Industrial Wax Market

Industrial Wax Market by Type (Fossil-based Wax, Synthetic Wax, Bio-based Wax), Form (Solid, Powdered Emulsions & Liquids), Application (Candles, Packaging, Coatings & Polishing, Building Materials, Other Applications), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

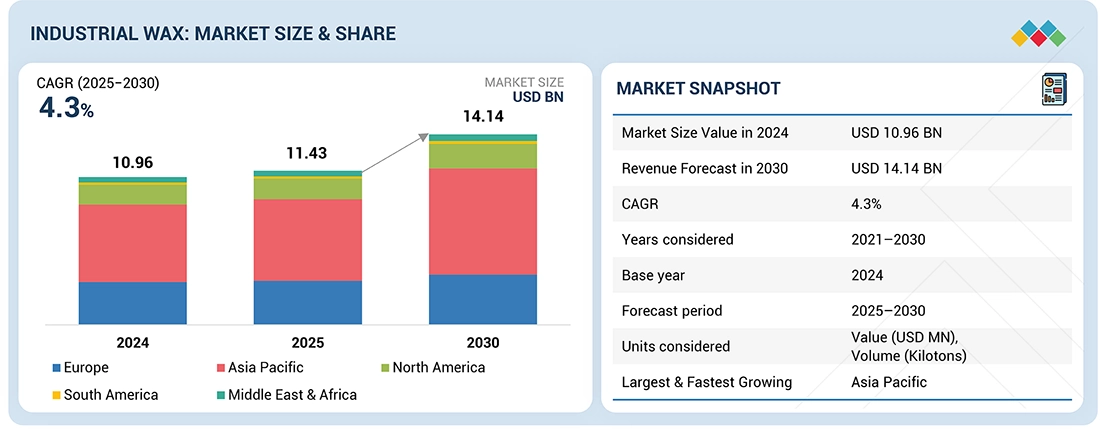

The industrial wax market is projected to reach USD 14.14 billion by 2030 from USD 11.43 billion in 2025, at a CAGR of 4.3% from 2025 to 2030. Industrial wax describes a category of functional waxes which are made from petroleum, synthetic processing, or bio-based resources with formulations that meet the specific industrial requirements of melting points, viscosity, and chemical stability. The rise in demand for industrial wax is attributed to the ever-increasing applications of wax in various industries, including personal care, rubber and tire, food packaging and candle manufacturing.

