Lateral Flow Assay Components Market Size, Growth, Share & Trends Analysis

Lateral Flow Assay Components Market by Type (Membrane, Pad), Application (Clinical Testing (Infectious, Cardiac Marker Test, Fertility, Pregnancy, Cholesterol Testing), Veterinary, Food Safety), Technique, End User & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global lateral flow assay (LFA) components market is projected to grow from USD 0.39 billion in 2025 to USD 0.49 billion by 2030, at a CAGR of 4.4%. Growth is driven by rising health awareness and the shift toward home-based healthcare, as consumers increasingly adopt self-monitoring and rapid testing solutions. Demand is further supported by the high prevalence of infectious diseases and an aging population, highlighting the need for accessible, reliable diagnostics. Expanding use of home-based tests and point-of-care (POC) diagnostics in hospitals, clinics, and remote settings also drives market expansion. However, inconsistent test performance and competition from alternative technologies may limit growth. Still, opportunities are emerging through broader applications of LFA components in clinical diagnostics, food safety, and environmental testing, despite limited reimbursements and the need for specialized storage and logistics.

KEY TAKEAWAYS

-

BY PRODUCTBy product, the lateral flow assay components market is segmented into membranes, pads, and other components. Rising demand for high-sensitivity, rapid diagnostics drives membrane innovations in surface chemistry and flow uniformity.

-

BY APPLICATIONBy application, the lateral flow assay components market is segmented into clinical testing, veterinary diagnostics, food safety & environmental testing, and drug development & quality testing. Growing demand for rapid, decentralized diagnostics drives adoption across clinical testing.

-

BY TECHNIQUEBy technique, the lateral flow assay components market is segmented into sandwich assays, competitive assays, and multiplex detection assays. Growing focus on high-sensitivity testing drives adoption of sandwich assay formats across clinical diagnostics.

-

BY END USERBy End User, the lateral flow assay components market is segmented into medical device manufacturing companies and medical device contract manufacturing companies. Rising demand for integrated diagnostic solutions drives component consumption among major medical device producers.

-

BY REGIONThe lateral flow assay components market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is the fastest-growing region, expected to achieve a CAGR of 5.3% during 2025–2030 due to rising diagnostics demand and healthcare expansion.

-

COMPETITIVE LANDSCAPEThe global lateral flow assay components market is highly competitive, with key players focusing on technological innovation, expanded manufacturing capacities, strategic partnerships, and portfolio diversification. Rising demand for point-of-care testing, home diagnostics, and reliable rapid tests drives companies to strengthen their market positions.

The global lateral flow assay components market is expected to experience steady growth, driven by increasing health awareness and the growing adoption of home-based and point-of-care testing solutions. The high prevalence of infectious and chronic diseases, along with the need for rapid, reliable diagnostics in hospitals, clinics, and remote settings, further supports market expansion. In addition, the versatility of LFA components across clinical diagnostics, food safety, and environmental monitoring is creating new opportunities for market players. However, challenges such as inconsistent performance of LFAs, competition from alternative diagnostic technologies, limited reimbursements in certain regions, and the requirement for specialized storage and transportation to maintain component integrity may constrain growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Growing awareness of health and preventive care is expected to fuel demand for lateral flow assay (LFA) components over the forecast period. Continuous technological progress in rapid diagnostics and the development of highly sensitive LFA materials are set to reshape the market’s revenue dynamics. To sustain growth in this evolving landscape, manufacturers must prioritize product reliability, user-friendly design, and alignment with end-user needs. Despite growing opportunities, many companies have yet to fully leverage emerging applications in point-of-care testing for chronic diseases, food safety, and environmental monitoring. Strategic collaborations with diagnostic kit developers, research institutions, and pharmaceutical companies can help broaden the adoption of LFA components across multiple industries. Organizations that embrace innovation and adapt to these trends are well-positioned to achieve stronger market share and long-term revenue growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High prevalence of infectious diseases

-

Rise in geriatric population

Level

-

Inconsistent performance of LFAs impacting demand for components

-

Alternative diagnostic technologies

Level

-

Expanding applications driving demand for LFA components

-

Rising demand for LFA components in food & beverage industry

Level

-

Limited reimbursements

-

Need for specialized storage and shipping for LFA components

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High prevalence of infectious diseases

