Elastomeric Membrane Market by Type (Sheet, Liquid Applied), Application (Roofs & Walls, Underground Construction, Wet Areas), End-use Industry (Non-residential, and Residential Construction), and Region - Global Forecast to 2022

[142 Pages Report] Elastomeric Membrane Market size was valued at USD 27.82 Billion in 2016 and is projected to reach USD 41.10 Billion by 2022, at a CAGR of 6.7% during the forecast period. High demand for the elastomeric membrane in the construction industry, and regulations related to energy optimization are driving the elastomeric membrane market across the globe.

Objectives of the Study

- To analyze and forecast the market size for the elastomeric membrane, in terms of volume and value

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To define, describe, and forecast the elastomeric membrane market on the basis of type, application, and end-use industry

- To forecast the elastomeric membrane market size with respect to five main regions, namely, North America, Europe, Asia-Pacific, the Middle East & Africa, and South America

- To strategically analyze micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, regional expansions, and R&D in the elastomeric membrane market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Years considered for this report

- 2016 Base Year

- 2017 Estimated Year

- 2022 Projected Year

Research Methodology

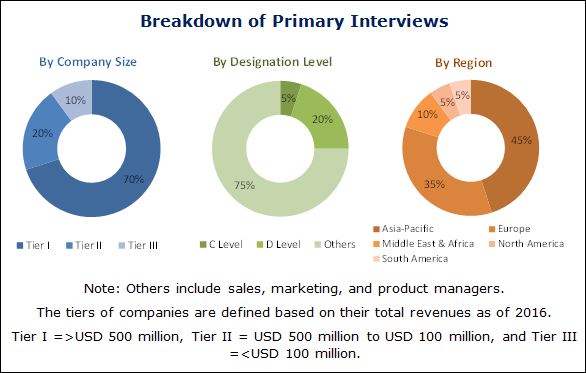

This study estimates the size of the elastomeric membrane market for 2017 and projects its growth by 2022. It provides a detailed qualitative and quantitative analysis of the elastomeric membrane market. Secondary sources, such as Hoovers, Bloomberg Business Week, and Factiva, among others have been used to identify and collect information useful for this extensive, commercial study of the elastomeric membrane market. Primary sources such as experts from related industries and suppliers of elastomeric membrane have been interviewed to obtain and verify critical information and assess future prospects of the elastomeric membrane market.

To know about the assumptions considered for the study, download the pdf brochure

The key players profiled in the report include, BASF, Sika, Carlisle Companies Inc., SOPREMA, Kemper System, Saint-Gobain, Firestone Building Products Company, Johns Manville, GCP Applied Technologies Inc., and Standard Industries Inc.

Target Audience:

- Manufacturers of Elastomeric Membranes

- Chemical Suppliers

- Traders, Distributors, and Suppliers of Elastomeric Membranes

- Raw Material Suppliers

- Government and Research Organizations

- Industry Associations

This study answers several questions for stakeholders, primarily which market segments they should focus upon during the next two to five years to prioritize their efforts and investments. It also provides a competitive landscape of the elastomeric membrane market.

Scope of the Report:

The elastomeric membrane market has been segmented as follows:

Elastomeric Membrane Market, by Type:

- Sheet

- Liquid Applied

Elastomeric Membrane Market, by Application:

- Roofs & Walls

- Underground Construction

- Wet Areas

- Others

Elastomeric Membrane Market, by End-Use Industry:

- Non-residential Construction

- Residential Construction

Elastomeric Membrane Market, by Region:

- Asia-Pacific

- Europe

- North America

- Middle East & Africa

- South America

The market has further been analyzed for the key countries in each of these regions.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for this report:

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the rest of Asia-Pacific elastomeric membrane market into Australia and New Zealand

The elastomeric membrane market is projected to reach USD 41.10 Billion by 2022, at a CAGR of 6.7% from 2017 to 2022. The elastomeric membrane market is expected to be driven by increasing residential and non-residential construction projects that are resulting in the growth of the construction industry. Moreover, regulations for energy optimization are increasing in order to address environmental concerns. Since elastomeric membranes such as TPO and EPDM contribute to energy savings, these regulations are expected to drive the elastomeric membrane market.

On the basis of type, the elastomeric membrane market has been segmented into sheet and liquid applied elastomeric membrane. The market for sheet membrane type of elastomeric membrane is the largest due to its superior performance and increasing demand for flat roofs in non-residential buildings. Sheet membranes such as TPO and EPDM are widely used in the enhancement of energy efficiency of buildings. High demand for green roofing in green buildings is expected to trigger the use of sheet membranes. The liquid applied membrane is the fastest-growing type owing to its seamless installation, convenience associated with its use, and availability of less expensive grade products as compared to sheet membranes.