KEY TAKEAWAYS

-

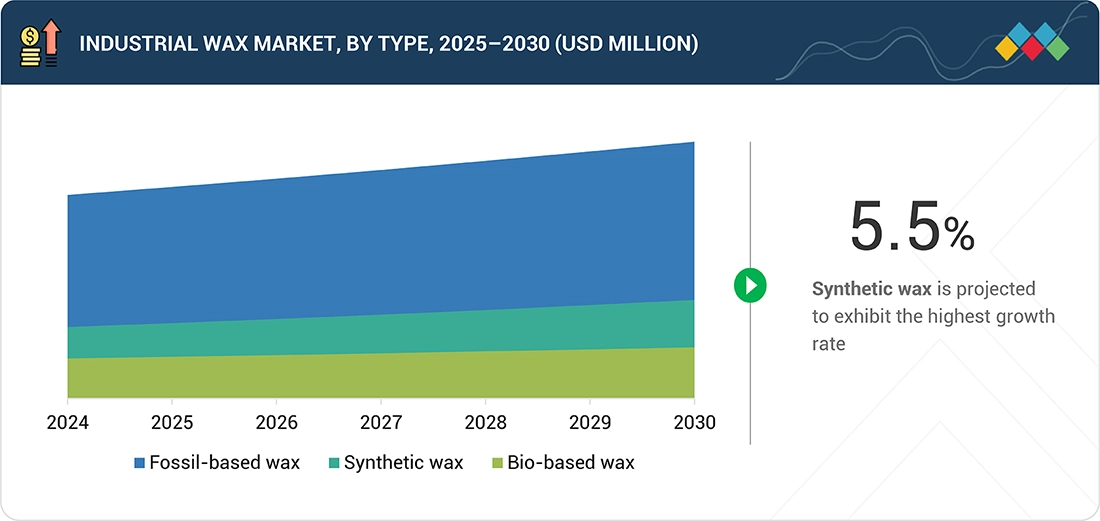

BY TYPEThe industrial wax market by type includes fossil-based wax, synthetic wax, and bio-based wax. Fossil-based wax dominates the market in terms of demand, due to steady growth in end-use industries like candles, packaging, cosmetics, and coatings.

-

BY FORMThe industrial wax market by form includes solid, emulsions & liquids, and powdered. Each serves different industrial uses and has unique market trends. Solid wax is the largest segment due to its widespread use in candles, packaging, rubber processing, coatings, and building materials.

-

BY APPLICATIONThe industrial wax market by application includes candles, packaging, coatings & polishing, cosmetics & personal care, hot melt adhesives, tire & rubber, food & pharmaceuticals, and other applications. Cosmetics & personal care is the fastest-growing segment because of the rising demand for premium skincare, haircare, and cosmetic products.

