Polyethylene Wax Market by Process (Polymerization, Modification, Thermal Cracking), Type (LDPE, HDPE, Oxidized, Micronized), Application (Plastic Processing, Hot-melt Adhesive, and Ink & Coating), and Region - Global Forecast to 2022

The polyethylene wax market is projected to reach USD 1.32 Billion by 2022, at a CAGR of 4.1%. In this study, 2016 is considered as the base year to estimate the size of the polyethylene wax market, while 2017 to 2022 is considered as the forecast period.

The Objectives of Polyethylene Wax Market Study

- To analyze, define, segment, and forecast the polyethylene wax market.

- To analyze the market according to process, type, and application.

- To determine the size of the polyethylene waxes market in various regions, namely, North America, Europe, APAC, South America, and the Middle East & Africa

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the polyethylene wax market

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contribution to the polyethylene waxes market

- To profile key players in the polyethylene wax market and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as investments, expansions, joint ventures, mergers & acquisitions, new product launches, and research & development (R&D) activities in the polyethylene wax market

- To analyze opportunities in the polyethylene wax market for key players and provide detailed competitive landscape for market leaders

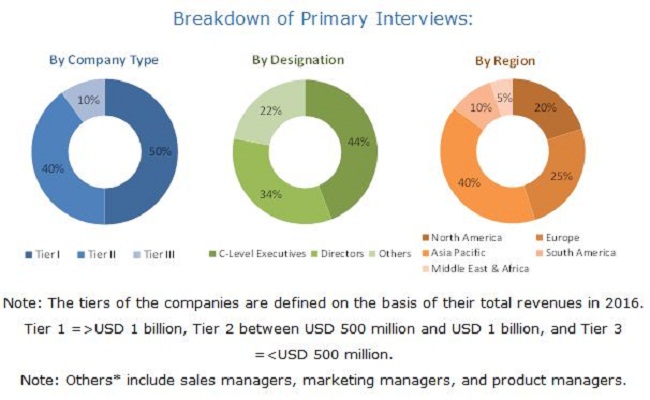

Both top-down and bottom-up approaches were used to estimate and validate the global size of the polyethylene wax market and estimate the sizes of various other dependent submarkets. The research study involves the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, Chemical Weekly, and other government, private, and company websites to identify and collect information useful for this technical, market-oriented, and commercial study of the polyethylene waxes market. After arriving at the overall market size, the total market was split into several segments and sub-segments. The figure given below provides a breakdown of primary interviews on the basis of company type, designation, and region during the research study on the polyethylene wax market.

To know about the assumptions considered for the study, download the pdf brochure

Key Players in Polyethylene Wax Market

The polyethylene wax market has a diversified and well-established ecosystem of upstream players, such as raw material suppliers and downstream stakeholders, such as manufacturers, vendors, and end users. BASF (Germany), Clariant International (Switzerland), Trecora Resources (US), Mitsui Chemicals (Japan), and Honeywell International (US), are some of the leading manufacturers and suppliers of polyethylene wax market.

Key Target Audience in Polyethylene Wax Market

- Manufacturers of Polyethylene Wax

- Raw Material Suppliers

- Traders, Distributors, and Suppliers of Polyethylene Wax

- Regional Associations of Manufacturers of Polyethylene Wax

- Government and Regional Agencies, and Research Organizations

- Investment Research Firms

Polyethylene Wax Market Report Scope

This research report categorizes the polyethylene wax market based on process, type, application, and region.

Polyethylene Wax Market, by Process:

- Polymerization

- Modification

- Thermal cracking

- Others

Polyethylene waxes market, by Type:

- Low Density Polyethylene Wax

- High Density Polyethylene Wax

- Oxidized Polyethylene Wax

- Micronized Polyethylene Wax

- Others

Polyethylene wax market, by Application:

- Plastic Processing

- Hot-melt Adhesive

- Ink & Coating

- Others

Polyethylene wax market, by Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

The market has been further analyzed for the key countries in each of these regions.

