Liquid-applied Membrane Market

Liquid-applied Membrane Market by Type (Bituminous, Elastomeric, Cementitious), Application (Roofing, Walls, Roadways), Usage (New Construction, Refurbishment), End-use Industry (Commercial, Residential), And Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The liquid-applied membrane (LAM) market is projected to reach USD 33.50 billion by 2030 from USD 25.27 million in 2025, at a CAGR of 5.8% from 2025 to 2030. The LAM market is experiencing strong growth propelled by increasing demand for seamless, long-lasting, and cost-competitive waterproofing solutions for commercial and residential segments. Urbanization, climate resilience efforts, and sustainable construction trends drive expansion.

KEY TAKEAWAYS

-

BY TYPEElastomeric membranes lead the LAM market as the largest and fastest-growing segment due to high performance and durability.

-

BY APPLICATIONRoofing is the largest application of LAM. It is driven by use in residential and commercial projects, while building structures are the fastest growing type, propelled by urban mega-projects and demand for durable, crack-bridging solutions.

-

BY USAGENew construction is the largest usage segment for LAMs, which are highly adopted in the commercial, residential, and infrastructural segments due to their applications and durability.

-

BY END-USE INDUSTRYKey trends for LAM end-use industries include growth and investments in residential construction and commercial & public infrastructure.

-

BY REGIONThe Asia Pacific is expected to grow the fastest, with a CAGR of 7.4%, driven by massive urbanization, infrastructure development, and government investments in smart cities, metros, and green buildings.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations by leading players such as Sika AG (Switzerland), Mapei S.P.A. (Italy), Soprema (France), Fosroc, Inc (UAE), Saint-Gobain Weber (France), H.B. Fuller (US), Wacker Chemie AG (Germany), Johns Manville (US), Bostik (France), GCP Applied Technologies (US), and Tremco (US). These companies are heavily investing in new technologies.

The liquid-applied membrane market is experiencing strong growth due to growing construction and increasing investments in building & construction. It is also propelled by increasing demand for seamless, long-lasting, and cost-competitive waterproofing solutions for commercial and residential segments. Urbanization, climate resilience efforts, and sustainable construction trends drive expansion. The North America LAM market is supported by infrastructure rebuilding and green building opportunities, while Europe is influenced by strict environmental standards and retrofitting demand. The Asia Pacific is advancing as a result of urbanization and government investment in infrastructure, most notably in India and China.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of liquid-applied membrane suppliers, which, in turn, impacts the revenues of liquid-applied membrane manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expanding construction industry

-

Rising renovation & refurbishment activities

Level

-

Requirement of skilled labor

-

Increasing demand for sheet membrane as substitutes

Level

-

Growth in emerging markets

-

Growing demand for energy-efficient buildings and green roofs

Level

-

Environmental & health concerns related to liquid-applied membrane

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expanding construction industry

The growing construction industry fuels global demand for LAMs, driven by urbanization and infrastructure development in both developed and emerging economies. LAMs are favored in construction for their ease of application, flexibility, and superior water and chemical resistance. They are used in roofing, basements, balconies, tunnels, and bridges—key components of modern buildings. Rising demand for multi-family housing and high-rises in residential buildings increases use of LAMs for water protection. In commercial and industrial sectors, projects like shopping malls and warehouses utilize liquid membranes for durability and energy efficiency. Infrastructure projects such as highways, airports, and subways also rely on LAMs for waterproofing and longevity. The push for sustainable construction boosts demand for green, low-VOC membranes. As investments grow worldwide, especially in the Asia Pacific, the Middle East, and Africa, the need for high-performance liquid membranes continues to rise.

Restraint: Requirement of skilled labor

The need for skilled workers restricts the liquid applied membrane market due to complicated installation requiring expertise in surface prep, membrane thickness, and uniform application. Poor installation leads to adhesion issues, cracking, water seepage, and increased maintenance, which is problematic in regions lacking trained applicators, especially in developing areas. Costs and project delays from training requirements further discourage use despite long-term benefits. Different LAM types demand specific handling and curing skills, adding to the challenge. In fast-paced construction, the shortage of skilled workers can delay projects or lead to the rejection of LAMs, hindering widespread adoption, especially where technical training is limited.

