Transfer Membrane Market by Type (PVDF, Nitrocellulose, Nylon), Transfer Method (Tank, Semi-dry, Dry), Application (Western, Northern, Southern Blot, Protein Sequencing), End user (Academia, Diagnolab, Pharmaceutical Companies) - Global Forecast to 2023

[124 Pages Report] The transfer membrane market is projected to reach USD 187.9 million by 2023 from USD 174.8 million in 2018, at a CAGR of 1.5% during the forecast period.

Years considered for the study

- Base Year-2017

- Estimated Year-2018

- Forecast Period-2018-2023

Objectives of the study are:

- To define, describe, and forecast the market by type, transfer method, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, and opportunities) along with the current trends

- To strategically analyze micromarkets with respect to their individual growth trends, prospects, and contributions to the total market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the revenue of the market segments in North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as acquisitions and expansions in the market

Research Methodology

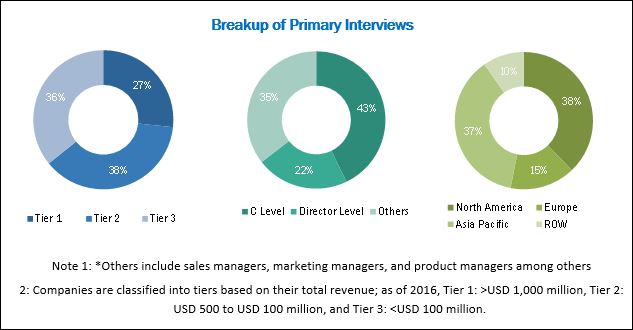

This research study involved the usage of extensive secondary sources, directories, and databases such as D&B, Bloomberg Business, and Factiva, along with government databases, to identify and collect information useful for this technology-based, market-oriented, and commercial study of the transfer membrane market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess future prospects.

The secondary sources referred to for this research study include corporate filings (such as annual reports, SEC filings, investor presentations, and financial statements); research journals; press releases; as well as articles published by various Bioinformatics service providers, and professional associations.

To know about the assumptions considered for the study, download the pdf brochure

Merck KGaA (US), Thermo Fisher Scientific (US), Bio-Rad Laboratories (US), GE Healthcare (US), PerkinElmer (US), Pall Coporation (US), Advansta (US), GVS (Italy), Santa Cruz Biotechnology (US), Abcam (UK), ATTO Corporation (Japan), Carl Roth (Germany), Macherey-Nagel (Germany), Azure Biosystems (US), and Axiva Sichem Biotech (India), , are some of the key players in the global market. Some of the leading players in the market adopt inorganic growth strategies such as acquisitions to enhance its market position.

Stakeholders

- Transfer membrane manufacturers

- Transfer membrane suppliers and distributors

- Research laboratories and academic institutes

- Government & non-government laboratories

- Venture capitalists and other funding organizations

- Healthcare institutions (hospitals and diagnostic clinics)

- Pharmaceutical and biotechnology companies

- Forensic laboratories

- Contract research organizations

Scope of the Report

This research report categorizes the transfer membrane market into the following segments and subsegments:

Transfer Membrane Market, By Type

- PVDF

- Nitrocellulose

- Nylon

Transfer Membrane Market, By Transfer Method

- Tank Electrotransfer

- Semi-dry Electrotransfer

- Dry Electrotransfer

- Other Transfer Methods

Transfer Membrane Market, By Application

- Western Blotting

- Northern Blotting

- Southern Blotting

- Protein Sequencing and Amino Acid Analysis

- Others Applications

Transfer Membrane Market, By End User

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Diagnostic Laboratories

- Other End Users

Transfer Membrane Market, By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Rest of APAC

-

Rest of the World

- Middle East and Africa

- Latin America

*Note: Other applications include colony/plaque lift and dot/slot blots.

Other transfer methods include diffusion blotting and vacuum blotting.

Other end users include contract research organizations, blotting service providers, food & beverage companies, and forensic laboratories.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

The global transfer membrane market is expected to reach USD 187.9 million by 2023 from USD 174.8 million in 2018, at a CAGR of 1.5% during the forecast period. Factors such as increasing public and private funding for life science research, the significantly high prevalence of target diseases across the globe, and increasing R&D spending by pharmaceutical and biotechnology companies are expected to drive the growth of market.

The report analyzes the global market by type, transfer method, application, end user, and region.