-

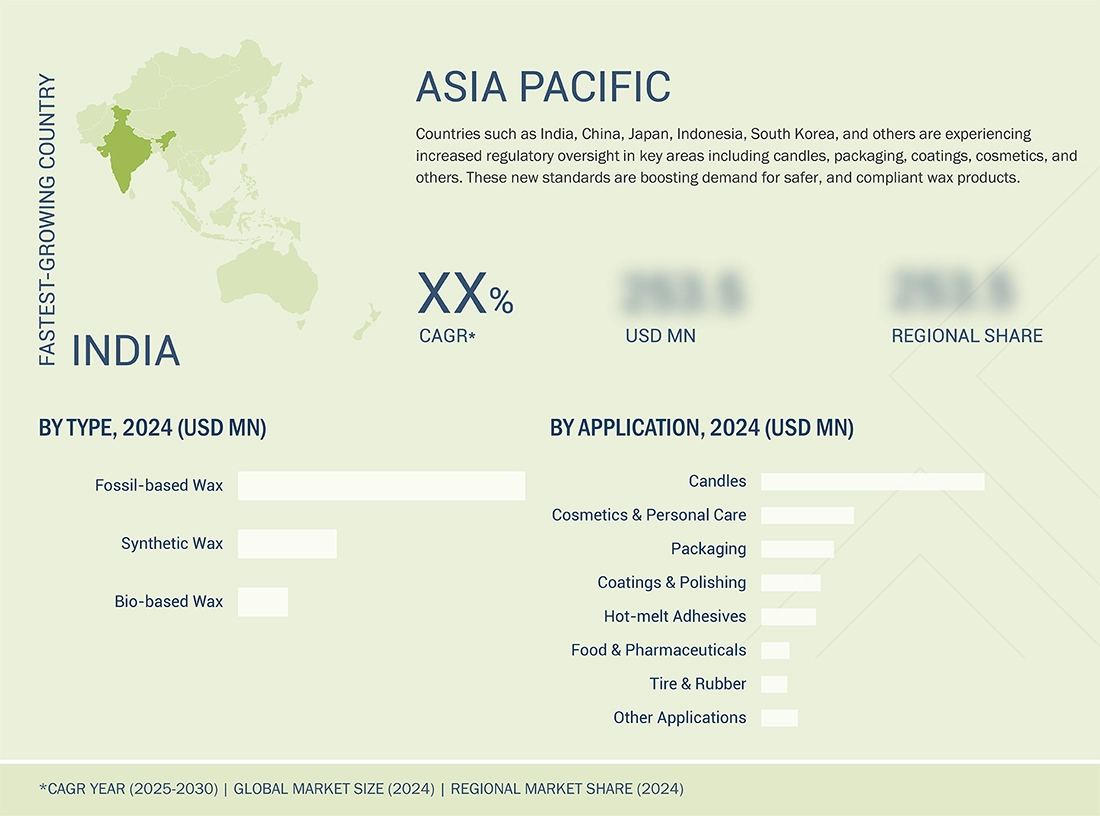

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 5.4%, driven by the growth of the manufacturing sector, increasing candle production, expanding packaging industry, and shifting manufacturing facilities toward India, China, and ASEAN countries.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic product launches, partnerships & collaborations, mergers & acquisitions, and expansions from leading players such as Exxon Mobil Corporation, Shell plc, Sasol, Numaligarh Refinery Limited (NRL), Petrobras, and China Petroleum & Chemical Corporation. These companies are emphasizing sustainability, process optimization, and customized wax solutions to meet diverse industrial applications.

In food packaging, waxes are applied to enhance moisture resistance and surface finish. The personal care industry employs waxes for binding to achieve desired textures as well as when used in creams, balms, or sticks, for stability. The scented candle market has contributed the highest percentage in industrial wax consumption. Waxes applied in the rubber and tire industries help with the processing of materials to improve the performance and longevity of the tires. As the world begins to urbanize along with lifestyle changes and increased disposable incomes in emerging economies, consumption is being augmented, and emerging developments in bio-based waxes and synthetic waxes create more opportunities for markets to expand.

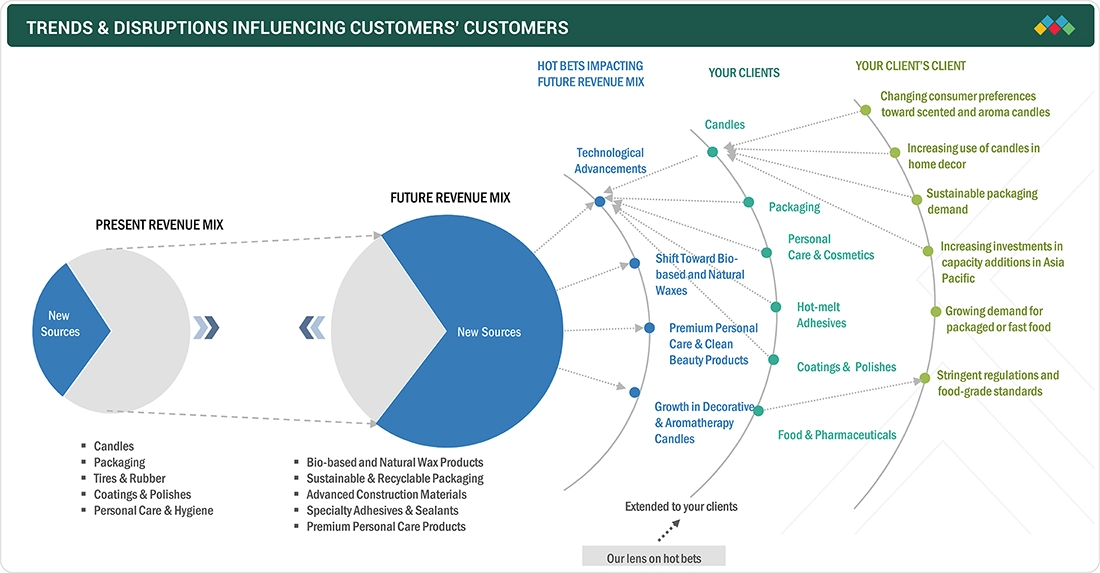

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Customers are migrating in the industrial wax market towards sustainable, bio-based, and recyclable materials. Simultaneously, the shifting rules, increasing price of raw materials, and the expansion of packaging, cosmetics usage are altering the demand trends and forcing businesses to be innovative.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand in packaging industry