The global lateral flow assay (LFA) components market is primarily driven by the persistent burden of infectious diseases, including tuberculosis, dengue, hepatitis, influenza, and HIV. According to the World Health Organization (WHO), tuberculosis accounted for about 8.2 million new cases in 2023, while dengue reached over 7.6 million cases globally by April 2024, with more than 16,000 severe cases and 3,000 deaths. Additionally, viral hepatitis caused around 1.3 million deaths in 2022, making it the second leading infectious killer worldwide. This ongoing disease prevalence emphasizes the urgent need for rapid, cost-effective, and reliable diagnostic tools. Lateral flow assays play a crucial role as front-line testing methods due to their speed, affordability, and ease of use, particularly in resource-limited settings. Consequently, demand for nitrocellulose membranes, sample pads, conjugate pads, and absorbent pads continues to rise, supporting mass-scale diagnostic production globally.

Restraint: Popularity of alternative diagnostic technologies

While lateral flow assays are valued for their affordability, speed, and ease of use, the global LFA components market faces competition from ELISA, PCR, and advanced molecular assays. These technologies offer higher sensitivity, full quantification, and reproducibility, making them preferable for clinical and high-precision applications. They can process complex samples and provide detailed diagnostic insights, limiting LFA adoption in laboratories and specialized healthcare settings. Consequently, demand for core LFA components—such as nitrocellulose membranes, conjugate pads, and absorbent pads—is restrained. Additional LFA limitations, including qualitative outputs, cross-reactivity, and sensitivity to sample properties, further restrict usage. Manufacturers are therefore focusing on improving membrane performance, material consistency, and pad reliability to maintain market relevance amid advancing alternative diagnostics.

Opportunity: Expanding applications of lateral flow assays and related components

Expanding applications are driving significant growth in the global lateral flow assay (LFA) components market. Traditionally used for infectious disease and cardiac testing, LFAs now support saliva-based diagnostics, enabling non-invasive detection of biomarkers like cortisol and α-amylase. In behavioral health, LFAs assist in substance detection and on-site monitoring, addressing mental health and addiction needs. Agriculture adoption is rising, with LFAs detecting GMOs and assessing crop quality to support food safety and biotechnology. In biosecurity, LFAs identify biological threats such as anthrax, enhancing preparedness, while environmental testing uses LFAs to detect contaminants in water, soil, and ecosystems. These applications boost demand for high-quality components—including nitrocellulose membranes, conjugates, and pads—creating opportunities for suppliers to innovate beyond healthcare.

Challenge: Need for specialized storage and shipping for lateral flow assay membranes

The storage and shipping of LFA membranes remain a key challenge for the components market. Nitrocellulose and PVDF membranes are highly sensitive, and their quality directly affects LFA sensitivity and reliability. Small variations in pore size, surface chemistry, or structure can impact performance. Membranes must be kept under controlled conditions, protected from extreme temperatures, chemical vapors, and sunlight, while nitrocellulose’s flammability requires careful handling. These strict requirements increase logistical complexity and costs, necessitating specialized packaging, climate-controlled storage, and secure transport. Any deviation risks product degradation, test failures, and credibility loss, limiting supply chain efficiency and slowing overall market growth for LFA components.

Lateral Flow Assay Components Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides a broad portfolio of LFA components including membranes, and pads for diagnostic applications. | Ensures high-quality, consistent assay performance; scalable production; reliable support for R&D and manufacturing workflows. |

|

Offers Unisart CN membranes designed for lateral flow devices with customizable properties for diverse diagnostic needs. | Accelerates time-to-market; provides reproducible, defect-free membranes; supports flexible assay design and high-quality results. |

|

Manufactures absorbent, conjugate, and sample pads, including plasma separation pads for lateral flow devices. | Improves fluid handling and assay reliability; customizable for specific applications; reduces production time and variability. |

|

Supplies Hi-Flow Plus nitrocellulose membranes and SureWick pads for lateral flow assays, emphasizing clinical and industrial diagnostic use. | Delivers superior consistency and reliability; maintains high performance across batches; widely used in clinical diagnostics. |