On the basis of type, the market is divided into nylon membranes, nitrocellulose membranes, and PVDF membranes. In 2018, PVDF Membranes are expected to command for the major share of the market. This can be attributed to the advantages of PVDF membranes over its counterparts, such as better protein retention, strength, chemical compatibility, and wide applications in western blotting.

Based on end user, the market is segmented into academic and research institutes, pharmaceutical and biotechnology companies, diagnostic laboratories, and other end users. Among these, the academic and research institutes segment is expected to account for the largest share of the transfer membrane market in 2018, owing it to the rising financial support from private as well as government bodies for life science research in various nations.

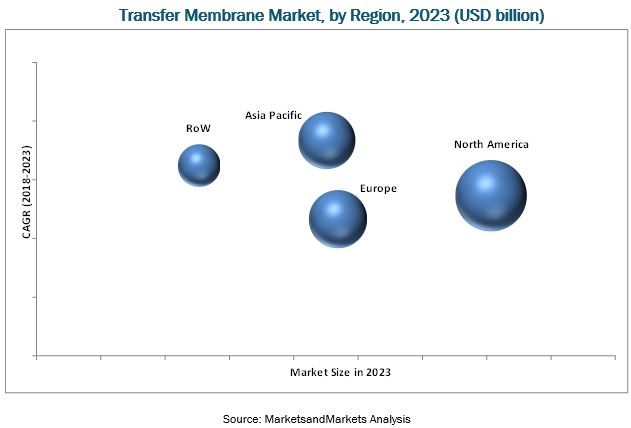

This report covers the market data across four major geographies, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America is expected to account for the largest share of the global transfer membrane market in 2018, followed by Europe. The large share in the North American region is mainly attributed to the presence of leading transfer membrane manufacturers in the region, availability of government and private financial support for life science research, and high target disease prevalence in the region. Factors such as rising proteomic research and growing scale of life science projects funded by government and private bodies, are driving the growth of the Asia Pacific market.

The the availability of alternative technologies and the need of skilled professionals are expected to restrain the growth of the market in the forecast period.

As of 2017, Merck KGaA (US) dominates the global transfer membrane market through its broad product portfolio, strong geographical presence, and wide customer base across the globe. Thermo Fisher Scientific (US) held the second leadership position in the global market. Other prominent players in the global market included PerkinElmer (US), , Bio-Rad Laboratories (US), GE Healthcare (US), Pall Coporation (US), Advansta (US), GVS (Italy), Santa Cruz Biotechnology (US), Abcam (UK), ATTO Corporation (Japan), Carl Roth (Germany), Macherey-Nagel (Germany), Azure Biosystems (US), and Axiva Sichem Biotech (India),.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Transfer Membrane: Market Overview

4.2 Transfer Membrane Market, By Type (2018 vs 2023)

4.3 Market, By Transfer Method (2018 vs 2023)

4.4 Market, By Application (2018 vs 2023)

4.5 Geographic Analysis: Transfer Membrane Market, By End User, 2018 vs 2023 (USD Million)

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Public and Private Funding for Life Science Research

