Southeast Asia Waterproofing Systems Market by Preformed Membranes (Modified Bitumen, PVC, TPO, and EPDM), Liquid Applied Membranes (Elastomeric, Cementitious, Bituminous), Integral Systems (Pore Blocking Admixtures, Crystalline Waterproofing Admixtures), Waterproofing Chemicals (Bitumen, Elastomers, PVC, TPO, EPDM, and Concrete) - Forecasts to 2021

[88 Pages Report] The market size of Southeast Asia waterproofing systems is projected to reach USD 5.35 Billion by 2021, at a CAGR of 14.52% during the forecast period. The base year considered for the study is 2015, while the forecast period considered is 20162021.

Objectives of the study:

- To define, describe, and forecast the Southeast Asia waterproofing systems market on the basis of preformed membranes, liquid applied membranes, integral systems, and waterproofing chemicals

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

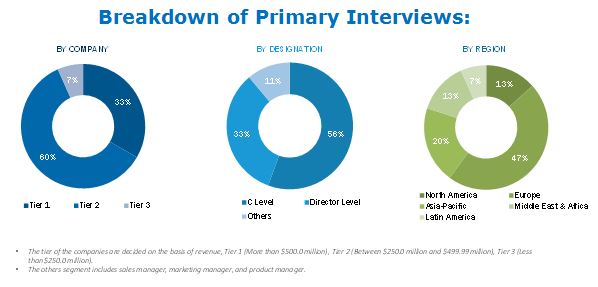

Top-down and bottom-up approaches have been used to estimate and validate the size of the market and various other dependent submarkets in the overall Southeast Asia waterproofing systems market. The research study involves extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, ICIS, Securities and Exchange Commission (SEC), as well as government and private websites to identify and collect information useful for the technical, market-oriented, and commercial study of the Southeast Asia waterproofing systems market.

To know about the assumptions considered for the study, download the pdf brochure

The value chain for the waterproofing market starts from waterproofing chemicals, such as bitumen, elastomers, PVC, TPO, and, EPDM, suppliers. Wacker Chemie A.G (U.S.) and BASF SE (Germany) are the major waterproofing chemicals providers. These waterproofing chemicals are supplied to the major manufacturers of waterproofing membranes/system/technology such as Carlisle Companies Inc. (U.S.), Soprema Group (France), The Dow Chemical Company (U.S.), Johns Manville (U.S.), Pidilite Industries (India), Fosroc International Ltd. (U.K.), Mapei S.p.A (Italy), Firestone Building Products (U.S.), SIKA AG (Switzerland), GSE Environmental (U.S.), and, GAF Material Corporation (U.S.).

This study answers several questions for various market players across the value chain, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments.

Key Target Audience:

- Manufacturers of preformed membranes, liquid applied membranes integral systems, and waterproofing chemicals

- Traders, distributors, and waterproofing suppliers

- Regional manufacturer associations and general waterproofing associations

- Government and regional agencies and research organizations

Scope of the Report:

This research report categorizes the waterproofing market on the basis of preformed membranes, liquid applied membranes, integral systems, waterproofing chemicals, and countries.

On the basis of Preformed Membranes:

- Modified Bitumen

- PVC

- TPO

- EPDM

On the basis of Liquid Applied Membranes

- Elastomeric

- Cementitious

- Bituminous

On the basis of Integral Systems:

- Pore Blocking Admixtures

- Crystalline Waterproofing Admixtures

- Others

On the basis of waterproofing Chemicals:

- Bitumen

- Elastomers

- PVC

- TPO

- EPDM

- Concrete

- Others

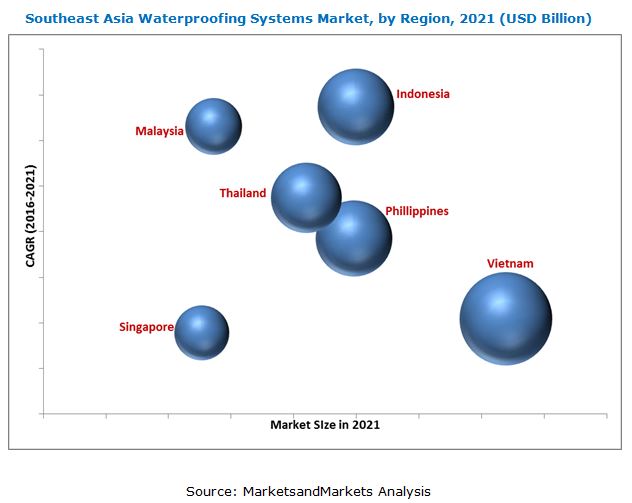

On the basis of Countries:

- Indonesia

- Thailand

- Malaysia

- Singapore

- The Philippines

- Vietnam

- Others

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the company. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players

The market size of Southeast Asia waterproofing systems market is estimated to reach USD 5.35 Billion by 2021, at a CAGR of 14.52% during the forecast period. The rising demand for waterproofing is backed by the growing building & construction industry in the region, especially in the developing countries, such as Indonesia, Malaysia, Thailand, Singapore, and Vietnam. Rapid growth in the construction industry made it the largest contributor to the market in Southeast Asia in 2015.

