Medical Plastics Market by Type (Engineering Plastics, HPP, Standard Plastics, Silicone, and Others), Application (Medical Disposables, Prosthetics, Medical Instruments & Tools, Drug Delivery, and Others), Region - Global Forecast to 2024

To get the latest information, inquire now!

Medical Plastics Market

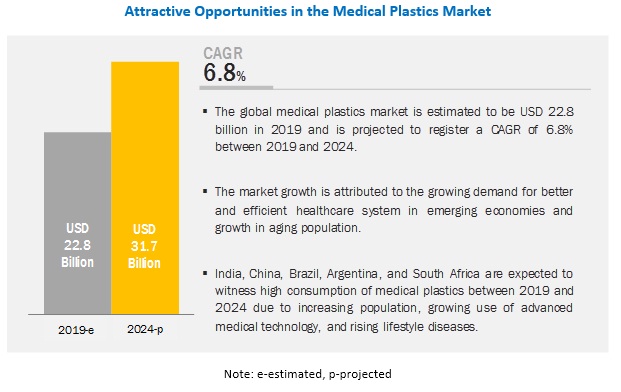

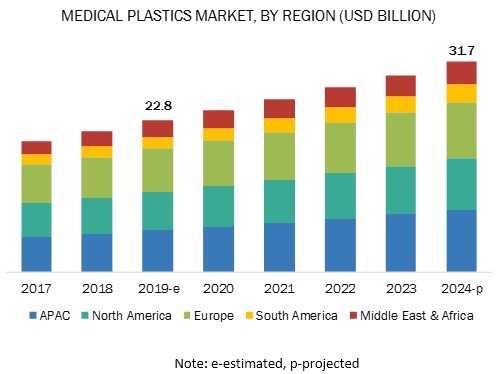

The medical plastics market was valued at USD 22.8 billion in 2019 and is projected to reach USD 31.7 billion by 2024, growing at a cagr 6.8% from 2019 to 2024. The major drivers for the market include demand for advanced medical devices from the aging population and growing healthcare investments in emerging economies such as China and India. In addition, rise in disposable income & changing lifestyle, demand for affordable and efficient healthcare systems, increasing use of advanced medical technologies, such as 3D printed implants and customized devices are driving the market.

Exploring various polymer types in drug delivery and the application of silicone in medical devices

Client’s Problem Statement

The client wanted to analyze polymer types and silicone-based medical devices based on different parameters. It engaged with us to identify potential polymer types and silicone-based applications in the healthcare industry.

MnM Approach

We provided the client with a quantitative analysis of various polymer types, their use in drug delivery devices, and different medical devices manufactured from silicone. We also evaluated various primary and secondary parameters and provided detailed market numbers for the requirements mentioned above. Provided below are some parameters:

1. Identification of multiple polymers used in the manufacturing of drug delivery devices.

2. Analysis of major polymers and market sizing as per polymers used in drug delivery devices.

3. Identification and analysis regarding the use of silicone in various applications in the medical industry.

Revenue Impact (RI)

After analyzing the solutions provided by us, our client could provide valuable insights to its clients, helping them to boost revenue growth by around USD 100 million–USD 200 million through venturing into new markets in the healthcare sector.

Based on type, the engineering plastics segment is projected to lead the medical plastics market during the forecast period.

Engineering plastics provide many advantages over standard plastics, such as good malleability, faster production time, low weight, resistance to high impact, flame, shock, and chemicals, and better friction reduction. Improving standards and regulations mandating high quality of plastics used in medical applications are responsible for the large market size in this segment. In addition, the increasing use of engineering plastics in robotic assistance, AI-driven procedures, 3D printing of implants and prosthetics, and others are driving the use of engineering plastics.

Based on application, the medical disposables segment is projected to register the highest CAGR during the forecast period.

The medical disposables segment is projected to register the highest CAGR between 2019 and 2024.