Polyethylene Wax Market Report Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Polyethylene Wax Market Regional Analysis

- A country-level analysis of the polyethylene wax market based on all segmentation considered.

Polyethylene Wax Market Company Information

- Detailed analysis and profiles of additional market players

The polyethylene wax market is projected to grow from USD 1.08 Billion in 2017 to USD 1.32 Billion by 2022, at a CAGR of 4.1% from 2017 to 2022. Major factors driving the market are the increasing use of polyethylene wax in various applications, such as plastic processing, hot-melt adhesive, ink & coating, and others.

Modification is the fastest-growing segment of the polyethylene wax market. The LDPE and HDPE waxes are obtained through the polymerization process. These waxes are generally used as a lubricant for PVC processing, a modifier in hot-melt adhesives, and an additive in the water-based emulsion to improve slip, rub, and scratch resistance.

Oxidized is the fastest-growing segment of the polyethylene waxes market during the forecast period. The growth of oxidized polyethylene wax is backed by its use in different applications such as lubricants for PVC processing, dispersing agents for polar masterbatches, surface modifiers in hot-melt adhesives, and processing aids in various industries.

Ink & coating is the fastest-growing application segment of the polyethylene wax market in 2016. Polyethylene wax is used as an additive in the ink & coating industry to impart mark and scratch resistance, improved slip, and rub and moisture resistance.

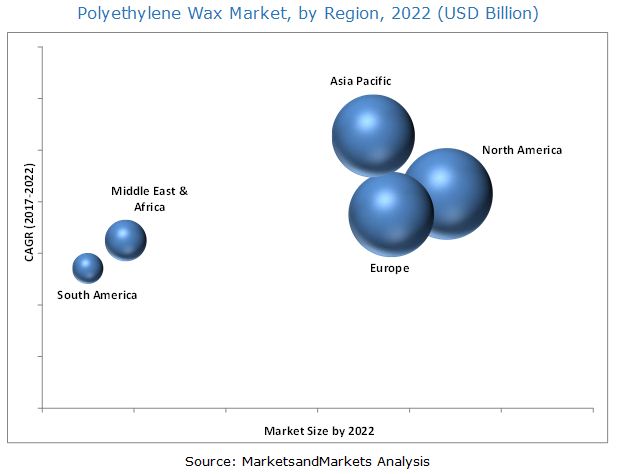

The polyethylene wax market in APAC is expected to witness the highest growth during the forecast period. Emerging economies, such as China, India, and various Southeast Asian countries are attracting several global players to increase its footprint and market share in APAC.

Factors such as volatility in the prices of raw materials may restrain the growth of the polyethylene wax market, globally.

Key Polyethylene Wax Market Industry Players

BASF (Germany), Clariant International (Switzerland), Trecora Resources (US), Mitsui Chemicals (Japan), Marcus Oil and Chemical (US), and Honeywell International (US) are some of the key market players in the polyethylene waxes market. Diverse product portfolios, strategically positioned R&D centers, continuous adoption of various growth strategies, and advancements in technologies for the development of new types of products and technologies are the factors responsible for the strong position of these companies in the polyethylene wax market.

Frequently Asked Questions (FAQ):

How big is the Polyethylene Wax Market industry?

The polyethylene wax market is projected to grow from USD 1.08 Billion in 2017 to USD 1.32 Billion by 2022, at a CAGR of 4.1% from 2017 to 2022.

Who leading market players in Polyethylene Wax industry?