|

Provides membranes and absorbent pads suitable for dipstick and device formats in lateral flow assays. | Offers high-quality membranes and pads for efficient fluid flow; supports various LFA formats; enhances assay sensitivity and reproducibility. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem map of the lateral flow assay (LFA) components market illustrates the key players, functions, and interactions across the value chain. It encompasses major product categories such as membranes, pads, and conjugate materials, along with their respective applications and testing techniques used in diagnostic kits. Manufacturers in this ecosystem are responsible for research, product formulation, optimization, and commercialization, ensuring that each component meets strict performance and regulatory standards. The distribution network—supported by third-party logistics providers, distributors, and e-commerce platforms—plays a vital role in marketing and timely delivery to downstream partners. Research and development are carried out by in-house facilities, contract research organizations (CROs), and contract development and manufacturing organizations (CDMOs), enabling flexibility, cost efficiency, and faster product innovation. At the downstream end, medical device manufacturers and contract producers drive demand by incorporating these components into point-of-care and home diagnostic kits. Additionally, investors and healthcare regulators influence the market’s evolution by shaping policies, funding innovation, and ensuring compliance—making them essential enablers of growth within the LFA components landscape.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Lateral Flow Assay Components Market, By Product

The lateral flow assay components market is divided into membranes, pads, and other components. Among these, membranes led the market in 2024 as they form the essential platform where test and control lines capture and detect target analytes. Nitrocellulose remains the preferred material due to its exceptional protein-binding properties and proven reliability, while alternatives such as cellulose acetate, polyvinylidene fluoride (PVDF), charge-modified nylon, and polyethersulfone (PES) are gaining popularity for improved flow regulation and chemical stability. Variations in pore size and capillary flow rate allow manufacturers to tailor membranes for faster or more sensitive tests. Continuous advancements in uniformity and surface treatment have expanded membrane versatility, solidifying their position as the largest revenue-contributing segment in the LFA components market.

Lateral Flow Assay Components Market, By Application

The lateral flow assay components market is divided into clinical testing, veterinary diagnostics, food safety & environmental testing, and drug development & quality testing. Among these, clinical testing held the largest market share in 2024, propelled by the extensive use of LFA-based rapid test kits as accessible alternatives to centralized laboratory immunoassays. The segment includes pregnancy and fertility testing, infectious disease testing, cardiac marker testing, cholesterol testing, drugs-of-abuse testing, and other diagnostic uses. LFAs enable faster, cost-effective, and portable point-of-care testing suitable for mass screening and low-resource environments. Pregnancy and fertility testing remain the most established category, while infectious disease testing continues to drive growth. Additionally, expanding use of cardiac and lipid marker LFAs supports chronic disease management, reinforcing clinical testing as the dominant revenue-generating application within the lateral flow assay components market.

Lateral Flow Assay Components Market, By Technique

The lateral flow assay components market is divided into sandwich assays, competitive assays, and multiplex detection assays. Among these, sandwich assays held the largest market share in 2024 due to their superior sensitivity, specificity, and suitability for detecting larger analytes such as viral antigens, bacterial pathogens, and key biomarkers. In this technique, the analyte is “sandwiched” between two antibodies, producing a signal proportional to analyte concentration and ensuring reliable quantitative detection. Sandwich assays dominate applications like pregnancy testing (hCG), infectious disease testing (HIV, hepatitis B, H. pylori), and cardiac marker analysis (troponin, CK-MB, myoglobin). Their consistent signal strength enhances result accuracy, supporting both clinical and home-based diagnostics. Rising use of point-of-care devices has increased demand for membranes, conjugate pads, and nanoparticles optimized for this format, reinforcing sandwich assays as the leading revenue-generating technique in the lateral flow assay components market.

Lateral Flow Assay Components Market, By End User

The lateral flow assay components market, by end user, is divided into medical device manufacturing companies and medical device contract manufacturing companies. Among these, medical device manufacturing companies held the largest market share in 2024, owing to their extensive involvement in designing, engineering, and producing a broad portfolio of diagnostic devices. Leading players such as Abbott (US), Hoffmann-La Roche (Switzerland), Danaher Corporation (US), Siemens Healthineers (Germany), and Thermo Fisher Scientific (US) are key consumers of membranes, pads, conjugates, and housing materials. The rising prevalence of infectious diseases, an expanding elderly population, and increasing adoption of home-based and point-of-care testing continue to strengthen this segment. In parallel, contract manufacturing companies are experiencing steady growth as OEMs outsource production for scalability and cost efficiency, particularly in Asia-Pacific. Nevertheless, medical device manufacturers remain the primary revenue-generating end users in the lateral flow assay components market.