The use of medical plastics is increasing due to their versatility. Medical disposables can be defined as single-use products that are used in surgical as well as procedural applications. The use of these medical products in procedural applications and general checkup is increasing. In addition, the use of these disposables as instructed by various agencies, such as USFDA and Europe FDA are propelling the demand for medical plastics globally. Increased incidences of chronic diseases, changing lifestyle of middle-income group, demand for better healthcare facilities, and increase in the aging population are the major drivers for the market.

APAC is projected to be the largest market during the forecast period.

APAC is projected to be the largest medical plastics market during the forecast period. This growth is attributed primarily to the industrial and urbanization in the region. In addition, APAC has immense growth potential driven by the increasing demand for a better healthcare system. APAC consists of some vast and rapidly growing economies, such as China, India, Indonesia, Malaysia, Vietnam, and Thailand. Across these economies, local governments are reforming regulations in fields such as IT integration, advanced materials, and others in the healthcare industry to increase the efficiency and efficacy of medical devices and related healthcare services. The major drivers for the medical device sector in APAC are changing reforms regarding value-based care in existing systems, ecosystem partnership across value-chain, increasing R&D, and digitalization of the healthcare system.

Key Players in Medical Plastics Market

SABIC (Saudi Arabia), BASF (Germany), Celanese (US), Evonik (Germany), Solvay (Belgium), and Covestro (Germany) are some of the leading market players. New product launch, agreement & collaboration, investment & expansion, and merger & acquisition were the major growth strategies adopted by the market players between 2017 and 2019 to enhance their regional presence and meet the growing demand for medical plastics in the emerging economies.

Medical Plastics Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2019 |

USD 22.8 billion |

|

Revenue Forecast in 2024 |

USD 31.7 billion |

|

CAGR |

6.8% |

|

Years considered for the study |

2017–2024 |

|

Base year |

2018 |

|

Forecast period |

2019–2024 |

|

Units considered |

Value (USD), Volume (Kiloton) |

|

Segments |

Type, Application, and Region |

|

Regions |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies |

SABIC (Saudi Arabia), BASF (Germany), Celanese (US), Evonik (Germany), Solvay (Belgium), and Covestro (Germany) |

This research report categorizes the medical plastics market based on type, application, and region.

By Type:

- Engineering plastics

- High performance plastics (HPP)

- Standard plastics

- Silicone

- Others (TPE, TPU, Biodegradable Polymers, Synthetic Rubber, and Polymer Blends)

By Application:

- Medical disposables

- Prosthetics

- Medical instruments & tools

- Drug delivery

- Others (medical trays, sterilization trays, and lab wares)

By Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In August 2018, SABIC collaborated with a consulting and product designing firm, Nottingham Spirk (Cleveland, US). This collaboration helped both the companies to commercialize multiple specialty plastics suitable for a broad array of industry verticals, such as medical, automotive, and aircraft.

- In June 2019, BASF signed a Memorandum of Cooperation with SIBUR (Moscow, Russia) to develop innovative polymer solutions at PolyLab Research & Development Center located in Russia. This collaboration is targeted to develop an innovative range of high-performance solutions, particularly for long-term durable goods.

- In April 2018, Celanese expanded by starting a new GUR ultra-high molecular weight polyethylene facility at Nanjing, China. This facility helped the company meet the demand for specialty materials in the medical, automotive, consumer goods and other industries.

- In October 2019, Evonik launched a commercial line of bioresorbable PLA-PEG copolymers for medical devices under the brand name, RESOMER PLA-PEG. Through this product development, the company expanded its portfolio for functional biomaterials.

Critical questions the report answers:

- What are the upcoming hot bets for the medical plastics market?

- How are the market dynamics for different types of medical plastics?

- What are the significant trends in applications influencing the market?

- Who are the major manufacturers of medical plastics?