Key players profiled in the polyethylene wax market report are Honeywell International (US), Clariant International (Switzerland), Trecora Resources (US), Mitsui Chemicals (Japan), Marcus Oil and Chemical (US), and BASF (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in Polyethylene Wax Market

4.2 Market Size, By Process

4.3 Market Size, By Type

4.4 Market Growth, By Application

4.5 APAC: Market, By Country and Process

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing End-Use Applications of Polyethylene Wax

5.2.2 Restrain

5.2.2.1 Volatility in Raw Material Prices

5.2.3 Opportunities

5.2.3.1 Increased Use of Polyethylene Wax in Plastic Processing and Hot-Melt Adhesives in Road Marking Application

5.2.4 Challenges

5.2.4.1 Limited Investment in New Product Development

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Rivalry

6 Polyethylene Waxes Market, By Process (Page No. - 37)

6.1 Introduction

6.2 Polymerization

6.3 Modification

6.4 Thermal Cracking

7 Polyethylene Wax Market, By Type (Page No. - 42)

7.1 Introduction

7.2 High-Density Polyethylene (HDPE) Wax

7.3 Low Density Polyethylene (LDPE) Wax

7.4 Oxidized Polyethylene Wax

7.5 Others

8 Polyethylene Wax Market, By Application (Page No. - 48)

8.1 Introduction

8.2 Plastic Processing

8.3 Hot-Melt Adhesive

8.4 Ink & Coating Industry

8.5 Others

9 Polyethylene Wax Market, By Region (Page No. - 56)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.2 Japan

9.2.3 India

9.2.4 South Korea

9.2.5 Vietnam

9.2.6 Indonesia

9.2.7 Rest of APAC

9.3 North America

9.3.1 US

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 Italy

9.4.3 France

9.4.4 Poland

9.4.5 UK

9.4.6 Spain

9.4.7 Rest of Europe

9.5 Middle East & Africa

9.5.1 South Africa

9.5.2 Saudi Arabia

9.5.3 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 83)

10.1 Overview

10.2 Market Ranking

10.3 Competitive Scenario

10.3.1 Merger & Acquisition

10.3.2 Investment & Expansion

10.3.3 Partnership

11 Company Profiles (Page No. - 86)

11.1 Honeywell International

11.2 Mitsui Chemicals

11.3 Clariant

11.4 Trecora Resources

11.5 BASF

11.6 SCG Group

11.7 Innospec Inc.

11.8 The Lubrizol Corporation

11.9 Euroceras

11.10 Westlake Chemical Corporation

11.11 Other Key Players

11.11.1 Marcus Oil and Chemical

11.11.2 Coschem

11.11.3 Wiwax

11.11.4 Deurex

11.11.5 Michelman

11.11.6 The International Group

11.11.7 SQI Group

11.11.8 Lion Chemtech

11.11.9 Ceronas

11.11.10 Paramelt

11.11.11 Synergy Additives

11.11.12 BYK Additives & Instruments

11.11.13 Cosmic Petrochem

11.11.14 EP Chem

11.11.15 Qingdao Bouni Chemical

12 Appendix (Page No. - 106)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Authors Details

List of Tables (74 Tables)

Table 1 Market Size, By Process, 2015–2022 (USD Million)

Table 2 Market Size, By Process, 2015–2022 (Kiloton)

Table 3 Market Size By Polymerization, By Region, 2015–2022 (USD Million)

Table 4 Market Size By Polymerization, By Region, 2015–2022 (Kiloton)

Table 5 Market Size By Modification Process, By Region, 2015–2022 (USD Million)

Table 6 Market Size By Modification Process, By Region, 2015–2022 (Kiloton)

Table 7 Market Size By thermal Cracking Process, By Region, 2015–2022 (USD Million)

Table 8 Market Size By thermal Cracking Process, By Region, 2015–2022 (Kiloton)

Table 9 Market Size, By Type, 2015–2022 (USD Million)

Table 10 Market Size, By Type, 2015–2022 (Kiloton)

Table 11 HDPE Wax Market Size, By Region, 2015–2022 (USD Million)

Table 12 HDPE Wax Market Size By Polymerization, By Region, 2015–2022 (Kiloton)

Table 13 LDPE Wax Market Size, By Region, 2015–2022 (USD Million)