REGION

Asia Pacific to be fastest-growing region in global wearable healthcare devices market during forecast period

The global lateral flow assay components market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among these, the Asia Pacific region is the fastest-growing market due to rapid healthcare infrastructure expansion, strong economic growth, and rising investments from domestic and international players. High-growth countries such as China, India, Japan, South Korea, Taiwan, Australia, and Singapore are key contributors, supported by increased healthcare expenditure, aging populations, and demand for point-of-care and home-based diagnostics. Emerging Southeast Asian economies like Vietnam, Indonesia, and the Philippines are also driving growth through manufacturing expansion and foreign investment. Despite challenges such as limited awareness, infrastructural gaps, and reimbursement issues, the presence of both local and multinational suppliers strengthens the regional ecosystem, positioning Asia Pacific as the primary growth engine for LFA components.

Lateral Flow Assay Components Market: COMPANY EVALUATION MATRIX

The lateral flow assay components market is dominated by Danaher Corporation (US), Sartorius AG (Germany), Merck KGaA (Germany), Ahlstrom (Finland), and Advanced Microdevices Pvt. Ltd. (India). Danaher strengthens its leadership through strategic acquisitions, expanded manufacturing capacities, and a diversified portfolio of membranes, pads, and conjugates. Sartorius AG focuses on high-quality nitrocellulose membranes, R&D, and technology-driven, customer-focused solutions. Merck KGaA leverages its Science & Lab Solutions division and U.S.-based production to support rapid diagnostic kit manufacturing. Ahlstrom emphasizes innovative membrane materials and consistent quality, while Advanced Microdevices Pvt. Ltd. benefits from regional expertise and growing adoption in emerging markets. Collectively, these strategies—including product innovation, portfolio diversification, regional expansion, and technology-led solutions—enable market leaders to maintain dominance in an environment shaped by rising point-of-care testing, home diagnostics demand, and increasing prevalence of infectious and chronic diseases.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 0.38 Billion |

| Revenue Forecast in 2030 | USD 0.49 Billion |

| Growth Rate | CAGR of 4.4% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Lateral Flow Assay Components Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- May 2023 : Cytiva (US) completed the integration of Pall Life Sciences to expand its biotechnology and LFA component portfolio

- October 2023 : Cytiva (US) opened a new manufacturing facility and Experience Center in Pune, India, doubling its production capacity for components.

- July 2022 : Merck KGaA (Germany) broke ground on its first lateral flow membrane production facility in Sheboygan, US, to produce Hi-Flow Plus membranes for rapid diagnostic tests.