The Southeast Asia waterproofing systems market is segmented into preformed membranes, liquid applied membranes, integral systems, and waterproofing chemicals. In 2015, the preformed membranes segment accounted for the largest market share, in terms of value, which is projected to register the second-fastest growth, between 2016 and 2021, owing to its superior waterproofing properties over other waterproofing system/technology.

Modified bitumen is the most extensively used preformed membrane and has the largest market size. It is composed of single ply and built-up roofing. These membranes offer various advantages, including excellent performance at cold temperature and handling characteristics, high fatigue (cycling) resistance, elasticity, and strength.

Liquid applied membranes such as elastomeric, bituminous, and cementitious are commonly used in the building & construction industry for various applications, including roofing, walls, floors, basements, interior & exterior surface protection, and so on. Elastomeric membranes is expected to be the fastest-growing segment in liquid applied membranes during the forecast period due to excellent throughput with high liquid flow rates at low differential pressures, ensuring robust performance even in the most extreme applications.

Crystalline waterproofing admixture is expected to dominate the integral systems waterproofing market in Southeast Asia owing to its fine properties, which help in improving the quality and age of concrete structures. These admixtures exhibit properties that help in reducing absorption and water permeability by acting on the capillary structure of concrete made of cement.

Bitumen and elastomers were the most extensively consumed waterproofing chemicals in 2015. The major advantages of bitumen and elastomer include high penetration & gap filling and improved adhesion, as well as durability and moisture resistance due to which there is an increase in demand for both bitumen and elastomers. The primary driver of the Southeast Asia waterproofing systems market is the increasing demand from developing countries. The waterproofing applications such as roofing & walls, floors & basements, tunnel liners, and so on have wide scope of expansion, which in turn is expected to increase the consumption of waterproofing chemicals during the forecast period.

The waterproofing system/technology manufacturers are affected by price-sensitive customers. Most of the waterproofing raw materials are petroleum-based and are vulnerable to fluctuations in commodity prices. Oil prices have been highly volatile recently, with fluctuation of 8.0%. This is a major challenge for the waterproofing industry to predict the future price of basic raw materials resulting in low investments in waterproofing system-related projects.

Carlisle companies Inc. (U.S.) company is one of the major manufacturers of waterproofing & roofing systems, which competes with its competitors in terms of pricing, innovative products, long-term warranties, and customer care services. It also focuses on product innovation as a part of its major strategy to increase its global presence. The company adopts acquisitions and expansions as the key business strategies to increase its revenues.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Executive Summary (Page No. - 10)