On the basis of application, the elastomeric membrane market has been segmented into roofs & walls, underground construction, wet areas, and other applications. Roofs & walls is the largest as well as the fastest-growing application in the elastomeric membrane market. High expenditure on non-residential projects involving, commercial, institutional, and office buildings is expected to drive the growth of elastomeric membrane market in flat roofs.

On the basis of end-use industry, the elastomeric membrane market has been classified into residential construction and non-residential construction. The non-residential construction segment is both, the largest and the fastest-growing. Growing foreign investments in the construction industry, high-end commercial projects, and industrial development are expected to drive this segment. Growing construction of commercial buildings such as shopping malls, multiplexes, show rooms, institutional buildings, offices, and industrial buildings are resulting in the growth of the market. Industrial construction projects are also increasing due to growing manufacturing activity and growth in retail construction to meet consumer needs. These factors are cumulatively expected to result in high growth of the elastomeric membrane market in this sector.

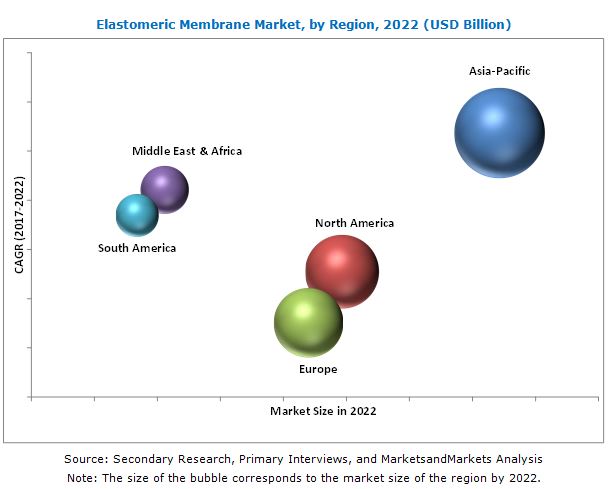

Based on region, the elastomeric membrane market has been segmented into Asia-Pacific, North America, Europe, the Middle East & Africa, and South America. The Asia-Pacific elastomeric membrane market is the largest and fastest-growing market due to substantial investments in residential and non-residential construction projects to meet the housing and infrastructural needs of the growing population. Cheap labor, cheap & accessible raw materials, and public infrastructure projects have boosted construction activities, thereby, increasing the demand for elastomeric membrane in this region.

The key restraining factor in the elastomeric membrane market is the fluctuating price of raw materials. Moreover, companies such as BASF, Sika Carlisle Companies Inc., SOPREMA, Kemper System, Saint-Gobain, Firestone Building Products Company, Johns Manville, GCP Applied Technologies Inc. and Standard Industries Inc. are active in the market and are providing innovative products to the construction industry. Moreover these companies are engaged in mergers & acquisitions and investments & expansions strategies to enhance their foothold in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Significant Opportunities in the Elastomeric Membrane Market

4.2 Elastomeric Membrane Market, By Application

4.3 Elastomeric Membrane Market, By End-Use Industry and Country

4.4 Elastomeric Membrane Market, By Region

4.5 Elastomeric Membrane Market, By Type

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 The Growing Construction Industry