-

Expanding cosmetics & personal care industry

Level

-

Environmental regulations and restrictions related to petroleum-based waxes

-

Availability of alternatives and capital-intensive production

Level

-

Development of sustainable and bio-based wax

-

Rapid urbanization and increased consumer spending on personal care and automobile products

Level

-

Volatile raw material prices

-

Supply–demand imbalance, import dependency, and product performance consistency

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing packaging demand fueling the industrial wax market

Increasing global packaging demand has had a large impact on the consumption of industrial waxes, primarily in areas where protection, longevity, and aesthetics are important. Industrial waxes are widely used in corrugated packaging, coated paper, and other food-grade containers, largely due to their ability to resist moisture, seal products, and enhance surfaces. Unparalleled levels of online shopping have led to insurmountable shipping volumes, requiring stronger packaging materials, whether for protection or aesthetics. Also, the e-commerce industry has increased its dependence upon more sustainable packaging options, providing wax complexes with the opportunity to improve wax formulations that align with both biodegradable and recycling options and meet both process and environmental requirements. As growth continues in industries the use of wax-treated packaging options will continue to grow.

Restraint: Environmental regulations and restrictions related to petroleum-based waxes

Many industrial waxes, especially from petroleum feedstock are under scrutiny as non-bio-degradable products and for their environmental impact during production and after-use disposal process. Governing bodies across the European Union, North America, and parts of Asia are also beginning to impose rules aiming for compliance for VOC emissions and hazardous waste disposal and carbon footprint of wax manufacturers as well end users. The demand for sustainable alternatives is forcing many industries transition from traditional paraffin waxes to more bio-based or synthetic products, but this transition is often limited by higher capital costs, lack of scalability, and varied performance properties of eco-conscious waxes. Furthermore, many industries, including packaging (primary or secondary) and cosmetics, are further restricted in their use of industrial waxes for food safety and environmental labeling requirements that restrict the use of products that are either not at REACH or FDA or similar global thresholds.

Opportunity: Development of sustainable and bio-based wax

Sustainable and bio-based wax innovation is being highlighted as a significant growth opportunity in the industrial wax category, as consumers become more environmentally savvy, regulators follow through with mandated changes, and consumers drive demand for eco-friendly products. Many traditional petroleum-based waxes are being substituted or replaced with nature-derived waxes from sources, such as soy, palm, beeswax, and sugarcane. Bio-based waxes provide equivalent performance benefits like, but not exclusively: water resistance, gloss enhancement, and barrier protection while complying with environmental and safety requirements. In packaging, such as food-grade, food, or e-commerce applications, bio-based waxes are starting to establish themselves as sustainable coatings that promote circular economy purposes. Additionally, improvements in formulation capabilities are supporting production effectiveness and consistency with bio-waxes consistent across multiple streams of the supply chain in personal care, food processing, adhesives, as they increase capacity and consistency of the respective performances of the bio-waxes involved.

Challenge: Volatile raw material prices

The price volatility of raw materials is a major challenge for industrial wax players and end buyers. Industrial waxes are made from primarily petroleum-based feedstocks: paraffin, microcrystalline wax and synthetic hydrocarbons. Waxes are reliant on crude oil for pricing and production, which can swing wildly based on forces, such as geopolitical conflict, supply chain disruptions related to the pandemic, and purposeful changes from energy policy, expected and unexpected. The cost of wax production spiked and soared as the price of crude oil surged; more uncertainty continues to cause cost variations of many raw wax feedstocks, particularly since many of the competitors have either limited processing capacity or none. This price volatility makes it extremely difficult for manufacturers to arrange long-term contracts (fixed pricing) for wax production or maintain pricing for months in the market. Increasingly, categorical cost variance and margin pressures are related to the acknowledged changing wax price volatility. Price volatility leads to the manufacture of even small-scale scale not able to competently plan for wax acquisitions or be inefficient in business.