1.1 Waterproofing Chemicals

1.2 Preformed Membranes

1.3 Liquid Applied Membranes

1.4 Integral Systems

2 South East Asian Waterproofing Systems Market, By Type (Page No. - 15)

2.1 Waterproofing Chemicals

2.2 Preformed Membranes

2.3 Liquid Applied Membranes

2.4 Integral Systems

3 South East Asian Waterproofing Systems Market, By Country (Page No. - 25)

3.1 Indonesia

3.2 Thailand

3.3 Malaysia

3.4 Singapore

3.5 Phillippines

3.6 Vietnam

4 Competitive Landscape (Page No. - 48)

4.1 Overview

4.2 Competitive Situations and Trends

4.3 Competitive Benchmarking and Landscape

4.3.1 Expansions

4.3.2 New Product/Technology Launches

4.3.3 Mergers & Acquisitions 3

4.3.4 Agreements and Partnerships

5 Company Profiling (Page No. - 56)

5.1 Carlisle Companies Inc

5.1.1 Business Overview

5.1.2 Products Offered

5.1.3 Recent Developments

5.1.4 SWOT Analysis

5.1.5 MnM View

5.2 Soprema Group

5.2.1 Business Overview

5.2.2 Products Offered

5.2.3 Recent Developments

5.3 The DOW Chemical Company

5.3.1 Business Overview

5.3.2 Products Offered

5.3.3 Recent Developments

5.3.4 SWOT Analysis

5.3.5 MnM View

5.4 W.R Grace & Co

5.4.1 Business Overview

5.4.2 Products Offered

5.5 BASF SE

5.5.1 Business Overview

5.5.2 Products Offered

5.5.3 Recent Developments

5.5.4 SWOT Analysis

5.5.5 MnM View

5.6 Sika AG

5.6.1 Business Overview

5.6.2 Products Offered

5.6.3 Recent Developments

5.6.4 MnM View

5.7 Johnsmanville Corporation

5.7.1 Business Overview

5.7.2 Products Offered

5.7.3 Recent Developments

5.8 Pidilite Industries Limited

5.8.1 Business Overview

5.8.2 Products Offered

5.8.3 Recent Developments

5.8.4 MnM View

5.9 Fosroc International Limited

5.9.1 Business Overview

5.9.2 Products Offered

5.9.3 Recent Developments

5.10 Mapei S.P.A

5.10.1 Business Overview

5.10.2 Products Offered

5.11 Chryso S.A.S

5.11.1 Business Overview

5.11.2 Products Offered

5.12 GSE Environmental

5.12.1 Business Overview

5.12.2 Products Offered

5.12.3 Recent Developments

5.12.4 MnM View

5.13 GAF Material Corporation

5.13.1 Business Overview

5.13.2 Products Offered

5.13.3 Recent Developments

5.13.4 MnM View

List of Tables (68 Tables)

Table 1 South East Asian Waterproofing Chemicals Market Size, By Country, 20142021 (Kiloton)

Table 2 South East Asian Waterproofing Chemicals Market Size,By Country, 20142021 (USD Million)

Table 3 South East Asian Waterproofing Chemicals Market Size, By Type, 20142021 (Kiloton)

Table 4 South East Asian Waterproofing Chemicals Market Size, By Type, 20142021 (USD Million)

Table 5 South East Asian Preformed Membranes Market Size, By Country, 20142021 (Million Square Meters)

Table 6 South East Asian Preformed Membranes Market Size, By Country, 20142021 (USD Million)

Table 7 South East Asian Preformed Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 8 South East Asian Preformed Membranes Market Size, By Type, 20142021 (USD Million)

Table 9 South East Asian Liquid Applied Membranes Market Size, By Country, 20142021 (Million Square Meters)

Table 10 South East Asian Liquid Applied Membranes Market Size, By Country, 20142021 (USD Million)

Table 11 South East Asian Liquid Applied Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 12 South East Asian Liquid Applied Membranes Market Size, By Type, 20142021 (USD Million)

Table 13 South East Asian Integral Systems Market Size, By Country, 20142021 (Kiloton)

Table 14 South East Asian Integral Systems Market Size,By Country, 20142021 (USD Million)

Table 15 South East Asian Integral Systems Market Size, By Type, 20142021 (Kiloton)

Table 16 South East Asian Integral Systems Market Size,By Type, 20142021 (USD Million)

Table 17 Indonesia: Waterproofing Chemicals Market Size, By Chemistry, 20142021 (Kiloton)

Table 18 Indonesia: Waterproofing Chemicals Market Size, By Chemistry, 20142021 (USD Million)

Table 19 Indonesia: Preformed Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 20 Indonesia: Preformed Membranes Market Size, By Type, 20142021 (USD Million)

Table 21 Indonesia: Liquid Applied Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 22 Indonesia: Liquid Applied Membranes Market Size, By Type, 20142021 (USD Million)

Table 23 Indonesia: Integral Systems Market Size,By Type, 20142021 (Kiloton)

Table 24 Indonesia: Integral Systems Market Size, By Type, 20142021 (USD Million)

Table 25 Thailand: Waterproofing Chemicals Market Size, By Chemistry, 20142021 (Kiloton)

Table 26 Thailand: Waterproofing Chemicals Market Size, By Chemistry, 20142021 (USD Million)

Table 27 Thailand: Preformed Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 28 Thailand: Preformed Membranes Market Size, By Type, 20142021 (USD Million)

Table 29 Thailand: Liquid Applied Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 30 Thailand: Liquid Applied Membranes Market Size, By Type, 20142021 (USD Million)

Table 31 Thailand: Integral Systems Market Size, By Type, 20142021 (Kiloton)

Table 32 Thailand: Integral Systems Market Size, By Type, 20142021 (USD Million)

Table 33 Malaysia: Waterproofing Chemicals Market Size, By Chemistry, 20142021 (Kiloton)

Table 34 Malaysia: Waterproofing Chemicals Market Size, By Chemistry, 20142021 (USD Million)