Table 14 LDPE Wax Market Size, By Region, 2015–2022 (Kiloton)

Table 15 Oxidized Polyethylene Waxes Market Size, By Region, 2015–2022 (USD Million)

Table 16 Oxidized Market Size, By Region, 2015–2022 (Kiloton)

Table 17 Other Polyethylene Waxes Market Size, By Region, 2015–2022 (USD Million)

Table 18 Other Market Size, By Region, 2015–2022 (Kiloton)

Table 19 Polyethylene Waxes Market Size, By Application, 2015–2022 (USD Million)

Table 20 Market Size, By Application, 2015–2022 (Kiloton)

Table 21 Market Size By Plastic Processing, By Region, 2015–2022 (USD Million)

Table 22 Market Size By Plastic Processing, By Region, 2015–2022 (Kiloton)

Table 23 Market Size By Hot-Melt Adhesive, By Region, 2015–2022 (USD Million)

Table 24 Polyethylene Wax Market Size By Hot-Melt Adhesive, By Region, 2015–2022 (Kiloton)

Table 25 Market Size By Ink & Coating Industry, By Region, 2015–2022 (USD Million)

Table 26 Market Size By Ink & Coating Industry, By Region, 2015–2022 (Kiloton)

Table 27 Market Size, By Other Applications, By Region, 2015–2022 (USD Million)

Table 28 Polyethylene Waxes Market Size, By Other Applications, By Region, 2015–2022 (USD Million)

Table 29 Market Size, By Region, 2015–2022, (USD Million)

Table 30 Market Size, By Region, 2015–2022, (Kiloton )

Table 31 APAC: Polyethylene Waxes Market Size, By Country, 2015–2022, (USD Million)

Table 32 APAC: Market Size, By Country, 2015–2022, (Kiloton)

Table 33 APAC: Market Size, By Process, 2015–2022, (USD Million)

Table 34 APAC: Market Size, By Process, 2015–2022, (Kiloton)

Table 35 APAC: Market Size, By Type, 2015–2022, (USD Million)

Table 36 APAC: Market Size, By Type, 2015–2022, (Kiloton )

Table 37 APAC: Market Size, By Application, 2015–2022, (USD Million)

Table 38 APAC: Market Size, By Application, 2015–2022, (Kiloton )

Table 39 North America: Polyethylene Waxes Market Size, By Country, 2015–2022, (USD Million)

Table 40 North America: Market Size, By Country, 2015–2022, (Kiloton)

Table 41 North America: Market Size, By Process, 2015–2022, (USD Million)

Table 42 North America: Market Size, By Process, 2015–2022, (Kiloton)

Table 43 North America: Market Size, By Type, 2015–2022, (USD Million)

Table 44 North America: Market Size, By Type, 2015–2022, (Kiloton)

Table 45 North America: Market Size, By Application, 2015–2022, (USD Million)

Table 46 North America: Market Size, By Application, 2015–2022, (Kiloton)

Table 47 Europe: Polyethylene Waxes Market Size, By Country, 2015–2022, (USD Million)

Table 48 Europe: Market Size, By Country, 2015–2022, (Kiloton)

Table 49 Europe: Market Size, By Process, 2015–2022, (USD Million)

Table 50 Europe: Market Size, By Process, 2015–2022, (Kiloton)

Table 51 Europe: Market Size, By Type, 2015–2022, (USD Million)

Table 52 Europe: Market Size, By Type, 2015–2022, (Kiloton)

Table 53 Europe: Market Size, By Application, 2015–2022, (USD Million)

Table 54 Europe: Market Size, By Application, 2015–2022, (Kiloton)

Table 55 Middle East & Africa: Polyethylene Waxes Market Size, By Country, 2015–2022, (USD Million)

Table 56 Middle East & Africa: Market Size, By Country, 2015–2022, (Kiloton)

Table 57 Middle East & Africa: Market Size, By Process, 2015–2022, (USD Million)