Industrial Wax Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilizes microcrystalline and synthetic waxes in lipsticks, balms, and creams to enhance texture, stability, and smooth application. | Improved product stability and shelf life Enhanced sensory appeal and moisturization Reduced product returns and higher consumer satisfaction |

|

Incorporates Fischer-Tropsch (FT) and paraffin waxes into tire rubber compounds to protect against ozone, UV radiation, and mechanical stress. | Enhanced tire durability and crack resistance Improved heat and oxidation stability Reduced maintenance costs and longer service life |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Industrial wax forms as a multi-step service with suppliers manufacturing companies and end-use markets. Suppliers of raw materials provide feed stocks, such as derivatives of petroleum; synthetic hydrocarbons or bio-based oils, which are utilized as the starting points for industrial wax. Manufacturers then take the input products (feedstocks) and turn them into the industrial wax market range of products, including, but not limited to paraffin, microcrystalline, synthetic, and natural waxes, and may contain functional characteristics across a collection of the family of applications. The above illustrates how many people, stakeholders are involved in very person-maintained activities that all connect to the upstream activities or use either extracting or refining a wax or being utilized downstream as people use one of the many functional industrial wax products.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial Wax Market, By Type

During the forecast period, fossil-based wax is expected to hold the largest market share in the industrial wax market, driven by price, availability, and multiple end-use potential in key industries. Fossil-based waxes include paraffin and microcrystalline waxes and are sourced from petroleum refining processes. Fossil-based wax is a consideration in several categories due to its high gloss, moisture resistance, chemical stability, and compatibility with many additives and formulation options. Therefore, fossil-based waxes are generally used in packaging, rubber processing, adhesives, candles, and coatings. In industries like packaging and automotive, fossil-based waxes will typically improve barrier properties and increase durability potential for the end product. These performance characteristics are also significant incentives for value chain participants and manufacturers, especially as they relate to profit potential at scale. The market share dominance of fossil-based wax is driven by lower production costs, established and mature supply chains, and affordability.

Industrial Wax Market, By Application

The candle segment is expected to hold the largest market share in the industrial wax market during the forecast period due to existing consumer demand, cultural values, and their many varied applications. Industrial waxes use paraffin, synthetic blended wax, and are used in candles due to good burn properties, being moldable, and being amenable to scents. Candles are not just functional light sources, but decorative, therapeutic, and lifestyle products in the realm of décor and aromatherapy. Changes in urbanization, increase in disposable incomes, and the cultural shift toward wellness and aesthetics have fueled candle consumption across developed and developing markets. Many scented and decorative candles are marketed to consumers as luxury items or mood enhancers and due to retail and e-commerce expansion, have become more popular.

REGION

Asia Pacific to be leading region in global industrial wax market during forecast period

During the forecast period, the Asia Pacific region is projected to capture the largest share of the industrial wax market and is expected to continue to do so due to the rapid pace of industrialization, increasing base of manufacturing, and high levels of consumption across key end-use applications. Within the Asia Pacific region, countries such as China, India, Japan, and South Korea have exhibited an increasing demand for industrial waxes, especially in packaging, personal care, rubber, and candle-making industries. The middle class is growing in the region, in addition to the urban population and changing lifestyles, which is increasing the demand for wax-based products from cosmetics and hygiene products to decorative candles and packaging items. They are also projected to be a high-potential market in India, due to collaborations and investments in packaging, fast-moving consumer goods (FMCG), and the automotive industry, which is expected to drive wax consumption.