5.2.1.2 High Prevalence of Target Diseases Across the Globe

5.2.1.3 Increasing R&D Spending By Pharmaceutical and Biotechnology Companies

5.2.2 Restraints

5.2.2.1 Availability of Alternative Technologies

5.2.2.2 Need of Skilled Professionals

5.2.3 Opportunities

5.2.3.1 Emerging Markets

5.2.3.2 Research and Development Activities in the Field of Proteomics

5.2.4 Challenges

5.2.4.1 Durability and Sensitivity of Transfer Membranes

6 Transfer Membrane Market, By Type (Page No. - 36)

6.1 Introduction

6.2 PVDF Transfer Membranes

6.3 Nitrocellulose Transfer Membranes

6.4 Nylon Transfer Membranes

7 Transfer Membrane Market, By Transfer Method (Page No. - 45)

7.1 Introduction

7.2 Tank Electrotransfer

7.3 Semi-Dry Electrotransfer

7.4 Dry Electrotransfer

7.5 Other Transfer Methods

8 Transfer Membrane Market, By Application (Page No. - 51)

8.1 Introduction

8.2 Northern Blotting

8.3 Southern Blotting

8.4 Western Blotting

8.5 Protein Sequencing and Amino Acid Analysis

8.6 Other Applications

9 Transfer Membrane Market, By End User (Page No. - 58)

9.1 Introduction

9.2 Academic and Research Institutes

9.3 Pharmaceutical and Biotechnology Companies

9.4 Diagnostic Laboratories

9.5 Other End Users

10 Transfer Membrane Market, By Region (Page No. - 65)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 UK

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 Rest of Asia Pacific

10.5 Rest of the World (RoW)

10.5.1 Middle East and Africa

10.5.2 Latin America

11 Competitive Landscape (Page No. - 89)

11.1 Transfer Membrane Market Ranking Analysis, By Key Player, 2017

12 Company Profile (Page No. - 91)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Abcam

12.2 Advansta

12.3 Atto Corporation

12.4 Axiva Sichem Biotech

12.5 Azure Biosystems

12.6 Bio-Rad Laboratories

12.7 Carl Roth

12.8 GE Healthcare

12.9 GVS

12.10 Macherey-Nagel

12.11 Merck KGaA

12.12 Pall Corporation (Subsidiary of Danaher Corporation)

12.13 Perkinelmer

12.14 Santa Cruz Biotechnology

12.15 Thermo Fisher Scientific

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 115)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (64 Tables)

Table 1 Number of Hiv Infections and Aids-Related Deaths in 2016

Table 2 Comparison of Transfer Membranes

Table 3 Transfer Membrane Market, By Type, 2016–2023 (USD Million)

Table 4 PVDF Membranes Market, By Region, 2016–2023 (USD Million)

Table 5 PVDF Membranes Market, By Transfer Method, 2016–2023 (USD Million)

Table 6 PVDF Membranes Market, By Application, 2016–2023 (USD Million)

Table 7 PVDF Membranes Market, By End User, 2016–2023 (USD Million)

Table 8 Nitrocellulose Membranes Market, By Region, 2016–2023 (USD Million)

Table 9 Nitrocellulose Membranes Market, By Transfer Method, 2016–2023 (USD Million)

Table 10 Nitrocellulose Membranes Market, By Application, 2016–2023 (USD Million)

Table 11 Nitrocellulose Membranes Market, By End User, 2016–2023 (USD Million)

Table 12 Nylon Membranes Market, By Region, 2016–2023 (USD Million)

Table 13 Nylon Membranes Market, By Transfer Method, 2016–2023 (USD Million)

Table 14 Nylon Membranes Market, By Application, 2016–2023 (USD Million)

Table 15 Nylon Membranes Market, By End User, 2016–2023 (USD Million)

Table 16 Transfer Membrane Market, By Transfer Method, 2016–2023 (USD Million)

Table 17 Market for Tank Electrotransfer, By Region, 2016–2023 (USD Million)

Table 18 Market for Semi-Dry Electrotransfer, By Region, 2016–2023 (USD Million)

Table 19 Market for Dry Electrotransfer, By Region, 2016–2023 (USD Million)

Table 20 Market for Other Transfer Methods, By Region, 2016–2023 (USD Million)

Table 21 Transfer Membrane Market, By Application, 2016–2023 (USD Million)

Table 22 Market for Northern Blotting, By Region, 2016–2023 (USD Million)

Table 23 Market for Southern Blotting, By Region, 2016–2023 (USD Million)

Table 24 Market for Western Blotting, By Region, 2016–2023 (USD Million)

Table 25 Market for Protein Sequencing and Amino Acid Analysis, By Region, 2016–2023 (USD Million)

Table 26 Transfer Membrane Market for Other Applications, By Region, 2016–2023 (USD Million)

Table 27 Market, By End User, 2016–2023 (USD Million)

Table 28 Market for Academic and Research Institutes, By Region, 2016–2023 (USD Million)

Table 29 Market for Pharmaceutical and Biotechnology Companies, By Region, 2016–2023 (USD Million)

Table 30 Market for Diagnostic Laboratories, By Region, 2016–2023 (USD Million)

Table 31 Transfer Membrane Market for Other End Users, By Region, 2016–2023 (USD Million)

Table 32 Market, By Region, 2016–2023 (USD Million)

Table 33 North America: Transfer Membrane Market, By Type, 2016–2023 (USD Million)

Table 34 North America: Market, By Transfer Method, 2016–2023 (USD Million)

Table 35 North America: Market, By Application, 2016–2023 (USD Million)

Table 36 North America: Market, By End User, 2016–2023 (USD Million)

Table 37 North America: Market, By Country, 2016–2023 (USD Million)