- What are the factors governing the medical plastics market in each region?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Medical Plastics Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.3.1 Medical Plastics Market Analysis Through Primary Interviews

2.4 Limitations

2.5 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Medical Plastics Market

4.2 Medical Plastics Market Size, By Application

4.3 Medical Plastics Market, By Major Countries

4.4 APAC Medical Plastics Market, By Country and Application, 2018

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Demand for Advanced Medical Technology and Devices

5.2.1.2 Growing Healthcare Investments in Emerging Economies

5.2.1.3 Shift Toward Minimally Invasive Medical Procedures

5.2.2 Restraints

5.2.2.1 Time-Consuming Regulatory Approval Process

5.2.3 Opportunities

5.2.3.1 R&D to Develop Advanced Plastics

5.2.3.2 Development of Patient-Specific Implants and 3D Printed Devices

5.2.4 Challenges

5.2.4.1 Waste Management Concerns

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview and Key Trends

5.4.1 Introduction

5.4.2 Trends and Forecast of GDP

5.4.3 Trends of Healthcare Industry

6 Medical Plastics Market, By Type (Page No. - 49)

6.1 Introduction

6.2 Standard Plastics

6.2.1 The Advent of New Technologies in Surgical and Procedural Operations is Augmenting the Demand for Standard Plastics

6.2.2 Polyvinyl Chloride (PVC)

6.2.3 Polyolefin (PE)

6.2.4 Polypropylene (PP)

6.2.5 Polystyrene (PS)

6.2.6 Poly(Methyl Methacrylate) (PMMA)

6.3 Engineering Plastics

6.3.1 Engineering Plastics Offer Higher Impact, Flame, Shock, and Chemical Resistance Than Standard Plastics

6.3.2 Polyamide (PA)

6.3.3 Acrylonitrile Butadiene Styrene (ABS)

6.3.4 Polycarbonate (PC)

6.3.5 Polyacetal

6.3.6 Others

6.4 High Performance Plastic (HPP)

6.4.1 HPP Exhibits Heat Stability and High Chemical Resistance

6.4.2 Polyetheretherketone (PEEK)

6.4.3 Polytetrafluoroethylene (PTFE)

6.4.4 Polyphenylsulfone (PPSU)

6.4.5 Other HPPS

6.5 Silicone

6.5.1 The Biocompatibility of Silicone is Increasing Its Use in Medical Implants

6.6 Others

6.6.1 Thermoplastic Elastomer (TPE)

6.6.2 Thermoplastic Polyurethane (TPU)

6.6.3 Biodegradable Polymers

6.6.4 Polymer Blends and Synthetic Rubber

7 Medical Plastics Market, By Application (Page No. - 58)

7.1 Introduction

7.2 Medical Disposables

7.2.1 The Growth in Demand for Catheters and Syringes are Fueling the Market for Medical Plastics

7.2.2 General Disposables

7.2.3 Medical Bags

7.2.4 Catheters

7.2.5 Syringes

7.3 Prosthetics

7.3.1 The Use of 3D Printed Customized Prostheses and Lightweight Implants is Gaining Traction

7.3.2 Limb Prosthesis

7.3.3 Implants

7.4 Medical Instruments & Tools

7.4.1 Increasing Surgical and Procedural Applications are Driving the Demand for Medical Plastics

7.4.2 Surgical Instruments

7.4.3 Diagnostic Instruments & Devices

7.4.4 Dental Tools

7.5 Drug Delivery

7.5.1 The Growing Requirement of Innovative Drug Delivery Systems is Expected to Boost the Demand for Medical Plastics

7.6 Others

8 Medical Plastics Market, By Region (Page No. - 70)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 The Country’s Advanced Medical Technology Industry is the Major Driver for the Market

8.2.2 Canada

8.2.2.1 The Medical Plastics Market in the Country is Highly Regulated

8.2.3 Mexico

8.2.3.1 The Country is One of the Most Prominent Medical Device Markets in the Region

8.3 Europe

8.3.1 Germany

8.3.1.1 The Country is the Largest Market for Dental Equipment in Europe

8.3.2 France

8.3.2.1 Non-Invasive Surgery, Orthopedics, and Disposable Medical Equipment Segments Offer Opportunities for Medical Device Manufacturers