Industrial Wax Market: COMPANY EVALUATION MATRIX

In the industrial wax market matrix, China National Petroleum Corporation (Star), a Chinese company, leads the market. The company primarily supplies paraffin wax for various industrial uses. CNPC sources high-paraffin crude oil from its Daqing and Shenbei fields, with paraffin contents of 25% and 42% respectively, giving it a unique advantage in producing premium paraffin products. HF Sinclair Corporation (Emerging Leader) is gaining traction. The company's sites in Petrolia and Amsterdam are dedicated to producing specialty products such as white oils, petrolatum’s, and waxes that serve various end-use industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 10.96 Billion |

| Market Forecast in 2030 (Value) | USD 14.14 Billion |

| Growth Rate | CAGR of 4.3% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | By Type: Fossil-based wax, Synthetic wax, Bio-based wax By Form: Solid, Emulsions & Liquids, Powdered By Application: Candles, Packaging, Coatings & Polishes, Cosmetics & Personal Care, Hot-melt Adhesives, Tire & Rubber, Food & Pharmaceuticals, and Other Applications |

| Regions Covered | North America, Asia Pacific, Europe, South America, the Middle East & Africa |

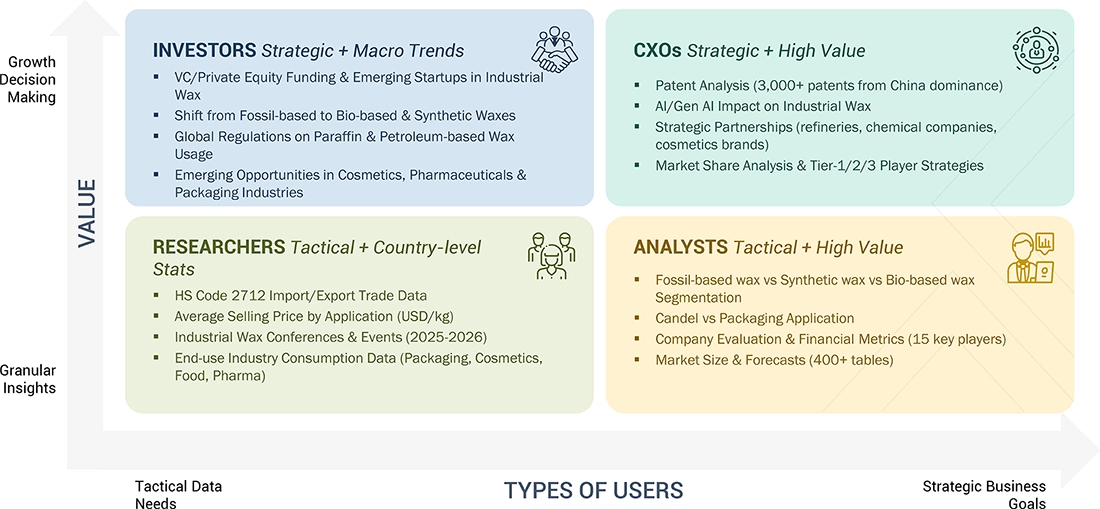

WHAT IS IN IT FOR YOU: Industrial Wax Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Industrial Wax Market | Detailed company profiles of industrial wax competitors (financials, product portfolio, production capacity) End-use industry mapping (cosmetics, packaging, pharma, candles, coatings) Policy & regulation analysis for fossil-based vs. bio-based wax adoption | Identified & profiled 20+ industrial wax producers across APAC Mapped demand trends across high-growth segments (cosmetics, packaging, healthcare) |

RECENT DEVELOPMENTS

- February 2025 : Sasol Chemicals expanded its micronized wax portfolio with the introduction of SASOLWAX LC Spray 30 G and LC Spray 30 G-EF. These new solutions offer a 32% lower Product Carbon Footprint (PCF) compared to the company's existing market-leading products, Spray 30 G and Spray 30 G-EF

- June 2025 : Shell GTL SaraCare, a new product line for the personal care and cosmetics market, was soft-launched at the in-cosmetics Asia event held in Bangkok, Thailand.

- August 2024 : Sasol Chemicals launched SASOLWAX LC100, a new industrial wax grade developed to support sustainability goals across the packaging adhesives sector. This latest addition to the company’s product portfolio offers a 35% lower cradle-to-gate Product Carbon Footprint (PCF) compared to conventional alternatives, without compromising on performance or quality.