Opportunity: Growth in emerging markets

Emerging markets like Asia-Pacific, Latin America, the Middle East, and Africa offer major opportunities for the liquid applied membrane (LAM) industry due to urbanization, population growth, and infrastructure investments. Governments prioritize roads, bridges, airports, and buildings needing durable waterproofing. Markets are demanding higher quality, durability, and eco-friendly features, which LAMs provide with flexibility, watertight sealing, and protection from water, UV, and chemicals. Initiatives on affordable housing and smart cities, especially in India, China, Brazil, and South Africa, boost demand. Global companies are entering these markets via partnerships, acquisitions, and local manufacturing to capitalize on growth and reduce costs. With limited market penetration, these regions hold significant expansion potential for LAM producers.

Challenge: Environmental and health concerns related to liquid-applied membrane

Environmental and health concerns linked to liquid applied membranes pose a significant challenge for the market, especially with tightening global regulations and increasing public awareness about sustainability and worker safety. Most traditional LAM formulations, especially solvent-based ones, contain high levels of volatile organic compounds (VOCs), which contribute to air pollution and pose serious health risks to applicators. Long-term exposure to VOCs can lead to respiratory issues, skin irritation, headaches, and other serious health problems, making occupational safety a top priority during installation. Furthermore, improper use, disposal, or spillage of certain liquid membranes, notably bituminous or polyurethane-based types, can contaminate soil and water, harming the environment. This has led many countries to implement stricter standards that limit the use of certain chemicals or require low VOC emission levels, as mandated by LEED, BREEAM, or national green building codes. In emerging markets, lack of awareness or compliance with safety standards can worsen these issues, putting workers and the environment at risk. As sustainability becomes a central factor in construction decisions, manufacturers are driven to develop eco-friendly, water-based, or bio-based products that reduce health hazards without compromising performance. Meeting these demands while maintaining cost competitiveness remains a primary challenge for the LAM industry.

Liquid Applied Membranes Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of LAMs on bridge decks, tunnels, and metro structures in major infrastructure projects | Robust resistance to extreme weather and vibrations in public works, scalable application for massive EPC contracts |

|

Integration of elastomeric liquid membranes for roof and exterior wall waterproofing in integrated townships like Godrej City in Pune and Godrej Waterside in Kolkata | Eco-friendly low-VOC formulations aligning with green certifications, extended structure longevity in humid climates, cost-effective retrofitting for mixed-use projects |

|

Use of LAMs on foundations, roofs, and podium decks in large-scale residential and commercial developments | Durable barrier against groundwater and urban flooding, minimized construction delays with quick-curing application, lower lifecycle expenses through crack-bridging flexibility, and improved property resilience in high-density urban environments |

|

Application of liquid applied membranes for waterproofing terraces, balconies, and basements in luxury residential projects | Seamless protection against heavy monsoons, reduced maintenance costs for high-end properties, enhanced energy efficiency with thermal insulation, and compliance with sustainable building standards for premium living |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The liquid-applied membrane ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, and end users. The raw material suppliers provide PU, bituminous compounds, cementitious materials, and others to liquid-applied membrane manufacturers. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Liquid-Applied Membrane Market, By End-use Industry Type

The residential building segment is the fastest-expanding end-use segment in the liquid-applied membrane industry. This is mainly driven by a global increase in urbanization, growing housing needs, and a strong emphasis on low-cost and energy-efficient residential structures. In new developments and reconstruction works, LAMs offer a budget-friendly solution to waterproof buildings, prevent mold formation, and avoid structural damage. Moreover, growing pressure on environmentally friendly building processes and eco-friendly construction is fuelling the adoption of water-based and low-VOC liquid membranes in residential work.