8.3.3 UK

8.3.3.1 The Highly-Regulated Healthcare Industry and Strong Medical Device Market are the Governing Factors for the Medical Plastics Market

8.3.4 Italy

8.3.4.1 Italy has an Established Healthcare Industry

8.3.5 Spain

8.3.5.1 Public Hospitals, Health Centers, and Research Institutions are the Major Consumers of Medical Devices in the Country

8.3.6 Netherlands

8.3.6.1 The Country is Witnessing Extensive R&D on Medical Instrumentation

8.3.7 Rest of Europe

8.4 APAC

8.4.1 China

8.4.1.1 The Country Attracts International Investments in Medical Device Manufacturing Units

8.4.2 Japan

8.4.2.1 The Implementation of the AI and Big Data Technologies in the Healthcare Industry is Favorable for the Market

8.4.3 South Korea

8.4.3.1 There has Been Increased Domestic Manufacturing of Smart Medical Devices in the Country

8.4.4 India

8.4.4.1 Government Initiatives for the Healthcare Sector are Expected to Boost the Demand for Medical Plastics

8.4.5 Rest of APAC

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 Initiatives, Such as Ntp and Vision 2030, are Expected to Drive the Medical Plastics Market in Saudi Arabia

8.5.2 UAE

8.5.2.1 The Dubai Industrial Strategy (DIS) 2030 is Expected to Create Opportunities for the Market

8.5.3 South Africa

8.5.3.1 The Medical Plastics Market is Expected to Grow Due to the Launch of Government Schemes

8.5.4 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Brazil has Strong Healthcare Demographic Growth

8.6.2 Argentina

8.6.2.1 The Country is an Important Location for Medical Tourism

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 110)

9.1 Overview

9.2 Competitive Leadership Mapping, 2018

9.2.1 Visionary Leaders

9.2.2 Innovators

9.2.3 Dynamic Differentiators

9.2.4 Emerging Companies

9.3 Competitive Benchmarking

9.3.1 Strength of Product Portfolio

9.3.2 Business Strategy Excellence

9.4 Market Ranking of Key Players

9.4.1 SABIC

9.4.2 BASF

9.4.3 Celanese Corporation

9.4.4 Evonik

9.4.5 Solvay

9.5 Competitive Situation & Trends

9.5.1 New Product Launch

9.5.2 Investment & Expansion

9.5.3 Agreement & Collaboration

9.5.4 Merger & Acquisition

9.5.5 Joint Venture

10 Company Profiles (Page No. - 123)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

10.1 SABIC

10.2 BASF

10.3 Celanese Corporation

10.4 Evonik

10.5 Solvay

10.6 Arkema

10.7 Covestro

10.8 Ensinger

10.9 Lubrizol

10.10 Trinseo

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

10.11 Other Companies

10.11.1 Biomerics

10.11.2 DSM

10.11.3 Eastman Chemical Company

10.11.4 E. I. Du Pont De Nemours and Company

10.11.5 Invibio

10.11.6 Lanxess

10.11.7 Londyllbasell

10.11.8 Mitsubishi Chemical Advanced Materials

10.11.9 Polyone

10.11.10 Röchling

10.11.11 Rtp Company

10.11.12 Saint Gobain Performance Plastics

10.11.13 Tekni Plex

10.11.14 Teknor Apex

10.11.15 Wacker Chemie

11 Appendix (Page No. - 155)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (88 Tables)

Table 1 GDP Trend in Major Economies, USD Billion (2017–2018)

Table 2 Population Age 65 and Above (% ) (2016–2018)