5.2.1.1.1 Residential Construction

5.2.1.1.2 Non-Residential Construction

5.2.1.2 Increasing Regulations for Energy Optimization

5.2.1.3 Increasing Regulations in the Construction Industry

5.2.2 Restraints

5.2.2.1 Health Hazards Associated With Bitumen

5.2.3 Opportunities

5.2.3.1 Growing Importance of Green Roofing

5.2.3.2 Increasing Water Management Activities in Asia-Pacific Region

5.2.4 Challenges

5.2.4.1 Fluctuating Raw Material Prices

5.2.4.2 High Price of Elastomeric Membrane

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

6 Macroeconomic Indicators (Page No. - 44)

6.1 Introduction

6.2 Real GDP Growth Rate Forecast of Major Economies

6.3 Construction Contribution to GDP in USD Billion

7 Elastomeric Membrane Market, By Type (Page No. - 46)

7.1 Introduction

7.2 Elastomeric Sheet Membrane

7.2.1 Modified Bituminous Membrane

7.2.1.1 Styrene-Butadiene-Styrene (SBS)

7.2.1.2 Atactic Polypropylene (APP)

7.2.2 EPDM

7.2.2.1 Black EPDM

7.2.2.2 White EPDM

7.2.3 TPO

7.2.4 PVC

7.2.5 Others

7.3 Elastomeric Liquid Applied Membrane

7.3.1 Acrylic Liquid Applied Membrane

7.3.1.1 Acrylic

7.3.2 Polyurethane

7.3.3 Others

7.3.3.1 Polyurea

7.3.3.2 Pmma

7.3.3.3 Others

8 Elastomeric Membrane Market, By Application (Page No. - 53)

8.1 Introduction

8.2 Roofs & Walls

8.2.1 Roofs

8.2.1.1 Sloped Roofs

8.2.1.1.1 Low Slope

8.2.1.1.2 High Slope

8.2.1.1.3 Mansard Slope

8.2.1.2 Flat Roof

8.2.2 Walls

8.2.2.1 Exterior

8.2.2.2 Interior

8.3 Wet Areas

8.3.1 Internal Wet Room Areas

8.3.2 Artificial Water Bodies

8.4 Underground Construction

8.4.1 Underground Structures

8.5 Others

9 Elastomeric Membrane Market, By End-Use Industry (Page No. - 58)

9.1 Introduction

9.2 Residential Construction

9.3 Non-Residential Construction

9.3.1 Institutional & Commercial Construction

9.3.2 Industrial Construction

9.3.3 Public Infrastructure

10 Elastomeric Membrane Market, By Region (Page No. - 62)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 U.K.

10.3.3 Italy

10.3.4 France

10.3.5 Russia

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Australia

10.4.6 Rest of Asia-Pacific

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 Rest of Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Rest of South America

11 Competitive Landscape (Page No. - 99)

11.1 Market Ranking Analysis

11.1.1 Standard Industries Inc.

11.1.2 Sika

11.1.3 Firestone Building Products Company

11.1.4 Carlisle Companies Inc.

11.1.5 Soprema

12 Company Profile (Page No. - 101)

(Business Overview, Products Offered, Scorecard of Product Offering, Scorecard of Business Strategy, and New Product Launch)

12.1 Standard Industries Inc.

12.2 Sika

12.3 Firestone Building Products Company

12.4 Carlisle Companies Inc.

12.5 Soprema Group

12.6 BASF SE

12.7 GCP Applied Technologies Inc.

12.8 Johns Manville

12.9 Kemper System

12.1 Saint-Gobain

12.11 Other Companies

12.11.1 Copernit S.P.A.

12.11.2 Paul Bauder GmbH & Co. Kg

12.11.3 Fosroc

12.11.4 Henry Company

12.11.5 Derbigum

12.11.6 Renolit

12.11.7 Iko Industries

12.11.8 Mapei S.P.A

12.11.9 Pidilite Industries Ltd

12.11.10 The 3M Company

12.11.11 Noble Company

12.11.12 W. R. Meadows, Inc.

12.11.13 Tremco Incorporated

12.11.14 Duro-Last, Inc.

12.11.15 Covestro Ag

*Details Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 134)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (85 Tables)

Table 1 Forecast of Real GDP Growth Rates From 2016 to 2022

Table 2 Elastomeric Membrane Market Size, By Type, 20152022 (Million Square Meter)

Table 3 By Market Size, By Type, 20152022 (USD Million)

Table 4 Elastomeric Sheet Membrane Market Size, By Type, 20152022 (Million Square Meters)

Table 5 Elastomeric Sheet Membrane Market Size, By Type, 20152022 (USD Million)

Table 6 Elastomeric Liquid Applied Membrane Market Size, By Type, 20152022 (Million Square Meters)

Table 7 Elastomeric Liquid Applied Membrane Market Size, By Type, 20152022 (USD Million)

Table 8 Elastomeric Membrane Market Size, By Application, 20152022 (Million Square Meters)

Table 9 By Market Size, By Application, 20152022 (USD Million)

Table 10 Elastomeric Membranes Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 11 By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 12 Global Elastomeric Membrane Market Size, By Region, 20152022 (Million Square Meters)

Table 13 Global Elastomeric Membrane Market Size, By Region, 20152022 (USD Million)

Table 14 North America: Elastomeric Membrane Market Size, By Country, 20152022 (Million Square Meters)

Table 15 North America: By Market Size, By Country, 20152022 (USD Million)

Table 16 North America: By Market Size, By Type, 20152022 (Million Square Meters)

Table 17 North America: By Market Size, By Type, 20152022 (USD Million)

Table 18 North America: By Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 19 North America: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 20 U.S.: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 21 U.S.: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 22 Canada: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 23 Canada: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 24 Mexico: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 25 Mexico: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 26 Europe: Elastomeric Membrane Market Size, By Country, 20152022 (Million Square Meters)

Table 27 Europe: By Market Size, By Country, 20152022 (USD Million)

Table 28 Europe: By Market Size, By Type, 20152022 (Million Square Meters)

Table 29 Europe: By Market Size, By Type, 20152022 (USD Million)

Table 30 Europe: By Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 31 Europe: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 32 Germany: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 33 Germany: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 34 U.K.: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 35 U.K.: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 36 Italy: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 37 Italy: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 38 France: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 39 France: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 40 Russia: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 41 Russia: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 42 Rest of Europe: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 43 Rest of Europe: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 44 Asia-Pacific: Elastomeric Membrane Market Size, By Country, 20152022 (Million Square Meters)