Liquid-Applied Membrane Market, By Application Type

Roofing is among the most significant and fastest-growing application areas for liquid-applied membranes (LAMs) due to requirements for long-lasting, seamless, and weather-tight waterproof solutions. Liquid-applied membranes find broad applications in new roofing installations and reconditioning existing roofs because they are easy to use, flexible, and follow complex roof curvatures and penetrations. LAMs offer a smooth, jointless membrane that drastically minimizes the chances of leaks over conventional sheet-based membranes. They are extremely good at withstanding UV radiation, thermal expansion, ponding water, and adverse weather conditions, making them a perfect choice for flat or low-slope roofs typical for commercial and industrial buildings.

REGION

Asia Pacific to be fastest-growing region in global liquid-applied membrane market during forecast period

The Asia-Pacific region is the fastest-growing and most promising market, fuelled by urbanization, population growth, and large-scale infrastructure development. China, India, Japan, South Korea, and various other Asian nations are witnessing a tremendous increase in construction activity in the residential, commercial, and industrial segments. This growth is directly contributing to the demand for effective and long-lasting waterproofing solutions such as LAMs. China and India, especially, are at the forefront of the regional market with government-led initiatives for infrastructure modernization, low-cost housing, and smart city developments. Such projects cover wide-scale road work, bridge construction, metro development, and residential complexes, all of which demand durable, weather-resistant waterproofing systems.

Liquid Applied Membranes Market: COMPANY EVALUATION MATRIX

Sika AG (Star), a Swiss company, leads the market through its high-quality LAM products, which find extensive applications in roofing, walls, roadways, and other applications. Bostik (Emerging Leader) is gaining traction with its technological advancements in LAMs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 23.96 Billion |

| Revenue Forecast in 2030 | USD 33.50 Billion |

| Growth Rate | CAGR of 5.8% from 2025-2030 |

| Actual data | 2024–2030 |

| Base year | 2024 |

| Forecast period | 2025–2030 |

| Units considered | Value (USD Million), Volume (Million Square Meter) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Europe, North America, Asia Pacific, the Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Liquid Applied Membranes Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Interest in competitive benchmarking |

|

|

| Need clarity on regional waterproofing regulations and standards |

|

|

| Need to assess future market growth hotspots |

|

|

RECENT DEVELOPMENTS

- June 2025 : Sika has acquired Gulf Additive Factory LLC in Qatar, a well-established manufacturer of construction chemical products. This strategic move enhances Sika’s presence in the rapidly expanding Qatari construction market and opens up significant opportunities for future growth. Gulf Additive Factory LLC (GAF) is well-regarded for its superior product quality and strong technical capabilities. The company offers a comprehensive portfolio that includes concrete admixtures, mortars, flooring systems, waterproofing solutions, and façade systems

- March 2025 : Sika has completed the full acquisition of HPS North America, Inc., a leading supplier of building finishing materials in the U.S. market. HPS, known for distributing Schönox-branded products produced by Sika Germany, will now be fully integrated into Sika USA. This strategic move will strengthen Sika’s position in the building finishing segment and is expected to drive substantial efficiency improvements while supporting further expansion in the region

- December 2024 : Mapei has inaugurated its new headquarters in Olomouc, Czech Republic — a strategic investment aimed at supporting its ongoing growth and reinforcing its ties with the local region

- October 2024 : Mapei has expanded its footprint in the UK through the acquisition of Wykamol by Mapei UK, enhancing its waterproofing product portfolio. Wykamol is a well-established manufacturer known for its expertise in damp proofing, structural waterproofing, and property renovations solutions

- June 2024 : Saint-Gobain has finalized its acquisition of Fosroc, a prominent global player in construction chemicals with a strong presence in India, the Middle East, and the Asia-Pacific region. This move enhances Saint-Gobain’s footprint in rapidly growing emerging markets—especially India and the Middle East—and aligns with the Group’s strategic vision to lead globally in light and sustainable construction solutions