Table 3 Current Healthcare Expenditure (Percentage of GDP), 2014–2016

Table 4 Mapping of Polymers With Processing Technologies

Table 5 Overview of Compatibility of Polymers With Sterilization Techniques

Table 6 Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 7 Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 8 Medical Plastics Market Size in Medical Disposables Application, By Region, 2017–2024 (Kiloton)

Table 9 Medical Plastics Market Size in Medical Disposables Application, By Region, 2017–2024 (USD Million)

Table 10 Medical Plastics Market Size in Prosthetics Application, By Region, 2017–2024 (Kiloton)

Table 11 Medical Plastics Market Size in Prosthetics Application, By Region, 2017–2024 (USD Million)

Table 12 Medical Plastics Market Size in Medical Instruments & Tools Application, By Region, 2017–2024 (Kiloton)

Table 13 Medical Plastics Market Size in Medical Instruments & Tools Application, By Region, 2017–2024 (USD Million)

Table 14 Medical Plastics Market Size in Drug Delivery Application, By Region, 2017–2024 (Kiloton)

Table 15 Medical Plastics Market Size in Drug Delivery Application, By Region, 2017–2024 (USD Million)

Table 16 Medical Plastics Market Size in Other Applications, By Region, 2017–2024 (Kiloton)

Table 17 Medical Plastics Market Size in Other Applications, By Region, 2017–2024 (USD Million)

Table 18 Medical Plastics Market Size, By Region, 2017–2024 (Kiloton)

Table 19 Medical Plastics Market Size, By Region, 2017–2024 (USD Million)

Table 20 North America: Medical Plastics Market Size, By Country, 2017–2024 (Kiloton)

Table 21 North America: Medical Plastics Market Size, By Country, 2017–2024 (USD Million)

Table 22 North America: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 23 North America: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 24 US: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 25 US: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 26 Canada: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 27 Canada: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 28 Mexico: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 29 Mexico: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 30 Europe: Medical Plastics Market Size, By Country, 2017–2024 (Kiloton)

Table 31 Europe: Medical Plastics Market Size, By Country, 2017–2024 (USD Million)

Table 32 Europe: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 33 Europe: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 34 Germany: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 35 Germany: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 36 France: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 37 France: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 38 UK: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 39 UK: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 40 Italy: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 41 Italy: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 42 Spain: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 43 Spain: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 44 Netherlands : Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 45 Netherlands: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 46 Rest of Europe: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 47 Rest of Europe: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 48 APAC: Medical Plastics Market Size, By Country, 2017–2024 (Kiloton)

Table 49 APAC: Medical Plastics Market Size, By Country, 2017–2024 (USD Million)

Table 50 APAC: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 51 APAC: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 52 China: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 53 China: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 54 Japan: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 55 Japan: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 56 South Korea: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 57 South Korea: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 58 India: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 59 India: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 60 Rest of APAC: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 61 Rest of APAC: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 62 Middle East & Africa: Medical Plastics Market Size, By Country, 2017–2024 (Kiloton)

Table 63 Middle East & Africa: Medical Plastics Market Size, By Country, 2017–2024 (USD Million)

Table 64 Middle East & Africa: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 65 Middle East & Africa: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 66 Saudi Arabia: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 67 Saudi Arabia: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 68 UAE: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 69 UAE: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 70 South Africa: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 71 South Africa: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 72 Rest of Middle East & Africa: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 73 Rest of Middle East & Africa: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 74 South America: Medical Plastics Market Size, By Country, 2017–2024 (Kiloton)

Table 75 South America: Medical Plastics Market Size, By Country, 2017–2024 (USD Million)

Table 76 South America: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 77 South America: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 78 Brazil: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 79 Brazil: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 80 Argentina: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 81 Argentina: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 82 Rest of South America: Medical Plastics Market Size, By Application, 2017–2024 (Kiloton)

Table 83 Rest of South America: Medical Plastics Market Size, By Application, 2017–2024 (USD Million)

Table 84 New Product Launch (2017–2019)

Table 85 Investment & Expansion (2017–2019)

