD Million)

Table 70 India: Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 71 India: Non-Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 72 India: Antimicrobial Coatings for Medical Devices Market Size, By Device Type, 20132020 (USD Million)

Table 73 RoAPAC: Antimicrobial Medical Devices Coatings Market Size, By Type of Material, 20132020 (USD Million)

Table 74 RoAPAC: Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 75 RoAPAC: Non-Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 76 RoAPAC: Antimicrobial Medical Devices Coatings Market Size, By Device Type, 20132020 (USD Million)

Table 77 RoW: Antimicrobial Medical Devices Coatings Market Size, By Type of Material, 20132020 (USD Million)

Table 78 RoW: Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 79 RoW: Non-Metallic Antimicrobial Medical Devices Coatings Market Size, By Type, 20132020 (USD Million)

Table 80 RoW: Market Size, By Device Type, 20132020 (USD Million)

Table 81 Agreements, Collaborations, and Partnerships, 20122014

Table 82 Expansions, 20122014

Table 83 Marketing & Promotion, 20122014

Table 84 Recent Developments, 20122014

List of Figures (54 Figures)

Figure 1 Market Segmentation

Figure 2 Research Methodology Steps

Figure 3 Sampling Frame: Primary Research

Figure 4 Break DOWn of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-DOWn Approach

Figure 7 Data Triangulation Methodology

Figure 8 Non-Metallic Coatings Segment to Witness Higher Growth During the Forecast Period

Figure 9 Silver Coatings Segment to Grow at the Highest CAGR During the Forecast Period

Figure 10 Polymeric Coating Segment to Grow at the Higher CAGR During the Forecast Period

Figure 11 Implantable Devices Segment to Grow at the Highest CAGR During the Forecast Period

Figure 12 Asia-Pacific Slated to Witness the Highest Growth in the Antimicrobial Medical Devices Coatings Market During the Forecast Period

Figure 13 Attractive Opportunities in the Antimicrobial Medical Devices Coatings Market

Figure 14 Non-Metallic Coatings to Witness the Highest Growth During the Forecast Period

Figure 15 North America to Dominate the Antimicrobial Medical Devices Coatings Market, By Device Type

Figure 16 Silver Coatings Segment to Witness Highest Growth Rate During the Forecast Period

Figure 17 Asia-Pacific to Witness Highest Growth Rate From 2015 to 2020

Figure 18 Antimicrobial Medical Devices Coatings Market: Drivers, Restrains, Opportunities, & Burning Issues

Figure 19 The U.S. Regulatory Process

Figure 20 Regulatory Approval Timeline - U.S.

Figure 21 European Regulatory Process

Figure 22 Regulatory Approval Timeline Europe

Figure 23 Japanese Regulatory Process

Figure 24 Regulatory Approval Timeline Japan

Figure 25 Chinese Regulatory Process

Figure 26 Regulatory Approval Timeline - China

Figure 27 Regulatory Process in India

Figure 28 Regulatory Approval Timeline - India

Figure 29 Australian Regulatory Process

Figure 30 Regulatory Approval Timeline - Australia

Figure 31 Global Antimicrobial Medical Devices Coatings Market, By Type

Figure 32 Non-Metallic Coatings Segment to Grow at the Highest CAGR During the Forecast Period

Figure 33 Silver Coatings Segment to Grow at the Highest CAGR During the Forecast Period

Figure 34 Asia-Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 35 Polymeric Coatings Segment to Grow at the Highest CAGR During the Forecast Period

Figure 36 Asia-Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 37 Global Antimicrobial Coatings for Medical Devices Market, By Device Type

Figure 38 Implantable Devices Segment to Grow at the Highest CAGR During the Forecast Period

Figure 39 North America is Expected to Command the Largest Share of the Global Antimicrobial Coatings for Medical Devices Market in 2015

Figure 40 The U.S. to Witness the Highest Growth in the North American Antimicrobial Coatings for Medical Devices Market (2015)

Figure 41 Germany to Witness the Highest Growth in the European Antimicrobial Coatings for Medical Devices Market (2015)

Figure 42 Japan to Witness the Highest Growth in the Asia-Pacific Antimicrobial Coatings for Medical Devices Market (2015)

Figure 43 Geographic Snapshot: RoW

Figure 44 Agreements, Collaborations & Partnerships Were the Key Strategies Adopted By Players in the Market

Figure 45 Organic Growth Strategies, By Key Players (2012-2015)

Figure 46 Inorganic Growth Strategies, By Key Players (2012-2015)

Figure 47 Mapping of Top 10 Players for Each Key Growth Strategy (2012-2015)

Figure 48 Geographical Revenue Mix of Top Players

Figure 49 BASF SE: Company Snapshot

Figure 50 Covalon Technologies Ltd.: Company Snapshot

Figure 51 Royal DSM: Company Snapshot

Figure 52 The DOW Chemical Company.: Company Snapshot

Figure 53 Hydromer, Inc.: Company Snapshot

Figure 54 PPG Industries, Inc.: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Antimicrobial Coatings for Medical Devices Market