Table 38 US: Transfer Membrane Market, By Type, 2016–2023 (USD Million)

Table 39 Canada: Market, By Type, 2016–2023 (USD Million)

Table 40 Europe: Market, By Type, 2016–2023 (USD Million)

Table 41 Europe: Market, By Transfer Method, 2016–2023 (USD Million)

Table 42 Europe: Market, By Application, 2016–2023 (USD Million)

Table 43 Europe: Market, By End User, 2016–2023 (USD Million)

Table 44 Europe: Market, By Country, 2016–2023 (USD Million)

Table 45 Germany: Market, By Type, 2016–2023 (USD Million)

Table 46 France: Market, By Type, 2016–2023 (USD Million)

Table 47 UK: Market, By Type, 2016–2023 (USD Million)

Table 48 Rest of Europe: Market, By Type, 2016–2023 (USD Million)

Table 49 Asia Pacific: Market, By Type, 2016–2023 (USD Million)

Table 50 Asia Pacific: Market, By Transfer Method, 2016–2023 (USD Million)

Table 51 Asia Pacific: Market, By Application, 2016–2023 (USD Million)

Table 52 Asia Pacific: Market, By End User, 2016–2023 (USD Million)

Table 53 Asia Pacific: Market, By Country, 2016–2023 (USD Million)

Table 54 China: Transfer Membrane Market, By Type, 2016–2023 (USD Million)

Table 55 India: Market, By Type, 2016–2023 (USD Million)

Table 56 Japan: Market, By Type, 2016–2023 (USD Million)

Table 57 Rest of Asia Pacific: Transfer Membrane Market, By Type, 2016–2023 (USD Million)

Table 58 RoW: Market, By Type, 2016–2023 (USD Million)

Table 59 RoW: Transfer Membrane Market, By Transfer Method, 2016–2023 (USD Million)

Table 60 RoW: Market, By Application, 2016–2023 (USD Million)

Table 61 RoW: Transfer Membrane Market, By End User, 2016–2023 (USD Million)

Table 62 RoW: Market, By Region, 2016–2023 (USD Million)

Table 63 Middle East and Africa: Transfer Membrane Market, By Type, 2016–2023 (USD Million)

Table 64 Latin America: Transfer Membrane Market, By Type, 2016–2023 (USD Million)

List of Figures (35 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Transfer Membrane Market, By Type (2018 vs 2023)

Figure 8 Market, By Transfer Method (2018 vs 2023)

Figure 9 Market, By Application (2018 vs 2023)

Figure 10 Transfer Membrane Market, By End User (2018 vs 2023)

Figure 11 Market, By Region, 2018

Figure 12 Financial Support for Life Science Research is Driving Market Growth

Figure 13 PVDF Transfer Membrane Segment Will Continue to Dominate the Market By 2023

Figure 14 Tank Electrotransfer Segment Will Continue to Dominate the Market By 2023

Figure 15 Western Blotting Will Continue to Dominate Market By 2023

Figure 16 Academic and Research Institutes Segment to Account for the Largest Share of the Market in 2018

Figure 17 Transfer Membrane Market: Drivers, Restraints, Opportunities, & Challenges

Figure 18 NIH Funding for Biomedical Research (2013–2017)

Figure 19 PVDF Membranes Segment to Dominate the Market in 2018

Figure 20 Tank Electrotransfer Segment to Dominate the Market in 2018

Figure 21 Western Blotting Segment to Dominate the Market in 2018

Figure 22 Academic and Research Institutes Segment to Dominate the Market in 2018

Figure 23 Number of Transfer Membrane-Based Research Studies Published in Pubmed During 1977-2017

Figure 24 North America is Estimated to Be the Largest Market for Transfer Membranes in 2018

Figure 25 North America: Transfer Membrane Market Snapshot

Figure 26 Europe: Market Snapshot

Figure 27 Asia Pacific: Market Snapshot

Figure 28 Transfer Membrane Market Ranking, By Key Player, 2017

Figure 29 Abcam: Company Snapshot (2017)

Figure 30 Bio-Rad Laboratories: Company Snapshot (2017)

Figure 31 GE Healthcare: Company Snapshot (2017)

Figure 32 Merck KGaA: Company Snapshot (2017)

Figure 33 Danaher Corporation: Company Snapshot (2017)

Figure 34 Perkinelmer: Company Snapshot (2017)

Figure 35 Thermo Fisher Scientific: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Transfer Membrane Market