Table 58 Middle East & Africa: Market Size, By Process, 2015–2022, (Kiloton)

Table 59 Middle East & Africa: Market Size, By Type, 2015–2022, (USD Million)

Table 60 Middle East & Africa: Market Size, By Type, 2015–2022, (Kiloton)

Table 61 Middle East & Africa: Market Size, By Application, 2015–2022, (USD Million)

Table 62 Middle East & Africa: Market Size, By Application, 2015–2022, (Kiloton)

Table 63 South America: Polyethylene Wax Market Size, By Country, 2015–2022, (USD Million)

Table 64 South America: Market Size, By Country, 2015–2022, (Kiloton)

Table 65 South America: Market Size, By Process, 2015–2022, (USD Million)

Table 66 South America: Market Size, By Process, 2015–2022, (Kiloton)

Table 67 South America: Market Size, By Type, 2015–2022, (USD Million)

Table 68 South America: Market Size, By Type, 2015–2022, (Kiloton)

Table 69 South America: Market Size, By Application, 2015–2022, (USD Million)

Table 70 South America: Market Size, By Application, 2015–2022, (Kiloton)

Table 71 Polyethylene Wax Market Key Players, 2016

Table 72 Merger & Acquisition, 2014–2017

Table 73 Investment & Expansion, 2014–2017

Table 74 Partnership, 2014–2017

List of Figures (33 Figures)

Figure 1 : Market Research Design

Figure 2 : Market Data Triangulation

Figure 3 HDPE Wax to Account for the Largest Share During the Forecast Period

Figure 4 Polymerization to Be the Dominating Process in the Market of Polyethylene Wax During the Forecast Period

Figure 5 Plastic Processing is the Largest Application of Polyethylene Wax During the Forecast Period

Figure 6 APAC Expecting Highest Growth in the Forecast Period

Figure 7 Emerging Economies Offer High Market Growth Opportunities in Polyethylene Wax

Figure 8 Modification to Register the Highest Cagr Between 2017 and 2022

Figure 9 Oxidized Wax to Register the Highest Cagr Between 2017 and 2022

Figure 10 Inks & Coatings to Register the Fastest-Growing Rate During the Forecast Period

Figure 11 China Accounted for the Largest Market Share of APAC Polyethylene Wax in 2016

Figure 12 : Market Drivers, Restraints, Opportunities, and Challenges

Figure 13 Porter’s Five Forces Analysis

Figure 14 Polymerization is the Widely Used Process to Manufacture Polyethylene Wax

Figure 15 HDPE Wax to Market of Lead Polyethylene Wax During the Forecast Period

Figure 16 Plastic Processing to Be the Major Application of Polyethylene Wax During the Forecast Period

Figure 17 India and China Emerging Hotspot in Global Pe Wax Market During Forecast Period

Figure 18 APAC : Polyethylene Wax Market Snapshot

Figure 19 North America : Market Snapshot

Figure 20 Germany to Market of Lead Polyethylene Wax in Europe During the Forecast Period

Figure 21 Saudi Arabia to Market of Lead Polyethylene Wax in Middle East & Africa

Figure 22 Brazil to Market of Lead Polyethylene Wax in South America

Figure 23 Companies Majorly Adopted Inorganic Growth Strategies Between 2014 and 2017

Figure 24 Honeywell International: Company Snapshot

Figure 25 Mitsui Chemicals: Company Snapshot

Figure 26 Mitsui Chemicals: Swot Analysis

Figure 27 Clariant: Company Snapshot

Figure 28 Trecora Resources: Company Snapshot

Figure 29 BASF: Company Snapshot

Figure 30 SCG Group: Company Snapshot

Figure 31 Innospec Inc.: Company Snapshot

Figure 32 The Lubrizol Corporation: Company Snapshot

Figure 33 Westlake Chemical Corporation: Company Snapshot

Growth opportunities and latent adjacency in Polyethylene Wax Market