Table of Contents

Methodology

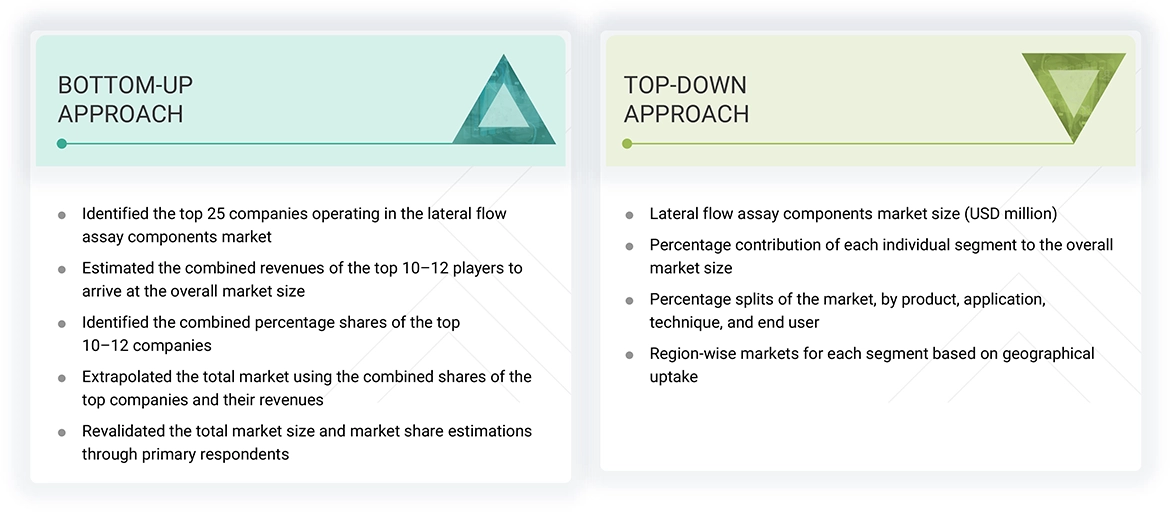

The study focused on key activities to estimate the current market size for the lateral flow assay (LFA) components market. Extensive secondary research was conducted to gather information on the industry. The next step involved validating these findings, assumptions, and size estimates with industry experts across the value chain through primary research. Various methods, such as top-down and bottom-up approaches, were used to calculate the total market size. Subsequently, market segmentation and data triangulation were employed to determine the sizes of segments and subsegments within the lateral flow assay components market.

The four steps involved in estimating the market size are:

Secondary Research

The secondary research process involves extensively using secondary sources such as directories, databases (including Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, investor presentations, SEC filings from companies, and publications from government agencies like the National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), Global Burden of Disease Study, and Centers for Medicare and Medicaid Services (CMS). These sources are utilized to gather information for the global lateral flow assay components market study. They also help gather key details about the main players, market classification, and segmentation based on industry trends, down to the most detailed level, as well as significant developments related to market and technology perspectives. Additionally, a database of leading industry players was created using secondary data research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from various companies and organizations operating in the LFAs market and the lateral flow assay components market. Primary sources from the demand side include medical device manufacturing companies and medical device contract manufacturer companies.

The following is a breakdown of the primary respondents:

Note 1: Other designations include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2024, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = < USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were estimated based on revenue mapping of major product manufacturers and OEMs active in the worldwide lateral flow assay components market. All key service providers were identified at the global and/or regional, or country level. Revenue mapping for the respective business segments and sub-segments was conducted for the major players. The global lateral flow assay components market was split into various segments and sub-segments based on:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of LFA components providers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from LFA components (or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global lateral flow assay components market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After determining the overall market size using the method described above, the total market was divided into several segments. Data triangulation and market breakdown methods were used wherever applicable to complete the market segmentation process and obtain precise data for all segments and subsegments. The data was triangulated by analyzing various factors and trends from both demand and supply sides.

Market Definition

LFA components typically include membranes (such as nitrocellulose, polyvinylidene difluoride, nylon, or polyether sulfone membranes with immobilized antibodies) and pads (such as sample, conjugate, and absorbent pads) that are fixed to an inert backing material to create the assay. These components can be used for various applications, including clinical testing, food and beverage testing, and drug-of-abuse detection testing, among others.

Stakeholders

- Manufacturers and distributors of LFA components

- Trade associations and industry bodies

- Medical device contract manufacturing companies

- Research and Consulting Firms

- Venture Capitalists and Investors

- Government Organizations

Report Objectives

- To define, describe, segment, and forecast the lateral flow assay components market by product, application, technique, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall lateral flow assay components market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product excellence

- To study the impact of AI/Gen AI on the market, along with the macroeconomic outlook for each region

Key Questions Addressed by the Report

Which are the top industry players in the lateral flow assay components market?

Key players include Danaher Corporation (US), Sartorius AG (Germany), Merck KGaA (Germany), Ahlstrom (Finland), Advanced Microdevices Pvt. Ltd. (India), DCN Diagnostics (US), Fortis Life Sciences, LLC. (US), Cobetter (China), Axiva Sichem Pvt. Ltd. (India), Nupore Filtration Systems (India), and BALLYA (China).

What are some of the major drivers for this market?

Major drivers include the high prevalence of infectious diseases, rising geriatric population, increasing adoption of home-based tests, and growing demand for point-of-care diagnostics.

Which products have been included in the global lateral flow assay components market?

Products include membranes, pads, and other components. Membranes held the largest market share in 2024.

What are the major applications of LFA components and devices?

Major applications include clinical testing, veterinary diagnostics, food safety and environmental testing, and drug development and quality testing. Clinical testing held the largest market share in 2024.

Which region is lucrative for the global lateral flow assay components market?

The Asia Pacific region, particularly China and India, is expected to experience the highest CAGR and offers promising opportunities for LFA components.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Lateral Flow Assay Components Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Lateral Flow Assay Components Market