Table 35 Malaysia: Preformed Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 36 Malaysia: Preformed Membranes Market Size, By Type, 20142021 (USD Million)

Table 37 Malaysia: Liquid Applied Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 38 Malaysia: Liquid Applied Membranes Market Size, By Type, 20142021 (USD Million)

Table 39 Malaysia: Integral Systems Market Size, By Type, 20142021 (Kiloton)

Table 40 Malaysia: Integral Systems Market Size, By Type, 20142021 (USD Million)

Table 41 Singapore: Waterproofing Chemicals Market Size, By Chemistry, 20142021 (Kiloton)

Table 42 Singapore: Waterproofing Chemicals Market Size, By Chemistry, 20142021 (USD Million)

Table 43 Singapore: Preformed Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 44 Signapore: Preformed Membranes Market Size, By Type, 20142021 (USD Million)

Table 45 Singapore: Liquid Applied Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 46 Singapore: Liquid Applied Membranes Market Size, By Type, 20142021 (USD Million)

Table 47 Singapore: Integral Systems Market Size, By Type, 20142021 (Kiloton)

Table 48 Signapore: Integral Systems Market Size, By Type, 20142021 (USD Million)

Table 49 Philippines: Waterproofing Chemicals Market Size, By Chemistry, 20142021 (Kiloton)

Table 50 Philippines: Waterproofing Chemicals Market Size, By Chemistry, 20142021 (USD Million)

Table 51 Phillippines: Preformed Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 52 Phillippines: Preformed Membranes Market Size, By Type, 20142021 (USD Million)

Table 53 Philippines: Liquid Applied Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 54 Philippines: Liquid Applied Membranes Market Size, By Type, 20142021 (USD Million)

Table 55 Phillippines: Integral Systems Market Size, By Type, 20142021 (Kiloton)

Table 56 Phillippines: Integral Systems Market Size, By Type, 20142021 (USD Million)

Table 57 Vietnam: Waterproofing Chemicals Market Size, By Chemistry, 20142021 (Kiloton)

Table 58 Vietnam: Waterproofing Chemicals Market Size, By Chemistry, 20142021 (USD Million)

Table 59 Vietnam: Preformed Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 60 Vietnam: Preformed Membranes Market Size, By Type, 20142021 (USD Million)

Table 61 Vietnam: Liquid Applied Membranes Market Size, By Type, 20142021 (Million Square Meters)

Table 62 Vietnam: Liquid Applied Membranes Market Size, By Type, 20142021 (USD Million)

Table 63 Vietnam: Integral Systems Market Size, By Type, 20142021 (Kiloton)

Table 64 Vietnam: Integral Systems Market Size, By Type, 20142021 (USD Million)

Table 65 Expansions, 20122016

Table 66 New Product/Technology Launches, 20122016

Table 67 Mergers & Acquisitions, 20122016

Table 68 Agreements and Partnerships 20122016

List of Figures (19 Figures)

Figure 1 Waterproofing Chemicals:Bitumen Type Segment Expected to Dominate the Waterproofing Chemicals Market Between 2016 - 2021

Figure 2 Preformed Membranes : Epdm Type Preformed Membrane to Be the Fastest Growing Segment Between 2016 and 2021

Figure 3 Liquid Applied Membranes :Elastomeric Membranes Projected to Be the Fastest Growing Liquid Applied Membrane Segemnt During the Forecast Period

Figure 4 Integral Systems: Crystalline Waterproofing Admixture Expected to Be the Largest Type Segment in the Integral Systems Market, 2016 vs 2021

Figure 5 Companies Adopted Expansion as the Key Growth Strategy During the Last Four Years

Figure 6 Market Evolution Framework, 2013-2016

Figure 7 Expansion: Most Popular Growth Strategy Between 2012 and 2016

Figure 8 Carlisle Companies Inc: Company Snapshot

Figure 9 Carlisle Companies Inc: SWOT Analysis

Figure 10 Soprema Group: Company Snapshot

Figure 11 The DOW Chemical Company: Company Snapshot

Figure 12 The DOW Chemical Company: SWOT Analysis

Figure 13 W.R Grace & Co: Company Snapshot

Figure 14 BASF SE: Company Snapshot

Figure 15 BASF SE SWOT Analysis

Figure 16 Sika AG: Company Snapshot

Figure 17 Sika AG: SWOT Analysis

Figure 18 Pidilite Industries: Company Snapshot

Figure 19 Mapei S.P.A.: Company Snapshot

Growth opportunities and latent adjacency in Southeast Asia Waterproofing Systems Market