Table 45 Asia-Pacific: By Market Size, By Country, 20152022 (USD Million)

Table 46 Asia-Pacific: By Market Size, By Type, 20152022 (Million Square Meters)

Table 47 Asia-Pacific: By Market Size, By Type, 20152022 (USD Million)

Table 48 Asia-Pacific: By Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 49 Asia-Pacific: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 50 China: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 51 China: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 52 Japan: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 53 Japan: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 54 India: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 55 India: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 56 South Korea: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 57 South Korea: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 58 Australia: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 59 Australia: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 60 Rest of Asia-Pacific: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 61 Rest of Asia-Pacific: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 62 Middle East & Africa: Elastomeric Membrane Market Size, By Country, 20152022 (Million Square Meters)

Table 63 Middle East & Africa: By Market Size, By Country, 20152022 (USD Million)

Table 64 Middle East & Africa: Elastomeric Membrane Market Size, By Type, 20152022 (Million Square Meters)

Table 65 Middle East & Africa: By Market Size, By Type, 20152022 (USD Million)

Table 66 Middle East & Africa: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 67 Middle East & Africa: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 68 Saudi Arabia: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 69 Saudi Arabia: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 70 UAE.: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 71 UAE.: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 72 Rest of Middle East & Africa: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 73 Rest of Middle East & Africa: Elastomeric By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 74 South America: Elastomeric Membrane Market Size, By Country, 20152022 (Million Square Meters)

Table 75 South America: By Market Size, By Country, 20152022 (USD Million)

Table 76 South America: Elastomeric Membrane Market Size, By Type, 20152022 (Million Square Meters)

Table 77 South America: By Market Size, By Type, 20152022 (USD Million)

Table 78 South America: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 79 South America: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 80 Brazil: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 81 Brazil: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 82 Argentina: Elastomeric Membrane Market Size, By Form, 20152022 (Million Square Meters)

Table 83 Argentina: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 84 Rest of South America: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (Million Square Meters)

Table 85 Rest of South America: Elastomeric Membrane Market Size, By End-Use Industry, 20152022 (USD Million)

List of Figures (33 Figures)

Figure 1 Elastomeric Membrane Market: Research Design

Figure 2 Breakdown of Primary Interviews

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Elastomeric Membrane Market: Data Triangulation

Figure 6 Sheet Elastomeric Membrane to Dominate Elastomeric Membrane Market Between 2017 and 2022

Figure 7 Roofs & Walls to Dominate Elastomeric Membrane Market Between 2017 and 2022

Figure 8 Non-Residential Construction to Dominate Elastomeric Membrane Market Between 2017 and 2022

Figure 9 Asia-Pacific Dominated Elastomeric Membrane Market in 2016

Figure 10 China to Be the Largest Market for Elastomeric Membrane Between 2017 and 2022

Figure 11 Emerging Economies to Offer Lucrative Growth Opportunities for Market Players Between 2017 and 2022

Figure 12 Roofs & Walls to Be the Fastest-Growing Application in Elastomeric Membrane Market, 20172022

Figure 13 Non-Residential Construction to Be the Largest End-Use Industry in Elastomeric Membrane Market

Figure 14 Asia-Pacific Accounted for the Largest Share of Elastomeric Membrane Market

Figure 15 Sheet Elastomeric Membrane to Account for the Largest Market Share During Forecast Period

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the Elastomeric Membrane

Figure 17 Porters Five Forces Analysis

Figure 18 Sheet Membrane to Dominate the Elastomeric Membrane Market During the Forecast Period

Figure 19 Roofs & Walls to Dominate the Elastomeric Membrane Market During the Forecast Period

Figure 20 Non-Residential Construction Industry to Dominate Elastomeric Membrane Market During the Forecast Period

Figure 21 India to Register Fastest Growth in Elastomeric Membrane Market

Figure 22 Environmental Regulations Driving the Elastomeric Sheet Membrane Market

Figure 23 Germany Dominates Elastomeric Membrane Market in Europe

Figure 24 Growing Investments in Infrastructure to Drive the Asia-Pacific Elastomeric Membrane Market

Figure 25 China Dominates Asia-Pacific Elastomeric Membrane Market

Figure 26 Commercial Construction Projects Driving Elastomeric Membrane Market in Middle East & Africa

Figure 27 Industrialization to Drive the Elastomeric Membrane Market in South America

Figure 28 Sika: Company Snapshot

Figure 29 Carlisle Companies Inc.: Company Snapshot

Figure 30 Soprema Group: Company Snapshot

Figure 31 BASF SE: Company Snapshot

Figure 32 GCP Applied Technologies Inc.: Company Snapshot

Figure 33 Saint-Gobain: Company Snapshot

Growth opportunities and latent adjacency in Elastomeric Membrane Market