- June 2024 : Shell GTL Microcrystalline Wax, a premium synthetic wax derived from natural gas through the Fischer-Tropsch process, was officially launched in Hamburg, Germany.

- April 2024 : Exxon Mobil Corporation announced the launch of its new Prowaxx™ wax product line, marking a significant update to its global wax portfolio. The new product range introduces a clear naming system for slack wax, semi-refined wax, and fully refined wax products, aligning with the company’s commitment to innovation and consistency across markets.

Table of Contents

Methodology

The study involved four major activities to estimate the current size of the global industrial wax market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of industrial wax through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the industrial wax market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and subsegments of the market.

Secondary Research

The market for the companies offering industrial wax is arrived at through secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the industrial wax market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of vendors, forums, certified publications, and whitepapers. Secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the industrial wax market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of industrial wax offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

The following is the breakdown of interviews with experts:

Note: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global industrial wax market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Industrial waxes include a very broad group of organic compounds that are solid under room temperature, usually white or yellowish-colored, and that become free-flowing liquids at moderately high temperatures. These waxes consist mainly of complex mixtures of hydrocarbons with carbon chains usually having more than 20 atoms and have melting points that depend on their individual chemical compositions. Industrial waxes are broadly categorized into three main types based on their origin: fossil-based, synthetic, and bio-based. Fossil-based waxes include both mineral and petroleum-derived varieties, such as paraffin wax and microcrystalline wax. Synthetic waxes, such as Fischer-Tropsch (FT) wax, are chemically engineered to meet specific performance criteria. Bio-based waxes are sourced naturally, implying both animal and vegetable waxes, and hence would be considered more sustainable options for waxes. Owing to their particular physical properties, including hydrophobicity, lustrous finish, lubrication, and resistance to chemicals, these waxes serve as basic raw materials for industries, such as packaging, rubber, adhesives, cosmetics, and coatings.

Stakeholders

- Industrial Wax Manufacturers

- Raw Material Suppliers

- Converters and Processors

- Distributors and traders

- Industry Associations and Regulatory Bodies

- End Users

Report Objectives

- To define, describe, and forecast the global industrial wax market in terms of value and volume

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the market segmentation and forecast the market size based on type, form, and application

- To analyze and forecast the market segments, with respect to size in five key regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America, along with the major countries in each region

- To strategically analyze micromarkets concerning individual growth trends, growth prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To analyze recent developments, such as expansions, mergers & acquisitions, in the market and draw a competitive landscape

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To provide the impact of AI/Gen AI on the market

Key Questions Addressed by the Report

What are the major drivers influencing the growth of the industrial wax market?

The major drivers are growing packaging demand and the growth of the cosmetics & personal care industry, both of which support market expansion.

What are the major challenges in the industrial wax market?

Price volatility of raw materials poses significant challenges for the industrial wax market.

What are the restraining factors in the industrial wax market?

Environmental regulations and restrictions act as key restraining factors.

What is the key opportunity in the industrial wax market?

Innovation in sustainable and bio-based waxes presents significant opportunities for market expansion.

Who are the key players in the industrial wax market?

Key players include China Petrochemical Corporation (China), Shell PLC (UK), ExxonMobil Corporation (US), Sasol Ltd. (South Africa), Petrobras (Brazil), Numaligarh Refinery Limited (India), BASF SE (Germany), HollyFrontier Specialty Products LLC (US), HCI Wax (a division of HCI Inc.) (US), and The International Group, Inc. (Canada).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Wax Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Industrial Wax Market

MANDELA

Jul, 2019

Understanding the challenge in maximising production for organic products.

bastian

Feb, 2018

Market dynamics, growth trends, key manufacturers present in the market.

Jonathan

Nov, 2019

Specific information required on beeswax and paraffin wax. Need to understand supply scenario to refineries..

William

Jul, 2017

Interesed in Paraffin Wax industry.

See

Jan, 2018

Interested in the PE and PP recycling market.