Table 86 Agreement & Collaboration (2017–2019)

Table 87 Merger & Acquisition (2017–2019)

Table 88 Joint Venture (2017–2019)

List of Figures (36 Figures)

Figure 1 Medical Plastics Market: Research Design

Figure 2 Medical Plastics Market: Bottom-Up Approach

Figure 3 Medical Plastics Market: Top-Down Approach

Figure 4 Medical Plastics Market: Data Triangulation

Figure 5 Medical Plastics Market Analysis Through Secondary Sources

Figure 6 Medical Plastics Market Analysis

Figure 7 Medical Instruments & Tools Segment is the Largest Application of Medical Plastics

Figure 8 APAC to Be the Fastest-Growing Medical Plastics Market

Figure 9 Growing Demand in Emerging Economies to Drive the Medical Plastics Market

Figure 10 Medical Disposables to Be the Largest Application of Medical Plastics

Figure 11 India to Register the Highest CAGR

Figure 12 China and Medical Disposables Segment Accounted for the Largest Market Shares

Figure 13 Drivers, Restraints, Opportunities, and Challenges in the Medical Plastics Market

Figure 14 Medical Plastics Market: Porter’s Five Forces Analysis

Figure 15 Aging Population in Major Economies

Figure 16 Current Healthcare Expenditure of Major Economies

Figure 17 Medical Disposables to Be the Largest Application of Medical Plastics

Figure 18 Medical Plastics Market in India to Register the Highest CAGR

Figure 19 North America: Medical Plastics Market Snapshot

Figure 20 Europe: Medical Plastics Market Snapshot

Figure 21 APAC: Medical Plastics Market Snapshot

Figure 22 Companies Adopted New Product Development and Expansion as Key Strategies Between 2017 and 2019

Figure 23 Medical Plastics Market: Competitive Leadership Mapping, 2018

Figure 24 SABIC: Company Snapshot

Figure 25 SABIC: SWOT Analysis

Figure 26 BASF: Company Snapshot

Figure 27 BASF: SWOT Analysis

Figure 28 Celanese: Company Snapshot

Figure 29 Celanese: SWOT Analysis

Figure 30 Evonik: Company Snapshot

Figure 31 Evonik: SWOT Analysis

Figure 32 Solvay: Company Snapshot

Figure 33 Solvay: SWOT Analysis

Figure 34 Arkema: Company Snapshot

Figure 35 Covestro: Company Snapshot

Figure 36 Trinseo: Company Snapshot

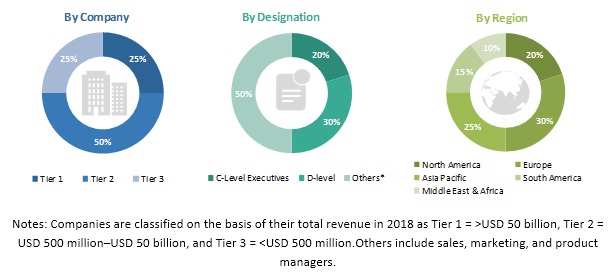

The study involved four major activities in estimating the current medical plastics market size. The exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles from recognized authors; authenticated directories; and databases. Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total market players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply sides and demandsides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology & innovation directors, consultants, managers, and related key executives from major companies and organizations operating in the market. The primary sources from the demand side included lab technicians, technologists, and sales/purchase managers from end-use industries.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the medical plastics market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research.

- All the percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the medical device sector.

Objectives of the Study:

- To define, describe, and forecast the medical plastics market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type and application

- To forecast the size of the market with respect to five regions, namely, Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze the micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze the competitive developments such as merger & acquisition and investment & expansion in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis:

- A country-level analysis of the medical plastics market is provided on the basis of application.

Company Information:

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Medical Plastics Market

Medical Equipment market and investment opportunities in adjacent market

looking for medical plastics developed from Poli isobutylene

Information on the Medical plastic market

Information on plastic disposable market in medical application