Table of Contents

Methodology

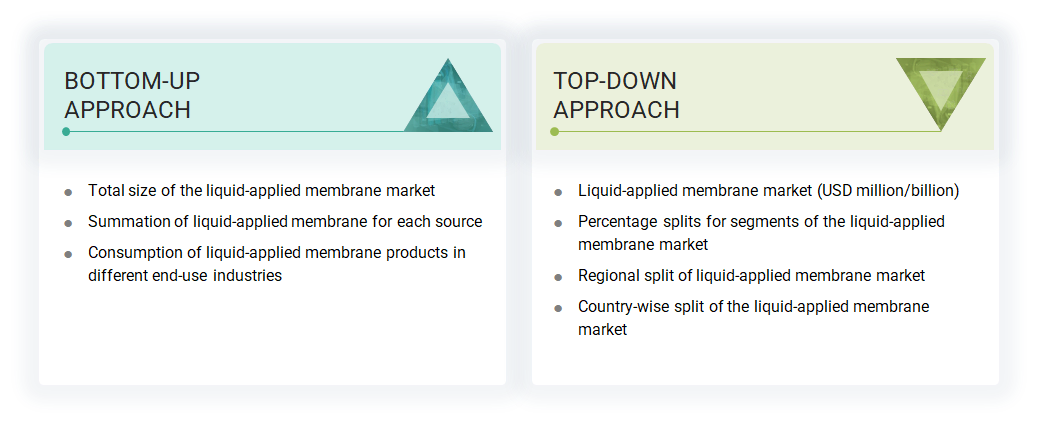

The study involved four major activities to estimate the current size of the global liquid-applied membrane market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of liquid-applied membrane through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the liquid-applied membrane market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the liquid-applied membrane market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The liquid-applied membrane market comprises several stakeholders in the supply chain, which include raw material suppliers, equipment suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the liquid-applied membrane market. Primary sources from the supply side include associations and institutions involved in the liquid-applied membrane market, key opinion leaders, and processing players.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the liquid-applied membrane market by type, application, usage, end-use industry, and region. The research methodology used to calculate the market size includes the following steps:

Data Triangulation

After arriving at the overall size of the liquid-applied membrane market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

A liquid-applied membrane (LAM) is a fully bonded, seamless coating that is applied in liquid form and cures to create a flexible, rubber-like waterproof barrier. It is well-suited for a wide range of waterproofing and roofing applications and can be applied over various substrates such as concrete, asphalt, and bitumen.

Stakeholders

- Liquid-Applied Membrane Manufacturers

- Raw Material Suppliers

- Equipment Suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-use Industries

- Associations and Industrial Bodies

Report Objectives

- To define, describe, and forecast the size of the liquid-applied membrane market in terms of value and volume

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To forecast the market size based on type, application, usage, end-use industry, and region

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific, South America, and the Middle East & Africa (MEA), along with their key countries

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- Analyzing the opportunities in the market for stakeholders and providing details of the competitive landscape for the market leaders

- To strategically profile leading players and comprehensively analyze their key developments, such as new product launches, expansions, and deals in the liquid-applied membrane market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook

Key Questions Addressed by the Report

What primary factor is propelling the growth of the liquid-applied membrane market?

Rising growth in the construction industry is the key driver for the liquid-applied membrane market.

How is the liquid-applied membrane market segmented?

The market is segmented by type, application, usage, end-use industry, and region.

What are the major challenges in the liquid-applied membrane market?

Environmental and health concerns related to certain membrane formulations pose major challenges.

What are the major opportunities in the liquid-applied membrane market?

Growth in emerging regions offers significant opportunities for market expansion.

Which region has the largest demand?

The Asia Pacific region has the highest demand for liquid-applied membrane products.

Who are the major manufacturers of liquid-applied membrane products?

Major manufacturers include Sika AG (Switzerland), Mapei S.P.A. (Italy), Soprema (France), Fosroc, Inc. (UAE), Saint-Gobain Weber (France), H.B. Fuller (US), Wacker Chemie AG (Germany), Pidilite (India), and others.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Liquid-applied Membrane Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Liquid-applied Membrane Market

Patrick

Jul, 2017

Liquid Applied Membrane Market.